String Automotive, provider of the Dealer Positioning System (DPS), recently debuted its next competitive intelligence mobile app for dealerships — StringDPS Pulse.

The company said StringDPS Pulse is being offered after a wildly successful beta period with requests for the app quadrupling the original goal set for the time period.

What String Automotive contends is the first of its kind in automotive, the free app not only can help dealerships track their competitors based on geo-targeting, but it also can compare market share by ZIP code and area, provides model by model comparisons, and serves up detailed new inventory pricing and turn information down to trim level.

In addition, a “competitor feed” feature can enable dealers to track changes in pricing and marketing from competitors and adjust accordingly. The result is a mobile game plan with pinpoint accuracy of competitors and opportunities to win in the dealer's own market.

“We rolled out this app in beta to a select group of key clients and influencers and everyone was blown away by the precise level of competitive market share information and detailed comparisons it provides,” String Automotive chief executive officer Ken Kolodziej said.

“One of our beta testers told me DPS Pulse allowed him to walk into his sales meeting, look at his phone, and tell his team their No. 1 competitor and top sales ZIP code in real-time,” Kolodziej continued.

StringDPS Pulse is currently free to any dealer who owns an iPhone, with plans for Android models coming soon. Interested dealers can find and download DPS Pulse in the app store on their phone.

“This is a secret weapon for dealerships that will not only analyze market share, but also strategically help outperform competitors,” Kolodziej said. “It’s the only mobile solution on the market that gives dealers this information in an easy, accessible format, and best of all, we're giving it away for free."

String Automotive is in the middle of a tremendous growth period, with more than 130 percent year-over-year growth in 2016 alone. In addition to a rapid expansion in dealer rooftop numbers, String has also increased its ad agency partners, brought on multiple technology integration partners, and completed three product introductions in the last year.

String Automotive’s Dealer Positioning System is a marketing intelligence platform that can combine multiple sources of data from inside and outside the dealership to provide a rich, actionable plan to dominate market share in each geographic area. By showing dealership personnel where they can lift market share, which channel will be most effective in doing that, and what message will resonate best with those target customers, String can help dealerships make the most of their marketing budgets.

To download StringDPS Pulse on your iPhone, visit the Apple App Store or http://dpspulse.com.

Contining a string of company developments that include a new president and chief executive officer as well as a new regional sales VP, LeasePlan USA now is bringing new enhancements to ePlan, the online fleet management tool that can help companies gain more control over their fleets.

With a streamlined new interface, featuring an easy-to-use wizard and expanded comparison parameters, LeasePlan highlighted on Wednesday that its new Life Cycle Cost Analysis (LCCA) tool can help lessees decide which vehicles to include in their fleet. The tool offers powerful decision-making information, such as market value depreciation and projected maintenance expenses, using LeasePlan’s proven proprietary models.

LeasePlan clients also can enjoy an enhanced executive summary report, which can give fleet managers a comprehensive look at their fleet’s operating costs for better budgeting.

“We are committed to delivering the most comprehensive information to our clients so they can make smart decisions and drive their business forward,” said Nancy D’Amico, chief information officer. “We encourage fleet managers to demo the new technology to see the new features,” which also include new time-saving functionality for drivers.

The company went on to mention ePlan for Drivers is enhancing safety services and streamlining registration renewal processes. Drivers can now view a more complete picture of their safety training history, better manage motor vehicle records, more easily view registration requirements and upload images to complete renewal as well.

Many of these enhancements will roll out with the next updates to MyLeasePlan, a mobile app launched in 2016 that makes it easy for drivers to manage their company vehicles while on-the-go.

“The latest innovations are just a stepping stone to the next iteration of MyLeasePlan’s mobility solutions, which we are excited to launch in April at NAFA’s Institute & Expo,” added Kristofer Bush, vice president of marketing.

Coinciding with the launch of its tool in Texas, Blinker — which contends it offers the only mobile app that allows people to buy, sell, finance or refinance their vehicle by simply snapping a photo — was selected as a winner of the 2017 South by Southwest (SXSW) Interactive Innovation Awards.

Blinker was picked from hundreds of applicants around the world for the SXSW awards that honor the “best and latest advancements in the digital industry.” Blinker said it was recognized this week for its creativity, form, function and overall experience in the “New Economy" category, which is awarded to the brand that is best “redefining the exchange of goods and services.”

Blinker is led by John Elway Dealers and Summit Automotive Partners founder Rod Buscher.

“Blinker is honored to receive the SXSW Interactive Innovation Award. Blinker isn't just a new car app — it’s a whole new approach to car ownership,” said Buscher, who is now chief executive officer of Blinker. “Blinker uses technology to put people in control of car ownership in the same way that Airbnb revolutionized their industry. No banks or dealers which means no extra fees or markups.”

