Criminals are becoming more creative in their approach to commit synthetic ID fraud, and new technology recently detected a ploy by an individual who tried a scheme at two different Michigan dealerships.

According to the Federal Trade Commission, 1.7 percent of identity fraud complaints indicated that an auto-finance contract had been generated fraudulently, up from 0.8 percent in 2015.

To curtail this trend, Equifax is working with Oplogic, a company that manages and processes customer information with a simple ID scan, to help reduce unwanted threats stemming from synthetic ID fraud.

The Synthetic ID fraud occurs when a criminal combines real (usually stolen) and fake information to create a new identity. The two companies’ solutions recently helped stop an auto crime at a Michigan dealership.

Driver’s Synthetic Identity Verification from Oplogic, powered with Equifax identity validation tools, is helping dealers reduce unwanted threats. In the attempted fraud scam, a woman visited a dealership with the intent to purchase a vehicle. When she presented her Texas driver’s license, the dealership concluded that the license was synthetic after running a license scan in the patented Oplogic Deal Operator CRM system.

When the same person made a similar attempt shortly thereafter at a different dealership that uses Oplogic Deal Operator CRM, authorities made an arrest.

“The Oplogic Deal Operator CRM combined with Equifax fraud detection and identity validation tools is helping dealerships stop criminals in their showrooms before the crime occurs,” Oplogic president John Parent said. “This adds a much-needed level of protection for dealers and lenders.”

Using this system, dealers can identify fraudulent credentials early in the sales process and before the test drive occurs. The process involves the dealership scanning the potential buyer’s driver’s license using Oplogic CRM software. During the scan, the license is verified against Equifax data and fraud tools to confirm identity.

“Fraudulent activity has become more complex over the years, and it continues to cost billions in lost revenue for dealers and lenders,” said Ken Allen, senior vice president of identity and fraud at Equifax.

“Our data analytics platforms have also become much more sophisticated, and in partnering with leading solution providers such as Oplogic we are making great strides in reducing the number of fraudsters who attempt to create synthetic identities inside the showroom,” Allen went on to say.

Equifax has expanded its set of offerings that help mitigate synthetic ID fraud with the addition of FraudIQ Synthetic ID Alerts — which are based on patent-pending algorithms that analyze attributes such as authorized user velocity and identity discrepancies to help determine if the identity presented could be synthetic.

Because of responses like “no,” “out of stock,” and “no appointments,” service providers could be losing almost $23,000 annually per location in revenue, according to insight data released from call analytics provider Marchex.

Marchex Institute’s most recent study on auto service agent phone calls with consumers points out how much money stores can often lose out on when unsatisfied consumers don't return after receiving a "no" type of answer.

Businesses with 100 plus locations could lose an average of $2.3 million each year and auto service agents say “no” just about 6 percent of the time, according to the study.

“These types of insights are critical to identifying problem areas across a business and can be the first step toward a solution,” Marchex senior vice president and head of automotive Matt Muilenburg said in a news release. “Companies need to take a closer look at why they’re saying ‘no’ to their customers, consider the revenue loss that results from that, and determine what steps they can take to say ‘yes’ more often.”

While auto service providers say "yes" to consumers most of the time, the study still illustrates room for growth. Stores equipped with these insights and agents with an understanding of the implications that "no" types of responses can help stores be more competitive.

Meanwhile, the study also found out that stores leave consumers unsatisfied the most on weekends.

On weekends, Machex found that among the calls it surveyed, store agents are 17-percent more likely to say that there aren’t any available appointments and they also say that they're closed 24-percent more often compared to weekdays.

Furthermore, the study insights come from over 1.8 million calls made to just about 5,000 stores of seven auto brands, which the Marchex Institute examined for 30 days, according to the company.

Marchex looked out for several different phrases indicating a negative response from dealership agents to see how many calls might end with a negative outcome.

While employing the Marchex script tracking tool, the Marchex Institute measured a total of 50 different phrases and variations suggesting a negative response to customer questions, as well as the frequency agents spoke those phrases to potential customers.

Last month, the company shared that Marchex speech analytics technology has interpreted an estimated 100 million phone calls, and more than 400 million minutes of conversations since April of last year.

Additionally, the call analytics provider explained that agents who offered car shoppers a satisfactory alternative option following a negative response did not make the cut for the study's ‘no’ calls list.

Operators feeling charitable can help the National Independent Automobile Dealers Association next week.

