As plush as showrooms can be sometimes, consumers often do not want to spend hours finalizing vehicle delivery, so Chase and AutoFi are collaborating to help dealers.

On Thursday, Chase announced a partnership with AutoFi, a financial technology company that helps customers select and finance vehicles through their dealers’ website and reduce the time it takes to complete the sale. Chase is the first national bank on the AutoFi platform.

“AutoFi helps dealers provide a fast and easy digital car-buying experience that consumers want,” said Mark O’Donovan, chief executive officer of Chase Auto Finance. “Our customers are our top priority — both dealers and car buyers. We want to provide them with the best financial experience whether they are in a dealership or online.”

Nearly half of consumers want to purchase and finance vehicles online, according to Chase’s research.

The AutoFi digital retailing platform can connect dealers with buyers and finance companies. Chase pledged to deliver financing terms online through the AutoFi platform, often within seconds.

“We are thrilled to partner with Chase. We share a common vision of using technology to deliver a delightful consumer purchase experience,” said Kevin Singerman, chief executive officer of San Francisco-based AutoFi.

“Our partnership brings tremendous value to the dealer community leveraging the breadth of Chase’s full spectrum lending and automated capabilities to deliver a comprehensive digital retailing solution to dealers across the nation,” Singerman continued.

For more information about Chase Auto Finance, visit www.chase.com/auto-loans or www.chasedealer.com.

Along with a trio of perspectives from the auction and dealer worlds, the Black Book Market Insights report looking at the first full week of activity in 2018 showed truck segments with larger depreciation than cars.

Editors also determined only one vehicle group — subcompact luxury crossovers — maintained its value from the previous week. Black Book also noticed compact vans saw the heaviest depreciation, dropping in value by 1.70 percent.

“The first week of the year saw used-vehicle values continuing to decline at a pace not much different from the average weekly decline in the month of December,” said Anil Goyal, senior vice president of automotive valuation and analytics at Black Book.

Volume-weighted, editors reported that overall car segment values decreased by 0.57 percent last week, slightly improved from the average weekly decrease of 0.62 percent in values spotted during the previous four weeks.

Black Book indicated the luxury car segment decreased in value at the highest rate among all the car segments.

Again looking at volume-weighted data, editors found that overall truck segment values (including pickups, SUVs, and vans) decreased by 0.66 percent last week, slightly worse than the average weekly decrease of 0.62 percent in values reported during the previous four weeks.

The opening stanza of 2018 allowed Black Book’s representatives in the lanes to gather expectations from a wide array of industry professionals. The rundown began with an auction owner in South Carolina.

“Auto auctions can always use more cars and that supply need will continue in 2018,” the owner said. “The new tax plan should be a boost. The industry could use that surge since the ‘tax season’ has become shorter.”

Next, Black Book collected the thoughts from an executive at one of the auction chains.

“I believe the supply side of the auction business will grow due to more off-lease and repo units becoming available to remarketers. I also feel that the overall dynamics of the industry will be similar to 2017, which is good.”

Finally, Black Book relayed the outlook of a franchised dealer from Georgia.

“We feel like our new- and used-car business will improve in 2018 from a pretty darn good 2017. All of the economic indicators substantiate that theory and the recently passed tax laws should provide a boost both short- and long-term,” the dealer said.

In my more than 15 years in the auto industry, I’ve seen various ups and downs in the market as well as both wild optimism and doom and gloom. We’ve experienced record-breaking new-car sales the last few years, and as we dive deep into 2018, most dealers are optimistic that we’ll continue to enjoy strong sales, with only a small decline in overall volume.

Here are three trends to keep an eye on in 2018:

Tight used-car inventory

Following what’s now called the Great Recession in 2008, we saw a lot of belt tightening both from consumers and dealers. That was followed by “Cash For Clunkers” and also the trend of consumers hanging on to their vehicles for eight to 10 years before eventually selling or trading them in. Fast forward a decade later, and most of the consumers who decided to hold on to their used car longer than normal have finally given in, disposed of their vehicle, and upgraded. The result? Fewer in-market car shoppers ready to sell, trade and purchase. Which of course means less readily available inventory for dealers to stock their lots with.