After launching in its home state of Colorado back in September, Blinker made its services available in Texas this week, too. Blinker can verify ownership records and buyer and seller identities, handles payments through the app, conducts a 17-point fraud check and offers a free Carfax Vehicle History Report with every listing.

Furthermore, Blinker integrates Black Book pricing guidance, ensures the seller receives payment securely and transfers the title electronically. Blinker also can allow people to sell their vehicle even if they still have an outstanding installment contract.

Blinker thinks it’s made the process of refinancing a vehicle easier than ever. Owners can download the Blinker app, snap a photo of their car and driver’s license and answer a few finance-related questions. Blinker instantly can display new monthly payment and cash back options, if applicable.

To finalize their new Blinker contract, owners can sign documents directly in the app. Blinker specialists can handle all the paperwork and pay off their existing contract. Owners can reach Blinker finance specialists by phone or email for help.

“We offer car loans that are competitive, transparent and easy to complete from anywhere — all in the Blinker app. Car owners can refinance an existing loan in minutes — all on their mobile device. No banks, no dealerships,” Buscher said.

Blinker, which has grown to include 54 full-time employees, added that it will be expanding into other states in 2017.

On Monday, Black Book announced another regular analysis offering covering the wholesale market — the Black Book Used Vehicle Retention Index — saying this product is designed to offer an “unbiased, accurate” view of the strength of today’s used wholesale market values.

Editors explained the Black Book Used Vehicle Retention Index is calculated using Black Book’s published wholesale average value on 2- to 6-year-old used vehicles as percent of original typically-equipped MSRP. Black Book’s wholesale average is a benchmark value for used vehicles selling in the wholesale auctions with the vehicle quality in average condition. The index is weighted based on used vehicle registration volume and adjusted for seasonality, vehicle age, mileage, condition, segment mix, and inflation (MSRP).

Aggregated from daily vehicle value updates, and captured throughout hundreds of wholesale physical and online auto auctions across the country, the company went on to note the Black Book Used Vehicle Retention Index is designed to represent data across all regions of the U.S. The index is based on a comprehensive list of vehicles included in the Black Book wholesale database, and includes no bias toward any brand, auction or region, ensuring a more accurate reporting of the used vehicle market.

The Index dates back to January 2005, three years prior to the beginning of the economic recession, where Black Book published a benchmark index value of 100.0 for the market. In March of this year, the index reading came in at 115.9, indicating a 16-percent increase in used vehicle retention strength since 2005.

That being said, editors pointed out the index has fallen steadily since October 2015, when the index registered a score of 127.0. This recent trend illustrates a continued, slow weakening of the used-vehicle market as a result of cresting demand and increased supply in the used market.

As more 2- to 6-year vehicles return to the market in the coming years, Black Book said this index can provide an overall measurement of strength/weakness in wholesale used vehicle value retention. During the recessionary period, the index experienced a sharp drop of about 14 percent from Jan. 2008 to Jan. 2009.

In 2010, the index recovered nicely and gained 10 percent during the year. After the recession, the index continued to rise persistently until 20111 and remained high till 2015. The index lost 6 percent in 2016.

Black Book added the index is expected to continue its slow decline in 2017 as the used-vehicle market loses strength.

When broken down by segments, the index shows some interesting trends, especially comparing two contrasting vehicle segments.

Compact car values have continued to decline sharply during the last two years due to the lack of consumer demand and higher supply for these vehicles.

On the other hand, full-size SUV index values are currently near all-time high.

“Automotive professionals today base critical, profit-dependent decisions on accurate, unbiased data that offers clear insight into the market,” said Anil Goyal, senior vice president of automotive valuation and analytics at Black Book. “The Black Book Used Vehicle Retention Index represents the industry’s guide into the strength of the market, with no bias.”

To obtain a copy of the latest Black Book Wholesale Value Index, go to this website.

Infiniti dealerships throughout the country will now be able to work with automotiveMastermind to implement its predictive analytics technology, which provides dealer sales teams key insights and valuable consumer information unique to car shoppers, the company announced on Monday.

Since the year began, Infiniti is the second OEM to partner with the predictive analytics and marketing automation technology provider, and the 10th brand overall.

“As Infiniti is seeking to drive business in the highly competitive luxury market, this is the perfect opportunity for us to help them improve sales and customer retention,” Marco Schnabl, automotiveMastermind chief executive officer and co-founder, said in a news release. “The recent introduction of the QX50 concept demonstrates that Infiniti is looking to gain traction in the booming crossover market segment.

“Our behavior prediction technology helps dealerships tap into that growing market by showing them who they should be contacting and marketing to in order to generate the fastest and most efficient growth of sales.”

The automotiveMastermind technology encompasses a proprietary algorithm that crunches thousands of data points to calculate how likely a consumer is to purchase a new vehicle.

Dealer management system information is combined with big data — which includes social media, financial, product and customer lifecycle information to produce an automotiveMastermind Behavior Prediction Score — one simple number which is a ranking from 0 to100.