For the sixth consecutive year, ADESA, a business unit of KAR Auction Services, will auction off a premier vehicle during the NIADA Convention and Expo to benefit the NIADA Foundation.

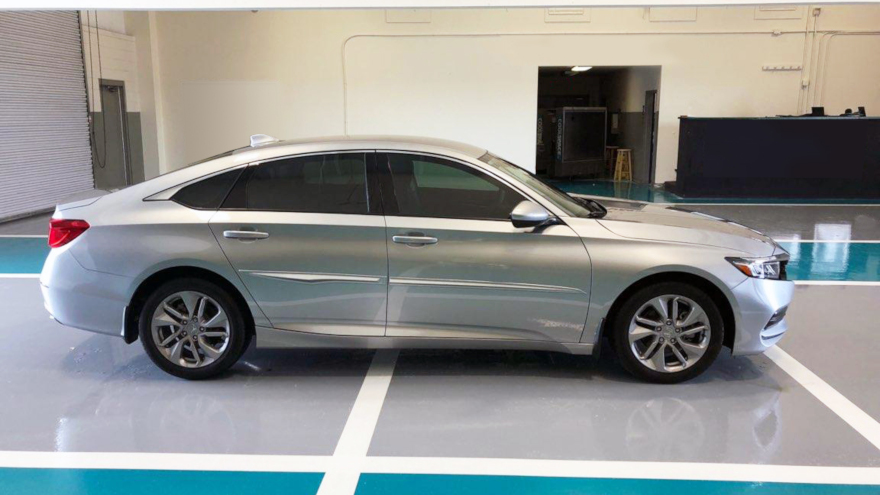

This year's vehicle is a silver 2018 Honda Accord sedan with a mere 1,188 miles on the odometer. The vehicle will be on display in the Expo Hall during the Convention, which begins Monday at the Rosen Shingle Creek Resort in Orlando, Fla. The Expo opens the next evening.

The auction will be held at 1:30 p.m. ET on Thursday at the NIADA Dealer Lounge in the center of the Expo Hall.

ADESA will transport the vehicle free for the winning bidder to any location in the continental U.S.

All proceeds from the auction will benefit the NIADA Foundation, which coordinates the association's commitment to charitable giving as well as awarding scholarships to deserving college-bound students across the nation and providing training and educational opportunities to automobile dealers and the general public.

Past foundation activities include raising more than $180,000 to assist members of the automotive community affected by last year's hurricanes, as well as additional disaster relief efforts, making significant donations to charities nationwide, providing matching funds for local charitable projects and funding endowments for university scholarships.

During the past five years, officials tabulated that ADESA-sponsored auctions at the NIADA Convention have raised a total of $125,200 for the NIADA Foundation. During last year's event, a 2016 Nissan Frontier SV pickup sold for $28,000.

More details about this year's NIADA events can be found here.

Don’t be surprised if some of the stores along “car row” in your market undergo a major ownership change some time before the end of the year.

According to the latest Blue Sky Report released this week, Kerrigan Advisors is expecting 2018 to be an active year for dealership buy/sells with an increasing number of buyers and sellers coming to market with the volume of transactions increasing as the calendar turns.

The report identified three key trends shaping 2018 and into 2019, including:

— Private dealers partner with outside capital to finance growth plans

— Public dealership groups become increasingly acquisitive

— Buyers focus on current performance rather than pro forma when pricing blue sky

“Kerrigan Advisors sees movement toward increased consolidation in auto retail, as well as continued increase in capital investment from outside the industry. Buyers are excited by the long-term opportunity and healthy pace of the current market, and see it as a chance to increase investment,” said Erin Kerrigan, managing director of Kerrigan Advisors.

“At the same time, we expect this shift toward economies of scale, coupled by current high values, to entice smaller dealership groups to sell as part of their estate planning,” Kerrigan continued.

In the report — which can be downloaded here — Kerrigan Advisors went into more detail about why and how outside capital is working its way into the franchised dealer space. The firm believes that the trend began to surface noticeably when Warren Buffet and Berkshire Hathaway acquired the Van Tuyl Group in 2015.

Firm experts said, “a growing pool of professionally managed and invested capital is looking to follow Buffet’s lead and invest in auto retail. The Buffet acquisition not only served as an endorsement of auto retail, it also showed many that such an investment could be done.

