Jim Ellis Automotive found a way to help local law enforcement charge up its fleet.

In collaboration with the DeKalb County Sheriff’s Office in Atlanta, Jim Ellis Chevrolet helped launch the county’s first electric vehicle take-home program for up to 100 jailers.

Historically, the dealer group said jailers have not received a take-home vehicle. Jim Ellis Chevrolet’s access to a large inventory of electric vehicles, coupled with competitive pricing, enabled the county to find an innovative way to recharge their employee retention and recruiting efforts.

“For us to have this partnership illustrates how Jim Ellis Chevrolet is part of the community,” Jim Ellis Chevrolet general manager Ralph Sorrentino said in a news release. “DeKalb County Sheriff’s Office is a leader in law enforcement in the state introducing many new programs. We are proud to work alongside another leader within the community.”

In addition to offering the numerous brands and models of EVs in the Atlanta area, Jim Ellis Automotive Group highlighted that it also continues to make substantial investments in EV sales and service training, state-of-the-art EV tools and the latest generation of EV diagnostic systems.

Plans are also in development to create an exclusive network of charging stations for Jim Ellis customers.

“The future is electric and it’s here now,” Jim Ellis Automotive Group president and CEO Jimmy Ellis said in the news release. “When our customers are ready to take the next step to an electric future, we’ll be ready to serve them.”

As America continues to lean into the idea of electric vehicles, new research from AAA did find some hesitation, with top objections such as range anxiety, cost and accessibility holding consumers back from plugging into these models.

Armed with that information, AAA Club Alliance (ACA), the fourth largest club in the national AAA federation, recently partnered with Recurrent to ease concerns.

Colleen St. Leger, who is vice president of business acceleration and innovation for AAA Club Alliance, explained through a news release that this new partnership between ACA and Recurrent can provide AAA members who drive electric vehicles with personalized monthly battery reports as a benefit of membership.

AAA’s latest consumer survey, taken in February, revealed that one-quarter of Americans say they would be likely to buy an electric vehicle (powered exclusively by electricity and not a hybrid) for their next auto purchase, with millennials leading the way at 30%.

Of those who want to buy an EV, the common factor is a strong desire to save on fuel costs, with 77% citing this as a top reason for interest, according to the AAA research.

AAA believes with rising gas prices, Americans’ conversion to electric vehicles will continue to increase. However, consumer hesitation surrounding range and accessibility to charging continues to draw concerns.

Other consumer-concern specifics from AAA survey about EVs included:

• Higher purchase price – 60%

• Concern there are not enough places to charge – 60%

• Concern about running out of charge when driving – 58%

• Unsuitable for long-distance travel – 55%

• High cost of battery repair or replacement – 55%

• Unable to install a charging station where they live – 31%

The organization said EV charging stations are popping up everywhere from AAA Car Care Centers to rest areas, fast-food restaurants and shopping centers. There are currently more than 51,000 public plug-ins in the U.S., with more expected soon, according to AAA.

“With higher gas prices this year, we are certainly seeing a lot of interest in electric vehicles,” said Bob Kazmierczak, director of approved auto repairs for AAA Club Alliance. “There are some basic things to consider before deciding whether to purchase an EV, from daily driving habits to charging plan to the cost of ownership. Drivers should also review all tax refund and incentives to make sure their purchase would qualify.”

Chevrolet showed up in the heart of electric vehicle country one Friday in September to show off its Bolt EV and Bolt EUV (electric utility vehicle).

The automaker aims to overcome a setback with its entry-level electric vehicle after it had to recall more than 140,000 because of a battery defect. Despite that glitch, General Motors is betting on a healthy demand for the EV. And indeed, the outlook for the Bolt — both new and used — may be …

Read more

Electric vehicles remain a small slice of the overall used-car market, but the segment has grown in the past decade, especially in recent years, as additional automakers have entered the market.

Specifically, just 0.6% of used-car sales are EVs, according to Autonomy’s debut EV Market Report released Tuesday. And for the largest continent of pre-owned vehicles — model-year 2018 through 2020 vehicles — EVs have just a 0.4% share of the total number of used cars for sale.

Still, more recent model-years are showing …

Read more

TrueCar positioned its latest research project to coincide with the opening of the 2022 North American International Auto Show in Detroit, as the Motor City has been charged up with electric vehicles and a visit from President Joe Biden, who quipped, “You know, you all know I’m a car guy.

