Attention buy-here, pay-here dealerships with related finance companies as well as lease-here, pay-here operators.

If your book of business contains individuals who are actively serving in the military, a stern letter from the Department of Justice and the Consumer Financial Protection Bureau (CFPB) is directed at you.

The federal agencies issued a joint letter last week reminding auto finance companies of their responsibilities to recognize important legal protections for military families under the Servicemembers Civil Relief Act (SCRA).

While servicemembers have the same rights as non-military borrowers, officials reiterated the SCRA provides additional rights to protect servicemembers and their families against unique financial challenges.

Officials explained the letter was designed to ensure that auto finance companies are aware of key provisions within the SCRA, including:

—Wrongful vehicle repossessions: The SCRA prohibits an auto finance company from repossessing a vehicle during the borrower’s military service without a court order, even if the borrower financed or leased the vehicle prior to entering military service.

—Failure to terminate vehicle leases without penalty: The SCRA allows servicemembers to terminate motor vehicle leases early and without penalty after entering military service or receiving qualifying military orders for a permanent change of station or deployment.

—Violations of auto finance interest rate benefits: The SCRA also limits interest rates on contracts incurred prior to military service to no more than 6% per year, including most fees. If servicemembers make a proper request, a creditor must forgive and not defer any interest greater than 6%.

The CFPB said its recent research has shown that servicemembers tend to carry more auto finance debt at younger ages than their civilian counterparts, largely due to the need for transportation while living on a military base.

“Auto finance companies that play by the rules should not be disadvantaged by competitors that violate the legal rights of military families,” CFPB director Rohit Chopra said in a news release. “The CFPB is closely monitoring the auto finance industry to ensure that servicemembers and their families are being treated fairly.”

Assistant attorney general Kristen Clarke added, “The Civil Rights Division is entrusted with the responsibility of ensuring that the rights of the brave men and women of our nation’s armed forces are safeguarded from discrimination and unfair treatment.

“We work every day to ensure that these rights, including those related to auto financing, are protected through litigation, outreach, and policy development,” Clarke went on to say.

The entire letter can be viewed online here.

To use sports analogies, the letter might be a Hail Mary on the last play of a football game or swinging for the fences with two outs in the bottom of the ninth inning of a baseball game.

On Monday, Consumer Financial Protection Bureau director Richard Cordray penned a one-page, five-paragraph letter to President Trump, imploring him not to squash the bureau’s proposed rule that would prohibit the use of class action waivers in arbitration clauses.

According to the document shared with BHPH Report on Tuesday, Cordray delivered a straightforward message to Trump less than a week after Vice President Pence broke a tie in the U.S. Senate on a vote for a Congressional Review Act resolution to stop the CFPB’s arbitration rule from going into effect.

“The resolution is now before you to decide whether it will stand or fall,” Cordray wrote to the President. “This letter is not about charts or graphs or studies. Instead, it is simply a personal appeal to you, asking you to uphold this rule.

“Many have told me I am wasting my time writing this letter — that your mind is made up and that your advisors have already made their intentions clear,” Cordray continued. “But this rule is all about protecting people who simply want to be able to take action together to right the wrongs done to them. When people are wronged or cheated, they deserve the chance to pursue their legal rights.”

Cordray then divulged a situation perhaps some industry supporters might not find surprising; that the CFPB’s top boss and Trump “have never met or spoken.” President Obama tapped Cordray, who at the time was Ohio’s attorney general, to lead the CFPB beginning back in 2013.

“But I am aware that over the course of your long career in business you often found it necessary to go to court when you thought you were treated unfairly,” Cordray continued in his message to Trump. “Of course, most Americans cannot afford to do this on their own, so they have to band together to be able to fight companies like Wells Fargo that opened millions of fake accounts or Equifax when it allowed sensitive personal data to be breached for more than 145 million Americans.”

Cordray closed his message this way.

“I think you really don’t like to see American families, including veterans and service members, get cheated out of their hard-earned money and be left helpless to fight back. I know that some have made elaborate arguments to pretend like that is not what is happening. But you are a smart man, and I think we both know what is really happening here,” Cordray wrote.

When Congressional Review Act resolutions made their way through both the Senate and the House, industry groups including the National Independent Automobile Dealers Association, the National Automobile Dealers Association, and the American Financial Services all cheered the development.

While the President hasn’t taken action yet, the immediate reaction from the White House seemed clear. The administration mentioned a recent report by the Department of the Treasury.

“The evidence is clear that the CFPB’s rule would neither protect consumers nor serve the public interest. Rather, under the rule, consumers would have fewer options for quickly and efficiently resolving financial disputes,” a White House statement said.

