Perhaps the next “up” to come through your dealer website or walk into the showroom might want to own more than one vehicle.

While the rate of ownership of cars and light trucks has steadily declined since its peak a decade ago, it is starting to climb, according to a University of Michigan researcher.

In his ninth report in a series examining recent changes in various aspects of motorization in the U.S., Michael Sivak of the U-M Transportation Research Institute (UMTRI) found that vehicle-ownership rates per person and per household are up, on average, 1.4 percent since 2012-2013.

However, both rates are down, on average, 4.4 percent from their peak in 2006.

"Whether the recent increase in vehicle ownership represents the beginning of a new long-term trend, it is too early to tell,” Sivak, a research professor at UMTRI, said in a news release.

Sivak said the vehicle ownership rate per person for 2015 is about the same as it was in 2000, while the rate per household for 2015 is about the same as it was in 1993.

In addition, the report looked at distance-driven rates per person and per household, both of which peaked in 2004. While the two rates for 2015 are down, on average, 7.8 percent from their peak, both have risen, on average, 2.1 percent since 2013.

The rate per person for 2015 is about the same as it was in 1997, while the rate per household for 2015 is about the same as it was in 1994.

Sivak’s report used data from 1984 to 2015 from the Federal Highway Administration, ProQuest and the U.S. Census Bureau.

Dealerships are losing an average $380,000 annually in service revenue as a result of missed opportunities to digitally engage with and retain millennial car buyers, according to a study released by AutoLoop on Tuesday.

As the purchasing power of this key demographic expands, modifications to digital engagement strategies will be required to increase low millennial retention rates, says the provider of auto industry marketing and customer relationship management solutions.

AutoLoop's 2016 Digital Engagement study suggests that significant gaps in dealership service experience has resulted in a service customer retention rate 12 percent lower than previous generations, as well as a customer referral rate 50 percent lower.

"By 2020, millennials will command $1.4 trillion annually in purchasing power and represent 30 percent of total retail sales, so it's important that dealerships know how to win their business," Doug Van Sach, AutoLoop vice president of analytics and data services, said in a news release. "Although millennials as a whole are more brand-fickle than other generations, it's a mistake to believe they are incapable of becoming loyal customers. Our research uncovered opportunities in several key areas for dealers to better cater to this elusive demographic."

The survey revealed that dealers have notable shortcomings in three key areas, according to AutoLoop.

-

Insufficient online presence for service department

-

Lack of digital engagement (with tools such as online scheduling, mobile apps, SMS/text notifications and eCommerce)

-

The in-store service experience

"Dealers need to dramatically increase digital and mobile advertising for their service business, particularly on third-party websites," said Van Sach. "If they don't, they risk losing millennial shoppers to competitors, especially tire retailers and quick lube chains."

Millennials are seven times more likely than other generations to be swayed by a digital ad, according to AutoLoop.

The company found that 41 percent of millennials were influenced by a digital ad before their last service visit and that 75 percent of millennials are highly influenced by online reviews, compared to 56 percent of Gen X-ers and 32 percent of baby boomers.

Thirty-seven percent of millennials prefer to make service appointments via a website or a mobile app, compared to 25 percent of Gen X-ers and 17 percent of baby boomers. But in spite of their preference, they are particularly less likely to make an appointment, according to AutoLoop.

"These results indicate that many dealerships are still not using online scheduling tools and, in particular, mobile scheduling," Van Sach said. "It's critical that dealerships integrate their marketing and appointment programs so they can convert more millennial service shoppers into customers."

According to AutoLoop, only 48 percent of millennials always make an appointment, whereas 57 percent of Gen X-ers and 69 percent of baby boomers.

“Despite the high level of digital research by millennials, dealers are routinely outspent by aftermarket companies in digital advertising — if they are visible at all,” AutoLoop said.

Millennial shoppers also prefer SMS communications from the dealers far more, according to the study. Sixty-six percent favor SMS/text notifications, while only 46 percent of Gen X-ers and 21 percent of baby boomers.

"Most dealers still don’t use SMS to keep customers informed throughout a service visit, and very few dealers have eCommerce options," said Van Sach. "Given these gaps in the digital experience, the lower service retention rates among millennials are no surprise."

