A jump in bankruptcies lasted just two months before returning to levels seen during most of last year.

Epiq recently released its May bankruptcy filing statistics from its AACER bankruptcy information services business, reporting that new filings for May dropped to 34,734 across all chapters.

Read more

Bankruptcy filings are continuing to trend higher as segments of the financial world continue to move toward what experts might think of as normal.

Epiq recently released its April bankruptcy filing statistics from its AACER bankruptcy information services business and discovered total new filings exceeded 40,000 for the second straight month.

Across all chapters, Epiq said there were 40,886 cases filed in April.

Analysts indicated the new filings were driven by 38,813 new non-commercial or individual filings, down from March’s 41,156 cases, but up 16% over the average in the prior seven-month period.

“Bankruptcy filings in April extended the spike we saw in March,” said Chris Kruse, senior vice president of Epiq AACER. “This is an additional indicator that new non-commercial bankruptcy filings may be returning to pre-pandemic levels.

“We have seen some seasonality over past years in Q2 filings, but we are in unchartered territory with the pandemic and therefore remain cautious,” Kruse continued in a news release.

Epiq noted that there were 147,868 total new bankruptcy filings across all chapters for the first four months of the year, down from 215,704 for the same period in 2020.

The two largest categories in April were in non-commercial filings, with 29,777 new Chapter 7 cases and 8,957 new Chapter 13 cases.

Commercial Chapter 11 filings dropped 26% versus March with 287 new filings in April.

Epiq went on to mention commercial filings across all chapters declined 10% versus March’s 2,293 cases with a total of 2,073 new filings.

“The continued decline in commercial filings demonstrates the ability for companies to access needed capital as an alternative to seeking bankruptcy,” said Deirdre O’Connor, senior managing director of corporate restructuring at Epiq.

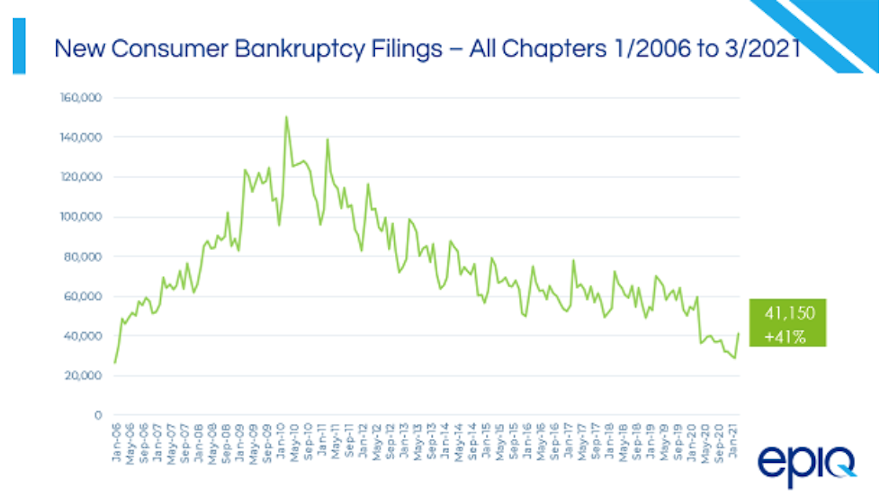

The first quarter closed with the largest amount of consumer bankruptcy filings registered during a single month since the pandemic began.

According to filing statistics from Epiq’s AACER bankruptcy information services business, there were 41,150 new non-commercial consumer filings in March, representing a 41% month-over-month increase and the largest single month of new filing activity since COVID-19 was declared a pandemic last March.

All told, Epiq reported that March new filings spiked to 43,425 cases, also driven by commercial filings across all chapters that increased over February’s historic low with a total of 2,275 new filings. That figure marked a 16% increase month-over-month.

“Bankruptcy filings in March saw large increases over February,” said Chris Kruse, senior vice president of Epiq AACER.

“The vaccination roll-out and corresponding economic recovery is gaining momentum that will accelerate the return to pre-pandemic new bankruptcy filings levels,” Kruse continued in a news release. “We approach the second quarter of 2021 cautiously anticipating the bankruptcy backlog that emerged during the pandemic may be peaking.”

Epiq indicated there were 106,958 total new bankruptcy filings across all chapters during the first quarter, down from 177,245 in the same period in 2020.

The firm said the two largest increases in March were in non-commercial consumer filings with 30,802 new Chapter 7 cases and 10,265 new Chapter 13 cases, increases of 9,939 and 1,945 over February, respectively.

