Are you a cars’ geek? Do you know all about cars, latest automotive technologies, and rare automobiles? Then your place is on autoremarketing.com – the website where the newest information about vehicles is published on a regular basis. The site has become popular in a brief time. And how could it not, since it manages to satisfy the curiosity of all car fans from all over the USA?

Besides great articles on cars, including EVs, hybrids, self-driving cars, CUVs and SUVs, the website has an extensive collection of podcasts, available to all visitors. The magazine has the best possible contributors working in its benefit, so reading it is a must for any car enthusiast. But can a cars' fan like you know any possible detail about cars and not own the coolest car in your neighborhood? It doesn’t make sense at all. You know everything about car chassis styles, car engines’ power output, gearboxes, and trends and it is perfectly logical for you to own a car that speaks out about its owner.

You say you already own a car. It’s not the one you’ve been dreaming of, but it gets you to work in the morning. We say that this is not enough anymore. This is why we are happy to announce about autoremarketing.com concluding a partnership with USA’s friendliest online loan matching service – BadCreditLoansBear.Com!

How does that concern you?

If you are a loyal reader of autoremarketing.com, then you can take advantage of the newest alliance on the market and take a loan under the most convenient terms and conditions, especially for the Autoremarketing.com readers.

Why is BadCreditLoansBear so unique?

Autoremarketing.com has chosen to work with BadCreditLoansBear to the benefit of its readers because of the expertise and loyalty in regards to its customers is admirable. The online loan matching service works exclusively with authorized direct lenders and bans any attempt of predatory lending practices. The clients’ data is protected by sophisticated mechanisms so that no third party gets unauthorized access to this information.

Also, the rates and fees that our lenders operate with are the most competitive on the market, and we promise, you will find no better offer anywhere else. Access Bad Credit Loans Bear Com, apply for a loan and buy your dream car – the one you have been longing for all your life!

Though incentive levels remained essentially flat in May, spending still came in at the second highest rate seen this year.

That’s according to Cars.com data, as the site reported on Wednesday that overall incentive spending in May came in at approximately $2,680 per vehicle.

NADA Used Car Guide also reported on incentive spending this week, noting that spending incentive spending remained essentially flat in May, growing by just 0.3 percent on an annual basis to an average of $2,673 per unit, according to Autodata Corp.

And as the seasonal summer slowdown approaches, incentive spending is expected to remain high throughout June and the rest of the summer, Cars.com predicts, as manufacturers rush to make room for new models.

"Manufacturers are still seeing relatively high inventory levels and are anxious to move metal," said Jesse Toprak, chief analyst for Cars.com. "Consumers will get the most value on any large-vehicle category this summer.

"The most significant inventory surplus is in the large-truck category, and as a result, we are seeing generous incentives from manufacturers and dealer discounting for vehicles such as the Silverado and F-Series. The popular mid-size sedan segment, which has become extremely competitive, is also full of models with relatively high incentives," he added.

Toprak said the industry is in the middle of a "perfect storm for attractive leases," created in part by high resale values and very low interest rates.

NADA UCG senior director of vehicle analysis and analytics Jonathan Banks offered additional analysis on last month’s spending in the latest NADA Guidelines report.

He pointed out that this past month’s minor increase, according to AutoData, was the smallest recorded in almost 18 months and "was also counter to historical trends as more often than not manufacturers push incentives higher in May."

Year-to-date, spending is at an average of $2,650, which is in line with April’s figure.

Though most manufactures are rushing to ramp up spending, Banks said, "Domestic brands continued to outspend their import counterparts on incentives by a wide margin in May."

For example, Buick’s incentive average of $6,024 per unit last month was highest among mainstream brands last month, and almost $4,000 higher than the industry average.

Chrysler came in second place for mainstream brands, with average incentive spending of $5,000.

And though GMC and Volkswagen spent similar amounts in incentives last month, at a combined average of $3,300, Banks pointed out the brand’s trends were headed in opposite directions.

VW’s figures represented a 34-percent increase, while GMC reduced spending by 24 percent last month.

"Incentives on Ford and Ram product was roughly $3,200 per unit, while spending for remaining brands was at or below the mainstream average of $2,700," Banks shared, rounding out the big non-luxury spenders in May.

Subaru, Mazda, Toyota and Hyundai have spent less per unit than other non-luxury brands year-to-date, with spending remaining low this past month.

