With wholesale values surging each week during the month, it probably comes as no surprise that the Black Book Used Vehicle Retention Index for March set a new record.

Black Book reported on Monday that its index reading came in at 141.2, representing an 8.9 point (or 6.7%) increase from February.

Analysts also noted the index currently stands 23% above where it was at this same time last year, right before a record drop due to the start of the COVID-19-related economic closures.

“Wholesale prices continued to increase each week, with an accelerated rate of increase throughout March,” Black Book senior vice president of data science and analytics Alex Yurchenko said in a news release.

“Continuous shortages of used and new inventory, coupled with elevated demand driven by the federal stimulus and an improved labor situation in the last two months, drove wholesale prices to record heights across all segments,” Yurchenko continued.

“This month, most of the car segments led the increases, with the compact car segment increasing by 10 points (7.5% increase) and the mid-size car segment increasing by 9 points (6.9%),” he went on to say.

In a separate statement also released on Monday, Curt Long made several similar assertions after the U.S. Commerce Department released new-vehicle sales data for March. Long is chief economist and vice president of research at the National Association of Federally-Insured Credit Unions (NAFCU).

“Vehicle sales soared in March to 17.8 million annualized units, continuing a trend of good news for the American economy,” Long said. “Strong fiscal support, more stimulus checks, low-interest rates, better weather, and great March job numbers all contributed to this surge.

“Fleet sales are slow, with GM reporting a 35% decline versus a year prior, but consumer sales have more than made up the difference,” he continued. “The problem in 2021 will be supply, as microchip shortages worldwide have affected many industries and paused production on some Ford and GM lines. Supply issues have not hindered sales yet but could ripple into the summer and fall.

“Overall, NAFCU expects a very strong year for vehicle sales and beginning of the post-COVID recovery,” Long went on to say.

And with sales surging, the Black Book index might remain steady, too.

The Black Book Used Vehicle Retention Index is calculated using Black Book’s published wholesale average value on 2- to 6-year-old used vehicles, as percent of original typically equipped MSRP. It is weighted based on registration volume and adjusted for seasonality, vehicle age, mileage and condition.

To obtain a copy of the latest Black Book Wholesale Value Index, go to this website.

The BMW 5 Series is the best car to buy used over new, according to a new study from car search engine iSeeCars.com.

The 5 series led iSeeCars’ list of the top 15 cars with the greatest change in price between gently used and new versions.

The BMW 5 Series midsize sedan is joined by another BMW sedan, the compact 3 Series, in the No. 9 spot. The third-ranked Infiniti Q50, seventh-ranked Infiniti Q60 and the 10th-ranked Mercedes-Benz CLA were additional luxury sedans on the list.

“Buyers who opt for a 1-year-old version of these sedans can enjoy significant savings ranging from $13,420 for the Mercedes-Benz CLA to $24,207 for the BMW 5 Series,” iSeeCars executive analyst Karl Brauer said in a news release. “These price drops reflect the declining popularity of sedans, especially among luxury buyers that have switched to SUVs in recent years.”

Luxury vehicles led the way on the list, with seven out of the top 15. Five of those vehicles were luxury sedans.

The iSeeCars study showed the average 1-year-old lightly used car costing 17.0% less than its new version. But some vehicles have as little as a 2.1% price difference.

Others show price differences as high as 36.4%. The Tesla Model 3 led the cars with the smallest differences, along with several pickup trucks.

Luxury sedans led the cars with the largest differences.

For its study, iSeeCars.com analyzed asking prices from more than 2.6 million new and used cars sold from August to March. The company identified the top 15 cars with the smallest price difference between new and 1-year-old used versions of the same vehicle, as well as the 15 cars with the largest price differences.

The iSeeCars study also identified the best cars to buy new, showing the new cars with the smallest price differences over gently used versions. The top three cars to buy new, according to the study, are the Tesla Model 3, the Toyota Tacoma and the Kia Telluride.

But regarding used, Brauer said the used-car market is still seeing the effects of plant shutdowns during COVID-19. That has led to higher prices and shorter supplies of in-demand vehicles such as pickup trucks, he said.

“While lightly used cars typically provide cost savings over their new versions, sometimes buying a new version of the car is a smarter financial decision, especially for consumers taking advantage of the lower finance rates that typically come with new cars,” he said.

