Another technology-enabled platform designed to utilize data to optimize wholesale dealer trades throughout Canada and the United States received a significant injection of investment funding this week.

Signal Automotive announced a $20 million investment led by Kayne Partners Fund, the growth private equity group of Kayne Anderson Capital Advisors.

Formed in 2017, Signal said its platform is a unique combination of proprietary software and managed services that can optimize the buying, selling and inventory allocation processes for licensed dealers

Signal’s Predictive Inventory Engine (PIE) is designed to allow selling dealerships to receive near real-time, guaranteed offers on their trades. The company said that buying dealers can get consistent access to inventory with a streamlined process that can enable them to buy efficiently at scale.

The platform utilizes millions of real-time vehicle and market data points to assist dealers in optimizing their inventory mix and understanding what is and isn’t selling for them, as well as their geographic market.

Using PIE, Signal then can show a dealer a curated list of available vehicles best suited to them. Signal said its platform is the only place where a dealer can purchase “20 vehicles in 20 minutes.”

Vehicles are then delivered front-line ready to dealers’ lots, with all logistics and transportation included in the price.

“We launched Signal three years ago with a vision of tech enabling wholesale, an often-overlooked segment of the $1.4 trillion automotive sector in the U.S.,” said Steve Jillings, co-founder and chief executive officer of Signal Automotive. “We couldn’t be happier with the progress we’ve made and how receptive our dealer partners have been as we bring wholesale out of the shadows.

“And now, along with the entire Signal team, I am thrilled to have Kayne Partners as our first outside investor. We could not have chosen a better group to build a world-class company with,” Jillings continued in a news release.

Kayne Partners Fund managing partner Nate Locke described why the firm made this financial commitment to Signal Automotive.

“We are very excited to partner with Steve and the Signal team. Their technology-focused disruptive approach to the overlooked wholesale automotive market is driving considerable value for both buyers and sellers,” Locke said.

“We are eager to help Signal accelerate its growth and continue developing innovative technologies to establish itself as a critical part of the supply chain for its dealer partners,” Locke continued.

Signal indicated that it will utilize the financing to expand its dealer network across North America and further investment into its technology platform and data analytics capabilities to enable its dealer partners to be even more efficient.

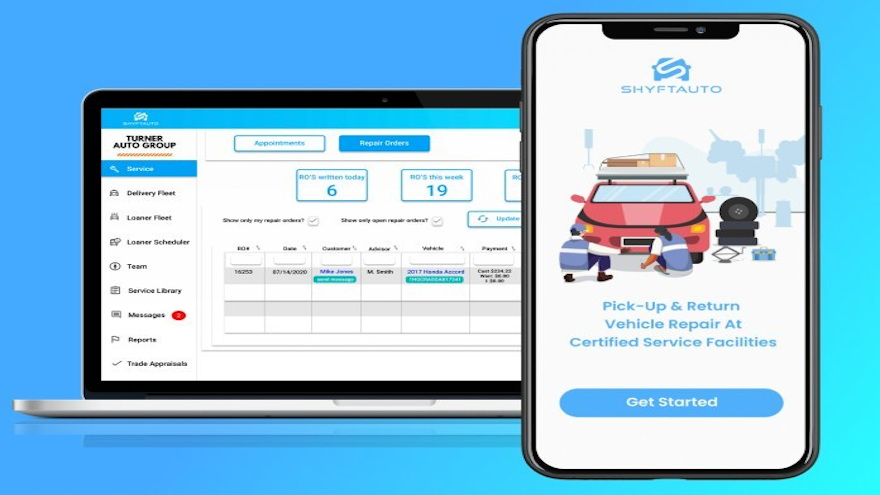

Shyft Auto is looking to leverage its recent momentum as an award-winning app designed to help connect consumers to automotive service facilities for contactless service experiences.

On Tuesday, the company announced the launch of a Republic crowdfunding campaign to fund development, national expansion and application improvements.

Shyft Auto was just named Best Global Automotive Software Vehicle Repair Customer Management Solution by Corporate Vision and also among the Top 10 Startups to Watch by the North Carolina Tech Awards.

The company highlighted that consumers can connect with automotive service facilities through a mobile iOS, Android or web-based application. Consumers can schedule an appointment, schedule pickup and delivery requests, track the status of their vehicle while it's being serviced, communicate with the automotive service facility, pay once the vehicle is completed and view service histories and records without calling the automotive service facility.