Sixty-three percent of millennials said they would like to pay by phone, compared to 51 percent of Gen X-ers and 24 percent of baby boomers, according to the study.

Millennial respondents who participated in the study cited the following three reasons as to why they prefer to pay by phone:

-

Getting their vehicle faster (49 percent)

-

Avoiding the checkout process (35 percent)

-

Avoiding the service advisor (16 percent)

Another in-store experience gap AutoLoop points to is the presentation of inspection results.

Millennials lack of understanding of their inspection results has had a significant negative impact on referral rates.

Only 51 percent of millennials understand their inspection results, compared to 58 percent of Gen X-ers and 63 percent of baby boomers.

"Dealers need to focus on improving their in-store experience if they want to retain millennials' business and get more referrals," Van Sach said. "We recommend monitoring service advisors for process compliance and implementing technology that educates consumers and offers more choices, such as mobile tablets, service repair videos and pricing and financing options."

Additionally, AutoLoop’s findings suggest that millennials chose a service center for price and financing options far more often.

“This generation values being presented with different price and financing options for services,” AutoLoop said.

Thirty-two percent of millennials were found to choose a service center because of price and financing options — which is two times more than non-millennials — who are most likely to select a store due to their use of OEM parts and the expertise of technicians.

The 2016 AutoLoop Digital Engagement study surveyed 1,000 auto consumers and analyzed the purchase behavior of more than four million customers representing 1,000 dealerships throughout the U.S.

To view the study visit, http://autoloop.net/life-after-loyalty-whitepaper.aspx.

PERQ announced Monday it launched Auto Website Conversion Course, a free series of online best practice tutorials designed to help dealers clean up their sites and create more potent conversion paths.

Decluttering dealership websites and directing attention to targeted messaging, along with personalized calls to action, can significantly increase click-through rates and lead data collection, according to the marketing technology provider.

“Most dealership websites are jammed with a cacophony of offers, messages and static lead forms that, more often than not, lack relevance to the visitor. It’s the equivalent of walking into a dealership and having multiple salespeople yelling offers and information at you all at once without bothering to ask what your name is, if you’re ready to buy or if you want a new or used vehicle,” Russ Chandler, PERQ product marketing manager, said in news release.

“It’s no wonder the average dealership website converts less than three percent of their traffic.”

PERQ’s analysis found that dealerships who declutter by offering a streamlined and interactive experience see a 42-percent increase in CTRs, a 15-percent profit lift and a five-fold increase of data collected on sales leads.

“These websites are not ‘bugging’ visitors with messages they have no interest in but, instead, target consumers based on their website behavior, dynamically adjusting what is pushed to them,” PERQ said.

Four declutter best practices PERQ advocates for dealer websites include the following:

-

Entice visitors to seek more useful information. It creates an opportunity to gather data that will help provide a more informed and streamlined sales experience.

-

Inventory CTAs and conversion tools to understand what works and what doesn't.

-

Analyze how effectively a CTA is converting.

-

Re-evaluate remaining CTAs and make informed decisions on which CTAs to display based on user behavior.

All data for PERQ’s analysis came from its FATWIN Web Engagement platform. It virtually trains dealership websites to have relevant, real-time conversations with visitors through dynamic interactions that change based on the consumer’s behavior.

Visit PERQ’s Auto Website Conversion course webpage for more information about its lesson plan.

Infiniti dealerships throughout the country will now be able to work with automotiveMastermind to implement its predictive analytics technology, which provides dealer sales teams key insights and valuable consumer information unique to car shoppers, the company announced on Monday.

Since the year began, Infiniti is the second OEM to partner with the predictive analytics and marketing automation technology provider, and the 10th brand overall.

“As Infiniti is seeking to drive business in the highly competitive luxury market, this is the perfect opportunity for us to help them improve sales and customer retention,” Marco Schnabl, automotiveMastermind chief executive officer and co-founder, said in a news release. “The recent introduction of the QX50 concept demonstrates that Infiniti is looking to gain traction in the booming crossover market segment.

“Our behavior prediction technology helps dealerships tap into that growing market by showing them who they should be contacting and marketing to in order to generate the fastest and most efficient growth of sales.”

