There remains a “fair gap” and “a good amount of play between” the typical retail price between a new vehicle and a used or even a certified pre-owned model.

However, Kelley Blue Book senior analyst Alec Gutierrez is seeing trends that are putting pressure on his current assertions.

Gutierrez mentioned during a call with the media earlier this week that the average incentive figure is above $3,500 per unit. ALG pinpointed incentive spending at $3,511 percent unit in March, climbing by $415 from a year earlier.

So the difference between similar models that are new versus nearly-new, CPO or whatever moniker a dealership salesperson might use is “tightening every day with incentives and dealer discounts,” Gutierrez said.

“I would expect to this trend continue,” he continued. “Used cars are going to come back in greater and greater volumes. Manufacturers are going to have to decide if they’re going to keep using incentives on the new-car side to maintain some form of competitiveness.

“Certainly if interest rates rise, that will shake things up even further,” Gutierrez went on to say.

And speaking of those interest rates, Edmunds mentioned that its analysis showed the average APR on installment contracts for new-vehicle deliveries in March reached 5.02 percent — the highest reading in seven years. This figure is up from 4.87 percent in February and 4.80 percent in March of 2016.

Edmunds executive director of industry analysis Jessica Caldwell pointed out the last time interest rates for new-model sales crossed the 5-percent mark was in February 2010.

“With high incentives, record inventories and interest rates at the highest we've seen in seven years, we're seeing a lot of signs right now that the tide is turning for the auto industry,” Caldwell said. “The training wheels that were put in place during the recession are coming off, and the industry is now being challenged to see if it can find the right balance on its own.

“While we’re not facing uncharted territory from a historical perspective, it will be interesting to see how the busy spring selling season unfolds as we navigate toward a more a normal pattern,” she added in analysis delivered to Auto Remarketing.

And, of course, the more levers automakers pull to keep new vehicles from piling up in inventory more than they already are, the more the potential impact on the used-vehicle market. The American International Automobile Dealers Association reported that average length of time a new model sat on a dealer’s lot hit 70 days in March — the longest stretch of time since July 2009.

“The industry’s performance in March suggests that sales may be plateauing,” AIADA president Cody Lusk said in a news release. “Now is the time for dealers to tighten their operations.”

ALG chief economist Oliver Strauss added in another news release, “Hefty incentives have negative impacts to resale values, and that can be even more potent in combination with a heavier mix of leasing being used across both the mainstream and luxury segments.”

During the media conference call, Autotrader senior analyst Michelle Krebs alluded to the segment of the retail equation likely to be most benefitting from the jostling between the new- and used-vehicle arenas — potential buyers.

“That adds another layer of complexity. Do you buy the new car or the nearly new car? There’s incentives being offered on some of the certified pre-owned vehicles. It’s going to take some really close shopping to get the best deal, and there are great deals and improving deals out there,” Krebs said.

Analysts who compiled White Clarke Group’s United Kingdom Asset & Auto Finance Survey 2017 say that the U.K. finance market has been resilient in the face of historic changes in the past year, but challenges will remain in 2017 and beyond.

The firm noted its survey points to a series of key factors that will have the greatest impact on the market, including:

• Brexit

• Legislation

• Vehicle sales (new and used)

• Residual values growing demand for PCH

• New technology and innovation

• P2P lending

“The first and most encouraging point to note is that the asset and auto finance market not only continued to grow in 2016, in spite of fears of what might happen in the aftermath of the vote to leave the EU and wider concerns about the global situation, it has carried on growing into 2017 and shows little sign yet of slowing,” White Clarke Group chief executive officer Brendan Gleeson said in the report.

“Nonetheless, there are genuine concerns about the potential effects of Brexit, even though the Article 50 starting pistol has only just been fired and the UK won’t be exiting the EU until 2019,” he continued.

Gleeson went on to say, “One outcome is that auto finance deals are expected to remain very competitive. Dealers need to ensure customers genuinely understand the benefits of finance. Keeping up with developments in finance technology is paramount.”

The complete survey report can be downloaded here.

ForeverCar said it understands vehicle service contracts remain important revenue generators for dealers. They provide useful safety and budget protection benefits for consumers that purchase them for new and used vehicles. The company acknowledged VSC closing rates average 35 percent to 40 percent, excluding lease and cash customers who don’t buy service contracts, and that’s a lot of opportunities that dealers are leaving on the table.