Best cars to buy used

In addition to the luxury vehicles making a strong showing on the list, three non-luxury sedans of varying sizes also made the list.

Those include the second-ranked midsize Hyundai Sonata, the compact Nissan Sentra at No. 8, and the 11th-ranked subcompact Mitsubishi Mirage G4.

“In addition to sedans seeing lower demand, these sedans are not hot sellers in their segments,” Brauer said. “However, these vehicles, especially the Sentra and the Sonata, which were completely redesigned for 2020, present additional savings opportunities on already affordable vehicles.”

The sixth-ranked subcompact Mercedes-Benz GLA and the 12th-ranked midsize Cadillac XT5 were two luxury SUVs making the list.

“The Mercedes-Benz GLA was redesigned for 2021, which lessens the demand for used versions from the previous generation,” Brauer said. “The Cadillac XT5 hasn’t resonated with buyers like competitive vehicles in the popular luxury midsize SUV category, resulting in big discounts in the used market.”

Coming in at No. 5 is the convertible version of the popular sports car, the Ford Mustang.

“The Ford Mustang is America’s best-selling sports car, which means supply is high and pricing is lower for used models,” Brauer said. “This presents an attractive deal for buyers who have always wanted a Mustang.”

Three SUVs rounding out the list are the Hyundai Santa Fe at No. 13, the 14th-ranked GMC Yukon XL, and the 15th-ranked Kia Sorento.

“The midsize two-row Hyundai Santa Fe and three-row Kia Sorento are both praised for their value and quality, but buyers may be passing them up for the hotter and more upscale Palisade or Telluride,” Brauer said. “Full-size SUVs like the GMC Yukon XL generally drop significantly in price given their high starting prices, and the Yukon XL’s 2021 redesign may cause used prices to drop even further.”

Brauer said buyers should consider some important factors when deciding between a new and a lightly used version of the same vehicle, and one is that although buying used typically provides upfront cost savings compared to buying new, sometimes used vehicles only offer small savings. That is especially the case when taking finance rates and rebates on new models into account, Brauer said.

“Additionally, new cars aren’t subjected to the wear and tear of some lightly used cars, so the extra cost might be worth the added peace-of-mind,” Brauer said. “On the other hand, buying used can provide significant savings, allowing buyers to purchase higher-quality or better-equipped vehicles that may otherwise be out of their price range.”

iSeeCars Top 15 Cars to Buy Used Over New

| Model |

% price difference from new |

$ difference |

| BMW 5-Series |

36.4% |

$24,207 |

| Hyundai Sonata |

36.1% |

$9,898 |

| Infiniti Q50 |

34.9% |

$16,322 |

| Mitsubishi Eclipse Cross |

31.6% |

$8,041 |

| Ford Mustang |

31.0% |

$13,422 |

| Mercedes-Benz GLA |

30.9% |

$13,562 |

| Infiniti Q60 |

30.9% |

$16,944 |

| Nissan Sentra |

30.2% |

$6,209 |

| BMW 3-Series |

29.7% |

$15,266 |

| Mercedes-Benz CLA |

29.5% |

$13,420 |

| Mitsubishi Mirage G4 |

29.2% |

$4,781 |

| Cadillac XT5 |

28.7% |

$14,851 |

| Hyundai Santa Fe |

28.7% |

$9,061 |

| GMC Yukon XL |

27.8% |

$22,639 |

| Kia Sorento |

27.3% |

$8,489 |

| Overall Average |

17.0% |

|

CHART SOURCE: iSeeCars.com

Seriously. This value spike hasn’t happened since Black Book started to track week-over-week wholesale price changes in 2009 when smartphones were in their infancy.

According to Black Book’s newest Market Insights, wholesale prices increased 1.49%, breaking the previous week-over-week record rise of 1.46% established during the week ending July 25.

“Sellers continue to report that available inventory is dwindling, especially on those in-demand 0 to 2-year-old vehicles that are being kept in fleet and rental longer due to delays in replacement inventory,” Black Book said in the report.

Of course, with tax season happening and consumers getting an additional bump via the latest federal stimulus package, dealers still need used vehicles to retail. Black Book also touched on what used-car managers are doing now with values to higher.

