J.D. Power released its 2023 ALG Residual Value Awards last week, and topping the mass-market brand rankings for the second year in a row was Honda, while Lexus earned best premium brand honors for the third straight year.

Breaking it down by segment, Kia earned five model-level awards to top the list, with Honda and Toyota each next with four.

Kia also earned honors as most improved mass market brand, as it climbed three spots in the rankings, while Porsche (which climbed four) was most improved among premium brands.

“This year’s achievement by Kia speaks volumes about how far the brand has come,” Eric Lyman, who is vice president of the ALG division at J.D. Power, said in a news release. “The marketplace is acknowledging that Kia has a very strong product lineup in terms of design, quality and residual values. Kia has become a force to be reckoned with.”

Award-winning vehicles broken down by brand be found below:

- Kia: K5, Rio, Sportage, Soul and Telluride

- Honda: Civic, Passport, HR-V and Odyssey

- Toyota: GR Supra, 4Runner, Tacoma and Tundra

- Land Rover: Range Rover Velar, Discovery and Range Rover Evoque

- Chevrolet: Bolt EV and Silverado 2500 HD

- Lexus: IS and LX

- Mercedes-Benz: AMG GT 4-Door and Metris

- Porsche: 911 and Macan

- Acura: Integra

- Audi: A6 Allroad

- GMC: HUMMER EV Pickup

- Jeep: Wagoneer

- Subaru: WRX

In a separate news release from Stellantis, Jim Morrison — who is senior vice president and head of Jeep brand North America — said of the Jeep Wagoneer earning honors in the large SUV category: “Wagoneer is a breakthrough vehicle if ever there was one.

“The market was waiting for a product with its unique blend of prestige, capability and comfort. Like the original, Wagoneer has filled a significant void, and it's done so with genuine flair, demonstrating our commitment to redefining American premium and a unique customer experience.”

Black Book regularly recaps what happened during the previous week within the wholesale market, as highlighted in this previous report.

On Friday, the division of Hearst announced an expanded data offering for its residual valuations, looking forward as long as 10 years.

Previously, Black Book said residual values were available for up to seven model years, forecasting future values from one to 72 months.

Black Book said it has expanded used-vehicle residuals to include the most recent 10 model years and now forecasts future values for one to 120 months.

Black Book explained in a news release that this 10-year residual offering can provide finance companies, dealer groups, insurance companies and fleets the ability to more precisely value their older, longer-term portfolios.

“With used prices continuing to be high, consumers are financing older vehicles. In addition, loan terms are increasing and are currently at a 67-month term for new cars and a 66-month term for used cars, which requires our customers to have a longer outlook,” said Alex Yurchenko, senior vice president and chief data science officer at Black Book, who will be giving a presentation about residual values during Used Car Week, which begins on Nov. 14 in San Diego.

This enhanced residual valuation capability is available upon request, according to Black Book.

To find out more, visit www.blackbook.com or call (800) 554-1026.

Edmunds shared data on Thursday that highlights just how much equity the 4 million consumers who began a vehicle lease in 2019 might now possess.

Perhaps more than $7,000 to $10,000 in some instances.

Read more

Perhaps now more than ever with the used-car market in a place never previously seen, having tangible insight into residual values is even more crucial to automakers, finance companies and dealerships.

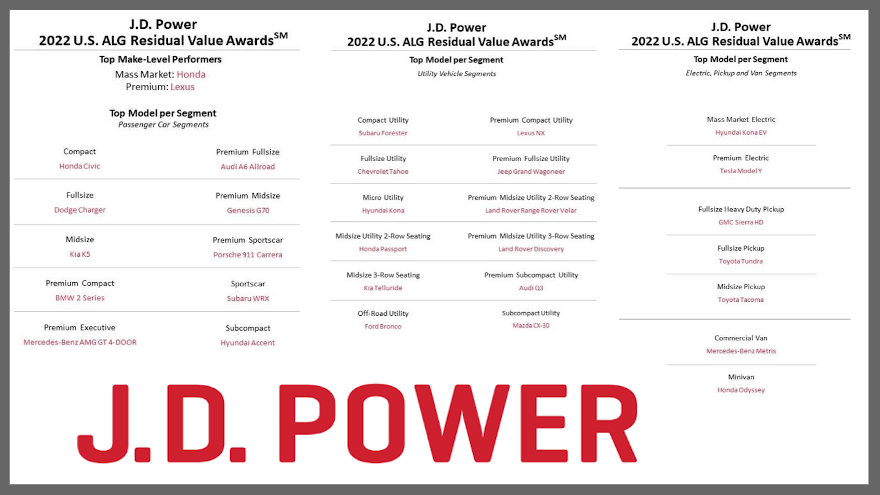

With that scene in mind, experts announced the recipients of the J.D. Power 2022 U.S. ALG Residual Value Awards, highlighted by Honda and Lexus being named brand award winners in the mass market and premium segments, respectively.