“Further, the rule would harm our community banks and credit unions by opening the door to frivolous lawsuits by special interest trial lawyers,” that statement continued. “By repealing this rule, Congress is standing up for everyday consumers and community banks and credit unions, instead of the trial lawyers, who would have benefited the most from the CFPB’s uninformed and ineffective policy.”

Twice now in roughly the past month, the Consumer Financial Protection Bureau largely became the conversation topic when a collection of dealers gathered, and raucous sounds filled a hotel venue.

In September, a fire alarm triggered a brief evacuation as a CFPB representative was in the midst of a segment during the National Policy Conference hosted by the National Independent Automobile Dealers Association. Then earlier this week during the Fall BHPH Conference orchestrated by the National Alliance of Buy-Here, Pay-Here Dealers, noise began to echo inside the hotel venue literally just hours after a razor-thin vote margin in the U.S. Senate squashed the CFPB’s rule to ban arbitration.

A few minutes after the collection of BHPH dealers and industry service providers cheered when NIADA’s Steve Jordan — who was moderating a panel discussion about regulatory developments and relayed the Senate vote implications — hotel staff nearby began using equipment that emanated noise similar to when a forklift or large truck is moving in reverse.

Because he had to pause for a moment since nothing else could be heard, the ever-clever Jordan quipped, “That’s not a panic alarm. That’s the CFPB backing up and taking stock of their position,” drawing a round of laughter as the equipment noise suddenly stopped.

If the CFPB representative who attended NABD’s event was in the room at the time, that individual likely wasn’t smiling about the situation. Vice President Pence broke a 50-50 Senate deadlock on Tuesday night about the time Game 1 of the World Series concluded — giving the industry a victory some leaders might contend would surpass the Los Angeles Dodgers taking the opener of the Fall Classic.

For NIADA and NABD member dealers, the policy momentum their organizations are generating is undeniable. While the efforts NIADA, NABD or the alphabet soup of industry lobbying establishments undeniably had some kind of impact on the CFPB arbitration rule stoppage, another concrete development clearly shows the political horsepower the independent dealership community is revving.

On Oct. 17, NIADA hosted Speaker of the House Paul Ryan for an exclusive business roundtable discussion in Fort Worth, Texas. To me, what’s even more notable about NIADA having a session with the lawmaker who is third in line to the White House should the president and vice president become unable to serve, I learned it was Ryan’s office who reached out to the dealer organization to coordinate a meeting while the lawmaker was in the Lone Star State.

Again, think about it. One of the five most powerful U.S. politicians sought out the organization that tries to speak for an operator who might have five cars or 500 vehicles in inventory with a portfolio of $10,000 or $100 million.

“We left the meeting very hopeful and encouraged,” Jordan said.

Another key component: The roundtable that drew more than 50 attendees didn’t include “dead air,” according to comments shared with me about the 60-minute session. During this week’s BHPH Conference, NABD’s Ken Shilson touched on the likely reason why dealers could conduct a productive conversation with the Speaker of the House about complicated topics. One example was comprehensive tax reform where some proposals would eliminate the net interest expense deduction — something crucial to dealers who rely on financing for the acquisition of inventory and other operating expenses.

“Regulatory protection starts with education,” Shilson told attendees at NABD’s event. “Get the necessary education so you know how to play the game properly and to do the right thing.”

Coming up in November is Used Car Week in Palm Springs, Calif. During Pre-Owned Con, Auto Fin Con, Repo Con and the National Remarketing Conference, discussions and references about the CFPB are likely to happen several times. I’ve already warned my Cherokee Media Group teammates that if they suddenly hear unusual noises that they not be alarmed. It’s likely just an industry leader mentioning how the used-car space took another step forward with regard to regulation.

Nick Zulovich, who is senior editor of BHPH Report and SubPrime Auto Finance News, can be reached at [email protected].

NIADA members left an opportunity to meet with a variety of federal lawmakers and their staffs with a sense of accomplishment in relaying what it’s like to be an independent dealerships nowadays.

The National Independent Automobile Dealers Association's National Policy Conference and Day on Capitol Hill wrapped up last week, providing an illustration of — and a reason for — NIADA’s growing footprint in Washington D.C.

NIADA's annual Washington event brought independent dealers to the nation's capital from across the country to meet with federal legislators and regulators and make the voice of the independent dealer and small business heard among America's policymakers.

This year's event drew 202 attendees, the most ever for what was formerly known as the National Leadership Conference.

“This is what makes a difference to our industry and our members,” NIADA president David Andrews said.

