Three-quarters of consumers in a July seller survey said having a trade-in they could apply towards their next purchase was “very or extremely important,” CarGurus said in its 2022 Consumer Insights Report.

And these days, those customers are fetching a pretty penny for their old rides.

In the company’s latest auto sales forecast, Thomas King, president of the data and analytics division at J.D. Power, said consumers will likely have an average equity of …

Read more

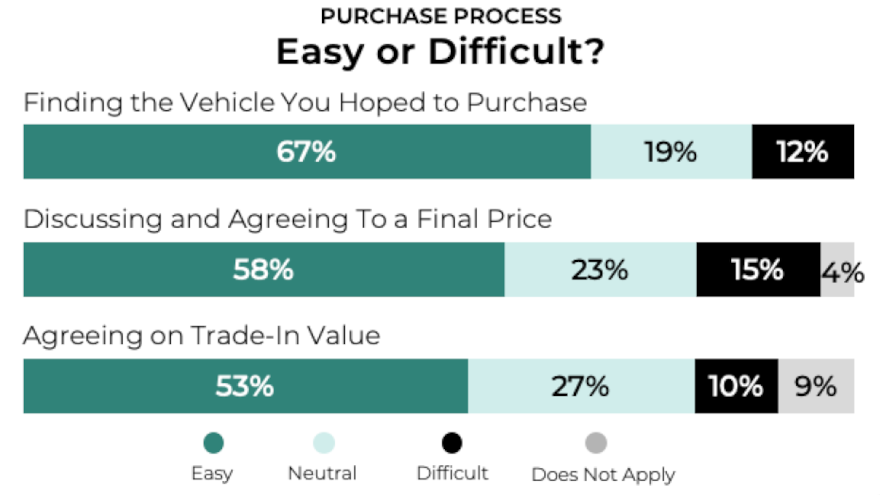

Last week, CDK Global rolled out a new research project to gauge current and potentially future retail activities at dealerships.

The automotive retail software provider launched the Ease of Purchase Scorecard, a monthly snapshot of the consumer vehicle purchase process at dealerships.

According to the latest survey data, 82% of auto retailer customers are finding …

Read more

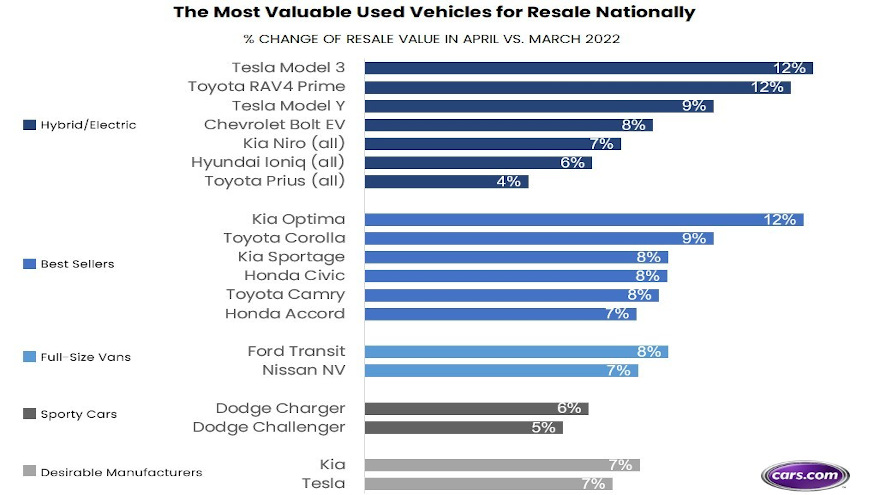

Cars.com found a way to get 99% of dealers to agree on something.

And if you’re a used-car manager, you might need only one guess to pinpoint what it is.

Cars.com said an overwhelming 99% of surveyed dealers said they are paying more for trade-ins now than two years ago.

According to a news release, almost 60% of surveyed dealer estimate an increased payout between 11% and 20%.

Furthermore, more than one in three dealers report paying over 20% more than two years ago, based on findings from a Cars.com dealer panel survey conducted on April 18.

According to wholesale data from Accu-Trade, a Cars.com Inc. company, consumers can gain the highest resale value on vehicles that are electric or hybrid, best sellers in the market, from desirable manufacturers, sporty cars just in time for summer and, interestingly, full-size vans.

Some of the most valuable used vehicles for resale right now include the 2018 through 2021 model years.

Cars.com added that consumer experiences support the dealer findings.

Among those surveyed who traded in a vehicle in the last year, approximately two-thirds received a higher offer than expected.