Scores closest to 100 illustrates that a consumer is more likely to buy.

Additionally, the technology can feed talking points and customized micro-targeted predictive marketing campaigns directly to sales teams’ desktops and mobile devices.

The talking points can then be complemented with customized customer-specific and micro-targeted predictive marketing campaigns.

“Dealers cannot rely on pricing or new design elements alone to increase sales – with Mastermind they are able to use sophisticated technology to let them know exactly who is ready to buy,” automotiveMastermind sales and marketing vice president Andrew Gillman said. “Our success lies in determining the motivating factors for each individual person. As soon as a dealer partner on-boards our technology they see immediate gains in retention and sales.”

The other OEMs automotiveMastermind currently works with are Acura, Audi, BMW, Cadillac, Honda, Lexus, Mercedes-Benz, MINI and Toyota.

As president of Intellaegis, the software company that built masterQueue, and a founding partner in RepoRoute, I’d like to share some thoughts on the importance of field management software and where we see this new technology taking the industry.

We see this moment as one of the most critical times in the history of auto finance. Delinquency is spiking, repossession companies are breaking company volume records, and there are more dollars delinquent in auto loans over 30 and 90 days than there has ever been. According to the Federal Reserve Bank of New York, the industry just passed the previous high from the Great Recession of 2007-2008. Here’s what Bill Ploog, former head of collections in auto finance at Ally Financial sees as the entire industry is seeing a spike in delinquent dollars past due.

Before I talk more about the present, I’d like to take you a journey through the past, helping you understand why technology can make a huge difference for the repossession industry. Everyone is blogging and tweeting about FinTech, financial services technology. There’s a reason, and this article should shed some light on why that is in the auto finance industry.

My first job in auto finance was as a field rep for Chrysler Credit in Sacramento, Calif., in 1982. My main task was to collect delinquent customer payments in the field. If the customer couldn't pay, I repossessed their car. Pretty straight forward. No tow truck, just me, a Curtis Key Cutter, the factory key code from the invoice and the adrenaline of a 22-year-old. I worked almost exclusively in the field, and I built my own routes where I’d travel each day. It was a manual process, it took time and I made mistakes.

After five years, I left Chrysler, and my wife and I started a skip-tracing company in 1988. We did this because the auto finance industry was growing, and we saw an opportunity. Lenders were taking more chances on making loans, which meant more repossessions, and that meant more skip accounts. Kind of similar to how it is now.

Before we understand why “good” field management software is a must have component of any repossession agency, we should first understand the assignment, routing and field management process, and how it’s evolved through the years.

Deterioration of the repossession process

One of the main reasons we we’re successful in 1988 in building one of the first skip companies was we started to see the quality of the repo assignment decrease from where it was when I’d started just six years earlier. It wasn’t that there were that many more skips, but collectors were creating skips because they weren’t putting in the fundamental work to reach the customer at an earlier stage of their delinquency. Bottom line, they weren’t verifying the address prior to placing the account for repossession as I was trained to do at Chrysler. The captive lenders also eliminated field reps, and while “door knock” companies started to come into the market soon thereafter, it wasn’t quite the same as having your own employee in the field.

We also noticed collectors were wasting repossessors’ time running bad addresses, and the customers were digging deeper holes for themselves as they went from three to four payments past due, which was creating more “skips.” The customer knew by then their car was out for repo, so they tried to hide it, and many customers avoided all contact. In a sense, we turned them into a skip but not being more efficient in the collection process at an earlier stage.

Once public records data became more accessible for collectors and skip-tracers in the late 1990s, the skip problem magnified with more unverified, bad addresses assigned for repo, and repo success percentages continued to decrease significantly. Collectors and even skip-tracers got lazy; they just saw a new address and “shot-gunned” it to a repo company. There were little to no consequences they thought, as it was a contingent assignment, so it didn’t “cost” them anything to have the agent check the address.

The problem was simple, and it still is simple. No one was (or is) making calls and verifying addresses before placing an assignment for repo. The “collectors” and “skip-tracers” just look for an address and they place it for repo without making phone calls to verify the information. Problem with this is it is not “free,” not even close. As Bill Ploog says, “Collections is a race against time.”

If you use this mentality, once the account is placed for repossession, every day is critical. Assigning an account for repo to an unverified address wastes valuable time, and while the “price” of a contingent repo is zero, if the car doesn’t get recovered, the “cost” of an inefficient assignment can be significant, especially when the loan charges off as a total loss.

So, when more and more bad addresses started getting assigned to the field, it opened the door for not only a skip-tracing industry to eventually be formed, but nearly 30 years later, its opened the door for field management software to be developed to help repo agencies, and specifically to allow repossessors to work more efficiently in the field.