Moving over to the luxury side of the business, luxury brand spending averaged $3,400 per unit in May, according to the NADA UCG report.

Cadillac led the pack with average spending of $6,156, up 16 percent year-over-year.

Lincoln’s average of nearly $5,500 followed closely behind, Banks said.

And though Infiniti dropped spending by 2 percent, its $4,500 spend per unit in May was still highest among import luxury brands.

Land Rover only spend $674 toward incentives in May, which marks the lowest incentive rate among luxury brands for the month. This was just below Porsche’s figure of $829.

At the same time chief executive officer Mary Barra faced General Motors shareholders during the company’s first annual meeting with her in control, Swapalease.com noticed in its latest report on vehicle incentives from May that one particular trend jumped out at site executives.

Despite all the attention associated with the automaker’s recalls, Swapalease reported that few GM brands are currently listed with a cash incentive.

Executives explained cash incentives are a normal practice in the world of sales, but what makes this report different is that the Swapalease.com marketplace involves person-to-person transactions.

According to incentives data from May listings, only 5 percent of vehicles with incentives were from GM. Swapalease executives believe the GM recalls in the news recently have had little impact on a person’s ability to attract someone else to take over their lease.

Overall, incentives in the Swapalease.com marketplace have fallen slightly from the same time a year ago. The average personal cash incentive offered came in at $2,215.56 at the end of May, compared with an average of $2,464.78 last year.

Swapalease.com executive vice president Scot Hall explained lessees typically offer a cash incentive as a way to sweeten the offer when looking to escape the contract.

“With manufacturers focused on more transparency, a larger number of recalls have been instituted since the recession,” Hall said. “We believe consumers are becoming immune to the issue of recalls in general.”

Supporting this theory, a recent customer survey conducted by Swapalease found that 90.4 percent of drivers believe recalls are a part of everyday life now, and they will not change their purchase decision.

Vehicles currently with the largest incentives include the Ford Expedition ($3,900), Mercedes R-Class ($3,000), and Nissan Murano ($2,500). Vehicles currently with the lowest incentives include the Volkswagen CC ($1,143), Ford Edge ($1,150) and the Chevy Volt ($1,663).

GM Stockholders Gather

Barra addressed stockholders at the company’s annual meeting on Tuesday, telling them the OEM is in the best position to meet and exceed competitive challenges despite the turmoil surrounding the recall for defective ignition switches.

“In every market, consumers have more and better automotive choices than ever before,” Barra said. “And the competition is only going to get tougher. This is a reality. Another reality is that GM is positioned to be stronger, leaner and more responsive than ever before.”

During the meeting, Barra reiterated steps the automaker is taking in response to the ignition switch recalls, and she again expressed her deepest sympathies to the victims and their families.

“I know there are no words that can ease their pain and grief,” Barra said. “I have and will be guided by two clear principles: To do right thing for those that were harmed and to make sure we accept responsibility for our mistakes and commit to doing everything within our power to prevent this sort of problem from ever happening again.”

And according to an online report, GM doesn’t plan to dismiss any more employees as result of the botched recall. During her town-hall style employee address at the GM Vehicle Engineering Center in Warren, Mich., last Thursday, Barra confirmed 15 individuals who were determined to have acted inappropriately are no longer with the company. She also mentioned disciplinary actions have been taken against five other employees as a result of finding from the investigation completed by former U.S. attorney Anton Valukas.

“We feel we’ve taken the appropriate actions as it relates to the ignition switch recall,” Barra told reporters before Tuesday’s shareholders meeting, according to this report from Reuters.

If certified pre-owned Honda Civics or Ford Escapes turn quickly at your dealership, here’s more good news. Those units were the top two new models attached to a lease in the first quarter.

During a span in which leasing hit record levels, Experian Automotive found that the Civic and the Escape led the way in terms of leasing market share.

According to Experian’s latest State of the Automotive Finance Market report, Civics commanded a 3.45-percent leasing share in the first quarter of this year. The Ford Escape wasn’t far off that pace at 2.91 percent.

The remainder of the leading leased vehicles in Q1 settled as follows:

— Honda Accord: 2.81 percent

— Honda CR-V: 2.69 percent

— Ford Fusion: 2.54 percent

— Nissan Altima: 2.34 percent

— Toyota Camry: 2.32 percent

— Toyota RAV4: 1.97 percent

— Toyota Corolla: 1.93 percent

— Volkswagen Jetta: 1.81 percent

Of all new vehicles financed, 30.2 percent were leased in Q1 2014, compared to 27.5 percent in Q1 2013. Interestingly, of all new vehicles sold (whether financed or purchased in cash), a staggering one in four, or 25.6 percent, were leased in Q1 2014, compared to 22.9 percent in Q1 2013.