Cars.com also reported that 63% of consumers cited above-expectation values for mass-market models and 59% for luxury brands. That’s according to the Cars.com consumer survey fielded on April 11-14.

“The ongoing inventory shortage has caused a broad ripple effect in market conditions. As new vehicles became more elusive, shoppers pivoted to the used-car market, pushing used-car prices up 37% in the first quarter,” Cars.com editor in chief Jenni Newman said in the news release. “Eager for quality inventory, dealers are making lucrative offers for popular vehicles maintained in good condition with low mileage.

“I sold one of my family’s extra cars to our local dealership just as used-car prices were increasing, making 50% more on its sale than I would have before the pandemic. Today, I’m considering selling our second family car to capitalize on the high used-car prices,” Newman went on to say.

Consumers looking to maximize the return on their current vehicle in this profitable market can sell to other individuals for free on Cars.com/sell or use its marketplace to connect with and sell directly to nearly 20,000 dealers across the country.

“Consumers should check with their local dealership to find out which vehicles are most valuable in their local market,” Cars.com said.

The potential customer cultivating that DrivenIQ did during NADA Show 2022 in Las Vegas is starting to reap a notable harvest.

The technology company that looks to help businesses best advertise to their ideal customers recently announced that more than 250 dealers have signed on to the company’s new DriveBid platform, powered by Black Book.

The DriveBid platform integrates Black Book’s VIN-specific valuation and VIN decoding data.

The company explained DriveBid is a consumer-driven live trade-in marketplace that can help dealers sell more vehicles while sourcing valuable inventory direct from the consumer.

“It was great to be back to in-person events, and we’re thrilled with the success that we saw in Las Vegas at NADA, our industry’s largest convention,” DrivenIQ chief executive officer Albert Thompson said in a news release. “DriveBid connects dealers who need inventory with consumers who are looking for the best offer for their vehicle in a real-time, easy-to-use online platform.

“DriveBid empowers consumers to watch live bidding and simultaneously communicate with dealers to ask and answer questions, as well as to explore inventory for their next vehicle purchase. Black Book’s data allows us to create transparency in the trade-in and vehicle purchasing process that until now, has never existed,” Thompson continued.

The DriveBid marketplace can allow consumers to place their vehicle into a virtual garage and receive Black Book’s trade-in valuation or valuation range for their vehicle. Dealers can then bid on the vehicle or make a purchase offer.

At the same time, dealers can display their inventory so that consumers can shop for their next vehicle.

“Integrating Black Book’s data into DrivenIQ’s DriveBid platform provides dealers with the data they need to increase their revenue and maximize their profit,” Black Book president Jared Kalfus said in the news release. “Dealers will have up-to-date, precise data so that they can more competitively bid for new inventory, make more desirable trade offers and sell more vehicles.”

For more information, visit DriveBid.com.

Executives with DrivenIQ, which specializes in data and data technologies that help businesses target their advertising to the most ideal audience, joined the Auto Remarketing Podcast recently to talk about the company's busy March and much more.

DrivenIQ announced last month that it has acquired Visitor Data Inc. The company also announced that it will be launching a trade-in marketplace in June that lets dealers bid and buy live trade-ins directly from consumers.

DrivenIQ is already taking pre-registration for DriveBid from car dealers.

To listen to this conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

During this episode of the Auto Remarketing Podcast recorded this month at NADA Show 2022 in Las Vegas, Ian Isch, executive director of sales and leader development at Edmunds, explained how record used-vehicle prices have complicated the negotiation between dealers and potential buyers about an appraisal and trade-in value.

Isch also shared his main recommendations to help dealerships of all sizes.

To listen to this conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

CarGurus said Wednesday it has brought its CarGurus Instant Max Cash Offer program — which allows dealers to acquire used cars online from consumers — to five more states.

CarGurus Instant Max Cash Offer launched in late July and was initially available in Florida, Massachusetts and Texas.

The company has now added Georgia, Michigan, Pennsylvania, Connecticut and Rhode Island to that list.

“CarGurus Instant Max Cash Offer has struck at the core of the two most prevalent trends impacting automotive today,” CarGurus president and chief executie officer Sam Zales said in a news release.

“Consumers want to do more car shopping and selling online, and we are empowering more to do so with this five-state expansion. As a result, we’re helping our dealer partners solve their greatest pain point through access to our growing supply of exclusive used inventory,” Zales said.

“We’re thrilled by the early success we’ve had with CarGurus Instant Max Cash Offer from both the consumer experience and dealer response perspectives and look forward to building on our momentum and continuing our nationwide rollout.”

The platform is powered by CarOffer, a company in which CarGurus purchased a majority stake this winter.