More ramifications

In recent years, we’ve seen the percentage of successful repossessions decrease significantly. Today, it’s at a point where repo agencies have hundreds or thousands of “open” addresses to run, addresses the client expects them to check routinely. These are addresses where statistically, the chances of the car showing is slim to none. This could have been determined if the people placing the assignment had done the leg work of making calls to verify the address prior to placing it for repo.

Sounds simple right, just make calls, verify addresses, and place for repo. If you’re not doing this, you can sign up for a demo at www.masterQueue.com and we can show you how it’s done, but that's a different topic, so let me continue.

In 1990, we created Crown Auto Recovery, and we quickly became one of the larger repo agencies in Los Angeles. We did this not because we were having trouble finding the skips, but because we were having trouble getting them repossessed. The repo agencies were either so busy running bad addresses for others that my addresses weren’t getting run, or they were fabricating updates and saying it didn’t show when I knew it did, and they did that because they either we’re too busy and couldn’t handle all the work, or they had a repossessor in the field who fabricated an update back to the office, which then went back to the client. I know this because I was going out and repossessing my own locates when the agent said my car “didn’t show” and in most cases it was there, and I knew it would be there because I verified it.

By opening a repo agency, routing changed for me, as I wasn’t just routing myself as I did at Chrysler. Now I was routing a dozen guys every day and night. The order of each route and the decision to run, or not run each address that night was based on a variety of factors:

—Capacity: How many repossesors did I have versus how many addresses needed to be checked. Rarely did I have less work than I had manpower, and usually I had two to three or more times the work I could handle. It was my job to insure our company put out the best routes to insure my guys would pick up cars, and not run 15 addresses and get skunked. I quickly learned to remove the addresses that needed to be verified or skip-traced, so they wouldn't get mixed with verified addresses that should be checked.

—My intuition.

—The skill of a skip-tracer in my office.

—The skill of a repossessor versus the type of car he’s after and what is required to take it. Remember we didn’t use tow trucks back then.

—The number of hours he worked the night before. How many cars did he repossess? Did he get a full night’s sleep? Where is he on his weekly commission versus how much time is left in the pay period? Has he repossessed enough cars to pay his rent, or has he repossessed a bunch of cars and he may take the night off or worse, he may mail in his updates and say he checked an address, but really didn’t?

—The quality of the assignment from the specific lender.

—The repossession percentage of the lender placing the assignment.

—The skill of a collector at the lenders office, to how many times we’d already been by the house, to the type of vehicle, did we have a key code, a color, etc.

—The chances of picking up a car in a general sense from this neighborhood. We picked up a higher percentage of cars in the San Fernando Valley as there are a lot of apartments with open parking versus in Arcadia where there are a lot of single family homes with garages.

For sure, intuition played the biggest part as technology was almost non-existent back then, so it was a lot of labor, knowledge, information, time and intuition going through my head to build routes.

Each assignment also brought a different thought to my head, from “That’s a Ford deal from Alice at XYZ Bank. That’s guaranteed money.” Or, “second placement, 7 Series BMW that’s 90 days past due from XYZ Finance Company at a house in Arcadia. That’s probably his mother’s house with a garage. That’ll never show.”

Next developments

Fast forward a few more years to 1993 and we’d now sold Crown. We moved to Sacramento, and we started another repo company — River City Auto Recovery. We also now had cell phones, computers and repossession software, but we were still receiving assignments and sending updates to clients through fax. We were also still printing assignments and manually routing them onto repossessors’ clipboards, paper assignments, based on where they lived, or what area we wanted to send them to that night.

We we’re doing it manually through all the process management we’d built to try and run an efficient repo company, and all the customers personally identifiable information was sitting on that clipboard every night.

That’s how I approached routing when I worked at Chrysler and when we owned our own repo companies. Routing was a manual process, and for many it still is, either manually in the office or manually by a repossessor, and from what I hear and see, it’s even manual for these people who use routing software’s other than RepoRoute, and even for some who use RepoRoute, but at least we give them an easy way to be “old school” and create manual routes.

When Michael Eusebio, president at Digital Dog Auto Recovery, approached me three years ago to have our company partner with them on building routing software, I knew there had to be a better way to manage this process more efficiently than everyone was doing. I quickly realized the repossession industry hadn’t changed much from when I was in it, except the job of routing usually got outsourced to the actual repossessors. It was rare to find a company creating routes for drivers as I’d done.

Some repossessors have great intuition and are proficient and some are excellent at routing manually. It’s an art that comes with a sense of pride and a badge of honor that's worn based on results, just like skip-tracing. The problem is, how do you teach intuition to a new employee who has never repossessed a car, or a guy who just doesn't have that skill, but maybe he’s a great employee and a great repossessor when he see’s the car, but putting a route together is not his strongest asset? Also, the real question is can a machine do a better job at routing than the repossessor, or can there be a way to combine the human skill with machine learning in a software platform to build an efficient way to route repossessors.

