Continuing a theme in the Black Book Market Insights report series, wholesale truck prices are softening amid the spring selling season’s peak.

And, really, the early part of 2016, in general.

This downturn for many segments so far this year runs contrary to the trends spotted in the second half of last year, according to Black Book — and the last three weeks, the softness in values has been particularly noticeable, the company said, for segments like compact utilities and pickups.

A few truck categories are, as Black Book senior vice president of automotive valuation and analytics Anil Goyal put it, “facing the inevitable.”

For trucks, the three-week rate of decline in values has been 0.35 percent. For cars, it has been 0.13 percent. Last week, the decrease for car values was 0.04 percent. For trucks, it was 0.3 percent.

“Some truck segments are facing the inevitable,” Goyal said in the report. “Half of all truck segments declined at a higher rate than the luxury car segment, the cars’ worse performing weekly segment.”

So, what does Goyal mean by “inevitable?” Well, the strength they’ve shown in recent times won’t last forever, Black Book explained.

With additional truck supply hitting the market (which has already started to happen in 2016), prices will fall, the company said.

One other nugget from this week’s report: two car segments (compacts, up 0.4 percent; sporty cars, up 0.05 percent) actually increased in value last week. The compact car, in particular, had its highest weekly retention in more than a year. Aside from the flat subcompact crossover, all truck segments were down.

NADA Used Car Guide executive analyst Jonathan Banks frequently referenced the “reversal of a market” when he discussed nearly a half dozen different topics during his news conference on Friday to kick off the NADA Convention & Expo.

Banks told the media and other industry observers that the supply of used vehicles, credit conditions for buyers and new-vehicle incentives will reverse course from where they have stood for the past five years.

Beginning with supply, Bank indicated the amount of vehicles in the used market will increase significantly this year.

“We’re looking at a surge of about 800,000 vehicles coming off their leases this year,” Banks said. “Most of that volume will be dominated by compact and midsize cars with midsize and compact utility volume considerably higher as well.”

As a result of the increase, NADA UCG noted that late-model supply is forecasted to hit its highest level since 2008 and will be the biggest drag on used-vehicle prices this year.

So how will the industry handle all those vehicles that eventually will land in dealership inventory? Banks touched on the availability of consumers to secure financing for a purchase.

Banks projected credit conditions will likely reverse this year even though they are currently solid. At some point, however, Banks thinks the Federal Reserve will follow up its December decision to increase its target funds rate.

As a result, NADA UCG predicted that new- and used-vehicle loan rates should increase “subtly.”

Like credit and supply, Banks mentioned new-vehicle incentive spending is forecasted to switch direction this year.

For the past five years, NADA UCG noticed used vehicle prices have been “very strong.” Banks described a low used-vehicle supply and “fantastic” credit conditions contributed to “stable” used-vehicle prices

But as a result of changes to both supply and credit, NADA UCG suggested that OEMs will likely be more aggressive in their incentive spending.

Banks explained the outcomes of the reversal in used-vehicle market trends that will contribute to an expected 5 to 6 percent decline in used prices. Among them, depreciation as a result of higher incentive spending, will likely be a key outcome of the changed market, according to the NADA UCG expert.

Banks went on to mention steeper depreciation will increase the amount of time finance companies and consumers are in a negative equity position. He pointed out that this situation makes it harder for dealerships to sell vehicles in the future and raises the risk of higher incentive pricing.

In general, NADA UCG suspects that depreciation will increase most for trucks and utilities due to sharper increases in supply, however overall declines will be less than on cars.

In one scenario, Banks explained how the number of leases taken instead of traditional financing has exploded over the past several years. Banks pointed out the explosion can partially be attributed to high vehicle retention values as they keep payments low, despite higher new vehicle prices.

If new-vehicle prices are kept low with bigger incentives, Banks emphasized they will become a drag on used-vehicle prices moving forward.

“The big question is how much will OEMs increase incentives to cover the added expense? The size of the lease market would cost the industry hundreds of millions of dollars for midsize utility vehicles alone,” Banks said.

NADA UCG finalizes integration with MonroneyLabels.com

A recently signed deal between NADA Used Car Guide and MonroneyLabels.com created what the companies contend is the fastest and most accurate way for dealers to reproduce vehicle window stickers containing the NADA Values Online product.

