Long gone are the days when rows of racks with glossy vehicle brochures filled dealerships' showrooms. Shoppers often find information via mobile devices or what’s being offered by companies such as RelayCars.

RelayCars, a company that provides the virtual reality automotive experience designed to put consumers in the driver’s seat of thousands of vehicles, recently announced the expansion of their VR suite of applications with the launch of the new RelayCars, now in roomscale.

The company explained roomscale can allow users to move freely and naturally around the virtual showroom while customizing car options and researching their next vehicle.

Furthering the future of vehicle research and shopping, this technology can give consumers a more efficient way to shop for cars that may not physically be on the dealer lot or even browse from the comfort of their homes.

Officials also emphasized dealers will now have the ability to instantaneously showcase a wider range of vehicles and help consumers to make informed purchasing decisions through the realistic environment.

RelayCars in roomscale is available via digital distribution platform, Steam.

While wearing a headset, shoppers and dealers are able to select vehicles from the expanding model selection and place them in one of three designated spaces on the showroom floor. Users can interact with the environment and the showcased vehicle models to view them from any angle, change the vehicle color, enter the interior, step back to check out the vehicle in full, or walk right up to the vehicle for a more in depth look at the design and detail.

“This is the first time we are offering our users the opportunity to walk around their customized virtual showroom to observe, compare and interact with the vehicles on another level,” RelayCars chief operating officer Gina Callari said in a news release.

“The technologies enabling virtual reality are evolving at such a pace that being able to provide more interactive and realistic experiences for our customers is of the utmost importance to us at RelayCars,” Callari continued.

RelayCars in roomscale is available on Steam supported VR headsets including Windows Mixed Reality, HTC Vive and Oculus Rift.

For more information about RelayCars, visit www.relaycars.com.

Automotive dealers have long used Facebook’s automotive inventory ads to reconnect with people who had visited their website or app.

Now, Facebook has enhanced those ads to help dealerships reach more potential customers who have shown interest in purchasing a vehicle online.

Citing a recent Facebook IQ survey, the social media company notes that 63 percent of car buyers discover new vehicles online. With Facebook’s newly enhanced ads, dealerships can now reach more prospective car shoppers based on their visits to other auto- and dealer-related pages, websites and apps.

Facebook explains how the ads work: If someone is using several car and dealership sites to research and compare vehicles, automotive inventory ads allow dealers to upload their car inventory with details such as make, model, year and location. Facebook then automatically tailors ads to show the most relevant vehicles to the right prospective buyers. People who have visited a car-related Facebook page but have not yet visited the dealership’s website are an example of those prospective buyers.

The social media company provided examples showing how the ads are bringing strong results. Facebook said that by using automotive inventory ads to reach local auto buyers, Lexus Santa Monica in California achieved 3.2 times more vehicle detail page (VDP) views and three times lower cost per VDP view compared to previous prospecting campaigns with the same budget. Castle Chevrolet in Illinois is another dealer that Facebook tracked, and that business achieved a 27-percent increase in reach using the new ads, compared to a prospecting conversion campaign using lookalike audiences.

Users can opt out of any automotive inventory ad they see, according to Facebook. All they have to do is click on the upper right-hand corner of an ad. As is the case with all Facebook ads, auto advertisers can reach customers without being able to access personal information about them.

Automotive inventory ads are now available globally for all advertisers on Facebook, Instagram and Audience Network, according to Facebook.

A representative from Lexus Santa Monica says the dealership is happy with the results mentioned earlier, such as the increase in VDP views. “Enabling Facebook automotive inventory ads for prospecting provides an efficient, cost-effective way for us to expand our campaign to reach more engaged in-market shoppers,” Brad Burlingham, vice president of marketing for LAcarGUY and Lexus Santa Monica, said in a news release.

Tech start-up Joydrive announced this week that a pair of franchised stores in New York joined its network of nearly 50 dealerships that are looking to connect with vehicle buyers who want to complete delivery at home.

