Aside from surging numbers from 2016 model-year vehicles, auction sales volumes slowed in June, according to the latest Guidelines report from NADA Used Car Guide.

But year-to-date volume is still on the rise, particularly for late-model vehicles.

NADA Used Car Guide data indicates that there have been 2.29 million auction sales of vehicles up to 8 years old through six months of 2016. That beats year-ago figures by 5 percent.

There have been 1.34 million late-model vehicles (3 years old or younger) sold at auction this year, which is up 9 percent year-over-year.

Put differently, late-model vehicles represented more than 58 percent of auction sales volume in the first half.

One slice of the late-model segment — 2016 vehicles — were particularly strong in June.

This was the only segment to see an increase in auction sales volumes (up 30 percent) for the four weeks ending June 27, NADA Used Car Guide said.

However, overall auction sales volume was down 6 percent.

Year-to-date, the 2013 model-year class has seen the greatest increase (27 percent) with 509,000 cars being sold at auction. This is no surprise, NADA Used Car Guide said, with off-lease gains as high as they are.

Segment-wise, large pickups were the biggest story in the first half of the year. Their auction sales volume climbed 34 percent, more than any other segment, NADA Used Car Guide said.

While circling back as to how current wholesale price levels might impact movements during the second half of the year, Cox Automotive chief economist Tom Webb acknowledged scores of vehicles currently are sitting at auction because they have an open recall and cannot be sold. The situation might become even more obvious depending on how many current Volkswagen diesel owners opt to dispose of their units as a part of the automaker’s ongoing rectification of what’s been dubbed in some circles as “Dieselgate.”

Of course, there are vehicles from a wide array of badges that can’t go down the lanes, which Webb indicated is “obviously extremely unfortunate because we’ve had some very good pricing in the market now.

“When they’re available for sale, you’re not only fighting the seasonal trend but also probably a cyclical trend downward, too. It’s been extremely unfortunate, and I know everyone would rather have those units available, but that’s simply not possible,” Webb continued when he hosted his quarterly conference call soon after the latest Manheim Used Vehicle Value Index was released.

Unlike the VW situation where the OEM and federal regulators continue to collaborate on an approved repair, other open recalls are not triggering as much of a public outcry but still are causing issues for auctions, consignors and dealers.

“For many of them, the parts are not readily available so they are not going to come back into the market very quickly,” Webb said. “There is some concern that if you were able to wave a magic wand and fix all of these open recall units and push them on the market that would have a depressing impact on price. But the fact of the matter is there is no magic wand and they will come back into the market at a relative steady rate."

As previously reported by Auto Remarketing, Manheim said that wholesale prices are now at their highest level in more than four years after rising every month in the second quarter. Webb attempted to project what the current level might do to price movements later in the year, especially in autumn as off-rental activity ticks higher in conjunction with off-lease volume that’s already on the rise.

“I would say frankly I’m a little surprised by the strength in wholesale prices so far this year,” Webb said after the latest Manheim data indicated the Manheim Index now is only 1.3 percent away from the record high reached in May 2011.

“As anticipated, the volumes have been quite strong and they pretty much have been in line with what we’ve expected,” he continued. “There are of course some units sitting at auction that you can’t sell because of recalls. One could argue that might have had a positive impact in terms of prices, but that’s arguable.

“Almost everyone is expecting that prices will decline. To get to what we’ve expected for the year, we’re going to have to have a steeper fall off,” Webb went on to say.

As parts for recalls become available, it means the service bays at franchised dealerships are humming. Webb pointed out what that situation means for auctions beyond just bringing down the sales hammer each week.

“The amount of reconditioning work that is done varies quite a bit by consignor and the types of vehicle segments that they’re selling,” Webb said. “Given the shifts we’ve had, that favors the recon environment from our standpoint. Off-lease units that get into the open auction process are probably going to have more recon attached if they get to the physical auction.