Used-car acquisition is at the core of any strong dealership’s business model, and finding the “right” units to stock isn’t easy. Over the last several years, it’s been even tougher to find inventory through traditional channels (physical auctions, trade-ins, etc.)

The recent hurricanes have also had a significant impact, with Black Book estimating that up to 1 million vehicles (including commercial and fleet vehicles) along the Gulf Coast were salvaged. That development sucked the inventory out of many markets, as used vehicles were routed to the flooded areas where demand was high.

What we’ll continue to see in 2018 is increased competition for a limited inventory pool. That means dealers will need to roll up their sleeves and look for alternative sources of used vehicles. That might mean more online and non-traditional auctions, dealer-to-dealer transactions, and street purchases.

Consolidation will continue

Large dealer groups and mega chains will continue to grow and expand in 2018. That can either be a threat to or opportunity for smaller dealers, depending on how they position themselves.

Let’s face it. The mega chains have economies of scale that single-point or small multi-roof operations just don’t have. At the same time, though, large dealer groups are much like a battleship, turning slow and unable to react quickly in some instances.

Single-point and small dealer groups have the ability to pivot and change direction quickly.

They can try new strategies for vehicle acquisition, sales and marketing, and quickly gauge results and implement change. They can also harness the power of selling “local” and leverage relationships within their community.

The good news for smaller dealers is that they can operate just as efficiently as larger dealer groups. The mega chains have the resources to analyze data and optimize local inventory, but so do the small dealers who implement the right inventory-management tools.

The right time to research new tools and vendors isn’t when sales are down; it’s when things are going well. So if a downturn is coming, and it will at some point, be ready. Get your house in order now, and make sure your team is armed with the processes and tools it needs to be as efficient as possible for the lowest monthly cost to your store.

More distractions

Is your dealership worried about self-driving cars, vehicle-subscription services, and ride sharing? How about Carvana grabbing market share, or Amazon getting into auto sales?

These developments are real, they have legs, and they will take some market share from local dealers. But there’s no need to panic. There is a long runway in front of us before some of these things take off. In some instances, the infrastructure, processes and regulations are potentially decades away.

I predict we will see small incremental changes in pockets around the country, but not to the extent that the auto industry will be completely revolutionized in 2018.

Rather than worry about things you can’t control, you should continue to focus on what you can control: your inventory, merchandising and customer experience. Leveraging good up-to-date data will help you select and sell the rights cars at the right price for your local market.

Also, nearly all dealers can benefit from creating an “Amazon-like” experience for shoppers. This means total transparency across all departments, a quick and simple way for consumers to transact online, a customer-first approach, zero-pressure sales departments, and top-notch customer service. Focus on speed and making it easy for your customers to do business.

Overall, I think 2018 has the potential to be a great year for dealers! Those positioned to see the most success will be the ones that re-evaluate their processes and operations regularly (as every good dealership that wants to evolve and grow should do).

Dealers, don’t be distracted by all the noise of pending disruption. Listen to it, take note, and be cautious. But remember, focus on what you can control, and position yourself accordingly in your local market. I wish all of you a Happy New Year and continued success in 2018.

Josh Dougherty is vice president of sales with DealersLink (www.dealerslink.com), an automotive systems integration and networking technology company based in Broomfield, Colo.

Larry H. Miller Dealerships recently acquired a Nissan store in Centennial, Colo., growing its footprint in the Denver Metro area to 12 stores.

The store has been renamed Larry H. Miller Nissan Arapahoe and is located at 10030 East Arapahoe Road.

