Did your dealership hit its retail sales targets for the month and quarter? Whether or not your store did, a new shopper study CDK Global might illuminate why more vehicles rolled over the curb than you expected or that batch of models still is in inventory.

CDK Global said there are a lot of assumptions made about Gen Z — loosely defined as individuals born between 1997 and 2012 — and the need for instant gratification, from simple online purchase experiences to real-time social media engagement.

However, when it comes to buying a vehicle, CDK Global discovered Gen Z seems to be more thoughtful and spends more time weighing decisions, while finding the experience of buying a new car more frustrating than any other generation.

In a recent survey, CDK Global asked more than 1,100 shoppers of all ages who recently purchased a vehicle about the car-buying experience. It found Gen Z respondents, most of whom were buying their first car (56%), were least likely to recommend their dealership experience than older generations with a net promoter score (NPS) of just 32, compared to an NPS of 49 for millennials and 53 for Baby Boomers.

With Gen Z most interested in understanding all their options (81%) compared to millennials (73%), Gen X (60%) and Baby Boomers (45%), the need for education — both online and from a knowledgeable representative at the dealership — proves to be critical, according to the CDK Global study.

The survey results also showed deeper insights into Gen Z vehicle shoppers, such as:

—They found it more difficult to buy a car online (22%) than any other generation.

—Waiting on a salesperson ranked near the top of their list of friction points at the dealership, and 45% ranked it as the most frustrating part of buying a vehicle.

—They were much more likely to buy luxury brands (39%) compared to millennials (29%), Gen X (27%) and Baby Boomers (12%).

“Buying a car is much more complex than buying a smartphone. Consumers are presented with seemingly endless options like trim levels, stand-alone features, accessories, service packages, financing and insurance,” CDK Global chief operating officer Joe Tautges said in a news release. “In today’s world of simple and convenient shopping experiences, we not only have to make cars easier to buy, but we also have to meet consumers where they are based on their unique needs.

“By implementing more seamless processes at the dealership, sales departments can work more efficiently and spend more quality time with their customers explaining products and processes in greater detail,” Tautges added.

For more information on this survey, including additional generational insights on vehicle shoppers, download the white paper via this website.

Dealer Image Pro recently announced results from an industry survey it commissioned to better understand how dealers are using vehicle photography and video to best merchandise cars and trucks in today’s digital retailing landscape.

Dealer Image Pro presented an online survey to more than 3,000 automotive dealer professionals during June.

According to a news release, only 12% said they use a software or application to take and upload their own vehicle photos, with another 30% saying they have to train someone new to take photos every week.

The company discovered nearly 20% also said it takes them a day or two to get their photos and videos loaded onto their website.

Furthermore, 53% of those dealers surveyed use a photo vendor service showing that this older form of merchandising can be convenient, but certainly not optimal.

Dealer Image Pro went on to mention almost 26% of respondents said they currently spend $30,000 to 40,000 per month in digital advertising while another 24% say they spend more than $40,000 per month in ad spend while a whopping 75% say they bring their cars to market with photos only three days per week or less.

“These figures ultimately show automotive dealerships missing crucial time to bring their vehicles to market each week, as the advertising dollars spent on vehicle listings are a direct reflection of the time lost. This lost time posting new inventory is costing dealers thousands in additional revenue each month,” Dealer Image Pro said in a news release.

The average dealership spent more than $312,000 on online advertising in 2021, according to Statista.

“Automotive professionals are not maximizing the time they spend on bringing the vehicle to market versus the amount of advertising dollars spent,” Dealer Image Pro said.

The firm added that 31% of automotive dealer professionals surveyed said they see their vehicle detail pages (VDPs) up significantly this year, with 33%seeing their gross profit margin increase 10% to 15% above sticker price.

“We still see dealerships using a physical camera when taking vehicle photos and videos, which shows just how obsolete the process is for some in today’s digital world,” Dealer Image Pro founder and chief executive officer Peter Duffy said in the news release. “We used to be the photo vendor using cameras. We loved this experience. It’s how we cut our teeth in this industry.