Meanwhile, Shyft Auto explained that automotive service facilities also have a web-based application to engage with consumers. Facilities can schedule and manage appointments, manage drivers, fleets and teams available to facilitate pickup and delivery requests, SMS message customers, request and receive online payments, manage loaner vehicles, service libraries, and pickup radius.

Facilities can even charge for pickup and delivery requests if they desire, according to Shyft Auto

“Our mission is to take the inconvenience and anxiety out of vehicle service for consumers while helping automotive service facilities (ASF) increase revenue, retention, and customer satisfaction scores by offering a more engaging and completely digital experience. We are very excited to share our vision, hard work, and cutting-edge technology with the world,” Shyft Auto chief executive officer Marcus Aman said in a news release.

“Automotive service facilities are seeing a 35-120% increase in revenue while consumers are rating them 92% or higher in customer satisfaction ratings. On average, our technology can save an ASF around two hours a day per employee, while the consumer benefits from having auto maintenance or repair from the comfort of their home or work,” Aman went on to say.

Shyft Auto said its fund campaign will include investment amounts start at as little as $150. Investors can receive perks like Shyft Auto merchandise, a Zoom call with the founders and even dinner in person.

Republic operates a family of businesses, including an investment platform that provides retail investors around the world with compliant access to curated startups and blockchain projects.

Founded in 2016, Republic operates under U.S. equity crowdfunding regulations and is under the supervision of the U.S. Securities and Exchange Commission and the U.S. Financial Industry Regulatory Authority.

To invest in Shyft Auto, visit https://www.republic.co/shyft-auto. Questions can be sent to [email protected].

A company providing a solution primarily to just independent dealerships in Utah received a funding injection to broaden its customer base nationwide and with franchised stores, too.

Carketa, the Utah-based developer of the Carketa Recon Software as a Service app and the Carketa Condition Report announced on Thursday that it closed a $1.375 million seed round financing led by Crosslink Capital with additional funding from Hack VC.

Carketa reiterated that its mission is to help independent and franchised dealers sell more vehicles faster online.

Carketa was founded last year and primarily marketed to Utah-based independent dealers.

“With this funding Carketa is expanding sales to independent and franchised dealers nationwide” Carketa chief executive officer Brady Thurgood said in a news release.

Carketa was formed to improve the reconditioning process to simply sell more vehicles per month. The company explained the Carketa Recon is dynamically reconfigurable to match any dealers current process and is tightly coupled with the Carketa Condition Report, a 200-point inspection system detailing a vehicle’s current condition.

With Carketa Recon, a dealer can upload inventory from a dealer management system (DMS), manage cars from the auction to the customer with active inventory management and vehicle valuations.

And with Carketa Connect, dealers and customers can track the vehicle through the recon process, often selling the unit before it’s on the front line.

Carketa co-founder Jason Berry also owns Action Auto, one of Utah’s fastest-growing independent dealerships.

“Carketa has helped my dealership set record-setting sales months even through COVID-19,” Berry said

Crosslink Capital is based in San Francisco with a focus on investments in digital media, internet services, financial technology, and business services. Parter Jim Feuille explained why the firm decided to fund Carketa.

“We’re excited to lead the seed round for Carketa,” Feuille said. “We have been impressed by what the team accomplished in a short period of time and look forward to supporting their vision to produce better car dealer solutions as car sales move on-line.”

Carketa also said it is expanding its sales team across the country and into Canada, too.

“We’re excited about what the next 12 to 18 months holds for Carketa,” Thurgood said. “Online car selling is a significant change in auto retailing. We are fortunate to be in a position to help dealers deliver a more efficient car selling experience. Research shows 90% of car buyers do their research online.”

For more details, go to Carketa.com.

Manheim says it is ramping up its investment in Simulcast and plans to add a host of new features to the digital auction platform later this year and early next.

The company declined to provide a specific breakdown of the investment but did note that it is part of the 2-year, $100 million overall digital investment that Manheim began in 2018.

As for a timeline, Manheim is currently testing the new features with a group of dealers and plans a more extensive rollout later in the year, the company said.

“The new Simulcast updates further evolve a technology that has transformed the remarketing industry by bringing the auction to the dealer,” Manheim president Grace Huang said in a news release.

“These new features give dealers real-time access to even more vehicle details and images, so they can make faster, smarter bidding decisions,” she said.

“They’re also part of a bigger commitment by Manheim to invest in ways to improve the auction experience for dealers, creating a safer way to buy while helping them more effectively run their businesses.”