“Accurately forecasting residual values in the auto industry is a key factor in assessing an estimated $225 billion lease portfolio of vehicles in the United States,” said Eric Lyman, vice president of ALG, the division of J.D. Power.

“The brands and vehicle models that rise to the top demonstrate that they score well across the award program’s criteria, including manufacturers’ superior design and quality,” Lyman continued in a news release.

The J.D. Power U.S. ALG Residual Value Awards recognize models projected to hold the highest percentage of their manufacturer’s suggested retail price following a three-year period of ownership.

ALG explained this value retention is a key variable in the lease cost of a vehicle, underscoring an automaker’s success in the areas of long-term quality and design, as well as the overall desirability of automotive brands and their models.

ALG added it is also a vital component to vehicle shoppers as it helps forecast a vehicle’s resale value once they sell or trade-in the vehicle for a new one, consistently cited as an important purchase consideration by shoppers.

For model-year 2022, ALG highlighted 19 different brands have won awards in 29 segments. The award process consists of evaluating 284 models through analysis of used-vehicle performance, brand outlook and product competitiveness.

The company explained eligibility for a brand award requires a manufacturer to have model entries in at least four different segments. To account for differences across trim levels, model averages are weighted based on percentage share relative to the entire model line.

In addition to the mass market brand level award, Honda also took home three model-level awards.

And Lexus ranked highest among premium brands while only having one segment-winning model.

“The achievement of Lexus speaks to an impressive, industry-leading continuity of residual value across its entire lineup,” Lyman said. “It’s like a decathlete who wins only one of the 10 individual events but scores enough points in each of them to stand atop the podium.”

Honda and Hyundai shared the most model-level awards, with three each. They are followed by a diverse list of OEMs winning in two categories: Audi, Kia, Land Rover, Mercedes-Benz, Subaru and Toyota. That list included:

• Honda: Civic, Passport and Odyssey

• Hyundai: Accent, Kona and Kona EV

• Audi: A6 Allroad and Q3

• Kia: K5 and Telluride

• Land Rover: Range Rover Velar and Discovery

• Mercedes-Benz: AMG GT 4-Door and Metris

• Subaru: WRX and Forrester

• Toyota: Tacoma and Tundra

Noteworthy for 2022, ALG said the Mercedes-Benz AMG GT 4-Door topped long-time segment leader Lexus LS in the premium executive segment, while the new Ford Bronco beats out perennial winners Jeep Wrangler and Toyota 4Runner for top honors in the off-road utility segment.

Also of note, ALG mentioned there are the increasingly popular electric vehicle winners, which are highlighted by the Kona EV in the mass market electric segment and the Tesla Model Y in the premium electric segment.

“Numerous variables affect the actual residual value of a vehicle over a multi-year lease term. Examples include mileage, quality/reliability, options and feature sets, weather and macroeconomic environment,” ALG experts said.

“Since these factors need to be taken into account in order to accurately forecast residual values, the more granularity and greater the understanding of the effect of each variable, the better equipped manufacturers and lenders are able to maximize profitability,” they continued.

“The combination of J.D. Power insights and data with the deep experience of ALG in residual values allows for even more accurate end-of-lease forecasting capabilities,” they went on to say.

When someone doesn’t pour beer correctly, a lot of “froth” could form, limiting how much of the cold beverage ends up in your glass.

ALG used “froth” as part of their imagery to summarize its updated residual value forecast after going through the four ingredients analysts used to form it.

Read more

Black Book understands dealerships and finance companies need the most accurate data possible, especially with the pandemic creating so many unprecedented circumstances.

In response on Wednesday, Black Book announced that its most precise valuation yet — VIN-specific history adjusted valuations — is now available for residual values in their self-service batch processing platform, ValuEngine as well as their API.

Black Book pointed out that history adjusted valuations already have been available in wholesale, retail, trade-in, current and historical values. The incorporation of history adjusted valuations into Black Book’s residual values are geared to provide customers with the ability to get VIN-specific at a residual level; what the company believes is an industry first.

“We’re excited to introduce History Adjusted Valuations into our residual values,” said Kyle Luck, vice president of product management & software development at Black Book.