“Buyers are reporting that the lack of inventory is pushing them to purchase higher mileage and ‘edgier’ units and requiring them to put more into reconditioning,” Black Book said.

“With this increase in reconditioning cost, along with the increased time and cost for transportation, the final transaction cost in many cases is seeing a larger increase than the base wholesale value changes reflect,” Black Book went on to say.

As they say in other parts of the financial world, let’s do the numbers to get a grasp on what’s happening.

Black Book reported overall car values soared 1.58% higher last week, topping the prior week's increase of 1.42%.

Analysts said eight of their nine car segments posted price gains of more than 1% with subcompact cars more than doubling the figure with a value spike of 2.12%.

The value rise for compact cars wasn’t far off that pace as Black Book said they jumped 1.61%, “making them attractive buys for dealers looking to sell to consumers with stimulus and tax return money.”

And dealers looking for vehicles at a higher price point are having to come up with more floorplan funds, too, since Black Book discovered the prestige luxury car segment had its largest single-week increase ever recorded. It was the first time this segment broke the 1% mark for a weekly value gain, rising 1.20%.

Looking over at trucks, Black Book determined overall prices jumped 1.44%, nearly doubling the prior week's value climb of 0.82%.

And like their subcompact counterparts in the car world, analysts spotted the values for subcompact crossovers soared more than 2% higher, pacing the entire truck rundown with a gain of 2.03%. Compact crossovers made a healthy value increase, too, rising by 1.71%.

Furthermore, pickups both small and full-size are fetching higher prices, too, as Black Book pegged the value jump for them at 1.79% and 1.62%, respectively.

You don’t have to be a famous chef or cook — someone on television or your beloved grandparent — to recognize three key ingredients currently are bountiful for searing wholesale prices.

Stir together tight wholesale volume, rising retail demand and consumers flush with federal stimulus money and you have auction metrics hotter than bread factory ovens.

Black Book spelled out the depth of the situation through its Market Insights released on Tuesday as analysts noticed overall wholesale prices jumped 1.03% this past week.

“The market continues to see consistent week-over-week growth in wholesale values as the additional round of stimulus spurred retail demand and sent dealers to the auctions to source replacement inventory from a market that was already tight on supply,” Black Book said in the newest report.

“With the release of the additional round of stimulus payments getting into consumers’ bank accounts this past week, dealers reported an increase in activity on their new and used lots. Additionally, BHPH dealers are reporting that some customers are using this money to pay off their existing loans,” analysts continued.

Black Book determined that overall car segments values jumped 1.42% compared to the previous week. That’s on the heels of a 1.12% value gain.

Analysts pointed out that prices for compact cars nearly set a record for a single-week rise, spiking 2.23%, acknowledging the segment is “in high demand due to the vehicles in this segment being in a price point that is good for tax season (and stimulus check) buying.”

Black Book noted the record came during the week ending June 19 when compact car values soared 2.29% higher.

All told, analysts said five car segments generated week-over-week gain of more than 1%, including midsize cars, full-size cars, near luxury cars and sporty cars. Even prices for premium sporty cars are on the rise as they increased by 0.61%.

Overall truck values increased 0.82%, according to the report.

Again, triggered by budget-conscious consumers, Black Book indicated prices for subcompact crossovers posted gains exceeding 1.00% for the fourth week in a row. Values for subcompact crossovers as well as luxury subcompact crossovers both jumped by 1.78% this past week to pace the truck segments.

According to the report, other notable gains within the truck segments included small pickups (up 1.31%) and minivans (up 1.26%).

Dealers looking for things to cool off in the wholesale kitchen might be waiting a while based on the trio of other observations Black Book offered in the report.

“Auction sales rates, as a percentage of total offered for sale, continue to grow, with the only no-sales being the result of sellers’ unwillingness to budge on their desired pricing and buyers being hesitant due to current retail price levels,” analysts said.

“With the release of the newest round of federal stimulus into consumers’ bank accounts and the increase in demand it spurred on dealer lots, the expectation is that used demand will continue to be strong as those dealers look to replenish their inventory after a strong week of retail sales. With this knowledge, remarketers are continuing to push their floors higher each week,” they continued.