“Nissan has been a standout brand for us, and this location on Arapahoe Road is very conducive to selling cars,” LHM president Dean Fitzpatrick said in a news release. “We look forward to continuing to operate with integrity and provide an outstanding level of service to our customers as we grow in the Denver market.”

LHM now operates a total of 14 dealerships in Colorado and employs over 1,200 people across the state, according to the group.

Larry H. Miller Nissan 104th opened just last year. Larry H. Miller Dodge Ram Havana, Larry H. Miller Colorado Chrysler Jeep, Larry H. Miller Fiat Denver and Larry H. Miller Nissan Southwest opened in 2016.

Additionally, LHM’s first Nissan store, Larry H. Miller Nissan Highlands Ranch, opened in 2006.

The group’s portfolio includes 64 dealership locations in seven western states.

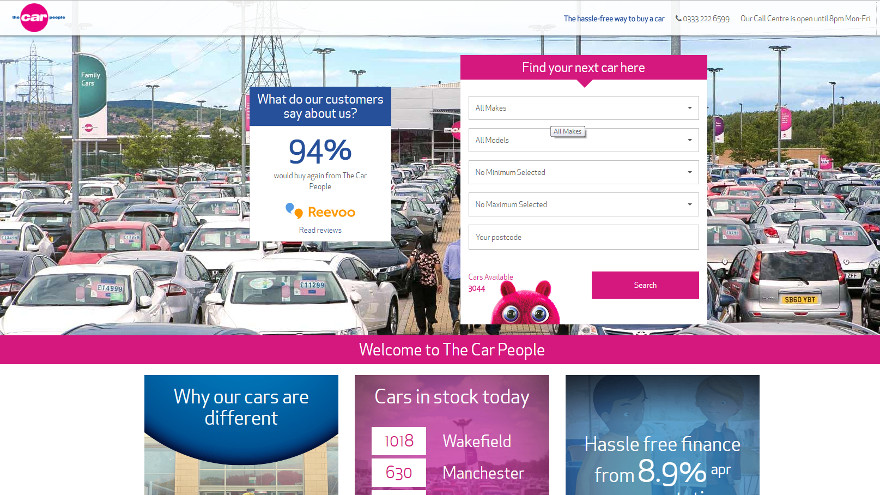

Penske Automotive Group is buying another used-car retailer in the U.K., a move the group’s chairman says “almost doubles” its standalone pre-owned store business in the country.

The dealer group said Tuesday it has signed a deal to purchase The Car People, a used-car retailer with four large-scale locations that sell a combined total of approximately 18,000 units per year.

The Car People launched in 2000 and has stores in Wakefield, Sheffield, Manchester and Warrington, Penske said.

“I am excited to be joining forces with the team at The Car People, a great business that operates under a similar model to our own,” Penske Automotive Group chairman Roger Penske said in a news release.

“The acquisition of The Car People strengthens the company’s market position in our second largest market, almost doubles the size of our U.K.-based Used Car Supermarket business, and continues to further our diversification strategy within the transportation services industry,” he said.

The purchase, which is subject to certain conditions, will likely close in the first quarter. The dealer group estimates The Car People will bring in about $300 million in annualized revenue, and estimates annualized accretion from the deal at $0.05 to $0.07 per share.

This follows a similar move Penske made in early January, when it announced an agreement to buy CarShop, a U.K. chain of five standalone used-car retail stores. That acquisition was completed in February.

“The acquisition of The Car People enables us to accelerate the expansion of our Used Car Supermarket Division and reinforces our commitment to significantly grow our used-car business,” said Darren Edwards, chief executive of Penske’s U.K. operations.

“Combined with the acquisition of CarShop earlier this year, this new acquisition will provide for potential significant operational synergies within this part of our business,” he said.

Stateside, Penske announced a deal last December to buy U.S.-based used-car retailer CarSense, closing that acquisition in January.

Both moves from earlier this year appear to be bearing fruit for the company.

