For a typical internal combustion engine vehicle, the deterioration of its components can be thought of as “lots of paper cuts” that occur over the car’s lifetime, says Recurrent CEO Scott Case.

But for an electric vehicle, its component degradation is typically, “noting, nothing, nothing and then ‘WHAM!’ whenever the battery fails,” Case said.

“If that’s within warranty, no problem,” he said. “That actually could be a great situation for a used-car buyer. If you can get your hands on a car that might have 100,000 miles on it and a brand-new battery in it, because it just got replaced within warranty or somebody else paid to do it, well that's worth a lot of money. It's a hidden gem.”

However, Case said, “if you're buying a car that only has two years left on the warranty and there's this question mark (about the battery life), you better

Read more

The market for used hybrid and electric vehicles remains limited, but supply appears to be on the rise, and for some models, there was even some price relief in recent months.

Of the 10 used vehicles with the largest price declines (percentage-wise) in the second half of 2022, seven were alternative-fuel vehicles, including …

Read more

As an added benefit for Cherokee Media Group Premium Members, we are offering special episodes of the Auto Remarketing Podcasts featuring general sessions from Used Car Week in November.

Our next special episode features the "How Tomorrow’s Thriving Secondary EV Market Is Taking Shape Today" panel discussion at the National Remarketing Conference, featuring Scott Case of Recurrent, John Combs of ADESA and Terence Rasmussen of CarMax.

To listen to the podcast …

Read more

With the first-ever tax credits for used electric vehicles having become effective on Jan. 1 as part of the Inflation Reduction Act, that shopper on your dealership’s lot is likely to have this question on their mind.

Does the used EV I’m interested in qualify for this tax credit?

With that in mind, EV analytics company Recurrent announced a tax credit eligibility tool on Tuesday to provide guidance.

The user simply punches in the vehicle identification number to see if the car is likely to qualify.

“I have spent hours poring over the tax credit bill with legal experts and the eligibility criteria can read like a puzzle,” said Liz Najman, policy research and communications manager at Recurrent, in a news release.

“This eligibility tool makes it much easier,” Naiman said. “In about 30 seconds, a car shopper will have a good idea if a used EV is likely to receive a tax credit – no tax law background required.”

Recurrent estimates that around 23% of the 34,800 used EV listings would qualify. As recently as October, it was just 12%, and Recurrent expects further growth in eligible vehicles with used-car prices easing.

Price is one of several criteria for the tax credit, which includes vehicle restrictions (battery size, model year, seller, sale price) and buyer restrictions (annual income, prior use of this tax credit).

Keyless entry is one of the convenience features of used electric vehicles that dealership salespeople can highlight to potential buyers.

And it’s also one of the paths hackers use to get control of EVs, according to a report released on Tuesday by VicOne, an automotive cybersecurity solutions provider established by cloud security company Trend Micro.

VicOne’s 2022 automotive cybersecurity report warns that the EV industry faces growing cybersecurity risks, especially through keyless entry, charging stations and in-vehicle entertainment (IVI), resulting in vulnerability to attacks.

Experts said the threat of ransomware and data breaches targeting car factories and supply chains will also significantly impact the industry.

The report also offered four key predictions for 2023 based on trends in cyberattacks, including:

—Hackers’ existing attacks on automotive supply chains will become more targeted, distributing ransomware through spam or drive-by download to increase efficiency.

—Ransomware will continue to affect the automotive supply chain and expand its targets to cloud suppliers and automotive components.

—Vulnerabilities in open-source software will affect more automotive components.

—Attackers will bypass digital locks and exploit vulnerabilities to manipulate payment mechanisms.

“VicOne’s vision is to protect the cybersecurity of future vehicles, said Ziv Chang, vice president of VicOne’s automotive cyberthreat research lab, in a news release. “As the market booms, cyberattacks will proliferate and the overall industry will face greater challenges than ever.

“Relying on Trend Micro’s 30 years of in-depth technical experience in cybersecurity, VicOne reminds automotive supply chain partners to be on alert for cyber security attacks and threats. Only if enterprises abandon old thinking and implement tailored cybersecurity solutions can the industry quickly respond to emerging threats,” Chang went on to say.

To download a full copy of the research report titled, “Reading The Signs: Automotive Cybersecurity In 2022,” go to https://vicone.com/en/reports/2022-automotive-cybersecurity-report.

As electric vehicles sales rise, so will the number of used EVs on the market. Two panels at Used Car Week earlier this month addressed the importance of determining EV residual values and how subscription services will play a role in EV adoption.