We believe this can be done, and after three years we’ve begun to prove this is the case, and it’s called RepoRoute.

I always knew there must be a better way to route than to spend hours manually doing it, but technology hadn’t advanced enough for me to come up with any ideas back then, and by 1999, we’d sold all of our companies; Skipbusters, ARS and River City Auto Recovery, and I was out of the repo industry, for a while anyway.

When Michael and James McNeil at Digital Dog were encountering the same manual route generation problems mentioned above, and given the advancements in technology, their rapid growth, and the need for a solution, the opportunity to build RepoRoute interested me and my partners so we jumped in. We kicked around some basic ideas, hired a developer and got started. We could have easily just put out software that met some basic needs, as many software companies do, but that’s not how we have learned to create a lasting product. To build technology that will really solve issues, software that’s “sticky,” you have to address all the issues, and in repossession routing that means much more than just putting pretty pins on a map.

Three years later, we’re seeing companies who use www.RepoRoute.com help us evolve the product into a game changing platform for their business.

If you are in the repo business and you aren’t already breaking records for more repossessions than you have ever done, then you are doing something wrong. The work is there. This also means those of us in the auto finance collection space better hold on, as we’ve just gotten busier by a great deal, and the trend is showing this will increase at a record clip. How do you solve the problems this type of high-risk growth causes? In my opinion and based on my experience; two words: better technology. If you are in the repossession industry, two more words: RepoRoute.

I have a tremendous amount of respect for repossessors, maybe more than for any other profession. I know first-hand how tough and how dangerous a job it can be. The reason I hesitated for so many years to have anyone but me do the routing was I always felt routing was the single most important job in running a successful repo company.

6 lessons learned

So building successful routes in 2017 starts with a few key tips:

—Less is More. Having a system to identify what addresses you shouldn't waste time working is critical. This is the key to valuable routing software, and to do that, the software has to help you identify this easily, and quickly, and when possible, automatically. It’s important to run less addresses to pick up more cars and that’s exactly what we’ve been able to do. This is a core value proposition we’ve built into RepoRoute. We do this better than any platform I’ve seen, and our users who embrace the platform attest to this.

—I always thought the repossessor shouldn’t have to waste their valuable time creating routes of where to go. First off, it can take an hour or more, and once you get a car or get a call with a rush deal, or something else happens, you have to either start over or spend time recreating a modified or new route. I always felt our repossessors should be home with their families, or getting an extra hour of sleep before going to work, not sitting at a table trying to figure out which deals that have never been hit should get routed, or which deals that were ran once before may happen to show that night. Push a button, create a route, that’s our goal. In some cases we’re there, in some cases we are still perfecting the algorithms as it takes time and volume and historical results to do this. We’ve done the same at masterQueue and now we run millions of pieces of data every year and that volume creates predictive analytics, which helps automate decisions of where to go, or not.

—Evaluate your clients, and stop working for the non-profitable ones. At RepoRoute, we wanted to insure that the deals being routed were the ones our clients wanted to be ran, and if we could help build technology to do that, we felt this would be a sustainable product others would get value from. If you have a client giving you work that’s resulting in a 70 percent recovery percentage and they gave you 10 deals, and the same day you received 10 deals from a client you’re struggling to make a profit from because the quality of their assignments is so low, do you want software that helps you decide what deals to run that night? Could we build software that can tell users that level of detail? Heck Yeah, and that’s what we have done with RepoRoute. If you are managing your repo company without technology like RepoRoute, you’re operating with one hand tied behind your back. Call Michael or James and let them explain how RepoRoute has made DigitalDog and DayBreak Metro, the two repo companies they own and operate, more efficient, and how margins have increased and their clients and employees are happier than ever.

—Build solid technology and a winning team. The next challenge in building RepoRoute was how could we leverage technology in the same manner we’d done in masterQueue. We started with quality first, partnering with industry leader Google for our mapping, industry leader Rackspace for Security, compliance and performance, and by hiring an experienced Full-Stack developer we could build a team around. He didn’t know anything about repossession or routing, but we did. We also knew we wanted to incorporate predictive analytics into the platform, creating automation when it was convenient, but at the same time allowing the repossessor the ability to create a route on their own if they wanted to. We also needed to measure which way was more efficient, and over time, as was the case with masterQueue, we were confident that we could build a blend of both to get the best results for the repossessor, the repo agency and the client, and the consumer.

The consumer? Yes, this is also important as now the Consumer Financial Protection Bureau tracks everything, so it’s important to not be making contact with the wrong person, or someone who already has been contacted and should not be contacted again. We’re also seeing preventable, senseless tragedies where technology can improve the background check and training process. In this case a Mom lost her life, and the question is would this person even have been there to repossess her car if proper background checks have been performed, and would he have acted in this manner if proper training been documented to have been performed?

