LotLinx recently announced a new partnership to fully link VistaDash's marketing metrics platform to LotLinx TURN, which provides dealers with metrics on targeted shoppers, total spend, sold VINS, conversions and engagements on vehicle detail pages.

To help dealers make marketing decisions that improve their ROI and digital ad spend, LotLinx customers now have access to VistaDash metrics via their TURN dashboard, the company said.

The newly integrated VistaDash platform is the result of research by PCG's Brian Pasch. LotLinx said he designed the platform to both provide dealers with unbiased marketing metrics and yield helpful insights related to different business goals.

"VistaDash is the brainchild of Pasch, whose book "Swimming with the Digital Sharks" has been hailed by the auto industry for its research on digital advertising inefficiencies and dealers' inability to obtain actionable marketing metrics," LotLinx said in a news release.

The platform's metrics inspect ad traffic quality and allow dealership managers to easily examine and identify strategies for increasing their return on ad spend, according to the company.

"With VistaDash, it's our mission to help dealers finally understand their data," added Pasch.

He said "through this partnership with LotLinx TURN, our products are working side-by-side to provide our clients with strategy, transparency and actionable data to help them succeed—and that is invaluable in today's digital age."

Additionally, LotLinx said it was the primary sponsor for PCG's seven-city Automotive Engagement Conference held earlier this year where the companies showed dealers its latest online strategies for connecting with shoppers.

LotLinx and PCG will be at the upcoming Digital Dealer 23 Conference and Expo from September 18-20 in Las Vegas.

The companies plan to educate dealers about avoiding "digital sharks" and utilizing data-driven solutions, according to LotLinx.

While it appears dealers are having trouble fulfilling one specific segment on their inventory shopping lists, Black Book’s latest price update indicated dealers aren’t paying quite as much when they do find the units they want.

The newest Black Book Market Insights report showed an increase in wholesale vehicle depreciation, especially in the car segments. Although cars had a higher depreciation percentage overall, editors noticed the compact van category for trucks saw the highest depreciation out of all vehicle categories with a 1.74 percent decline in value.

“The wholesale vehicle market experienced broad declines last week across most vehicle segments,” said Anil Goyal, Black Book’s senior vice president of automotive valuation and analytics, one of the many experts set to be a part of this year’s Used Car Week, which runs from Nov. 13 through 17 in Palm Springs, Calif.

According to volume-weighted data, editors determined overall car segment values decreased by 0.58 percent last week, higher than the average weekly decrease of 0.43 percent in values spotted during the previous four weeks.

Black Book found that the prestige luxury car, sporty car and sub-compact car segments declined the most by 1.03 percent, 0.89 percent and 0.78 percent, respectively.

Again considering volume-weighted information, editors reported that overall truck segment values — including pickups, SUVs and vans — softened by 0.40 percent last week; a figure more than than the average weekly decrease of 0.28 percent in values registered in the previous four weeks.

As previously noted, compact vans declined the most at 1.74 percent, while the small pickup segment wasn’t far off with a drop of 1.46 percent.

So now that we know the movements associated with what dealers are paying, what about what they’re seeing coming down the lanes and how they want to stock their lots? The anecdotes Black Book’s representatives at the auctions provided gave a pretty clear picture of what’s happening nowadays.

Starting in Tennessee, Black Book’s observer said, “Used-vehicle retail remains OK, but dealers are struggling to get nice trades. They are all in need of quality used pickup trucks, which are especially difficult to find.”

Down in Florida, the truck story continued with the lane watcher saying, “We had a good auction this week. There were more no-sales on trucks as consignors were holding out for ‘home run’ money due to the low supply.”

While not specifically mentioning trucks, Black Book’s personnel stationed in Colorado reported, “Inventory is low at the auctions so, in turn, the conversion percentages are good.”

Continuing out West, the story in California was, “The no-sales here were mostly due to over-valued higher mileage units.”

Wrapping up in Michigan, lane observers heard from dealers about another segment in the sales calendar as the recap indicated, “We are starting to see the annual back-to-school activity in the lower-priced units. This typically lasts for three or four weeks here.”