“Previously, acquiring and investing in auto dealerships seemed nearly impossible for outside capital,” the firm continued in its report. “Auto retail had a perceived impenetrable barrier to entry. The challenge for most of these private investors is how to invest and with whom.

“Traditionally, auto dealers were disinterested in bringing on equity partners, believing a partnership would overly limit their control of their business. The negatives simply outweighed the positives,” the firm went on to say. “However, as growth through acquisition has increasingly become an imperative to future success, a rising number of dealers are seeking capital partners to fund their acquisition plans.”

With those trends forming a backdrop, Kerrigan Advisors highlighted that during the first quarter the auto dealership buy/sell market continued its high level of activity, fueled by a healthy economy and an increased pool of sellers reacting to auto retail’s future.

Fresh investment and capital from new players, including international buyers, kept the Q1 pace at a high level — though down from last year’s peak, according to The Blue Sky Report.

Kerrigan Advisors explained the continued steady pace of a 17 million SAAR, compounded by pressure on dealership profits and emerging changes to the dealership business model, have essentially defined the market into two camps, which include:

— Buyers who have outside capital or resources to embrace and drive change

— Sellers who are increasingly reliant on OEM incentives for profitability and are concerned about how coming changes will impact generational succession plans

Among the most noteworthy transactions underscoring this trend is AutoCanada’s acquisition of Kerrigan Advisors’ client Grossinger Automotive Group. Kerrigan pointed out the Grossinger transaction was the largest transaction ever made in auto retail by a non-U.S. company.

“As with 2017, we’re continuing to see the economic benefits of consolidation, and how that’s attracting new buyers to auto retail,” Erin Kerrigan said. “There is also a rising interest by many dealers in selling. In particular, smaller dealership groups, who are struggling to maximize profit through economies of scale, are concerned about the viability of their family business for future generations.

“These dealers would rather sell now when values are high then risk the unknown,” she added.

Kerrigan Advisors acknowledged this cautious approach to unknown factors also has changed the way buyers are approaching the market. While the past saw them base valuations on future potential earnings, today’s focus is on current performance.

“In the last decade, buyers mostly priced acquisitions based on expected pro forma earnings post-transaction,” said Ryan Kerrigan, managing director of Kerrigan Advisors. “With industry sales slowing, however, many are now unwilling to base their purchase price on what a dealership could do. They are focused on what the dealership is currently doing in terms of profit. That is what drives value today.”

Blue Sky Report data and analysis from the June quarterly report also included:

— Actual transactions declined quarter over quarter, but the number of franchises represented in each transaction increased by 45 percent. As a result, the total number of franchises sold in the quarter remained on pace with 2017.

— Multi-dealership transaction activity increased 27 percent in the first quarter of 2018, compared to 2017. Kerrigan Advisors expects the pace of multi- dealership transactions to remain high in 2018.

— Among franchises being acquired, domestic franchises (44 percent) maintained their leading position with the highest buy/sell market share, followed by import non-luxury franchises (40 percent) and import luxury franchises (16 percent).

— Import franchises had the highest turnover rate — a reflection of high buyer demand and low franchise supply. The supply/demand imbalance of many import franchises also results in higher blue sky values and multiples.

— U.S. public auto retailers’ U.S. acquisition spending increased 62 percent in the first quarter of 2018, compared to Q1 2017. At this spending level, public retailers are tracking toward over $1.5 billion of U.S. acquisition spending in 2018, a level that would exceed 2014’s peak level.

— Private buyers, however, continue to dominate buy/sell markets with almost 80 percent of franchises. Private buyers are accessing debt and equity capital to finance their growth and compete with the publics for sizable acquisitions.

The Blue Sky Report published by Kerrigan Advisors is a quarterly report on dealership M&A activity, as well as franchise values. It includes analysis of all transaction activity for the quarter, and lays out the high, average and low blue sky multiples for each franchise in the luxury and non-luxury segments.

Cox Automotive discovered two trends originating in May that might frustrate some dealerships, especially stores that might have landed a bit short of monthly goals. In May, wholesales prices moved higher as used-vehicle sales softened.

Before used-car managers reach for their stress balls, here are the specifics.

Cox Automotive determined wholesale used-vehicle prices (on a mix-, mileage- and seasonally adjusted basis) increased 1.25 percent month-over-month in May. This rise brought the Manheim Used Vehicle Value Index to 134.2, which marks a 4.9-percent increase from a year ago and the highest level since last November.