“The data is clear though, the path of least resistance is taking your content in-house with software on a mobile device,” Duffy continued. “Cars should be brought to market the day they’re out of recon. Full stop. This trend was evident 2-3 years ago, but after the last two years it’s crystal clear. The trick now for dealers is to find the right photo software to streamline their big lot operations.

“A software or company that gets their photos edited photos and videos published daily. a company that keeps your photographers trained, and QCs the content. Basically, getting an end-to-end solution that helps all automotive dealerships list and sell their vehicles faster,” he went on to say.

Duffy recently appeared on the Auto Remarketing Podcast to discuss vehicle photos and more best practices. The episode can be found below.

This dealership news roundup begins with another Canadian-based group expanding its footprint in the United States.

A couple of days after Steele Auto Group finalized an acquisition with Group 1 Automotive, Knight Automotive Group made a deal with the John Elway Dealership Group.

According to a news release from Performance Brokerage Services, the firm assisted in the sale of John Elway’s Claremont Chrysler Dodge Jeep Ram in California to Knight.

The firm said the dealership will remain at its current location at 620 Auto Center Drive in Claremont, Calif., and has been renamed Knight Claremont Chrysler Dodge Jeep Ram.

Knight Automotive Group was founded by Ted Knight more than 45 years ago, and is now led by his son and president, Kevin Knight.

Knight Automotive Group is one of the largest dealers in Canada with 14 locations. This acquisition marks the group’s third dealership in southern California.

Knight Automotive Group vice president Braeden Mueller said in the news release, “The Knight Group wants to thank Jason Stopnitzky and his team for their efforts in finding another store that aligned with our objectives. Jason has continued to impress us with his level of market knowledge and professionalism through the entire process. We look forward to continuing our relationship with Performance Brokerage Services.”

Stopnitzky is the co-founder Performance Brokerage Services and was the exclusive agent for this transaction.

“We recently worked with Kevin Knight and Braeden Mueller of Knight Automotive Group on their acquisition of two Ford dealerships in California and are proud to have assisted with their third transaction in the US. We look forward to working with both groups again in the future and wish them both tremendous success,” Stopnitzky said.

John Elway Dealership Group is headquartered in Englewood, Colo., and was established in 2004. The group now operates seven dealerships across California, Colorado and Utah.

“This is our second transaction with the John Elway Dealership Group, recently having sold to them Porsche of Salt Lake City. It is always a pleasure working with such a professional and first-class organization, and we thank them for entrusting our firm with the sale,” Stopnitzky said.

Established California VW store changes hands

According to another news release from Performance Brokerage Services, the firm helped to facilitate the sale of Volkswagen of Oakland in California from Mike Murphy to Putnam Auto Group.

Volkswagen of Oakland is located in the heart of downtown Oakland and has been a part of its community since the late 1950s. The announcement indicated the dealership will remain at its current location at 2740 Broadway.

The dealership has been family owned and operated for the past 26 years by the Murphy family, with Mike Murphy serving as president and his two sons, Chris and Mike Jr., serving as general manager and used car manager.

Following the sale, Murphy said, “I have been an auto dealer in the San Francisco Bay area for 40 years. As I was approaching retirement, I reached out to Jason Stopnitzky of Performance Brokerage Services to handle the sale of my dealership. Having worked with Jason in the past on other transactions, I was always impressed with his professionalism and attention to detail. Jason found me an excellent buyer and the whole process went smoothly. I am very grateful to Jason and the entire team at Performance Brokerage Services who were a joy to do business with.”

Putnam Auto Group has been serving the Bay Area since 1965. Putnam Auto Group established their presence in Northern California when Joe Putnam acquired a Buick dealership in Burlingame, and they are now one of the oldest dealership groups in the Bay Area. The group offers 16 brands across its 13 dealerships in California.

During the last past five years, Performance Brokerage Services has advised on the sale of more than 250 dealerships.

“I have known Mike Murphy for the past 20 years. It was an honor and a privilege to help him retire from the auto industry after 40 years and represent his family through this legacy transition. I want to congratulate Mike on his well-deserved retirement and wish him luck on his next chapter,” Stopnitzky said.

Mike Calvert Toyota announces VIP program for registered nurses

Mike Calvert Toyota is looking to help crucial providers of medical care.

