Dealer Image Pro thinks current pre-owned vehicle window stickers and buyer’s guides need refreshing, especially since sometimes they cannot stick to the glass or are illegible.

On Wednesday, the service provider launched a window sticker and buyer’s guide generator through its existing Photo Assistant platform to merchandise vehicles better in today’s digital retailing landscape.

Via a partnership with Netlook, Dealer Image Pro said its window stickers and buyer's guides have several features, including:

• Full color with dealer-branded designs

• Weatherproof and stick on outside of the window (no need for dealers to retrieve vehicle keys)

• Easily readable for approaching customers on the outside of the vehicle windows

• Factory accurate with the sticker and buyer's guide information coming from an automaker VIN decode

• Available to include a scan QR code feature that links to dealership vehicle detail pages (VDPs) for the latest pricing

• Available to add a text/lead generation feature that sends a lead directly to the dealership BDC

• Up to date with all the current Federal Trade Commission mandates and double-sided with legal verbiage printed on the back

Dealer Image Pro sees that combining window stickers and buyer’s guides with photos and videos of the vehicle are significant to the customer’s ultimate buying decision

The company said that Photo Assistant via an iPad can complete the work without having to rely on a separate vendor.

Dealer Image Pro pointed out that buyer’s guides are mandatory for preowned vehicles under the FTC’s Used Car Rule.

Dealer Image Pro said operators can face up to $46,517 in fines if buyer’s guides are not seen on the vehicle.

“When I started shooting vehicles at dealerships in 2009, I had no idea window stickers and buyer’s guides could have an impact, not only on the revenue of the dealership, but the convenience of the dealership as a whole,” Dealer Image Pro founder and CEO Peter Duffy said in a news release. “Now that we’ve mastered getting a dealership perfect vehicle photos and videos through the convenience of Photo Assistant, the next logical step we wanted to go was giving the in-house photographer the ability to print window stickers and buyer’s guides all on one device without having to use a different application.

“Current window stickers and buyer’s guides do not represent the look and feel of the modern dealership, which is why a solution was needed now to help automotive dealerships list and sell their vehicles faster,” Duffy went on to say.

To book a demo and learn more about Dealer Image Pro’s window sticker and buyer's guide generator, visit https://www.dealerimagepro.com/demo/.

HGreg liked the results of pilot program using some of ACV’s digital solutions, so the dealership group decided to use more of the provider’s tools.

A news release distributed on Monday highlighted HGreg’s attempts to accelerate its consumer sourcing strategy via the Drivably trade-in and lead nurture website solution and to improve internal operations through its adoption of Monk computer vision technology.

Following a successful Drivably pilot program at Kendall Nissan, HGreg deployed Drivably at all of its U.S. franchised stores.

HGreg further enhanced its digital capabilities by leveraging Monk ACV’s artificial intelligence-powered computer vision technology for used vehicle condition evaluation and damage classification.

“We are proud to be the first automotive group in North America to leverage this AI-powered damage detection when buying and selling used vehicles at our dealerships around the country,” HGreg president and chief executive officer John Hairabedian said in the news release.

“HGreg was founded on a commitment to reinvent the vehicle buying journey by providing transparency,” Hairabedian continued. “Monk’s cutting-edge imaging technology will ensure that our dealerships can offer consumers the most accurate vehicle condition reports possible as they navigate their car buying experience.”

Drivably provides HGreg with an easily integrated consumer buying experience that can leverage a condition-adjusted machine learning model for vehicle evaluation. Through Drivably, HGreg can offer consumers the best price for their vehicle, helping to secure the trade-ins and gain new customers who use trade-ins to buy new vehicles.

If dealers decide not to keep consumer trade-ins for frontline retail inventory, they can wholesale the trades leveraging ACV’s inspection services and wholesale digital marketplace.

HGreg’s digital adoption includes enhancing their internal processes, as well.

With its integration of Monk, the group will leverage this new AI-powered technology to standardize and semi-automate the purchase and resale of used cars on their platform. Monk’s AI damage detection technology is now fully integrated into HGreg’s internal vehicle inspection operations, elevating the level of transparency of the condition report made available to its customers.

“We are honored to work with HGreg on delivering unprecedented levels of transparency to the automotive industry and a seamless vehicle appraisal experience to consumers looking to offload or trade in their cars,” ACV vice president of business and AI strategy Aboubakr Laraki said. “As the Monk solution expands its global footprint into North America, our industry-leading machine learning vision technology will enable dealers to acquire vehicles more efficiently as well as provide new avenues for accessing that inventory.”

