It’s been a busy month for the team at Performance Brokerage Services, as the automotive dealership brokerage firm announced its involvement in two more closings this week.

After being involved in the transaction of a Toyota store in Washington, the firm also helped to facilitate the moves involving a Minnesota Subaru rooftop and a Chrysler Dodge Jeep Ram dealership.

According to separate news releases, Performance Brokerage Services advised Scott Bement in the sale of St. Cloud Subaru in St. Cloud, Minn., to an unspecified buyer. The firm also announced the sale of Plaza Chrysler Dodge Jeep Ram in Orangeburg, S.C., from Joseph Nolette to Tony Thomas.

Performance Brokerage Services noted that Bement originally purchased St. Cloud Subaru in November 2006, moving his family to the city northwest of Minneapolis so he could be running the store daily. Bement built a new facility in 2015 that nearly doubled the dealership’s size to keep up with its growing demand.

Bement mentioned in the news release his happiness that the franchised store will remain a fixture in the community at its current location at 141 Park Avenue South in St. Cloud.

Subaru St. Cloud has partnered with the local Boys and Girls Club and donated proceeds generated through Subaru’s Share the Love program for the past seven years, totaling more than $213,000.

“It was a privilege to have represented Scott Bement in the sale of his Subaru dealership,” said Performance Brokerage Services Midwest partner Paul Kechnie, who served as the exclusive agent for this transaction.

“Subaru is a highly desirable franchise, demonstrating exceptional performance in specific markets and regions, and St. Cloud Subaru was no exception,” Kechnie continued. “We thank Scott for entrusting our team to guide him through the buy-sell process and to capitalize on this unique moment in time.”

The Performance Brokerage Services team also helped another principal capitalize on the active buy-sell market as part of the transaction the South Carolina Chrysler Dodge Jeep Ram dealership.

According to another news release, the dealership will remain at its current location at 2801 St. Matthews Road in Orangeburg but operating with a new name — Tony T Chrysler Dodge Jeep Ram of Orangeburg.

Performance Brokerage Services highlighted Thomas began his career in the automotive business more than 20 years ago, holding a broad range of positions within dealerships retailing both domestic and import brands.

Thomas previously was a partner at Hyundai of Silsbee in east Texas who also has been actively involved with the Houston area Boys and Girls Club of America mentoring program as well as his own foundation started in 2011, the Tony T Foundation, which also looks to help at-risk youth.

One of Thomas’ colleagues, Lekeitha Morris, had this to say: “I have known Tony over 30 years in several roles. Over the years, I have found Tony to demonstrate exceptional organizational skills and unprecedented time management skills. I have witnessed him completely change the trajectory of dealerships.”

Now Thomas will be looking to do the same with Tony T Chrysler Dodge Jeep Ram of Orangeburg as Nolette makes a pivot with his dealership business.

“Attorney Mark Ornstein at Bass Sox Mercer referred me to Mr. Joseph Nolette to help sell his dealership in Orangeburg, South Carolina so that he could focus on his Florida dealerships,” said Performance Brokerage Services Southeast partner George Chaconas, who was the exclusive advisor for this transaction.

“It was an honor and privilege representing Mr. Nolette. Buddy Irby, the CFO and operations manager, was instrumental and an integral part in facilitating the transaction. I want to thank Joe and Buddy very much for the opportunity to be of service. Best wishes,” Chaconas went on to say.

Both transactions triggered praise by the involved parties for Performance Brokerage Services, which has been involved in more than 200 deals during the past five years.

Bement said, “Buying or selling an auto dealership can be a challenging transaction. I was happy to have people with experience like Paul Kechnie and Performance Brokerage Services to work through the details with me. Paul was always available, professional, and fair. Paul and Performance Brokerage Services have my recommendation.”

And Thomas added, “I would like to thank and highly recommend Performance Brokerage Services for helping with this acquisition. George Chaconas and Courtney Bernhard worked hard to identify the type of opportunity I was looking for and also provided excellent communication during the process. I am looking forward to working together on future deals.”