The latest dealerships to connect with Joydrive include Sunrise Toyota of Oakdale, N.Y., and Sunrise Chevrolet in Forest Hills, N.Y. Between the two dealerships, another 1,000 vehicles now can be delivered through Joydrive, which says it provides an end-to-end solution that can allow vehicle buyers to price new and used cars from a variety of dealerships and purchase within Joydrive without ever visiting a dealership.

Jimmy Berg, dealer principal of both Sunrise Toyota and Sunrise Chevrolet, said, “Our dealerships take a lot of pride in that we are family owned and treat our customers like family. We have many customers that want to buy online and get their car delivered to their home, and we are excited to announce that we can now offer our great Sunrise customer service through Joydrive.”

One of the first dealerships to join Joydrive is glad to be on the platform.

“Whether Netflix or Amazon, consumers have come to expect an easy online purchasing experience, and we are excited to partner with other Joydrive dealers to offer consumers that experience. Our customers continually tell us how easy and welcoming the Joydrive purchase process is,” said Chris Brown, owner of Subaru of Puyallup, located south of Seattle.

When the start-up first rolled out its platform at the beginning of the year, the company explained that Joydrive works in three steps:

1. Buy online: The entire process can be completed online, from vehicle selection to delivery. After securing a vehicle with a $500 fully refundable deposit, a user-friendly dashboard shows all details of the transaction including trade-in, vehicle service contracts, financing options and delivery scheduling.

Of Joydrive’s first 250 transactions in beta mode, 40 percent included a trade-in, and 60 percent included financing.

2. Home delivery: Communicating through the dashboard, customers coordinate the vehicle delivery date and time with their licensed dealer representatives. Joydrive first delivered vehicles from California to Montana with an average distance of 135 miles.

Because vehicles are located on dealer lots, delivery can occur as fast as one day.

3. Five-day return period: Buying a vehicle can be the largest transaction customers make, so Joydrive and their dealer members offer a five-day return period or up to 250 miles to ensure customers love their purchase.

For more details, go to www.joydrive.com.

It’s got to be frustrating for dealers to see a competitor’s sticker on a vehicle that has a temporary license plate, likely signaling a recent delivery. And surely consumers aren’t pleased when they can’t purchase the vehicle they want at a cost they can afford.

In an effort to find solutions to reduce instances of both of those scenarios, Jumpstart Automotive Media on Tuesday announced a joint study with research firm, Ipsos, titled, “Today’s Auto Buyer and the Digital Retailing Experience.”

The report looks at points of view from both the consumer and the dealer to better understand the shopping journey, and how and where digital and mobile strategies have changed the consideration, negotiation and buying processes. While recognizing that the vehicle-buying process still carries an air of frustration and distrust, the goal of the research is to identify opportunities to make the buying process more satisfying all around.

Jumpstart commissioned Ipsos to conduct a comprehensive study into the consumer and dealer points of view. The study design included qualitative research consisting of a five-day online discussion with 28 U.S. consumers, a four-day online discussion with 28 dealers and nine 60-minute phone interviews with dealership GMs and owners. Following these results, quantitative research was conducted in the form of online surveys of 263 recent buyers, in-market or intending car shoppers, and 54 dealership employees.

How consumers select a dealership

The first disconnect the study revealed was in perceptions about how consumers select a dealership. Dealers’ perceptions were that their reputations and prior positive experiences are what bring consumers in the door.

However, study orchestrators found the most influential factors in consumers’ selection of a dealership are, by far, a low price and having the right inventory.

In fact, consumers were almost twice as likely as dealers to identify the “lowest price” as the more influential between those two factors. Consumers came in at 49 percent, while dealers registered at 24 percent.

Where shopping and research begins

The study indicated consumers spend an average of nine hours researching online before walking into a dealership, visiting an average of seven automotive sites, including manufacturer, dealer and third-party websites.

