How about these potential signals of improvements for used-car managers scouring the lanes for necessary inventory without using their entire floorplan allotment with a single click or tap?

Black Book reported on Tuesday that car segments posted the lowest weekly gain in values in 17 weeks. Analysts added that truck values showed their lowest weekly improvement in 15 weeks.

Read more

While Cox Automotive’s measure of wholesale vehicle values is still at an all-time high, the rate of week-over-week increases has slowed in the first half of June.

And values may have reached an apex.

That’s according to the mid-month reading of the Manheim Used Vehicle Value Index, which came in at 203.6.

That is up 36.4% from June 2020 and compares to May’s full month-reading of 203.0. The latter was the fourth straight record month for the index, which hit the 200 mark for the first time ever.

Adjusted for mix, mileage and seasonality, the first half of June showed a 0.29% uptick in wholesale prices over May.

Trend lines in the Manheim Market Report data showed prices climbing, “but at a decelerating pace” during the month’s opening two weeks, with metrics showing that there may have been a peak already in wholesale values.

“The Three-Year-Old MMR Index, which represents the largest model year cohort at auction, experienced a 0.8% cumulative increase over the last two weeks, with last week recording the lowest weekly increase in 20 weeks,” Cox Automotive said in the index report.

“Over the first 15 days of June, MMR Retention, which is the average difference in price relative to current MMR, averaged 99.6%. This indicates valuation models are more closely reflecting market prices than we have seen since early January,” analysts added.

Among other points: The analysis also said sales conversion rates fell from May to the first half of June, but are still higher than what is historically typical.

Last week had a 6-percentage-point lead in sales efficiency compared to the average for June 2019.

“The latest trends in the key indicators suggest wholesale used vehicle values likely peaked last week,” Cox said.

Meantime, in the new-vehicle market, average transaction prices in May reached the third-highest level on record, according to analysis from Kelley Blue Book.

At $41,263, last month’s new-car ATP was the highest ever for the month of May and trailed only December ($41,335) of last year and February of this year ($41,333) on the all-time list, Cox said.

The new-car ATP was up 5.4% year-over-year and 1.2% from April.

Black Book’s latest installment of Market Insights showed how dealerships now are paying nearly $27,000 for a piece of inventory that cost just $20,000 at the beginning of the year.

And there’s little evidence to refute the notion that the same unit might approach $30,000 soon stemming from the current pace of wholesale price increases.

Read more

Last weekend might have marked more than just Americans commemorating Memorial Day. Black Book now is watching closely for a potential pivot in the wholesale market.

Analysts explained their reasonings in their latest installment of Market Insights released on Tuesday.

Read more

May was the fourth straight record month for the Manheim Used Vehicle Value Index, which hit the 200 mark for the first time ever, spokespeople with parent company Cox Automotive confirmed.

The index reading for May was 203.0, which beat year-ago figures by 48.2%.

Read more

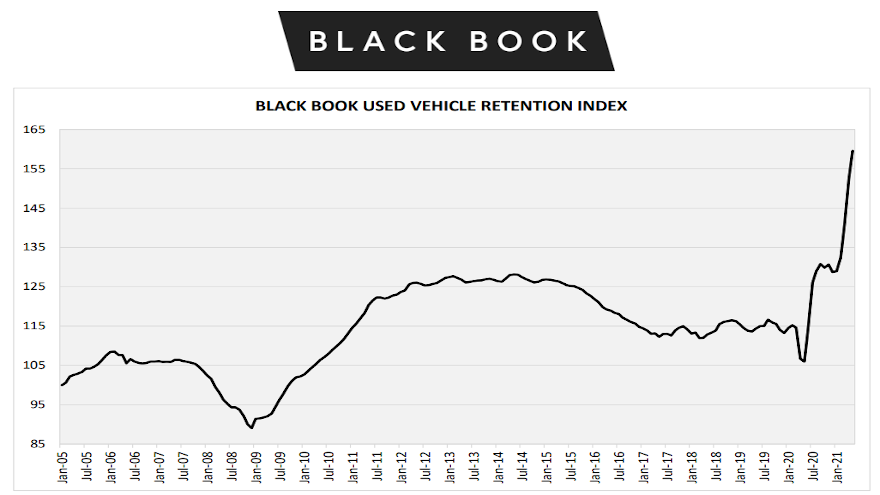

While slightly softer than the previous weeks in the month, Black Book highlighted another weekly wholesale value uptick — extending the industry’s streak to 18 in a row — lifted its Used Vehicle Retention Index to another record.