When a dealership group opens up standalone used-car stores, one of the questions that ultimately comes up is, “Where will the inventory come from?”

At AutoNation, the retailer has found some initial success in hosting car-buying events at its AutoNation USA used-car store in Houston.

The dealer group — which also has an AutoNation USA store in Corpus Christi, Texas — had held two “We’ll Buy Your Car” events at the Houston store, chief operating officer Lance Iserman said during AutoNation’s Aug. 2 quarterly earnings call.

Iserman, who is also the group’s executive vice president of sales, said AutoNation was able to acquire high-quality vehicles during those events, calling it a “good source” for the retailer to obtain inventory going forward.

Within the AutoNation franchised stores, three-quarters of used-car inventory comes from trade-ins, with 15 percent coming from auctions and 10 percent generated via off-lease, Iserman said.

As far as how that will translate to AutoNation USA stores, he noted that, obviously, standalone used-car stores don’t have that capacity to acquire off-lease, but AutoNation hopes to ramp up its “We’ll Buy Your Car” strategy.

“Currently, our inventory is a mix of auction purchases, vehicles from our franchised stores and our ‘We’ll Buy Your Car’ events,” Iserman said of AutoNation USA. “And that will be less dependent on our franchised stores as we move forward.”

More details on AutoNation USA

Sharing some overall thoughts on AutoNation USA, AutoNation chief executive Mike Jackson said: “This is an overarching approach where it’s one brand, including the franchised business and the extension into the USA stores, all with a one-price system.

“(It’s) very challenging, complex to create, as we talked about, but I think it will be very compelling, once we successfully implement it … AutoNation Parts and AutoNation Accessories are crucial to being able to do higher volume with better margins, with lower reconditioning costs and still put a frontline, outstanding vehicle (on the lot).

“Knowledge of the marketplace for our pricing system, including the auctions, needs to be there,” Jackson said. “So I think we have it pretty well thought through.”

Overall used-car results

Through six months of 2017, used-vehicle retail revenue for the dealer group is up 2 percent at $2.29 billion, while overall used revenue (which includes wholesale, as well) is down 2.4 percent at $2.44 billion.

Retail used-car gross profit is down 17.5 percent at $148.9 million, with overall used gross profit down 13.4 percet at $151.5 million.

Used-car retail sales, however, are up 3.6 percent, with AutoNation having sold 118,874 used units in the first six months of 2017.

In the company’s earnings press release, Jackson specifically addressed used-car margins. In the second quarter, gross profit per used vehicle retailed was $1,270, down from $1,531 a year ago.

For the first half, it fell from $1,572 to $1,253.

“Our pre-owned margins declined due to implementation challenges with our centralized One Price strategy during the quarter,” Jackson said in the news release. “However, we’ve taken decisive action to resolve those issues by realigning our leadership and structure to fully realize the opportunity of our brand extension strategy.”

In general, Jackson said during the call he expects growth in the retailer’s overall used-car business in 2018 through acquiring, reconditioning and selling used cars — and doing so at right price. AutoNation USA is still a relatively small piece of that overall used-car business, he said, so its operational impact reflects as much.

Asked why he is confident that the performance of the core used-car business will improve next year, Jackson said: “We’re absolutely thrilled with the customer response to One Price. It’s attracted tremendous traffic — new buyers — and they really express how much they like the process.

“We also see our ‘We’ll Buy Your Car’, which will be a very attractive source of vehicles, ramping up very nicely,” he said. “We know we’re going to have parts at a much more attractive price.

“So, I have good consumer response, building good sourcing to attract cars, good capability to recondition on a lower-cost basis. That gives me confidence we can grow the business profitably.”

Element Fleet Management recently introduced Connected Data, a new service for fleet performance insights that streams vehicle data from both OnStar and other connected car systems in non-GM vehicles.

Connected Data gives fleet managers the ability to tailor analytics to meet common reporting and regulatory needs, according to Element.