Luck continued in a news release, saying “1-72-month projections with history adjustments are immediately available in our ValuEngine product and web API.”

Black Book reiterated that its residual values are based on wholesale values and go through an editorial process as well as statistical modeling. The incorporation of history adjusted valuations into the process gives a “never-before-seen level of precision,” according to Jared Kalfus, Black Book’s executive vice president of revenue

“Residual forecasts are used in lease portfolio valuations to estimate depreciation expenses or assess reserve levels, forecast gains or losses, benchmark and trend analyses, and most importantly, to help our clients manage credit and residual risk,” Kalfus said.

“This level of precision will give our customers a significant advantage over their competition,” he went on to say.

To get more information about ValuEngine, residual values, or history adjusted valuations, visit www.blackbook.com or call (800) 554-1026.

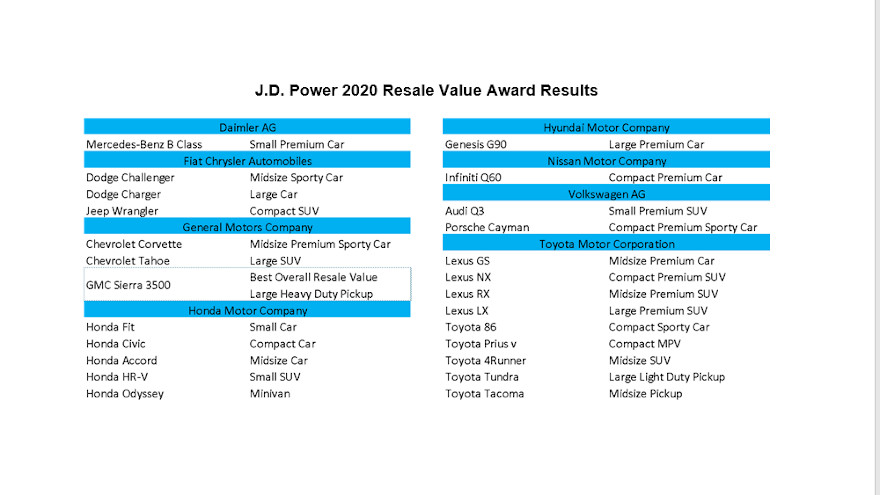

In a year like no other, 2020 saw the automotive sector go through major disruptions in production, sales and shifts in key consumer values like dependability and trustworthiness. As a result, a new group of vehicle models are rising to the top in resale value.

The J.D. Power 2020 Resale Value Awards are presented to vehicle models with the best resale value across 25 car, truck, van and SUV segments, in addition to the model with the best overall resale value in the automotive industry. The winners (by manufacturer) can be found in the photo window above.

Noteworthy is the emergence of the Genesis brand, the luxury division of the Hyundai Motor Company. The Genesis G90 model earns the top spot for the best resale value in the large premium car segment, a very impressive feat for a model that entered the market with the 2017 model year. The G90 displaces perennial leaders in the segment like Lexus, BMW, Mercedes-Benz and Porsche. There are two primary reasons:

- The Genesis brand ranked highest in Overall Vehicle Dependability among all brands in the J.D. Power 2020 U.S. Vehicle Dependability Study. This is the first year that Genesis has been included in the study — and it knocked Lexus out of the top spot.

- Genesis was one of only three luxury brands that performed better than the industry average in the J.D. Power 2020 Initial Quality Study.

The strong showing by Genesis across categories demonstrates that consumers continue to reward OEMs that build innovative and dependable vehicles, even in the midst of a pandemic.

Reductions in incentive spending raise questions about affordability, resale values

The pandemic has caused major production interruptions that have led to significant declines in overall incentive spending by OEMs that have effectively raised prices to consumers.

This has resulted in affordability concerns among new-vehicle buyers. This will be an important factor to observe over the next year, as it is likely to influence how consumers value vehicles coming into the used-vehicle market in 2021.

However, the ascension of many unexpected models to a top spot in 2020 is likely to put pressure on other models as we move deeper into the decade. This is extremely exciting for consumers, as it will very likely result in the introduction of innovative products packed full of the latest technology and safety features.

Over the long run, we expect incentive spending to rebound. That said, it is not going to be like flipping a light switch. As the industry works through the consequences of the pandemic—and consumers see the positive effects of the new vaccines that will precede a return to some sense of normalcy—more traditional incentive dynamics will return.

In the meantime, we can expect to see some great products on the market as brands vie for top spots in used vehicle valuations.