“But in terms of the practices of the individual consignors, I don’t think they have substantially changed,” he continued.

“Where we have seen some changes is there is probably better utilization where buyers who are buying units and doing post-recon work at our facilities,” Webb went on to say. "Some of that has been because we’ve been better at marketing it as well as related to the recalls because the dealers’ service facilities are backed up with their own recall activity. Therefore, to the extent they can get the work done at auction, they avail themselves for that opportunity.”

Also of note, Webb quickly touched on conversion rates and what they might do to the wholesale market going forward.

“The conversion rates at auction were not very good in March and early April, but they’re now back to normal or even a little bit higher than normal, which is a good thing,” he said.

Unless you’ve been living under a 2-ton truck, you likely haven’t missed the news that leasing hit a high during the first quarter this year, surpassing 30 percent of all new-vehicle transactions.

Given that information, you’ve likely thought about what happens as all these off-lease vehicles start returning to the market in droves.

Here at Auto Remarketing, we’ve been thinking a lot about this, too, asking such questions as: “How will this affect used-car pricing?” And even, “Should we panic?”

We recently spoke with Andrew Stuart, president and chief executive officer of TD Auto Finance, to get his take on the matter.

“I’ve been in this business my entire career. I’ve seen a lot of cycles come and go,” Stuart said.

Read: He’s got some insight to lend.

“We’ve had steady increases in the overall new vehicle sales figures across the U.S. from 2010 to 2016, going from 11.6 million cars to 17.8 million is the latest forecast for this year,” he said.

“More importantly, we’ve noticed that from 2010 to 2015 fourth quarter, we’ve seen a 42-percent increase in leasing. As a lender, we’re paying attention to that. I think that as these consumers are utilizing leasing on a more frequent basis across the spectrum (as opposed to just using leasing in the luxury segment, where it’s always been a big factor), we’re going to start seeing some young cars returning to the market in greater numbers.”

Consider that more than 3 million vehicles will reach the end of their lease this year. That number is expected to rise to 3.6 million next year and 4 million in 2018, according to Manheim — levels, Stuart notes, not seen since the early 2000s.

“My view as a lender is that it’s going to do two things. First, it creates an opportunity for financing,” Stuart said.

“Obviously, these cars are going to be sold through dealers and retail channels, so there should be an opportunity there for all of us that are playing in the auto lending space and for dealers as well.”

But the other side of the coin, Stuart said — one that he’s been watching very carefully — is that the influx is going to put downward pressure on prices.

“It’s simple supply and demand,” he said.

While some have referred to the increase in off-lease vehicles as a “glut,” Stuart feels that description is premature.

“My personal view is that we’re not there yet. I think we need to be careful though and keep a close on eye on it. … There has been pent-up demand (for used vehicles),” he said. “But I think we’re kind of getting to that tipping point, where over the last few years we’ve certainly seen the effect of that pent-up demand driving used-car prices.

“Looking at Manheim and NADA (indices), we see that used-car prices have been above-average for sure. But there’s certainly a case to be made that we could be getting to a tipping point.”

As for what that tipping point may be, Stuart hesitated to put a specific number on it.

“My view is that given the fact that we’ve been running below 2 million lease returns for the last several years, we’re seeing this dramatic upturn driven by an increase in leasing percentage. … I think that over the coming years we are going to see pressure on used-car prices,” he said.

“I don’t want to use the word glut or overdramatize it, but I go back to the early 2000s. That was ‘normal’ leading up to the financial crisis. Then over the last several years we’ve had this pent-up demand we’ve been working through, so used cars have been being absorbed very easily in the marketplace.

“I don’t want to give the impression that I’m worried about the market,” he emphasized. “I think we’re at a healthy level.”

Stuart mentioned a trend worth considering: Traditional car ownership is coming under pressure. Car sharing is increasing in popularity, he said. More people in urban environments are looking at the cost of car ownership.

