KAR Global chief economist Tom Kontos might have channeled his inner weatherman when he used the term “perfect storm” as part of his description of the current wholesale market.

Kontos elaborated about what he meant and more during another conversation for this episode of the Auto Remarketing Podcast.

To hear the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Have a hot-shot Green Pea at your store who is itching for a spiff or other recognition you offer? Here is a suggestion based on the latest wholesale observations contained in the latest installment of Black Book Market Insights.

Ask the new dealership teammate to find vehicles that do not need much, if any, reconditioning and for a price that won’t make a huge dent in the floorplan resources.

That person likely will be hunting for a while since Black Book said this past week marked 15 consecutive weeks with the overall market values increasing.

Of those 15 consecutive weeks, analysts determined nine of them generated price overall increases of at least 1%.

“With the global microchip shortage and other supply chain disruptors forcing OEMs to alter their new car production, it is expected that this elevated market will continue throughout the summer,” Black Book said in the newest report.

“Remarketers are raising floors and holding firm with this knowledge that the supply is tight and will remain that way,” analysts continued.

And if those Green Peas think they found some vehicles at a decent price, perhaps ask them to take a closer look at the conditions of brakes and tires or body panels to check for scratch and dent needs.

“Conversion rates have been declining over the last few weeks as the quality of inventory being offered for sale continues to decline. It is getting harder for buyers to find average or better condition grade vehicles,” Black Book said.

“Condition of units has been the hot topic with buyers in recent weeks, as there are fewer average to clean units available,” analysts added. “When buyers do find one, they are having to pay top dollar to secure it.

“For everything else, their reconditioning costs are increasing to ensure they get the units retail ready,” Black Book went on to say.

If you’re worried about those Green Peas cleaning out the spiff account, here is more evidence of how difficult the challenge is nowadays.

Overall, Black Book said car values rose another 1.25% last week as five of the nine segments posted gains exceeding 1.00%.

Analysts pointed out that in recent weeks subcompact cars (up 1.15% last) and compact cars (up 1.56% last) generated the largest increases. But last week, the largest jump in prices came from the midsize car segment, which rose +1.62%.

“The luxury segment gains have slowed but are still large compared to normal seasonal patterns. Typically, these segments would be declining this time of year and rarely see increases, even during the spring market,” Black Book said.

“Sporty cars continue to see large week-over-week gains,” analysts added about those summertime rides that had an increase of 1.19% last week.

Meanwhile, Black Book determined value increases among the truck segment intensified last week as the overall level rose 0.98%. All 13 segments moved higher with five truck categories climbing more than 1.00%.

Leading the increases were subcompact crossovers (up 1.56%), followed by minivans (up 1.46%), small pickups (up 1.31%) full-size Trucks (up 1.22%), which have averaged a weekly increase of 1.39% during the last nine weeks.

“The luxury crossover/SUV segments have slowed the rate of gains,” Black Book said. “But for comparison, in 2019 these segments were declining.”

In other words, “Good luck Green Peas!”

Make that three straight months of records for the Manheim Used Vehicle Value Index.

The Cox Automotive business unit’s measure of wholesale car prices came in at 194.0 for April, which beat year-ago figures by 54.3% and was nearly a 15-point jump from the prior record set a month before (179.2).

Mix, mileage and seasonally adjusted, wholesale values were up 8.3% from March, according to Manheim’s report.

Beyond the 54.3% overall spike in used-car prices last month, the gain for pickups was particularly noteworthy, as their values were up 77.9%.

And all market classes included in the index report showed year-over-year increases of at least 41%. That includes a 51.6% jump in midsize car prices, a 48.5% climb for compact cars and a 48.2% uptick for SUV/CUV prices.

Van prices climbed 46.3% and luxury prices were up 41.8%

Breaking the prices down further, rental risk prices climbed 32% from April 2020 and 7% from March of this year.

On the supply front, April ended with wholesale days supply at 17, down from the typical level of 23.

April’s wholesale price surge picked up from March, a record month itself.

According to KAR Global’s measure of wholesale prices in March, values were not only up 25.9% from the COVID-impacted March 2020, but beat March 2019 prices by 22.8%.