“The time is now for EVs,” said EY partner and eMobility automotive leader Felipe Smolka on the “Managing Residual Values in An Era of Rapid Technological Change” panel.

By 2035, some 85 million EVs will be on the road in the United States and Canada, estimates consultancy EY.

Access to data is crucial to …

Read more

On the same day Autonomy founder and CEO Scott Painter was on stage for the NAVIcon portion of Used Car Week in San Diego, VinFast was at the Los Angeles Auto Show 2022, announcing an order from the electric vehicle subscription company of more than 2,500 VF 8 and VF 9 vehicles.

According to a news release, this is VinFast’s largest corporate order to date, and one of Autonomy's largest electric vehicle orders.

In August, Autonomy ordered 23,000 electric vehicles across 17 different global automakers, including VinFast, to operate its subscription services.

At that time, Autonomy planned to order 400 VF 8 and VF 9 models and now has officially increased the order to more than 2,500 vehicles from the Vietnamese automaker.

“We are excited to add VinFast to our subscription lineup and help raise U.S. consumers’ interest and awareness of VinFast and their luxury electric vehicles through Autonomy’s car subscription. Autonomy’s affordable month-to-month model makes it much easier for consumers to make the switch to an electric vehicle and to consider new brands and models on the market,” Painter said in the news release.

According to the agreement, VinFast will begin delivering vehicles to Autonomy over the next 12 months, as it starts exporting vehicles to international markets.

Le Thi Thu Thuy, vice chairwoman of Vingroup and chairwoman of VinFast, said: “This is an exciting moment for VinFast as our vehicles are about to enter the U.S. market. The order from Autonomy is a testament to the trust we have built in the market. Bringing the VF 8 and VF 9 to Autonomy’s EV subscription fleet will give consumers yet another way to experience our brand and discover the benefits of our premium smart EVs. Collaborating with Autonomy will also help us quickly achieve our goal of accelerating the electrified mobility revolution and building a sustainable future for everyone.”

With $5 billion in electric vehicle charging network funds (and more to come) available under the Bipartisan Infrastructure Law, states are lining up for their share of federal largesse.

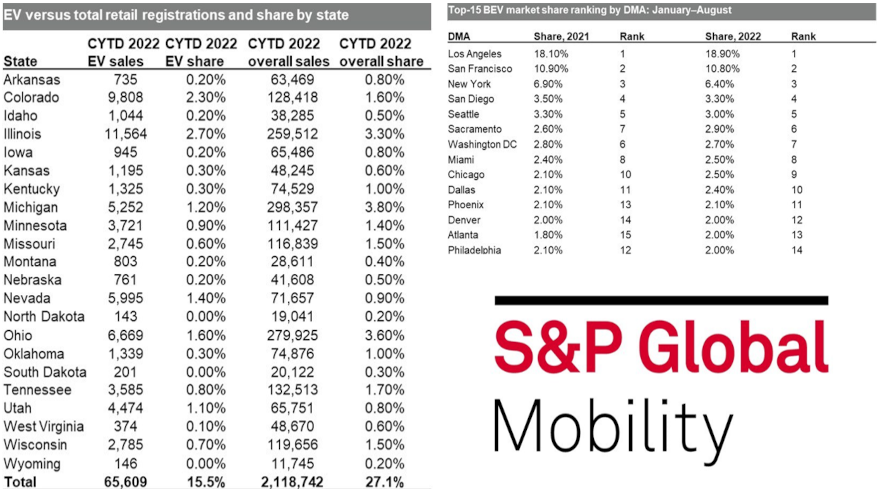

However, outside of the large coastal cities, retail registrations of EVs have yet to take hold, according to new analysis from S&P Global Mobility. The top-eight EV markets in the US are all in coastal states, and represent 50.5% of total EV registrations in 2022. The greater Los Angeles and San Francisco metropolitan areas alone account for nearly one-third of total share of the US EV market.

While the 22 Heartland states represent 27.1% of total US vehicle retail sales through August, their representation in EV adoption has remained stagnant from 2021 into this year—at a tepid 15.5% share. Only Colorado and Nevada (and to a minuscule extent, Utah) outpunch their overall retail share in EV representation, according to S&P Global Mobility data.

Given their fluid geography and county boundaries, “Greater Los Angeles” includes the contiguous Los Angeles, Orange, Riverside, and San Bernardino counties. “San Francisco Bay Area” includes the Bay Area of San Mateo, Santa Clara, Alameda, Contra Costa, Solano, Napa, Sonoma, and Marin counties.

For this calculation, S&P Global Mobility analysts categorized heartland states as Arkansas, Colorado, Idaho, Illinois, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Ohio, Oklahoma, South Dakota, Tennessee, Utah, West Virginia, Wisconsin and Wyoming.

