Online car leasing marketplace Honcker closed a seed financing round of $3.6 million on Thursday, and said it will now provide delivery to customers in eight states.

Honcker plans to use the round, which was led by Evolution Corporate Advisors, to grow its dealership network, geographic footprint and customer base.

Additionally, Honcker will use the funds for creating more features to help streamline the car-leasing process, it said.

“Consumers never need to visit a dealer again to lease a car. Honcker is disrupting the traditional leasing experience for customers while digitally extending the rooftops of its dealer-partners,” Evolution founding partner Gregg Smith said in a news release.

In addition to Evolution, also participating in the round was Lead Edge Capital.

Honcker now has 200-plus dealer partners and is available in the New York Tri-State area, Los Angeles, Arizona, Nevada, Pennsylvania and Florida, the company said in a news release.

“Honcker is revolutionizing the automotive industry by bringing the entire car leasing process online — from selection to pricing to closing — and providing a seamless lease execution process that can be completed by a consumer in just minutes from the convenience of their own home on their mobile device,” Honcker founder and chief executive Nathan Hecht said in a news release. “This injection of capital from our new value-added partners will now allow us to truly step on the gas.”

This news came a day before another company in this space, Fair, announced two major investments.

Fair, an app that provides used-car leasing to consumers on a flexible basis, said Friday it is closing a BMW i Ventures-led strategic funding round that also includes investments from Penske Automotive Group, among other strategic investors.

Additionally, Fair has secured a total of nearly $1 billion in offers for dedicated capital coming from two entities: a group of institutional investment banks typically backing auto debt portfolios and a Sherpa Capital-led entity. The latter entity is being developed to fund projects innovating the transportation industry, including ride-sharing and flexible ownership.

The interest in flexible and/or alternative vehicle shopping and ownership appears to be palpable of late.

On the same day (Oct. 10) that Porsche Cars North America announced it was teaming up with Clutch Technologies to pilot a sports car and SUV subscription program in Atlanta, Hyundai launched a Shopper Assurance program the company says “streamlines and modernizes the car-buying experience” by making four often-challenging elements of car-buying easier, including moving some of the process online.

Then the following week, alternative leasing platforms Fair and Honcker land huge investments.

In a recent phone interview, Hecht explained what he believes had led to a groundswell of interest in alternative leasing.

“It’s a combination of a few different things, but the first thing I’d highlight is time,” Hecht said. “For the first time in the automotive industry, there’s actually innovation happening. And innovation on many different levels. It starts with the vehicle itself: self-driving cars, electric vehicles and so on. And now it’s starting to trickle down all the way through the entire auto experience.

“So once there’s innovation, it attracts capital. Once capital is available, the entrepreneurs sort of start to breathe. And the result is that there’s a lot of very interesting things going on. And I think it’s still very early days and there’s huge opportunity,” he said.

That opportunity, for Honcker, began to take shape Thursday.

Amid changing car ownership models, autonomous vehicles, digital retailing and other innovations, there’s another area of automotive that’s perhaps ripe for disruption: the leasing process.

Including, but not limited to, the used-car side of that business.

Fair, for instance, is an app that provides used-car leasing to consumers on a flexible basis, and launched last month in the Apple App Store.

Fair president and co-founder Georg Bauer, along with co-founder Scott Painter, found pre-owned leasing to be an underserved market.

“Thirty-eight million used vehicles change ownership annually in this country. And most of these cars are financed, on average, with 60-month loans,” Bauer said in a September phone interview.

“I mean, honestly, how boring is that from a dealer and a consumer perspective?” he said. “Scott and I felt this space needs some innovation badly there, and that’s what Fair is all about.”

Some, like Flexdrive and Clutch Technologies, are geared more toward the subscription model versus a lease, per se, but they arguably offer an alternative to would-be lessees.