“I’m here because the auto show and the vehicles here give me so many reasons to be optimistic about the future. And I really mean it. Just looking at them and driving them, they just give me a sense of optimism,” Biden said.

TrueCar refreshed its national consumer attitude survey from March regarding EVs. The survey uncovered a continued growth in consumer interest and willingness to consider an EV as their next vehicle purchase.

Researchers discovered key indicators across the board show consumers are becoming more comfortable with EVs as a viable option, and that while fears regarding charging costs and range anxiety still exist, they are lessening.

“Consumers across the nation are showing a growing acceptance toward considering an EV as their next vehicle purchase,” TrueCar president and chief executive officer Mike Darrow said in a news release. “Since March 2022, the percentage of consumers reporting they would consider an EV as their next purchase grew from 52% to 59%.”

Among the August National Consumer EV Survey highlights:

—Consumers’ likelihood to purchase an EV as their next vehicle continues to grow

—EV considerers (percent somewhat or extremely likely) up from 52% to 59%

—EV rejectors (percent somewhat or extremely unlikely) shrunk from 24% to 19%

—Despite gas prices leveling off, those prices continue to drive EV consideration

—Almost 1/3 (31%) of consumers now say they are much more likely to consider purchasing or leasing an EV due to gas prices, up from 27% in March

—More consumers now say they would purchase an EV if it met their range needs, up from 73% to 77%

—The proportion of consumers concerned about the cost to charge an EV dropped dramatically, from 54% to 42%

However, researchers indicated not all areas of the country are as robustly leading the charge toward EVs.

TrueCar focused in on Detroit metro area consumers ahead of the opening of its annual North American International Auto Show, which carries a heavy focus on the industry transformation toward EVs.

“Our focus on Detroit area consumers showed a lower percentage of people willing to consider EVs as a next purchase,” Darrow said. “This might be attributable to the area’s strong ties to the auto industry and its love of performance vehicles or could be an indication that the middle of the country lags behind the coasts in its appetite for EVs.”

When looking at the Detroit-area Consumer EV Survey, TrueCar determined:

—Detroit residents are significantly less likely to purchase an EV in the future

—Only 49% report being likely (somewhat or extremely) to purchase an EV in the future (verus 59% nationwide)

—Part of this reluctance could be up to exposure, according to TrueCar, which found that Detroit residents have significantly less experience with EVs: two-thirds (66%) have neither owned nor driven one in the past (versus 57% nationwide)

—They are less likely to consider an EV specifically due to the rise in gas prices, perhaps reflecting lower prices in the Detroit metro than in many other areas

—23% report being much more likely to purchase an EV due to high gas prices (vs. 31% nationwide)

To help narrow the consumer education gap on purchasing and owning EVs, TrueCar is now providing informational guides for consumers that are searching and buying EVs online at www.truecar.com.

Autonomy now is plugged in with J.D. Power.

Last week, the electric vehicle subscription company said it is now offering access to its services through J.D. Power’s consumer website at JDPower.com.

The move comes after Autonomy recently landed relationships with Liberty Mutual as well as DigiSure in connection with insurance along with AutoNation to gain scale.

After gaining that momentum, Autonomy founder and chief executive officer Scott Painter described what it means for the company to align with J.D. Power, a global leader in data analytics and customer intelligence and a key destination for consumers searching for information on their next vehicle.

“J.D. Power is one of the most trusted global brands by both consumers and the automotive industry,” Painter said in a news release. “Presenting Autonomy’s EV subscription service on JDPower.com opens up an important new channel to access an EV, one that doesn’t require long-term debt or long-term commitments and can be completed digitally through a smartphone.”

Now, consumers shopping for a vehicle on JDPower.com will be able to learn more about EV subscriptions by clicking on an Autonomy ad on the website. The Autonomy service is currently available in California and is gearing up for expansion to other regions of the country.

“New-vehicle subscriptions, which have emerged as an interesting alternative for consumers looking for something other than a purchase or a lease, represent a new frontier in automotive retailing,” J.D. Power president and CEO Dave Habiger said in the news release.

“Subscriptions are prevalent in many other areas of our lives, so it only makes sense that we would offer access to this new channel on our website, which is an important source of consumer information on not only the latest vehicles, but also important trends in the marketplace,” Habiger continued.