But now, ForeverCar is offering what it thinks is radical dealership digital technology that can provide dealers a revolutionary way to maximize service contract sales and gain revenue “without lifting a finger.” This VSC sales and remarketing technology will be introduced at Digital Dealer 22 next Tuesday, Wednesday and Thursday at the Tampa Convention Center in Tampa, Fla.

ForeverCar contends it’s the vehicle service contract industry’s only dealer-branded portal providing an engaging and intuitive user experience. Whether interacting with the tool in a dealership’s finance office or online, ForeverCar says it can provide the only end-to-end buying experience of its kind.

This sophisticated yet hands-off portal resides in the cloud and the F&I desktop. Customers selecting coverage for their higher mileage vehicles may finance the purchase through a vehicle installment loan or finance it directly through funding sources integrated into this platform. Either way, dealers earn commission on every sale.

ForeverCar is debuting the only technology portal of its kind that markets VSC sales to a dealer’s customer database, helping dealers monetize those original investments.

This digital self-serve dealer-branded portal includes:

• Digital marketing attracts and sells consumers' investment protection for high-mileage vehicles.

• Digital re-targeting recaptures lost VSC lead opportunities. ForeverCar’s remarketing engine can close at least 15 percent of retargeted opportunities.

• Digital sales engage the consumer at a time convenient to them. No irritating phone calls or direct mail — just a streamlined experience providing a menu of plan benefits and pricing to fit the consumer’s risk profile and budget.

ForeverCar’s platform is designed to channel the power of peer review and raises the bar for customer service and satisfaction while helping monetize old leads. Sales, service and retention will increase for any dealership interested, according to the company.

ForeverCar went on to say it can deliver these benefits, too, including

1. Provides a powerful tool for remarketing to dealer customers who declined a VSC when purchasing their vehicle.

2. Monetizes leads that did not convert the first time or converted as a vehicle sale but not a service contract.

3. Leverages the power of peer review by providing web-based customer insight from TrustPilot.

Dealers can experience this dealer-branded portal by visiting booth No. 729 at Digital Dealer 22.

To learn more about ForeverCar and to schedule a demo, go to info.forevercar.com/dealers or contact Brooke Schulz Fernandez at [email protected] or (312) 273-8303.

Over recent years, car shoppers’ increased attraction to research vehicles via a mobile device represented a noticeable shift within the industry, says Libby Murad-Patel, who is marketing and strategic insights vice president at Jumpstart Automotive Media.

In March, Murad-Patel and her team released Jumpstart’s Insights Book; A Collection of Consumer Insights Illustrating Today’s Auto Shopping Paths — its seventh annual comprehensive report detailing the research behavior of car shoppers, as well as U.S. car shopping trends.

Jumpstart's latest year-long analysis examined the shopping patterns of visitors to its portfolio of automotive websites, which represent more than 25 million in-market shoppers.

“From our audience perspective, the biggest shift that we've seen this year is that we’re getting a much more mobile heavy audience,” Murad-Patel said during a phone interview with Auto Remarketing.

She said with the mobile-heavy audience, much of the traffic brought to Jumpstart’s portfolio sites comes in directly from a search.

“What we often find is that we’re getting a lot of shoppers who are already in their consideration set and coming in through direct keyword searches, so that is driving them to our sites in a more organic fashion," added Murad-Patel.

Shoppers visiting Jumpstart’s sites exclusively from a desktop has dropped 24 percent from 2015, according to the report.

This trend implies that many car shoppers who begin their initial research for a purchase on a desktop will likely do some additional browsing from a mobile device as well.

Last year, Jumpstart said its desktop audience totaled just 37 percent, while its smartphone and tablet audience was 56 percent and 7 percent, respectively.

Additionally, when shoppers do research on their phone they are more likely to have a better idea of what they are looking for, according to Murad-Patel.

“What we often find is that we are getting a lot of shoppers who are already in their consideration set and coming in through direct keyword searches so that is driving them to our sites in a more organic fashion,” she said.

Interestingly, mobile brings more shoppers to vehicle detail pages than search.

“We’re finding that our audience is really accessing vehicle detail pages,” Murad-Patel said.

According to her assessment, 60 percent of traffic to vehicles details pages comes in through organic search, and mobile accounts for 67 to 68 percent of traffic.

“Because shoppers are actively doing their research in a more mobile fashion, they’re already into some sort of a narrow consideration set,” she said. “Having a more narrow consideration set before they even start their shopping activity is getting them to vehicle details pages faster because they’re not doing as much upper funnel research."