The upgrades to Manheim Simulcast, a platform launched in 2002, are below, as listed in Manheim’s news release:

- One platform that makes it easier for dealers to view the bidding/buying experience

- Odometers and auction lights, indicating any special conditions of the sale, that are now visible for vehicles on the run list

- Photo tabs that provide more visuals, larger images and multiple views, allowing dealers to see the vehicles from different angles without being onsite

- A responsive bid window that dealers can enlarge or compress based on their monitor size to make it easier to see all relevant information

- The ability to scroll forward or backward through the run list to preview vehicles before they’re on the auction block and follow the vehicle status after it leaves the block to potentially submit a bid on any unsold vehicles

- Visible proxy bid amounts to remind dealers that they have already placed a bid

Through July, there have been approximately 1.3 million cars sold to Manheim digital buyers so far this year, according to the auction company.

More than a third (35%) of year-to-date physical auction volume at Manheim has been sold through Simulcast and more than 60% of live-sale attendance was on the platform.

Last year, there were 14.5 million bids placed through Simulcast.

Close to half of Manheim’s vehicle sales last year were done digitally and the company expects that share to go over 50% this year, it said.

This spring, the company launched its first all-digital auction location.

Manheim Tucson became Manheim’s first auction to incorporate a 100% digital format, utilizing a four-lane setup where cars are parked in designated spots and sold to buyers both physically present at the facility and online. An auctioneer has them up for sale digitally through oversized monitors that include enhanced images, barcode price scanning and condition report info.

Buyers and sellers can participate in person at the auction or online through Manheim Simulcast.

“Initial dealer reaction has been very positive from our first all-digital auction launched at Manheim Tucson in May,” Huang said in an emailed Q&A for Auto Remarketing’s Power 300 issue.

“Dealers have told us that they like the benefits of a digital experience, from being able to bid in four lanes from one location to preventing the chance of accidents that can happen in the physical lanes,” Huang said.

“We chose Manheim Tucson for our first all-digital auction because it handles mainly dealer vehicles under $5,000, which can be challenging to sell through digital channels like Manheim Simulcast,” she said. “The early success of this location is proof that our innovative, all-digital experience can appeal to all types of buyers and work for all vehicle price points by creating an experience as close as possible to a live physical sale.”

While Manheim Tucson is 100% digital, the company has over 100 digital-only lanes throughout its other physical auction facilities and plans to add more, Huang said.

Peer-to-peer carsharing marketplace Turo has landed a quarter-billion-dollar investment from IAC, an internet and media holdings company whose portfolio includes the likes of Vimeo, HomeAdvisor, Investopedia, tripsavvy, Angie’s List, Tinder, Match and many more.

With the $250 million Series E funding announced Wednesday, Turo has now raised $470 million.

“This latest round of funding brings Turo past the billion-dollar valuation mark — a milestone I couldn’t be prouder of as I reflect on the years of hard work by the devoted Turo team and, of course, the amazing Turo community,” Turo chief executive officer Andre Haddad said in this blog post.

“This fresh flood of funding will help us invest further in growth and refining the customer experience, to get us ever closer to our mission of putting the world’s one billion cars to better use, and our vision that wherever in the world you are, you can find the perfect vehicle for your next adventure from a trusted Turo host,” he said.

IAC becomes Turo’s largest shareholder and has the option to increase its stake over time, IAC said.

CEO Joey Levin, who is set to join Turo’s board of directors as part of the investment, said in a news release: "We like marketplaces. Turo has incredible scale and is benefiting from clear network effects in a very large market where consumers want better, more tailored experiences — perfect for IAC.

“Just as we've seen with travel, dating and home services, technology is accelerating a shift in the transportation space as the economics of car ownership change and the more than $60 billion global car rental market faces disruption and expansion with peer-to-peer carsharing services like Turo taking hold,” Levin said.

“Turo has built the best product and proven out the model, and only just begun to penetrate the market. We're excited to back Andre and the winning team at Turo, and hopefully this investment is a good start.”

Turo's most recent funding round was in September 2017, and the company has experienced two-times annual growth in the last two years, according to the news release announcing the investment. Turo operates in the U.S., Canada, U.K. and Germany.

The U.K. and Germany have been the more recent additions, with growth there coming at 8x annually over the last two years, the news release said.

