It was nearly two-and-a-half years ago and the used-car market was amid the early hard punches of the COVID-19 pandemic.

That’s the last time that the Manheim Used Vehicle Value Index showed a year-over-year decrease, according to data from Cox Automotive.

While used-car values are still well above where they were in 2020, September marked the first year-over-year dip in the Manheim index since May of that year.

Cox Automotive reported Friday that wholesale vehicle prices …

Read more

In each month of the third quarter, wholesale used-vehicle prices fell sequentially.

That’s according to data and analysis around the latest Black Book Used Vehicle Retention Index, which dropped 4.1% in September, the third straight month-over-month decline.

Still, the index, which came in at 176.5 for the month, was …

Read more

The timeframe for data included in the newest Market Insights from Black Book coincided with the first day of October. That week also included Hurricane Ian smashing into Florida before drenching the Carolinas and other parts of the East Coast.

With the resulting flooding likely destroying an undetermined number of vehicles, Black Book’s analysts are keeping watch of the wholesale market, which saw values drop another …

Read more

Vanity Fair reported last week that James Earl Jones was retiring as being the voice of Darth Vader in future “Star Wars” projects.

Too bad.

Jones’ narration of the opening segment of Black Book’s Market Insights might have been appropriate to articulate how wholesale values softened another …

Read more

There’s a widening gap between wholesale and retail used-car prices, and it’s one that could end up helping dealers in the final months of the year.

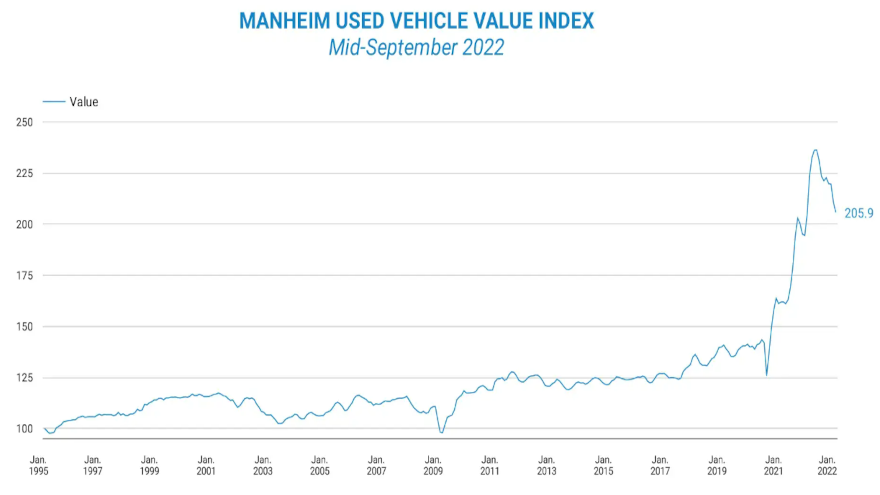

The mid-month reading of Cox Automotive’s Manheim Used Vehicle Value Index was down 2.3% from August on an adjusted basis, and just 0.6% higher year-over-year, according to a Data Point report from the company.

Unadjusted, prices were down 1.4% from August and down 1.5% year-over-year.

“Interestingly, retail used prices have not yet started following wholesale prices down at the same accelerated rate,” said Kevin Chartier, vice president of Manheim Market Insights, in a separate video report around the new Manheim Market Insights series.

“Retail used prices have been relatively flat all year,” Chartier said. “As a result, spreads between retail and wholesale prices continue to improve, which should go a long way toward helping dealers offset potential losses associated with liquidating excess and aged inventory heading into winter.”

According to the Cox Automotive data set, average weekly list prices for retail used cars are above $28,000 in September, compared around $26,000 in September 2021 and $21,000 in September 2020.

In the pre-COVID days of September 2019, used listing prices were below $20,000.

The Cox data set also delved into inventory levels.

The charts indicate that available used retail supply is between 2.4 million and 2.6 million units, with available wholesale supply between 100,000 and 150,000 units.

Chartier said during the video that as of mid-September, there was 48 days supply of retail used vehicles, which is a “normal” level and typical for this time of year.

Meanwhile, wholesale supply has climbed modestly since the start of 2022, but remains more than 40% softer than where it was during pre-COVID September 2019, Chartier said.

“With retail used supply back in the normal range, and spreads between retail and wholesale prices expanding, we expect wholesale prices declines to begin moderating in the fourth quarter, and are likely to follow a more typical fall seasonal pattern,” he said.

Black Book explained that typically it takes six to eight weeks for retail market prices to reflect declines in wholesale pricing.

The newest installment of Market Insights showed the automotive world is about at that point.

Analysts reported wholesale values fell another …

Read more

Wholesale prices are softening so much that even year-over-year comparisons made by Cox Automotive show only modest differences.

Cox Automotive reported on Monday that wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) dropped …

Read more

Upon reporting that wholesale values dropped another 0.93%, Black Book gave a succinct summary of the current auction scene through its latest installment of Market Insights released on Tuesday.

Analysts said, “The market continued to …

Read more

While still higher versus a year ago, Cox Automotive noticed its wholesale price index made a near-record move lower in August.

Cox Automotive reported on Thursday via a Data Point that wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased …

Read more

Perhaps the timeframe should be considered since the drops in wholesale values and estimated average weekly sales rate reported by Black Book derive from the span that closed during the heart of Labor Day weekend.

Still, Black Book said on Wednesday that wholesale values dropped by another 0.93% last week, while the estimated average weekly sales rate slumped to …

Read more