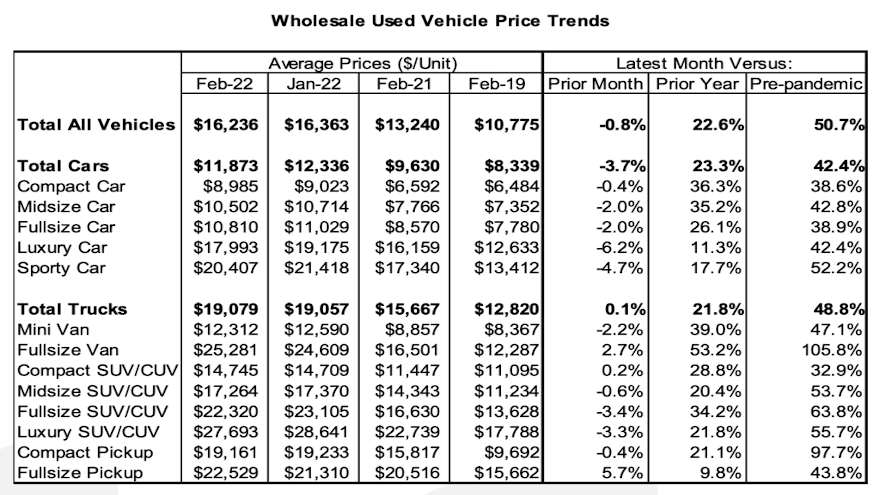

Though still considerably higher than year-ago levels, wholesale vehicle prices declined sequentially for the second consecutive month.

And the slowdown appears far from over, according to Cox Automotive, which said its Manheim Used Vehicle Vehicle Index came in at 223.5 in March.

While up 24.8% year-over-year on a mix-, mileage- and seasonally adjusted basis, that reading is 3.3% softer than February’s.

Without the seasonal adjustment, prices were up 0.6% from February and 23.2% from March 2021.

Looking forward, the current month could be …

Read more

Along with his usual review of wholesale price data compiled within KAR Global, chief economist Tom Kontos also used his regular industry update to offer a forward-looking price assessment, leveraging figures from the U.S. Bureau of Labor Statistics.

For his newest Kontos Kommentary, Kontos examined the historical relationship between the used- and new-vehicle consumer price indexes generated by the federal agency. He blended the data to create the ratio of the used vehicle CPI to the new vehicle CPI going back to January 1990.

Read more

What you might have thought of as just a back-lot beater that only starts, steers and stops might be the vehicle currently most in demand in both the wholesale and retail markets.

Black Book said the “real headline” of last week was the value increase for vehicles 8 to 16 years old, as analysts determined prices for these units rose 0.19% during the stretch that closed on the day after April Fool’s Day.

Read more

Black Book said the estimated average weekly sales rate continued to climb, as during the timeframe that concluded on Saturday, it stood at 67%, marking a similar rise they saw last week and “another positive indicator for a spring market.”

Analysts rattled off several more reasons why spring might be germinating in the wholesale market despite some places still getting snow. Black Book said wholesale values softened just 0.28% last week, only about half of what the downward movement was a week earlier.

Read more

Black Book identified “the real winners right now” amid a wholesale market where prices are still softening and the estimated average weekly sales rate has not jumped like this time last year.

Analysts determined wholesale values dipped another 0.51% during the week that closed in between St. Patrick’s Day and the first day of spring; typically, a time when dealers are feeling pretty lucky because some are making a pot of gold during tax season sales.

Read more

Average gas prices in the U.S. were at $4.239/gallon on Monday, which is $1.374 higher than they were a year ago, according to the U.S. Energy Information Administration.

It’s no wonder, then, what has happened to the cost of used vehicles that run on alternative sources of energy, even amid a market already inflated by material and geopolitical impacts …

Read more

Major League Baseball settled its labor dispute last week, so spring training is intensifying quickly in Florida and Arizona.

But wholesale prices softened another 0.64% last week, prompting Black Book to wonder when dealers are fully ready to embrace the spring season.

In the latest installment of Market Insights, Black Book on Tuesday said, “week-over-week adjustments are still larger than typically experienced this time of year, as the market still waits to see if we will see the ‘spring bump.’”

While not as much as the previous week, Black Book indicated car segment values on a volume-weighted basis decreased more than the overall market, softening 0.81% last week. For reference, the previous week’s decrease for cars was 0.97%.

Analysts said prices in all nine car segments declined last week, with sporty cars pacing the decreases at 1.33%, marking a third week so far in 2022 with drop exceeding 1%.

Perhaps showing some preps for spring retail activities, Black Book noticed that prices for compact cars softened the least at 0.38%, reducing the previous week’s value decline (0.72%) by more than half.

The value decrease decelerated among trucks, too, as Black Book’s volume-weighted data showed overall truck segment prices decreased 0.56% last week; which was not as much as the previous week’s drop of 0.85%.

Almost like clockwork, analysts said prices for full-size vans rose another 0.37%, increasing for 59th week in a row. Black Book pegged the average rise during the stretch at 0.62%.

And with a gallon of gas well above $4 nearly everywhere, analysts pointed out that values for full-size SUVs still are showing stability, ticking up 0.01%.

Meanwhile, Black Book said prices for sub-compact and compact luxury crossovers declined 1.02% and 1.11%, respectively.

One other metric to mention before getting into Black Book’s newest expectations. Analysts said that the estimated average weekly sales rate has started to pick up over the last few weeks with the latest estimate at 65%, noting that this is “a positive indicator of a traditional spring/tax-season market.”

Last spring, Black Book recapped that the estimated average weekly sales rate increased around 10 percentage points during a six-week period, rising from about 64% to 75%.

“The lanes are heating up as dealers plan for a spring/tax-season market. Franchise dealers have been somewhat absent as they continue to purchase upstream or at grounding, but large independent dealers and rental companies have been hot and heavy in lane,” Black Book said in the newest report.

“With several manufacturers freezing fleet sales, rental companies have struggled to meet demand and have been actively purchasing vehicles both in lane and at dealerships,” analysts continued. “It seems like rental companies have started being more active in lane as COVID restrictions are rolled back and Americans prepare to travel.

“As wholesale values continue to decrease — this week at 0.64%, more than twice the depreciation seen this same week pre-pandemic — some sellers are still holding tight to their floors while others sell it all,” Black Book went on to say.

“With additional production constraints due to chip and raw material shortages, and OEMs warning against aggressive dealer market adjustments, used vehicles will be in the spotlight again as we head into the first big buying season of the year,” analysts added.

Tuesday was the first day of March, and signs of the spring market might be germinating in the lanes.

According to Black Book’s Market Insights, wholesale prices still declined last week, but not as much as analysts had seen earlier in February. Black Book pegged the latest weekly value decline at 0.61%, which is 17 basis points less than the decrease analysts noticed during the previous week.

Read more

It’s shaping up to be an unusual spring.

Spring training isn’t the usual buzz because of the labor clash involving Major League Baseball. And Black Book is seeing wholesale values soften, even as IRS data shows a double-digit rise in federal income tax filings that often can fuel what happens in the lanes.

Read more

The delicious chicken wings and cold beer you might have enjoyed for Super Bowl Sunday likely are long gone, but Black Book’s experts are seeing the potential for something tasty cooking at the auction, with values declining at a pace much higher than seen before the pandemic.

After considering the data Black Book shared in its newest Market Update on Tuesday, you can be the judge if what’s on the possible wholesale menu will be to the delight of dealers or consignors.

Read more