The automotiveMastermind technology encompasses a proprietary algorithm that crunches thousands of data points to calculate how likely a consumer is to purchase a new vehicle.

Dealer management system information is combined with big data — which includes social media, financial, product and customer lifecycle information to produce an automotiveMastermind Behavior Prediction Score — one simple number which is a ranking from 0 to100.

Scores closest to 100 illustrates that a consumer is more likely to buy.

Additionally, the technology can feed talking points and customized micro-targeted predictive marketing campaigns directly to sales teams’ desktops and mobile devices.

The talking points can then be complemented with customized customer-specific and micro-targeted predictive marketing campaigns.

“Dealers cannot rely on pricing or new design elements alone to increase sales – with Mastermind they are able to use sophisticated technology to let them know exactly who is ready to buy,” automotiveMastermind sales and marketing vice president Andrew Gillman said. “Our success lies in determining the motivating factors for each individual person. As soon as a dealer partner on-boards our technology they see immediate gains in retention and sales.”

The other OEMs automotiveMastermind currently works with are Acura, Audi, BMW, Cadillac, Honda, Lexus, Mercedes-Benz, MINI and Toyota.

For dealers who have found themselves grappling with limited ad dollars, mirroring OEM ad spending during seasonal events is a strategy that can help maximize campaign efforts throughout the rest of the year.

“Digital marketing has increased substantially over the past couple of years, all dealers are struggling to find ways to be competitive in their market,” James Grace, senior director of analytics products at Cox Automotive, said in a phone interview with Auto Remarketing.

“I think one of the most effective ways of them being competitive is really paying attention to what the OEMs are doing and where they are putting national ad dollars.”

As OEMs push lease incentives, financing deals, and cash-back offers during holiday weekends such as President's Day last month, dealers should follow the lead of automakers, says Grace.

Following the Super Bowl ad madness in January or early February, President’s Day weekend usually stimulates auto sales for the month.

During this President’s Day weekend, the dealership network for Dealer.com — a Cox Automotive company based in Burlington, Vt. — saw website engagement go up significantly compared to the first six weekends of the year, according to Grace.

“In this particular case around President’s Day, from a dealer website perspective, it was a record weekend,” said Grace.

There was a 19-percent increase in both visits and quality visits that weekend, compared to the first six weekends of the year and a 30-percent increase in average search attributed visits.

“The data continues to suggest that where there’s a higher level of coordination, communication and alignment, the results are better in terms of activity we see on websites as well as sales,” Grace said.

“We’re seeing a couple of interesting trends. One is around incentives and ad spend, where if we look across all of the different OEMs, in some cases there’s a positive correlation. Roughly two-thirds of the time there’s a positive correlation between OEM incentives and digital ad spend by dealers.”

Consumer web traffic, which is a sign that consumers are shopping for cars on dealers’ sites, demonstrates the power of a coordinating with OEM activities, he explained.

“As we’re tracking more and more of these seasonal events, whether it’s President’s Day, the Super Bowl or anything else, we’re definitely seeing an increase in the trend of additional traffic being driven by those events,” Grace said.

“Ultimately, I think dealers need to pay more attention to what the cadence is around them — from OEMS, companies like us and other places where there’s this kind of seasonal ad spend,” added Grace. “When you sort of pour a little a bit of dealer focused advertising into that mix the return you get for that dealer focused advertising is multiplied in the context of these larger national efforts.”

Jessica Stafford, vice president of marketing for Cox Automotive, agrees with Grace.

She saw a similar increase in web traffic following ad campaigns launched during NBA All-Star weekend.

“I think the combination of this specific ad campaign as well as the normal behavior that we see for weekends is why we want dealers to spend a little bit more thought around what their mobile strategy is, specifically around advertising and other ways of capitalizing on theses sort of seasonal trends that we see,” she said.

On the night of the game, Feb. 19, Cox Automotive's Autotrader brand had its highest mobile traffic day ever. The site reached an estimated 677,000 mobile sessions and 2.5 million mobile vehicle detail page views.

“The idea of leveraging the strength and the buying volume that’s out there from the bigger national advertisers is key,” Stafford said. “We see these trends and try to leverage them in order to drive even more consumers to their client’s listing.”