Even at the dealership, car shoppers have their mobile device in hand. Four in 10 shoppers use a mobile device at a dealership, and that number increases to two-thirds for millennials, and 83 percent for millennial men in particular, according to the report.

“Automotive websites have gotten a lot better with navigating the consumer to the information they need in a more efficient manner," Murad-Patel added. "They’re not having to spend as much time or as many clicks — going through one content area to another to get the information they’re looking for.”

To download the complete study, visit this website.

Black Book announced on Tuesday that its vehicle valuation insights are now available to eAutoAppraise dealer partners because the company now serves as the online trade-in solution’s new trade appraisal engine.

“We’re excited to partner with eAutoAppraise, a superior online appraisal engine that offers dealers a chance to close more deals quicker and make strong profit margins,” Black Book senior vice president of sales Jared Kalfus said in a news release. “An accurate valuation on a trade is a key component to the car-shopping experience, and customers that come equipped with a more narrow number in mind have a better experience at the dealership.”

The new partnership is geared to allow eAutoAppraise dealers to provide its customers with customizable value ranges on vehicles, which are based on uniquely tailored questions.

Ranges are produced when a customer answers a series questions aimed at obtaining details of their vehicle trade.

“This part of the vehicle shopping process is a key driver that will lead to more successful sales transactions, especially since customers will experience a less adversarial relationship with their dealer through a more conclusive, transparent valuation of their trade,” Black Book said.

The used-car valuation and residual value forecast solutions provider said that with a more specific valuation, customers can purchase their vehicle in less time.

“Our mission is to provide dealers with the best leads possible for increased sales, and to serve as the catalyst for simple vehicle sales transactions,” said Barry Brodsky, managing partner of eAutoAppraise. “The vehicle trade appraisal component is extremely crucial to any new vehicle transaction, and with Black Book powering our valuation, process we’re confident that we can offer up an experience that will increase customer satisfaction online and at the dealership.”

Along with the offerings of its new partnership, eAutoAppraise also can provide dealers a back office suite with values and direct mapping to for geo-targeting.

AutoGravity, which leverages advanced mobile technology to help vehicle shoppers secure financing, confirmed on Monday that its network of partner dealerships has grown to more than 1,400 franchised dealers.

The growth of the dealer network coincides with AutoGravity also highlighted that over 250,0000 users — more than half of whom are millennials — have downloaded AutoGravity iOS and Android apps.

Both milestones arrived roughly a month after Black Book announced an agreement to power vehicle trade appraisal for AutoGravity.

“This newly released data confirms that there's growing demand for a consumer-friendly, mobile-first car shopping experience,” said Serge Vartanov, co-founder and chief marketing officer of AutoGravity. “Dealers and lenders understand the changing needs of consumers and have partnered with AutoGravity to empower shoppers with transparency, convenience and choice.”

Since launching in 2016, AutoGravity has achieved significant growth across the United States, securing partnerships with some of the nation's top auto finance companies, as well as four of the top five national dealer groups, representing all new and used vehicle brands available in the country.

“The momentum we see at AutoGravity underscores how eager dealerships are to embrace new technology and thrive in the digital age,” said Aleks Bogoeski, co-founder and vice president of dealer network at AutoGravity.

“Rapid growth in our dealer network provides even more options to car shoppers turning to AutoGravity,” Bogoeski continued. “By empowering our users, AutoGravity gives partner dealers unparalleled exposure to ready-to-buy customers. We built a solution where everyone wins.”

Additional data-driven findings AutoGravity shared on Monday included the following:

—New cars remain popular with boomers. AutoGravity data shows two-thirds of car shoppers ages 50 and older who pursue financing do so for new vehicles. In contrast, only half of AutoGravity car shoppers ages 18 to 25 who pursue financing do so for new vehicles.

—Japanese brands perform in California. Japanese economy and luxury car brands are more searched relative to domestic brands in California (as compared to the U.S. overall).

—Economy cars continue to be a popular choice. Economy brands rank in the top four most searched for vehicles across the U.S., and luxury brands round out the top seven.

—Millennials more cost sensitive than Gen X. Among vehicle shoppers seeking financing on AutoGravity, millennials look to borrow about 15 percent less (finance amount requested) and seek to contribute roughly 25 percent less via a cash down payment relative to shoppers ages 36 and older.

AutoGravity is available for download on the Apple App Store and the Google Play Store. AutoGravity is also available as a mobile-responsive web app at www.autogravity.com.