“Supply continues to be constricted as there is a reduction in rental units returning to the market, as well as trade-ins being kept by dealers and lease turn-ins being held by the grounding dealer instead of being sent to auction,” analysts went on to say.

If the current wholesale market is a Las Vegas blackjack table, consignors are hitting on 18 and still winning while dealers are watching their floorplan money quickly flow to the house.

For the second consecutive week and now eighth time in its data set going back to 2009, values for all 22 vehicle segments tracked by Black Book moved higher compared to the previous week. And for the timeframe ending last Friday, 14 different segments generated price gains of at least 1%.

“This past week saw another round of all segments reporting increases in wholesale values,” Black Book said in its newest Market Update released on Tuesday.

“New- and used-inventory shortages coinciding with the traditional spring/tax season bump, as well as an additional round of stimulus, has led to larger than normal weekly gains in values. With used supply remaining tight, remarketers are raising floors and holding firm,” analysts continued in the report.

Black Book indicated overall car-segment values moved up at nearly the identical pace (1.12% last week versus 1.11% during the prior week).

Full-size cars paced the value gains, jumping 1.57%. Also increasing by at least 1% were subcompact cars (up 1.30%), compact cars (up 1.11%), midsize cars (1.41 cars), near luxury cars (up 1.18%) and sporty cars (up 1.02%).

Overall truck values nearly surpassed the 1% threshold, too, as analysts pegged the price gain at 0.99%.

Black Book pointed out that eight out of the 13 truck segments reported value gains exceeding 1%, with three of those eight categories rising more than 1.50%.

Analysts determined the subcompact crossover segment posted the largest increase among trucks for the third week in a row, jumping 1.59%.

Black Book said values for highly popular full-size trucks have doubled the rate of increase from 0.50% two weeks ago to 1.00% last week.

And values of small pickup trucks are soaring, too, jumping 1.52% this past week after rising 1.06% during the prior week, according to the report.

Black Book reported on Tuesday that all 22 vehicle segments its analysts watch for weekly wholesale price updates moved higher.

In a follow-up message to Auto Remarketing on Wednesday, Black Book said that across-the-board climb has happened only seven times since the company began to track the week-over-week changes in 2009.

And in perhaps a not-so-surprising fact, Black Book indicated all seven of those instances have surfaced since the pandemic began.

Black Book vice president of vehicle valuations Laura Wehunt and senior vice president of data science Alex Yurchenko combed through that 12 years of data and found that all 22 vehicle segments moved higher during the weeks ending:

March 5

Feb. 26

Aug. 14, 2020

Aug. 7, 2020

July 31, 2020

July 17, 2020

July 10, 2020

“Since the COVID-19 pandemic started a year ago, we have seen extreme volatility in the used automotive market, starting during the summer of 2020 and picking back up again at the beginning of 2021,” Wehunt and Yurchenko said in a message to Auto Remarketing. “We are experiencing a shortage of used inventory and supply chain disruptions that have caused tightness in new vehicle supply.

“On top of that, we are experiencing elevated demand for used vehicles as a result of the limited new inventory pushing buyers to used, and due to the shortage of used vehicles that has been caused by reduced rental returns due to cutbacks in ordering last year, lack of repossessions, and lease and trade-in vehicles being kept by dealers and not being taken in the same volume sold at wholesale auctions. All of these forces led to increased prices across all segments,” they continued.

Wehunt and Yurchenko acknowledged that the wholesale world is in the midst of the spring market, which typically results in prices pushing higher. But again, pandemic-triggered factors are in play this season.

“It is not uncommon for values in some segments to see increases in the spring, particularly the mainstream segments that traditionally are attractive to price-sensitive buyers that are looking to spend their tax return as a down payment on a used vehicle,” Wehunt and Yurchenko said.

“What’s notable is that even the segments that typically decline during economic downturns (e.g. luxury cars), had increased values in 2020 and 2021 due to the K-shaped economic recession,” they went on to say.

March Madness isn’t just happening on the college basketball court.

The newest Market Insights from Black Book released on Tuesday showed that each of the 22 vehicle segments analysts track for the weekly update moved higher a week ago. The across-the-board rise pushed car prices higher by 1.11% and truck prices up by 0.58%.