Prices for each of the six vehicle segments Cox Automotive tracks for its index update moved higher in May, with vans leading the way via a 10.2-percent climb.

Coming in roughly at half of that upward price pace were compact cars at 5.7 percent SUVs and CUVs at 5.0 percent. Midsize car prices jumped 4.0 percent, and prices for pickups rose by 2.0 percent.

Even luxury cars squeezed in with a 0.2-percent uptick.

Meanwhile, that slightly more expensive used metal didn’t roll over the curb quite as frequently in May.

According to Cox Automotive estimates, used-vehicle sales volume decreased by 1 percent year-over-year in May. However, analysts contend the annualized pace of used-vehicle sales is up 1 percent over last year.

Analysts also estimated the May used SAAR to be 39.7 million, flat on a month-over-month basis.

So what does all of the May data mean? Cox Automotive offered this clarity with the index update.

“Looking at trends in the weekly Manheim Market Report (MMR) prices, the traditional spring bounce this year started three weeks later than it did in 2016 and earlier years and peaked in April in week 15,” analysts said.

“Used-vehicle prices are now moving down but remain higher now compared to where they were at the beginning of the year than any of the last three years,” they continued. “Price comparisons to last year are starting to get tougher as 2017 saw very low depreciation starting in May and lasting throughout the summer.”

One other note about the wholesale market: Cox Automotive also noticed rental risk pricing strengthened.

Analysts indicated the average price for rental risk units sold at auction in May moved up 8 percent year-over-year. But rental risk prices softened 1 percent compared to April.

Cox Automotive added that the average mileage for rental risk units in May (at 43,000 miles) climbed 11 percent above year-ago readings but dipped 1 percent month-over-month.

Turning the page from the used-vehicle space, Cox Automotive also touched on May new-vehicle sales, which increased 5 percent year-over-year, triggered in part by one more selling day compared to May of last year.

Analysts pegged the May SAAR at 16.8 million, up from last year’s 16.7 million. However, the reading broke the streak of eight straight months of new SAAR coming in at or above 17.0 million.

Cox Automotive stated cars continue to see sharp declines as new sales in May fell 9 percent compared to last year. Light trucks outperformed cars in May and were up 14 percent year-over-year.

Combined rental, commercial and government purchases of new vehicles were up 18 percent year-over-year in May, led by increases in commercial (up 2 percent) and rental (up 30 percent) fleet channels, according to Cox Automotive.

“New vehicle inventories came in under 4 million units for the first time in three months, and inventories are at their lowest levels since January,” analysts said.

Cox Automotive closed its Manheim Index report by highlighting how strong economic momentum continues.

Analysts acknowledged the employment report for May was much stronger than expected as job creation increased to 223,000 when experts had expected 190,000. The prior two monthly numbers were also revised up for a net increase of 15,000 more jobs than originally estimated.

Consumer confidence, as measured by the Conference Board, increased in May to 128, the second highest level for the year and the third best level in more than 17 years.

Vehicles aren’t the only industry merchandise that recently rolled over the curb in the Atlanta market.

Haig Partners represented Ken Page and Scott Smith, principals of Automotive Associates of Atlanta (AAA), in the sale of two of their six Atlanta dealerships to Asbury Automotive Group and Jim Ellis Automotive Group.

Asbury has acquired Toyota of Union City, and Jim Ellis Automotive has acquired Cobb County Kia.

“We are excited to bring Toyota of Union City into our Nalley platform in metro Atlanta,” Asbury chief executive officer David Hult said. “We will be able to take advantage of Nalley’s strong market presence, its leadership and great people in the stores that really generate great returns.

And we have a high-performing store in Nalley Honda just across the street,” Hult added.

Smith explained why he made this move.

“We have been very proud to represent Kia and Toyota in the Kennesaw and Union City communities,” Smith said. “These transactions have allowed me to refinance and fund my acquisition of the remaining Atlanta locations from my long-time partner and good friend Kenny (Page).”

Page Automotive Group and Automotive Associates of Atlanta will maintain ownership of dealerships in Florida, Maryland and Georgia.

“Haig Partners was able show us the value of approaching multiple targeted buyers to generate the value required to make this dream come true,” Page said. “Haig Partners found us great partners that will provide our employees with new opportunities and will represent the local markets well.

“Both Scott and I believe the team at Haig Partners was highly instrumental in managing the negotiation process and bringing the transactions to a conclusion. I am very happy for Scott in his new endeavor and look back on our years as partners with great fondness.”

