Just like fuel prices and the costs of many other goods and services, the volume of bankruptcy filings jumped significantly to finish the first quarter.

According to data provided by Epiq Bankruptcy, filings in March increased …

Read more

Despite February being the shortest month on the calendar, Epiq and the American Bankruptcy Institute (ABI) spotted a sequential rise in total filings during the month.

Read more

With a murky filing situation on the horizon for businesses — potentially trickling down to impacted consumers — bankruptcy experts are closely watching the newest data and trends originating from the first month of 2022.

Last week, Epiq released its January 2022 bankruptcy filing statistics from its Epiq Bankruptcy AACER Platform. Overall, the global technology-enabled services provider to the legal services industry and corporations said new filings in January totaled …

Read more

Total annual bankruptcy filings decreased nearly 25% year-over-year, according to data shared and discussed by Epiq and the American Bankruptcy Institute (ABI).

Read more

It’s been 40 years since bankruptcy filings have been at the pace experts from Epiq and the American Bankruptcy Institute (ABI) are seeing in 2021.

Last week, Epiq released its November bankruptcy filing statistics from its AACER bankruptcy information services business.

Read more

While still not recovered to the activity level seen before the pandemic, bankruptcy filings are trending higher.

Epiq recently released its October bankruptcy filing statistics from its AACER bankruptcy information services business. The firm said October new filings for all chapters increased 1.8% to 31,471, up from 30,920 in September.

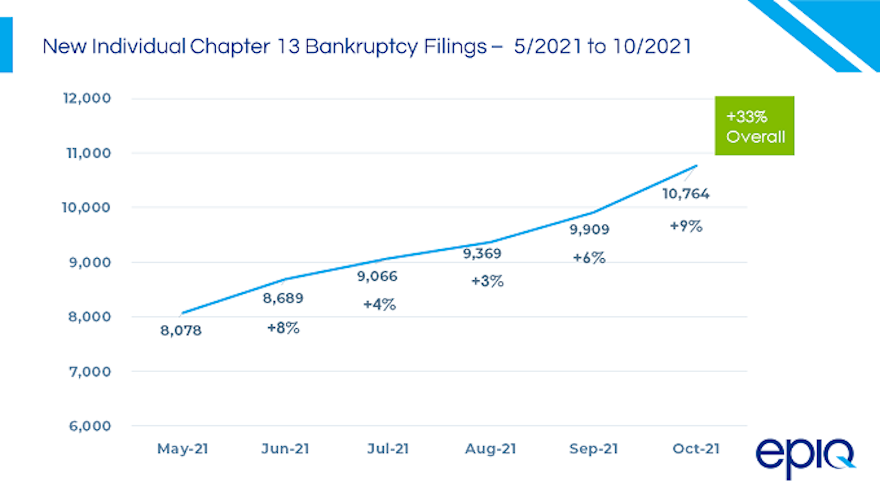

Epiq indicated total individual Chapter 13 filings rose 8.6% compared to September, with 10,764 new filings versus 9,909 filings in September 2021.

Experts said total individual Chapter 7 filings softened 1.9% over September, with 18,874 new filings compared to 19,942 in the prior month.

“Although October had one less business day than September, October 2021 filings were up 1.8% month-over-month. However, new filings remain significantly lower than the comparable pre-COVID number of 67,878 for all chapter new filings in October 2019,” said Chris Kruse, senior vice president of Epiq AACER, in a news release.

Epiq pointed out that Chapter 13 individual filings increased for the fifth consecutive month, growing 33% since May when 8,079 new cases were filed. However, experts said these filing rates remain 55% below the comparable 23,688 pre-COVID new filings in October 2019.

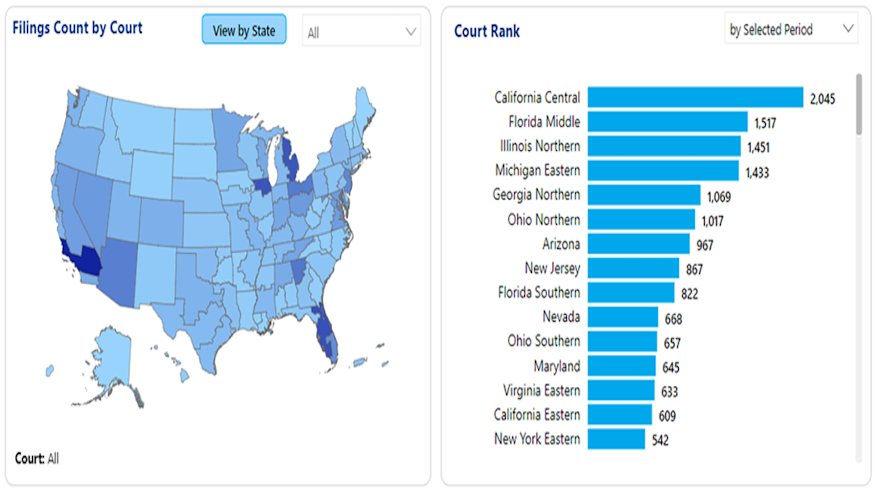

The five states leading the October individual Chapter 13 new filings included Georgia, Alabama, Florida, Tennessee, and Illinois.

Epiq went on to mention total commercial Chapter 11 filings in October increased by 21.1% with a total of 293, compared to 242 new filings in September 2021.

As a subset of the total new Chapter 11 commercial filings, Epiq added Chapter 11 Subchapter V filings were up 16.7% with 84 new filings, compared to 72 new filings in September 2021.

The American Bankruptcy Institute (ABI) combed through the Epiq data and offered this reaction in a separate news release.

“With the expiration of government relief programs, supply shortages and inflationary price increases, families and businesses are contending with a number of economic challenges,” ABI executive director Amy Quackenboss said. “Bankruptcy provides struggling companies and consumers with a reliable lifeline when faced with an uncertain financial future.”

Delving deeper into the Epiq information, ABI noted that the average nationwide per capita bankruptcy filing rate in October was 1.33 (total filings per 1,000 per population), a slight decrease from the filing rate of 1.34 during the first nine months of 2021.

ABI added that average total filings per day in October were 1,574, a decrease of 18% from the 1,915 total daily filings in October 2020.

Furthermore, states with the highest per capita filing rates (total filings per 1,000 population) in October included:

1. Alabama (3.14)

2. Nevada (2.69)

3. Tennessee (2.45)

4. Indiana (2.24)

5. Georgia (2.14)

The American Bankruptcy Institute (ABI) and Epiq combed through all of the filing data that’s been generated through the first three quarters of the year to try to project what might happen during the remainder of 2021 and beyond.

Read more

Just like the pandemic is slowing defaults and vehicle repossessions, COVID-19 is keeping bankruptcy courts quieter than usual, too.

Epiq released its August bankruptcy filing statistics from its AACER bankruptcy information services business this week.

Read more

Not since June 2006 — when Disney first released “Cars” in movie theaters — have there been bankruptcy trends like what Epiq and the American Bankruptcy Institute (ABI) are now explaining.

Epiq recently released its June 2021 bankruptcy filing statistics from its AACER bankruptcy information services business and reported the lowest June filings since 2006 for five categories.

Read more