In the third quarter, Penske Automotive’s CarSense and CarShop standalone used-car business lines retailed a combined 11,626 units, according to company earnings.

Year-to-date, which includes results since acquisition, the standalone platforms had retailed 30,952 used units through three quarters.

Quarterly revenue from the standalone stores in Q3 approached $200 million, while year-to-date revenue was at $535.7 million.

Gross profit per unit retail was at $1,152 in the quarter, with the year-to-date figure at $1,222.

F&I gross profit per unit on these sales were $1,188 in Q3 and $1,182 year-to-date through Q3, putting the total variable gross profit per unit at $2,340 and $2,404, respectively.

During the Q&A portion of Penske’s quarterly earnings call in October, Roger Penske was asked if his viewpoint on CarShop and CarSense had changed since the dealer group purchased the respective used-car standalone retailers.

“Yeah, it’s changed. I like it more,” Penske said with a laugh.

“I think we’re very fortunate to get into this business,” he said. “The technology, the people. We’ve had no turnover with senior management. Both of these businesses, I think they applaud the fact we’ve come in with capital, with ideas, with an expansion mode offense.”

DealerRater has introduced additional enhanced offerings as part of its new Connections product suite that is designed to create personal connections between dealerships’ top salespeople and ready-to-buy shoppers.

First launched in September, DealerRater Connections allows dealerships to create dealer and employee profiles linked to their reviews shared across DealerRater’s strategic syndication partner sites.

The new DealerRater Connections Plus leverages ReviewBuilder, which offers users an automated and customized way to earn more reviews. And the new Connections Premier offering provides dealerships with a dedicated Success Partner whose role is to jumpstart onboarding and keep employee profiles up-to-date.

“Over the past 15 years, we have witnessed a growing importance around a dealership’s online reputation to build more trust in the car buying process. In that time, consumers have written more than four million dealership reviews on DealerRater,” company general manager Jamie Oldershaw said in a news release. “In an effort to bring our dealer partners a new level of automation, convenience and personalization to their review-building program, we’re thrilled to introduce DealerRater Connections Plus and DealerRater Connections Premier.

“We know the majority of car buyers prefer to select a salesperson before arriving at the dealership, and 80 percent of DealerRater Certified Salespeople say their employee profile helps them sell more cars,” he said. “It goes without saying that we want to make it as easy as possible for dealers to reach shoppers by building their digital footprint and drive business growth.”

Additionally, using ReviewBuilder, dealers can solicit up to four times more reviews automatically via text or email through integrations with most DMS systems, according to DealerRater.

“DealerRater reviews help me stand out in a crowd of other salespeople and lets the customer know I’m a trustworthy sales consultant who will take good care of them,” said Rick Kruger, DealerRater certified salesperson and sales and leasing consultant at Don Ayres Honda in Fort Wayne, Ind.

“Building strong rapport with a customer is critical to making a sale, and through my employee profile I get to build that relationship before they even walk in the showroom. Not to mention, I have more customers seeking me out – some have traveled more than 150 miles just for me,” Kruger continued.

What was nurtured in the classroom is now ready for deployment to help your dealership service drive.

This week, EFG Companies announced the launch of Driver’s Advocate, a mobile app representing the culmination of both the 2015 and 2016 Northwood University Innovator of the Year Award winning products. Driver’s Advocate was designed to foster greater consumer loyalty through service drive retention, while also providing theft protection and inventory management.

Driver’s Advocate provides consumers with:

• A service scheduler

• Direct, mileage-based messaging with service and maintenance reminders

• A loyalty point tracker, where loyalty points can be used for discounts on services provided, and/or as a down payment towards their next vehicle purchase with the selling dealership

• A theft tracker that alerts consumers when their vehicle moves while they are not in it

• An easy-to-use fuel finder

The mobile app features click-to-call roadside assistance, centralized, easy access to consumer protection plans, recall notifications, a service center locator, full vehicle information repository and transparent dealer pricing.