Analysts added commercial Chapter 11 filings were down 9% over February with 384 new filings in March.

“While the government has extended economic stabilization measures and lenders remain flexible to meet the economic hardships of the COVID-19 pandemic, bankruptcy provides a proven shield to families and businesses with mounting debt loads and financial uncertainty,” American Bankruptcy Institute executive director Amy Quackenboss said in a separate news release.

“Recent action by Congress and the administration will ensure that households and small businesses continue to have greater access to the financial fresh start of bankruptcy,” Quackenboss continued.

President Joe Biden on March 27 signed the “COVID-19 Bankruptcy Relief Extension Act” into law to extend provisions providing financially distressed consumers and small businesses greater access to bankruptcy relief.

ABI explained the legislation will extend personal and small business bankruptcy-relief provisions that were part of last year's CARES Act through March 2022.

Some of the key provisions of last year’s relief packages were the increased debt limit to $7.5 million for small business debtors electing to file under subchapter V and allowing individuals to seek COVID-19–related hardship modifications, among other changes. More information is available on this website.

“The decline in commercial chapter 11 filings is a direct reflection of both lenders and owners working with companies to protect their investments outside of a bankruptcy process,” said Deirdre O’Connor, senior managing director of corporate restructuring at Epiq.

ABI looked deeper into Epiq’s latest information to mention that the average nationwide per capita bankruptcy filing rate for the first three months of this year increased to 1.38 (total filings per 1,000 per population) from the 1.23 filing rate of the first two months of 2021.

States with the highest per capita filing rates (total filings per 1,000 population) for Q1 included:

1. Alabama (3.29)

2. Delaware (2.98)

3. Nevada (2.85)

4. Tennessee (2.56)

5. Georgia (2.27)

ABI has partnered with Epiq in order to provide the most current bankruptcy filing data for analysts, researchers and members of the news media.

Bubble talk in March is not limited to just discussions about which teams will qualify for the major college basketball tournaments.

The term surfaced when Epiq and the American Bankruptcy Institute (ABI) reviewed February filings and looked ahead to what the bankruptcy landscape might be later this year.

Epiq reported its February bankruptcy filing statistics from its AACER bankruptcy information services business and indicated February experienced the lowest number of new monthly bankruptcy filings across all chapters in 15 years. The 31,188 filings were the lowest since February 2006 when 26,617 cases were completed.

Experts explained the continued slide represents a decrease of 3% compared to January. They also mentioned filing 45% decline year-over-year as last February the bankruptcy system completed 56,209 new cases.

A total of 29,261 consumer filings were registered in February, down from the 53,097 consumer filings recorded in the same month last year.

Epiq indicated Chapter 13 non-commercial filings dropped 7.25% on a sequential basis with only 8,320 new cases completed in February. Chapter 7 non-commercial filings ticked 1.8% lower in February with only 20,850 new cases.

“New bankruptcy filing rates continue a historic slide,” said Chris Kruse, senior vice president of Epiq AACER. “The bubble that emerged last April as the global pandemic picked up steam is now getting bigger, and the backlog of new filings is growing.

“We still expect new filings rates will change course and grow substantially in the second half of 2021 as vaccination rates climb, government stimulus ramps down, and COVID-19-related policies are relaxed, forcing filers to evaluate their financial positions,” Kruse continued in a news release from Epiq.

Meanwhile, commercial filings in February across all chapters fell to 1,945 new cases, dropping 38% year-over-year.

“Access to capital, agreements among stakeholders, and general economic uncertainty has caused a continued pause in commercial Chapter 11 filings in February,” said Deirdre O’Connor, senior managing director of corporate restructuring at Epiq. “The decline in Chapter 11 cases reveals that seeking bankruptcy protection does not appear to be the most viable option for companies that are currently experiencing liquidity challenges.”

In its news release, ABI recapped how the moves made by federal lawmakers are impacting bankruptcy metrics.

Sen. Richard Durbin, the Illinois Democrat and chair of the Senate Judiciary Committee Chair, along with Sen. Chuck Grassley, the committee ranking member and Iowa Republican introduced the COVID-19 Bankruptcy Relief Extension Act on Feb. 25. ABI explained the measure would temporarily extend the COVID-19 bankruptcy-relief provisions for consumers and small businesses enacted as part of the March 2020 CARES Act and December 2020 omnibus appropriations bill.

As the provisions are set to sunset on March 27, ABI Durbin and Grassley’s proposal would push the sunset dates for these provisions to March 2022.