The new service offers dealers a selection of different data feeds they can use to optimize their fleets. Users can explore odometer reporting, vehicle diagnostics and driver behavior data.

Access to data feeds is available via Xcelerate, customized reports and Element strategic fleet consultants.

“Today’s fleets are in a unique position to harness the power of connected vehicles across an increasingly connected digital fleet workflow, one that integrates data from drivers, suppliers and the vehicle itself,” Element Fleet Management North America products and services senior vice president Michele Cunningham said. “Connected Data delivers just the subset of vehicle and driver data that customers need, making it easier to gain insights and take action in areas like optimal replacement, preventive maintenance, and assessing and mitigating driver risk and more.”

Connected Data is currently available in three packages: Odometer, Fleet and Safety.

The Odometer package provides mileage reporting compliance data and vehicle utilization insight. Fleet includes the offerings of the Odometer package, along with integrated location and diagnostics data.

The Safety packed is fitted with Fleet package data, in addition to driving pattern information used to identify high-risk drivers, help improve safety and reduce accident expense. The data covers hard braking, fast acceleration and speeding.

For additional information about Connected Data's offerings, visit elementfleet.com/fleet-services/car-light-duty/vehicle-fleet-connected-data.

Continuing a “normal pattern of stability,” the franchised auto dealer count in the U.S. climbed modestly in the first half of the year, with 98 percent of markets showing no real change, according to Urban Science.

The firm’s 2017 mid-year Automotive Franchise Activity Report indicates there were 18,199 dealership rooftops as of July 1. That’s up 0.2 percent from January.

The number of franchises was 32,046 on July 1, up from 32,012 at the start of the year.

“Over the last several years, the dealership network has set a new normal pattern of stability,” Urban Science global director of data Mitch Phillips said in a news release. “The data shows that 98 percent of local markets had virtually no net change (+/- 1 dealership).”

However, Phillips goes on to point out that Texas had the biggest net increase in dealer count at nine, while Florida added seven. Pennsylvania (six added), Missouri (five) and Ohio (four) rounded out the top five.

“An interesting observation is California and New York, both typically on the most active list, are no longer included on the most active list, demonstrating a period of stability,” Phillips said.

While dealer count has remained steady, sales throughput — which is sales divided by dealer count — is likely to dip this year.

“With a stable dealer count, the throughput record is controlled by the sales volume. With the current range of 2017 sales forecasts being less than 2016, throughput is forecasted to fall around 25 units to 940 units,” Phillips said.

Used sales at franchised stores climbs

Turning to a separate analysis, the average used-car sales per store at franchised dealerships in June was slightly more than 49 units, and the average days-to-sell was a little more than 43, according to data that CompetitorPro shared with Auto Remarketing.

The data is based on internal VIN analysis on dealership websites (which are publicly accessible) by CompetitorPro. The number of franchised dealers in June’s data set was 19,306, as CompetitorPro counts individual franchises as separate dealerships.

Here’s how the used-car sales operation looked like at franchised dealers in June, based on CompetitorPro data.

- Total used-car inventory: 1,414,204

- Dealer count in data set: 19,306

- Average used inventory per store: 73.3

- Average days in inventory: 26.9

- Total used-car sales: 948,415

- Average used-car sales per store: 49.1

- Average days to sell: 43.1

- Average price of used cars sold: $18,642

Stay tuned to upcoming print editions of Auto Remarketing, where will include a full and updated data set on the used-car market from CompetitorPro.

Auto/Mate Dealership Systems recently unveiled a new texting engine built into its dealership management system designed to help dealers quickly communicate with customers.

Sales and service departments can use the new texting engine for a variety of customer experience related functions, according to Auto/Mate.

"Auto/Mate’s Texting is simpler and far less expensive than most tools currently available in the market," Mike Esposito, Auto/Mate president and chief executive officer said in a news release. "Texting allows dealers to meet customer expectations, have a written record of messages sent and received and improves customer perception of their brand."

The company said its texting engine is designed to be as easy to use as messaging applications on smartphones.