“Dealers offering Driver’s Advocate benefit from a significant customer retention tool through the app’s service scheduler, couponing feature and maintenance notifications based on individual consumer mileage,” said Greg Grimes, vice president of operations with the Rohrich Auto Group. Grimes served as a mentor in the 2016 Northwood Innovator of the Year Contest, and Rohrich Auto Group is the first to pilot Driver’s Advocate.

“In addition, dealers have the ability to use the loyalty point tracker as a way to encourage customers to return for their next vehicle purchase if they choose to apply the loyalty points towards a cash value for a down payment,” Grimes added.

According to nationwide consumer research conducted by EFG Companies, more than 65 percent of consumers desire reminders about their vehicle maintenance, and the majority would also like to receive service reminders and specials from their dealership.

The research also indicated 63.5 percent of respondents said the availability of a dealership loyalty program would impact their decision to service at a dealership. And according to the National Automobile Dealers Association, 83 percent of customers that perform their routine maintenance with the selling dealer will return to them to purchase another vehicle.

“In today’s retail automotive market, the finance and insurance office of a dealership has the unique opportunity to take on a different role in addressing two significant dealer priorities,” EFG Companies president and chief executive officer John Pappanastos said.

“Through products like Driver’s Advocate, dealers can create those one-on-one consumer relationships to address individual needs rather than taking the mass approach,” Pappanastos continued. “In addition, these products have the potential to increase service drive volume and traffic, translating directly to repeat and referral business, which, as we all know, make up the lowest cost sales for the average dealer.”

Of the top mobile app attributes that EFG’s research showed consumers find most valuable, eight are available in the Driver’s Advocate app, including:

—Recall warnings

—Regular maintenance reminders

—Repair history

—Tire and wheel reminders

—Service interval reminders

—Contact information for warranties and roadside assistance

—Vehicle warranty or service contract details

—Service center locator.

In a world where, as reported by Cox Automotive, 70 percent of vehicle buyers never return to the dealership for maintenance, EFG Companies is convinced the mobile app will increase service drive retention by rewarding customers for their loyalty and keeping vehicle maintenance top-of-mind.

By providing consumers with instant access to their vehicle information and their protection plans through Driver’s Advocate, dealers also have the ability to enhance their customer service levels in the service drive.

“Using the app, a customer can pull relevant product and vehicle information for the service manager to put into their system, increasing the efficiency of initiating and processing claims,” said John Stephens, executive vice president at EFG Companies. “By streamlining claims processing in this way, dealers will be able to initiate work on the vehicle much faster, and get consumers back on the road, leading to a more satisfied consumer base.”

Lastly, the theft tracking feature is obviously useful for consumers, but also dealers before the sale.

“This opens several doors when it comes to inventory management,” Stephens said. “Dealers can track their inventory in real time, access test drive history and of course monitor for inventory theft.”

According to a 2016 study by the Insurance Information Institute and the Federal Bureau of Investigation, vehicle theft is on the rise. Officials said, 707,758 motor vehicles were reported stolen in the 2015, up 3.1 percent from 2014.

The Driver’s Advocate mobile app is based on the winning products for the 2015 and 2016 F&I Innovator of the Year competitions at Northwood University.

The winning concept from 2015 was originally designed by three Northwood undergraduate students to provide consumers with a convenient way to stay current on vehicle maintenance and prevent theft. The 2016 winning concept was designed to address Millennial and Generation Z concerns around financial security and deliver on dealership goals around customer retention.

According to a recent report by J.D. Power, millennials will nearly replace Baby Boomers in the car market by the year 2020. Driver’s Advocate addresses three concerns that are top of mind for this generation.

Saddled with $1.31 trillion in student loan debt, EFG Companies insisted this generation is hyper aware of taking on more debt. Using the point tracker, millennials have the ability to reduce or even eliminate their out-of-pocket expense in putting a down payment on their next vehicle.