Among the provisions is keeping the eligibility limit for small businesses electing to file for subchapter V under Chapter 11 at $7.5 million to provide more vulnerable businesses with a streamlined path for restructuring their debts. ABI noted this eligibility limit for small businesses was increased from $2,725,625 of debt to $7.5 million by the CARES Act.

“While the COVID-19 pandemic continues to have a serious financial impact across the globe, the economic stabilization measures put in place by the government have enabled many distressed families and businesses to delay filing for bankruptcy,” ABI executive director Amy Quackenboss said. “Bankruptcy remains a proven shield for families and companies seeking protection from the lingering financial distress and economic uncertainty caused by the pandemic.

“As further stabilization efforts are considered by Congress, this important legislation will allow more time for families and small businesses to utilize the important bankruptcy provisions of the CARES Act and December’s omnibus appropriations bill,” Quackenboss went on to say.

Experts also mentioned the average nationwide per capita bankruptcy filing rate in February was 1.23 (total filings per 1,000 per population), a slight decrease from January’s rate of 1.25.

Average total filings per day in February came in at 1,643, a 44% from the 2,958 total daily filings recorded last February.

The newest data went on to show states with the highest per capita filing rates (total filings per 1,000 population) in February included:

1. Delaware (3.09)

2. Alabama (3.03)

3. Nevada (2.57)

4. Tennessee (2.23)

5. Georgia (2.10)

The ongoing year-over-year decline in bankruptcy filings because of the pandemic prompted experts to get creative to summarize the situation.

According to data provided by Epiq, the American Bankruptcy Institute (ABI) reported that total consumer and business filings fell more than 40% in January 2021 compared to the opening month of last year. The data showed total filings in January came in at 32,298, representing a 44% decrease from the January 2020 filing total of 58,160.

Epiq went on to explain that January generated the lowest monthly number of new bankruptcy filings across all chapters since February 2006 when the industry posted 26,617 filings.

While reiterating the year-over-year decline, Epiq added that the January bankruptcy filing statistics from its AACER bankruptcy information services business showed last month’s total also marked a 6% softening from December.

Breaking down the January filing amount, ABI and Epiq said consumer filings constituted 30,263 cases while commercial filings totaled 2,035.

Also of note, they pointed out that commercial Chapter 11 filings in January totaled 479, a 24% drop from the 631 commercial Chapter 11 filings in January of last year.

“Out of court solutions, available liquidity, and general uncertainty has caused a significant pause in Chapter 11 filings this past month,” said Deirdre O’Connor, senior managing director of corporate restructuring at Epiq. “We appear to be suspended in an air bubble at the moment.”

Chris Kruse, senior vice president of Epiq AACER, added in a news release, “The new year data continues to show extreme softness in new U.S. bankruptcy filings. The optimism around a new political administration and potential new government relief for consumers has kept new filings historically low.”

ABI mentioned the Small Business Reorganization Act of 2019 (SBRA), in effect as of Feb., 19, 2020, was enacted to provide Main Street business debtors with a more streamlined path for restructuring their debts. In response to the economic distress caused by the COVID-19 coronavirus pandemic, the CARES Act was enacted on March 27, increasing the eligibility limit for small businesses looking to file under SBRA’s subchapter V from $2,725,625 of debt to $7,500,000.

ABI added the threshold will return to $2,725,625 on March 27.

“Continued government relief programs, moratoriums and lender deferments have helped families and businesses offset the challenges of elevated unemployment rates and growing debt loads during the COVID-19 pandemic,” ABI executive director Amy Quackenboss said in a news release.

“As further stabilization efforts are considered by Congress, an extension of the eligibility limit for small businesses electing to file for subchapter V under chapter 11 will provide vulnerable businesses with a proven shield in financially uncertain times,” Quackenboss continued.

ABI noted that the average nationwide per capita bankruptcy filing rate (total filings per 1,000 population) was 1.25 for January, a slight decrease from the 1.71 rate registered last January.

Experts also discovered the average daily filing total in January 2021 was 1,700, a 39% decrease from the 2,770 total daily filings posted last January.

Furthermore, states with the highest per capita filing rates (total filings per 1,000 population) through January included:

1. Delaware (4.88)

2. Alabama (3.06)

3. Nevada (2.48)

4. Tennessee (2.45)

5. Georgia (2.13)

When might this “bubble” disappear and a potential spike in bankruptcies arrive?

“We continue to expect new filings will grow substantially in the second half of 2021, notwithstanding any likely short-term stimulus,” Kruse said.