David Paris is an executive analyst at J.D. Power Valuation Services.

In a year like no other, 2020 introduced a range of new factors that have driven long-term projections for determining future value retention in the luxury segment of the used-vehicle market.

Supply chain issues driven by the COVID-19 pandemic disrupted production, which reduced supply as demand also plummeted over the course of the year.

In the final analysis, this combination of trends served to largely stabilize prices. Looking ahead, the outlook for both supply and demand are rising in a synchronized manner as economic prospects improve with the deployment of vaccines and treatments that appear to mark the beginning of the end of the current economic crisis.

It is precisely in this context that residual values play a critical role in the health and stability of the luxury automotive industry.

Vehicles that retain strong residual values offer an unmistakable benefit to automakers and consumers alike. Such models allow for a competitive cost of ownership and leasing advantage. Indeed, in 2020, demand for leases loomed large in establishing residual value retention for luxury vehicles. In 2020, leasing accounted for 53% of luxury sales, compared with the mass market category in which 27% of vehicles ended up in the lease market.

When it comes to the overall luxury segment of the market, SUVs continue to grow in popularity. Consumers in both the luxury and mass market categories are drawn to SUVs because of their practicality and increasing levels of fuel efficiency. On the vehicle development side of the equation, many manufacturers have forgone traditional passenger cars in favor of SUVs. This a trend that we’ve seen for years as passenger car sales dwindle, in favor of SUVs and trucks.

Typically, increased levels of supply returning to the used market suppresses used vehicle values. That, however, is not occurring this year as the outlook for SUVs remains healthy because of increasing levels of demand — for both new and used units.

What does this all mean?

From a financial viewpoint, the best models to lease are those with a high residual value compared with their original MSRP. Typically, high residual values result in lower lease payments, as well. Consumers who purchase their vehicles benefit as well. High residual values allow owners to accrue positive equity more quickly.

Here are the vehicles with the strongest residual values in the J.D. Power 2020 Luxury Residual Value All-Stars.

2020 Lexus LX

Large Premium SUV Segment — 57% J.D. Power Residual Value Projection

Large premium SUVs remain popular choices for their ruggedness and people-hauling capabilities. The 2020 Lexus LX embodies these qualities and has been a top performer in the segment for years. While it’s no secret that the LX is based on the fan-favorite Toyota Land Cruiser, Lexus has taken advantage of the Land Cruiser’s rock solid off-road platform, refined it and packed it full of enough premium content to transform it into the top contender in the luxury segment.

Largely unchanged over the past several years, the flagship SUV of Lexus does not have multiple trim levels. However, it does come well equipped with a significant list of standard features. The main choices available to customers revolve around: seating arrangements, color, and a few extra-luxurious add-ons. While the formula is simple, Lexus has made it work, earn the LX a 57% residual value projection.

Flashback: MY19 Large Premium SUV All-Star – Lexus LX 52%

2020 Lexus RX L

Midsize Premium SUV Segment — 54% J.D. Power Residual Value Projection

The killer feature for consumers evaluating their Midsize SUV options, is the availability of third-row seating. Up until 2018, the only Lexus SUVs models that offered third-row seating were the GX and LX models. This all changed with the introduction of the RX L, which is a slightly stretched version of the brand's popular RX model. By adding 4.4 inches of length — and a third row of seats — the RX L can carry up to seven people making the model more versatile than ever before.

For 2020, Lexus made some subtle changes inside and outside of the RX L, improving the vehicle’s ride quality. New infotainment and safety systems were also added. These, and other improvements have elevated the RX L to the top of its segment. As a result, the 2020 Lexus RX L's 36-month residual value is expected to be 54%, beating the overall segment residual of 49%.

Flashback: MY19 Mid-Size Premium SUV All-Star – Land Rover Discovery 54%

2020 Porsche Macan

Compact Premium SUV Segment — 53% J.D. Power Residual Value Projection

Compact Premium SUVs also continued to attract demand in the luxury segment. With each passing year, market share of this segment has risen, along with the number of vehicles available. Overall, the compact premium SUV segment is expected to carry an average 36-month residual value of 49%.

The Porsche Macan is projected to be one of the top vehicles in this category with a projected 36-month residual value of 53% — a figure that is four percentage points better than the overall segment average.

Starting in the $50,000 range, the Macan is the lowest priced vehicle offered by Porsche. For the 2019 model year, the Macan received a refresh which included a new front fascia with oversized vents to give the SUV a broader stance, along with a new rear fascia, which featured the brands new full-width taillight design that has now become a staple across all Porsche models.