But dealer websites are far more influential than even dealers themselves perceive, according to the findings.

While dealers assume that consumers start their research on other sites, visiting the dealer website closer to the purchase, customers surveyed commonly stated that they use the dealer website very early in their shopping process.

Closing the gap on price differences

The study noted that perhaps the biggest difference between dealer perceptions and consumer realities is in negotiating the sale price.

While consumers prefer to do the majority of fact-finding online, the study pointed out that face-to-face communication becomes increasingly important to them at the end of the process. Three quarters (76 percent) of consumers think they will get a better price by negotiating in person as opposed to online.

That doesn't mean they like negotiating. Nor do dealers, according to the study.

Jumpstart and Ipsos determined this is one area where dealers and consumers misunderstand each other. Nine out of 10 consumers had at least some interest in a “no-haggle” model for vehicle buying, while dealers hate price haggling but feel customers expect it. Both sides would like to streamline the transaction process.

The report shed further light on the tension and differences of what's considered a “fair price.”

The study noted that 81 percent don’t believe a dealer’s “lowest price” and still expect to be able to negotiate savings of a few hundred to a few thousand dollars.

At the same time, the report acknowledged customers may not understand how vehicles are priced, which can lead to distrust and frustration.

“The art of a successful car deal is aligning customer desires, such as a fair price and a smooth, quick transaction, with dealer expectations that leverage their solid reputations,” said Libby Murad-Patel, vice president marketing and strategic insights for Jumpstart.

“This report goes into great detail in the motivations and beliefs of both sides, while offering actionable strategies for dealers to attract and better serve today’s auto buyers,” Murad-Patel added.

Michael Baer, senior vice president at Ipsos, added, “Like every other industry we study, digital content and communications have fundamentally altered the auto buying/selling process.

“Consequently, the dealership experience is completely changed from what it once was — consumers are visiting fewer of them, are doing their research in advance and are visiting them better prepared for negotiations,” Baer went on to say.

“There’s an emerging need for dealers/manufacturers to re-think and re-design the dealership experience and the role of dealers and salespeople to better fit consumers’ needs and expectations,” he said.

The entire report can be accessed via this website.

Jumpstart Automotive Media shared data with Auto Remarketing on Wednesday about how much vehicle-shopping activity dropped off within the path of Hurricane Florence.

With potential buyers likely watching for warnings about torrential rains and flooding, Jumpstart examined shopping activity over the past seven days, compared with metrics recorded during the previous four weeks. According to Jumpstart, the market near where Florence made landfall — Wilmington, N.C. — saw local vehicle shopping activity decline by 76 percent.

“Wilmington, N.C., saw some of the most damage from the storm, and obviously families were primarily concerned for the safety of their families during and after the storm,” Jumpstart said.

Other regional areas where vehicle shopping declined significantly during the last seven days compared to the previous four weeks included:

— Florence-Myrtle Beach S.C.: Down 60 percent

— Greenville-New Bern-Washington N.C.: Down 58 percent

— Charleston, S.C.: Down 37 percent

— Raleigh-Durham, N.C.: Down 16 percent

— Norfolk-Portsmouth-Newport News, Va.: Down 15 percent

As flooding recedes, shopping activity likely will rebound in these areas stemming from the need for replacement vehicles. Cox Automotive kept its estimate at potentially 20,000 to 40,000 units.

Meanwhile, service providers such as Insurance Auto Auctions already have taken steps to handle the processing of flood-damaged vehicles.

Also ready to offer support is Vemark, a provider of digital workflow integration and vehicle remarketing solutions. On Wednesday, Venmark announced its availability as a recovery expert to help speed Florence flood vehicle disposition efforts.

“Flood-related catastrophic events like Florence present a tremendous challenge because of the scale of logistics and the massive quantity of vehicles that are likely to be affected,” Vemark chief executive officer Doug Mellette said.