Black Book reported its May index reading came in at 159.6, increasing 7.1 points or 4.7% from the previous record set in at April at 152.4.

Read more

Going into Memorial Day weekend and the unofficial start of summer, Black Book used its latest installment of Market Insights to give a well-rounded recap of the rising wholesale price trajectory that’s now lasted four months with average weekly increases above 1.0% for the past 11 weeks.

Black Book explained these rapidly rising values can be attributed to the basics of

Read more

Data contained in the newest Kontos Kommentary might have reinforced value of the latest functionality of ADESA’s platform to help dealers still be profitable during times of unprecedented wholesale prices.

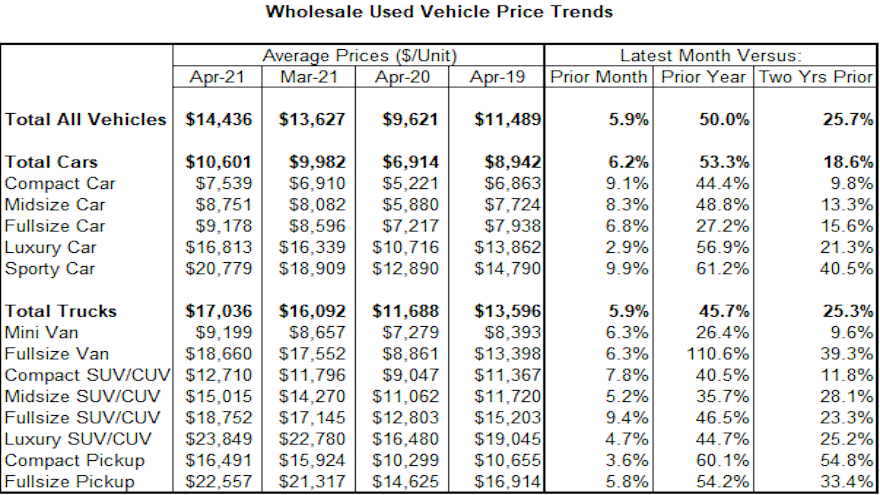

Coinciding with the launch of the company’s proprietary “% to Retail” tool, KAR Global chief economist Tom Kontos said average wholesale vehicle prices cracked the $14,000 mark for the first time ever in April, and then proceeded to set new highs above $15,000 in May.

According to KAR Global Analytical Services’ monthly analysis of wholesale used vehicle prices by vehicle model class, wholesale prices in April averaged $14,436 — up 5.9% compared to March 50.0% above the reading in April 2020, and 25.7% higher when compared to pre-COVID/April 2019

“This is the latest sign of the seemingly never-ending rise in wholesale values resulting from a deluge in demand and a drought in supply,” Kontos said in his latest analysis.

“Retail used vehicle and CPO sales did slow down a bit in April, but it is unclear if sales were limited by demand or supply and nevertheless remained high,” he continued.

With those metrics in mind, KAR Global also announced that all 24/7 bid/buy vehicle listings on ADESA’s digital marketplace now showcase the current bid of the vehicle compared to the estimated national used retail market price.

KAR highlighted “% to Retail” is powered by autoniq, a sister company to ADESA and a provider of app-based vehicle pricing and evaluation information.

According to a company news release, the new feature is aimed at helping dealers quickly analyze vehicle pricing and make better-informed decisions on the best inventory for their lot.

“Our customers are experiencing unusual market dynamics across North America, so having instant access to real-time intelligence on vehicle valuation has never been more helpful and important,” said John Hammer, chief commercial officer of KAR Global and president of ADESA. “With the ‘% to Retail’ feature, we’re making it easier and faster for dealers to identify vehicles priced right for their wholesale-to-retail strategy.