Some new-car models, particularly a few luxury vehices, are resold after just one year of ownership signficantly more often than the average car is, according to a newly released analysis by iSeeCars.com

While just 1.5 percent of car buyers resell their new cars within the first year of ownership, iSeeCars spotlighted 11 models thatn see at least twice the rate of resale when compared to average car, says the research firm.

iSeeCars analyzed more than 24 million individual new car sales and counted how many of those new cars were reselling as used within the first year.

Six of the 11 models are from BMW and Mercedes-Benz.

The top three models include the BMW 3 Series, BMW 5 Series, and Mercedes-Benz C-Class

“All re-sold at rates that are quadruple the average of all models,” said iSeeCars.com

“This is partly attributed to dealers reselling their loaner vehicles which they have an oversupply of due to incentives from the automakers.”

The following is a list of the new cars resold most often as used within the first year of ownership, according to iSeeCars.com, along with percentage going this route.

BMW 3 Series, 8.0%

BMW 5 Series, 7.1%

Mercedes C-Class, 6.1%

Nissan Versa Note, 4.0%

Dodge Dart, 3.9%

BMW X3, 3.9%

BMW 4 Series, 3.9%

Mercedes E-Class, 3.9%

Chrysler 200, 3.8%

Subaru WRX, 3.3%

Nissan Versa, 3.2%

"While some might be surprised that these luxury brands top the list, these auto manufacturers offer their dealers incentives to buy new cars to use as loaner vehicles, which are then sold as used when they are still under a year old," Phong Ly, chief executive officer of iSeeCars.com said in a news release. "This is a marketing strategy with a two-fold purpose. It puts brand-new models in the hands of current owners when they bring their cars in for service, increasing the likelihood that they will buy another car from that brand. In addition, it essentially increases the brand's new car sales, which help to give them the ability to claim the title of 'top luxury brand', something that BMW and Mercedes-Benz compete for every year."

iSeeCars suggests that one reason these models are being resold within the first year of ownership is linked to quality or perceived quality of the cars.

Aside from the BMW and Mercedes-Benz models, the remaining models on the list, all ranked an average of three stars or less in the J.D. Power 2016 U.S. Initial Quality Study, which surveys consumers after 90 days of ownership, iSeeCars said.

"It's not surprising that consumers would make a change after a short amount of time if they felt the quality was lacking," Ly said. "After all, a new car is a very expensive purchase and one that consumers spend a significant amount of time with multiple times a day."

Additionally, the high resale rate of the 11 models represents an excellent opportunity to find bargains on them.

Nine of the 11 models have an estimated discount 12.7 percent higher than the average car, according to iSeeCars.com.

The following is a list of each model's average discount.

Chrysler 200: 29.9%

Dodge Dart: 27.4%

Nissan Versa Note:20.2%

Mercedes C-Class: 19.6%

Mercedes E-Class: 19.3%

BMW 5 Series: 18.2%

BMW 3 Series: 18.0%

BMW 4 Series: 17.3%

Nissan Versa: 14.1%

BMW X3: 12.7%

Subaru WRX: 6.2%

iSeeCars analyzed more than 24 million individual new car sales of model years 2015-2017 within calendar years 2015 and 2016.

The firm used each car's Vehicle Identification Number to see whether the car was re-listed between four months and a year of its sell date.

New cars with over 500 miles and used cars with less than 4000 miles were excluded from the study.

The amount of cars relisted as used was then articulated as a percentage of the number of new car sales by iSeeCars.com.

General Motors Financial recently launched two new floor plan program updates for participating dealers that the company thinks are “competitive differentiators in the industry.”

GM Financial — which reported that it had 792 dealerships in North America leveraging its commercial offerings as of the close of 2016 — highlighted the two floor plan updates include:

—$3,000 GM Financial DealerSource buy fee credit, which can be applied towards GMF DealerSource off-lease buy fees.

—30-day interest-free period for dealers who purchase off-lease vehicles on GMF DealerSource and finance with GM Financial's floor plan.

The company mentioned that other exclusive remarketing perks GM Financial floor plan dealers can receive include reduced buy fees on GMF DealerSource inventory, a grounding dealer purchase incentive on GMF DealerSource purchases (which is also tied to Dealer Dividends) and reduced selling fees in GM Financial’s lane at physical auction sites.