“Our team at Vemark has the management experience, process understanding, technology tools and industry relationships to help those impacted come through the event as successfully as possible,” Mellette continued.

During more than 30 years of advising clients following major hurricanes, Vemark has found that flood vehicles sold during the first 10 ot 20 days after the disaster bring significantly higher returns.

Vemark acknowledged that events such as Florence represent a traumatic and emotional time for vehicle owners. Picking up vehicles and expediting inspection ensures timely claims processing, significantly reducing call volumes from anxious policyholders and improving customer satisfaction.

To facilitate this, Vemark works with clients to set up a ground zero control center and secure local storage to get vehicles processed quickly.

And the company is ready for these chores in the Carolinas.

“The recovery from Florence will be one of the most difficult we’ve seen yet,” Mellette said. “Our message is very simple: Even if you already have a process and vendors identified, we’re here to help you in any way we can. Vendors often become overwhelmed by the scale of challenges and the volume of business. If that happens to you, simply call us, and we will respond immediately.”

To learn more about Vemark’s Florence recovery services, call (561) 701-9803, ext. 201.

Furthermore, for customers who did not lose their vehicle during the storm but endured other hardships, finance companies are taking steps to help.

Toyota Financial Services (TFS) announced it is offering payment relief options to its customers affected by Florence. This broad outreach includes any Toyota Financial Services (TFS) or Lexus Financial Services (LFS) customer in the designated disaster areas.

Impacted lease and finance customers residing in the devastated areas may be eligible to take advantage of several payment relief options, some of which include:

— Extensions and lease deferred payments

— Redirecting billing statements

— Arranging phone or online payments

Toyota Financial Services said it will proactively attempt to contact customers via email and telephone in the affected areas to assess their needs and inform customers of the options available to them.

We at Toyota Financial Services care about the safety and well-being of our customers and want to help those impacted by the hurricane. We extend our heartfelt thoughts to those affected by the devastating storm,” company officials said.

Dealership sales and marketing strategies can now benefit from a new solution that delivers sales insights and market share data.

A new tool that offers real-time analytics and insights is now available exclusively through iHeartMedia, which claims to have over 131 million social followers and reach roughly a quarter of a billion broadcast listeners each month.

iHeartMedia has partnered with internet marketing service provider AUTOFLYTE to create AUTOFLYTE EDGE, which provides dealers with daily sales and market share data from their local area, the companies announced in a news release Tuesday.

“We are committed to technology-driven innovation and having the ability to offer even more targeting solutions for our advertisers that leverage the unparalleled local reach of radio,” iHeartMedia executive vice president of automotive business development and partnerships John Karpinski said in a news release. “AUTOFLYTE has partnered with the industry authority for automotive sales statistics to create the most powerful and credible insights tool available, and we have partnered with AUTOFLYTE to bring this revolutionary technology to the market.

“With the new AUTOFLYTE EDGE platform, we will provide our auto partners the ability to break free from previous automotive marketing confinements and use timely information to precisely target new buyers,” said Karpinski.

Furthermore, AUTOFLYTE EDGE is designed to optimize auto dealers' advertising campaigns to help dealerships market both smarter and speedier. Using the new solution's daily sales insights, such as the most recent market dynamics and trends, dealers can easily customize and update their sales and marketing strategies, according to iHeartMedia.

“With iHeartMedia and AUTOFLYTE’s exclusive real-time insights and data, this new tool is nothing short of a game changer for how we do business at our dealership,” said Steve Hurley, owner of Stingray Chevrolet of Plant City, Fla. “For the first time, we are able to specifically tailor our marketing plans based on what our customers want today versus months ago. We’ve been waiting for something like this and are already seeing success.”

iHeartMedia’s move to exclusively provide AUTOFLYTE EDGE and other services stems from iHeartMedia’s ongoing focus to provide brands and marketers solutions for reaching consumers across its roughly quarter of a billion monthly broadcast listeners, the news release said.

