1-year-old used cars were 1.3% pricier than new cars last month, says iSeeCars

It may seem counterintuitive, but in January, asking prices for used vehicles from the 2020 and 2021 model years were 1.3% higher on average than the new-car editions from 2021 and 2022 model years.

That’s according to a report from iSeeCars.com, which analyzed 1.5 million sales of these vehicles last month.

“While choosing a lightly used car has traditionally been a cost-saving measure for car shoppers, that is no longer true in today’s market as the effects of plant shutdowns and resulting pent-up demand continue,” iSeeCars executive analyst Karl Brauer said in the report.

“The used vehicles that are commanding the highest increases over their new versions include a mix of two extremes: expensive gas-guzzling SUVs and more economical small cars and hybrids, which shows that even practical and budget-minded consumers are being forced to spend more for their vehicles,” he said.

As Brauer alluded to, the used-to-new price gap is exponentially higher for some models, which iSeeCars detailed through its ranking of “Top 15 Used Cars More Expensive than New.”

At the top of that list is the Mercedes-Benz G-Class, where a 1-year-old model costs 35.6% more than a brand new one.

“The Mercedes-Benz G-Class opulent off-roader is a status symbol that had record sales numbers in 2021,” said Brauer. “Its success led to a shortage of new versions, forcing dealers to halt orders in January and leading well-funded buyers to the used car marketplace.”

Backlogs were the name of the game for the models in the Nos. 2 and 3 spots: the Chevrolet Corvette, where a 1-year-old unit will cost 20.2% more than a new one, and the Tesla Model 3, which had a 17.8% higher price for lightly used.

“The mid-engine Chevrolet Corvette is one of the most highly-anticipated American sports cars ever made, and demand for the car has exceeded supply since its launch for the 2020 model year,” Brauer said. “Dealers have a backlog of orders for the 2022 model, and long waitlists have formed for the high-performance Z06 version coming for the 2023 model year, elevating demand for lightly used versions.”

As for the Model 3, he said: “Deliveries for new base versions of the Model 3 aren’t expected until June of 2022, heightening the already high demand for used examples, which are in relatively short supply.”

Other vehicles on the list include a mix of various-sized SUVs, along with a pickup, minivan and two subcompact cars.

Regarding the latter, Brauer said of the No. 11 Kia Rio and No. 15 Hyundai Accent: “These vehicles are among the most affordable cars on the market, and the surge in used car prices have made economical cars like these the only affordable options for many consumers. It’s likely buyers see their used car price tags of under $20,000 and don’t comparison shop against new prices for the same models, which cost about $2,000 less — assuming you can find one on a (dealer’s) lot.”

And his comments on the No. 10 Kia Telluride SUV may explain why these later-model used cars, in general, are fetching such high prices.

“The Kia Telluride has been a red-hot seller since its debut in the spring of 2019, and dealers have been charging over MSRP because it’s in such high demand,” said Brauer. “The price hikes have trickled down to the used car market, where used Tellurides aren’t yet abundant and buyers may be willing to spend whatever, it takes for a used version because it’s likely the only one available.”

Conversely, the iSeeCars analysis also breaks down the 15 new cars that have the highest price over their 1-year-old used counterparts.

Topping that list was the Ford Mustang, where a new model is 19.4% more expensive than a 1-year-old used model.

In general, Brauer said: “Used-car prices are not seeing the dramatic drop they have historically seen due to a unique market condition we're experiencing related to new car shortages. Used-car shoppers can still save money buying a lightly-used car versus a new car, but the savings are 25 to 30 percent what they would normally be when buying used versus new right now.”

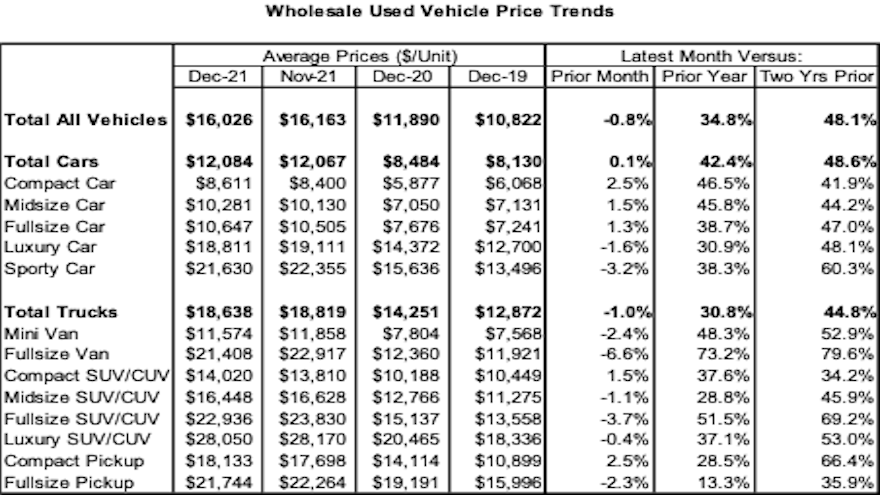

One-year-old used vehicles have also been fetching higher prices than usual in the auction lanes, at least in 2021. A January presentation from Cox Automotive shows that the 1-Year-old Model Manheim Market Report Index by Week was elevated above 100% for most of last year, finishing 2021 above 130%.

Comparatively, the weekly price index for 1-year-old cars finished just below 100% in 2020, and was in the 90s to finish the most recent preceding years, according to the Cox/Manheim data.

One major driver of low 1-year-old supply of wholeale and retail supply (and subsequent high prices) is the low number of off-rental vehicles at auction.

The Cox report indicates that in the fourth quarter, rental check-ins at auction were around 30% of what they normally are, as "lack of new replacement vehicles (is) suppressing de-fleeting activity."