“Independent of seasonality, wholesale values remain above pre-Covid levels by over 20%, as a perfect storm in used-vehicle demand faces a perfect drought in used vehicle supply. These trends continued well into April,” KAR chief economist Tom Kontos wrote in his commentary on March used-car price trends.

And the 9.5% sequential increase in wholesale prices for March was a record, according to J.D. Power Valuation Services.

“What we saw in March was truly historic. It represents the biggest monthly wholesale increase that we've ever seen, period. It was a process that built up steam steadily over the month with 3% upticks every week for three weeks. It represents a major break with the historic 1.5% – 2.0% increases that have typically been logged in March through the five years leading up to 2020,” J.D. Power Valuation Services executive analyst David Paris said in an analysis.

The Black Book Used Vehicle Retention Index for April showed how much different the wholesale market is now compared to a year ago when the pandemic really began to intensify.

Black Book reported on Thursday that its April index reading came in at 152.4, representing a rise of 11.2 points or 8.0% from March and establishing another record for the wholesale reading.

The firm said its index currently stands 43% above where it was the same time last year during initial economic shutdown due to COVID-19.

“Wholesale prices continued their ascent each week in April, although the rate of increase declined slightly at the end of the month,” Black Book senior vice president of data science and analytics Alex Yurchenko said in a news release.

“Demand for used and new vehicles remained strong, but available inventory continued to decline,” Yurchenko continued. “This elevated demand and low inventory coupled with low incentives levels on new vehicles helped the retention index to increase for the fourth month in the row.

“This month, all segments showed increases, with compact car and minivans having the largest gains,” he added.

The Black Book Used Vehicle Retention Index is calculated using Black Book’s published wholesale average value on 2- to 6-year-old used vehicles, as percent of original typically equipped MSRP. It is weighted based on registration volume and adjusted for seasonality, vehicle age, mileage and condition.

To obtain a copy of the latest Black Book Wholesale Value Index, go to this website.

Convoluted, complicated and difficult all might be appropriate adjectives to describe what’s happening in the auction lanes nowadays.

While Black Book is seeing an ever so slight deceleration in the upward trajectory of wholesale prices, analysts also pinpointed a handful of specific models in which dealers actually are being forced to pay above MSRP for a used version because of supply constraints.

“Driven by an extreme shortage of rental returns and limited inventory of new vehicles, the price trends of newer used vehicles were experiencing larger weekly gains compared to the older units,” Black Book said in the newest installment of Market Insights released on Tuesday.

“Within the last three weeks, newer used units reached levels that, in some cases, exceed new-car pricing while the rate of growth has slowed for older units,” analysts continued in the report.

“For example, in addition to Ford F-150 Raptor, 2020-21 Chevrolet Corvette and 2021 Jeep Gladiator and Wrangler, dealers are paying above MSRP for 2021 Kia Telluride and Hyundai Palisade, as well as other mainstream models,” Black Book went on to say.

For used-car managers who can’t stomach the thought of paying that much for a current-model-year unit, perhaps they can go to the dealer-consignment lanes to find inventory that could turn quickly.

However, Black Book cautioned dealers not to expect to find many bargains.

“Available inventory on dealer lanes has improved in recent weeks, as more dealers are taking their trade-ins to auction to take advantage of the strong wholesale demand,” Black Book said. “Despite the low inventory on the lots, the margins that can be made at their local auction is too good to pass up.

“With the ongoing new-inventory shortage, the availability of used units is expected to remain tight throughout the summer, especially with rental and fleet companies holding their units in service longer until replacements are available,” analysts continued.

“New inventory levels are not anticipated to recover until 2022 due to the ongoing supply-chain issues,” Black Book went on to say.

So, buckle up, dealer friends. Climbing price points like these are continuing to be seen by Black Book’s analysts.

Black Book reported that car segment value gains slowed this past week, increasing 1.17% after the week prior came in at 1.71%. Analysts also noted that for the first time since middle of March, all nine car segments did not generate price jumps exceeding 1% and none of them broke the 2% mark.

Still, the average weekly value increase for compact cars during the past seven weeks is a “staggering” 2.17%, according to Black Book.

Analysts also pointed out the latest price rises by full-size cars (up 0.99%), luxury cars (up 0.83%) and prestige luxury car (up 0.62%) are still well above normal seasonal changes.