CarGurus Instant Max Cash Offer utilizes the CarOffer Buying Matrix platform to facilitate consumer car sales to dealers

Consumers can go to the “Sell My Car” page on the CarGurus website and type in the vehicle information to receive offers from the dealer network.

If the consumer chooses to move forward with the offer, CarGurus picks up the vehicle (at the location designated by the consumer) through a “white glove” concierge service, inspects the vehicle at that location and delivers it to the dealer’s lot. The consumer is paid once the car passes the inspection.

Dealers who are in the CarGurus/CarOffer network can utilize this tool by filling out CarOffer’s Buying Matrix.

Perhaps it’s a question you asked a dealership manager or store colleague this summer when used-vehicle values were as hot as the outside temperature.

“Can you believe what we had to give on that trade?”

Well, in what might be good news for dealers’ used departments, trade-in values are returning to normal levels after skyrocketing during the summer months, according to the newest data from Edmunds released on Thursday.

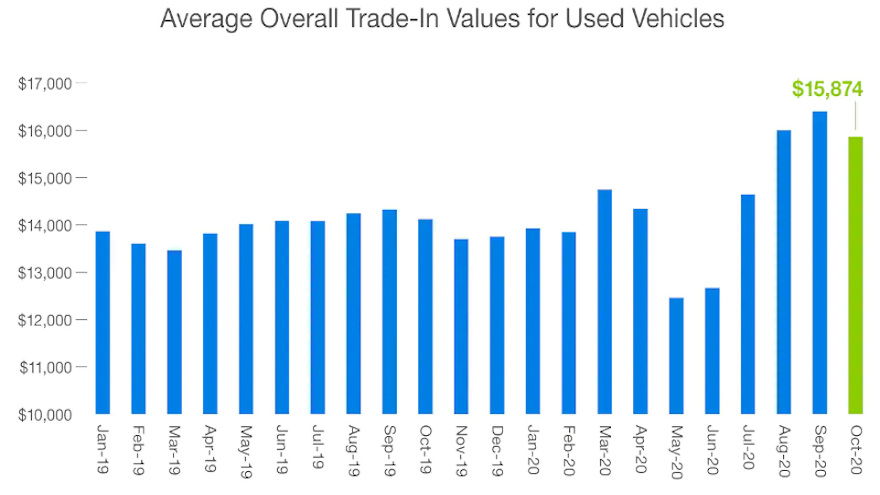

Edmunds data showed that the average value for all vehicles traded in during October dropped to $15,874, a 3.3% decrease compared to $16,411 in September.

Analysts said the average value for 3-year-old vehicles also dipped in October to $20,401, a 1.7% decline compared to $20,747 in September.

“After experiencing a remarkable surge over the past few months, used-car values are finally cooling down now that some of the major supply issues faced by the industry are being addressed,” Edmunds executive director of insights Jessica Caldwell said in a news release.

“While inventory is still tight in some areas, we're expecting to see more lease returns make their way to the used market,” Caldwell continued. “This steady supply of near-new inventory will help address the increased demand we’ve been seeing in the market during COVID-19.”

Edmunds experts also took a look at trade-in values for some of the most popular cars, SUVs and trucks sold in the U.S. — the Toyota Camry, Honda CR-V and Ford F-150 — and found that they all notably decreased across the board in October compared to September.

The average trade-in value for all used Toyota Camrys dropped to $12,508, a 7.6% decrease compared to $13,539 the previous month.

The average trade-in value for all used Honda CR-Vs fell to $15,461, a 3% month-over-month dip from $15,943.

And the average trade-in value for all used Ford F-150s dropped to $23,677, a 5% decline compared to $24,911 in September.

“We’re finally hitting the tipping point in the used-car market,” Edmunds senior manager of insights Ivan Drury said.

“If your household has a second vehicle that you are thinking about selling because it’s going unused during the pandemic, there’s no point in holding onto it in the hopes of its value increasing again,” Drury continued. “You won’t get a dramatically higher value for your trade-in than you would have just last month, but you should still get a bit more money than usual since values are still inflated.”

Although used-vehicle values have decreased, Edmunds data also pointed out that that the average transaction price (ATP) for used vehicles has stayed relatively flat because of the increased supply of near-new off-lease and off-rental vehicles hitting the market.

The ATP for all used vehicle purchases in October climbed to $22,418, a 0.5% increase compared to $22,299 in September, according to Edmunds.

Analysts added the ATP for 3-year-old used vehicle purchases in October dipped to $24,007, a 0.3% decrease compared to $24,067 in September.

“Car shoppers might not see a huge dip in used prices, but the good news is that they’ll definitely see a much wider variety of near-new vehicles with more desirable features available than they would have just a month or two ago,” Drury said.