The store that’s part of Vaughan Automotive announced its commitment to nurses at the frontline with its Noble Nurse VIP Program. This program is dedicated to emphasizing and appreciating the importance of nurses by providing them with complimentary car services, discounts and programs.

“Mike Calvert Toyota’s priority is to give back to the nurses who have put themselves on the frontline and given so much to the community,” Vaughan Automotive owner and chief executive officer Shawn Vaughan said in a news release.

“To show our appreciation, we want to provide Texas registered nurses with automotive services, programs, and the recognition and appreciation that they deserve,” Vaughan continued.

The Mike Calvert Toyota Noble Nurse VIP Program is available to registered nurses with the purchase of a new Toyota or certified pre-owned Toyota. This program includes oil changes for life (a $1,493.85 value over five years), free sanitation of vehicle interiors, and a free car wash, vacuum and tire shine with service.

Nurses are also provided with a $500 dealer discount on selected vehicles and 10% off accessories, maintenance and repair.

Nurses that are platinum members of the Texas Nurses Association receive prepaid rental assistance with repair (48 hours only) and complimentary services.

During May, which also is National Nurses Month, Mike Calvert Toyota provided any registered nurse with a free oil change and tire rotation.

This year, Mike Calvert Toyota issued 138 free services to nurses, with a total investment of $4,907 in giving back to the community.

The dealership news roundup includes a store opening, another rooftop changing hands and a group expanding its leadership team.

Let’s begin with more activity within mergers and acquisitions, as Haig Partners served as the exclusive sell-side advisor to Group 1 Automotive on the sale of Sterling McCall Hyundai South Loop in Houston to Steele Auto Group.

The deal announced on Thursday involved two of the largest groups in North America. Haig noted that publicly traded Group 1 generated $13.5 billion in revenue and retailed 307,000 new and used vehicles last year, while Steele is Atlantic Canada’s largest auto dealership group with 55 franchised dealerships, seven independent dealerships, three powersports dealerships and eight collision centers.

Steele has since expanded into the U.S., as Sterling McCall Hyundai is its sixth U.S. dealership, all in Texas. The dealership will be rebranded Steele South Loop Hyundai.

With the sale of Sterling McCall Hyundai South Loop, the team at Haig Partners has been involved in the purchase or sale of 79 dealerships in Texas.

“It was an honor to represent Group 1 Automotive in the sale of Sterling McCall Hyundai South Loop in Houston. Sometimes the best buyer for a dealership is located right next door. But in this case, our process surfaced the best buyer in Canada, 2,500 miles away,” Haig Partners president Alan Haig said in a news release.

“This transaction is further proof that many buyers are interested in expanding into Texas,” Haig continued. “With high population growth, low taxes and a business-friendly climate, Texas, Florida and other similar markets bring elevated dealership values. The transaction also demonstrates that demand for dealerships remains high even though the macroeconomic outlook is troubled at the moment.

“Dealerships are still producing record levels of profits, so buyers want more of them,” he went on to say.

Hello Auto Group opens new Subaru dealership

Switching from the Lone Star State to the Golden State, Hello Auto Group this week announced today the opening of its new Subaru dealership in California.

The group now includes Kia of Valencia and Hello Mazda of Valencia (located in Santa Clarita) Hello Mazda of Temecula and Hello Subaru of Temecula (located in Temecula) and Hello Mazda of San Diego.

The new Subaru dealership includes 24 service bays and created more than 70 jobs in the Valencia-Santa Clarita community.

“Hello Auto Group is excited to open a new location in Valencia-Santa Clarita,” Hello Auto president Karl Schmidt said in a news release. “As we grow in the Southern California region, we are confident our new dealerships will provide exceptional value and services to the surrounding community.”

The group mentioned that Subaru moved out of Valencia three years ago, leaving Subaru owners having to travel roughly 18 miles and upwards of an hour outside this community to find the nearest Subaru dealership.

“Our new Hello Subaru dealership in Valencia-Santa Clarita is going to fill a void in the community and will also bring a fresh approach to car sales,” Schmidt said. “The Hello Auto Groups unique upfront business model and commitment to giving back to the community aligns with the Subaru brand and has received positive reception throughout California.”