In the car world, sporty cars lived up to their name by pacing the price increases for the third consecutive week, rising by 1.78% or $305.

Meanwhile, the latest report indicated each of the four mainstream car segments all generated value gains this past week of at least 1.00%.

Analysts added that even the luxury segments are gaining price steam with near luxury vehicles climbing 0.78% and prestige luxury models gaining 0.60%.

Over in the truck space, Black Book noticed the sub-compact crossover segment continues to pull the entire space higher, leading the way with a gain of 1.23%.

Small pickups (up 1.06%) and full-size SUVs and crossovers (up 1.01%) also each posted value gains of more than 1.00%, according to the report.

“The luxury SUV segments are seeing increases, but the weekly gains are staying much smaller than the mainstream segments,” analysts said. “All luxury crossover/SUV segment increases were well below 0.50%, a sharp contrast to the larger increases experienced by the mainstream segments.”

Two truck segments Black Book has often discussed didn’t generate price rises as robust as they have in the past as values for full-size pickups moved up by 0.50% and values for full-size vans rose by 0.32%.

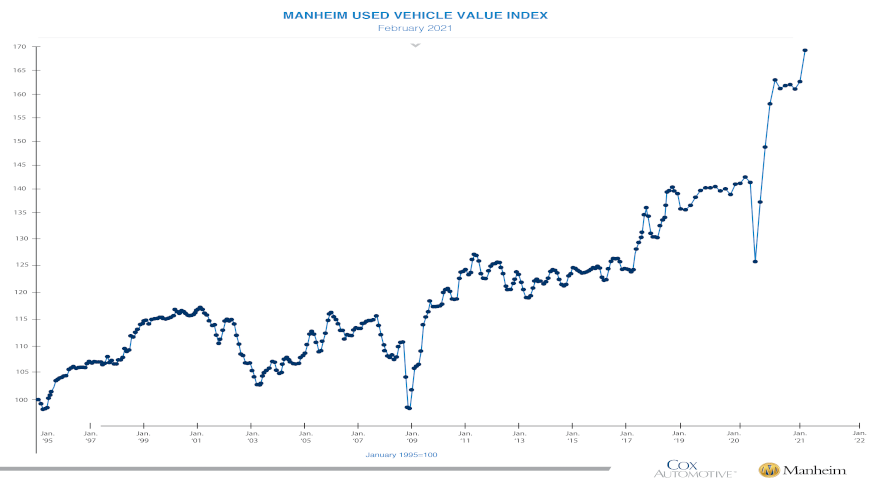

Not only did soaring wholesale prices push the Manheim Used Vehicle Value Index to a new record, but the February reading also smashed the previous high by 5.5 points.

Cox Automotive reported on Friday that wholesale used-vehicle prices (on a mix-, mileage- and seasonally adjusted basis) increased 3.79% month-over-month in February. That climb brought the index to 169.2, a 17.9% increase from a year ago, surpassing the previous high of 163.7 posted in August.

Temperatures plunged last month and impacting auction activities as chronicled in this special series from Auto Remarketing. Meanwhile, the Manheim Market Report (MMR) showed values heated up and prices strengthened as the month progressed.

Analysts indicated the 3-year-old MMR Index — which represents the largest model year cohort at auction — ticked up 0.9% during the closing week of the month, leaving prices 2.4% higher through the four weeks of February.

“The increase last week was the strongest increase for that week for any year since 2014,” Cox Automotive said in commentary that accompanied the latest index update.

“Over the month of February, MMR Retention, which is the average difference in price relative to current MMR, averaged 101%. The sales conversion rate also increased for most of the month,” analysts added.

Looking deeper into the February data, Cox Automotive reported prices for pickup soared 33.4% higher year-over-year. That’s more than the next two segment increases combined as prices for luxury cars rose 16.9% and prices for SUVs and CUVs jumped 14.3%.

The other three segments analysts track for the index all increased in February, too, but not as much as the overall rise. According to the update, prices for vans moved 9.1% higher year-over-year while the increase was 7.9% for midsize cars and 4.4% for compact cars.

Also of note on the pricing front, Cox Automotive touched on what happened in the rental-risk space in February.

What has this price escalation done to supply? Cox Automotive addressed that question by citing vAuto data.