Of all the financial turbulence created by the pandemic, a record-setting number of bankruptcies was not among the unprecedented developments.

In fact, according to data shared by the American Bankruptcy Institute (ABI) and Epiq, last year generated the fewest filings since 1986.

The 2020 bankruptcy filings across all chapters totaled 529,068, representing the smallest number in 34 years when the annual figure was 530,438 total filings.

In 2019, there were 757,634 total filings.

Officials calculated the 30% drop year-over-year marked the second-largest percentage decrease since the 70% drop in filings recorded in 2005-06. They explained that the decrease was the result of the implementation of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, which prompted total bankruptcies to rise to 2,078,415 ahead of its enactment then fall to 617,660 total filings in 2006.

Officials determined total consumer filings came in at 496,565 nationwide in 2020, which were 31% fewer than the 718,584 total filings during 2019. The 2020 consumer filing total was the lowest since the 495,553 filings registered in 1987.

ABI and Epiq also noticed that Chapter 13 filings decreased 46%, as the 152,828 Chapter 13 cases in 2020 declined from the 282,712 filings in 2019.

Meanwhile, the category that continues to grow year-over-year is commercial Chapter 11 filings, which were up 29% with 7,128 new filings in 2020 compared to 5,518 in 2019.

“The peak in Chapter 11 filings for Q2 and Q3 is due to preexisting distressed companies coupled with the onset of a zero-revenue environment. The federal backstop proved a vital lifeline for the stabilization of corporations to protect the U.S. economy,” said Deirdre O’Connor, managing director of corporate restructuring at Epiq.

“This federal intervention created record-breaking capital deployment fueled by investors chasing yield as companies attempt to ride out this storm,” O’Connor continued in a news release.

The 2020 commercial Chapter 11 filing total also was the highest total since the 7,789 filings registered in 2012 when the economy still was recovering from the Great Recession.

“Continued government relief programs, moratoriums and lender deferments have helped families and businesses weather the economic challenges over the past year resulting from the COVID-19 pandemic,” ABI executive director Amy Quackenboss said in a separate news release.

“While stabilization programs have achieved their intended effect in keeping families and businesses afloat amid the pandemic, bankruptcy provides a proven economic shelter for companies and consumers facing mounting financial distress,” Quackenboss continued.

Furthermore, looking at just December information, the total new U.S. bankruptcy filings across all chapters came in at 34,304 for the month, the lowest monthly total since January 2006.

“New bankruptcy filings continue to slide into record territory as the global pandemic spurs regulatory intervention to keep U.S. consumers and businesses afloat,” said Chris Kruse, senior vice president of Epiq AACER. “The second stimulus package totaling over $900 billion is getting capital into the market and delaying bankruptcy filings across the country.”

In late December, Congress passed and President Trump signed H.R. 133, the “Consolidated Appropriations Act of 2021,” into law, which combined $900 billion in stimulus relief for the COVID-19 pandemic in the U.S. along with a $1.4 trillion omnibus spending bill for the 2021 federal fiscal year.

Officials recapped that a new round of stimulus payments were provided to Americans. Also measures such as enhanced unemployment benefits, the Paycheck Protection Program and eviction moratoriums were re-established, and greater bankruptcy-relief measures were incorporated into the new law.

ABI and Epiq went on to mention that the average nationwide per capita bankruptcy filing rate for 2020 decreased slightly to 1.71 (total filings per 1,000 population) from the 2.44 rate during 2019.

States with the highest per capita filing rates (total filings per 1,000 population) through December included:

1. Alabama (3.85)

2. Delaware (3.62)

3. Tennessee (3.39)

4. Nevada (2.94)

5. Mississippi (2.85)

ABI has partnered with Epiq, a leading provider of managed technology for the global legal profession, in order to provide the most current bankruptcy filing data for analysts, researchers and members of the news media.

The American Bankruptcy Institute said filings are on pace for the lowest annual total since 2006, the year after the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 went into effect and placed new requirements on filers.

But ABI executive director Amy Quackenboss sees the potential for the trend turning depending on what state and federal officials do.

According to data provided by Epiq, total U.S. bankruptcies in November declined 39% year-over-year, dropping from 56,085 filings to 34,478 cases.

ABI noted that consumer bankruptcies also decreased 39% in November, as the 32,143 filings dropped from the 53,063 consumer filings registered in November of last year.

Officials added that commercial bankruptcy filings totaled 2,335 in November, representing a 23% decline from the 3,022 commercial filings last November.