Overall, loans and leases for new vehicles were easier to obtain in Q1 2014. For new vehicle loans, the average credit score was 714, down from 722 in Q1 2013. For leases, the average credit score was 721 in Q1 2014, compared to 731 in Q1 2013.

“Over the last several quarters, leasing has come back as a very desirable option for consumers,” Experian senior director of automotive credit Melinda Zabritski said.

“Whether they are interested in getting the latest and greatest models or simply do not want to commit to a long-term purchase, consumers are leasing new vehicles in greater numbers than ever before,” Zabritski continued. “However, what they need to remember is that without good credit, it may be more difficult to get a lease, and that leases have mileage caps so they need to make sure their lifestyle fits the leasing requirements.”

As Zabritski mentioned, consumers with credit scores that fell into the prime or super-prime categories constituted 69.72 percent of the leases written in Q1. Just 8.24 percent had subprime credit histories, and only 1.57 percent were considered deep subprime.

No matter the credit category, Experian determined consumers on average now are paying $412 monthly in lease payments; that’s $2 lower than a year ago. The lease contract term they signed in Q1 averaged 35 months with 66.60 percent of leases written in the past quarter spanning 25 to 36 months.

Turning back to those 10 leading models that led lease activity in Q1, Experian’s data showed how much lease the average monthly payment was for a lease as compared to a traditional loan contract, giving the F&I more ammunition to write leases and boosting the anticipation for used-car managers looking for CPO inventory down the road. Here are how those numbers settled:

— Honda Civic

Loan: $347

Lease: $251

— Ford Escape

Loan: $343

Lease: $328

— Honda Accord

Loan: $429

Lease: $321

— Honda CR-V

Loan: $425

Lease: $323

— Ford Fusion

Loan: $426

Lease: $323

— Nissan Altima

Loan: $414

Lease: $288

— Toyota Camry

Loan: $412

Lease: $309

— Toyota RAV4

Loan: $443

Lease: $332

— Toyota Corolla

Loan: $357

Lease: $269

— Volkswagen Jetta

Loan: $384

Lease: $277

You can’t secure a traditional consumer lease from Tesla. But the company did recently introduce its new Resale Value Guarantee program that offers a similar deal.

The program offers to buy back a Model S between 36 months and 39 months at a guaranteed residual.

According to Tesla officials, "When combined with a car loan provided by Tesla's banking partners, this program gives customers the functional equivalent of a lease."

But there’s a caveat.

The program is positioned as a lease program, but the owner still has to finance and pay taxes on the vehicle.

According to Scot Hall, executive vice president of Swapalease.com, these and other factors are keeping Tesla from enjoying the true benefits of a leasing program.

The car brand has introduced a program that is masked as a lease, but finding a way to offer a traditional lease will benefit Tesla's ability to compete against other luxury brands, as well as additional benefits for consumers, Hall suggested.

In April of this year, Tesla did launch a leasing program for small and medium size buisnesses in an effort to provide companies "the ease and simplicity of being able to deduct payments from their business taxes," according to the company. For more on Tesla business leasing, see the automaker's blog post here.

Hal explained that many other luxury brands use consumer-facing leasing programs as a way to ramp up growth as well as an outlet to push new EVs that compete directly with Tesla models.

"A standard lease program would benefit customers and help Tesla grow its brand further and compete against other luxury makers that are now focusing on EV technology," said Hall. "Look at the success luxury brands such as BMW and Mercedes-Benz have had as a result of their lease programs, which see between 50 percent and 70 percent lease rates for higher-end models. These lease programs have played a large part in the growth these brands have enjoyed over the years, particularly as they introduce EV models to compete against Tesla."

For information on the recent controversy regarding Tesla’s direct-to-consumer sales model, see the following Auto Remarketing stories:

FTC Staffers, NADA Debate Tesla Sales Model

Tesla Sales Model May Push No-Haggle Pricing Forward

More Affordable Tesla May Mean More Changes

If you’re looking for states that are ideal for putting together a lease deal, your best bet is likely the Northeast or Upper Midwest.