Summertime is typically one of the busiest times of the year for both new- and used-car sales as people are gearing up for vacation or getting ready for the upcoming school year. With inventories of cars and trucks in much shorter supply heading into holiday weekends like Memorial Day or July Fourth, this summer may look very different. Pent-up consumer demand makes it critical for dealers, OEMs, lenders and agency partners to be even more targeted in finding potential shoppers.

To stay competitive, it is not only important to identify who is actually in-market for a new vehicle, but also to identify who has the financial capacity to buy one.

Fewer incentives make each customer interaction crucial

Identifying financial capacity is crucial for automotive transactions today. During the first quarter of 2021, the average financial incentive on new vehicles fell 20% from a year earlier, according to research firm J.D. Power. With fewer incentives and more competition for the same shoppers, dealers and OEMs must have a clear picture of each customer’s financial capacity to capture potential sales without leveraging traditional incentives to obtain final approval.

In response, automotive brands and agency partners are combining traditional vehicle promotion data along with audience targeting segmentation data and insights. This data will help brands and agency partners better target consumers who are not just in-market for a vehicle, but those who have the financial capacity to make a vehicle purchase. This advanced set of data and insights provides the ability to target in-market make/model intenders along with their estimated financial capacity. OEM brands and agency partners can then run more effective retention, acquisition, and conquest campaigns across digital channels.

Extra layer of audience segmentation data for stronger campaign targeting

In the past, OEM brands and their agency partners have leveraged datasets based on unverifiable survey or panel data. This is where audience segmentation comes in.

Instead, sophisticated data today like differentiated data from Equifax is uniquely built using robust data sources, including anonymized, direct-measured data, estimated income and asset data, as well as aggregated credit information. This data only available from Equifax is uniquely predictive of a prospective buyers’ financial capacity.

Why is this important? Not all high incomes are the same.

Every household leverages debt differently. Differentiated data assets like audience segmentation can help OEMs gain fuller visibility into a person’s or household’s financial standing by taking credit-income spending behaviors into account.

With this additional information, OEMs have the ability to target people differently based on their unique financial situation – all while maintaining user privacy.

This level of data enables OEMs and advertisers to differentiate and reach online consumers that are more likely to have the financial capacity to truly purchase their products and services. Anonymized household economic data combined with discretionary spending, credit, demographics, buying behaviors, and insights into make and model preferences, deliver better-matched auto audiences that are more receptive to holiday campaigns and offers.

No doubt, the summertime buying season will feel much different this year. As the country relaxes pandemic-fueled restrictions, the automotive industry now finds itself coping with inventory challenges to meet increased buyer demand.

However, with the right data and insights, automotive brands and agency partners can ensure they’re getting the most out of their creative campaign investments by identifying the right customers who have the spending power to maximize each and every dealership or website visit during the summer.

Joey Watson is currently vice president of the auto direct and marketing services team at Equifax. He leads and supports a team that manages relationships with the nation's largest automotive dealer groups, OEMs and marketing agencies.

According to a news release from Performance Brokerage Services, McCurley Integrity Dealerships sold one of its dealerships to the Lum Family.

Performance Brokerage Services was involved in the sale of McCurley Integrity Toyota in Walla Walla, Wash., to the Lum Family, which has owned and operated dealerships for more than 50 years.

David Lum opened the family’s first dealership in 1969 in his hometown of Astoria, Ore. The store was originally Toyota of Astoria, but the operation has since moved six miles to Warrenton and renamed Lum’s Auto Center, offering Toyota, Chrysler, Dodge, Jeep and Ram.

The company added another store in 2018, again with the help of Performance Brokerage Services, with the purchase of Lum’s Buick GMC Cadillac in McMinnville, Ore.