As a result of the agreement between the two companies, users of NADA Values Online can print out an accurate, prepopulated, VIN-specific MonroneyLabels.com window sticker — which contains all the original factory options and OEM pricing of the vehicle and all on one sheet of paper.

“We are excited to work with MonroneyLabels.com on this product enhancement to NADA Values Online,” said Mike Stanton, vice president and general manager of NADA Used Car Guide

“Getting used vehicle inventory accurately priced and marketed quickly is a critical part of the selling process,” Stanton continued. “Our customers are empowered to deliver on that part of the process reliably and even more efficiently with this integration."

When asked what about the relationship between the two companies excites him most, MonroneyLabels.com chief executive officer Ned Nielsen said, "NADA Used Car Guide is one of the most trusted names in the industry, and we’re ecstatic about integrating with their leading product, NADA Values Online.

“By using our VIN-specific technology with NADA Values Online, MonroneyLabels.com will help change the way used vehicles are described, appraised and priced by giving everyone the correct factory option packages and pricing as built,” Neilsen went on to say.

Think about the old days for a second, Tom Kontos said. If there was a flood of cars from a certain segment (like off-lease) to hit the market, there wasn’t as many choices of business-to-business, competitive-bidding venues for the remarketing industry to sell those cars as there are today.

“In today’s world, with the embrace of multiple venues for selling cars, it helps mitigate the impact, to some degree, of an influx in supply that would normally put a lot of downward pressure on prices,” Kontos said in an interview with Auto Remarketing. “Now the cars can be, maybe, redistributed in various channels … there’s no flooding of the volume in one particular channel.”

In the introduction to the soon-to-be-released latest edition of the Pulse report from ADESA Analytical Services, Kontos writes about potentially increased new-car incentives and additional used-car supply growth adding more downward pressure on wholesale values.

Prior supply increases haven’t thrown off wholesale pricing too much so far, and Kontos doesn’t necessarily expect that to change this year.

“Balancing that downward pressure will be the continued embrace of upstream as well as traditional auction processes among remarketers, which will help dilute the usual negative impact of growing supply on wholesale values,” Kontos writes.

When asked about additional ways the remarketing industry is working to mitigate the impact of additional supply, he goes back to the additional sales opportunities and points this out: Even within the upstream venues themselves, there are “multiple iterations” of opportunity.

First, Kontos said, you could sell the car to the grounding dealer. Then, you can offer it to other dealers. And then make it an open sale.

Having these options opens the door to redistributing the inventory to other areas, so that not all of the inventory is concentrated in one specific corner of the country, Kontos said.

He goes on to note that “the other alternative would be to say, ‘OK, well, rather than try to draw the buyer into an upstream channel that allows them to bid on the car remotely, maybe what I should do is move this car physically to a different part of the country.’

“So, that’s kind of the old way of doing things, but it’s still tried and true, and it does work,” Kontos said.

Mix of vehicles

In the executive summary portion of the Pulse report, Kontos touches on the mix of wholesale consignment and how that has impacted and may continue to affect pricing.

“Just as new-vehicle sales growth was driven by trucks, which were in turn supported by low gasoline prices, wholesale used-vehicle price growth was concentrated in the van, SUV and pickup truck model class segments. Much of the year’s headline price trends were biased upward by a shift in sales to higher value off-rental and off-lease units, which masked underlying softness in the wholesale market arising from greater supply,” Kontos wrote.

“As that ‘richer mix’ reached a steadier state, wholesale prices fell to levels comparable or below those of the prior year,” he added. “In short, though retail demand has done an outstanding job of helping the wholesale market absorb incoming supply without dramatic reductions in price, this will be cumulatively a greater challenge going forward.”

Auto Remarketing asked Kontos about the market leaning towards those higher-value off-lease and off-rental units, and what he anticipates the mix to be like this year.

Kontos expects the mix to look much like it did in 2015. There should be less year-over-year change than there was last year.

The only caveat would be, “that we did have an influx of cars that were recalled in 2014, and they were held up for sale later on, and so they ended up selling in 2015,” he said.

“We won’t have that little anomaly, I don’t think, this year,” Kontos said. “So, that might change things a bit in the mix … If last year we saw a bit more off-rental program cars in high concentration in the first half of the year that would have sold in 2014, we won’t have that kind of anomaly in the data this year. But we will definitely see a mix that’s similar to last year in terms of younger, higher-dollar cars that are coming off lease or coming off rental.”