According to an infographic from Equifax that breaks down the lease ranges state by state on a U.S. map, leasing commanded at least a 20-percent share of full-year 2013 originations in the following states:

Connecticut

Massachusetts

Michigan

New Jersey

New York

Ohio

Rhode Island

The infographic, which cited the Equifax National Consumer Credit Trends Report and the Equifax Risk Score by State, also suggests that that average state credit score is “correlated” to lease penetration.

Case in point, six of the seven leading had average scores north of 700. The other, Ohio, was at 699.

The full map from Equifax can be seen here.

In a Kelley Blue Book analysis released late last month that pointed to April being “another solid month” for the new-car market, KBB senior analyst Alec Gutierrez attributed some of the sales strength to enticing lease deals.

Along with “rising consumer confidence and improving employment conditions,” Gutierrez said in the April 28 report that new-car sales “also are supported by improved credit availability, low interest rates and attractive lease offers.”

Over at Cars.com, chief analyst Jesse Toprak echoed some of the same sentiment a few days earlier: “Demand for new cars was fueled by low interest rates, very attractive lease specials and perhaps the best selection of models consumers have ever seen — across all brands.”

Interestingly enough, attractive lease deals were among the factors that Juan Flores, director of operations for the Trade-In Marketplace at AutoTrader.com, cited for a certain luxury model being somewhat hard to find earlier this spring.

According to used-car scarcity data that AutoTrader provides to Auto Remarketing, the Mercedes-Benz CLA Class was one of the vehicle that stood out nationally in March.

The CLA was the scarcest certified pre-owned vehicle in the country in March and ranked fourth on the list of hardest-to-find late-model used vehicles.

“The presence of the Mercedes-Benz CLA on this list is great for Mercedes Benz dealers. The introduction of a very refreshing style combined with attractive lease offers has stimulated consumer interest to a level that CPO consumers are paying attention,” said Flores. “Dealers should expect this level of vehicle scarcity for quite some time, or at least until the current CLA lease volume returns to market 24 to 36 months from now. The OEM should be very proud of this accomplishment.” To read more on scarcity trends, see here.

But it’s not just the offers that are strong in the leasing market right now — the penetration rate is quite strong as well.

“Leasing has accounted for approximately 25 percent of all retail sales so far this year, a trend which is supported by a continued strong outlook for used-car values along with low interest rates,” Gutierrez said in the KBB analysis from April 28.

In a similar vein, CNW Research dedicated part of its April Retail Automotive Summary to look at why consumers choose to lease.

According to its data for calendar-year 2013, 41.6 percent said they leased to get a lower monthly payment, while 27.5 percent said it was because of a low (or no) down payment.

Next, 16.6 percent cited the desire to have a nicer ride, 9.4 percent felt it was a better use of their money and 3.7 percent pointed to tax considerations. Lastly, 1.2 percent said it was because they didn’t have to deal with “trade-in hassle.”

Swapalease.com reported on Tuesday that lease credit approvals on its site in March rose from the yearly low established a month earlier.

The March rate came in at 69.6 percent, up from 66.7 percent recorded in February. Site analysts noted the 69.6 percent approvals mark is also the level of the last three months, indicating a credit approvals landscape that continues to hover near the “healthy” mark of 70 percent.

The site’s credit approvals rate during the past 12 months stands at 71.7 percent. Prior to March, the approvals rate had continuously dropped from early fall of last year when the approvals rate climbed to approximately 76 percent.

Since then, Swapalease has noticed an increasing rate of credit applications due to more lease shoppers entering the marketplace.

Executive vice president Scot Hall referenced recent data cited by Bloomberg that indicated consumers borrowed more for auto and other non-revolving loans in February, exceeding estimates from economists.

Bloomberg reported consumers borrowed $16.5 billion in advanced credit compared with $13.8 billion in January, signaling an American appetite for credit that keeps rising, according to Hall.

“A consumer that wants to borrow doesn’t always mean they will be approved, which is why our approval rate continues to hover near the 70 percent healthy mark,” Hall said

“Credit worthiness is the most important aspect of getting approved for a car lease, and Swapalease.com expects this number to remain at or near healthy levels for the near term,” he went on to say.

When a lease shopper is interested in taking over someone’s lease, Swapalease.com can match the two parties and helps the “buyer” connect with the lease company to being the credit approvals process.

“If anyone is not approved they can work with a Swapalease.com partner to repair or improve their credit standing before a re-application process,” the site said.