And while the hindrances associated with urban car ownership (parking, insurance, cost of owning vs. actual usage) are not new, the alternatives — driven by technology — to some degree are.

“As we’re able to make car sharing companies actually work for us in our daily lives, that’s when we start seeing people adapting to technology. It used to be that you had to hail a cab in the city. Now you’ve got it right on your mobile phone,” Stuart said.

“You can see it just looking at the manufacturers,” he continued. “Big investments are being made by OEMs to be a part of this.”

It’s not just the supply boost that slowed wholesale vehicle values in May.

Some of the decline, says ADESA chief economist Tom Kontos, was driven by flat used-car retail sales and a dip in certified pre-owned sales (albeit year-to-date CPO sales are still up and at a record pace).

“This limited the demand side support for wholesale values, which are already receiving downward pressure from supply growth,” Kontos said in his monthly video recap of the wholesale vehicle market (which can be seen in the window above).

Citing data from the National Automobile Dealers Association, franchised dealers saw their used retail sales fall 0.5 percent year-over-year in May, while independents were up 1.2 percent, he said in his May Kontos Kommentary report. Both showed significant month-over-month growth, however.

According to Autodata Corp., CPO sales in May dipped 4.6 percent year-over-year and 4.8 percent month-over-month, Kontos said. This was the second consecutive sequential decline.

“The bottom line is, we didn’t get the kind of demand side support we had been getting in previous months, this year and last year, to support wholesale used-car values,” he said.

Overall, wholesale values fell 1.4 percent month-over-month in May. Prices continued to beat year-over-year comparisons, with May prices up 2.4 from the same month of 2015.

“But even that is largely because of the price strength of trucks,” Kontos said.

Truck prices were down month-over-month in May (1.3 percent), but were up 5.8 percent year-over-year. Car prices softened 1 percent from April and 1.7 percent from May 2015.

Manufacturer consignment was fetching prices 2.5 percent higher on a month-over-month basis and 2.8 percent softer on a year-over-year basis, according to the ADESA report.

Fleet/lease consignment prices dipped 0.6 month-over-month and 0.8 percent year-over-year. Dealer consignment prices were down 1.9 percent from April and up 2.3 percent from May 2015.

Wholesale vehicle prices climbed sequentially for the second straight month and posted a year-over-year gain for the first time in 2016.

But don’t take that to mean those supply-driven expectations for downward sloping used prices are suddenly over, Tom Webb warns in commentary accompanying the latest Manheim Used Vehicle Value Index.

“They do suggest, however, that dealers have continued to achieve efficiency gains that are allowing them to bid up auction prices even as gross margins narrow,” he said, referring to the two straight months the index has climbed sequentially.

“That’s encouraging to commercial consignors who have been expecting, and preparing for, greater weakness in wholesale pricing,” said Webb, Cox Automotive’s chief economist.

The May reading of Manheim’s index was at 124.5, which is up 0.6 percent year-over-year.

Pickups, whose prices were up 6.3 percent from May 2015, vans (up 1.5 percent) and luxury cars (0.6 percent) showed value gains.

Midsize cars and SUVs/CUVs were both down 0.3 percent. Compact cars showed the most contraction, as their prices fell 5.1 percent.

The latter found Webb posing this question in his comments: “Did compact car prices find a floor?”

On a mileage- and seasonally adjusted basis, their prices were up more than 2 percent month-over-month.

“If you’re optimistic, view it as a ‘dead cat bounce.’ Year-over-year, compact cars remained the weakest segment — and they too had a sizable number of off-lease units coming back,” Webb said. “So, yes, if a floor was found, that would be a good thing.”

Regarding Webb’s point on off-lease volume for compact cars, it has also led to these vehicles — along with midsize cars — grabbing the most share of the certified pre-owned market.

According to the Q1 Used Vehicle Market Report from Edmunds.com, 21.1 percent of CPO sales in Q1 were midsize cars and 20.6 percent were compacts.