The texting engine also allows users to manage "do not text" records, create message templates and send welcome messages, according to the company.

Dealership personnel receive alerts from the DMS when texts from customers arrive.

"The increased opt-in rates and use of messaging allows dealership personnel to communicate with a higher percentage of their customer base on a regular basis, which is critical for establishing and maintaining relationships," Esposito explained.

Additionally, the texting engine can be used by dealerships to follow up with leads and set and confirm appointments.

Texts can be sent to customers from Auto/Mate's CRM.

"Texting is practical in service because it creates a written record of customer approvals and communications that can be used to identify issues within the dealership, retrieve details of discussions, monitor advisors and resolve customer conflicts," Esposito said.

Dealership personnel can use messaging to send service reminders, appointment reminders, service recommendation approvals, vehicle status updates and notifications that a vehicle is ready for pick up.

"We have reached a point where dealerships must embrace and use texting, or they risk being perceived as behind the times," Esposito added. "Our Texting engine makes it easy and affordable for dealerships to implement texting, delivering a better customer experience in both sales and service."

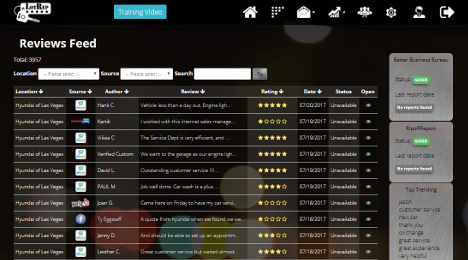

A new online review monitoring service, LotRep.com, designed to help dealers accurately monitor and track online consumer reviews in real-time via multiple platforms, launched Thursday.

The site’s software allows dealerships to efficiently and effectively manage online reviews, according to the company.

"Online reviews have changed the way business is done in this day and age. We know how crucial these reviews can be to auto dealers and their customers, but up until this point, monitoring them all has been nearly impossible," LotRep.com founder Brian Lack said in a news release announcing the launch. "We want to make it easier."

LotRep’s slate of features include:

- An all-in-one dashboard focusing on a review feed

- The ability to track and monitor various online review sites such as Cars.com, Yelp, Edmunds, Dealer Rater, SureCritic, The Yellow Pages, Facebook and Google

- An analysis of online reviews via statistics and reporting

- A "Review Requester" that allows dealership representatives to solicit reviews from buyers via sms or email

- A "trending list" on the main dashboard featuring rotating keywords and phrases trending on any monitored online reviews

- A mobile app designed including the most commonly used tools

- The ability to request reviews from customers

"By integrating LotRep.com into a regular customer service strategy at the dealership, auto retailers will be able to embrace online reviews as a key component to a strategic and effective business tool instead of a dreaded enemy," added Lack.

Access to LotRep.com is currently available free, at no cost for 30 days. For more information, interested dealers can visit, LotRep.com.

Chrome Data recently launched Colorized 360°, a new vehicle walk-around product that lets customers navigate between eight different colorized angles and stylized transitions when exploring various models.

The new product provides an interactive and customized experience that is designed to engage customers and improve sales.

Colorized 360° is fitted with a configurable player that allows users to customize dealer branding, logos and special programs to increase brand awareness.

“We’re very excited to provide another next generation merchandising tool for our customers,” Chrome Data general manager Craig Jennings said in a news release. “Colorized 360° puts car buyers in the driver’s seat to help them visualize driving and owning the vehicle. We know this translates to higher engagement and more vehicle sales.”

Colorized 360° can adapt to any platform. The technology links directly to Chrome Style IDs, Acode and VIN data for seamless integration with VDPs, SRPs, campaign landing pages.

Additionally, Colorized 360° is available at a reduced cost as part of the company’s new Chrome Media Bundle package which also includes the Chrome Image Gallery along with Model and VIN Virtual Test Drive Videos.

As consumers head out this month to shop for coveted back-to-school season items, Autotrader has come out with its top picks for certified pre-owned deals in August, which features long warranty term offerings from Jaguar and its sister brand, Land Rover.