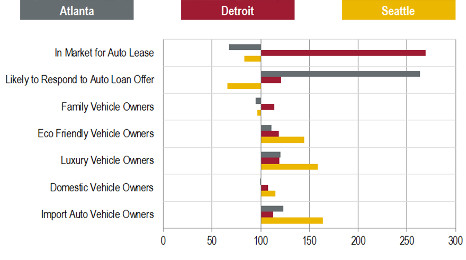

Equifax recently considered the difficult online advertising challenges faced by automakers, ad agencies, finance companies and dealers and how they can vary greatly by region. Analysts dissected trends from three major markets — Atlanta, Detroit and Seattle — in association with leasing potential.

Equifax found that these three markets demonstrate how complex it is to put the right message in front of optimal customers.

“A consumer may aspire to own a luxury sedan, but they may not be able to afford it, or they may need to buy a family car instead. That’s why it’s important for all of these groups to reach the right audience with the right offer for their brands and models,” Equifax’s Jeff Sporn wrote in a blog post on the company’s website.

“The easiest way to do this is to differentiate online consumers in real-time by understanding their preferences,” Sporn continued. “Many online advertisers simply focus on ‘auto intenders;’ but what, exactly, is the ‘intent’ of the intender? Auto marketers need deeper information that helps them determine whether an online consumer is more likely to purchase a luxury car versus a minivan. Or whether they prefer a loan or a lease. Armed with this insight, auto marketers can reach the right audience. When you deliver the right message to the right consumer you can significantly improve the ROI of your online spend.”

With those considerations in mind, Equifax examined trends originating from Atlanta, Detroit and Seattle and summarized them in the chart above. This information was compiled using the Equifax IXI auto-specific digital targeting segments. The bars represent an index value indicating how much more or less likely the cities are to have the listed attribute than the national average of 100.

“We can see clearly that Detroit is far above the national average when it comes to consumers likely to be in-market for an auto lease, while the other two cities are well below,” Sporn said. “Atlanta has more consumers likely to respond to a loan offer, while Detroit is also above the national average. Seattle is well below the national average, so advertisers extending lease or loan offers could divert their budget toward consumers in the other two cities.”

Sporn went on to mention another element about Seattle that makes it unique compared to the other two markets included in this study.

“The city indexes highest for luxury vehicle owners, eco-friendly vehicle owners, and import vehicle owners. Using other measures, we know that 17.0 percent of Seattle’s population is likely to have income greater than $150,000 (compared to 11.6 percent for Atlanta and 9.5 percent for Detroit),” Sporn said. “This means that Seattle is clearly an area that luxury brands will want to target, especially foreign brands and eco-friendly models. Their ads are likely to resonate better in the Northwest than in the other two cities.”

Sporn made one last point about the important of targeted online marketing.

“It’s important to note that these segments do not include any personally identifiable information so brands are not actually targeting or tracking known individuals,” he said. “Segments are estimates of likely household characteristics built using anonymous, aggregated, neighborhood-level data.”

In addition to dissecting April’s “plentiful” new-car incentives and lease deals spurred by the need to move inventory in preparation for the arrival of new vehicles, Cars.com said in an analysis this morning that special manufacturer promotions have driven leasing levels that approach all-time highs.

“Relatively slow sales pace in the first quarter of 2014 resulted in higher-than-expected inventory levels at many dealers’ lots, which can only mean more attractive deals for consumers in April,” said Jesse Toprak, chief analyst for Cars.com

“Manufacturers will take advantage of the seasonal uptick and warmer weather, which should bring an influx of shoppers to dealerships, by heavily promoting their vehicles,” he continued. “We'll also see continued promotion of low-APR financing incentives and generous leasing offers.

“Consumers are leasing new vehicles at near-record levels due to special manufacturer promotions featuring low payments, especially in the luxury-vehicle segment.”

Breaking down the incentive trends, the Cars.com analysis points out particularly robust deals for the “crowded” midsize sedan, compact and midsize SUV categories. There is tight competition in these segments as dealers and OEMs are fighting to capture shoppers’ attention.

In what it says is partly driven by “overstocked” supply among large vehicles, Cars.com said it expects automakers to be “generous” with incentives to get this inventory turning.

More specifically, Cars.com is projecting continued deals in the compact SUV segment — which it describes as “increasingly popular — the rest of this month and into the next.