Black Book noticed that prices in the truck segment didn’t rise as much this past week (up 0.89%) as they did when compared to the previous week (up 1.07%).

Analysts noted that while all 13 truck segments posted value increases, only four surpassed 1%. That’s down from the week prior when nine truck segments generated at least that much of a rise.

Prices for small pickups had jumped by at least 1% for eight weeks in a row, but last week that streak stopped with a gain of 0.94%. Black Book added that values full-size pickups climbed another 1.11% last week.

“Wholesale values continue to rise, but the rate of increase is shrinking each week. However, the value increases are still considered extremely large for single week gains compared to a ‘normal’ market,” Black Book said.

“Retail inventory levels — new and used — continue to be a challenge and the limited availability of quality vehicles in the wholesale market is also proving to be a challenge for buyers,” analysts went on to say.

Sale day certainly can be exciting when hundreds of units go over the block.

But that enthusiasm can quickly dissipate when vehicles to your store and a shop manager does a rundown of how much reconditioning they need to be front-line ready.

That’s the common scenario Black Book summarized in its latest installment of Market Insights released on Tuesday, as analysts spotted wholesale values surging higher for the 13th week in a row.

“The level of weekly increases has slowed from the record set three weeks ago, but the level of increases is nonetheless impressive,” Black Book said in the report. “Inventory levels continue to be tight, both in the new and used retail markets, as well as the wholesale market, further fueling the price required to source used inventory.

“The volume offered for sale each week has remained tight, but this past week there was a small improvement in the available volume, especially on the dealer lanes,” analysts continued. “However, conversion rates did drop slightly as sellers held firm to floors and buyers exhibited restraint on condition-challenged units.

“Condition of units is rising to the top of complaints for buyers as much of the available wholesale inventory in the market right now has some type of issue that needs to be addressed before it can be retailed,” Black Book went on to say.

“With the ongoing new inventory shortage, the availability of used units is expected to remain tight throughout the summer, especially with rental and fleet companies holding their units in service longer until replacements are available,” analysts added.

With those elements in mind, the situation sure sounds like dealerships will remain busy smoothing over dings and scratches, installing brakes and tires and perhaps more intense recon jobs — all while paying more the vehicle from the get-go.

All nine car segments in Black Book’s tracking generated value gains of more than 1% last week. And those popular units to retail during tax season — compact cars — posted a price gain of more than 2% for the fourth week in a row, jumping another 2.33% last week.

While prices for subcompact cars didn’t rise by more than 2% like they have in recent weeks, analysts said they still moved 1.88% higher as values for midsize cars increased 1.94%.

For trucks, all 13 segments ticked higher in Black Blook report but the overall value reading didn’t rise as much as it has in recent week, posting a climb of 1.07%

Analysts noticed units that might appeal to small and large families continued to see price climbs with subcompact crossovers leading the truck segment gains again last week with an increase of 2.13%. Prices for minivans weren’t far off that pace, rising 1.77% to build on their four-week average increase of 1.96%.

Value increases for full-size trucks are slowing a bit, but Black Book said they still rose 1.25%.

The only two segments noticeably below overall value trends are units at a higher price point anyway as Black Book said values for compact luxury crossover/SUVs ticked up 0.50% and prices for midsize luxury crossover/SUVs rose by 0.54%.

Higher prices. Fewer units flowing through the wholesale market. Vehicles in rougher condition.

The challenges for dealership used-car managers are as steep as ever, as recapped in the latest Market Insights from Black Book released on Tuesday.

While values didn’t rise quite as much last week as they had earlier in April, analysts said wholesale prices still jumped another 1.34% a week ago.