In essence, a similar mix, but with some differences in timing, Kontos said.

Among other consignment segments — including repossessions, rentals, lease, commercial fleet and dealer consignment — you can expect volumes to have a “general tendency to be higher” year-over-year, to varying degrees, Kontos said.

Much like the dealer consignment side of the auction lane, you can expect commercial consignment to rise this year and next.

According to a National Auto Auction Association forecast in Manheim’s 2016 Used Car Market Report, the drivers of the expected gains in commercial consignment are the spikes from prior years in new-car leases, outstanding finance contracts and business fleet purchases.

These would follow the year of growth in commercial consignment in 2015.

In the company's latest earnings conference call, executives with KAR Auction Services gave some color on how commercial consignment has trended for their ADESA subsidiary.

Commercial consignment at company’s physical auction locations was up 3 percent in the fourth quarter, a softer rate of increase than the 13-percent spike ADESA notched for the full year.

But don’t read too much into that.

“The lower commercial volume increase in the fourth quarter is not due to a lack of supply . We had a significant increase in the number of commercial cars on the ground at year-end. The consignors spent the ancillary services dollars on these vehicles, and they are ready to sell early in 2016,” said KAR chief financial officer Eric Loughmiller.

When prompted by a commercial consignment question during the Q&A later in the call, Loughmiller pointed out that there was a double-digit jump in the third quarter that preceded the 3-pecent dip and followed a strong second quarter and a “little weaker” first.

“It’s really the consignors, and it's predominantly going to be the OEMs and the captive finance companies, you had the cars coming back. They were selling aggressively on the upstream or the private-label site, which was up 32 percent for the quarter. But as it got to the physical auction, the cars are on the ground,” Loughmiller added. “They did the work to improve the quality of the vehicle, which is the ancillary services. And while we don't discuss a specific inventory number at ADESA, those cars are building up and we're seeing, as if you visit one of our sites, you'll see a lot of cars on the ground even right now.”

KAR chairman and chief executive officer Jim Hallett followed by saying that “there's the impact of the holidays that could be slowing down, pushing these cars to the channel.”

He also pointed out that less rapid increase in Q4 doesn’t indicate a trend, saying that, “I believe there's an anomaly that took place in the quarter.”

Overall, a couple of side trends to watch in commercial consignment:

- Off-rental: Manheim’s report indicates that the overall wholesale market took in about 1.66 million off-rental units last year (around 47 percent ended up being sold at an NAAA-member auction), and that should climb to about 1.8 million this year and stay there for a while.

- Off-lease: Volume here has been on rise since 2012, and should stay that way. Manheim Consulting data indicates there were 2.5 million off-lease units in 2015. That is projected to climb past 3 million in 2016, past 3.5 million in 2017 and approach 4 million in 2018

That said, Manheim’s report points out that many captives are using various sales platforms and technologies to offer off-lease units to their own dealer body, particularly the grounding dealer, before the cars head to action.

“As off-lease volumes grow in coming years, it is likely that the share of off-lease units bought by the grounding dealer will decline, but probably not by much since the captive lessor will still put priority on that first possible sale—and offer an attractive price to achieve it,” Cox Automotive chief economist Tom Webb, who authored the report, wrote in the analysis.

KAR Auction Services appears confident that its flow of General Motors vehicles and wholesale activity with the automaker won’t just disappear suddenly now that OEM rolled out a program that offers U.S. consumers online access to an exclusive inventory of low-mileage former company-owned, off-lease and daily rental vehicles.

Coming off a year where net income spiked 27 percent year-over-year and revenue jumped 12 percent above a year earlier, KAR chairman and chief executive officer Jim Hallett responded to an investment analyst asking how GM’s Factory Pre-Owned Collection service might impact the company’s performance this year and beyond.

“A couple of thoughts there is No.1 is that it’s very much in its infancy,” Hallett said when the company hosted its most recent quarterly conference call. “It’s just getting announced and just getting started.

“Secondly, I would say to you our job is not to try and direct the car or direct the customer to any one particular channel,” Hallett continued. “We’re going to sell cars whatever way the customer wants to get them sold. And yes, we are very much involved in the process with General Motors of facilitating these transactions, and we will be getting fees when those transactions take place.”