Hello uses a one-person sales model; a strategy suggested by industry leader Chip Perry.

“We aim to alleviate the stress that comes with buying a car,” Hello general manager Angel Maldonado said in the news release. “Hello Auto Group is proud to offer customer-centric services and processes that allow buyers to have the most seamless purchasing experience possible. It’s with great joy that we can expand our community-based business into new areas, yet still take our core values of being genuine, honest, respectful, and fair with us.”

Hello Auto Group also is committed to giving back to the community, so $25 from every vehicle delivery and $1 from every repair order go to a local philanthropic fund.

Castle Automotive Group adds to marketing leadership team

This week, Castle Automotive Group (CAG) expanded its marketing leadership team by bringing on Giancarlo Montenegro as director of marketing operations.

“Giancarlo’s ever evolving digital marketing experience is vital to the growth and direction of our internal marketing organization,” chief marking officer Sean Seltzer, who joined CAG in May.

“As Castle Automotive Group continues to evolve our marketing into a true transparent experience for all customers, Giancarlo’s skillset and drive for success will be a crucial part of our future,” Seltzer continued as the group currently owns nine dealership locations with 14 franchises throughout Illinois and northwest Indiana,

Montenegro possesses more than a decade of agency experience, overseeing digital strategy for multiple Fortune 100 companies across the automotive, financial/investment and technology sectors. He specializes in the curation of harmonious strategies across platforms to bridge the divide between media efficiencies and direct business objectives.

Montenegro joins the Castle Automotive Group fresh off his tenure as social director at Reunion Marketing. While at Reunion, CAG highlighted that Montenegro led a successful enhancement of Reunion’s product suite, propelling the firm to the forefront of Tier 3 automotive paid social.

We go out West for this round of dealership M&A.

Starting in Washington state, the Bud Clary Auto Group has purchased Auburn Volkswagen from Matt Welch, who acquired the dealership in 2006.

The news was shared in a release from Performance Brokerage Services, which facilitated the sale.

The family-owned Bud Clary Auto Group was founded in 1959 and has 14 stores in Washington representing 11 brands.

Bryce and Kelly Clary have been third-generation owners since 2016.

Bryce Clary said in a news release: “We would like to thank Jason Stopnitzky and Mark Shackelford of Performance Brokerage Services for their truly exceptional service. They helped find the perfect fit for our group, and their guidance throughout the process was invaluable. It could not have gone better with Matt Welch and Auburn Volkswagen, and Performance Brokerage Services made that happen. This is the third time working with Performance, and we are looking forward to working with them in the future!"

Elsewhere in the Pacific Northwest, Performance Brokerage Services announced that Teton Auto Group has purchased Coos Bay Toyota in Oregon from brothers Guy and Lee Hawthorne.

Teton Auto Group, which Mario Hernandez and Jim Parker founded in 2005, has a presence in Idaho, Oregon, Nevada, Colorado and Washington.

Even dealerships are having some trouble keeping a bright outlook amidst the notable headwinds we’re all facing nowadays.

According to the latest reading of the Cox Automotive Dealer Sentiment Index (CADSI), U.S. automobile dealer sentiment in the second quarter softened, as U.S. dealers’ attention turned to inflation, high costs and tight inventory.

Analysts said the dip represented the fourth straight quarter-over-quarter decline in market sentiment. Cox Automotive indicated the current market index peaked at 67 in Q2 2021 and has been trending downward since.

Still, at 54, analysts pointed out the current market index remains above the positive threshold of 50.

Cox Automotive mentioned key drivers of sentiment saw disparate shifts in Q2.

The three-month, forward-looking market outlook index sharply dropped from the previous quarter and, at 53, is well below the 63 recorded a year ago in Q2 2021.

The economy index increased slightly in Q2 to 50, up from 49 in the prior quarter. With the index now at 50, dealers are right at the positive threshold in judging the economy as strong.

With COVID concerns mostly in the past, Cox Automotive chief economist Jonathan Smoke said that dealers are navigating challenges created by inflation, high costs and tight inventory.