Next we had to build a winning team, so we brought one of our lead trainers and support people from masterQueue to run the team, Polly Schumacher, and we hired a second developer from Apple, whose background was in mapping. Customer support at the highest level is mandatory, and we treat our customers as they would want to be treated, in a friendly and attentive manner. With the leadership of our president Michael Eusebio, and the product development skills James McNeil brings, a former repossessor who is now an executive in one of the largest and most successful repossession organizations in the country, we are 100% confident we have the foundation of a winning team.

—Integration. So many charge-offs could be saved, wrongful repossessions prevented and manual labor eliminated if the tools available today to gather and utilize data were more efficiently connected as it relates to the repossession assignment process.

Early on, we recognized the need to integrate data so companies didn’t have to do so much copy and pasting, and so when assignments closed or updates were entered, they moved between systems through real-time bi-directional integrations with RDN, iRepo, Prios and other platforms, without the need to work in two systems, or to copy and paste data between systems. This prevents wrongful repossessions and it eliminates a great deal of manual work. We’ve built integration partnerships with the two largest assignment patforms RDN and MBSi (iRepo and RCM) to make the workflow for repossessors more efficient, and we’re definitely seeing great strides now in this direction through these partnerships. We spent additional time building deeper and more thorough interfaces with these platforms than anyone in the industry, and the results are fruitful for our clients as it cuts down the need to work in two or more systems. This also made everyone more efficient.

—Security. Fast forward to 2017, and we’re now seeing clients starting to mandate what software their data can reside in, or what software they want the user to work in. We’re being told by lenders this is due to security and compliance concerns, as they are just realizing how many systems their customer data is residing in, and the fact many of these systems have not been audited and verified as secure is a growing concern. This is also a concern of the CFPB, and after meeting with them last week I can share they are concerned about how data is being shared, and how systems talk to each other, or not, how frequently are consumers being contacted, and how is the information not to contact a consumer, or a related party being addresses by the lenders and their vendors, and is it done in one system, or at least in connected systems?

Building and operating masterQueue for 10 years, I can attest that these audits are becoming more comprehensive than ever. Lenders are now requiring full code reviews by external third parties, extreme levels of encryption of the data at rest and in transit, even non PII data must be treated like personally identifiable information (PII) and internal and external third party penetration testing to insure every means possible is being used and verified to prevent anyone other than those intended to see the consumer PII stored in any system containing the lenders customer data. I’ll write more about this new trend in another blog soon, as I believe it will shift the industry in a similar manner compliance started to do in 2011 when the CFPB was formed.

In the meantime, if you’d like to see a demo of RepoRoute, visit www.reporoute.com and fill out the demo form, or send us an email to [email protected] or give support and sales a call at (916) 800-1010 and they can set it up.

Remember, in business, sometimes you have to change your direction, and we give you that option in a simple to use, affordable platform with RepoRoute.

Be careful out there.

John Lewis is the president of Intelleagis and can be reached at [email protected].

On Tuesday, F&I solution provider EFG Companies rolled out what it dubbed the Drive Forever Worry Free Lifetime Wrap, an enhancement to the company’s limited powertrain protection.

EFG companies explained that the Drive Forever Lifetime Wrap is designed to help dealers close more deals at a higher gross with improved product pricing, expanded eligibility and an underlying complimentary coverage component.

The wrap is a second coverage upgrade option for dealers to utilize when providing customers with complimentary Drive Forever Worry Free Limited Powertrain Protection. Until now, dealers had the option to upgrade customers to a full vehicle service contract with terms up to 96 months/120,000 miles. The Drive Forever Lifetime Wrap provides expanded coverage options with no mileage or time limits.

With the Drive Forever Lifetime Wrap, EFG Companies insisted cost-conscious consumers will be better able to preserve their vehicle’s value and their savings. Beyond the benefits related to vehicle repairs, the coverage is fully transferrable, further enabling consumers to negotiate beyond just the value of their vehicle at resale.

The company went on to note Drive Forever Worry Free is a limited lifetime powertrain program for dealers to offer complimentary as a way to differentiate themselves from the competition. The Drive Forever Lifetime Wrap is an exclusionary coverage that matches the lifetime term of the complimentary product.

The coverage upgrade includes roadside assistance, rental reimbursement and a standard $100 deductible for the first three years.

EFG Companies projected that interest rates are expected to rise three times in 2017 — perhaps as soon as next week — and analysts are predicting lower used-vehicle values as off-lease vehicles enter the market. With an uncertain economic outlook, EFG Companies acknowledged dealers are looking for programs that create more foot traffic and help to close more deals at a higher margin.

“With dealer profit margins being squeezed in recent years, we’ve taken an in-depth look at how we at EFG can measurably facilitate dealer profitability, and customer retention,” said John Pappanastos, president and chief executive officer of EFG Companies.