HGreg elected to integrate with the Monk SDK (software development kit) and is the first dealer to launch Monk in North America to provide the guided photo capturing tool.

The technology is based on computer vision algorithms running pixel-level polygonal analysis to detect all damages visible to the human eye. Because the photo capture is guided by the software, the resulting smartphone images are high-quality data assets that can generate objective vehicle condition reports and reliable real-time detection and classification of damages.

Later this year, ACV said Monk and Drivably will be integrated to become a turnkey solution for dealers to offer to their consumers. ACV will leverage Monk’s AI-driven imaging technology to enable consumers to do a self-inspection right from their own mobile device, which will further inform the price dealers can offer consumers.

It might sound like someone’s prediction of the four college football teams that might be in the running for a national championship this season, but it’s the four newest states where the CarGurus Instant Max Cash Offer now is available.

On Thursday, CarGurus announced the rollout of this program in four additional states — Alabama, Oregon, Wisconsin and Oklahoma — as it’s now available to approximately 93% of the country’s population.

CarGurus Instant Max Cash Offer is a platform that combines CarGurus’ audience of 29.5 million monthly unique visitors in the U.S. with the power of CarOffer’s wholesale bidding system for automotive, the Buying Matrix.

CarGurus Instant Max Cash Offer allows consumers to sell their vehicle through CarGurus’ website by submitting the vehicle details online and instantly receiving the top bid from thousands of dealers across the country.

Upon accepting the offer and uploading the necessary documentation, sellers can schedule a pick-up or drop-off time.

CarGurus said this solution can provide a new and previously untapped inventory channel for dealerships, and it can allow consumers to sell their vehicles seamlessly from the comfort of their homes.

“CarGurus has become the destination for consumers to sell their car 100% online, and we have been tremendously excited by the success of and feedback on this offering,” CarGurus president and chief operating officer Sam Zales said in a news release.

“With this most recent launch bringing us to 93% population coverage, CarGurus Instant Max Cash Offer is now available nearly nationwide, and we will continue evaluating ways to serve lower-density areas where our offering is not yet available,” Zales continued.

The news release also contained the platform experience of Evelyn, a consumer who recently sold her vehicle using CarGurus Instant Max Cash Offer

“I never imagined selling a car could be this simple,” Evelyn said. “I received all paperwork in advance, the rep showed up on time, went through his checklist, and that was that. All I had to do was remove the plates, have the title, and sign in three places; end of story. This is the way to sell a car.”

For the latest information on and availability of CarGurus Instant Max Cash Offer, visit CarGurus.com.

Shortly after its purchase of Accu-Trade in February, Cars.com executives said bringing the company into the fold could help facilitate another inventory acquisition source for dealers: buying cars directly from the public.

That came to fruition this week with the official launch of Instant Offer, a new Accu-Trade-powered capability on Cars.com where consumers can sell their rides to the company’s network of some 20,000 dealers.

Instant Offer rolled out to select markets in May, and has generated more than 5,000 offers thus far, the company said. In expanding the solution across the country, Cars.com projects those numbers will “scale rapidly,” it said in a release.

“About 40% of the 27 million monthly shoppers on Cars.com have a car to trade in before purchasing a new one, and we wanted to offer a seamless experience for those consumers to connect with local dealers and have a convenient, safe and fast place to sell their car,” Cars.com president and chief commercial officer Doug Miller said in a news release

“Our new Instant Offer capability curates the best offer for a consumer and enables them to sell their used car to a qualified local retailer, collect a check and purchase a new vehicle all in the same day,” Miller said.

In a February interview with Auto Remarketing, Cars.com chief executive officer Alex Vetter alluded to the dealer benefits of going this route, particularly as inventory challenges persist.

“What we’re seeing dealerships do right now is, with the inventory shortage that every dealer is struggling with, they’re sourcing vehicles through new channels — buying cars directly from the public as a way to accelerate inventory turn and keep their operation humming. And Cars.com organically has close to 20,000 private sellers coming to our platform every month,” Vetter said.

“And if we can route those to dealers who are using the Accu-Trade tool to buy cars precisely and accurately and knowing what to pay, they can really solve a pain point for users, while at the same time, replenishing their own stock to buy cars that they can now retail directly,” Vetter said. “Again, that’s turning a cost-center into a profit-center. Progressive dealers are running buying operations today that are bypassing the traditional auction and literally sourcing cars direct from the public. Together with our dealer network, we want to activate that strategy for dealers all across the country.”