Turo said its peer-to-peer community includes more than 10 million people (hosts and guests combined) and close to 400,000 vehicles. It describes itself as “a peer-to-peer car sharing marketplace where you can book any car you want, wherever you want it, from a vibrant community of local hosts across the US, Canada, the UK, and Germany. Guests choose from a totally unique selection of nearby cars, while hosts earn extra money to offset the costs of car ownership.”

In September 2017, Turo announced it had raised $92 million in Series D funding. Daimler and SK Holdings — one of South Korea's largest conglomerates — led the round, with Liberty Mutual Strategic Ventures and Founders Circle Capital also joining the financing. Existing investors August Capital, Canaan Partners, Kleiner Perkins, GV, Trinity Ventures and Shasta Ventures also invested in the Series D round.

As part of that 2017 round, Turo announced it was acquiring Croove, the leading peer-to-peer car sharing marketplace in Germany, from Daimler.

Drive Motors changed its name while collecting $5 million in funding from a trio of sources, including Ally Financial.

According to a recent news release, the provider of digital commerce solutions for some of the world’s largest auto retailers and brands, officially changed its name to Modal and raised $5 million of venture capital. Those funds came from technology investor Peter Thiel, large Japanese dealer conglomerate IDOM and Ally Ventures, the investing arm of the auto finance company.

Modal looks to help dealers and brands to deliver digital transactions inside their existing websites and showrooms. Since launching three years ago, overall volume through Modal’s Checkout product has grown to more than $8 billion, powered in large part by the fact that some of the largest auto retailers in the U.S. now use Modal across hundreds of stores.

Modal’s largest customers report up to 20% gross ecommerce penetration and more than $500 more profit per vehicle from sales via Modal. Last year, Modal doubled its average monthly volume per store to over $1.8 million per month, with top performing stores generating over $10 million per month.

“In the past three years, we’ve grown our customer base from local dealerships to some of the world’s largest auto retailers and brands,” Modal chief executive officer Aaron Krane said. “With our new name and investors, we can build a global brand that shows our focus on technology and design.”

In software terms, the company explained that a “modal” is an interactive window that appears on top of a software application page and keeps the underlying page visible to the user. The benefit of a modal window is that it can create focus on the specific interaction while maintaining orientation within the original experience.

Common examples of modal design include pop-up boxes, chat windows, shopping carts and many more.

“We chose the name Modal because it’s distinct in our automotive B2B market, and it directly communicates our core values,” Krane said. “Modal’s products are designed to generate digital transactions as a transparent part of the retailer or brand’s own experience. We use technology and design to turn the complex car sale into an easy, modal transaction that buyers love.”

The company indicated the additional capital is being used to scale Modal’s commerce platform to meet the needs of its new global customers and to develop new commerce technologies that dramatically streamline the auto purchase transaction.

Modal expects to more than double the size of its teams in its San Francisco headquarters and its regional support offices.

“Our new investors are an exciting combination of technology and automotive leaders,” Krane said. “We entered this industry as outsiders, because most of us came from Silicon Valley, not automotive.

But while that initially felt like a setback, it has become one of our greatest assets. We’re building a team that can modernize auto retail and perhaps redefine auto ownership, too,” Krane went on to say.

More details about the company can be found at www.modalup.com.

This week included a pair of significant, technologically driven moves by the Blue Oval to capitalize on possibilities for electric vehicles as well as cloud connectivity.

On Wednesday, Rivian announced an equity investment of $500 million from Ford. In addition to the investment, the companies have agreed to work together to develop an all-new, next-generation battery electric vehicle for Ford’s growing EV portfolio by using Rivian’s skateboard platform.

And on Tuesday, Ford and the creators of Autonomic — a transportation mobility cloud (TMC) — signed a multi-year, global agreement with Amazon Web Services (AWS), which will expand the availability of cloud connectivity services and connected car application development services for the transportation industry.

Cox Automotive pointed out the investment with Rivian places Ford among the largest investors in the privately held company. Experts mentioned Rivian has been in the spotlight recently, with “interesting” concept vehicles appearing at major auto shows and, more notably, an infusion of $700 million led by Amazon in February.

“Ford’s investment in Rivian is a smart one,” Autotrader executive analyst Michelle Krebs said in commentary distributed by Cox Automotive on Wednesday. “Ford has committed to producing numerous electrified vehicles in the future, including pickup trucks, and Rivian has an intriguing concept to get the job done. Rivian leverages Ford’s leadership, expertise and massive volume in pickup trucks as well as its vast distribution network.