Eligible visitors to JDPower.com will be offered access to the Autonomy EV subscription service by clicking on Autonomy ads that appear when they are searching for relevant vehicle inventory or conducting EV research.

“This is why people visit JDPower.com; they’re trying to find the newest, most reliable information available when buying and researching vehicles,” said Tanya Parkes, vice president of the consumer division at J.D. Power. “That wealth of information now includes access to subscription services, along with data on buying and selling a vehicle. It’s all about bringing more clarity to the shopping experience.”

Autonomy co-founder and president Georg Bauer added, “Subscribing to a vehicle is the new and modern way of accessing mobility.

“By making our service available on JDPower.com, we will raise awareness of Autonomy and the unbeatable value proposition of a car subscription. Once consumers try it, we are confident that they will remain customers for life,” Bauer went on to say.

Recurrent now is working with two of the most notable names in the wholesale space — ADESA and Black Book — according to separate announcements made on Wednesday.

First, ADESA launched a new condition report feature to showcase battery performance of electric vehicles. Powered by Recurrent — an EV battery and range analytics company— the EV Range Score is available on the majority of used electric vehicles that transact on the U.S. market, providing buyers with more transparency and confidence when purchasing EVs.

Then, Black Book announced the integration of its VIN-specific data into a valuation tool built on Recurrent’s new Range Score.

Range Score is designed to make it easier to understand expected range in a used EV by comparing a unit’s current expected range to what was normal when new, which often differs from its EPA-rated range.

Leaders at ADESA and Black Book explained why they made the decision to align with Recurrent, which was one of this year’s Emerging 8 honorees.

“Electric vehicle adoption continues to accelerate, so we’re thrilled to evolve our condition reports to ensure customers have a more complete view of each vehicle,” ADESA president John Hammer said. “The addition of Recurrent’s Range Score ensures customers have access to the most relevant vehicle condition data — including a clearer understanding of EV battery health — and can make faster and smarter buying and selling decisions.”

“By combining our vehicle valuation data with Recurrent’s battery health data, consumers and dealers alike can access first-of-its-kind insight into the precise valuation of a used electric vehicle,” Black Book president Jared Kalfus said. “We are thrilled to have been selected to power this tool.”

During the inspection process, the vehicle VIN number for an eligible EV is shared through Recurrent’s software to generate a Range Score from zero to 100. That information is displayed clearly on the ADESA.com condition report with a Range Score badge.

Once the user clicks the badge, more information is shown including details on the warranty and expected battery performance in a full Recurrent Report.

“The battery represents a lot of the cost of a used EV and most of the concern that we hear from buyers—they want to know how the battery will hold up,” Recurrent co-founder and chief executive officer Scott Case said. “ADESA is establishing itself as a leader in the EV market by helping sellers pass that confidence on to buyers at each stage of the used car wholesale process.”

More than 50 dealerships have added Recurrent’s Range Scores to their used EV inventory. More detailed used EV reports, called Recurrent Reports, are also available to share information on battery warranties, expected range in different conditions, and how range is projected to change after three years of ownership.

Black Book said early results indicate that vehicles with Recurrent Reports can sell for thousands of dollars more than those without, and create a much better buyer experience by setting the right expectations around range.

For EV owners who are looking to sell, Recurrent will share their Range Score with dealerships and organize the offers so it is easy to compare and select a buyer.

Black Book’s vehicle valuation is combined with Recurrent’s new Range Score value, which uses modeling from 100 million recorded EV miles to make value adjustments for good batteries.

The new partnership is a step toward adding transparency to a rapidly growing used EV market that includes more than 2.5 million vehicles in the U.S. Initially eligible vehicle models include Chevrolet Bolt, Chevrolet Volt, Nissan LEAF, Tesla Model 3, Tesla Model S, Tesla Model X and Tesla Model Y.

“We founded Recurrent with the mission to give confidence to used EV buyers, and a lot of that starts with the price tag,” Case said. “The combination of Recurrent’s battery insights and Black Book’s auto market expertise looks a lot like the change that we originally hoped to see.”

In July, Autonomy finalized a partnership with EV Mobility, which provides electric vehicles on demand 24/7 as an amenity to luxury hotels as well as at multifamily apartment buildings and other commercial properties.