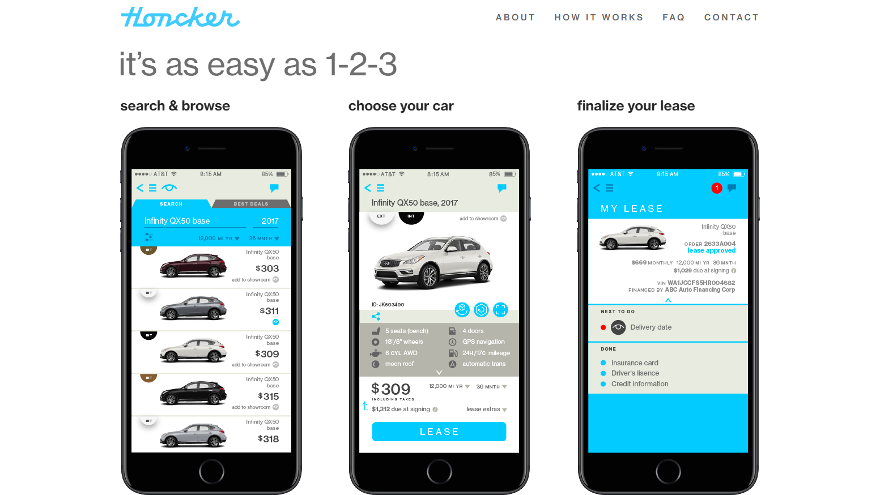

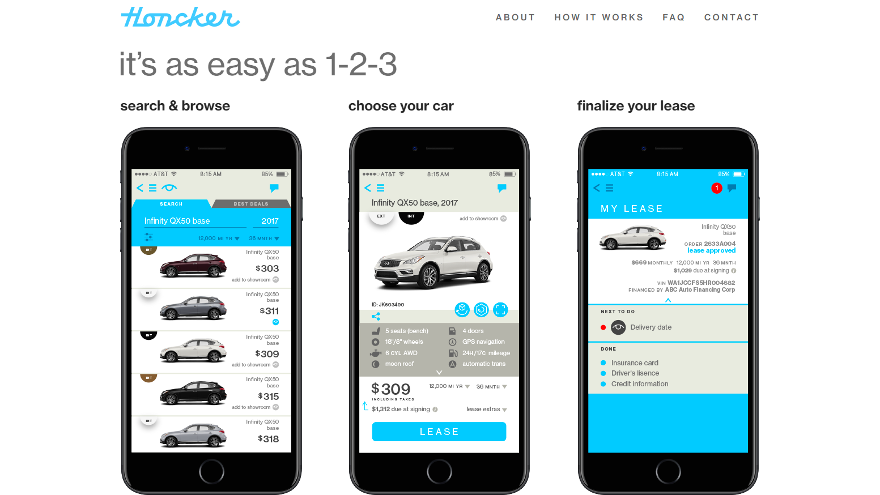

Another innovator to emerge in the leasing space in recent months is Honcker, an app that connects dealers and potential new-car lessees through an online marketplace.

Honcker took the often complicated process of shopping around for a lease and “distilled it down into a couple of swipes on an app,” founder Nathan Hecht said in a phone interview.

Honcker launched in the App Store nine months ago, with the first six months being a beta phase

Initially offered in New York/Tri-State area and the Los Angeles Basin, it has since added test markets in Florida, Philadelphia and San Francisco.

Hecht said two of the top 10 dealer groups are on board along with a mix of smaller, regional groups.

There are typically 35,000 vehicles available through the dealers utilizing Honcker, who represent 20 different brands.

So, what has led to this groundswell of interest in alternative leasing?

“It’s a combination of a few different things, but the first thing I’d highlight is time,” Hecht said. “For the first time in the automotive industry, there’s actually innovation happening. And innovation on many different levels. It starts with the vehicle itself: self-driving cars, electric vehicles and so on. And now it’s starting to trickle down all the way through the entire auto experience.

“So once there’s innovation, it attracts capital. Once capital is available, the entrepreneurs sort of start to breathe. And the result is that there’s a lot of very interesting things going on. And I think it’s still very early days and there’s huge opportunity,” he said.