The next closest was the compact crossover SUV, with a 13.6-percent share of Q1 CPO sales.

“Despite having little to negative year-over-year price growth, midsize and compact cars are the largest CPO segments,” Edmunds said in the report. “Leasing in these segments has become quite prevalent and has led to a healthy supply of vehicles that meet certification standards.”

Certified pre-owned vehicle sales keep setting new records, seemingly on a monthly basis. But NADA Used Car Guide executive analyst Jonathan Banks proposed that automakers and dealers are going to need more than just CPO programs in order to handle the steadily growing volume of off-lease units.

Part of what is triggering Banks’ concern is what he’s seen OEMs do so far this year. According to NADA UCG’s analysis of data from J.D. Power’s PIN Network, which covers about 35 percent of the total auto finance market, there has been a 5-percent rise for lease subventions.

“Manufacturers have been very reliant on lease subvention to keep (new-vehicle) sales humming,” Banks said. “I don’t believe this is sustainable.”

If the practice to turn new metal does not continue long-term as Banks suspects, there are still going to be additional off-lease vehicles for automakers and dealers to handle. It’s been widely reported by Auto Remarketing that industry experts see that off-lease volume growth this year could reach 800,000 units and maybe more.

“On the used-car side, manufacturers should really work closely with their dealers to create a comprehensive used-vehicle strategy that’s a lot more than just creating a certified program,” Banks said. “Certified is great and it’s great for a lot of customers. But there are a lot of customers who will be coming back that won’t want to pay the money for certified.

“They’re going to have all of this used inventory coming back,” he continued. “To me with the amount of data that’s available out there, I think manufacturers can work closely with the dealers on the lease maturities coming back. Get the vehicles to the right dealers. Price the off-lease supply correctly for the dealer so they can still make a profit. It’s all about working together to ensure that the off-lease inventory is getting to the right regions and are sold at the right price to get the right turn to keep that used-vehicle channel humming.”

Banks also cautioned that franchised dealers have to avoid a rivalry that might erupt within the store — a clash between the new department versus the used division.

“You’ve got to remove that idea that used vehicles are cannibalizing new,” Banks said. “You should look at new and used working together to enhance that customer experience for the individual franchise. CPO plays a role; some creative financing plays a role, too, in making sure that used buyer is getting the same brand experience as a new buyer.”

Stop me if you’ve heard this one before: there’s a massive amount of used-car supply hitting the market this year.

But the gobs of pre-owned inventory, particularly the off-lease variety, is a big story.

And perhaps it gets oodles of attention because of just how stark the contrast is to a few years ago, when many dealers were scrambling to fill their used-car lots.

And to their credit, dealers and the industry overall got creative: hitting the service lane for cars, lease pull-ahead programs, trades with other dealers and so on.

But the inventory glut has not made them any less innovative.

For instance, take vAuto, which launched a product at the NADA Convention & Expo called Stockwave that is designed to help dealers efficiently source auction vehicles that align with their inventory and profit objectives.

Interestingly enough, a flood of used cars helps drive the need for this, said vAuto founder Dale Pollak.

“It actually makes it more important, because there’s more cars to sift through,” Pollak said in an interview at NADA. “And the more inventory there is to look at, the longer it takes and the harder it is to keep objective (about) finding the right one. It really makes a big, ugly task very manageable, very efficient.”

vAuto certainly is not alone in the used-car sourcing space. In the expo halls at NADA and throughout the industry are companies that put a digital focus on helping dealers acquire the right used cars, be it through dealer-to-dealer trade networks, acquiring trade-ins from private consumers or wholesale remarketing channels.

Car Lister, TradeRev, DRIVIN, The Appraisal Lane, eAutoAppraise (which, according to the company’s website, helps generate sales leads for dealers from consumers looking to get a value on their trade).

