Here’s a statistic that might startle auctions and dealerships in the Golden State and beyond.

Southern California leads the nation in fatalities caused by defective airbags, according to Airbag Recall: Southern California, a group that comprises community organizations, public interest groups, private companies, elected officials, faith communities and other concerned parties unified in the effort to raise consumer awareness about the ongoing airbag inflator recall.

With claims such as that one as a backdrop, Silicon Valley tech startup Recall Masters explained that it is using digital forensics — the process of culling, processing and organizing enormous quantities of unstructured recall data — to identify hundreds of thousands of problem vehicles per month.

Recall Masters claims to have compiled these five achievements:

* Identified 63 million vehicles in open recall since 2000.

* Gotten hundreds of thousands of recalled vehicles into dealerships for repairs — reducing the danger on America's roads.

* Plugged 46 data sources into its system, making it the most comprehensive recall database in the world.

* Been the first software company to digitize “don’t drive” and “stop sale” recall tracking into its SaaS API and batch processing platforms.

* Generated millions of dollars in revenue without any outside funding.

Airbag Recall: Southern California asserted that at least 11 Americans — including three Californians — have been killed by defective airbag inflators, and approximately 180 Americans have suffered serious injuries, including cuts or lacerations to the face or neck, broken or fractured facial bones, loss of eyesight and broken teeth. The group insisted the risk for serious injury or death is particularly acute in southern California due to high temperatures that exacerbate the defect in the airbag inflator.

A new community mobilization effort organized by Airbag Recall: Southern California is educating communities across the region about the magnitude of the recall and helping affected drivers schedule life-saving, free repairs with local dealerships, where replacements parts are available for higher-risk vehicles.

“In southern California, many of us drive or ride in a car every day, several times a day. If your vehicle contains a defective airbag, this part of your daily life could threaten your life,” said Kenn Phillips, president and chief executive officer of Valley Economic Alliance, an organization whose mission is to elevate the economic vitality and stability of a five-city region including Burbank, Calabasas, Glendale, Los Angeles and San Fernando.

“To confront this issue head-on, the Valley Economic Alliance has partnered with auto body shops throughout the area to check drivers’ vehicles for outstanding recalls and to educate them on how to get their airbags replaced free of charge at a local dealership,” Phillips continued. “Our organization is committed to supporting outreach efforts throughout Southern California and to helping prevent another deadly accident caused by a defective airbag inflator.”

Gil Dyer, board director of the Latin Business Association, mentioned another component of the matter that’s making repairs to these recalled vehicles more complicated.

“It is critical that information about the airbag recall reaches all residents of the greater Los Angeles area, regardless of the neighborhood they live in or the language they speak,” Dyer said. “We must work together with local organizations to educate drivers about the airbag recall and to assure them that their privacy will be protected throughout the airbag repair process.

“Regardless of your immigration status or what type of vehicle you drive, visit AirbagRecall.com today. If your vehicle is impacted by the airbag recall, a dealership will fix it for free — no questions asked,” Dyer went on to say.

Multi-touch attribution provider Clarivoy recently announced the launch of an industry-wide study that will examine the current state and usage of attribution within the retail automotive industry to better understand which marketing investments most effectively lead to vehicle sales.

“While multi-touch attribution has been a big ‘buzzword’ lately, we think there is still a long way for us to go in educating dealers on its importance,” said Clarivoy chief executive officer Steve White. “The results of this study will help us gauge dealers’ baseline understanding of attribution, and their use of it, so that we as an industry can better help dealers understand and appreciate the dynamic and ever-changing customer journey that is not always accurately measured.”

Clarivoy said multi-touch attribution tracks and measures the multiple factors that influence a car buyer’s experience.

Dealers have relied on first or last-click attribution provided by Google Analytics which only measures engagements, not sales, according to Clarivoy.

The company said rather than rely on first or last click attribution, dealers can better determine how to bring in consumers by using multi-touch attribution.