Flashback: MY19 Compact Premium SUV All-Star – Lexus NX 51%

Luxury car segment retention solid, as well

While car segments are not expected to perform as well, overall, as their SUV counterparts, residual value expectations are still strong in this category.

2020 Porsche 911

Midsize Premium Sporty Car – 63% Power Residual Value Projection

The Porsche 911 is one of the most iconic sports cars ever produced, with its unmistakable styling and performance to back it up. The latest generation capitalized on these characteristics and took them to the next level. All-new for 2020, the 992 generation 911 is currently offered as a coupe and convertible, powered by a slew of twin-turbo six-cylinder Boxster engines, and the choice of either an automatic or manual transmission.

The 911 remains surprisingly practical for everyday use; however, while the front seats are comfortable, the rear seats can be a bit cramped. Make no mistake, the 911 is expensive but, with an estimated 63% residual value projection, owners will be in a good place down the road.

Flashback: MY19 Midsize Premium Sporty Car All-Star – Porsche 911 60%

2020 Volvo V90

Midsize Premium Car – 54% J.D. Power Residual Value Projection

While wagons are niche vehicles; they have a following that is extremely passionate. This has kept OEMs producing these very practical models. In 2020 Volvo integrated practicality with luxury to outperform other brands in the Midsize Premium Car segment with its V90 model. It received the sector’s highest residual score (54%) — a massive nine percentage points better than the segment average of 43%. It is an impressive accomplishment when you consider that, outside of a few cosmetic and safety system updates, the 2020 V90 remains unchanged.

A taller, more rugged V90 Cross Country is also offered by the brand; however, its residual value isn’t quite as strong at 48%.

Flashback: MY19 Midsize Premium Car All-Star – Lexus GS 50%

2020 Porsche Panamera

Large Premium Car – 51% Power Residual Value Projection

The Porsche Panamera was the brand’s first foray into sedan territory when it debuted in 2009. Now in its second generation, the current model was introduced for the 2017 model year with a slight update to the redesign.

With a residual of 51%, the 2020 Panamera sits at the top of the class and is six-percentage points better than the overall segment average of 43%. The Panamera is truly a family friendly version of the 911 and true to the brand’s DNA. With everyday usability and a full serving of Porsche performance, the Panamera is sure to maintain a favorable value proposition for years to come.

Flashback: MY19 Large Premium Car All-Star – Lexus LS 44%

Conclusion

As vehicles continue to become more expensive each year, and uncertainty in the market continues, the importance of residual values will also grow in importance — for dealers, consumers and vehicle manufacturers alike.

Purchasers looking to make strategic decisions can use J.D. Power residual values as a guide for smart shopping and retaining bargaining power when buying or leasing a new vehicle in these trying times.

Likewise, automakers, finance companies and dealerships can also use these residual values to forecast their portfolios and make better business decisions. Closely studying value retention performance — including trends in key features and specific makes and models such as the vehicles included in this list — will help decision-makers remain in-step with consumer demand, secure the right inventory and pricing, while ultimately decreasing time-on-lot and increasing vehicle transactions.

David Paris is senior manager of market insights, at J.D. Power Valuation Services.

The J.D. Power 2020 Mass Market Residual Value All-Stars can be found in this story.

When it comes to the pre-owned vehicles that are retaining their values the best, the pickup truck segment is leading the pack these days.

Or as the lead analyst from Edmunds puts it, used pickups are having a “moment in the spotlight.”

An analysis the company conducted in July examined all 2017 model-year trade-ins for the month and weighed the trade-in prices for those vehicles against their average original MSRP.

What Edmunds found was that of the 10 vehicles from model-year 2017 that retained the most value after three years, seven were pickup trucks.

That includes the Toyota Tacoma, which topped the list with an average value retention of 75%. The Ford F-350 Super Duty was second at 74%.

“Trucks have been an increasingly popular choice for new-car shoppers during the pandemic, but because of the factory shutdowns, new inventory hasn’t been able to keep up with demand,” said Jessica Caldwell, Edmunds’ executive director of insights, in a news release.

“Used trucks are now getting their moment in the spotlight and enjoying a period of particularly high value as more shoppers flock to the used market,” she said. “If you’ve been thinking about selling the truck in your driveway, now is the time to do it.”

Beyond the Tacoma and F-350, two other pickups cracked the top five and were among those with 3-year retention of at least 70%: the Toyota Tundra (tied for third with the Jeep Wrangler with 71% retention) and the Ford F-250 Super Duty, which was fifth at 70%.