“The Amazon investment in the Rivian mix may well give Ford an in with the delivery services, possibly with electric cargo vans. And, of course, sport utility vehicles are another big opportunity the two could collaborate on,” Krebs continued.

“Bigger picture, the first step to proliferate electric vehicles, and ultimately autonomous vehicles, is through commercial fleets,” she added.

Rivian said it already has developed two “clean-sheet” vehicles with adventurers at the core of design and engineering decisions. The company indicated its launch products — the five-passenger R1T pickup and seven-passenger R1S SUV — can deliver up to 400-plus miles of range and provide an “unmatched” combination of performance, off-road capability and utility.

The vehicles are slated to become available late 2020.

“This strategic partnership marks another key milestone in our drive to accelerate the transition to sustainable mobility,” Rivian founder and chief executive officer RJ Scaringe said in a news release. “Ford has a long-standing commitment to sustainability, with Bill Ford being one of the industry's earliest advocates, and we are excited to use our technology to get more electric vehicles on the road.”

Ford executive chairman Bill Ford added, “We are excited to invest in and partner with Rivian. I have gotten to know and respect RJ, and we share a common goal to create a sustainable future for our industry through innovation.”

Ford also said it intends to develop a new vehicle using Rivian’s flexible skateboard platform. This strategy is in addition to Ford’s existing plans to develop a portfolio of battery electric vehicles.

As part of its previously announced $11 billion EV investment, Ford already has confirmed two key fully electric vehicles: a Mustang-inspired crossover coming in 2020 and a zero-emissions version of the best-selling F-150 pickup.

“As we continue in our transformation of Ford with new forms of intelligent vehicles and propulsion, this partnership with Rivian brings a fresh approach to both,” Ford president and chief executive officer Jim Hackett said. “At the same time, we believe Rivian can benefit from Ford’s industrial expertise and resources.”

Rivian noted that it remains an independent company. The investment is subject to customary regulatory approval.

Following Ford’s investment, Joe Hinrichs, Ford’s president of automotive, will join Rivian’s seven-member board.

In commentary provided by the company via email, IHS Markit principal automotive analyst Stephanie Brinley said: “Ford’s $500 million investment into Rivian and the decision to work with the EV startup reflects, among other things, the ongoing shift in the automotive industry toward more focused partnerships and collaborations, versus traditional mergers.

“Creating this type of partnership is a path Ford has been moving forward with aggressively for the past two years. Both parties bring specific expertise to the partnership, and have much to offer each other,” she said. “This partnership model is particularly important for EVs and mobility technology, which are extremely capital intensive with a resulting scaled, profitable and sustainable mobility business possibly a decade or more away. The move also reflects the viability of Rivian’s business model, which includes both selling the skateboard and producing its own vehicles.

“Rivian is also free to use the Ford equity funds as it sees fit, and to work with other partners. Ford will benefit from lessons learned, as will Rivian. Rivian expects to be successful, and Ford should see return on that investment from a purely financial perspective as well.”

More details about collaboration involving Ford, Autonomic and Amazon

As mentioned previously, Ford, Autonomic and Amazon all entered into a multi-year, global agreement. The collaboration represents an expansion of the existing relationships involving Ford, Autonomic and AWS.

Amazon Web Services will power the Autonomic Transportation Mobility Cloud, giving automotive manufacturers and software developers the cloud infrastructure needed to build innovative connected vehicle services at scale, according to a news release.

Officials explained that through this collaboration, Autonomic’s TMC will be powered by AWS to become the standard connected car solution for Ford vehicles. Ford Mobility and Autonomic said they chose AWS for its global availability and the breadth and depth of AWS’ portfolio of services, including Internet of Things (IoT), machine learning, analytics and compute services.

“This collaboration will significantly expand our opportunity to deliver the very best experiences to Ford vehicle and mobility customers,” Ford Mobility president Marcy Klevorn said. “I am excited that our future cloud standard for connected vehicle solutions will be powered by AWS in addition to Autonomic’s Transportation Mobility Cloud.

“Working with AWS and Autonomic, Ford and our mobility partners will have access to the industry-leading mobility platform,” Klevorn added.

The companies continued that the collaboration with AWS can allow additional partnership and business opportunities for automakers, public transit operators, large-scale fleet operators and software developers.

As a technology partner in the AWS Partner Network (APN), Autonomic will also work with independent software vendors (ISVs) and system integrators (Sis) to offer vehicle connectivity services and capabilities for developing connected vehicle cloud services, vehicle features and mobile applications to automotive manufacturers and mobility application developers.