“(Consumers) read reviews of vehicle models and dealerships, search prices and bounce around from site to site like never before. As a result, the average number of dealerships visited before purchasing a vehicle is dwindling,” White said.

“It is more important than ever before that dealers know how effective their marketing dollars are at bringing those prospects from the anonymous browser into their showroom," he continued. "This study will provide valuable information about the state of attribution we can share with the industry.”

Dealers who are interested in participating in the study can visit www.clarivoy.com/survey.

Participants can register to receive an advanced copy of the study results, as well as the chance to win a $100 Amazon gift card.

“Our end goal is that the results will help more dealers gain the knowledge to answer the question they have been asking themselves forever, ‘Is my investment helping me sell more vehicles?’” White added.

Instead of financing a new purchase, online used-car retailer Vroom chief revenue officer Scott Chesrown says a pre-owned purchase is an answer to a consumer weary of investing in a new-car and due to the rate of depreciation after just a few years.

“When you purchase a pre-owned vehicle, especially, high-quality pre-owned cars at great financing rates, I think you protect your investment — much more than if you were to get a great financing rate on a new car that depreciates, according to Edmunds, on average about 10 to 15 percent when that car leaves the lot,” Chesrown said during a phone interview with Auto Remarketing.

“What we try to do from a finance perspective is make sure consumers aren’t locking themselves into some bad decisions,” he said.

Vroom currently works with a portfolio of more than 30 lenders that the company pairs with its pre-owned customers.

“We established relationships with lenders in kind of a traditional way, just reaching out to them and picking out the relationship.”

Chesrown said Vroom does nothing different than most car dealers could do.

“The difference is that as we’ve continued to grow in scale, the process that which we put our vehicles through from a reconditioning standpoint and the way we certify the cars,” he said.

“The growth plus the quality of vehicles has allowed us to really develop those relationships a little bit further to make sure that we can offer the best rates to our consumers.”

Vroom’s partners feel comfortable lending money, on the vehicles the company offers given their quality, according to Chesrown.

He said, “It’s very much an indirect model that you find at most dealerships; you just expand and make sure that you’re working with the right lenders so that you can service all ranges of credit.”

In a departure from some traditional dealers, there’s no negotiating that goes on at Vroom. The online retailer can provide finance rates within minutes of a shopper visiting the site.

“We try to bring our best foot forward with the consumer and give them our best possible rate up front; as a result, the finance terms that we get are consumer friendly,” Chesrown added. “When you work with good finance sources such as Capital One and big players that is the benefit we bring with kind of having that marketplace approach.”

There are different ways a consumer can secure financing. A consumer can start the process by visiting Vroom.com and going through a pre-approval process integrated with Capital One.

Consumers are asked to fill out a credit application, and once complete, they can receive a real-time offer back on a vehicle.

Chesrown said this uniquely allows Vroom to help consumers make educated finance decisions without hurting their credit.

“Everything comes in through our back-end system, and we score the credit against where we know fiscal lenders perform,” he explained.

Vroom then submits each credit application to up to three different lenders that it determines should align with what lenders typically offer based on the credit profile and asset class of the consumer.

“It’s a competitive process — it’s almost like a marketplace — the banks know that we’re not giving priority to any which one bank, but they’re doing that bidding for that consumer’s business and as a result, we end up getting really attractive finance rates for our consumers,” Chesrown added.

He said most car shoppers either want to know what they can be approved for and the current value of their car, so they can determine whether they want to make a purchase.

The company even offers consumers the ability to take a few photos from their phone and simply scan their VIN to receive a guaranteed offer back in minutes.

If a shopper favors a more traditional route or they’re just interested in understanding their financing options, they can create an account on Vroom.com to begin the approval process.

“We ask a couple of questions on the credit application. It’s all secured, and at that point, we either give them a pre-approval back from Capital One, or our credit team in Houston, who reviews all applications that come through our processing center,” Chesrown said.