Using a rolling seven-day estimate of used retail days’ supply, analysts determined used retail supply peaked at 115 days on April 8. They said normal used retail supply is about 44 days’ supply, and February ended at 34 days.

Cox Automotive also estimated that wholesale supply peaked at 149 days on April 9. Analysts said normal supply is 23 days, which is what it was at the close of February.

Nearly new, late-model vehicles are in high demand, especially by franchised stores with tight new-vehicle inventory because of manufacturing challenges.

Units with much lower actual cash values are wanted, too, as dealers of all stripes cater to budget buyers who got a financial bump via a stimulus or federal income tax refund.

Put the trends together and you have a primary reason why the Black Book Used Vehicle Retention Index set a new record in February.

Black Book reported that its index reading surpassed 130 for the first time, rising 3.4 points or 2.6% from January to land at 132.3.

“We continue to see tremendous strength of used-car prices across all segments,” Black Book senior vice president of data science and analytics Alex Yurchenko said in a news release that accompanied the latest index reading. “Fueled by the shortage of inventory at the wholesale market and issues with new-vehicle production, prices continued to climb in February.

“The full-size pickup truck segment remained strong with its Index increasing by 3.4 points and currently being 23% above its February 2020 level,” Yurchenko continued. The sporty car segment increased by 4.3 points and stands at 21% above 2020 levels.”

Pushing the index to that record were the price movements analysts spotted during the closing week of February and recapped in Black Book’s weekly Market Insights report.

Overall car prices surged 0.85% compared to the previous week, while overall truck prices climbed 0.60% based on the same comparison.

Other Black Book analysts reiterated the points Yurchenko made about what dealers — whether in the physical lanes or buying through online wholesale outlets — are doing nowadays.

“Sentiments from the retail side are that demand has been sensitive to weather conditions in certain parts of the country, but in general, dealers with inventory under $15,000 are seeing growth in demand,” Black Book said in the Market Insights report. “New dealers are concerned about their new inventory levels and are hoping to supplement their supply with viable used-vehicle substitutes.

“The microchip shortage continues to wreak havoc on new-vehicle production with Ford announcing last week that they will be forced to stop production at multiple facilities in Europe. Full impact of the shutdowns is still unknown, but they hope to have production at normal output by spring,” Black Book went on to say.

Spring certainly seems to be in full swing at the auction, especially when cars move in the lanes.

Black Book indicated a seasonal trend is gaining strength as sporty cars generated the largest car segment price increase a week ago, surging 1.89% after rising 1.09% during the prior week.

Analysts also pointed out that traditional tax season segments — especially vehicles below $10,000 — continue to do well as evident by the 1.75% price climb by subcompact cars.

Black Book added even the near luxury car segment has joined the price-climb movement as it “finally moved into positive territory” with a 0.43% price gain a week ago.

In the truck world, the overall price increase nearly doubled what analysts spotted a week earlier, which was a 0.33% price hike.

“The subcompact crossover segment’s low price point makes it an attractive choice for tax season preparation,” analysts said, noting that prices for these models jumped 1.39% last week.

Prices for full-size trucks continue to climb, too, rising another 0.75% last week after increasing 0.46% during the week prior.

Should wholesale prices maintain this pace, Black Book might be reporting another index record in March.

The Black Book Used Vehicle Retention Index is calculated using Black Book’s published wholesale average value on 2- to 6-year-old used vehicles, as percent of original typically equipped MSRP. It is weighted based on registration volume and adjusted for seasonality, vehicle age, mileage and condition.

The index dates to January 2005, when Black Book published a benchmark index value of 100.0 for the market. During 2008, the index dropped by 14.1% while during 2016, the index fell by just 6.4%.

During 2011, the index rose strongly from 113.3 to 123.0 by the end of the year as the economy picked up steam and used vehicle values rose higher. It continued to remain relatively stable, rising slightly until May 2014 when it hit a peak of 128.1.

To obtain a copy of the latest Black Book Wholesale Value Index, go to this website.

No matter how chief economist Tom Kontos and his team dissected most of their numbers, wholesale prices within the data available to KAR Global Analytical Services have demonstrated noticeable gains year-over-year.