As for Honcker, its focus is on the consumer experience. Hecht also believes dealerships are likely to stick around “in some form or another”

“And we look at ourselves as an extension of the dealership,” he said. “We’re not redesigning the lease, per se. So it’s still that 24-, 36-, 48-month term.”

But, nonetheless, a different take on the leasing process.

Scott Hall, executive vice president of Swaplalease.com, said these types of platforms are emerging amid two key market dynamics: One, new-car sales have been strong in recent years, despite a modest dip in 2017.

Two, leasing’s share of that new-car market has never been higher than current times.

“Again, we might be down slightly (this year) in terms of lease penetration,” Hall said, “But when you end the year where almost one in three vehicles is leased, that’s — in my opinion — reached the tipping point in the market.

“That’s a significant number of vehicles out there on the road,” he said. “And as a result, I think that’s giving some more fuel for these disruptors and different leasing platforms … to actually have a marketplace to play in and be able to make some money while they’re at it, hopefully.”

As a lease transfer marketplace, Swapalease itself has been a leasing alternative, although its history dates back nearly 20 years.

And leasing has come a long way since his company’s inception. These days, the challenge is less about explaining consumers about leasing itself, but educating them on what lease transfers and assumptions entail, Hall said.

“People are still to this day somewhat unclear on how leasing works and how the calculations work, and what have you. But more often than not, people are at least familiar with car leasing,” Hall said. “They may even know a little bit of the terminology. And even though they may not be an expert at it, again they have some familiarity.

“One of the biggest problems we ran into when we started was, that wasn’t the case. Leasing was still kind of a black box-type mentality, it was kind of mysterious. And so we not only had to teach people about leasing in many cases, then we had to teach them on the subset of lease transferring, as well, and help them understand how it works, what to expect and how to do it.”

The National Automobile Dealers Association recently rolled out a resource for members to help stores leverage vehicle leasing in a way that results in happy customers and compliant deliveries.

In light of the vehicle leasing business reaching an all-time high in 2016 with 4.3 million new units being leased, NADA said consumers are still leasing new cars at near-record levels. In fact, Experian Automotive reported that 30.83 percent of all new-vehicle turns during the second quarter came via a lease.

To help store manage that volume, NADA is offering its members a resource titled, “A Dealer Guide to Leasing Fundamentals.” The material aims to help dealers and their sales staff explain leasing, including how it compares to purchasing, so that customers can make the right decision for their individual needs.

Discussed are: closed-end consumer leases, how leasing benefits both customers and the dealership, and who are the best and worst candidates for leasing.

“Leasing appeals to many consumers who are able to acquire a more expensive vehicle, often with lower monthly payments, than they could have afforded as a purchase — and they can get into a new car every few years, with no depreciation risk,” NADA said.

“Still, many consumers don’t understand the leasing concept or vocabulary,” the association added.

NADA members can obtain this leasing guide by going to this website.

MUSA Auto Finance said its platform now offers capability that separates it from any captive or other provider specializing in leasing of new and pre-owned vehicles, especially for customers who already have strong credit backgrounds.

MUSA Auto Finance announced this week the launch of automated decisioning for leases submitted through Dealertrack, RouteOne or its online portal. The company said this development makes MUSA the first independent auto finance company in the country to pair auto-decisioning with leasing.

Officials said the development also marks the final step toward achieving a completely effortless, fully automated lease for both new and used vehicles.

“Prior to rolling out auto-decisioning, dealers might wait up to 20 minutes for a callback. But when you're dealing with prime customers who already know they're approved and just want to close the deal, that’s 20 minutes too long. With MUSA auto-decisioning, they'll get an answer within 30 seconds,” MUSA Auto Finance chief executive officer Jeff Morgan said

Morgan said MUSA’s underwriters have authority to rehash, make credit decisions and customize the callback to help a dealer over the finish line. “Our dealers can forget about waiting on hold. A couple of rings and you’ve got a live underwriter on the phone,” he said.

Once the decision has been returned, MUSA auto-populates the lease documents needed to finalize the funding package. As of this month, the following documents are automatically pre-populated for the dealer:

— Lease contract

— Credit application

— Agreement to provide insurance

— Vehicle condition report

— Funding checklist

President Richard Frunzi said MUSA completely eliminates or automates many of the challenges associated with the leasing process.