Though similar projects can be found in recent industry history, it’s interesting to note that operations for companies like these are ramping up just as used-car supply has begun to do the same.

Earlier this year, Car Lister, which also works on the consumer side, launched a fully transactional e-commerce platform that lets dealers buy, sell, and trade with — and ship inventory to — each other.

Through the Dealer Wholesale Platform, dealers can create national wholesale groups to manage movement of vehicles between members.

Andrew Iorgulescu — one of the co-founders of OPENLANE — is co-founder and president of The Appraisal Lane, a used-car trade network for dealers.

When it comes to the off-lease surge, it’s really all about redistribution. And that’s not a new issue, he says. If a dealer gets a vehicle that’s not a core car, they’ve always needed a way to move it elsewhere.

“Dealers are still going to need cars, consumers are still going to be trading in their Acuras at the BMW store. Those cars are still going to need to be redistributed,” he said. “Just because Acura has a lot more lease returns coming back doesn’t necessarily mean the BMW dealer is all of a sudden going to be swimming in Acuras.”

An additional thought on the sourcing side is this: it’s still about getting the right cars, even if there are a lot more from which to choose.

In mid-March, Black Book announced a deal with DRIVIN in which it would be the company’s exclusive vehicle valuation provider. In a news release on the deal, Black Book’s Jared Kalfus made a point that emphasized the notion of getting the right cars.

“DRIVIN is disrupting the used-car industry by offering dealers a better way to source, acquire and receive the right, quality inventory for their lot,” said Kalfus, Black Book’s senior vice president of sales. “We are excited by this long-term partnership and look forward to being their exclusive partner for valuation services, while offering our dealers access to DRIVIN’s pre-negotiated inventory and premier sourcing service via our Black Book Digital mobile app.

“DRIVIN helps dealers rethink their sourcing strategy and stock the right used cars for their lot based on consumer demand, local market analysis and profit margins,” he added.

Of the nine car segments that Black Book tracks, luxury cars showed the greatest price decline last week.

Their dip in prices (0.55 percent) was more than twice the overall percentage decline for the nine car segments (0.22 percent).

In a recap of the Black Book Market Insights reports, Black Book poses this question, which might as well have been rhetorical.

“Could this be a result of all the off-lease volume returning to the market?” the company asks, referring to luxury cars leading the decline.

Black Book’s data incudes volume-weighted wholesale price averages for vehicles from model-years 2007 through 2013.

Meanwhile, in its data set — which measured the price trends among vehicles up to 8 years old — NADA Used Car Guide found that on a month-over-month basis, there were several luxury segments leading the downward used price movement.

Luxury large utilities (down 0.7 percent) had the greatest sequential decline in March, with luxury large cars second (down 0.4 percent) and luxury midsize utilities in third (down 0.1 percent), according to NADA Used Car Guide’s April Guidelines report.

While still increasing, luxury compact utility (up 0.2 percent), luxury midsize cars (up 0.3 percent) and luxury compact cars (up 1.0 percent) were still below the average industry change (an increase of 1.1 percent).

But perhaps a better tell for the impact on off-lease volumes is found in quarterly data.

NADA Used Car Guide looked at the quarter-to-quarter price changes that occurred from Q4 of 2014 to Q1 of 2015.

It then measured how much difference (in percentage points) there was between those percentages and the quarter-to-quarter price changes that occurred from Q4 2015 to Q4 2016.

The biggest percentage-point gaps occurred in compact utility vehicles, compact cars and midsize utility vehicles.

“For example, compact utility prices rose by 2.3 percent from Q4 2014 through Q1 2015, while they declined by 1.9 percent over the period this year — a loss of 4.2 percentage points,” NADA Used Car Guide's Jonathan Banks wrote in the report.

“The Q1 fall in compact car and midsize utility prices stands at a similar average of 4 points. Given Used Car Guide’s outlook for sizeable increases in off-lease volume, prices for these segments should continue to erode at an above average rate as the year progresses,” he added.