Nate Klebacha and Kevin Nill of Haig Partners were the financial advisers to Page abd Smith. Stephen Dietrich of Holland and Knight served as legal counsel for the Cobb County Kia transaction, and Robert Bass of Bass Sox Mercer served as legal counsel for the Toyota of Union City transaction.

“Scott and Kenny asked us to help simplify their Atlanta operations, and we presented them with multiple solutions. Ultimately their choice to sell the Toyota and Kia locations was based upon what was best for their employees and the markets they served. We would like to congratulate Jim Ellis and Asbury for acquiring dealerships in the robust Atlanta market,” Klebacha said.

Nill added, “Unlike many situations where a buyer acquires all of the dealerships, this opportunity made more sense to identify and execute transactions with separate buyers. While adding complexity, it generated the funds necessary for Scott to acquire the group’s Atlanta Nissan dealerships.”

The team at Haig Partners has been involved in the purchase or sale of 14 Atlanta area dealerships and more than 280 dealerships nationwide.

Asbury now has 81 stores representing 29 brands in nine states.

Jim Ellis Automotive Group is an Atlanta-based dealership group with 14 stores representing 13 different franchises.

In response to franchised dealers’ frustrations when struggling to source used-vehicle inventory, a Ford dealer in Delaware has launched his own tech startup to deliver a technology solution.

Willis Ford managing partner Santosh Viswanathan is the founder of the new 20groupdealertrades.com, which offers a platform called SPIN where franchised dealers across the country can trade, buy or sell from each other, the company announced Wednesday.

Viswanathan said that the technology he has introduced is an industry disrupter built to save dealers both time and money.

Instead of continually working in their own “silos” to source used-vehicle inventory, he proposes that dealers leverage his company's platform, and work together instead.

“This technology is a disrupter in a retail environment where dealers have largely operated in silos and relied on paying heavy fees at the auctions,” Viswanathan explained in a news release.

When listing used inventory on the platform, each dealer has the control to determine their own time frame for vehicle sales, ranging from 45-day periods to 100 days or more.

A New York dealer group is looking to gain customers without waiting for “ups” to arrive at the showroom or store websites.

As local residents plan for summer travel, a new transportation option is available through Mobiliti, the first multi-dealer, multi-brand, national vehicle subscription service. New Yorkers who need vehicles for summer stays in The Hamptons, Jersey Shore or other vacation destinations, can subscribe to a vehicle to drive anywhere from 30 days to several months.

Beginning in June, Mobiliti is partnering with Island Auto Group to offer consumers a range of vehicles for one monthly fee that includes insurance, maintenance, warranty coverage and roadside assistance.

“A vehicle subscription service is for people who want a car but aren’t ready for ownership,” said Chance Richie, Mobiliti chief executive and co-founder. “It’s similar to a lease, but without the things consumers dislike most about leasing including long-term contracts and upfront costs, with the added benefits of bundled insurance, maintenance and roadside assistance.”

Using the Mobiliti app, available now on the App Store and Google Play, customers will be able to view available inventory at Island Auto Group after launch and select the vehicles to fit their needs and budget. Each vehicle is uniquely priced based on make, model and mileage options. There is no cost to become a Mobiliti member, but approval requires a minimum age requirement, good driving record, credit card and valid U.S. driver’s license.

“Knowing a lot of New Yorkers need a vehicle just for the summer, we are launching the Mobiliti subscription service with Island Auto Group in two phases,” Richie said.

“We’re offering limited vehicles this summer and will ramp up and increase our inventory in early fall to include a wider variety of makes and models,” Richie went on to say.

As new-vehicle sales plateau and the inventory of used vehicles increases this year, Mobiliti insisted that it can help dealers generate new business by providing customers with an alternative to leasing or buying, utilizing existing dealer inventory for a premium subscription service that can lead to additional sales.

“Mobiliti is helping to create another revenue stream and drive new customers to the showroom and service bays,” said Josh Aaronson, co-owner of Island Automotive.

“The Mobiliti platform also allows us to easily bundle mobile technology and a comprehensive insurance product with our inventory to offer a compelling subscription product to our customers” added Marcello Sciarrino, co-owner of Island Auto Group.

Mobiliti is working with Ally Financial to provide fleet financing credit facilities to qualified dealer partners. More details about that relationship is contained in a previous Auto Remarketing report, available here.