In addition to iHeartMedia Analytics, which the company launched in May, other marketing optimization tools iHeartMedia provides include SoundPoint, a programmatic real-time radio ad buying platform and SmartAudio.

Dealerships know how the haggling process often unfolds; one that sometimes irks potential buyers who are sitting at the desk while the salesperson scurries to the GM tower and back.

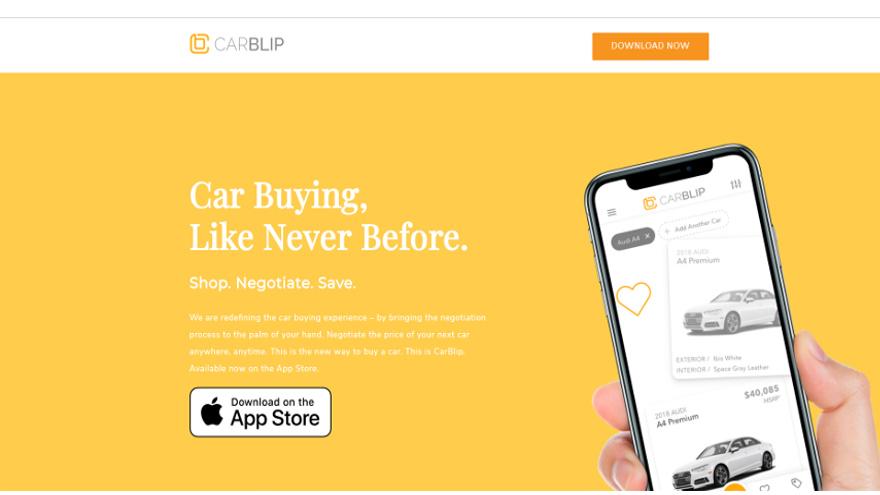

Well, a car buying and negotiation platform is turning to mobile technology that's trying to smooth the process; perhaps saving some literal steps for store personnel.

On Wednesday, CarBlip announced the launch of its mobile app in the Southern California market. The app is a direct-to-dealer, communication-based platform that can integrate live inventory and a Swipe to Submit feature, allowing users to shop and negotiate the price of a new vehicle directly from their mobile device before visiting a physical dealership.

CarBlip, who has been backed by Science Inc., the Santa Monica, Calif.-based incubator and investment firm, was founded by a multi-generational team of industry veterans and digital natives alongside a network of strategic alliance partners.

Through proprietary technology, CarBlip is dedicated to reinventing the purchase process with a seamless and expedited vehicle buying experience. By starting the negotiation process online, CarBlip thinks consumers will be able to significantly cut their overall time at the dealership.

“There is an evolution happening within the automotive industry's digital retail space. Consumers demand more control of the car buying process and CarBlip is providing this service by allowing consumers to start the negotiation process anywhere, anytime,” said Brian Johnson, CarBlip’s co-founder and chief executive officer.

“CarBlip is focused on bringing a better car buying experience to consumers and increased sales to dealers. Our dealer partners gain additional access to car buyers, especially the digitally-focused millennials,” Johnson continued.

Currently available for iOS only, the CarBlip app is available for download nationwide and exclusive to Southern California car buyers with plans underway to quickly expand nationwide.

“Today, the car buying experience involves a time-consuming negotiation process that’s exhausting for both the buyer and the seller," said Mike Jones, co-founder and CEO of Science Inc. “CarBlip’s new platform transforms that experience so that it's easy for buyers to shop, decide, and drive off in their new car, which gives dealers more time to see more buyers.

“We’re thrilled to be working closely with the team and are eager to see how they change the automotive landscape,” Jones went on to say.

Interested dealers can find more information about CarBlip by visiting www.carblip.com. And the app is available here.

As dealers, vendors and more gathered for NADA 2018 in Las Vegas, Cars.com launched its new social targeting product, as well as announced it will make available to its customers Conversations — an AI chat solution.