The platform allows shoppers in 46 states to obtain up to four finance offers on any make, model and trim of new or used vehicle by following four steps. The app can return personalized retail installment contract and lease offers within minutes.

Following a public comment period, the Federal Trade Commission said this past Friday that it has approved final consent orders with CarMax, Asbury Automotive Group and West-Herr Automotive Group, settling charges that they touted how “rigorously” they inspect their used vehicle, “yet failed to adequately disclose that some of the cars were subject to unrepaired safety recalls,” according to the regulator.

FTC officials explained the final orders announced prohibit CarMax, Asbury and West-Herr from claiming that their used vehicles are safe, have been repaired for safety issues, or have been subject to a rigorous inspection, unless they are free of open recalls, or the companies clearly and conspicuously disclose that their vehicles may be subject to unrepaired recalls for safety issues and explain how consumers can determine a vehicle’s recall status.

They added that the orders also prohibit the companies from misrepresenting material facts about the safety or recall status of the used vehicles they advertise.

In addition, the orders require the companies to inform recent customers by mail that vehicles they bought as far back as July 1, 2013 may be subject to open recalls.

The commission vote approving the final orders against CarMax, Asbury and West-Herr and letters to commenters was 2-0.

The FTC’s complaint against CarMax cited its claims about rigorous used-car inspections, including its “125-plus point inspection” and that its vehicles undergo, on average, “12 hours of renewing — sandwiched between two meticulous inspections.” The complaint also notes a TV commercial touting a team inspection and reconditioning, which included a message that appears for three seconds in tiny type at the bottom of the screen stating, “Some CarMax vehicles are subject to open safety recalls.”

Despite highlighting its inspections, the FTC said that CarMax failed to adequately disclose that some of the vehicles had open recalls. These recalls included defects that could cause serious injury, including the GM key ignition switch defect, as well as the Takata airbag defect.

Similarly, the FTC’s complaint against Asbury Automotive Group, which also does business as Coggin Automotive Group and Crown Automotive Group, alleged that the company made claims such as: “Every Coggin Certified used car or truck has undergone a 150 point bumper-to-bumper inspection by certified mechanics. We find and fix problems — from bulbs to brakes — before offering a vehicle for sale.”

However, as alleged, the FTC said Asbury advertised some certified used vehicles without adequately disclosing that some of the vehicles were subject to open recalls, including one that could cause fuel to leak and the engine to misfire or stall, and one that could cause a car to move in an unexpected or unintended direction.

The FTC’s complaint against West-Herr Automotive Group, the largest auto group in New York, cites claims about vehicles backed by the “West-Herr Guarantee” and touting a “rigorous multi-point inspection with our factory trained technicians.” However, the complaint alleged again that the company failed to properly disclose that some of the vehicles were subject to recalls for defects that could result in serious injury.

The car brands whose dealers currently deliver the highest-rated customer experience are Lexus, Kia, Chevrolet and Toyota, according to the findings of customer research and consulting firm Temkin Group’s seventh annual Temkin Experience Ratings report, which evaluates 331 companies across 20 industries.

Temkin surveyed 10,000 U.S. consumers and evaluated their recent experiences with companies across the three different “dimensions” listed below.

• Success: Can you do what you want to do?

• Effort: How easy is it to work with the company?

• Emotion: How do you feel about the interactions?

The firm averaged the three scores to produce each company's Temkin Experience Rating.

Of the 21 auto dealers included in this year’s ratings, Lexus dealers rank number one with a score of 77 percent.

Kia dealers came in second place with a score of 74 percent, and with a score of 73 percent, both Chevrolet and Toyota tie for the third spot.

The following lists the ratings of all auto dealers included in the annual report.

• Lexus: 77%

• Kia: 74%

• Chevrolet: 73%

• Toyota: 73%

• Mercedes-Benz: 72%

• Volkswagen: 72%

• Jeep: 71%

• Nissan: 71%

• Ford: 69%

• Subaru: 69%

• Cadillac: 68%

• Buick: 67%

• Honda: 67%

• Audi: 66%

• Hyundai: 66%

• BMW: 64%

• Chrysler: 63%

• Dodge: 62%

• GMC: 62%

• Mazda: 61%

• CarMax: 60%

A score of 80 percent or more is considered "excellent," a score of 70 percent and higher is deemed "good," and any score below 60 percent is considered "poor," the firm said.

Temkin also ranked the overall auto dealer industry against several other industries.

The auto dealer industry averages a rating around 69 percent, according to the analysis.