Now members of the American International Automobile Dealers Association say they’re going to “Google” something, it could have a vastly different meaning.

On Wednesday, AIADA announced a new affinity partnership with Google.

The association highlighted that Google’s automotive team supports manufacturers and dealers by enabling them to reach the right audience with the right message in the right moments.

The team is responsible for bringing the best of Google’s consumer insights, both national and regional, to their clients to empower them to make more informed marketing and business decisions.

Google is the only company endorsed by AIADA in this unique online space.

“Today’s announcement marks the addition of Google’s innovations in web search and advertising that have made its website a top Internet property and its brand one of the most recognized in the world,” AIADA president Cody Lusk said.

“As our members move their marketing dollars from more traditional advertising venues to online, it is increasingly important that we have partnerships to help them navigate this crucial transition to the web,” Lusk continued.

Meanwhile, AIADA and Google are collaborating on a free webinar to help managers and their store teams in a session titled, “Modern Search for Automotive Dealerships.”

The free webinar will be presented by Kelly McNearney, senior automotive strategist at Google and Peter Leto, head of industry automotive retail sales at Google. McNearney and Leto plan to discuss:

1. The latest data on automotive shoppers

2. How to identify and communicate with customers in your market

There are two opportunities to watch the webinar on June 19 with a session set for 10 a.m. ET and another session scheduled for 4 p.m. ET. Store personnel can register for the free event by going to this website.

AIADA emphasized that it researches hundreds of companies serving the automobile industry and selects only those firms that provide the highest value and quality products, sales, and services to participate in the member benefits program as an affinity partner.

For more information, visit AIADA.org.

Perhaps dealership managers won’t have to send lot porters to move those fuel-sippers to the front line for those Memorial Day weekend sales festivities just yet.

It’s true potential buyers likely will be paying a little more for fuel just to get to your dealership.

AAA reported this week that gas prices jumped 12 cents during the past 14 days and 6 cents since last Monday. AAA also indicated the movement pushed the national average to $2.93 — the highest price point going into the Memorial Day weekend since 2014.

But quick online poll orchestrated by Kelley Blue Book gave some indication that those additional costs might not overly influence buyers who could be buying as dealerships ramp up sales campaigns this Memorial Day weekend.

A majority of new-vehicle buyers — 60 percent to be exact — report that recent spikes in gas prices have not played a role in the new vehicle they are considering, according to the KBB.com poll.

As expected, Kelley Blue Book pointed out that survey participants who indicated higher prices have impacted the type of vehicle they are considering are now likely looking at smaller, less expensive, more efficient transportation.

While KBB didn’t have specifics about where survey participants resided, AAA did have concrete location information about where costs at the pump are increasing the fastest.

AAA reported that 14 states tout an average price at the pump of $3 or more. Outside of the typical West Coast states that often pay most for fuel, along with Idaho and Utah, AAA noted this count includes six Northeast and Midwest states, including Connecticut, Pennsylvania, New York, Washington, D.C., Illinois and Michigan.

In addition, AAA pointed out that Arizona, New Jersey, and Rhode Island are all within 4 cents of hitting the $3 mark.

“Compared to an average of the last three Memorial Day weekends, pump prices are nearly 50 cents more expensive and climbing,” AAA spokesperson Jeanette Casselano said in a news release. “Trends are indicating that this summer is likely to bring the national average to at least $3 per gallon.”

The KBB.com survey found that the “reasonable” price for a gallon of gas is $2.50, according to respondents.

Kelley Blue Book added that respondents indicated $4 per gallon is the tipping point, where fuel costs would greatly affect the type of vehicle a person will purchase.

Autotrader executive analyst Michelle Krebs offered additional perspective to Auto Remarketing on Wednesday afternoon, reflecting back a decade ago when gas prices surged and large, not-so-efficient vehicles became as appealing as the stale pastry inadvertently left behind after the last dealership sales meeting.

“As our survey showed, consumer fears about gas prices are not effecting consumer decisions yet,” Krebs said. “I think that could change if prices continue to go higher and for a sustained period of time.

“Dealerships now have a full range of vehicles,” she continued. “There are certainly small and midsized cars out there that get great fuel economy. But you’re not seeing consumers move away from sport utility vehicles. They really like them for the practicality and versatility. There isn’t the fuel-economy penalty that there used to be say 10 years ago when we had a gas-price spike. … The fleet 10 years ago was vastly different.”