The newly acquired Toyota dealership will remain at its current location at 606 North Wilbur Ave. in Walla Walla and be renamed Walla Walla Toyota. Justin Teubner, former general sales manager at Lum’s Auto Center of Warrenton, is now a partner and general manager for Toyota of Walla Walla.

Over the last five years, Performance Brokerage Services has been represented in the sale of more than 200 dealerships.

“We would like to thank McCurley Integrity Dealerships for entrusting us with the sale of their Toyota dealership in Walla Walla Performance Brokerage Services partner Jesse Stopnitzky said in the news release. “Working with two first-class and highly ethical organizations, the transaction was smooth, quick and remained confidential through the closing.

“It was important that we found a buyer who shared a similar philosophy of supporting and enhancing their communities. We wish the Lum Family great success with their acquisition,” Stopnitzky continued.

McCurley Integrity Dealerships was founded in 1981 by Bill McCurley. The company still has five stores in the state of Washington, with locations in each of the Tri-Cities and offering six brands. The company believes in being a part of its local communities and participates in numerous charitable events.

For the past 19 years, McCurley has organized an annual Octoberfest that raises donations for the local food banks during the holiday season. Bill McCurley’s son, Mason McCurley, serves as president.

The Lum family has remained active in the Astoria community by supporting various non-profit organizations and serving on boards across Clatsop County.

The dealerships are now under the leadership of David Lum and his wife Shirley’s three daughters Lori, Julie, and Pam.

Representing the Lum Family in this transaction were Craig Nichols and his son, Geoff Nichols, of Nichols Law Group, based in Portland, Ore.

Representing the McCurley Integrity Dealerships in this transaction was Jim Aiken of Aiken Law Group based in Issaquah, Wash.

HGreg.com showed again on Wednesday why it’s one of the fastest-growing automotive groups in North America.

The company announced that it has acquired Buena Park Nissan and Puente Hills Nissan, two established retailers located in the greater Los Angeles area.

According to a news release, the total value of the investment, including a robust inventory and renovations to upgrade to the next-generation storefront design, is estimated at a value of more than $100 million.

Company leadership said the acquisition enables HGreg to continue its growth plans for the West Coast, expand its inventory of quality, pre-owned vehicles and, ultimately, help customers save more, drive happier and enjoy the omnichannel vehicle buying journey that it has committed to streamlining.

“The response we’ve received since opening our first storefront and fulfillment center in L.A. last December has been astounding,” HGreg.com president and chief executive officer John Hairabedian said in the news release. “It certainly contributed to driving us forward, and faster, in our expansion plans.”

Effective immediately, the company said these locations will also offer the in-person and online services that HGreg.com has become known for including:

—Same-day delivery

—Contactless car-buying options

—Five-day money-back policy

—Payment by cryptocurrency

—Access to a deep and varied assortment of quality, carefully inspected pre-owned vehicles.

“Adding transparency throughout the car-buying journey, especially online, helps our customers truly enjoy their experience,” Hairabedian said. “It also gives them the confidence and reassurance that they can do this again – just as easily – whenever they’re looking to upgrade their vehicle or adjust their lifestyle.”

Located at 6501 Auto Center Drive in Buena Park, Calif., and 17320 Gale Ave in Industry, Calif., the new locations will be known as HGreg Nissan Buena Park and HGreg Nissan Puente Hills.

The company highlighted each contains a showroom, office space, services building, multi-story parking and an inventory of more than 500 quality new and pre-owned vehicles.

From a base of 150 employees between both locations, HGreg said it is embarking on a recruitment effort to fill up to 30 additional positions.

“The company stands apart from many in the industry by insisting that sales representatives do not receive a commission based on the value of a vehicle,” HGreg said, while adding that it’s encouraging applications to be submitted at HGreg.com/careers.

Brodie Cobb, the founder and chief executive officer of The Presidio Group, joins the Auto Remarketing Podcast to discuss why the dealership buy-sell market has been so hot over the last six to nine months.