"As a dealer, you don't need to be an expert on leases to get one done with MUSA,” Frunzi said. “In fact, dealers who have never done leasing before will find our process surprisingly simple. New or used, economy or luxury — we offer effortless leases for a wide range of vehicles.”

Frunzi said his company will lease used vehicles up to 7 model years old, a range that is unheard of among the few providers that offer used leasing.

“With the wide variety of vehicles that fit our program, we are converting a lot of customers who were planning to purchase and end up choosing our lease instead,” Frunzi said. “We can get them a lower payment and a shorter term, so they can trade up sooner and not worry about negative equity. The dealer gets repeat business faster, and the consumer saves money on a nicer vehicle. It’s no wonder leasing is skyrocketing in popularity, especially among millennials."

MUSA is now doing business in 29 states, with representatives already on the ground in Alabama, California, Florida, Georgia, Illinois, Missouri, Texas and Washington.

The company is also signing up dealers in Arizona, Arkansas, Delaware, Idaho, Indiana, Kansas, Kentucky, Michigan, Minnesota, Mississippi, Montana, Nebraska, New Jersey, New Mexico, North Carolina, Oregon, Pennsylvania, South Carolina, Tennessee, Utah and Virginia.

MUSA recently secured $175 million in funding capacity through a warehouse facility with Goldman Sachs and a capital investment from Crestline Investors. This funding will enable MUSA to launch its auto leasing program nationwide, as well as implement future enhancements to its online portal.

To learn more about MUSA’s leasing program, visit www.musaautofinance.com and click dealers.

Auto Remarketing confirmed on Wednesday that Uber is out of the vehicle-leasing business.

Based in part by what reportedly has been heavy residual value losses, an Uber spokesperson said the Uber will cease Xchange Leasing, the platform where drivers could lease vehicles and maintain monthly payments by serving as a driver for the online company.

“We have decided to stop operating Xchange Leasing and move towards a less capital-intensive approach,” the Uber spokesperson said.

The Wall Street Journal previously reported Xchange Leasing anticipated that residual value losses would average about $500 per unit. The actual losses turned out to be about $9,000 per unit, according to the newspaper.

That kind of disparity is what experts said could be a significant risk threat to the overall health of auto finance company portfolios. Experian Automotive’s Melinda Zabritski explained the possible problems if your customers are using the vehicle attached to the installment contract to drive for transportation services such as Uber.

Why?

Currently, Zabritski said, there is not a clear way to track which units are being used for those purposes and which are not.

To put into perspective the potential quandary, Zabritski pointed out that finance company underwriting scorecards often consider that the customer will roll up 20,000 miles or much less on the vehicle during each year of the contract.

When sister publication SubPrime Auto Finance News returned from Used Car Week last year, the Uber driver who provided transportation from Raleigh-Durham International Airport said he put more than 100,000 miles on his SUV in roughly 12 months.

So how do finance companies determine if the contract holder is driving the vehicle that much, especially for services like Uber?

“It’s been talked about, but right now there’s not a good way to measure it,” Zabritski said. “There are only a few states that require the registration as a livery service or taxi, in which case you could measure it from a vehicle standpoint. Like through an Experian AutoCheck report for vehicles, it would show up as a taxi.

“Not all states require that so lenders look at it and say, ‘Well, how can I look at it?’ You could look at employment, but just because I work for Uber doesn’t mean I’m a driver. There’s just no hard and fast way to do that,” Zabritski continued during a conversation following a panel discussion about the subprime market at this year’s Vehicle Finance Conference hosted by the American Financial Services Association back in January.

“It’s one of those things that it could be a potential risk since these cars are on the road significantly more than your average consumer,” she went on to say. “There’s more chance they could be in an accident, more wear and tear. As a lender, if I have to go repo this car, I think it’s got 40,000 miles on it and it’s really got 90,000. There’s that kind of potential impact.”