“In our ongoing contract holder research, we evaluate our protection products with regard to the value perceived by the consumer,” Pappanastos continued. “In the case of Drive Forever, on average, 82 percent of the time, contract holders rank it as a top three reason as to why they chose to purchase from a participating dealer.

“Based on this extensive research and ongoing feedback from dealers, we created the Lifetime Wrap as a natural extension of a program that provides distinct benefits to both dealers and consumers,” he went on to say.

Beyond the benefits of EFG’s complimentary Drive Forever Worry Free program, the company thinks dealers have a better opportunity to stay ahead of the competition with an upgrade that can give customers enhanced coverage for the life of their vehicle, not just their installment contract.

“This product gives dealerships an immediate means of capturing market share and increasing profit margins by turning the sales process into a more value-based conversation,” EFG Companies added.

For more information, go to this website.

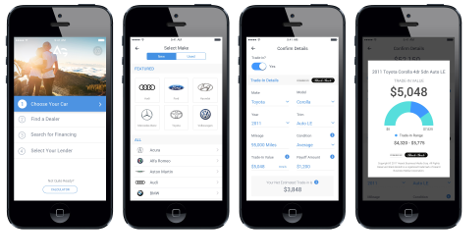

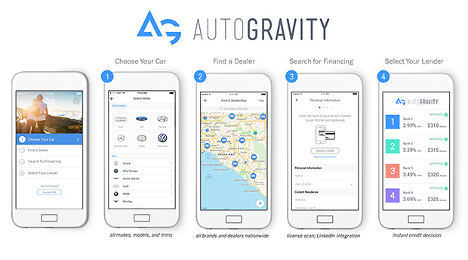

On Tuesday, Black Book announced an agreement to power vehicle trade appraisal for AutoGravity, a mobile auto financing tool that recently surpassed 200,000 downloads of its native iOS and Android smartphone apps.

The Internet is increasing in prominence for every part of the vehicle-buying process. A recent survey from eBay Motors found that 87 percent of vehicle shoppers used the Internet in some way in the past six months when buying a vehicle. AutoGravity caters to these shoppers by offering a one-stop-shop where customers can find their desired vehicle and dealer, value their trade and secure their financing — all on their smartphone.

The AutoGravity platform allows shoppers in 46 states to obtain up to four finance offers on any make, model and trim of new or used vehicle by following four steps. The app can return personalized retail installment contract and lease offers within minutes.

Black Book asserted that many dealers feel the trade appraisal portion of that process is responsible for sealing the deal in most sales opportunities. Customers now can obtain some of the most transparent and accurate trade appraisals with up-to-date vehicle valuation data powered by Black Book.

With more than 300 years of combined experience, as well as an editorial and analytics team monitoring daily auctions throughout the country, Black Book is offering AutoGravity and its customers access to timely and accurate valuation data.

“We’re pleased to bring AutoGravity our legacy of vehicle valuation data, combined with an analytics approach that enables the most accurate trade appraisals possible,” Black Book senior vice president of sales Jared Kalfus said in a news release.

“Online car financing and shopping will only grow more significant in the future, and a platform such as AutoGravity caters to the way consumers want to shop for cars and trucks.”

AutoGravity launched its app in California last year. Since that point, the company highlighted it has developed relationships with finance companies up and down the credit spectrum so it can cater to all consumers.

“AutoGravity serves a growing generation of digitally savvy car shoppers that seek convenience and control through their smartphones,” said Andy Hinrichs, founder and chief executive officer of AutoGravity.

“The ability to offer our customers the most accurate and transparent trade appraisals from Black Book is a critical part of our turnkey approach to the mobile car shopping and financing experience,” Hinrichs added in the news release.

AutoGravity is available for download from the Apple App Store and Google Play Store. AutoGravity is also available as a mobile-responsive web platform at www.autogravity.com. The app guides shoppers through an intuitive four step process:

1. Select any make, model and trim of new or used vehicle available in the United States.

2. Select any dealership from AutoGravity's proprietary national database; the platform automatically pinpoints your location and shows you the closest dealers selling the vehicle.

3. Search for financing for your selected vehicle, right on your smartphone. You can value your trade, scan your driver's license and connect to social media to quickly pre-fill your finance application.

4. Receive up to four finance offers within minutes. Simply select the loan or lease offer that’s right for you and head to the dealership to complete your purchase with peace of mind.

One of the benefits AutoGravity chief marketing officer Serge Vartanov often emphasized during a conversation with Auto Remarketing to discuss the mobile auto financing tool the firm is offering was empowerment.

Vartanov discussed empowerment in context of keeping dealerships in an important place of the vehicle-delivery process, but also while providing consumers with additional information that traditionally they could not obtain until arriving at the F&I office.

“Our belief is if you look at disruptive moments over the past 20 to 25 years, oftentimes when a tech player comes into an industry what they’re innovating is improving on something that lacks convenience or transparency or empowerment of efficiency and choice. We saw that when we talked with dealerships and car shoppers,” Vartanov said.