Though all transactions can easily be done online at a consumer’s pace, he said Vroom makes its team available to speak with shoppers on the phone if they prefer.

“We find a lot of times customers want to speak with us on the phone because it is an expensive transaction even if they’re doing the transaction totally online,” he added.

“Typically they want to have a few questions answered, and that’s where we make a team available to speak with the customer and answer any finance related questions should they arise.”

Additionally, from a compliance perspective, it’s really important that Vroom not store any sensitive information and makes sure lenders, secure information for consumers, according to Chesrown.

“I think that’s critical,” he said. “When consumers create accounts we have things such as name and email address, which is all encrypted.”

Consumer information is secured offsite through security measures, and Vroom has a team in place that focuses on security, both electronic and physical.

“When you’re processing titles and things along those lines, you have paper. It’s one of those facts of doing business in the automotive space you know you will have paper to some extent in order to process a transaction,” Chesrown added.

Vroom also has team members responsible for making sure that the company follows proper protocols, such as how employees discuss information with consumers over the phone, which entails verifying their identity before speaking about anything else.

“It’s probably the most critical piece in our business; especially with our volume, we need always to make sure we are tight on compliance,” said Chesrown.

“I think the biggest way to focus on that is eliminate the amount of sensitive information you hold on a consumer, so that’s where being a technology company has really helped us make sure that we’re not printing out unnecessary information you might find at car dealerships.”

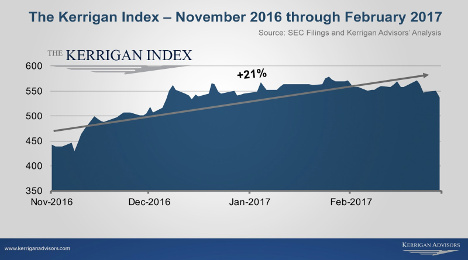

Two firms — Haig Partners and Kerrigan Advisors — each shared upbeat reports about the “robust” outlook for dealership buy-sell activity.

In fact, The Blue Sky Report from Kerrigan Advisors went so far as to say dealership buy/sell activity is set to rebound to record levels in 2017 as the firm released its analysis for the full year of 2016.

Although there was what Kerrigan classified as a slight decline — 8 percent — in overall transaction activity a year ago, and rising real estate costs are set to present a challenge for buyers, the report indicated what’s driving robust optimism are five factors, including

—An increase in “serious” sellers coming back into market

—Improved valuations

—Private buyer demand for large acquisitions

—Advantageous market fluctuations

—The “Trump Bump”

“Most dealers understand that the opportunity has passed to obtain above-market blue sky prices and, instead, are satisfied knowing that today’s valuation levels are still very high, particularly on a historic basis,” said Erin Kerrigan, managing director of Kerrigan Advisors.

“Buyers are finding pricing more reasonable in part because today’s sellers are serious about a sale. The market testers who were seeking ‘crazy’ blue sky values have primarily returned to operating their businesses, discovering those unrealistic values were not attainable,” Kerrigan continued.

Laying out the high, average and low multiples for each franchise in the luxury and non-luxury segments for the quarter, the report is geared to offer a detailed view of public and private company dealership acquisition activity. Other key findings from the report include:

• 221 dealership buy/sell transactions were completed last year, compared to the record of 241 transactions in 2015.

• 57 multi-dealership transactions were completed last year, resulting in an 8 percent increase over that 2015 record.

• Ford, Chevrolet, Toyota, Honda and Subaru are likely to be chief targets of acquisition activity.

• Domestic franchises saw their buy/sell market share increase by 42 percent in 2016.

• With truck sales still on the rise, domestic buy/sells will continue to dominate the 2017 buy/sell market.

• Public auto retailers’ acquisition spending decreased 21 percent in 2016 compared to 2015, with Lithia and AutoNation the only publics to make acquisitions of U.S. dealerships in 2016.

• Publics sold nearly as many dealerships as they acquired.