Wall Street observers asked Hallett again about the GM program, which went live on Feb. 9. The KAR boss reiterated that however GM or any other consignor or dealer wants to move metal through the online or in-lane channels at ADESA, the company is ready.

“I think this is an initiative by GM to get in front of the remarketing cycle and basically, post these cars on a website where the customer can go in and can view the inventory,” he said. “If a customer is able to identify a car that he or she wishes to purchase, then they connect them with the dealer and the dealer transacts the deal

“I don’t see it’s necessarily taking anything away from the physical side at ADESA. In fact, overall, I would say that we would view it as an opportunity,” Hallett went on to say.

Better inventory opportunity for independents?

In the opinion of KAR chief financial officer and executive vice president Eric Loughmiller, the best pieces of inventory independent dealers can offer are vehicles that didn’t end up in the certified pre-owned department at a franchised stores. Based on the expectation of off-lease volume continuing to grow this year, both Loughmiller and Hallett see independent dealerships having a better chance of securing more of those units.

Why? For the simple reason that there is only a set amount of franchised dealerships and the likelihood that these stores cannot absorb all of the off-lease inventory themselves.

“We know that they’ve whittled down the population of franchise dealers. It’s franchise dealers that are primarily buying these cars for CPO purposes. They’re not adding any more franchise dealers so that population is not growing,” Hallett said.

“So at some point in time when they have enough supply, these vehicles have to get released to the open market and it gives the independents an opportunity to buy those vehicles,” he added.

Double-digit volume rise at IAA

In the fourth quarter, Insurance Auto Auctions posted a 14-percent increase in revenue because its sales volume grew by 16 percent year-over-year. An investment analyst wondered if IAA could keep up that pace based on what he heard Copart say during its conference call, indicating that salvage auction company “gained a big customer win.”

Hallett defended Insurance Auto Auction’s performance, which included a Q4 gross profit rise to $88.6 million.

“First point is, I would say that the performance at IAA is primarily driven by the volume increases,” Hallett said. “And then in regards to customers, bottom line is there is wins and losses. There is always RFPs that are going to come and go, and we’re going to win some, we’re going to lose some.

“But things I would point to and ask you to focus on is, I would ask you to focus on our performance. And when you take a look at our performance year-over-year and the volume increase that we’ve demonstrated, I would think that would point to we’re winning more than we’re losing,” Hallett went on to say.

3 notes on ADESA Q4 sales performance

The company mentioned a trio of highlights associated with vehicles handled by ADESA during the fourth quarter:

— ADESA sold approximately 152,000 and 115,000 vehicles through its online-only offerings in Q4 of 2015 and 2014, respectively. Of those figures, approximately 80,000 units and 72,000 units, respectively, represented vehicle sales to grounding dealers.

— Dealer consignment vehicles represented approximately 49 percent of used vehicles sold at ADESA physical auction locations in the fourth quarter, compared with approximately 47 percent a year earlier. Vehicles sold at physical auction locations increased 6 percent year-over-year.

— The used-vehicle conversion percentage at physical auction locations, calculated as the number of vehicles sold as a percentage of the number of vehicles entered for sale at ADESA auctions, decreased to 56.1 percent in Q4, down from 56.8 percent a year earlier.

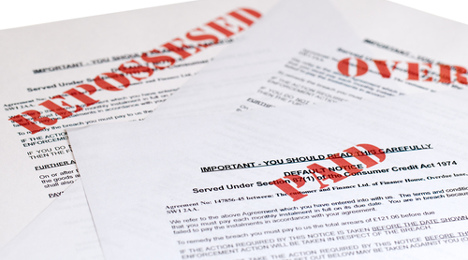

While the activity might remain stable once the vehicle enters the wholesale market, Manheim expects repossession volume to climb “modestly” this year based on one simple reason. There are more outstanding vehicle installment contracts in finance company portfolios nowadays.

Cox Automotive chief economist Tom Webb insisted “it will take some time” for the industry to see a return to the peak level of repossessions, which was 1.9 million repos in 2009.

“The previous peak obviously was caused by the financial market collapse where many households were sort of torn apart,” Webb said during a conversation with Auto Remarketing following the release of the 2016 Manheim Used Car Market Report, which contained the repossession projection.

“To get back to those (default) ratios, you would have to have an event such as that,” he continued. “If it just marginally increases up, the industry is very good about adjusting their underwriting standards as conditions deteriorate a little bit.”