While that Autonomy partnership focused on California, EV Mobility announced on Tuesday it recently expanded into properties in Florida, Washington and Nevada.

EV Mobility initially launched its services in Los Angeles, San Diego, and the Bay Area. The expansion enables EV Mobility to start to build its national footprint and support its continued growth, aligning with property owner and consumer demand.

In Florida, the expansion includes hotels in Stuart, Fort Lauderdale, and Palm Beach Gardens.

In Washington, the expansion includes the tallest residential building in Seattle, the Modern.

In Las Vegas, the company has deployed EVs at the English Hotel and will deploy at three additional hotels in the upcoming weeks.

As the multi-family apartment and hotel industry are starting to see the benefits of having EV Mobility as an amenity, the company said through a news release that it is experiencing ever increasing demand for its services.

Through partnerships with different property owner groups, EV Mobility said it will continue to expand strategically in cities across the country.

“The decision to expand our presence nationally was a logical next step in our business growth strategy,” EV Mobility chief executive officer Ramy El-Batrawi said.

“In every city and area we expand in, we will deploy enough properties to create density and have a real presence,” El-Batrawi continued. “We are a technology-driven platform allowing us to scale rapidly and cost effectively.”

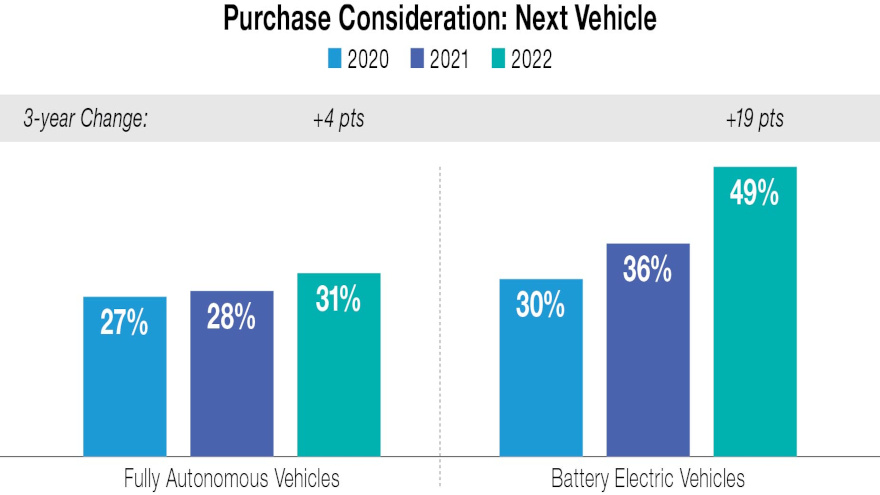

For years, Ipsos pointed out that automakers have talked about electric vehicles and autonomous driving as two connected parts of the future of vehicles.

But new research released by Ipsos on Thursday indicated that OEMs might be better off if they talked about these kinds of models separately.

Ipsos’ latest Mobility Navigator Study showed that while almost half of drivers (49%) say they’re interested in an EV for their next vehicle, only 31% would be interested in a fully autonomous car.

And Ipsos determined people are growing more interested in EVs every year, while interest in self-driving cars remains stubbornly low.

“Combining electrification and autonomous as a bundled technology advancement may not be a match made in heaven,” said Chance Parker, vice president of U.S. automotive and mobility development at Ipsos. “Dedicated education about autonomous vehicles with a clear safety benefit can help reduce misconceptions and improve trial and acceptance across all generations.”

However, Ipsos isn’t implying people aren’t interested in any new driving technology to help them on the road.

More than 60% of consumers in the study said they are interested in individual features like accident avoidance, night/all-weather vision and advanced driver assistance, which Ipsos noted as key advancements in driving technology.

Experts pointed out vehicles today offer more potential interactions for the driver, raising concerns over the level of driver distraction, and these worries are becoming a common issue.

In a U.S. poll of 1,000 adults conducted in 2021, Ipsos found that drivers believe they encounter a distracted driver in one of every two drives they take.

In addition to identifying which features and technology generate the most interest among consumers, the new Ipsos study results also reaffirm that the auto industry is facing a potentially sticky generation gap regarding these transformational technologies.

The latest Mobility Navigator data on electric vehicles shows a dramatic difference in attitudes toward electric vehicles by generation. Millennials and Gen Z consumers are much more positive about electric vehicles than their Boomer counterparts, according to Ipsos.