Cobb also addresses the potential for buyers coming in from outside the industry and much more.

Plus, he explains what made the recent Lithia Motors acquisition of The Suburban Collection somewhat unique.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

The flurry of dealership M&A moves continues in February.

We start with a public retailer from the Northwest that has expanded its presence in the Southeast.

Lithia Motors & Driveway announced last week that the group has purchased a Land Rover dealership and a Chrysler Jeep Dodge Ram store from Fields Auto Group. Both locations are in the Orlando, Fla., area.

Lithia also opened a previously awarded Infiniti store in downtown Los Angeles.

“We are excited to welcome the high performing Fields Auto Group to the Lithia & Driveway family," Lithia Motors & Driveway president and chief executive officer Bryan DeBoer said in a news release.

“This acquisition will further expand the reach of Driveway, our digital in-home solution, providing products and services throughout the entire vehicle-ownership lifecycle in our growing Southeast Region.”

The retailer anticipates the two Fields Auto Group stores in Florida will bring in annualized revenue of $200 million, with the LA store bringing in $40 million.

Kerrigan Advisors represented and advised Fields Auto Group on the sale.

“We were honored to represent Fields Auto Group in the sale of these valuable Florida stores,” founder and managing director Erin Kerrigan said in a separate news release. “Orlando is one of the top growth markets in the country, and dealerships there are highly coveted by buyers — especially luxury brands like Land Rover and popular nameplates, such as Jeep and Ram.

“Kerrigan Advisors’ transaction experience and knowledge of the Florida market was key to making this sale seamless and beneficial for all involved.”

Former NADA chariman Fox sells several stores

Next up, Haig Partners said Thursday it advised Fox Auto Group on its sale of Toyota, Honda, Subaru and CJDR stores in Auburn, N.Y. to Jonathan Sobel.

Owners Bill and Jane Fox, who are siblings, also plan to sell their Sharon Chevrolet store to longtime employee Michael Carrow, Haig Partners said in a release.

The Foxes have sold several of their dealerships to their respective general managers over the years.

“When we made the decision to sell, we carefully considered who should represent us. We interviewed several buy-sell advisors, and the clear choice was Haig Partners,” said Bill Fox, who was the 2015 chairman of the National Automobile Dealers Association, in a news release. “We preferred their straight-forward message, and they exceeded our expectations all along the way.”

Said Jane Fox in the release, “This group of dealerships is part of our legacy and we wanted to partner with the advisor that would listen to us and match us with a buyer who would share the respect we have for our customers and employees in Auburn. We wish Jonathan Sobel much success.”

Sobel added, “It's rare to have an opportunity to purchase Toyota, Subaru, Honda and Jeep franchises all together in one well-run group that has been under family ownership for 50 years. We look forward to maintaining the successful business that Jane and Bill built over the years.”

Nate Klebacha is a co-founder of Haig Partners. In the release, he noted: “Bill and Jane are wonderful people. We were honored to work with them through this process. Covid-19 appeared in the midst of the transaction, but the two sides were able to come together for a beneficial outcome. This transaction shows the resilience in automotive retail and how even a global pandemic cannot dimmish demand for well-run dealerships.”

Morrie's buys Wisconsin dealer group

Earlier this month, Morrie’s Auto Group announced it had purchased Brenengen Auto Group, a six-store group in Western Wisconsin.

The retailer made the purchase through a partnership with Brenengen founders Don and Cheryl Brenengen and the group’s management team.

Morrie’s CEO Lance Iserman said in a news release, “We are thrilled to add Brenengen to the Morrie's family. Brenengen is a natural complement to our existing business and has similar values rooted in a no-haggle, best-price approach and a focus on customer experience, community partnership, and overall culture. We are excited about the opportunity to work with Don and the existing Brenengen team to continue to grow the business and realize benefits for our collective customers, employees and brand partners.”