Other pickups in the top 10 included the Chevrolet Silverado 2500HD (68%), Chevrolet Colorado (67%) and Honda Ridgeline (65%), which were Nos. 7-9, respectively.

By truck segment, the leader for heavy-duty trucks was the F-350 Super Duty (74% retention), while the Tundra lead for large trucks (71%) and the midsize leader was the Tacoma (75%).

And the respective leaders of other segments had 3-year-old retention values north of 60%.

No. 1 for midsize SUVs was the Wrangler (71%), and for compact cars it was the Toyota Prius (61%). Topping the compact SUVs was the Honda CR-V (64%), while the best-retaining sports car was the Dodge Challenger (63%).

The subcompact car leader was the Honda Fit (61%) and the subcompact SUV leader was the Honda HR-V (61%). And still, there were other segments with leading vehicles above 50% retention.

“The trade-in values we’re seeing for 3-year-old vehicles certainly dispel the myth of cars losing half their value the moment you drive them off the lot,” said Ivan Drury, Edmunds’ senior manager of insights, in a release.

“With such high demand for used vehicles, this gives many current vehicle owners the opportunity to either upgrade their current vehicle by taking advantage of this greater equity or sell their vehicle outright and have extra cash on hand,” he said.

Subaru’s high residual value is a main reason that the automaker has won the top brand ownership cost category in the 2020 Kelley Blue Book 5-Year Cost-to-Own Awards, Eric Ibara said.

“Subaru claims the top brand position for the second year in a row, right on the heels of winning a Kelley Blue Book award for Best Resale Value Brand of 2020,” said Ibara, who is director of 5-Year Cost to Own for Kelley Blue Book, in the release.

Kelley Blue Book said its 5-Year Cost-to-Own Awards recognize new vehicles with the lowest projected ownership costs over the initial five-year ownership period. Kelley said it puts on the awards “to help in-market shoppers buy smart and save money.”

The awards recognize new vehicles with the lowest projected ownership costs over the initial five-year ownership period.

“Our 5-Year Cost to Own information breaks down typical ownership costs to help shoppers evaluate the impactful out-of-pocket expenses they will incur over time beyond the initial price paid,” Ibara said.

In the luxury brand category, Acura claimed the top prize. In many vehicle ownership cost categories, several of the key models in Acura’s lineup “performed well above the segment average,” Kelley Blue Book said.

The company said its 5-Year Cost to Own information considers depreciation, expected fuel costs, finance and insurance fees, maintenance and repair costs, and state fees.

With the data, according to Kelley, consumers can see the big picture of the cost of a new vehicle over time. That helps shoppers save money by choosing a vehicle that is best for their needs and long-term budget.

Kelley Blue Book, A Cox Automotive brand, developed its 5-Year Cost to Own information using Kelley Blue Book Residual Values to calculate depreciation costs.

To calculate total ownership costs for new vehicles, Kelley Blue Book applies a valuation methodology along with financial data from third-party providers.

Following is a list of the winners:

— 2020 Kelley Blue Book 5-year cost to own award: brand

Subaru

— 2020 Kelley Blue Book 5-year cost to own award: luxury brand

Acura

— 2020 Kelley Blue Book 5-year Cost to Own Awards: by vehicle category

Compact car: Hyundai Elantra

Mid-size SUV – 3-row: Mitsubishi Outlander

Mid-size car: Honda Accord

Full-size SUV: Chevrolet Tahoe

Full-size car: Chevrolet Impala

Luxury subcompact SUV: Lexus UX

Entry-level luxury car: Acura ILX

Luxury compact SUV: Lexus NX

Luxury car: Volvo V90

Luxury mid-size SUV – 2-ROW: Lexus RX

Sports car: Fiat 124 Spider

Luxury mid-size SUV – 3-ROW: Acura MDX

Hybrid/alternative energy car: Toyota Corolla Hybrid

Luxury full-size SUV: Infiniti QX80

Electric vehicle: Nissan LEAF

Off-road SUV: Jeep Wrangler

Subcompact SUV: Hyundai Venue

Mid-size pickup truck: Toyota Tacoma

Compact SUV: Subaru Forester

Full-size pickup truck: Chevrolet Silverado 1500

Mid-size SUV – 2-row: Hyundai Santa Fe

Minivan: Chrysler Voyager

(2020 model-year vehicles’ projected ownership costs are based on the average Kelley Blue Book 5-Year Cost to Own data for the initial five-year ownership period).