Webb reiterated that finance companies are naturally focused on converting repossessed units into cash as quickly as possible. The report highlighted that various laws and regulations dealing with the processes of collateral collection and liquidation often present a “stumbling block” to that quick conversion. But Manheim pointed out that finance companies and their auction partners have been successful in streamlining the processes they do control.

Webb emphasized that the entire process involving repo units is certainly different from the other commercial consignors in terms of their remarketing practices.

“As opposed to an off-lease unit, you don’t know what’s coming back,” Webb said. “The issue of reconditioning, to a large extent, it really hasn’t changed that much and to a certain extent it probably won’t. The repossessors in most cases they’re sole objective is to turn it into cash as quickly as possible.

“In terms of their practices, they’re more driven by whatever the compliance and regulatory issues are as opposed to trying to maximize the value of that vehicle,” he continued. “That’s certainly not to say that they don’t partner with an auction where they think the vehicle will sell well and an auction that properly markets their vehicles.

"(Finance companies) certainly have opportunities in the lanes to segment their own repo units,” Webb went on to say. “A lot of them are putting their repo vehicles into certain tiers corresponding to the quality of those units as opposed to doing a lot of reconditioning. They’re just pulling out those units that they know are better and letting the dealers know that.”

Last month’s auction sales volume accelerated from December, but still was softer than the year-ago period.

That’s according to the February Guidelines report from NADA Used Car Guide, which said there were 322,200 vehicles 8 years old or newer sold at auction during the four weeks ending Jan. 25.

That beat the prior month by 38 percent, but was down 4 percent year-over-year.

It should also be noted, however, that 2015 represented a five-year high for auction sales of cars 8 years old or newer, according to January’s edition of Guidelines. Specifically, 2015 auction volume for this group was at 4.17 million, up 5 percent. Three million of those were late-model units.

As for January’s dip, declining late-model volume (5 years old or newer) certainly had something to do with that, the report said.

For instance, this January had 20 percent fewer sales of prior-year models than last January. For vehicles from two model years prior, the volume decline from last January was 8 percent.

“Thus far, the total number of 2015 model-year sales collected over the past 13 months is running about 8 percent below the number of 2014 sales collected over a similar period. This runs counter to the 4-percent increase in 2015 model-year rental registrations,” NADA Used Car Guide’s Jonathan Banks said in the report.

That said, volume for vehicles from the 2010 through 2013 model years was up an average of 15 percent. These cars represented more than half (52 percent) of sales for the month, the report said.

If you’re embracing technology as a dealer, you’re likely already swimming in a sea of acronyms. You’ve got your CRM. Your DMS. You’ve got things covered from SEO all the way to F&I. But perhaps a lesser known acronym, VRM, or vehicle relationship management, seems to have a bit more vague definition depending on whom you ask.

But if you ask Roger Penske, Penske Automotive Group’s chairman and chief executive officer, what VRM means to him, he may tell you how it means trying to hold on to a car throughout the retail process, from the first sale all the way to its third, perhaps.

Penske Automotive hosted its fourth-quarter and full-year financial results conference call on Thursday, and one question fielded by Penske resonated with the topic of VRM: How does Penske Auto see the impending used-vehicle volume increase from the expected wave of off-lease vehicles? Is it a certified pre-owned opportunity? What’s the net effect on the company?

Pointing out that used inventory is actually down by roughly 1,000 units overall from where they were a year ago, Penske said he sees it as an opportunity to not only work on customer loyalty, but also keep the cars coming back again and again to bolster gross profits.

“I’ll give you a quick example,” he said. “In Atlanta, where we have two BMW stores that do over 300 used cars a month, probably 10 percent would be coming out of their loaner car fleet every month, another 10 percent would be non-BMW trades, and the rest are BMW.

“I think the ability for us to be able to recondition those, we get the benefit of that in our shops, in the parts and service, and then the ability to utilize some of the OEM’s programs,” Penske said. “That’s one of the things I don’t think people realize … both Mercedes and certainly BMW — and I know Toyota does — they have some very attractive programs on used cars that come out of loaner service or come off lease. Especially if you CPO them. So we’re going to take advantage of those.”