Conversations is the first integrated Dealer Inspire product announcement since Cars.com purchased Dealer Inspire and Launch Digital Marketing for $165 million in February.

Cars Social, designed to attract more leads through Facebook and Instagram, leverages Cars.com audience data and targets consumers on social media who previously researched inventory or expressed interest in similar vehicles in the market, the company explained.

Targeted social media users will see a social ad with inventory imagery from local retailers that fits their search and shopping preferences. Then those ads will redirect shoppers to their corresponding VDP pages on Cars.com. Further, a team of social media account managers will be available to dealers to “optimize campaigns and set up data feeds.”

“We know millions of people across the country, including Cars.com shoppers, spend a significant amount of time on social platforms, and a smart use of social media advertising moves shoppers through the sales funnel,” said Alex Vetter, president and chief executive officer at Cars.com. “We want to help dealers extend their reach and connect with these buyers wherever they shop.”

Further, Dealer Inspire product Conversations is described as a managed chat solution built with artificial intelligence and “synced with a dealership’s inventory”.

The Conversations platform was developed by Dealer Inspire, and will now be integrated with Cars.com through a Conversations Starter package.

All new chats will be answered by an AI chatbot named “Ana,” which can greet customers, answer frequently asked questions and schedule appointments. If she doesn’t know how to answer a question, she will transfer the customer to the dealerhship’s team or Dealer Inspire’s Managed Chat Call Center to expand on the response and capture the customer’s information for the dealer.

“AI is the next frontier in automotive,” said Vetter. “Cars.com intends to lead the industry by applying AI to create a smarter car shopping and selling experience for consumers and dealers. Conversations is the first AI chatbot that integrates seamlessly into a third-party site and a dealer website so that dealers can connect with consumers whenever and wherever they are shopping.”

Perhaps not every potential buyer who arrives at your dealership — or, more specifically, your store website — knows exactly what vehicle they want along with all of its attributes from the amount of horsepower to placement of cup holders and power outlets.

New data from thousands of consumer profiles studied by PERQ — experts in online consumer engagement and behavior — uncovered further evidence that the majority of visitors to dealership websites are hot new prospects who need to be guided into conversion.

The research also offered key insights into the features consumers value as they make their vehicle purchase decisions.

PERQ highlighted that its new study, Car Buyer Insights Report 2018, defies the conventional wisdom that most dealership website visitors are existing customers. The reality? They are not as 74 percent are brand new and 68 percent are still looking for information to educate them about the purchase, representing prime opportunities for conversion.

But according to the data, while 77 percent are at the beginning or middle of their purchasing process, they want to transact sooner rather than later, so an efficient, engaging website experience that guides them down the purchase funnel is critical.

“We are constantly monitoring consumer website behavior and the data continues to confirm how important it is that dealerships approach their website as fertile ground for new sales, rather than as a static receptacle for returning customers,” said Andy Medley, chief executive officer and co-founder of PERQ.

“The data shows that most website visitors are new to the dealership, not ready-to-buy, and expect to be in control of their shopping experience as they narrow down their choices,” Medley continued.

Here is another example of trends highlighted in the study:

Besides safety, what else is important to you when buying a vehicle?

— Interior space: 36 percent

— Performance: 31 percent

— Fuel economy: 28 percent

— Technology: 6 percent

PERQ’s takeaway: “Your website should be responsive to how a visitor engages with interactive experiences on your website. If they’re looking for more interior space and the assessment gives them a result of mini-vans, they should have the option to immediately go to the mini-van VDP or retake the assessment even if they’re not happy with the results.”

PERQ went on to mention its research also offers key insights on consumer preferences that can help dealership websites better interact with these visitors, such as data on the number of vehicle they want to test drive (nearly a third want to test drive more than one), and what they are looking for in a drivetrain — an astonishing 59 percent said four-wheel or all-wheel drive is a priority.