The latest installment of the Kontos Kommentary included not only an in-depth comparison of the January data, but KAR Global also delved into some wholesale price information procured from the first couple of weeks of February.

According to KAR Global Analytical Services’ monthly analysis of wholesale used vehicle prices by vehicle model class, wholesale prices in January averaged $12,551 — up 5.6% compared to December. The figure also was 16.6% above pre-COVID/January 2019 readings and 13.1% higher relative to January 2020.

Looking closer at 3-year-old vehicles with 36,000 to 45,000 miles that typically are in the off-fleet and off-lease lanes, KAR Global noticed 7% price increases for midsize cars and midsize CUVs/SUVs.

When holding constant for sale type, model-year age, mileage and model class segment, prices for those particular midsize cars rose $873 to $13,574, while prices for those specific midsize CUVs/SUVs jumped $1,443 to $22,043.

And when Kontos and the KAR Global team expanded their look at those off-fleet and off-lease units to examine weekly price movements of cars, vans and pickups, as well as CUVs/SUVs through Feb. 14, they found increases of more than 25% in a single week for vans and three different weeks when pickup prices rose more than 20%.

“Average prices have been well above year-ago levels each week since the start of the year, regardless of vehicle type. CUV/SUV prices appear to be up less dramatically than the rest of the major segments perhaps due to their relative abundance from strong new sales of these vehicles in recent years,” Kontos said in the latest analysis.

Kontos elaborated about the latest wholesale price information in this video.

KAR Global Wholesale Used-Vehicle Price Trends

| |

Average |

Price |

($/Unit) |

|

Latest |

Month |

Versus |

| |

Jan. 2021 |

Dec. 2020 |

Jan. 2019 |

Jan. 2020 |

Prior Month |

Pre-COVID-19 |

Prior Year |

| |

|

|

|

|

|

|

|

| Total All Vehicles |

$12,551 |

$11,890 |

$10,761 |

$11,096 |

5.6% |

16.6% |

13.1% |

| |

|

|

|

|

|

|

|

| Total Cars |

$8.989 |

$8,484 |

$8,374 |

$8,271 |

5.9% |

7.3% |

8.7% |

| Compact Car |

$6.190 |

$5,877 |

$6,495 |

$6,278 |

5.3% |

-4.7% |

-1.4% |

| Midsize Car |

$7,403 |

$7,050 |

$7,394 |

$7,280 |

5.0% |

0.1% |

1.7% |

| Full-size Car |

$7,992 |

$7,676 |

$7,729 |

$7,462 |

4.1% |

3.4% |

7.1% |

| Luxury Car |

$15,108 |

$14,372 |

$12.771 |

$12,656 |

5.1% |

18.3% |

19.4% |

| Sporty Car |

$16,195 |

$15,636 |

$13,044 |

$13,772 |

3.6% |

24.2% |

17.6% |

| |

|

|

|

|

|

|

|

| Total Trucks |

$14,924 |

$14,251 |

$12,793 |

$13,171 |

4.7% |

16.7% |

13.3% |

| Minivan |

$8,064 |

$7,804 |

$8,496 |

$7,932 |

3.3% |

-5.1% |

1.7% |

| Full-size Van |

$14,700 |

$12,360 |

$12,585 |

$12,871 |

18.9% |

16.8% |

14.2% |

| Compact SUV/CUV |

$10,950 |

$11,188 |

$10,962 |

$10,399 |

7.5% |

-0.1% |

5.3% |

| Midsize SUV/CUV |

$13,780 |

$12,766 |

$11.192 |

$12,347 |

7.9% |

23.1% |

11.6% |

| Full-size SUV/CUV |

$15,975 |

$15,137 |

$13,957 |

$13,787 |

5.5% |

14.5% |

15.9% |

| Luxury SUV/CUV |

$21,179 |

$20,465 |

$17,613 |

$18,427 |

3.5% |

20.2% |

14.9% |

| Compact Pickup |

$14,888 |

$14,114 |

$9,734 |

$11,062 |

5.5% |

52.9% |

34.6% |

| Full-size Pickup |

$19,653 |

$19,191 |

$15,552 |

$16,168 |

2.4% |

26.4% |

21.6% |

Source: KAR Global Analytical Services.