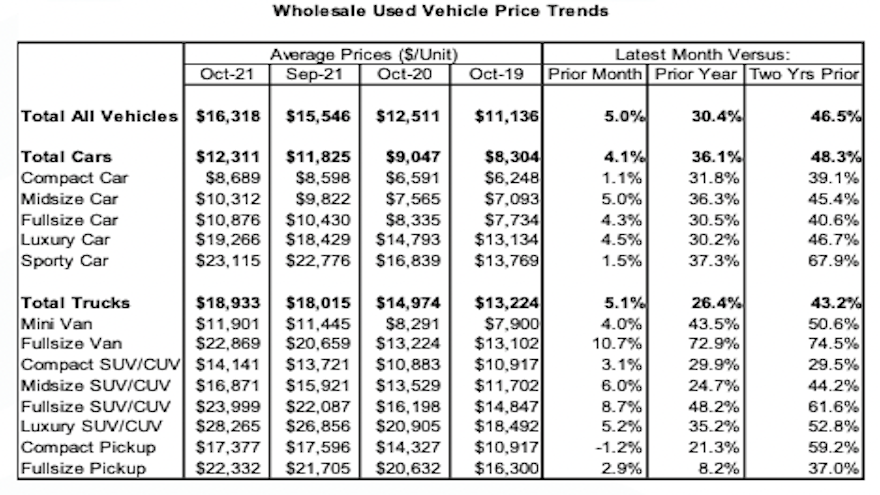

Used-car managers might agree with the description Black Book gave the 2021 wholesale market, calling it a “wild ride” in the first installment of Market Insights for the new year released on Tuesday.

Read more

The final reading of the Black Book Used Vehicle Retention Index put an exclamation point on just how unique 2021 was when it comes to wholesale prices.

Black Book revealed the December index reading on Tuesday, saying it increased another 5.8 points (or 3.1%) from November to land at 195.7.

Analysts determined that rise left their index 52.0% above where it was at the end of 2020.

Perhaps 2022 might be different.

“During the last two weeks of 2021, we started to see declines in wholesale prices in multiple segments, leading to only a small increase in the overall monthly Retention Index,” Black Book chief data science officer Alex Yurchenko said in a news release.

“As new inventory levels leveled off (and improved for some OEMs) and consumer demand softened, demand at wholesale channels slowed down at the end of the year,” Yurchenko continued. We expect a stable wholesale market in January, even as the number of COVID cases increases significantly across the country.”

The Black Book Used Vehicle Retention Index is calculated using the company’s published wholesale average value on 2- to 6-year-old used vehicles, as percent of original typically equipped MSRP. It is weighted based on registration volume and adjusted for seasonality, vehicle age, mileage, and condition.

To obtain a copy of the latest Black Book Wholesale Value Index, go to this website.

Well, perhaps you can call it a gift for used-car managers. At least wholesale values aren’t rising as much now as they did earlier this year.

That’s the gist of the latest Market Insights from Black Book, which described the auction scene as dealers get ready for what some stores call the “13th month.”

Read more

Used vehicles, in general, are pricier these days, fetching nearly 28% higher prices than they did a year ago, according to iSeeCars.com

And some models are seeing prices soar even higher than that.

Read more

Another day, another wholesale vehicle value index reaches a third-straight record high.

Same as the Black Book Used Vehicle Retention Index's record streak reported Monday, Cox Automotive said Tuesday that its Manheim Used Vehicle Value Index has now reached record highs for three straight months.

Read more

Auctioneers and ringmen need reflexes the caliber of professional athletes nowadays, especially if a clean, low-mileage vehicle is crossing the block.

Black Book recapped intensifying scenes now happening at auctions, as dealerships and yes, rental companies, vie for models that satisfy their respective customers.

Read more

On the auction block, on the dealer lot and in the consumer’s driveway: used-car prices are going up, and in some cases, breaking records.

Starting on the wholesale side of the market, the Black Book Used Vehicle Retention Index, which was released Monday, has now reached a record high for three straight months.

Coming in at 189.9 points for November, this marked a 9.7-point (or 5.4%) month-over-month increase and a 45.4% year-over-year spike.

“With no short-term resolutions to new inventory problems, dealers are continuing to spend money on used inventory, pushing wholesale prices up to new records across all segments in November,” Black Book chief data science officer Alex Yurchenko said in a news release.

“Cars of all sizes and vans had the largest increases as used and new inventory in those segments declined to much lower levels compared to other segments of the market,” Yurchenko said. “We expect the used-car prices to increase again in December, but at a much lower rate as the volume of new inventory is starting to level off and consumer demand is softening a bit with record breaking used retail prices.”

Speaking of retail prices, iSeeCars.com analyzed more than 1.9 million November sales of used vehicles ages 1 to 5 and determined they fetched an average of $31,848.

This was 27.9% higher than the average selling price in November 2020. And in October, prices for the same group of used vehicles was up 24.9% year-over-year, according to iSeeCars.

“Used car prices had drifted down, slightly, since they peaked in June, but they are back on the rise again, with the average used vehicle priced nearly over $7,000 above where it was last November,” iSeeCars executive analyst Karl Brauer said in an analysis.

“With microchip shortage-related plant shutdowns persisting throughout the year, automakers have not kept pace with pent-up demand, and lingering supply constraints that are expected to continue well into 2022,” he said.

Used cars are also fetching a pretty penny when consumers trade them in, according to an analysis late last month from J.D. Power.

The firm said in a forecast released Nov. 24 that trade-in values were likely to reach an average of $9,549 for the month, an 83% year-over-year increase. And here’s the kicker: monthly average trade-in values had never before eclipsed $9,000, J.D. Power said.

KAR Global chief economist Tom Kontos acknowledged during a recent Auto Remarketing Podcast that he and his analytical teammates are extra careful nowadays to make sure they’re seeing the latest wholesale value numbers correctly.

The latest information shared through the Kontos Kommentary reinforced why company experts are making those concerted efforts.

Read more

Wednesday marks the opening day of December, so Black Book took the opportunity to give auctions and dealerships a reference point for how the final month of the year might unfold in the wholesale market.

Read more

In a conversation recorded in person during Used Car Week, KAR Global chief economist Tom Kontos returned for another episode of the Auto Remarketing Podcast.

Kontos shared how often he and his KAR Global team had to be sure they were looking at wholesale trends correctly since so many unique patterns surfaced this year. And Kontos also touched on what he plans to watch closely in 2022.

To listen to the episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.