“No matter how much research you do online, you don’t really know until you go into the dealership and you’re taken into the F&I office what your deal is going to be. There’s an anxiety in that experience insofar as you don’t get to see all of your options as a car shopper. The process really does take quite a bit of time,” he continued.

“Our view is we can innovate against that. We can put car shoppers in a position where they’re able to see their indirect finance options that the dealer can also see because they’re the same lenders the dealer works with,” Vartanov went on to say. “If you can empower the consumer with those options, if you can let them know these are the lenders that have approved you, whether you’re super-prime or subprime, the experience for the car shopper, the dealer and even the lender is a lot better and much more robust.”

Thus far, it appears AutoGravity is gaining some robust momentum as the company recently announced that it has surpassed 200,000 downloads of its native iOS and Android smartphone apps. The platform allows shoppers in 46 states to obtain up to four finance offers on any make, model and trim of new or used vehicle by following four steps. The app can return personalized retail installment contract and lease offers within minutes.

“AutoGravity has brought car finance into the digital age,” said Andy Hinrichs, who became AutoGravity’s founder and chief executive officer after decades as an auto finance executive with captives such as Mercedes-Benz Financial Services.

“Our industry-leading technology has been embraced by top banks and captive auto lenders, as well as leading dealer groups who see customers shopping on their smartphones every day,” Hinrichs continued in a news release. “We’ve re-designed the car finance experience, taking it from hours to minutes for car buyers across the country.”

To arrive at this point has been no small task. Vartanov noted that more than half of AutoGravity’s employees are engineers since it took a coordinated effort to design the platform that can communicate with consumers, dealers and finance companies efficiently and securely.

“Every lender that joins AutoGravity we pass through a vetting process,” Vartanov said. “Our compliance team meets with the lender’s compliance team. Our IT and security teams meet with the lender’s IT and security teams. These lenders hold us up to extremely high standards because many of these lenders are large, publicly traded corporations. We’ve passed through those screens with flying colors."

Vartanov added later, “That’s critical because if you’re going to be partnering with lenders of this magnitude to be able to offer those indirect lending offers in the marketplace, you have to be at least as secure as the lender and you have to be as mindful of compliance and regulatory concerns as the lender is.”

AutoGravity launched its app in California last year. Since that point, Vartanov highlighted the company has developed relationships with finance companies up and down the credit spectrum so it can cater to all consumers, who evidently quickly leverage the technology once downloading it to a device.

“AutoGravity gives you the peace of mind of seeing multiple indirect offers anytime anywhere within minutes,” said Vartanov, who pointed out that the average user obtains offers within 10 minutes of downloading and opening the app for the first time.

And if these shoppers are already on the lot using their smartphones — as recent analysis pointed to that situation happening more often — AutoGravity’s platform could help grease the financing wheels to reduce the time it takes to finalize delivery.

“These are financed deals that the dealership participates in. With these indirect offers, the dealer can put them up very easily in their own systems without requiring an additional application from the customer. They’re deals where dealers have participation in the rate,” Vartanov said.

“What we heard again and again from dealers is you see car shoppers in the showroom looking at the phone, not necessarily talking to a living human being,” he continued. “What dealers have realized, and this is why they’ve embraced AutoGravity, you have to be there on the phone to be relevant and meet those consumer needs. This is true across the credit spectrum.”

Sounds like a situation that’s creating “empowerment.”

CDK Global announced on Friday that it recently chose nine new partners to join its growing program made up of 210 companies that together offer auto dealers, third parties and OEMs more than 315 different applications they can use to run their businesses.

The CDK Global Partner Program provides business-ready data, and serves as a marketplace of applications and integration selections.

“The partner program is focused on providing stronger security, better reliability and more choices for its dealer customers,” CDK Global said in a news release.

Currently, it serves more than 27,000 retail locations and automotive manufacturers, according to the integrated information technology and digital marketing solutions provider.

For a full list of vendors and applications available through the CDK Global Partner Program, visit www.cdkglobal.com/partners.

The program's new partners include:

-

Auto Data Direct, Inc. (Tallahassee, Fla.) – provides vehicle registration services

-

Auto Powered Solutions (Beaverton, Ore.) – provides service appointments online

-

AutoLoop (Clearwater, Fla.) – provides CRM and service appointments online

-

CloudOne (Vancouver, Wash.) – provides CRM and telephone services

-

CTMS LLC (Kent, Ohio) – provides vehicle registration services

-

Digital Dealership System, Inc. (West Palm Beach, Fla.) – provides business intelligence and analytics

-

GrowthFX, Inc. (Highland, Utah) – provides CRM customer marketing/follow-up

-

Minacs Limited (Fremont, Calif.) – provides service appointments online

-

Unotifi, LLC (Houston, Texas) – provides CRM