Don Brenengen added in the release, “We are thrilled to join Lance and the Morrie's team. Their culture of innovation and customer service combined with deep industry knowledge will create significant growth opportunities for our employees and a superior experience for our customers. We look forward to working as part of the Morrie’s team to further build the combined company's presence as a market leader in Wisconsin.”

Next up on our NADA Show 2021 editions of the podcast is an interview recorded Friday with Jamie Oldershaw, general manager of DealerRater.

Oldershaw talks with Auto Remarketing's Joe Overby about helping dealers convert positive reviews into future sales, how the dealership review landscape has changed in the last year, how dealers can "showcase" positive reviews and more.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

After releasing two new solutions for store clients, DealerSocket announced the newest member of its board of directors; an executive quite familiar with the automotive and technology worlds.

Appointed to the SaaS provider’s board is the current chief sales officer Ryder System, John Gleason, who previously was chief sales officer at ADP and CDK Global (formerly ADP Dealer Services).

“I am pleased to welcome John to DealerSocket’s board, and I look forward to working closely with him as an advisor to our company,” DealerSocket chief executive officer Sejal Pietrzak said in a news release.

“John brings a deep understanding of the automotive industry as a transformative sales leader for the past 30 years, and we look forward to leveraging his valuable perspectives and insights as we launch our unified solution that seamlessly integrates our Auto/Mate DMS with our CRM and Inventory+ products,” Pietrzak continued.

As chief sales officer at Ryder for the past 12 years, DealerSocket highlighted that Gleason has dramatically transformed the logistics and transportation company's sales organization, spearheaded the creation of an inside sales channel. He also was instrumental in driving Ryder’s revenue growth and market share.

Prior to joining Ryder, Gleason spent 30 years with ADP and CDK Global. As chief sales officer for worldwide sales, he led 5,500 sales associates worldwide and drove accelerated growth through talent development and channel optimization while also improving market share.

“I look forward to offering my experience and guidance to DealerSocket’s executive leadership team, which has done an incredible job building a strong dealer-first culture and integrating Auto/Mate into the company over the past year,” Gleason said.

“DealerSocket is investing deeply in its products and its customer support to offer dealers a connected platform across its suite of solutions. This is the right strategy to disrupt the DMS market and offer dealers seamless and frictionless workflows at every step of the consumer journey,” he continued.

“I believe this will also lead to significant market share growth for DealerSocket. This is an exciting time to join the company and its board of directors,” Gleason went on to say.

DealerSocket to debut series of real-time integrations

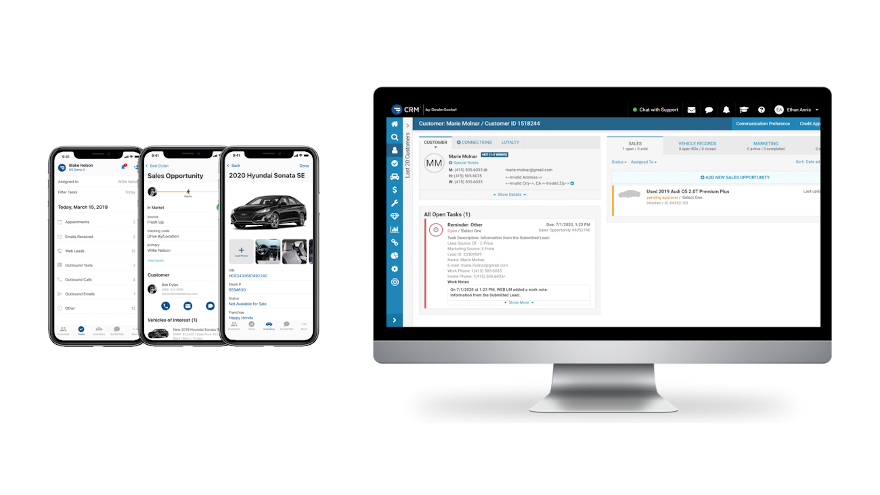

Speaking of technology investments, one of the moves DealerSocket announced in recent days involved the company taking another step toward unifying its Auto/Mate DMS, CRM, and Inventory+ products through a series of real-time integrations.