“U.S. auto dealers are certainly feeling the pressure of inflation and tight inventory,” Smoke said in a news release. “Franchised dealers continue to be very profitable, but the steep drop in the market outlook index indicates dealers are less enthused about the future.

“While all dealers are impacted by higher costs of doing business, the profit story is also different for independent dealers, as used vehicles have started depreciating again,” he added.

Analysts noted the Q2 2022 CADSI research was in market from April 25 to May 9, when COVID cases had retreated from omicron-driven records and activity was normalizing compared to the situation in January.

More on the inventory crunch

Cox Automotive acknowledged one worrisome sign in the latest CADSI report is the small improvement in the new-vehicle inventory mix index for franchised dealers.

The index increased only two points from Q1 and remains historically low at 25, an eight-point year-over-year decrease.

“Today’s market continues to be framed by constrained new-vehicle inventory,” Smoke said. “Low new-vehicle inventory and the associated low level of incentives and lack of discounting have priced many would-be buyers out of the market and into the used-vehicle market.

“Others may be delaying purchases, waiting for supply to improve, but supply has yet to see much change,” he continued.

On the used-vehicle side, Cox Automotive found that the inventory index dropped in Q2 2022 to 35, one point lower than the previous quarter but up 14 points year-over-year.

Analysts indicated the used-vehicle inventory mix index improved among franchised dealers versus independent dealers, showing a 5-point increase year-over-year in Q2 to 55.

Cox Automotive added that all index scores associated with inventory, however, remain below the 50 threshold, indicating dealers are still facing significant inventory challenges for both new and used vehicles.

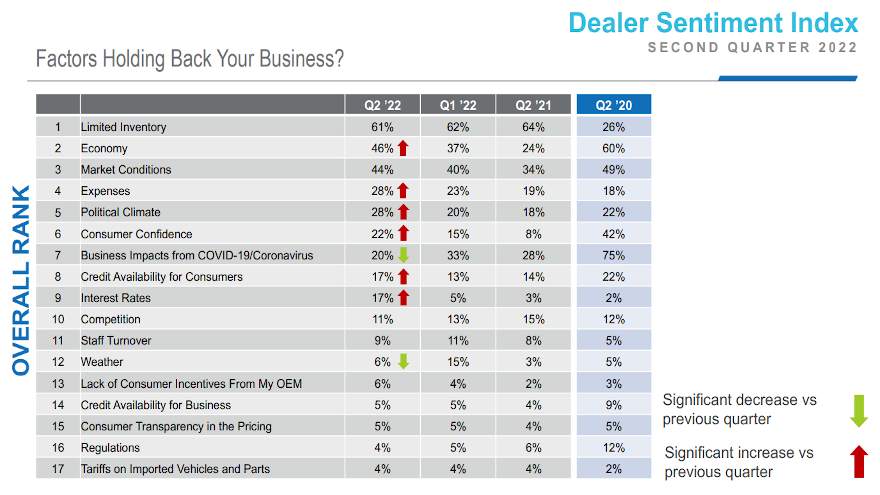

“Consistent with last quarter, limited inventory ranks as the No. 1 factor holding back dealer business in Q2,” Cox Automotive said.

While new-vehicle inventory remains tight, the newest sentiment report showed the view of new-vehicle sales improved, increasing from 50 to 52, meaning dealers are now more optimistic about new-vehicle sales. One year ago, the index score was 65, meaning significantly more dealers saw the market as good.

The new-vehicle incentives index dropped by 2 points quarter-over-quarter to 21, the lowest level since the question was added to the CADSI in Q3 2019.

On the other hand, analysts determined the used-vehicle sales index fell 5 index points to 47.

For franchised dealers, the used-vehicle sales index increased by 1 point for Q2, breaking a downward streak but is still below year-ago levels.

For independent dealers, the index fell 6 points from the previous quarter to 42 and is down 14 points from a year ago.

“Overall, most dealers view used-vehicle sales as weak,” Cox Automotive said.

Dealers worried about the economy & costs

Perhaps this component of the latest CADSI should be the least surprising

In Q2 2022, the cost index — specifically the cost of running a dealership — was at the highest level since the survey began in 2017.