CarOffer said Monday it has launched a national non-affiliated online used-car exchange desk called PremiumXchange (or PX), where dealers throughout the country can exchange cars with one another at prices determined by those dealers.

Through the Instant Market Value technology from CarOffer parent CarGurus, dealers can use PX to take advantage of price disparity from region to region.

In other words, a car one dealer has in stock could fetch more and be in greater demand in another market; PX helps the dealer maximize those opportunities and/or acquire the vehicles that would perform well in their market.

“Differing regional demand and market dynamics greatly affect inventory value from one dealership to another,” CarOffer said in a news release. “Identifying these trade scenarios instantly from a pool of hundreds of thousands of vehicles will give dealers a powerful new tool to manage their inventories.”

The platform is designed to digitize and automate dealer-to-dealer vehicle exchanges nationally. PX gives dealers a way to buy retail-ready units that would generate strong profit margins with quick turn times in their market.

“At the same time, these dealers will be selling or exchanging front line vehicles that haven't performed well for them because of unfavorable local market dynamics,” the company explained. “Trading this market disparity enables both dealers involved in the exchange to benefit, as each receives a vehicle much more likely to perform well in their specific markets.”

As such, the platform aims to aid in cutting aged inventory issues and wholesale losses.

“CarOffer is leveraging its unique platform with more than 10,000 enrolled dealer partners to create the largest non-affiliated online pre-owned vehicle exchange desk/platform in the U.S. The largest dealer groups in the country have less than 400 locations, so PremiumXchange’s 10,000+ will have no rival,” CarOffer founder and chief executive officer Bruce Thompson said in a news release.

Thompson added: “My team and I created the very first group trade tools in 2001 with the launch of American Auto Exchange (AAX). PremiumXchange represents a totally new level of capability. Our scale and national footprint of over 10,000 enrolled dealer locations, combined with CarGurus’ unique market pricing insight, IMV, are the key elements that make PX so powerful and virtually impossible to emulate. In my opinion, PremiumXchange has the potential to be transformative.”

CarGurus expands Instant Max Cash Offer to 5 more states

In related news, CarGurus announced in late May that its CarGurus Instant Max Cash Offer platform has launched in five more states: Nevada, Utah, New Mexico, Colorado, and Washington.

“With CarGurus Instant Max Cash Offer, both consumers and dealers have benefitted tremendously from its ease of use, and we’re building on this incredible momentum with this latest geographic expansion,” CarGurus president and chief executive officer Sam Zales said in a release. “By harnessing CarOffer’s Buying Matrix technology, we’ve been able to offer a hassle-free way for consumers to access top-dollar bids and for dealers to obtain new vehicles.”

Cars.com found a way to get 99% of dealers to agree on something.

And if you’re a used-car manager, you might need only one guess to pinpoint what it is.

Cars.com said an overwhelming 99% of surveyed dealers said they are paying more for trade-ins now than two years ago.

According to a news release, almost 60% of surveyed dealer estimate an increased payout between 11% and 20%.

Furthermore, more than one in three dealers report paying over 20% more than two years ago, based on findings from a Cars.com dealer panel survey conducted on April 18.

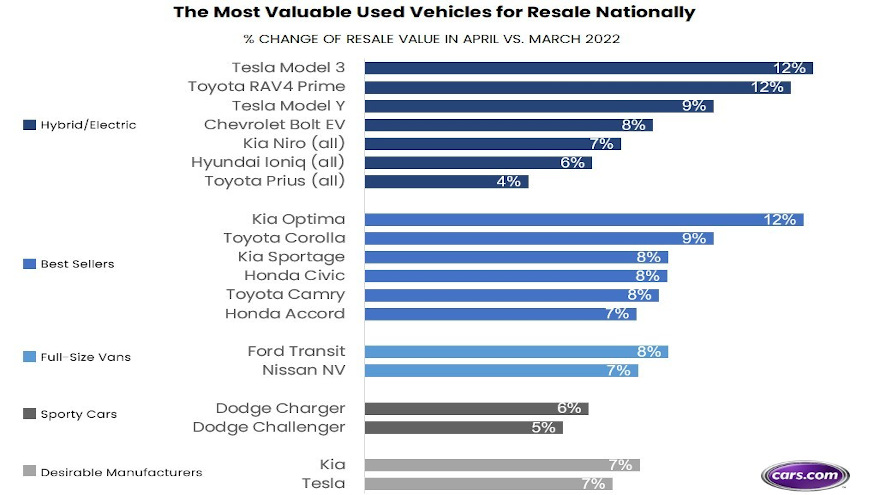

According to wholesale data from Accu-Trade, a Cars.com Inc. company, consumers can gain the highest resale value on vehicles that are electric or hybrid, best sellers in the market, from desirable manufacturers, sporty cars just in time for summer and, interestingly, full-size vans.