ABI went on to mention the 494,756 total bankruptcies through the first 11 months of 2020 are on pace to result in the lowest annual filing total since the 617,660 filings recorded in 2006.

“Government relief programs, moratoriums and lender deferments have helped families and businesses weather surging COVID-19 cases, elevated unemployment rates and growing debt loads to this point of the pandemic,” Quackenboss said in a news release.

“Unless renewed by Congress, the expiration of the stabilization programs will leave struggling consumers and businesses in a challenging and uncertain position. Bankruptcy provides a proven shield to companies and consumers facing mounting financial distress,” she continued.

The Epiq data also showed total filings for November decreased 14% compared to the 40,218 total filings in October. Total noncommercial filings for November dropped 15% from the October noncommercial filing total of 37,679.

ABI determined the average nationwide per capita bankruptcy filing rate (total filings per 1,000 population) stood at 1.74 for the first 11 calendar months of 2020, a slight decrease from the 1.78 rate registered during the first 10 months of the year.

The average daily filing total in November was 1,815, a 39% decrease from the 2,952 total daily filings registered in November of last year.

States with the highest per capita filing rates (total filings per 1,000 population) through the first 11 months of the year included:

1. Alabama (3.91)

2. Delaware (3.74)

3. Tennessee (3.46)

4. Nevada (2.95)

5. Mississippi (2.93)

ABI has partnered with Epiq, a leading provider of managed technology for the global legal profession, in order to provide the most current bankruptcy filing data for analysts, researchers and members of the news media.

Bankruptcy metrics came in mixed for September as the coronavirus pandemic continues to influence how cases move through the system.

But the head of the American Bankruptcy Institute offered three elements that could create “a dramatic climb in filings in early 2021.”

According to data provided by Epiq Systems, ABI indicated commercial Chapter 11 filings totaled 747 in September, a 78% increase above last September’s total of 420 filings, However, overall September business filings totaled 2,677, a decrease of 16% compared to the 3,190 business filings registered in September of last year.

ABI said total U.S. filings registered 39,701 in September, dropping 35% from last September’s total of 61,156. Officials determined the 37,024 consumer filings in September marked a 36% decrease from the consumer total of 57,966 compiled during the same month a year ago.

After reviewing the latest information among other economic conditions, ABI executive director Amy Quackenboss offered this forecast

“Families and businesses are faced with growing financial challenges because of the economic uncertainty due to the COVID-19 pandemic and mounting debt loads,” Quackenboss said in a news release.

“While fluctuating market conditions and high filing costs continue to be a challenge for struggling consumers and companies seeking the financial fresh start of bankruptcy, the expiration of government stabilization programs, high unemployment and a precarious financial outlook for many sectors will likely lead to a dramatic climb in filings in early 2021,” she said.

Looking at data through the first three quarters of the year, officials found that total U.S. bankruptcy filings softened 28% during the first nine months of the year. The 420,048 filings dropped from the 580,625 filings completed during the same span in 2019.

ABI mentioned the 394,618 total noncommercial filings through the first three quarters of the year also represented a 28% decrease from the noncommercial filing total of 551,082 compiled during the first nine months of last year.

Officials added commercial bankruptcy filings during the first nine months of the year dipped 14% to 25,430 from the 29,543 filings during the same period in 2019.

ABI went on to point out that the average nationwide per capita bankruptcy filing rate for the first nine months of 2020 decreased slightly to 1.81 (total filings per 1,000 population) from the 1.84 rate for the first eight months of the year.

Officials said the average daily filing total in September came in at 1,891, marking a 25% drop from the 2,527 total daily filings registered in September of last year.

States with the highest per capita filing rates (total filings per 1,000 population) through the first nine months of this year included:

1. Alabama (4.05)

2. Delaware (3.68)

3. Tennessee (3.59)

4. Mississippi (3.09)

5. Nevada (2.96)

ABI has partnered with Epiq Systems, a leading provider of managed technology for the global legal profession, in order to provide the most current bankruptcy filing data for analysts, researchers and members of the news media.

August consumer bankruptcy filings decreased both year-over-year and month-over-month. The head of the American Bankruptcy Institute explained why that movement happened.

Before getting into the reasoning from executive director Amy Quackenboss, ABI shared data this week provided by Epiq Systems that showed the 36,877 consumer filings in August represented a 42% drop from the consumer total of 63,132 cases registered during the same month last year.

Furthermore, according to the newest data, the 39,349 total U.S. bankruptcy filings completed in August marked a 41% decline from last August’s total of 66,530 filings.