Smile States are categorized as starting in California in the west, swinging through the Sun Belt and Southern coastal states, then swinging up the Atlantic coast to Virginia.

Coastal dominance

It is no surprise that California, a leader in green initiatives and EV adoption, dominates the top of share rankings. Greater Los Angeles (18.9% share of total EV sales), the San Francisco Bay Area (10.8%), and San Diego (3.3%) saw no change in their top-five position year-over-year when comparing rankings for calendar year to date (CYTD: January–August) 2022 versus 2021, while Sacramento improved its position from the previous year.

Additionally, of the 13 markets that increased share for CYTD 2022 versus 2021, most were in the “smile” states, including Atlanta, Austin, Dallas, and Houston. Only Chicago, Las Vegas, Missoula, and Salt Lake City represented share gains in big cities of “Heartland” states. Not all coastal markets are guaranteed share gains; New York and Boston registered slight EV share declines this year.

“BEV market share control on the two coasts is attributed to their higher mix of early adopters compared to buyers in middle America,” said Tom Libby, associate director of loyalty solutions and industry analysis at S&P Global Mobility. “Their demographic profile is more in sync with the traditional BEV buyer than the middle-American profile.”

But Libby sees potential in EV growth in top heartland markets: “More acceptance and much broader consumer awareness is resulting in a natural progression of adoption from the coasts to the Heartland.”

A chicken-and-egg scenario might also be in play. The coastal cities have worked harder at creating charging infrastructures, as well as incentives for homeowners to install charging equipment in their garages.

“There is no doubt that the lack of charger availability is an influence in midwestern states, but it is not the factor,” said James Martin, associate director of consulting for S&P Global Mobility. “An equally strong factor is the availability of product in form factors that customers are willing to purchase.

“There was no real option in terms of family friendly, moderately priced CUVs,” Martin added. “And some models, such as the Hyundai Kona EV, were initially not available in midwestern states — based on OEMs deciding to focus on Section 177 (CARB) states where automakers could accumulate credits. Now automakers are beginning to produce more mainstream electric vehicles. Availability of these vehicles will most likely be a factor in spurring installation of more charging infrastructure.”

With the BIL and Inflation Reduction Act (IRA) laws passed, more nationwide tax incentives will be available. The state receiving the most funds of the initial USD900-million tranche will be Texas—even though its major city with the most market share is Dallas, with a mere 2.4% chunk of the EV market (8,591 EVs retailed through August). Texas may be gambling that more charging infrastructure will spur EV demand in the state.

Heartland buyer profiles

Is there any difference in the buyer profile between coastal and heartland America?

Yes and no.

According to S&P Global Mobility loyalty analytics data, which tracks buyers’ return-to-market behavior, there is little difference in the demographic and psychographic profile of those moving into battery-electric vehicles.

Comparing inflow movement into BEVs from coastal market share leaders (Los Angeles, New York, Sacramento, San Diego, San Francisco, and Seattle) versus inland market share gainers (Atlanta, Austin, Chicago, Dallas, Houston, Missoula, Salt Lake City) shows few differences in the buyer cohorts. There are just more of those types of people in Coastal and Smile states.

Caucasian buyers with high household incomes dominate both regions’ adopter bases. The only difference is that the central markets skew more toward a slightly younger demographic.

Year-over-year comparisons between the two regions show similar results; both reflect the largest declines in share from Caucasian buyers and the highest gain from Asian-American buyers. The jump in inflow from Asian-American buyers signals the early adoption of this technology was not a passing phase.

“The typical Asian-American new-vehicle buyer is younger than that of any other ethnicity, including African-American and Hispanic,” Libby said. “Through the first eight months of 2022, 48% of Asian-American buyers were age 18-44. Younger buyers typically are more open to new ideas and products; their brand loyalty typically is lower than that of most other age groups.”

Is there a difference in brand preference between coastal and heartland buyers? Tesla’s dominance remains unchanged because it controls over 65% of all BEV conquest share in both areas. The brand’s public perception as the preminent BEV manufacturer solidified its position as the first choice of buyers willing to move from an internal combustion engine (ICE) vehicle to a BEV.

However, the year-over-year change in conquest share shows that demand for Tesla appears to be slowing down in the heartland markets. Both Kia and Hyundai were the leaders in market share gain, improving their position by more than 2 percentage points – even though the budget-conscious Hyundai Ioniq5 is sold in only 39 states. Mercedes-Benz, Rivian, and Ford were the other brands to appear among the top-five largest heartland gainers for CYTD 2022 versus 2021.