Uber’s online newsroom doesn’t list any specifics about how many drivers currently are in its network. However, Uber’s website highlighted it has drivers in nearly 250 North American cities, including major metro areas such as Chicago, New York and San Francisco as well as broadly classified regions such as Eastern North Carolina and Eastern Washington.

“Lenders will certainly use mileage when they’re doing pricing on originations. But also when they’re forecasting reserves, there’s a lot more analytics being put into place in those portfolios,” Zabritski said.

“In forecasting delinquency, there’s a lot about quality of the vehicle, the value if they do have to repo it and what the asset might be worth and what is the vehicle history since that can impact asset value. It’s those types of things that all get formulated in all of the planning,” she continued.

“And right now (with Uber), it’s a big unknown,” Zabritski added.

At least for Xchange Leasing, the ramification certainly appear to be known now.

Lease transfer approvals in August nearly hit what Swapalease.com classifies as “healthy.”

The site reported on Wednesday that vehicle lease transfer credit applicants registered a 68.3 percent approval rate for August, just shy of that “healthy” mark that Swapalease.com pegs at 70 percent.

Analysts pointed out the credit approval rate for August saw a noticeable improvement from the previous month’s rate of just 54.3 percent. In more complete context, a year ago the approvals rate was much lower, reaching only 57.7 percent at this time last year.

Swapalease.com also mentioned the jump in approvals more than likely came before Hurricane Harvey affected Texas and surrounding regions. This increase in lease credit approvals is likely due to a rise in consumer confidence, which has remained strong in the current economy.

The consumer sentiment index rose to its highest level since January during August, according to the Consumer Confidence Survey.

“A boost in consumer confidence can have a positive impact on the automotive industry,” said Scot Hall, executive vice president of Swapalease.com. “August’s numbers are hopefully the beginning of an upward trend in the amount of lease credit approvals we will see for the rest of 2017.”

As an increasing number of Texas residents in particular look to replace their damaged or destroyed vehicles, Swapalease.com added that it will keep its eye on lease transfer activity in and around the surrounding region.

When it comes to consumers taking over someone's vehicle lease contract, they appear to be pretty particular about which brands they are considering.

According to its quarterly lease trends report for the second quarter released on Tuesday, Swapalease.com discovered only three badges increased in search traffic from the first quarter. That group included Infiniti, Ram and Chrysler, which saw a rise in search traffic by 10 percent, 5 percent and 3 percent, respectively.

Among domestic brands, the report showed GMC saw the largest decrease in the quarter for search traffic. The brand saw its level soften by 12 percent. A year ago, Swapalease.com pointed out that GMC’s brand searches were up by 14 percent, showing that consumers may be turning their attention elsewhere for leases.

For European brands, the report indicated Volkswagen saw the biggest dip in search traffic, decreasing by 11 percent compared with the first quarter. Not a single brand in the European category increased in search traffic this quarter.

Within the Asian brand category, the report noted Acura performed the worst, decreasing in traffic by 11 percent.

Infiniti claimed its position as the largest share of overall traffic (10 percent). A year ago, it was Ram that boasted the most search traffic out of all categories.

Swapalease.com determined the average monthly payment on a lease in Q2 came in at $474.39, which is a slight change from Q1 when the average payment was $436.35.

BMW is currently the most expensive brand to lease with an average monthly payment of $862. Conversely, Volkswagen is the most inexpensive brand to lease with an average monthly payment of $318.

The report also mentioned that higher-priced leases — monthly payments above $500 — saw increases in the second quarter compared with the first, possibly indicating continued strength in the economy.

“Our second quarter lease trends report shows that leasing remains strong in the automotive marketplace today, with increases in value of payment and number of leases in the driveways,” said Scot Hall, executive vice president of Swapalease.com.

“We’re also seeing growth in SUVs, crossovers and sports cars interest, which mirrors much of what is taking place in the broader automotive market today,” Hall added.

The complete Q2 report can be downloaded here.

Back to school means once again the approval rate for lease transfer applications is headed back down.