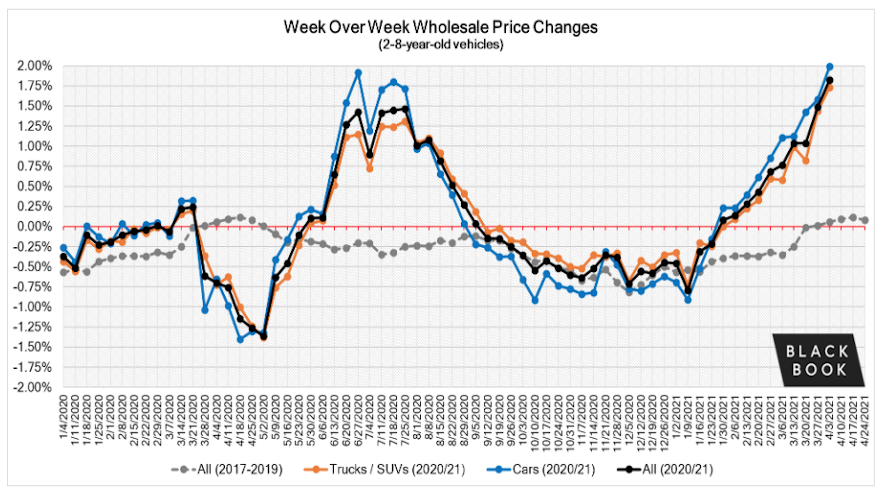

And if you want to romanticize about the “good old days” being just 24 to 48 months ago, Black Book reported the average value gain during the same week in 2017 through 2019 was just 0.12%.

What a wholesale world we’re now navigating, right?

“Condition of units is trending toward the ‘edgier’ side with damage, dash lights illuminated, and/or vehicles running on red and yellow lights,” Black Book said in its newest report. “There is also a noticeable increase in the number of vehicles being offered for sale with open recalls.”

And Black Book alluded to the supply situation being similar to what experts from other firms are saying, too.

“Remarketers are expecting their shortage of available units to last well into the summer,” Black Book said. “Reduced rental returns to the market and lack of substantial volume of repossessions continue to have the largest impact on the wholesale supply levels.”

But dealers still need vehicles to retail. Here’s what they’re paying at auction, according to Black Book’s newest metrics.

Overall car values rose 1.60% last week, a bit below the 1.79% surge they made during the week earlier.

Eight of the nine car segments generated price increases of at least 1.00% with compact cars soaring past 2% for the third week in a row and four out of the past five. The latest value climb for compact cars was 2.30%.

Prestige luxury cars was the only segment to have a price gain below 1.00%, yet still rising 0.72%. By comparison, values for those units during the same week in 2019 declined 0.29%.

After setting a weekly price increase record of 1.73%, Black Book determined overall truck values rose 1.48% last week with all 13 segments moving higher. Seven truck segments increased more than 1.00% with sub-compact crossovers (up 2.14%) posting their fourth week in a row of increases exceeding 2%.

Also of note, analysts pointed out that prices for full-size trucks increased another 1.75%, while values for minivans increased 1.83%.

While a new weekly wholesale price increase record was not set, these unprecedented times in the lanes prompted Black Book to expand its data tracking.

Analysts said in the newest Market Insights that they’re seeing a substantial increase in prices that dealers are willing to pay for higher-mileage units, especially models 2-years-old and newer.

Because of this development, Black Book started to update its mileage sensitivity curves on a weekly basis instead of the typical monthly cadence.

When looking at just those late models, Black Book indicated in the latest report that values in that particular space didn’t surge as much last week as they did during the previous week. But still, overall values for units less than 2-year-old increased by 1.42% week-over-week with cars rising 1.54% and trucks and SUVs climbing 1.37%.

Analysts described three factors that are pushing dealers to bring these units into inventory even if they have higher mileage than they would prefer.

“As new production continues to struggle to meet demand, the fleet and rental companies are holding onto their vehicles longer, further depleting the availability of used vehicles in the marketplace,” Black Book said.

“Recalls are another challenge for some sellers and buyers as the manufacturing delays are slowing down the access to parts necessary to make the fixes that would free the vehicles up for retail sale,” Black Book continued.

“The deteriorating condition of available units is leading to higher costs for buyers before it reaches their front-line,” Black Book went on to say. “Additionally, the level of reconditioning necessary is further delaying the time required before a vehicle is ready for retail.”

Looking at the entire wholesale market no matter how fresh or long-in-the-tooth the vehicle might be, analysts determined values still moved higher, but not quite to the level a week ago when they saw records fall faster than the auctioneer’s hammer.

Overall, Black Book said values last week moved higher by 1.59% with cars jumping by 1.79% and trucks and SUVs increasing 1.48%.

Once again, analysts noticed that all nine car segments posted another week of value gains exceeding 1.00%, with compact cars (up 2.54%) and subcompact (up 2.04%) leading the way.