By monitoring the status through a simple app, EFG went on to mention consumers can receive updates when their vehicle moves while they are not in it, as well as stay on top of vehicle maintenance to preserve resale value.

EFG and Northwood developed this program to spur a greater level of innovation in the F&I space to meet the rapidly evolving consumer demands. Every other year during Northwood’s fall semester, six teams of Northwood undergraduate automotive marketing and management students compete to conceptualize and build a new F&I product while earning course credit. The winning product is selected by a panel of judges based on its business merit and potential to be successfully developed for the retail automotive market.

“This marks the first competition product rolled out to the market,” Northwood University president Keith Pretty said.

“We expect great things from this product roll-out as it serves as a reflection of our philosophy of hands-on learning,” Pretty continued. “This will give our current students enrolled at Northwood the unique opportunity to see the impact their entrepreneurism and leadership can have on the industry.”

A percentage of the revenues generated from Driver’s Advocate will also be returned to Northwood University.

For more information, go to this website.

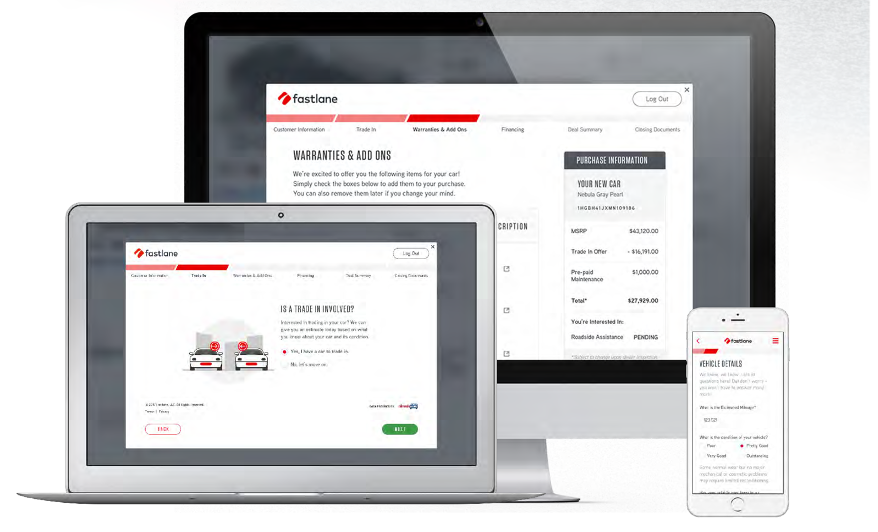

Fastlane recently announced it will enter the independent and used-car dealer market in January.

An e-commerce platform that gives automotive dealerships the ability to customize their online check-out processes, Fastlane facilitates an online car buying process that both showcases dealers’ available inventory and allows customers to acquire financing, service contracts and insurance.

With an initial focus on franchised dealership groups since its launch earlier this year, the company said it will enter the independent and pre-owned car dealership segment aggressively next year.

“We get numerous inquiries from independent and used-car dealers online and at trade shows, and now we have a product tailored and reasonably priced for these types of dealerships,” Fastlane vice president of sales David Luce said in a news release.

“There are nearly 30,000 independent dealerships in the U.S. market, representing 35-40 percent of the vehicles sold online. With online sales now being a key dynamic in the auto market, we believe our platform is uniquely positioned to help independent and used-car dealers stay competitive,” Luce continued.

Additionally, key tasks associated with the car buying process that Fastlane takes care of include: year, make, model, specifications and price information on each vehicle; warranty and service contract options; aftermarket product options; trade-in evaluations and accurate retail and lease payment information.

“We built Fastlane knowing that the online car-buying process typically differs from dealer to dealer and from region to region,” Fastlane chief executive officer Brandon Hall said.

“Our technical teams work closely with each dealer to determine how their online car buying experience should work. Then we configure it to their satisfaction. It’s a win-win that makes online purchasing easy for car dealers and their customers,” he said.