Some of the most valuable used vehicles for resale right now include the 2018 through 2021 model years.

Cars.com added that consumer experiences support the dealer findings.

Among those surveyed who traded in a vehicle in the last year, approximately two-thirds received a higher offer than expected.

Cars.com also reported that 63% of consumers cited above-expectation values for mass-market models and 59% for luxury brands. That’s according to the Cars.com consumer survey fielded on April 11-14.

“The ongoing inventory shortage has caused a broad ripple effect in market conditions. As new vehicles became more elusive, shoppers pivoted to the used-car market, pushing used-car prices up 37% in the first quarter,” Cars.com editor in chief Jenni Newman said in the news release. “Eager for quality inventory, dealers are making lucrative offers for popular vehicles maintained in good condition with low mileage.

“I sold one of my family’s extra cars to our local dealership just as used-car prices were increasing, making 50% more on its sale than I would have before the pandemic. Today, I’m considering selling our second family car to capitalize on the high used-car prices,” Newman went on to say.

Consumers looking to maximize the return on their current vehicle in this profitable market can sell to other individuals for free on Cars.com/sell or use its marketplace to connect with and sell directly to nearly 20,000 dealers across the country.

“Consumers should check with their local dealership to find out which vehicles are most valuable in their local market,” Cars.com said.

It’s been rough sledding for some dealerships, especially independent operators, to find the inventory they need with the ongoing wholesale price and volume landscape.

However, that’s not been the case at all for Mike Wimmer, chief executive officer and Founder of AutoLenders, an independent operation in business since 1979 that retails and leases used vehicles with multiple showrooms in Pennsylvania and New Jersey.

Wimmer explained how during this episode of the Auto Remarketing Podcast.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Another technological tool launched on Monday to help dealers acquire used inventory via vehicles being sold by private owners.

Topmarq unveiled its solution designed to be an online service with automated bidding and seller appointment setting. According to a news release, the platform is being released as a limited public beta.

Topmarq said it is currently focused on the Texas market, with plans for expansion to other major metros shortly

The company is led by chief executive officer and founder Quinn Osha, a former engineer at Axon. James Mark, a director of finance at LegalZoom and formerly with TrueCar, is an advisor with the company.

Topmarq explained it is positioned to help dealers solve inventory problems by going directly to local, private sellers. Topmarq’s proprietary tracking system can manage sellers through the pipeline until they set an appointment with a specific dealer, thereby removing the wasted dealer effort on lost leads.

“The U.S. vehicle market is in the midst of yet another massive shift as prices simmer from all-time highs through the pandemic,” Topmarq said in the news release. “Though pricing is showing signs of (receding), dealers across the country are still at a loss for how to increase their used inventory. Typical channels like wholesale auctions are seeing near-retail pricing that makes them a difficult choice for the average dealer.

“Rather than let a quality used vehicle slip into the wholesale channel, dealers can now get access to thousands of local sellers looking for a reasonable trade-in offer. The platform gives dealers access to submit custom offers directly to sellers based on detailed vehicle condition reports and VIN-based data,” the company went on to say.

To learn more details, go to www.Topmarq.com.

Here’s how a bank and a dealer group are working together to solve concerns for both consumers and dealerships.

U.S. Bank and Driveway are collaborating to pay vehicle sellers immediately with real-time payments, making Driveway the first online dealership to pay customers over the RTP network, according to a news release distributed on Wednesday.

U.S. Bank explained customers selling a vehicle on Driveway.com now can have the payment deposited instantly into their bank account after a sale is complete and before the vehicle even leaves their driveway and heads to the dealership to be a vital piece of inventory in a tight market.

Prior to this advancement, the bank acknowledged that customers waited 24 to 48 hours to be paid via ACH or several days via physical check.

The announcement indicated Driveway approached U.S. Bank a year ago to develop a payment solution that would be nearly frictionless and reduce the amount of time it took for online vehicle sellers to receive their payment. U.S. Bank said it brought the challenge to its global treasury management innovation studio to identify and test the best solution for Driveway.