• The private sector acquired 89 percent of the franchises sold in 2016.

• The average dealership’s real estate value is estimated at $10.3 million, while the average dealership’s blue sky (goodwill) value is estimated at $6.6 million.

The report also identifies the following four market trends, which Kerrigan Advisors expects to affect the buy/sell market in 2017 and beyond. They included:

• Buyers’ return on investment parameters drive buy/sell activity

• Sellers’ pricing expectations rationalize with a plateauing market

• Buyers seek investments in higher margin auto retail business segment

• Dealers are increasingly open to equity and growth capital partners

“Overall, we expect 2017 to be a very active year for buy/sells with private and more public buyers eager to put their capital to work. We find an increasing number of sellers coming to market motivated by current prices and a strong desire to capitalize on today’s buy/sell activity,” Kerrigan said.

“As more dealers find their succession plans have run their course, we expect the number of sellers to rise, given the generational shifts underway in auto retail and the aging of the U.S. dealer network,” she went on to say.

The Blue Sky Report, a Kerrigan Quarterly, is published four times a year and includes Kerrigan Advisors’ signature blue sky charts, multiples and analysis for each franchise in the luxury and non-luxury segments. The multiples are based on Kerrigan Advisors’ view of franchise values in the current buy/sell market and can be applied to adjusted pre-tax dealership earnings to estimate blue sky value.

To download the Kerrigan Advisors report, go to this website.

Haig Partners findings

The number of dealerships sold in the U.S. declined 6.5 percent from the peak levels reached in 2015, according to data published in the 2016 year-end edition of the Haig Report.

Haig Partners indicated demand shifted from luxury and import brands to domestic brands that are heavier in trucks and SUVs. The firm also said most franchise values remain unchanged.

Despite a decline in the number of dealerships sold, Haig’s report also mentioned the number of dealership groups sold increased 17.6 percent, as their owners took advantage of market conditions to exit the industry.

Haig went on to state demand for dealerships remains strong with public dealer groups, private dealer groups and institutional investors all looking for fairly priced acquisition opportunities.

The Haig Report is based on data gathered from many public sources, as well as interviews with leading dealer groups, and bankers, lawyers and accountants who specialize in auto retail.

Key findings from the 2016 Year End Haig Report include:

—357 dealerships sold in 2016, down 6.5 percent from 2015.

—Public company spending on U.S. auto dealerships fell 14.5 percent from 2015 as they spent more of their capital on stock buy-backs, European auto dealerships and truck dealerships/leasing.

—Sales of dealership groups increased 17.6 percent from 51 groups in 2015 to 60 groups in 2016, as owners took advantage of conditions to exit near all-time high valuations.

—21 percent fewer luxury dealerships sold, 25 percent fewer midline import dealerships sold, while sales of domestic dealerships increased 31 percent as compared to 2015.

—Macroeconomic indicators such as GDP, interest rates, employment, number of miles driven, gas prices and consumer sentiment are all highly favorable for dealers at the moment.

—Other trends such as used-vehicle pricing, incentive spending by the OEMs and loan losses are growing less favorable to dealers.

—Haig Partners average blue sky multiple fell 2.9 percent from 2015.

—Average profits per dealership fell 2.4 percent compared to 2015 to $1.467 million per dealership.

—Average estimated blue sky values per dealership dipped 5.4 percent from to 2015 to $6.83 million.

—Private equity firms and family offices are increasingly active and making substantial investments in auto retail.

“Despite the small contraction in 2016, we expect 2017 will be another strong year for dealership buy-sell activity,” said Alan Haig, president of Haig Partners. “There remain many buyers looking for dealerships, financing is still readily available, and more sellers are realizing that if they want to sell their dealerships before the next recession they will likely need to accept today's offer since tomorrow's offer could be lower.