“The recent rollout of new and unique remarketing programs for floor plan dealers represent true competitive differentiation for GM Financial from others in the industry,” said Nick Heinz, GM Financial vice president of remarketing. “We offer a very compelling value proposition to all GM dealers but these enhancements add to the already rich suite of benefits available to our most important dealer relationships.”

More details can be found through this website.

On Tuesday, F&I solution provider EFG Companies rolled out what it dubbed the Drive Forever Worry Free Lifetime Wrap, an enhancement to the company’s limited powertrain protection.

EFG companies explained that the Drive Forever Lifetime Wrap is designed to help dealers close more deals at a higher gross with improved product pricing, expanded eligibility and an underlying complimentary coverage component.

The wrap is a second coverage upgrade option for dealers to utilize when providing customers with complimentary Drive Forever Worry Free Limited Powertrain Protection. Until now, dealers had the option to upgrade customers to a full vehicle service contract with terms up to 96 months/120,000 miles. The Drive Forever Lifetime Wrap provides expanded coverage options with no mileage or time limits.

With the Drive Forever Lifetime Wrap, EFG Companies insisted cost-conscious consumers will be better able to preserve their vehicle’s value and their savings. Beyond the benefits related to vehicle repairs, the coverage is fully transferrable, further enabling consumers to negotiate beyond just the value of their vehicle at resale.

The company went on to note Drive Forever Worry Free is a limited lifetime powertrain program for dealers to offer complimentary as a way to differentiate themselves from the competition. The Drive Forever Lifetime Wrap is an exclusionary coverage that matches the lifetime term of the complimentary product.

The coverage upgrade includes roadside assistance, rental reimbursement and a standard $100 deductible for the first three years.

EFG Companies projected that interest rates are expected to rise three times in 2017 — perhaps as soon as next week — and analysts are predicting lower used-vehicle values as off-lease vehicles enter the market. With an uncertain economic outlook, EFG Companies acknowledged dealers are looking for programs that create more foot traffic and help to close more deals at a higher margin.

“With dealer profit margins being squeezed in recent years, we’ve taken an in-depth look at how we at EFG can measurably facilitate dealer profitability, and customer retention,” said John Pappanastos, president and chief executive officer of EFG Companies.

“In our ongoing contract holder research, we evaluate our protection products with regard to the value perceived by the consumer,” Pappanastos continued. “In the case of Drive Forever, on average, 82 percent of the time, contract holders rank it as a top three reason as to why they chose to purchase from a participating dealer.

“Based on this extensive research and ongoing feedback from dealers, we created the Lifetime Wrap as a natural extension of a program that provides distinct benefits to both dealers and consumers,” he went on to say.

Beyond the benefits of EFG’s complimentary Drive Forever Worry Free program, the company thinks dealers have a better opportunity to stay ahead of the competition with an upgrade that can give customers enhanced coverage for the life of their vehicle, not just their installment contract.

“This product gives dealerships an immediate means of capturing market share and increasing profit margins by turning the sales process into a more value-based conversation,” EFG Companies added.

For more information, go to this website.

Penske Automotive Group said Tuesday it has bought the Jaguar and Land Rover dealerships in Paramus, N.J., from the Prestige Family of Fine Cars. Penske expects the purchase to generate about $215 million in annual revenues.

"We are pleased with the opportunity to add the Jaguar and Land Rover dealerships in Paramus to the Penske Automotive footprint,” company president Robert Kurnick Jr., said in a news release.

“These new dealerships enhance the company's existing portfolio and bring additional scale in the New Jersey/New York metropolitan area to our business.

“We welcome the employees to the Penske Automotive Group team and look forward to working with them to grow the Jaguar and Land Rover businesses in this important market area," he added.

With the addition, Penske now has five Jaguar/Land Rover dealerships in the U.S.