“This marks the next stage of what has already been an immensely gratifying collaborative relationship with AWS,” Autonomic co-founder and chief executive officer Gavin Sherry said. “One of the many goals we have in common is to build a cohesive framework for vehicle makers and developers, allowing them to focus on creating some of the best experiences for customers who use our connectivity systems. Now, with the announcement of this strategic collaboration, our platforms’ capabilities will expand greatly.”

Officials also noted automakers and application developers can leverage the TMC to free themselves from the large investment and extensive time required to build their own connectivity layer. Instead, by connecting via TMC, they can apply those resources to creating innovative products and solutions that differentiate them in their marketplaces.

TMC, already connected to millions of vehicles, can provide secure, bi-directional connectivity to the cloud from vehicles. It securely can ingest and enrich vehicle data in real time, and it can give software developers easy access to the processed data to be able to create rich applications for drivers, fleet-owners, and vehicle manufacturers.

Officals added TMC is vehicle brand agnostic and can provide the API-centric, cloud-based software development experience that developers of mobile applications prefer.

AWS chief executive officer Andy Jassy closed by offering how the Ford and Autonomic developments could lead to more advancements in this space.

“The collaboration with Ford and Autonomic transforms the way automotive customers and partners develop connected vehicle cloud services,” Jassy said. “Autonomic customers will be able to bring innovative mobility services and differentiated customer experiences to their customers worldwide, by integrating TMC with AWS, the industry’s broadest and deepest cloud platform.

Such capabilities, together with AWS’s partner network community and broad customer base in automotive, will help reimagine the future of the automobile industry,” Jassy went on to say.

Cox Automotive is leading a $30 million investment round in San Francisco-based Fyusion, a company in the 360-degree and 3D imaging technology space.

The investment aims to “accelerate the digital buying and selling experience, bringing it closer to a live interaction,” Cox Automotive said in a news release announcing the investment.

Other participants in the round were not disclosed, but Fyusion vice president of business development and marketing Keith Martin said via email that this is a “strategic round with participation from other automotive businesses” in addition to Cox.

The funding, which is Fyusion’s B2 round and its fourth financing round, will bring its total raised amount to $68 million once the round has closed, Martin said.

Cox Automotive’s Manheim brand is working with Fyusion to provide dealers with 360-degree interactive viewing capabilities in the Manheim Express app. They also have plans to deliver for artificial intelligence to condition reports, in addition to “improved objectivity” to those reports.

“Dealers and consignors will benefit from increased confidence in their ability to make informed decisions, buy and sell vehicles faster and maximize profits,” Cox Automotive said in a news release.

Digital sales have been a major piece of Manheim’s strategy. Within Cox Automotive’s Manheim business, 43% of sales in 2018 — and over 2 million transactions — involved a digital buyer, the company said earlier this year.

Grace Huang, president of the Cox Automotive Inventory Solutions group that includes Manheim, said it’s not just that digital’s share at the auction chain is growing, but that the rate of growth is increasing, as well.

“And we’re pretty confident by the end of this year it will be in the 50% range,” Huang said in an interview with Auto Remarketing during NADA Show 2019.

“And this is going to be the year of the tipping point,” she said. “Obviously, we’ve been talking about it for 20 years, but believe it or not, it’s here.”

While Cox Automotive has said the digital’s share of its wholesale sales has climbed in recent years, top-notch imaging will be paramount to further adoption.

“Dealers tell us that high quality imaging is a key factor in continuing to drive digital adoption,” Huang said in the release about the investment. “We are continuing to invest in delivering the industry’s best 3D imaging and merchandising experience, allowing sellers to better market their vehicles digitally and buyers to purchase with greater peace of mind.”

And their collaboration doesn’t appear to stop there, as Manheim and Fyusion intend on building “innovative capabilities for inside- and outside-the-gate applications,” Cox Automotive said in its news release.

Fyusion co-founder and chief executive Radu Rusu said in the release, “Cox Automotive plays a critical role in making the car-buying process easier in the wholesale and retail marketplaces. We look forward to continuing to work together as Manheim works to give dealers advanced imaging capabilities that help them take full advantage of digital channels to reach more buyers and close more sales.”

Their collaboration extends to other pieces of Cox Automotive, as well, as Fyusion is working with other brands within the company to “differentiate the client experience in the digital marketplace.”