And when consumers are asked about autonomous driving technology, Parker noted the same gap emerges and may be getting worse.

“Differences in attitudes toward new technology between younger and older consumers are not new — but these technologies aren’t simply features than can be used or ignored as you see fit,” Parker said.

“Instead, both technologies completely change your relationship with your vehicle. Given the billions of dollars being poured into both technologies, the stakes are extremely high,” Parker continued

Ipsos mentioned another finding with far-reaching ramifications.

The study found that consumers ultimately want control of autonomous technology. Even those consumers who are pro-autonomous driving vehicles express that there is a time and place for it, since three out of four consumers who would consider autonomous technology say they would only want to use it in certain circumstances.

“This will also require more education for consumers, so they better understand and trust the technology,” Ipsos said. “And until full autonomy is embedded and accepted, it will mean that consumers need user-friendly controls and interfaces with which to control the autonomous tech in their vehicle.”

To learn more about the study, go to this website or watch an on-demand webinar.

Expert firms acknowledged the road to electrification has been repeatedly foretold by automotive industry watchers.

Yet, CDK Global and J.D. Power pointed out significant questions remain about how the transformation will take place, how long it will take and what will accelerate — or just as importantly put the brakes on — consumer adoption.

CDK Global and J.D. Power each shared research about electric vehicles and the necessary infrastructure to support them through separate projects.

Beginning first with CDK Global, the automotive retail software provider collaborated with Brookfield and recently released results of a survey that found significant challenges and opportunities the industry must address to get to an all-electric future.

With electric vehicle (EV) sales on the rise, CDK Global noted that gas-powered vehicles still make up most sales. And at less than 5% of the market, CDK Global estimated that sales of EVs would have to double every two years to get to a full-electric fleet by 2032.

To better understand the barriers to adoption and how to help accelerate the shift to EVs, CDK surveyed more than 1,100 consumers who recently purchased a vehicle or intend to purchase a vehicle in the next two years.

CDK’s study found that while EV owners are extremely satisfied with a net promoter score (NPS) of 69, they still have concerns about the amount of time it took to charge their vehicle (69%), the availability of charging networks (60%) and vehicle range (56%).

For non-EV shoppers, nearly half (46%) reported they do not plan to buy an EV at any point in the future, which reveals a need for dealers to better educate shoppers on EV options, while continuing to sell and service gas-powered vehicles through the next decade and beyond.

The survey also revealed several insights for dealers looking to stay ahead of the curve with their customers, such as:

—26% of shoppers who bought or planned to buy a gas-powered vehicle considered an EV — with 88% pointing to the dealer’s sales representative as introducing the option.

—EV buyers listed advanced technology as the top purchase motivator (25%), with a desire to reduce impact on the environment coming in second (23%).

—40% of EV shoppers postponed buying an EV until they had their own garage due to concerns around easy and convenient access to charging facilities.

The CDK project revealed four out of five EV owners (81%) plan to get their vehicles serviced at the dealer.

And while oil changes are the primary worry for owners of gas-powered vehicles, CDK discovered EV owners report the need for heath checks on batteries (61%), tire changes (44%) and high-voltage cable inspection (40%).

“While the headlines shout about the inevitability of an all-EV future, there is still a lot of work we must to do to pave the way, while continuing to take care of consumer needs in the meantime,” CDK Global chief marketing officer Barb Edson said in a news release.

“We believe the dealer is — and will continue to be — at the heart of automotive retail. By helping them better understand the realities of the market, they can plan more impactful sales and service programs and investments in their dealerships to meet consumer needs through this transition.”

For more information on the survey, including additional insights, a whitepaper from CDK Global titled, “The Charged Truth About Electric Vehicles” is available from this website.

Growing EV market threatens to short-circuit public charging experience

J.D. Power said the growth of electric vehicle (EV) sales during the past year has been remarkable but has added stress to an already beleaguered public vehicle charging infrastructure.

During this growth spurt, J.D. Power indicated owners in high EV volume markets like California, Texas and Washington, for instance, are finding the charging infrastructure inadequate and plagued with non-functioning stations.

These are among the key findings in the second annual J.D. Power U.S. Electric Vehicle Experience (EVX) Public Charging Study.