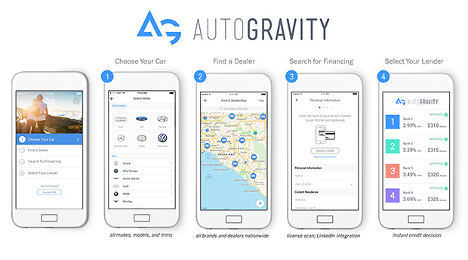

One of the benefits AutoGravity chief marketing officer Serge Vartanov often emphasized during a conversation with Auto Remarketing to discuss the mobile auto financing tool the firm is offering was empowerment.

Vartanov discussed empowerment in context of keeping dealerships in an important place of the vehicle-delivery process, but also while providing consumers with additional information that traditionally they could not obtain until arriving at the F&I office.

“Our belief is if you look at disruptive moments over the past 20 to 25 years, oftentimes when a tech player comes into an industry what they’re innovating is improving on something that lacks convenience or transparency or empowerment of efficiency and choice. We saw that when we talked with dealerships and car shoppers,” Vartanov said.

“No matter how much research you do online, you don’t really know until you go into the dealership and you’re taken into the F&I office what your deal is going to be. There’s an anxiety in that experience insofar as you don’t get to see all of your options as a car shopper. The process really does take quite a bit of time,” he continued.

“Our view is we can innovate against that. We can put car shoppers in a position where they’re able to see their indirect finance options that the dealer can also see because they’re the same lenders the dealer works with,” Vartanov went on to say. “If you can empower the consumer with those options, if you can let them know these are the lenders that have approved you, whether you’re super-prime or subprime, the experience for the car shopper, the dealer and even the lender is a lot better and much more robust.”

Thus far, it appears AutoGravity is gaining some robust momentum as the company recently announced that it has surpassed 200,000 downloads of its native iOS and Android smartphone apps. The platform allows shoppers in 46 states to obtain up to four finance offers on any make, model and trim of new or used vehicle by following four steps. The app can return personalized retail installment contract and lease offers within minutes.

“AutoGravity has brought car finance into the digital age,” said Andy Hinrichs, who became AutoGravity’s founder and chief executive officer after decades as an auto finance executive with captives such as Mercedes-Benz Financial Services.

“Our industry-leading technology has been embraced by top banks and captive auto lenders, as well as leading dealer groups who see customers shopping on their smartphones every day,” Hinrichs continued in a news release. “We’ve re-designed the car finance experience, taking it from hours to minutes for car buyers across the country.”

To arrive at this point has been no small task. Vartanov noted that more than half of AutoGravity’s employees are engineers since it took a coordinated effort to design the platform that can communicate with consumers, dealers and finance companies efficiently and securely.

“Every lender that joins AutoGravity we pass through a vetting process,” Vartanov said. “Our compliance team meets with the lender’s compliance team. Our IT and security teams meet with the lender’s IT and security teams. These lenders hold us up to extremely high standards because many of these lenders are large, publicly traded corporations. We’ve passed through those screens with flying colors."

Vartanov added later, “That’s critical because if you’re going to be partnering with lenders of this magnitude to be able to offer those indirect lending offers in the marketplace, you have to be at least as secure as the lender and you have to be as mindful of compliance and regulatory concerns as the lender is.”

AutoGravity launched its app in California last year. Since that point, Vartanov highlighted the company has developed relationships with finance companies up and down the credit spectrum so it can cater to all consumers, who evidently quickly leverage the technology once downloading it to a device.

“AutoGravity gives you the peace of mind of seeing multiple indirect offers anytime anywhere within minutes,” said Vartanov, who pointed out that the average user obtains offers within 10 minutes of downloading and opening the app for the first time.

And if these shoppers are already on the lot using their smartphones — as recent analysis pointed to that situation happening more often — AutoGravity’s platform could help grease the financing wheels to reduce the time it takes to finalize delivery.

“These are financed deals that the dealership participates in. With these indirect offers, the dealer can put them up very easily in their own systems without requiring an additional application from the customer. They’re deals where dealers have participation in the rate,” Vartanov said.

“What we heard again and again from dealers is you see car shoppers in the showroom looking at the phone, not necessarily talking to a living human being,” he continued. “What dealers have realized, and this is why they’ve embraced AutoGravity, you have to be there on the phone to be relevant and meet those consumer needs. This is true across the credit spectrum.”

Sounds like a situation that’s creating “empowerment.”