Here’s how the process is designed to work.

After a Driveway customer enters details about their vehicle, they receive an instant quote. If the customer wants to proceed, they receive an email invitation to provide their payment and bank details via a Driveway and U.S. Bank co-branded digital payment portal.

Following an in-person inspection by a Driveway valet and finalized sale, the payment is instantly deposited into the car seller’s bank account via the RTP network.

“We’re proud to deliver a new RTP solution that creates a faster, safer and more convenient payment experience for Driveway and its customers,” said Shailesh Kotwal, vice chair of U.S. Bank Payment Services. “Those selling cars on Driveway.com will benefit from an instant, frictionless payment experience while Driveway will achieve greater customer satisfaction from their innovative payment process.

“We look forward to working with innovative companies like Driveway in every industry to find RTP solutions that deliver instant value both internally and for their customers,” Kotwal continued in the news release.

The bank added that real-time payments will be available to Driveway customers following a pilot, which is now underway in Portland, Ore.

“RTP’s instant-payment solution is another innovative offering providing customer optionality, transparency and convenience in Driveway’s digital, buying-and-selling ecosystem,” Lithia and Driveway president and chief executive officer Bryan DeBoer said.

“Our new partnership with U.S. Bank empowers Driveway to provide full and immediate payment to customers, further modernizing our personal transportation solutions for consumers wherever, whenever, and however they desire,” DeBoer went on to say.

On Thursday, TrueCar announced the launch of its Sell Your Car offering and introduced its home delivery program in Texas.

The company highlighted Sell Your Car provides consumers with visibility into their vehicle’s value as well as an instant, online True Cash Offer, while providing dealers a channel through which they can easily acquire additional inventory.

To utilize Sell Your Car, consumers can input their vehicle’s details such as vehicle identification number (VIN), license plate or make and model. The seller then confirms the vehicle’s features and condition. They then receive a breakdown of the vehicle value, along with the instant online True Cash Offer, which once locked, is good for three days.

To complete the transaction, consumers can then connect with local dealers to drop off the vehicle and receive payment.

Meanwhile, the company highlighted TrueCar’s home delivery program, currently being tested in Texas, will enable any dealership to greatly expand the market reach for their used-vehicle inventory across their region or even nationally.

In addition, consumers benefit with expanded used-vehicle selection and the convenience of having a home delivery option.

TrueCar plans to expand the service to other markets in the second quarter, according to the news release.

The company stressed that both Sell Your Car and Home Delivery bring value to dealers and consumers and are part of TrueCar’s broader product roadmap. The company said these tools will play an important role in strengthening TrueCar’s auto-buying service for used vehicles as well as its TrueCar+ marketplace, which remains on track for commercial launch.

“Investments in TrueCar’s product roadmap are a capital allocation priority and will ensure that TrueCar has a robust and expanded portfolio for new and used cars to take to its dealer partners throughout 2022 and subsequently,” the company said in the news release.

“TrueCar remains committed to providing dealers and consumers with innovative products as the company builds a modern-day marketplace,” the company continued. “To position for the future, the company will continue to invest in technology and product updates as well as hiring in these critical areas during 2022.

“The company will also align marketing activities to support both the initial launches and subsequent ramp in market coverage for these offerings across states, regions, and nationwide,” TrueCar went on to say.

With approximately $245 million in cash and equivalents at the end of 2021, TrueCar indicated that it has financial flexibility to invest in its business as automotive retail continues to shift towards a more digital future.

“The company will continue to manage its business prudently and balance investments with other capital allocation priorities,” the company said. “These include potential tuck-in acquisitions to accelerate the company’s strategic plans and time to market for new features and products across the TrueCar+ marketplace and core offering.”

In addition to investing in its products and evaluating the marketplace for potential M&A opportunities, TrueCar said its cash position also provides an opportunity for further activity under our existing share repurchase program.

TrueCar has already repurchased nearly $82 million in shares of its common stock pursuant to its share repurchase program, including nearly $7 million since Feb. 28.

The company previously announced that its board of directors authorized up to $150 million in repurchases of the company’s common stock from time to time in the open market, privately negotiated purchases or pursuant to 10b5-1 trading plans, subject to applicable legal requirements.

TrueCar noted the repurchase authorization lasts through Sept. 30, although the share repurchase program may be modified, suspended or terminated by the board of directors at any time.