The 2016 Year End Haig Report also addressed the potential impact of the Trump administration on the value of dealerships. The report found values could go up if regulations are reduced, taxes are reduced and we enjoy faster economic growth, or down if we face higher interest rates, trade wars, escalating international tensions or a recession.

Haig Partners is seeing these conditions in its current engagements that include domestic, import and luxury dealerships that range from Florida to New York to California. The value of the transactions they have closed over the past two and a half years is approximately $900 million, including two of the largest transactions of 2016, so they have unique insights into current market conditions and how they impact dealership values.

The Haig Report is published each quarter and is a valued source of information to many in the auto industry who look to it for its comprehensive data, analyses and opinions about the auto retail industry. Included in each edition are Haig Partners' blue sky multiples that serve as a gauge for franchise values.

To download the Haig report, go to this website.

With 10 sales days left in the month to move certified metal, Autotrader editors released their list of the best certified pre-owned offers available in March. For potential buyers looking to head into spring with the purchase of a like-new vehicle, the site said this could be the right time for dealers to help their customers upgrade the vehicle.

Autotrader executive editor Brian Moody reiterated the CPO sales pitch dealership personnel can relay to “ups” arriving at the showroom in person or virtually in the business development center.

“Certified pre-owned programs typically include an extended warranty and other incentives that provide long-term value, such as bumper-to-bumper coverage and exceptionally low interest rates,” Moody said. “These deals are the perfect option for a used-car shopper who wants the confidence of a new-car purchase."”

To assist dealerships and their customers, the editors at Autotrader highlighted the top monthly certified pre-owned deals, which include:

— Buick’s CPO program touts six years or 100,000 miles of powertrain coverage from the original sale date — a generous term. This month, Buick is also offering 1.9 percent interest for up to 36 months to qualified shoppers on three popular certified pre-owned models: the Enclave, Encore, and LaCrosse.

— Chevrolet’s CPO program offers an additional year of bumper-to-bumper warranty coverage beyond the factory term, and touts six years or 100,000 miles of powertrain coverage from the original sale date. This month, it’s even more appealing, as Chevrolet is offering 1.9 percent interest for up to 36 months to qualified buyers on several popular certified pre-owned models: the Cruze, Equinox, Malibu, Silverado, and Traverse.

— Ford’s CPO program is impressive, as it offers an additional year of bumper-to-bumper warranty coverage, along with seven years or 100,000 miles of powertrain protection from the original sale date. Through the end of the month, Ford is offering 2.9 percent interest for up to 66 months on all of its certified pre-owned models to qualified shoppers — an impressively long term for used vehicles.

— GMC's CPO program boasts excellent warranty coverage: in addition to one extra year of bumper-to-bumper coverage, GMC's warranty offers six years or 100,000 miles of powertrain protection from the original sale date. This month, GMC is sweetening the pot even further with a special interest offer for qualified shoppers: 1.9 percent for up to 36 months on all Acadia, Sierra, and Terrain models.

— Infiniti's CPO program is clearly among the best in the industry, as it offers excellent coverage that can, in many cases, last for six years — with no mileage limit — from the vehicle’s original sale date. Not offering a mileage limit is truly impressive, and Infiniti makes things even more enticing in March with an excellent low-interest financing offer. That deal boasts 0.99 percent interest for up to 36 months on all certified pre-owned Infiniti models to qualified buyers.

— Land Rover's CPO program boasts coverage for up to seven years or 100,000 miles from the original sale date. In March, Land Rover makes things even more appealing with a low-interest offer for qualified shoppers. Although the offer varies from model to model, it boasts 1.9 percent interest for up to 60 months on most 2013-2015 models — and 0.9 percent interest over that term for the popular compact Range Rover Evoque to qualified shoppers.

— Toyota’s CPO program offers one year of bumper-to-bumper coverage, along with a powertrain warranty that covers vehicles for six years or 100,000 miles from the original sale date. This month, Toyota is sweetening that deal with several low-interest special offers — but the best deal is on the Prius. The hybrid model doesn't just get excellent fuel economy, but also touts interest rates from 1.9 percent for up to 60 months to qualified buyers — a new car deal with a new car warranty for a used car.