Ally Financial announced Monday that it has chosen 47 U.S. dealers as nominees for the 2018 TIME Dealer of the Year award.

Each year, the award recognizes several successful dealers who show a strong commitment to community service.

In addition to a $1,000 contribution from Ally for each dealer's charity of choice, the 47 nominated dealers will be formally honored during a ceremony at the National Automobile Dealers Association's 2018 NADA Show on March 23 in Las Vegas where Meredith Long, TIME news, luxury and style senior vice president and general manager, will introduce this year's nominees.

“Only a small fraction of the roughly 16,500 franchise dealers across the country are nominated for this award each year, putting the nominees into an elite group of automotive leaders,” Ally auto finance president Tim Russi said in a news release.

“This year's nominees have proven they understand, care and 'do it right' for their communities by giving in ways that make a difference to those in need. We are honored to celebrate their incredible stories and hope their examples motivate others to give,” Russi continued.

As the exclusive sponsor of the award program for the past seven years, Ally has contributed nearly $600,000 to the TIME Dealer of the Year program, according to the company.

Additionally, this year’s nominees will also be featured on AllyDealerHeroes.com, which promotes the philanthropic contributions and achievements of the award honorees.

Past award winners include Swope Toyota, Van Bortel Motorcars, AutoFair Honda, Teague Auto Group, Michael Alford and Mike Shaw Automotive Group.

While roughly 90 percent of car shoppers find printed brochures helpful when in search of their next vehicle, far fewer dealers feel the same, according to a recent study.

The Latcha+Associates' study that focuses on the car-shopping journey and the impact of marketing content such as printed brochures, found that just 32 percent of high-volume dealers and only 14 percent of low-volume dealers find printed brochures to be either extremely impactful or very impactful on driver's purchase decision.

Meanwhile, 61 percent of shoppers found them to be “somewhat helpful,” and 29 percent said they are “very helpful.”

After websites at 86 percent and automotive magazines at 30 percent, brochures are a top shopper touchpoint; 28 percent of shoppers report using a printed brochure, and 23 percent downloaded a brochure, according to the study.

Interestingly, the study also shows that at 26 percent, social media currently trails printed brochure popularity among shoppers.

Across gender and generation breaks, printed brochure utility is highly consistent as well. In addition to 88 percent of men and 91 percent of women, 88 percent of millennials, 89 percent of Gen X’ers and 94 percent of Baby Boomers said they find printed brochures either “somewhat helpful” or “very helpful.”

While printed brochures were found to be as important to dealers, many find printed brochures customized with dealer information beneficial, about six-in-ten salespeople (59 percent) that have seen customized brochures find them to be “very valuable.”

Additionally, among shoppers who have not used a printed brochure in your shopping experience, most said they were not offered one, (44 percent), followed by doesn’t help me compare vehicles (35 percent), and not enough detail available (27 percent).

When asked about what they think are the most important elements of printed brochures to shoppers, the study found that dealers feel brochures with information accompanying vehicle feature options, colors and drivers POV photos to carry the greatest value.

The most important printed brochure elements according to dealers include:

- Features and options, 55 percent

- Color and trim, 15 percent

- Specifications and dimensions, 14 percent

- Model line-up, 6 percent

- Photos, 6 percent

- Fuel economy, 4 percent

Latcha+Associates conducted its study comprised of focus groups, mobile surveys, phone interviews and in-person interviews with market research firm GfK.

“GfK used its vast experience and knowledge of location-based, mobile shopper marketing research to gather timely, relevant information on the impact of marketing content within the automotive purchase journey,” GfK executive vice president of consulting, automotive Dale Drerup explained in a news release introducing the study. “Combining that with Latcha's unrivaled automotive knowledge, we produced an objective, top-quality study detailing the different roles and value of marketing content throughout the in-market auto shopper’s path to purchase.”