Our digital marketplaces are expanding the pool of fresh inventory accessible to buyers, and ‘% to Retail’ will help them make better, faster and smarter bidding and buying decisions,” Hammer continued.

The company explained the “% to Retail” functionality uses KAR’s proprietary data science capabilities to evaluate data from across ADESA and KAR’s other digital marketplaces along with the latest industry, market and economic data to accurately estimate potential vehicle profitability. Buyers can filter their searches on ADESA by “% to Retail” range to focus their bidding and buying on vehicles within a particular range — and each listing will tell the dealer the estimated margin between the wholesale price/bid and the estimated retail sale.

KAR indicated that vehicles with a lower percentage to retail present the greatest opportunity for retail profit while those with higher percentages are closer to the estimated retail market price.

The company also mentioned search capabilities allow buyers to sort and/or filter vehicles by additional specifications like proximity, make and model, and condition to showcase all vehicles that are available.

“Dealers who piloted the ‘% to Retail’ functionality consistently found it easy to use and beneficial for finding the best, most competitively priced vehicles,” said Rick Griskie, president of digital marketplaces at KAR Global.

“This new feature allows our dealers to find the exact inventory that supports their overall retail strategy, and we’ve already seen early success with our dealers using the tool showing a 20% higher success rate in finding vehicles to purchase compared to those who did not use the tool,” Griskie went on to say.

Kontos pointed out another tidbit within the company’s latest data set that might reinforce the value of the ‘% to Retail’ functionality.

“Interestingly, compact cars and full-size SUVs/CUVs both had month-over-month increases of above 9%, exemplifying the breadth of demand across all used-vehicle segments, small and large,” said Kontos, who also offered his perspective through a video that can be seen here.

And Kontos also recently appeared on the Auto Remarketing Podcast to discuss the "perfect storm" impacting the wholesale market and more. That episode is available below.

The Manheim Used Vehicle Value Index appears headed for unprecedented territory.

After the first 15 days of May, the mid-month reading of the index eclipsed the 200 mark, climbing 48% from May 2020 and reaching 202.9.

A look at readings of the index dating back to January 1997 shows

Read more

Sweet 16, indeed.

Black Book reported on Tuesday via its latest installment of Market Insights that wholesale values now have increased for 16 consecutive weeks. It’s getting so intense in the lanes that some dealers are fetching better returns in the wholesale space rather than via retailing.

“Despite the limited inventory on dealer lots, many dealers are finding themselves receiving greater profit margins in the wholesale channel as opposed to their own retail lots,” Black Book said in the latest report.

“Armed with the knowledge that their available inventory in the pipeline is extremely limited, remarketers are finding that they are able to continue to raise their floors and hold firm on their set values,” analysts continued. “They plan to accept a no-sale this week with the expectation it will sell the next.”

With that as a backdrop, let’s get into more details of the value climbs Black Book tabulated.

Beginning with cars, analysts said the overall price increase came in at 1.30% with seven of the nine segments generating gains exceeding 1.00%.

While the value increase for compact cars didn’t surpass 2.00% again — rising only by 1.57% — analysts computed the nine-week average increase still is a hefty 2.04%.

And perhaps a glimmer of a slight turnaround at least in one place, Black Book mentioned the subcompact car segment posted a price increase below 1% for the first time since the middle of March.

However, if your potential retail buyers want a more sophisticated vehicle, it’s going to cost more to acquire that inventory, as Black Book noted significant value increases for near luxury cars (up 1.22%) and sporty cars (up 1.24%).

Over in the truck space, prices within all 13 segments moved higher, pushing the overall reading up by 1.12%. Six truck segments jumped by more than 1.00%.

Analysts found another example of how different the wholesale scene is now compared to 2019. Last week, values for compact crossovers jumped 1.86%leading the gains in the truck market. During the same week two years ago, values for those units ticked 0.08% lower.

How about one more? Full-size luxury moved 0.37% higher last week. During the same time period in 2019, those units softened by 0.59%.

And here’s a projection to round out Black Book’s latest analysis.

“New inventory is not expected to see improvement until the third quarter of this year, so values are expected to remain at elevated levels throughout the summer,” analysts said.

Perhaps Sweet 16 will evolve into Tremendous 30 and beyond.