— Volvo’s CPO program touts bumper-to-bumper coverage for up to seven years or 100,000 miles from a car's original sale date — longer coverage than virtually every rival. Volvo is offering a special finance rate in March. Through the end of the month, Volvo is touting 0.9 percent interest for up to 24 months on all certified pre-owned Volvo models to qualified buyers.

For additional details on the CPO programs mentioned, go to this website.

String Automotive, provider of the Dealer Positioning System (DPS), recently debuted its next competitive intelligence mobile app for dealerships — StringDPS Pulse.

The company said StringDPS Pulse is being offered after a wildly successful beta period with requests for the app quadrupling the original goal set for the time period.

What String Automotive contends is the first of its kind in automotive, the free app not only can help dealerships track their competitors based on geo-targeting, but it also can compare market share by ZIP code and area, provides model by model comparisons, and serves up detailed new inventory pricing and turn information down to trim level.

In addition, a “competitor feed” feature can enable dealers to track changes in pricing and marketing from competitors and adjust accordingly. The result is a mobile game plan with pinpoint accuracy of competitors and opportunities to win in the dealer's own market.

“We rolled out this app in beta to a select group of key clients and influencers and everyone was blown away by the precise level of competitive market share information and detailed comparisons it provides,” String Automotive chief executive officer Ken Kolodziej said.

“One of our beta testers told me DPS Pulse allowed him to walk into his sales meeting, look at his phone, and tell his team their No. 1 competitor and top sales ZIP code in real-time,” Kolodziej continued.

StringDPS Pulse is currently free to any dealer who owns an iPhone, with plans for Android models coming soon. Interested dealers can find and download DPS Pulse in the app store on their phone.

“This is a secret weapon for dealerships that will not only analyze market share, but also strategically help outperform competitors,” Kolodziej said. “It’s the only mobile solution on the market that gives dealers this information in an easy, accessible format, and best of all, we're giving it away for free."

String Automotive is in the middle of a tremendous growth period, with more than 130 percent year-over-year growth in 2016 alone. In addition to a rapid expansion in dealer rooftop numbers, String has also increased its ad agency partners, brought on multiple technology integration partners, and completed three product introductions in the last year.

String Automotive’s Dealer Positioning System is a marketing intelligence platform that can combine multiple sources of data from inside and outside the dealership to provide a rich, actionable plan to dominate market share in each geographic area. By showing dealership personnel where they can lift market share, which channel will be most effective in doing that, and what message will resonate best with those target customers, String can help dealerships make the most of their marketing budgets.

To download StringDPS Pulse on your iPhone, visit the Apple App Store or http://dpspulse.com.

While consumers are more apt to visit stores on days that are warmer and drier — making it easier for dealerships to move inventory — a report recently released by The Weather Company showed that cooler temperatures and inclement weather more likely drive consumers to choose to stay home and want to do research online via their mobile devices or home computers instead of making that trip out to a showroom floor to scout potential purchases.

Because the vehicle-buying process is heavily influenced by weather conditions, the report suggested dealership marketers would greatly benefit from taking steps to implement a weather strategy the most optimally crafted to support their endeavors.

The Weather Company said its latest report is designed to analyze how much this summer’s weather is expected to impact auto buying.

“What we see is that most severe weather and precipitation have a larger impact in keeping consumers out of the dealers,” The Weather Company’s vice president of automotive sales Sarah Ripmaster said during a phone interview with Auto Remarketing.

This summer, dealerships can optimize their marketing efforts if their strategy is developed with the weather in mind, the report suggested.

“The research shows that this coming summer — based on our historical data — is looking to be a drier summer and cooler summer,” Ripmaster said. “While the summer may be cooler, it doesn’t necessarily mean that consumers will not be into the dealerships, it’s more about figuring out the mindset of the consumer during different conditions.