The increased interest in the Korean brands coincides with a decrease among more established BEV manufacturers. However, that may not necessarily represent a drop in demand. For instance, Volkswagen has seen sizeable registration declines in 2022 for its ID.4 — mostly owing to supply chain snarls and market allocations to more EV-friendly regions. However, VW’s new ID.4 assembly line in Tennessee went live in October, and the automaker says it has 20,000 unfilled reservations and a plant capacity of 7,000 units per month.

Acceptance of BEVs is moving inward in America, albeit at a slower pace than expected. Libby believes it will take time before electrification is fully embraced in the heartland.

“The adoption of BEVs is a long-term process that needs to reach an inflection point similar to the adoption, or acceptance, of Asian-sourced vehicles in the US,” Libby says. “That inflection point is when the product becomes generally accepted and it usually occurs when volume and exposure reach a level that influences all the reluctant outliers.”

Vince Palomarez is product manager of loyalty solutions at S&P Global Mobility.

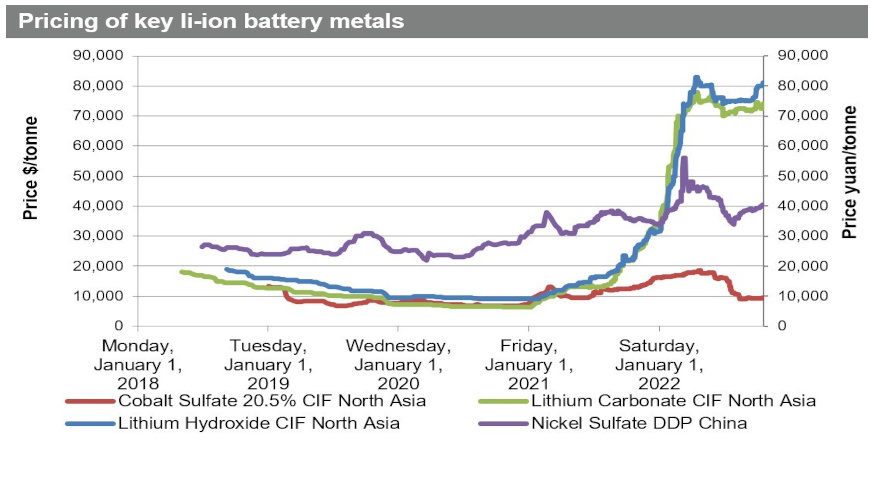

Geopolitical turbulence and the fragile and volatile nature of the critical raw-material supply chain could curtail planned expansion in battery production—slowing mainstream electric-vehicle (EV) adoption and the transition to an electrified future.

Soaring prices of critical battery metals, as observed by S&P Global Commodity Insights, are threatening supplier and OEM profit margins. This situation has quickly translated into increased component and vehicle prices, according to new analysis from S&P Global Mobility Auto Supply Chain & Technology Group.

Trade friction and ESG concerns are also affecting the development of the raw materials supply chain between markets. These collective developments add to the challenges of the electric vehicle transition.

Achieving its volume goals will require a steep growth curve for a burgeoning industry. For OEMs to hit their BEV and hybrid sales aspirations, S&P Global Mobility forecasts market demand of about 3.4 Terawatt hours (TWh) of lithium-ion batteries, annually, by 2030. This figure excludes the medium- and heavy-duty, and micro-mobility spaces, as well as consumer electronics and burgeoning demand for stationary energy storage. The 2021 output for the auto industry: 0.29 TWh.

Elements such as lithium, nickel, and cobalt do not just magically appear and transform into EV batteries and other components. The development chain is lengthy and complex, from their difficulty to extract to their complicated refining. The intermediate steps between excavation and final assembly are a particular choke point in terms of expertise and market presence. Currently, China is the clear leader in materials refining, as well as the packaging and assembly of battery cells. At issue is which other nations will step up to facilitate this industry transformation.

In terms of accessing battery raw materials, the equation boils down to: Who needs what, where will it come from, who will supply it, and who is best placed to benefit from this increased dependency on a handful of critical elements?

The latest S&P Global Mobility research evaluates the battery raw material supply chain from extraction to vehicle, identifying:

—A number of unfamiliar companies will play a major role in the processing and development of battery-electric vehicle (BEV) technology that will underpin the light passenger vehicles of the coming decade and beyond

—Potential trade friction could represent difficulties for major auto companies in extricating themselves from an established, nimble, and cost-effective supply of processed materials coming from or via mainland China

—Some OEMs are seeking the value and reassurance of “locked in” supply chain relationships straddling mine to vehicle, lessening the reliance on volatile spot markets and/or a need to work with less established industry partners

The process flow below identifies a well-understood and well-documented supply chain to provide the required nickel and lithium for Tesla’s NCA-based cylindrical cells produced in its “Gigafactory” near Sparks, Nevada.