After reaching a record low in Q2 2020 of 51 at the height of the pandemic, the cost index has been steadily increasing, according to Cox Automotive, which said, “Overall inflation in the U.S. economy is clearly contributing to this view.”

The CADSI report noted that the economy is the second leading factor impacting dealer business at 46%, up from 37% in Q1, with market conditions, expenses and political climate following closely behind.

“Dealers are worried about inflation and the possibility of a recession along with lagging consumer confidence,” Cox Automotive said.

Profits remain strong for franchised dealers

Here’s an area that’s remaining strong during this turbulence.

Cox Automotive mentioned the overall profit index saw a small decline to 53, down from 54, but remains higher than at any point before the COVID-19 pandemic.

Analysts recapped that the five highest profit index scores since 2017 have all been recorded in the past five quarters.

However, Cox Automotive pointed out that the profit index also indicates that franchised dealers believe profits are particularly strong, at 82, whereas more independent dealers now see profits as weak, with an index score of 44.

“Importantly, the cost index increased by 11 points in Q2 versus a year ago and reached a new record high of 76, suggesting that the overall cost of running a dealership continues to grow,” Cox Automotive said.

“On the plus side, the price pressure index increased only slightly in Q2 to 41, up from 37 in Q1, but remains historically low, indicating fewer dealers feel pressure to lower their prices,” analysts added.

Other trends to watch

Cox Automotive reported that the top 5 factors holding back the business across all dealers saw minor shifts in Q2. But analysts said three factors — economy, expenses and political climate — saw significant quarter-over-quarter increases.

Limited Inventory remains in the top spot. The economy rose to No. 2 ahead of market conditions. Expenses ranked fourth overall, while political climate rounded out the top 5 factors.

Notably, COVID-19 is no longer a top factor holding back business, falling to No. 7.

Cox Automotive Dealer Sentiment Index methodology

The Q2 2022 CADSI is based on 1,099 U.S. auto dealer respondents, comprising 568 franchised dealers and 531 independents.

Dealer responses were weighted by dealership type and sales volume to represent the national dealer population.

Analysts explained that for each aspect of the market surveyed, respondents are given an option related to strong/increasing, average/stable, or weak/decreasing, along with a “don’t know” opt-out. Indices are calculated by creating a mean score in which:

—Strong/increasing answers are assigned a value of 100.

—Average/stable answers are assigned a value of 50.

—Weak/declining selections are assigned a value of 0.

The entire report can be downloaded via this website.

Bryce Veon is chief executive officer of AutoSoft, a DMS provider for the auto industry.

He joins the Auto Remarketing Podcast to discuss the backstory of the second-generation family company, which his father started, how AutoSoft continues to innovate and how it distinguishes itself in the DMS field.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Cars.com found a way to get 99% of dealers to agree on something.

And if you’re a used-car manager, you might need only one guess to pinpoint what it is.

Cars.com said an overwhelming 99% of surveyed dealers said they are paying more for trade-ins now than two years ago.

According to a news release, almost 60% of surveyed dealer estimate an increased payout between 11% and 20%.

Furthermore, more than one in three dealers report paying over 20% more than two years ago, based on findings from a Cars.com dealer panel survey conducted on April 18.