"Even if it’s cooler, consumers have high energy," she continued. "They’re creative even if they’re feeling a little bit cool. They are more apt to want to be in a more creative environment, they want to be spoken to in a different way than if it were really, really hot or really, really cold.”

The report indicated that 76 percent of drivers surveyed said weather conditions determine whether when they chose to visit a dealership.

“That’s a really high number, and it’s important for OEMs to consider when marketing,” Ripmaster said.

Weather not only impacts sales but consumers’ behavior as well, she suggested.

“Weather is one of the highest drivers of behavior linked directly to consumer behavior, 66 percent test drive their vehicle before they make a purchase this is no surprise,” Ripmaster explained.

“What’s important to note is that as you’re driving consumers down the purchase tunnel and you’re getting them close to the purchase — we know that consumers don’t test drive vehicles when weather is inclement, when there’s heavy precipitation or when it’s freezing cold.”

She said if marketers don’t take steps to deploy messaging that is created specifically to connect with consumers during particular weather conditions, they may be wasting ad dollars.

“It’s important to understand the link between weather and consumers purchase behavior when digitally marketing to this consumer,” Ripmaster said. “When we know that there is a rain storm coming, an OEM marketer may want to suppress advertising messages.”

The following lists three conditions the report cites as keeping consumers away from lots the most.

• Snow/Hail: 76%

• Extreme Cold: 51%

• Fog: 40%

In December, the weather data provider surveyed more than 1,400 adults, ages 18 and up on weather.com for more than three weeks. To view the report visit, go to this website.

AIM Group, an interactive media and classified advertising consultancy firm, claims in a report that via “an unusual business model” CarGurus has leapfrogged Autotrader.com and Cars.com to become traffic leader among automotive advertising sites in the U.S.

In its 2017 Automotive Advertising Annual report, the AIM Group highlighted that it explores how “this low-profile company blew past the established market leaders.”

In a four-page case study about the growth of CarGurus, AIM Group’s Classified Intelligence Report auto annual examines its funding, its tactics, its business model and its future.

The 65-page annual report covers 30 countries and 100 companies. It profiles 35 disruptive auto advertising start-ups, and includes an "innovation roundup" of 58 steps taken in 2016 by established auto ad companies to strengthen their business. The report also includes a bonus of non-auto content in a "mini" edition of Classified Intelligence Report.

“Conventional wisdom says 'winner-takes-all' in classified advertising, but CarGurus has proven that a creative business model and a focus on end-users can up-end the market leaders," said Rob Paterson, AIM Group director of consulting.

“As CarGurus expands internationally, it will challenge well-established auto ad sites in markets like the U.K., Canada and Germany. Our report explores the competition in those countries and what CarGurus has been doing and plans to do in 2017 to attack the competition,” Paterson continued.

The report also covers the ways horizontal classified sites covering all categories have expanded their listings from auto dealers, and how a site redesign at a Russian auto site tripled traffic.

“The pace of innovation at auto sites is increasing, and this report can serve as a road map to the changes that can make a big difference to classified sites — whether they’re automotive or other classifieds,” Paterson said.

The report is available for $1,495 from AIMGroup.com, where a free preview edition is offered for download here. AIM Group said the report comes with a money-back guarantee.

With Buick and Lexus leading the way, quality of automotive service continues to show significant improvement and is driving an increase in overall customer satisfaction, according to the J.D. Power 2017 U.S. Customer Service Index (CSI) Study released on Thursday.

Furthermore, service departments should brace to use text messages more often to reach their customers more effectively.

J.D. Power’s study indicated service quality scores account for the greatest improvement, rising to 805 (on a 1,000-point scale) from 779 in 2015, when the project was redesigned. The other four measures — service advisor, service initiation, service facility and vehicle pick-up — all showed improvement from 2015 levels.

Overall customer service came in at 813, up from 800 over the same period, according to the study.