The industry came in 9th place out of the 20 industries examined and improved its average rating by twelve points between 2016 and 2017, from 57.1 percent to 68.6 percent.

To read the firm’s full report, visit www.TemkinRatings.com.

Particular car shoppers respond better or worse to different words when debating which car to buy, according to new research released by CDK Global on Tuesday.

The company’s latest edition in its Language of Closers series provides demographic specific entail that is valuable to dealers seeking out ways to most effectively describe inventory on their vehicle description pages.

“Our research examined the words that would eventually lead buyers of different demographics to leave a review website and head to a dealership site,” Jason Kessler, lead data scientist at CDK Global, said in a news release. “In our most recent analysis, we were able to pinpoint specific words that shed valuable light on what vehicle traits matter most to women, Generation-X consumers, recent college graduates, and parents."

CDK found a number of words that it says resonate with multiple demographics heavily.

For example, the research revealed that mentioning the word "power" attracted several groups. CDK suggests it helps to illustrate the experience of driving a vehicle in a relatable way.

“Certain words fell flat and failed to lead prospective buyers to a dealership site,” the provider of integrated information technology and digital marketing solutions said.

Women responded negatively to “bigger,” Generation-Xers would rather read "performance" over "design" and most parents fell that both "sound" and "tech" were low priorities compared to others.

Below is a list of the top and low performing words associated with four demographics that CDK highlights.

WOMEN

Top: drive, power, trip, comfortable, luxury

Low: bought, transmission, owned, bigger, cargo

GEN-X

Top: truck, power, luxury, package, performance

Low: back, seat, design, built, difference

COLLEGE GRADS

Top: buy, work, truck, power, highway

Low: company, designed, inside, warranty, light

PARENTS

Top: truck, leased, row, nice, purchase

Low: sounds, buying, control, tech, company

"As a leading provider of websites and digital advertising for dealers and OEMs, we are always looking for the best ways to help our customers bring the right buyers into their dealership. By making subtle changes to the language used on vehicle description pages, dealers can help customers easily identify cars that they both connect with and fit their lifestyle needs," Kessler added. "Ultimately, these changes will prime both dealers and customers for success."

For more information about The Language of Closers, visit http://www.cdkglobal.com/promo/language-of-closers-reviews.

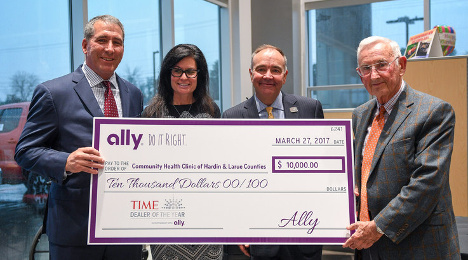

Ally and TIME held a celebration event in Kentucky on Monday to honor the 2017 TIME Dealer of the Year winner — Carl Swope — a second-generation dealer who currently oversees six dealerships representing nine brands in Elizabethtown, Ky., and Radcliff, Ky.

Swope was selected from a group of 49 nominees from across the country who are successful auto dealers that demonstrate a long-standing commitment to community service, Ally said.

The event was held at Swope Toyota in Elizabethtown. Business leaders from TIME and Ally joined local government officials and dealership personnel in attendance.

Ally said Swope has been chosen for his community involvement, support of civic activities, and dedication to local nonprofit organizations such as Hardin Memorial Health Foundation, Habitat for Humanity and Project United.

"On behalf of all of us at Ally, we are honored to recognize Carl Swope and his commitment to doing right and bettering the community and the state of Kentucky," Ally president of auto finance Tim Russi said in a news release. "Carl Swope embodies the character and type of leader that the Time Dealer of the Year program was built to recognize."

Swope and his family of dealerships have particularly supported the Community Health Clinic of Hardin and LaRue Counties since its founding in 2002.

In honor of Swope being named dealer of the year, Ally donated a $10,000 grant to the clinic.

"We are so grateful for Carl Swope's involvement with the Community Health Clinic of Hardin and LaRue Counties," chairman of the board of directors Dr. William Handley said. "We are elated that Carl has been chosen for this prestigious award, and we cannot thank him enough for his contribution to this organization. Day in and day out he continues to inspire and encourage thousands of community members."

Swope was first announced as the TIME Dealer of the Year at the National Automobile Dealers Association Convention in New Orleans on Jan. 27.

For more information about the award program, or to read about this year’s nominees, visit www.allydealerheroes.com.