Designed to improve accuracy by eliminating data rekeying and streamlining the submission of inventory, deal, and customer data into the DMS, DealerSocket explained these new, seamless integrations can deliver a deeply connected experience for users across DealerSocket's products.

The integrations are the result of significant investments DealerSocket directed toward streamlining workflows between its Auto/Mate DMS, CRM, and Inventory+ solutions to help dealers reduce transaction times, improve CSI and deal profitability and further optimize their inventory strategies in what's expected to be another strong year for the used-vehicle market.

“Our focus since acquiring Auto/Mate last year is on unifying our entire platform, so our solutions interact in a very unique way that blurs the lines of where one product stops and the next product starts,” DealerSocket chief product and technology officer Alok Tyagi said in a different news release.

“We now launch into NADA 2021 as a unified solution for all dealers in terms of data flow, our ability to serve as the digital backbone of a connected dealership, the way we can improve productivity through frictionless workflows, and how we guide the customer journey from online to the showroom. This unified experience also extends to how we service and support our customers,” Tyagi continued.

Working with customers, DealerSocket explained that it identified key data points users wanted shared between DealerSocket's CRM and Auto/Mate DMS products, including customer details such as contact information and communication preferences.

The company pointed out that this contact integration also can sync automatically each time a customer record is saved, so a change made to a customer's phone number in service through Auto/Mate's DMS is immediately reflected in the CRM, too.

Not having to confirm customer emails, phone numbers, and addresses in two systems had an immediate impact on time spent preparing sales and service campaigns for Jim Sigel Automotive, which utilizes both DealerSocket's Auto/Mate DMS and CRM solutions.

According to the DealerSocket news release, Jessie Sigel-Dean, the group's CRM coordinator, estimated she now saves anywhere from 10 to 25 minutes a day on her customer outreach efforts.

“This seamless, real-time integration has been super helpful in keeping customer information up to date without having to go into two systems. That’s huge for the service department, where having up-to-date phone numbers is essential,” Sigel-Dean said.

“We’ve been with Auto/Mate for eight years and on DealerSocket’s CRM for six years, and we were super excited about the two companies coming together. Based on what we’ve experienced so far, we’re really excited to see DealerSocket take this integration even further. It’s already made my life easier,” Sigel-Dean went on to say.

Like the CRM, DealerSocket mentioned that key data points for managing inventory were identified for the real-time integration between DealerSocket’s Auto/Mate DMS and Inventory+, including retail price, advertised price, mileage, and certified and title flag.

The company said the result is reduced double entry, increasing the accuracy of the data shared between the two solutions by removing the opportunity for human error.

DealerSocket will also demonstrate during the 2021 Virtual NADA Show a key integration that will unlock critical new features and functionality slated for 2021. Dubbed Unified Users, the integration can allow for a single sign-on experience across DealerSocket’s entire platform of integrated solutions.

“Unified Users represents a crucial part of DealerSocket’s infrastructure capability, enabling new admin controls so administrators at a dealership or across a dealer group can change access rights or disable users across the platform,” Tyagi said.

“It also means enterprise analytics that allows dealers to access data from multiple solutions on a single screen across our products, which then unlocks other capabilities like applying machine learning to those analytics to make the data and insights more predictive,” Tyagi added.

Details of DealerSocket’s next-generation mobile CRM

And in yet more technology investments by the company, DealerSocket also made a move in the mobile space, too.

DealerSocket recently launched its next-generation Mobile CRM app, which the company said sports a modern, easy-to-navigate user interface and streamlined workflows for an ultra-efficient, tap-and-go experience designed to save users valuable time and make accountability management easier with anywhere-at-anytime access to critical data.