Penske says the company is aiming for a 50 percent to 60 percent loyalty rate from his off-lease customers – whether that means they re-lease that same car, buy it, or choose to lease or buy another vehicle. Keeping that initial vehicle to be sold again and again — that’s Penske’s idea of VRM.

“We want to keep that vehicle, we want to take the vehicle from the customer off-lease, we want to sell or lease it to a second person and then get it back and then retail it at the end,” Penske said. “There’s some real opportunity for gross profit on each vehicle. We don’t want to lose those vehicles as they come through the cycle.”

The past four years of wholesale prices have been the most stable since the 1995 launch of the Manheim Used Vehicle Value Index, according to the company’s 2016 Used Car Market Report released Monday morning.

But can we expect that stability to continue?

Well, there will likely be compression in wholesale prices this year.

“But that’s different from a lack of stability,” Cox Automotive chief economist Tom Webb said in a phone interview with Auto Remarketing.

According to a National Auto Auction Association estimate in Manheim’s report, NAAA-member auctions were believed to have move 9.3 million vehicles last year, which would be a 6.3-percent year-over-year gain. Look for those numbers to jump again this year and next, according to NAAA.

Even with continued gains in used-car volume, Webb still sees the same keen remarketing practices that have kept the market from getting to a point where an extreme downward impact.

“Certainly, their practices are much better. They have been long planning for these volumes,” Webb said. “And in reality, the only thing that could be the monkey wrench would be the thing they can’t control, which is the state of retail demand.

“But in terms of an environment that we have right now, you would assume that the volumes are manageable, in the near-term,” Webb said.

And consider how wholesale prices trended in 2015. Even with all the various trend lines throughout the year, they still finished just 1.6 percent off the record high from May 2011, according to the report.

Overall, the report — though pointing out the challenges, like narrowing margins —shows a fairly healthy car market, both in terms of retail and wholesale, used and new. Franchised dealers, for example, have enjoyed six straight years of rising used-vehicle sales.

There was a record amount of new-car leases writtem in 2015, with just a shade under 4 million originations — and these cars have the potential to boost already record-breaking certified pre-owned sales.

“Whether you're measuring unit sales, revenues, operating efficiency, or profits; whether you're focused on retail or wholesale; or whether you're interested in new or used, it was another good year for the automotive industry,” Webb said in the Year in Review chapter of the report. “All indications are that the good times will continue to roll awhile longer.”

The battle between supply and demand is nothing new to dealers — and as we head further into the forecasted growth in used-vehicle supply, wholesale price softening is to be expected.

The latter is the message from ADESA Analytical Services’ executive vice president and chief economist Tom Kontos in the December edition of Kontos Kommentary, where he summed up the year quite succinctly and set the scene for 2016.

“2015 was largely a year when strong retail used vehicle and CPO demand, benign new-vehicle incentive activity, and the embrace of upstream as well as traditional auction processes among remarketers diluted the usual negative impact of growing supply on wholesale values,” Kontos said in the report.

“Further masking that impact was the displacement of off-rental program vehicle volume that appeared in the first half of the year rather than the last quarter of 2014,” he added. “These high-dollar, late-model units biased average wholesale prices upward for much of the year.”

Unfortunately, that dilution of wholesale values started to clear up by the end of the year, most notably in December, where Kontos says prices fell by upwards of 1 percent on both a month-over-month and year-over-year basis for various segments.

Let’s break it down. Wholesale used-vehicle prices in December averaged in at $9,763, a decrease of 1.2 percent month-over-month and down 1.0 percent relative to December 2014.

The only vehicle segment that showed any significant monthly increase was the minivan segment, while truck values, in general, declined less than cars and crossovers.

Looking at the various types of sellers, wholesale prices for vehicles remarketed by manufacturers were up 1.6 percent month-over-month but down 3.5 percent year-over-year. For fleet/lease consignors, both metrics were down 0.1 percent and 0.7 percent, respectively.

Within the fleet/lease consignment category, off-rental risk units showed small month-over-month and year-over-year price increases.

Three-year-old vehicles, however, did not, Kontos said. These vehicles — which he said are a “proxy for off-lease vehicles” — showed significant declines in both pricing metrics.

Dealer consignment saw a 2-percent decrease in December, compared to November, and a 1.2-percent decreased compared to December 2014.

To check out Kontos’ full breakdown of wholesale used-vehicle prices by vehicle model class, click here.