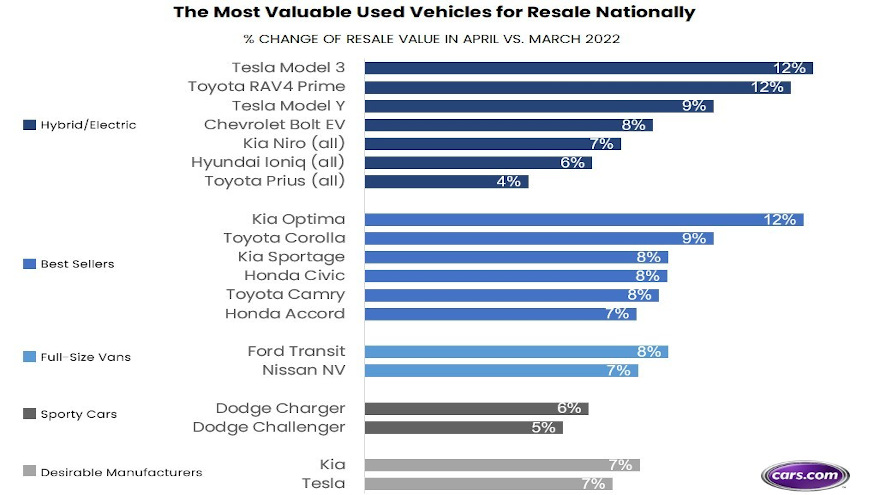

According to wholesale data from Accu-Trade, a Cars.com Inc. company, consumers can gain the highest resale value on vehicles that are electric or hybrid, best sellers in the market, from desirable manufacturers, sporty cars just in time for summer and, interestingly, full-size vans.

Some of the most valuable used vehicles for resale right now include the 2018 through 2021 model years.

Cars.com added that consumer experiences support the dealer findings.

Among those surveyed who traded in a vehicle in the last year, approximately two-thirds received a higher offer than expected.

Cars.com also reported that 63% of consumers cited above-expectation values for mass-market models and 59% for luxury brands. That’s according to the Cars.com consumer survey fielded on April 11-14.

“The ongoing inventory shortage has caused a broad ripple effect in market conditions. As new vehicles became more elusive, shoppers pivoted to the used-car market, pushing used-car prices up 37% in the first quarter,” Cars.com editor in chief Jenni Newman said in the news release. “Eager for quality inventory, dealers are making lucrative offers for popular vehicles maintained in good condition with low mileage.

“I sold one of my family’s extra cars to our local dealership just as used-car prices were increasing, making 50% more on its sale than I would have before the pandemic. Today, I’m considering selling our second family car to capitalize on the high used-car prices,” Newman went on to say.

Consumers looking to maximize the return on their current vehicle in this profitable market can sell to other individuals for free on Cars.com/sell or use its marketplace to connect with and sell directly to nearly 20,000 dealers across the country.

“Consumers should check with their local dealership to find out which vehicles are most valuable in their local market,” Cars.com said.

It’s been rough sledding for some dealerships, especially independent operators, to find the inventory they need with the ongoing wholesale price and volume landscape.

However, that’s not been the case at all for Mike Wimmer, chief executive officer and Founder of AutoLenders, an independent operation in business since 1979 that retails and leases used vehicles with multiple showrooms in Pennsylvania and New Jersey.

Wimmer explained how during this episode of the Auto Remarketing Podcast.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

For dealers who use CDK Global technology in their service drives, a new integration finalized on Tuesday could help speed up their businesses.

UVeye inspection technology has been integrated with the Fortellis Automotive Commerce Exchange platform used by more than 15,000 dealerships in the United States.

High-speed UVeye vehicle-inspection systems now can help write repair orders and speed customer service for dealers equipped with CDK Drive’s dealer management system (DMS) from CDK Global.

The UVeye application available in Fortellis Marketplace can allow dealers to create repair orders automatically based on high-speed scans of vehicle tires, underbody components and exteriors.

“The integration of automated vehicle-inspection data on the Fortellis platform will help dealers save time, increase profits and improve customer satisfaction,” UVeye founder and chief executive officer Amir Hever said in a news release.

Hever added that UVeye plans to make its service department technology available to other franchised and independent dealers through several other major automotive retail-management systems this year.

UVeye has facilities in North America, Europe and the Asia Pacific region, including offices in Israel, Japan, Germany and the United States. The company has raised more than $90 million since it was founded in 2016.

Volvo Cars, Hyundai Motors, Toyota Tsusho, W.R. Berkley Corporation, F.I.T. Ventures and CarMax are all members of the company’s investor group. It also has strategic partnerships with numerous dealership groups, auto auctions and vehicle fleets.

“We’re pleased to offer UVeye’s CDK Drive integration on Fortellis to continue delivering extraordinary innovation to dealers,” said Sandy Orlando, senior vice president of data and Fortellis at CDK Global.

“Leveraging the power of the Fortellis marketplace allows UVeye to be part of a growing number of companies creating products that are shaping the future of automotive retail,” Orlando went on to say.