The study measured customer satisfaction with service at a franchised dealer or independent service facility for maintenance or repair work among owners and lessees of 1- to 5-year-old vehicles.

“The quality of work — doing the job right the first time — can noticeably affect customer satisfaction and loyalty, but it shouldn’t be viewed in a vacuum,” said Chris Sutton, vice president of the U.S. automotive retail practice at J.D. Power. “Proactive communication with the customer, especially while the car is being serviced, is one element that has a direct influence on loyalty.”

The study indicated that among customers who are contacted by phone, 55 percent say they “definitely will” return for paid service. When receiving text message updates, that loyalty factor jumped to 67 percent.

Additionally, customers’ preference for communicating via text has increased 3 percent to 6 percent across all generational categories since 2015. More than four in 10 Gen Y1 and Gen X customers — 41 percent to be exact — now cite this preference, as do 25 percent of Boomers and 10 percent of Pre-Boomers.

“It’s not surprising to see the preference for receiving updates through text messages continue to rise, but only 3 percent of customers indicate they receive text message updates,” Sutton said. “Correcting that disconnect by adding more text message capability should be a priority with a service operation.”

Additional key findings of the 2017 study included:

—Service advisor scores big: The highest level of satisfaction is in service advisor with a score of 834. This is followed by service initiation (830), service quality (805), vehicle pick-up (803) and service facility (790).

—Technology affects satisfaction: Increases in the use of tablets by service advisors and online scheduling tended to increase customer satisfaction. Tablet usage increased to 24 percent from 17 percent in 2015, and online scheduling rose to 13 percent from 9 percent during the same period.

—Almost a clean sweep: Customers rated dealers higher than non-dealers in 15 of 16 attributes. The most noticeable advantages are amenities offered; comfort of waiting area and cleanliness of dealership. Non-dealers rate higher in time required to complete vehicle service — but only by 0.06 points on a 10-point scale.

—The value of getting it right the first time: The vast majority (94 percent) of customers who take their vehicle in for service indicate that the dealer fixed it right the first time. However, among the 6 percent of customers indicating the service work was not completed right on the first visit, satisfaction dropped to 639, which is 184 points lower than among those whose work was completed right the first time.

—Too much static: Dealers seem to have trouble servicing problems with radios. It’s unclear if the issue is vehicle- or service-related, but only 80 percent of customers who sought service for a radio reception problem indicate the dealer was able to fix it right the first time.

Lexus ranked highest in satisfaction with dealer service among luxury brands with a score of 874. Following in the luxury ranking were Audi (869), Lincoln (868), Porsche (867) and Cadillac (865).

Buick ranked highest in satisfaction with dealer service among mass market brands with a score of 860. Following in mass market brands were Mini (850), GMC (837), Chevrolet (829) and Nissan (822).

The 2017 U.S. CSI Study is based on responses from more than 70,000 owners and lessees of 2012 to 2016 model-year vehicles. The study was fielded between October and December 2016.

For more information about the 2017 U.S. Customer Service Index Study, visit this website.

The National Automobile Dealers Association reminded members that those who participate in its Dealership Workforce Study by completing a questionnaire and submitting their payroll records will receive two complimentary reports.

NADA officials recapped that the reports, titled “Automotive Retail: National & Regional Trends in Compensation, Benefits & Retention,” is one of the industry’s top resources for helping dealers meet their No. 1 challenge of attracting and retaining productive employees.

The report contains clear analysis of the light-vehicle and commercial-truck industry. The report includes national and regional data for 60 car and truck dealership positions.

In addition to data on pay, benefits and turnover, the report details the impact of work schedules, gender gap and generational challenges facing dealerships today.

Participants will also receive a complimentary individualized comparative report for each participating dealership.

To enroll in the 2017 Dealership Workforce Study, which is open through April 28, visit www.nadaworkforcestudy.com and enter your member or company ID. For questions, send an email to [email protected] or call (800) 557-6232.