Finding valuable trade-ins that can be turned quickly are likely even more important to dealerships now in a COVID-19 retail world.

To help dealerships locate those treasured vehicles, technology firm Outsell launched what it’s calling Outsell Equity, which is designed to help dealers identify buyers who are most likely to trade in their vehicles for another right now.

The company highlighted Outsell Equity includes triggers such as equity status and “similar payment” modeling that can accelerate sales retention by engaging past customers at exactly the right time with an individualized message.

Outsell explained the four steps of how the tool is geared to works:

• Outsell Equity automatically identifies customers and prospects who reach positive equity status, so that the dealer can inform them that they are in a good position to trade their current vehicle and purchase a new vehicle sooner than they normally would.

• Using a new “Similar Payments” feature, Equity can even show customers specific VINs that they can get with similar payments to what they have now.

• Then it automatically picks the best channel to reach them and deploys relevant equity campaigns (Email and/or Direct Mail).

• The software enables dealers to optionally add a custom offer to these campaigns (like all other Outsell automated campaigns).

A pair of dealerships shared their experience using Outsell Equity through a news release the company distributed on Monday.

“Outsell turned what used to be a huge slog of gathering incentives, making creative, and deploying haphazard and dull equity emails to our customers into something elegant and intuitive,” said Chris Basha, marketing & technology director at Carriage Auto Group. “There’s no need for a data scientist or a graphic designer anymore – Outsell turned similar payment upgrades into a piece of cake.”

Kevin O’Neill, director of sales, marketing, and technology for Classic Kia and Classic Toyota added, “Outsell Equity is user friendly. It allows us to quickly send out communications to the right customers and present a strong value proposition. You can be very specific in your targeting or you can have a broader approach. Either way it is simple to execute.”

Equity is included in Outsell’s comprehensive Enhanced package, which includes everything a dealer needs for automated virtual customer engagement, including artificial intelligence-driven, omnichannel marketing automation, sales and service conquest capabilities and in-market buyer detection.

Results for Outsell’s packaged solutions are guaranteed, tied to a dealer’s linked sales and repair orders (ROs), according to the company.

“Customer retention is key in this economy, and dealers need to do all they can to entice past customers to become repeat customers,” Outsell founder and chief executive officer Mike Wethington said. “Outsell Equity helps by surfacing these likely buyers and teeing them up for a sale with a relevant, customized message. Consolidating your vendor approach with Outsell leads to a superior customer experience because all the sales, service, and equity messaging is coordinated across each individual’s consumer lifecycle.

“We’ve long said that dealers need to sell smarter, not harder,” Wethington added, “and Outsell Equity is a prime example of how to do that effectively. Our dealers who are already using this solution tell us that it makes an impact quickly.”

A comprehensive, multi-year study conducted by Outsell, RXA and Experian showed that AI-driven consumer lifecycle marketing leads to:

• 23% increase in repeat sales

• 31% increase in service visits

• $427 increase in individual customer value

To learn more about Outsell Equity, visit https://www.outsell.com/equity.

As potential vehicle buyers arrive at dealership showrooms during the holiday shopping season, MAX Digital rolled out its latest solution designed to keep the atmosphere merry when it comes to finalizing trade-in values.

MAX Digital just launched MAX Trade Value, which the company described as a smart valuation tool that leverages deep market data to provide a quick and positive customer experience valuing a trade-in online.

The company explained this new tool in its digital retailing suite was requested by and developed in partnership with dealers. MAX Digital insisted user testing helped make it simple and intuitive for customers.

“Shoppers want to get a quick estimate and understand the support for that estimate at a glance,” MAX Digital vice president of product and engineering Ryan Walker said. “MAX Trade Value takes seconds to use and supports customers on their way to purchase.”

Early in the shopping experience, MAX Digital acknowledged consumers want to get a quick estimate without any strings attached to what their trade-in might be worth. MAX Trade Value is designed to deliver easy, instant feedback online.

The company noted this product joins the portfolio of tools that are geared to improve the full vehicle-buying experience including, MAX My Trade.

The company further pointed out MAX Trade Value can attract and engage interested shoppers on dealer websites, delivering highly qualified leads. MAX Trade Value is available to all dealerships, as part of an existing full partner package with MAX Digital or may be purchased individually with a wide range of integrations.

“We are consistently looking to understand where car shoppers have barriers to purchase today and how we can knock those down with a better experience,” Walker said. “The integration we are able to achieve for dealerships, helps shoppers get the answers they need today and sets up a positive buying experience in-store.”

For more information on MAX Trade Value, visit maxdigital.com/tradevalue.