“A number of key factors continued to keep bankruptcy filings from overwhelming the court system,” Quackenboss said in a news release. “The CARES Act helped businesses and consumers initially weather the economic shock of the pandemic, collection, eviction and foreclosure activity was largely suspended, and quarantining measures presented challenges for struggling debtors to meet with attorneys.

“However, with the expiration of government stabilization programs, elevated unemployment levels and growing economic uncertainty, we anticipate a dramatic climb in filings later this year,” she continued.

Perhaps what’s already happening on the commercial side is reinforcing Quackenboss’ projection.

Data from Epiq Systems indicated that commercial Chapter 11 filings in August increased 17% year-over-year, rising from 450 filings to 526 cases. But overall commercial filings in August totaled 2,472 cases, marking a 27% drop year-over-year from the 3,398 filings in August 2019.

Looking at the data from a sequential comparison, Epiq Systems determined that the August tally represented an 8% decrease from the 42,865 total filings in July. The 36,877 consumer filings in August also marked an 8% decrease from July’s consumer total of 40,085.

ABI went on to note that the August business filings dropped 11% to 2,472 from July’s business total of 2,780.

Dissecting the Epiq Systems information further, the average nationwide per capita bankruptcy filing rate in August came in at 1.84 (total filings per 1,000 per population), a slight decrease from the filing rate of 1.89 during the first seven months of the year.

The average total filings per day in August stood at 1,874, a decrease of 38% from the 3,024 total daily filings in the same month last year.

States with the highest per capita filing rates (total filings per 1,000 population) in August included:

1. Alabama (4.16)

2. Tennessee (3.65)

3. Delaware (3.49)

4. Mississippi (3.21)

5. Georgia (3.02)

ABI has partnered with Epiq Systems, a leading provider of managed technology for the global legal profession, in order to provide the most current bankruptcy filing data for analysts, researchers and members of the news media.

While overall bankruptcies remain lower year-over-year, a rise in a portion of commercial filings during July has the leader of the American Bankruptcy Institute (ABI) concerned about what might be happening later this year.

According to data provided by Epiq, ABI said total commercial Chapter 11 filings in July 2020 increased 52% from the previous year. Officials determined commercial Chapter 11 filings totaled 643 in July, climbing from the July 2019 total of 423.

Conversely, ABI found that total commercial filings decreased 17% in July 2020, as the 2,768 filings were down from the 3,314 commercial filings registered in July of last year.

Officials pointed out the 42,861 total bankruptcy filings in July 2020 were down 33% from the 64,345 total filings registered last July. They added total consumer filings dropped 34% in July, as the 40,093 filings fell from the 61,031 consumer filings posted in July of last year.

When looking at the data on a sequential comparison, the increases are more prevalent.

ABI indicated July’s commercial Chapter 11 filings represented a 6% increase from the 609 filings in June. The organization said total commercial filings ticked up 2% above the June commercial filing total of 2,713.

And officials went on to say that total bankruptcy filings in July represented a 1% increase over the 42,425 total filings recorded in June. And total noncommercial filings for July also marked a 1% rise from the June 2020 noncommercial filing total of 39,712.

“As the government considers renewing or bolstering lifelines to help stabilize the economy, the financial uncertainty due to the COVID-19 pandemic is weighing on families and businesses,” ABI executive director Amy Quackenboss said in a news release.

“We anticipate filings increasing in the next few months as more households and companies seek the shelter of bankruptcy amid intensifying financial distress,” Quackenboss continued.

ABI acknowledged Congress is currently considering another economic stimulus package as important aid provisions of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) have expired.

Officials reiterated the weekly unemployment bonus of $600 established by the CARES Act ended on July 31, and the deadline for businesses to apply for a Paycheck Protection Program loan was Saturday.

Turning back to the latest data, ABI mentioned the average nationwide per capita bankruptcy filing rate in July came in at 1.89 (total filings per 1,000 per population), a slight decrease from the filing rate of 1.92 during the first six months of 2020.

Officials added average total filings per day in July were 1,948, a 33% decrease from the 2,925 total daily filings in July 2019.

States with the highest per capita filing rates (total filings per 1,000 population) in July included:

1. Alabama (4.31)

2. Tennessee (3.75)

3. Delaware (3.70)

4. Mississippi (3.35)

5. Georgia (3.12)

ABI has partnered with Epiq, a leading provider of managed technology for the global legal profession, in order to provide the most current bankruptcy filing data for analysts, researchers and members of the news media.