Completely redesigned to accommodate the unique processes and preferences of sales, BDC, internet, and management teams, DealerSocket highlighted that its Mobile CRM is available on iOS and Android and can work seamlessly across any device to ensure accurate information across platforms.

The company indicated that dealers should experience an increase in closing ratios with the mobile app’s tap-and-type email and sales opportunity editing, an updated task interface with advanced filtering options and scheduling features, and enhanced customer and inventory search capabilities.

“When car shoppers submit an inquiry, they want instant gratification. When they’re on the lot and want to know what else is in inventory, they expect immediate answers. COVID-19 only accelerated the need for dealers to meet that demand via digital accessibility,” said Darren Harris, executive vice president and general manager of retail solutions at DealerSocket.

“Eliminating barriers to the sale and ultimately improving the customer experience by making the CRM accessible anytime from anywhere, our new Mobile CRM provides users with — as we like to say — the best of socket right in their pocket,” Harris continued in another news release.

DealerSocket said that the tool’s sleek new interface is apparent the moment users click onto the Mobile CRM’s home screen, which features more simplified workflows for accessing important menus and locations within the CRM.

An updated opportunities widget is designed to provide users with an immediate view of the last 20 recently accessed customers, along with filter options that mirror DealerSocket’s desktop CRM, and a global search feature that allows salespeople to look up opportunities by name and phone number.

The company went to mention the updated tasks interface blends workflows from the Mobile CRM’s prior version and the desktop CRM.

Additionally, the mobile tool’s updated inventory look-up feature can provide a new search bar offering search-by-feature functionality.

Furthermore, DealerSocket said the mobile app’s driver’s license scanner workflow also gets a new look and a more condensed click path for onboarding customers into the CRM, while the tool’s VIN scanner makes it easy to add a trade to a sales opportunity. Salespeople can also use the VIN scanner to search inventory.

The new Mobile CRM also can allow users to edit notification settings and switch between dealerships if part of a dealer group.

“COVID-19 confirmed what we always believed — that the CRM needs to be the central hub of a dealer’s retail strategy,” Tyagi said. “That’s why our focus when it comes to our award-winning solution is on streamlining workflows and allowing sales teams to do more from one system.

“The launch of our new Mobile CRM is an extension of that, freeing managers and sales teams to operate within the CRM anytime and from anywhere,” Tyagi went on to say.

The company shared that Zanchin Automotive Group implemented DealerSocket’s new Mobile CRM at four of its 30 rooftops. According to that news release, the impact was immediate.

BDC director Angie Terzic said lead-response times at those locations are down to 10 minutes or less, with team members even using the app to enter new opportunities into the CRM after store hours. Terzic said she likes it because she can address potential issues before they become problems.

“I use it all the time, even when I have access to my desktop. I don’t even take my laptop home with me anymore because I have everything I need on my phone,” Terzic said in the news release. “Now, more than ever, customers don’t want to come into the store. They can do everything online from their phone. Now, so can we.”

For more with DealerSocket, see the episode of the Auto Remarketing Podcast below, which features an interview with Tyagi and Harris.

Perhaps not since the Great Recession has the auto retail industry had a challenging year as it did in 2020.

But amid all the turmoil in the industry, last year “ultimately ended as the most profitable year on record for dealers,” says Erin Kerrigan, founder and managing director of Kerrigan Advisors.

Just consider the stock valuations of the publicly traded groups.

The strength in auto retail is evident in the December/year-end edition of The Kerrigan Index, which tracks valuation trends of the seven public auto retailers (Asbury Automotive Group, AutoNation, CarMax, Group 1 Automotive, Lithia Motors, Penske Automotive Group and Sonic Automotive).

For full-year 2020, the Kerrigan Index was up 29.65%, and for comparison sake, the S&P 500 Index climbed 16.26%, the company indicated.

Each of the component stocks within the Kerrigan Index reached an all-time record at some point during the year, the company said. Additionally, each showed year-over-year gains.