Now extrapolate that across the entire auto industry — and expand EV market share to encompass the bullish projections made for 2030 and beyond.

The greatest quantity of nickel required by any given vehicle brand for 2030 production is forecast to be Tesla — deemed to be some 139,000 metric tons (mT). However, in assessing the existing structure of their broader manufacturing bases, we expect each of Volkswagen, General Motors, and Stellantis to surpass this requisition amount. Developing modular battery packs that can be configured to fit multiple vehicle segments and can accommodate a variety of battery chemistry choices will ensure a degree of resiliency against raw material supply constraints and price fluctuations.

“We have identified a total of 28 extraction sources of battery-grade nickel over the coming 12 years to serve the light passenger-vehicle market, located in 15 countries worldwide,” said Richard Kim, associate director with S&P Global Mobility’s Supply Chain & technology team. “However, the supply base for the upstream material processing steps and formation of the fundamental battery cell cathode chemistries presents a challenging lack of geographic diversity.”

S&P Global Mobility research suggests that, while the process of either smelting or high-pressure acid leaching (HPAL) is typically done at the nickel extraction site, that is not the case for the process of conversion to nickel sulphate.

Of the 16 companies that can perform this process at present, 11 are in mainland China. By 2030 we expect the number of companies to increase to at least 24, of which 14 will likely be in mainland China. We forecast mainland China to process 824,000 mT of nickel sulphate annually by 2030, with Chinese mining giant GEM’s supply of nickel sulphate to key Tesla supplier CATL expected to be the largest supply contract by tonnage. By contrast, we forecast North America and Europe to process just 146,000 mT.

We must also consider risk in calculating access to cobalt — a material well understood for its limited sources of origin and concerns regarding ethical supply. Battery-grade cobalt bound for electrified light passenger vehicles currently originate from just 18 mines, totaling 52,000 mT – of which 29,000 mT is forecast to be mined in the Democratic Republic of Congo (DRC) in 2022. The United Nations has cited the DRC’s “deteriorating security situation,” its humanitarian crisis affecting 27 million people, as well as child-labor practices and the ongoing guerrilla campaign being waged over the exploitation of resources and food security.

Despite the conflicts ravaging the DRC, we still estimate that nation’s output bound for OEMs and suppliers to increase to 37,000 mT by 2030. However, reliance on the DRC will decrease from 56% to 17% in terms of total tonnage. We expect near tenfold increases in supply from countries such as Australia and Indonesia, while countries such as Vietnam, Finland, and Morocco will by then weigh in with meaningful contributions. Given the dynamics of the supply market, even for an OEM with locked-in cobalt contracts with miners, a portion of several automakers’ supply remains unknown at this stage.

“Geopolitics has coupled with a desire for supply chain dominance and independence in the battery raw material supply chain evolution to date,” Kim said. “China has established a firm head start. The evolution of their Belt and Road initiative clearly had one eye on the automotive industry transition to electrification, with broad strategic and logistical investments in Africa as well as Southeast Asia.”

S&P Global Mobility research clearly indicates that established battery raw material supply and processing operations under mainland Chinese ownership will continue to deliver much of the world’s supply of lithium-ion batteries and their constituent key elements.

However, the imposition of nationalistic policies such as the United States’ Inflation Reduction Act (and the automotive implications of it) look to belatedly redress some of this imbalance by promoting the setup of domestic supply chains, in return for lucrative subsidies to both the suppliers and the purchasing consumers.

The battery will be the defining technological and supply chain battleground for the industry in the next decade, and access to their constituent raw materials will be crucial. S&P Global Mobility will continue to assess the changing landscape of the battery raw materials market in real time, incorporating the latest industry developments and research.

Please contact [email protected] to find out more information around our insights to help you make data-driven decisions with conviction.

Graham Evans is director of auto supply chain and technology for S&P Global Mobility.

Through nine months of the year, sales of new electric vehicles are up nearly 70%, as dealers have moved an estimated 576,408 new EVs, according to Kelley Blue Book.

But in the used EV market, the turning point may come in January — which is when the Inflation Reduction Act of 2022 goes into effect.

The act, also referred to as IRA, includes the first-ever tax credits for used electric vehicles, according to Recurrent, a company that analyzes EV range.

Here’s the thing, though …

Read more