Swapalease.com reported vehicle lease credit applicants registered just a 54.3 percent approval rate for July, explaining the decline both on a sequential and year-over-year basis stemmed from in part because of college students leveraging the site in hopes of landing a better vehicle to drive to campus.

Site officials indicted July’s credit approval showed a decrease from the previous month (68.8 percent) as well as a year ago (57.7 percent). Overall, Swapalease.com pointed out that this year’s credit approval numbers have been somewhat lower than in years past.

Executive vice president Scot Hall explained this dip in lease credit approvals continues to be attributed to several factors that include a higher volume of lease applicants with less-than-stellar credit worthiness, as well as a higher number of applicants looking for vehicles in higher-priced categories.

Hall added that during this time of year, Swapalease.com typically sees a dip in the approval ratings because students with lower credit scores are looking for vehicle leases entering the new college school year.

“Both the state of the economy and the increased number of applicants indicate that more consumers are ready to lease vehicles,” Hall said. “Unfortunately, their credit doesn’t always reflect that readiness.

“As the economy continues to improve, giving more people the incentive to lease vehicles out of their reach, we expect to the number of declines to be higher than normal,” he went on to say.

Dealers could benefit from a new program to help them turn their new models from Jeep, Hyundai, Ram, Dodge, Fiat and Chrysler.

LegalShield, a consumer membership company that allows subscribers to connect with law firms for personal legal advice or assistance, formed a partnership on Monday with BonusDrive, a firm that can deliver benefit programs on behalf of insurance companies, employers, associations, credit unions, co-ops and other organizations.

The companies rolled out a program that offers a $500 rebate to members who buy or lease new Jeep, Hyundai, Ram, Dodge, Fiat and Chrysler vehicles. The partnership was unveiled by LegalShield chief executive officer Jeff Bell and BonusDrive co-chief executive officer Jim Evans.

“We always are attempting to enhance the benefits for our members,” Bell said. “For our members of LegalShield, the BonusDrive program is another easy way to bring them value at every turn.”

According to Evans, BonusDrive is unlike other offers from manufacturers and dealers, since it can be combined with applicable discounts, rebates, incentives and promotions LegalShield members already have negotiated.

Evans also noted that the rebate process is designed to be simple. After the LegalShield member makes the deal with a Jeep, Hyundai, Ram, Dodge, Fiat or Chrysler dealer, and the purchase or lease is complete, the member will need to fill out the quick BonusDrive application online within 60 days.

Once the application is approved, in approximately six weeks, the member will receive a check in the mail for $500, with no restrictions on how the money is to be spent.

LegalShield members can call (888) 982-6687), email [email protected] or visit www.BonusDrive.com for program and application details.

Swapalease.com reported that applicants through its website registered a 68.8 percent approval rate during June, a significant rebound from May when only 48.1 percent were approved.

Officials explained the company saw less of an influx of shoppers applying for higher-end luxury leases, which often drives up non-approval rates.

Through the first six months of the year, 62.4 percent of transfer applicants have been approved, compared to 67.4 percent the same time a year ago. Swapalease.com noticed a higher number of lease applicants registered for leases with monthly payments between $400 to $599 monthly; which is a “healthier sweet spot” for applicants finding approvals based on credit qualifications.

Swapalease.com officials also say many vehicles in this price range continue to be in the luxury and entry-luxury categories, such as BMW 3-Series, Audi A4/A6 and Mercedes-Benz C-Class type vehicles. There is often a higher number of vehicles in this class, and a higher percentage of applicants find approvals from the lease company.

What’s more, smaller SUVs and crossovers continue to grow in volume in the marketplace, and even these vehicles come at a monthly price point that’s typically more prone to an applicant finding an approval.

“As our lease credit approvals have continued to experience volatility from month to month, we’re beginning to have a better understanding as to why,” said Scot Hall, executive vice president of Swapalease.com.

“We have a greater diverse set of cars and trucks in our marketplace today compared with five or ten years ago, and this means that we are experiencing more volatility in approvals from month to month depending on the volume and deals offered by certain tiers of vehicles,” Hall added.