“It’s critical for dealerships to expect their website to act as one of their best sales team members,” Medley said. “If they don’t, they are missing a massive opportunity, and letting all those dollars spent driving traffic turn into vapor.”

The PERQ research results can be downloaded here.

The connection of finance and technology is getting even stronger, especially for younger consumers.

The latest "Expectations & Experiences" consumer trends survey from Fiserv finds that digital experiences are influencing how people manage and make decisions about borrowing and investing. The survey indicated four of the top five loan payment methods are now electronic, and 21 percent of millennial investors use a robo-adviser service to make investments.

The survey also highlighted that smartphones are making a significant impact on lending and investment-related financial decisions, especially among millennials. Nearly half of millennials (48 percent) report they would be comfortable using their smartphone to research loan options, compared to 19 percent of older generations.

“For most people, borrowing and investing money are careful decisions that require research, advice and trust in the provider,” said Byron Vielehr, president of depository institution services at Fiserv.

“Digital experiences are now an integral, and maturing, part of their consideration and management process,” Vielehr continued. “Importantly, these results underscore the need for providers to continually evolve and develop engaging experiences that help people make informed decisions to reach their goals, whether it’s borrowing for the perfect home or investing for retirement.”

And perhaps a vehicle purchase, too.

While most consumers are comfortable researching and completing loan activities online, the study showed the key factors for choice of a lender relate to cost and consumer experience.

Topping the list of selection factors among those with at least one loan are interest rates (83 percent) and low fees/service charges (83 percent), followed by customer service (75 percent), company reputation (70 percent) and knowledge of staff (65 percent).

Fiserv mentioned 65 percent of consumers say prior experience with a lender is important.

The study went on to say many consumers expressed willingness to try new ways of interacting with their lender, if there’s a benefit.

For instance, if it makes the loan process faster, more than half of consumers would be willing to use a mobile device to e-sign loan documents (56 percent), take and upload photos of loan documents (54 percent) and verify their identity with a photo (51 percent).

Another 42 percent of consumers indicate they would be willing to provide access to their financial information by providing their credentials to other online banking applications, up from 32 percent in 2016.

Digital channels, especially mobile, are now leading ways of communicating with a lender, although context matters based on the interaction.

Fiserv’s study showed a lender’s mobile app is the preferred way to check when a next loan payment is due (21 percent), check the balance term (20 percent) and request a payoff (17 percent), among consumers who have conducted each of these activities in the past six months.

For account questions, consumers significantly favor speaking live with a representative via phone (21 percent) over using an automated voice response system (12 percent), e-chat (11 percent) or the mobile app (11 percent).

The Fiserv endeavor noted that human interactions remain an important part of financial advice, especially for the 34 percent of consumers with at least $100,000 in household investable assets.

Study orchestrators noted that 58 percent of these affluent consumers work with a financial adviser. Among those without an adviser, only 11 percent report high interest (8-10 on a scale of 0-10) in using one.

At the same time, 32 percent of affluent consumers who invest their own money grade their knowledge and expertise as a “C” or lower, suggesting an opportunity to bridge the gap with a hybrid of human and digital advice.

Among all consumers who invest on their own, only 8 percent use a robo-adviser service. However, use of such a service is much more likely among millennials (21 percent) and urban consumers (18 percent).

The survey was conducted online within the United States by The Harris Poll June 13-29, 2017. A total of 3,095 interviews were conducted among U.S. adults ages 18 and older who met the following criteria: Someone in the household currently has a checking account with a bank, credit union, brokerage firm or other financial organization and has used their checking account to pay a bill or make a purchase in the past 30 days.

One of the longest running surveys of its kind, Fiserv insisted its Expectations & Experiences project builds on years of consumer survey data to provide insight into consumer financial behaviors and attitudes.

A paper with details from "Expectations & Experiences: Borrowing & Wealth Management" can be downloaded here.