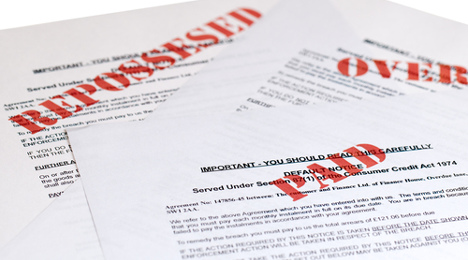

Experian Automotive’s latest State of the Automotive Finance Market report pinpointed the 10 states with the highest rates of 60-day delinquency after the fourth quarter as well as the 10 states where delinquency to the point where repossession is necessary are the lowest.

The two states tied for the highest 60-day delinquency rate each posted a reading 18 basis points higher than any other area. Experian indicated the rates for both Louisiana and Mississippi came in at 1.20 percent.

The complete rundown of the 10 states with the highest levels of 60-day delinquency includes:

—Louisiana: 1.20 percent

—Mississippi: 1.20 percent

—New Mexico: 1.02 percent

—Maryland: 1.01 percent

—Alabama: 0.97 percent

—South Carolina: 0.96 percent

—Georgia: 0.95 percent

—West Virginia: 0.84 percent

—Texas: 0.83 percent

—Nevada: 0.76 percent

Meanwhile, the 10 states where 60-day delinquency rates were lowest in the fourth quarter cover some of the more remote portions of the country, including where Experian spotted the lowest rate in Q4. Hawaii came in at 0.26 percent.

The places where vehicle installment contract holders are keeping up with their payment schedules best and 60-day delinquencies are lowest include:

—Hawaii: 0.26 percent

—South Dakota: 0.28 percent

—Oregon: 0.30 percent

—Minnesota: 0.33 percent

—Washington: 0.35 percent

—Iowa: 0.36 percent

—Maine: 0.38 percent

—Idaho: 0.39 percent

—New Hampshire: 0.40 percent

—Utah: 0.41 percent

You can expect 3.1 million off-lease units to hit the market this year, which is 800,000 more than there were in 2015, according to a data in a presentation from NADA Used Car Guide at last week’s NADA Convention & Expo.

This is expected to drive late-model supply to 13.4 million units this year, which beats last year’s figure by 12 percent, NADA UCG says, and would be the largest pool of cars 5 years and under since 2008.

That means more pickings for automaker certified pre-owned programs, which are on pace to reach another record year of sales.

And this cornucopia of cars in the CPO age range is, again, driven by a swarm of cars coming off lease.

That begs the question: where will off-lease cars be most prevalent?

Experian Automotive, in its presentation during an NADA Convention press conference, answers that both from a vehicle and geographic standpoint.

According to Experian’s data set, the Toyota Camry is expected to be the most common car coming off lease, with around 25,000 units returning to market. The Honda Civic is not far behind, with a shade under 25,000 coming off-lease.

The Honda Accord is next at approximately 20,000 off-lease units, followed by the Toyota Corolla, which is projected to have about halfway between 15,000 and 20,000 off-leases.

The Honda CR-V and Ford Escape are neck-and-neck, with Experian forecasting about 15,000 lease returns for each of those models.

Rounding out the top 10 are the Nissan Altima at No. 7 and Ford Fusion in eighth (both under 15,000), followed by the Lexus RX350 at No. 9 and the Toyota RAV4 in 1Oth. (both between 10,000 and 15,000 lease returns).

Geographically, here are the 10 market areas for consumer off-lease units, based on total estimated market count, according to Experian:

New York: 306,812

Los Angeles: 231,814

Detroit: 156,701

Miami-Fort Lauderdale: 81,670

San Francisco-Oakland-San Jose: 56,183

Cleveland-Akron (Canton): 45,641

Boston (Manchester): 41,923

Chicago: 35,577

West Palm Beach-Fort Pierce: 33,368