The most significant gain was at Lithia, which was up 127.18%. Next up was AutoNation, which climbed 41.34%, followed by Asbury (up 30.25%), Group 1 (up 28.99%) and Sonic (up 21.29%).

Penske climbed 17.08% and CarMax was up 7.24%.

“What’s really notable is that the auto retail stocks, and The Kerrigan Index, have traded at all-time highs throughout the final months of 2020. In spite of a historically crisis-driven and volatile year, the stocks are valued higher than ever before,” said Ryan Kerrigan, managing director of Kerrigan Advisors, in a release.

“Clearly, Wall Street is bullish on auto retail, and comfortable that it will continue to evolve on pace with technology and consumer behavior,” he said.

The Kerrigan Index certainly had some rollercoaster moments throughout the year. It declined 51.8% to its trough on March 18, then bounced back the following quarter. Eventually, values were approaching records in the third, the company said.

Kerrigan Advisors reported in its Third Quarter 2020 Blue Sky Report that dealership earnings climbed 94% in Q3.

“The rise in earnings helped to create an active buy/sell environment, with 186 transactions in the first nine months of 2020,” said Erin Kerrigan.

“COVID-19 or not, that’s a 15.5% increase over the first nine months of 2019,” Kerrigan continued in the release, with the firm attributing that data point to The Banks Report, Automotive News and its own research.

“Throughout the year, the market has rewarded retail competence, confidence, and proven retail processes. Despite being one of the toughest years in auto retail history, 2020 ultimately ended as the most profitable year on record for dealers,” she said.

And it was a year of a “comeback” that ultimately ended with the aforementioned stock gains for the seven public retailers.

“This was the ultimate comeback year, and auto dealerships were its comeback kids,” Erin Kerrigan said. “In a year of raging unpredictability — from smooth sailing to collapsing financial markets, closed doors to critical inventory supply shortages — auto retail stayed resilient and continued to prosper.”

CallRevu recently upgraded its communications intelligence (CI) solution to help dealerships monitor and improve their communications with customers.

This week, the company launched a platform innovation that harnesses artificial intelligence and machine learning using CallRevu’s unique automotive lexicon developed during the past 12 years from millions of human transcribed calls.

CallRevu highlighted this new technology can analyze all phone communications from every dealership lines and department, distinctively harvesting rich insights and producing actionable data to help store managers improve the customer experience and grow their revenue.

With over 90% accuracy, CallRevu’s CI platform is designed to give dealers what they need — both quantity with quality — to provide the call connectivity metrics with detailed call flow, voicemail monitoring and keyword search combined with customer alerts, customer satisfaction monitoring and spam / robo-dialing reports that pinpoint areas for action.

“At CallRevu, we know that artificial intelligence and machine learning are only as good as the training data,” CallRevu vice president of technology Jeff dePascale said in a news release.

“This is why we have amassed over 100 million calls transcribed by humans to develop the largest, automotive specific lexicon, which enables us to deliver unparalleled quality. And now we do this for every call, and every line,” dePascale continued.

CallRevu also mentioned users will have increased visibility into the customer journey — from inquiry to sale — with rich data points that can help them identify, analyze and optimize their processes and approach.

The company said early adopters are witnessing notable gains in productivity with some dealerships claiming greater than 44% improvements achieved from the new capabilities, intuitive interface and the self-service tools that empower them to do more.

“CallRevu believes data is good, insights are better, but what dealers really want is predictive and prescriptive alerts that focuses their attention on action,” CallRevu chief executive officer Anthony Giagnacovo said.

“CallRevu has a rich history of firsts, and we believe the CI Platform is another example of CallRevu innovation and how we continue to lead the industry, with our sole focus on automotive that allows us to package and deliver information that is intuitive, real-time, mobile-first and readily accessible, and most importantly designed for action,” Giagnacovo continued. “And there is so much more we are bringing to market in 2021.”

For more details, visit callrevu.com.