“It is expected for this segment to increase this time of year, but not by this amount,” analysts said about compact-car prices that increased what seems like a paltry 0.53% during this same week in 2019.

And how about another even more stark example for what an unprecedented time this is?

Black Book said that prestige luxury cars generated the smallest increase last week at 1.09%. But during the same week two years ago, analysts pointed out values of those prestige luxury cars actually softened by 0.28%.

Turning to the truck space, Black Book found that 10 of the 13 segments generated value increases of 1.00% or more.

Like in the car space, compact and subcompact crossovers paced the truck-price rises with increases of 2.23% and 2.07%.

“Despite the OEMs doing their best to prioritize full-size truck production, new inventory continues to be limited, which continues to put pressure on the used market,” analysts said about those full-size trucks that posted a value rise of 1.57%.

It’s one thing for wholesale vehicle prices to “bounce” this time of year. But what happened last month was a “leap,” says Cox Automotive chief economist Jonathan Smoke.

After increasing 26.2% year-over-year, the Manheim Used Vehicle Value Index reached an all-time high of 179.2, according to a news release from Cox Automotive.

The month-over-month gain in March was 5.87% (mix-, mileage- and seasonally adjusted).

“It is not uncommon to see a spring bounce in wholesale prices, but a 26.2% increase is a leap by any measure,” Smoke said in a news release. “We continue to experience high demand and limited supply.

“And, as we begin to see the light at the end of the tunnel that is the coronavirus pandemic, increasing consumer confidence and decreasing unemployment create market conditions that lead to sizeable gains in the first quarter.”

Breaking down the wholesale price movement by segment, the most notable increase in the data set was for pickups, whose prices climbed 47.7%. Luxury cars (21.7%) and SUV/CUV (21.4%) were next, followed by vans (up 18.9%), midsize cars (18.6%) and compact cars (12.8%).

There were also gains in the weekly Manheim Market Report prices. The MMR Index for 3-year-old vehicles climbed 6.4% over the month’s four full weeks.

These price gains are occurring are amid tight supply.

There were 18 days’ supply of wholesale inventory at month’s end, compared to the normal rate of 23 days. The peak of wholesale supply happened on April 9, 2020, when it reached 149 days.

At this pace, dealerships are going to see their used-vehicle retail margins pinched tighter than when a salvage unit goes into the crusher.

Not only did values for every vehicle segment included in Black Book’s Market Insights increase by more than 1% in a single week, but four categories also generated gains greater than 2%.

Overall, analysts said wholesale prices jumped 1.82% last week with cars soaring 1.99% and trucks spiking 1.73%.

And how about these stats for some perspective? According to the report, the average gain during the same week during 2017 through 2019 came in at just 0.21% for cars.

The average truck movement? Well, values actually softened 0.06% during that timeframe.

“Wholesale supply continues to be tight, and it doesn’t sound like it is going to get better anytime soon,” Black Book said in the report. “Even as prices continue to rise, sales rates remain incredibly strong due to the lack of new and used inventory and strong retail demand.

“Delays in new-inventory deliveries are forcing fleet and rental companies to keep units in service longer, further depleting the availability of used inventory in the market,” analysts continued.

“Consignors are reporting that they have slowed their rate of increases in floor pricing. But despite this, their transaction prices continue to rise each week,” Black Book went on to say.

Two of the four vehicle segments posting those value gains above 2% probably shouldn’t surprise used-car managers. Those tax season specials made even more appealing by additional federal stimulus money pushed values for compact cars up by 2.45% and for midsize cars by 2.62%.

Analysts pointed out that even premium sporty cars are getting into the upward value march, as prices in that segment went from a 0.32% to a jolt of 1.48% this past week.

In the truck domain, values of vehicles often utilized by families led the upward price charge with sub-compact crossovers rising 2.64% and minivans increasing 2.46%.

Popular full-size trucks nearly crossed the 2% value rise threshold, too, as analysts pegged their gain at 1.91%.

“As supply chain disruptions force OEMs to prioritize production of their profit leading models, the compact van (up 1.78%) and full-size van (up 1.06%) segments have been left with little supply in the market, further fueling the growth in values of these niche segments,” analysts said.