Despite that more public charging stations are in operation than ever before, J.D. Power found that customer satisfaction with public Level 2 charging declined from last year, dropping to 633 (on a 1,000-point scale) from 643 in 2021, while satisfaction with the speedier DC (direct current) fast charger segment remains flat at 674.

J.D. Power explained this lack of progress points to the need for improvement as EVs gain wider consumer acceptance because the shortage of public charging availability is the number one reason vehicle shoppers reject EVs.

The study showed Tesla Destination ranks highest among Level 2 charge point operators with a score of 680 and Tesla Supercharger ranks highest among DC fast chargers with a score of 739.

“Public charging continues to provide challenges to overall EV adoption and current EV owners alike,” said Brent Gruber, executive director of global automotive at J.D. Power. “Not only is the availability of public charging still an obstacle, but EV owners continue to be faced with charging station equipment that is inoperable.

“The National Electric Vehicle Infrastructure (NEVI) Formula Program promises to provide funds to states for building out their EV public charging infrastructure. This will lead to sizable growth in the availability of EV charging stations, but just adding stations isn’t the answer,” Gruber continued in a news release.

“Stations need to be added to areas where there are currently gaps in heavily traveled routes and in high-density areas for people who don’t have access to residential charging, but most importantly, designed with things for users to do while charging — regardless of the use case. Then, we need to make sure those stations are reliable,” Gruber continued.

The study measured EV owners’ satisfaction with two types of public charge point operators: Level 2 charging stations and DC fast charger stations. Satisfaction was measured across 10 factors, including:

—Ease of charging

—Speed of charging

—Cost of charging

—Ease of payment

—Ease of finding this location

—Convenience of this location

—Things to do while charging

—How safe you feel at this location

—Availability of chargers

—Physical condition of the charging location

Other key findings of the 2022 study include:

• Most owners relatively satisfied with ease of charging process: Satisfaction with the ease of charging at a DC fast charger is 745 among battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) owners, and satisfaction with the ease of charging at a Level 2 charging station is 699.

J.D. Power explained this finding indicates that current EV owners understand the operation of both types of chargers, so the systems themselves do not prompt issues. But virtually all other attributes related to public charging score lower. Some, like cost of charging, are much lower: 473 for DC fast chargers and 446 for Level 2 chargers.

• Public charger operability and maintenance a key issue: Growth of the public charging infrastructure is making it easier for EV owners to find public charging stations. The index for ease of finding a location is 724 among users of DC fast chargers and 683 among users of Level 2 chargers.

But J.D. Power said the industry needs to do a better job of maintaining existing charging stations. The study found that one out of every five respondents ended up not charging their vehicle during their visit. Of those who didn’t charge, 72% indicated that it was due to the station malfunctioning or being out of service.

• Owner satisfaction with availability of public charging stations differs by region: Led by California, the Pacific region has the highest number of public chargers. At the same time, it has the highest concentration of EV owners, yet they are not as satisfied with the availability and condition of public chargers as EV owners in some other geographic areas.

The West North Central region (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota and South Dakota) has the highest level of satisfaction with the availability of public charging. The East North Central region (Illinois, Indiana, Michigan, Ohio and Wisconsin) has the highest level of satisfaction with the condition of public chargers.

• DC fast charger users are planners: Users of Level 2 chargers cite convenience and price as the two key reasons for choosing a charging location. Users of DC fast chargers, on the other hand, are often on a planned road trip which, along with convenience, determines their choice of charging location. Often, they have few logical alternatives.

“Everyone knows that the landscape of gas stations is focused on convenience — readily available, fast fueling and quick convenience items,” Gruber said. “Although fast charging is seemingly getting faster by the day, to expedite the charging process vehicles will need to accommodate the newest ultra-fast chargers.

“Currently, only a handful of vehicles can take advantage of the fastest charging speeds. And no matter how fast their vehicle charges, EV owners still indicate they need more options for things to do during each charging session to enhance convenience and fill the down time,” Gruber went on to say.

The 2022 U.S. Electric Vehicle Experience (EVX) Public Charging Study is driven by a collaboration with PlugShare, a leading EV driver app maker and research firm.

The study examines consumer attitudes, behaviors and satisfaction, setting the standard for benchmarking the overall experience of public EV charging.

Respondents included 11,554 owners of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

The study was fielded from January through June. Drivers who visited the charging location but didn’t charge their vehicle were asked why they decided not to charge.