"Going CPO is a great option for car shoppers looking to get a lot while spending less," Autotrader executive editor Brian Moody said in a news release. "All CPO vehicles undergo extensive, manufacturer-required, multi-point inspections, giving the buyer the utmost confidence that they are buying the best the brand has to offer when it comes to a pre-owned vehicle."

Autotrader editors' top picks for certified pre-owned deals for August include:

— Through the end of the month, Buick's CPO program’s incentive options include powertrain coverage that lasts for 6 years or 100,000 miles from the original sale date and 12 months or 12,000 miles of bumper-to-bumper coverage. Qualified shoppers can get 1.9 percent interest on the Buick Enclave, Encore and LaCrosse.

— Chevrolet's current CPO offerings include a powertrain warranty for 6 years or 100,000 miles from the original sale date and a bumper-to-bumper warranty that covers vehicles for 12 months or 12,000 miles. This month, qualified shoppers can also get 1.9 percent interest on CPO versions of the Chevy Cruze, Equinox, Malibu, Silverado and Traverse.

— This month, Jaguar's CPO program offers bumper-to-bumper warranty coverage for 7 years or 100,000 miles from the original sale date. The automaker is also offering 1.9 percent interest for up to 60 months on 2014 and 2015 XF models, as well as 2.9 percent interest for up to 60 months on its XJ model. Additionally, eligible shoppers interested in the brand’s F-TYPE sports car, can get 1.9 percent interest for up to 60 months.

— Land Rover is offering 7 years or 100,000 miles of bumper-to-bumper coverage from the original sale date on its CPOs. In addition to, 1.9 percent interest for up to 60 months on 2014 and 2015 Range Rover Sport and Evoque models and 1.9 percent interest for the 2015 Land Rover Discovery Sport. The brand’s CPO 2013 to 2015 Range Rover models are also available for 1.9 percent interest for up to 60 months.

— Nissan's CPO program offers 7 years or 100,000 miles of powertrain warranty coverage and 1.95 percent interest for up to 36 months, or 3.95 percent interest for up to 72 months. Nissan is also offering shoppers paying cash up to $500 cash back on any CPO model or $750 cash back on a CPO Leaf electric car.

— Toyota currently boasts 7 years or 100,000 miles of powertrain coverage from the original sale date, as well as an additional 12 months or 12,000 miles of bumper-to-bumper coverage through the end of the month. CPO versions of its Sienna model are available to qualified buyers at 2.9 percent interest for up to 60 months.

— At Volkswagen, shoppers get an additional 2 years or 24,000 miles of bumper-to-bumper warranty coverage this month, as well as a 60-month term with 1.99 percent interest for all CPO vehicles. This month, the automaker will pay up to $500 towards each customers’ first payment on select CPO models, according to Autotrader.

Click here to get additional details for these CPO programs.

ADAM Systems, provider of dealer management solutions, recently announced that its DMS has been fully integrated with retention solution Xtime Spectrum, a Cox Automotive brand.

“We are excited to expand our already extensive offering to our client base. The ADAMConnect API continues to allow us to partner with industry leading solutions, like Xtime Spectrum, and work between our platforms in a transparent and secure manner that really brings value to Fixed Ops departments and their customers,” director of product management for the ADAM DMS platform John Cowan said in a news release.

Through a two-way exchange of data, the integration between ADAM Systems and Xtime can provide dealers enhanced customer relationships and retention.

“For a busy shop like ours, it is critical that we schedule service appointments accurately to meet our customer’s expectations,” said Premier Kia president Robert Alvine. “The seamless integration between Xtime and ADAM DMS expedites this process and allows our service advisers more time to give customers a higher level of service.”

The data exchange can help dealers speed up the service write-up process, giving staff more time to manage the service lane process, according to ADAM Systems.

“A great service experience doubles repurchase loyalty, and robust integration is critical," Jim Roche, Xtime senior vice president of marketing added. “Our goal is to help dealers build more value and convenience at every customer touch point, and we're thrilled to have ADAM as a technology partner to provide a better service to dealers and vehicle owners.”