“We need to tell these people who we are, what we do and what we do for the communities we operate in,” Andrews continued. “We’re telling them what’s going on in our world — the real world. We’re trying to protect our businesses, our industry, our members and our future.

“And you can see what a big difference it makes. Now they know about NIADA and what we do, and they care about us and about what we have to say,” Andrews went on to say along with elaborating even more during a recent episode of the Auto Remarketing Podcast that’s available here.

As always, the conference concluded with the climactic Day on the Hill when 14 teams of NIADA dealers and industry partners took to Capitol Hill and met with more than 110 members of the Senate and House of Representatives or their legislative staff.

Association leadership insisted that number clearly shows how NIADA's political reach continues to expand. It’s 20 more than last year, and it means dealers had direct interaction with more than a fifth of the combined membership of the House and Senate in a single day.

“Our presence has really expanded in Washington D.C., and as a result, Congress is taking notice of the importance of our industry's positions,” NIADA chief executive officer Steve Jordan said. “This is exactly how we drew it up five years ago when we decided to restart this event and bring our member dealers to Washington.”

Among the teams were 10 representing NIADA's affiliated state associations. Teams from Georgia, North Carolina, South Carolina, Alabama, Texas, Ohio, the Mid-Atlantic region (MARIADA), Colorado, Illinois and Virginia visited all or most of their representatives and senators.

NIADA’s teams spoke to legislators about a number of issues currently pending in Congress, advocating in support of tax reform as well as major reforms to the Consumer Financial Protection Bureau to make it more responsive, transparent and accountable.

They also spoke in favor of repealing the CFPB's arbitration rule — a measure that has already passed the House and is awaiting a vote in the Senate — and against a blanket ban on sales of recalled vehicles by independent dealers.

“It’s absolutely crucial for us to be here,” said Stephanie Isakson of Parker Auto Sales in Knoxville, Tenn. “There were a lot of issues we talked about that had the legislators and staffers genuinely surprised by what we told them, about the things that happen day to day that they don't live.”

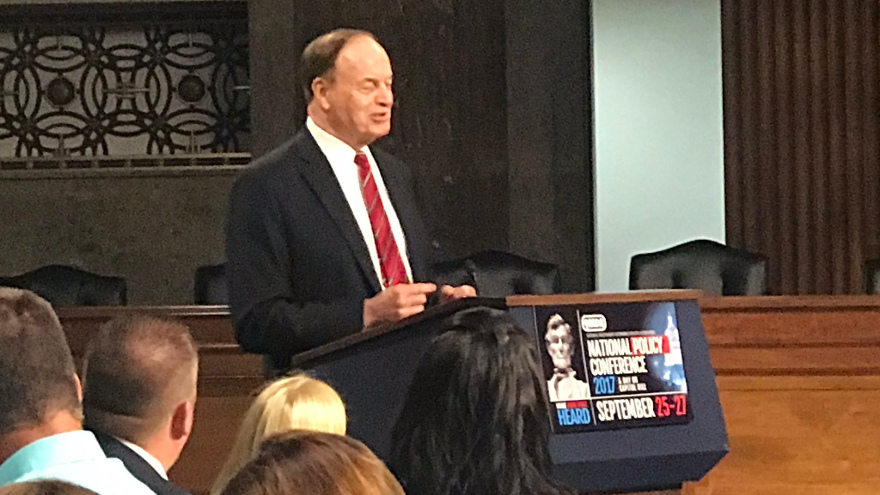

During the Day on the Hill's Power Luncheon in the Senate Rules and Administration Committee meeting room, Sen. Richard Shelby (R-Ala.) told attendees he’d been asked why businesspeople need to come to Washington.

“I’ll tell you why you need to come,” Shelby said. “You need to come up here and see what’s going on. Somebody's going to influence the tax policy. You’d hope to be part of that. Somebody’s going to influence the regulatory policy that affects everything you do.

“That's why you're here and why you should be here. … When we vote on things, it affects you, one way or the other — good or bad. When people push regulations and you say, 'Gosh, who did this? How could they do that? Why would they do that? It makes no sense.' All of it affects you,” Shelby went on to say.

The 2017 National Policy Conference also included the presentation of the inaugural NIADA Legislator of the Year award to Rep. Roger Williams (R-Texas) at a Tuesday night reception.

That same evening, the PAC Cup was awarded to the Southeast Region for contributing the most to the NIADA-PAC fund from among the association's four regions. In all, the competition raised more than $100,000 for the PAC fund.

In addition to legislators, representatives of several federal regulatory agencies — and, for the first time, the White House — spoke to attendees Tuesday, providing updates and answering specific compliance questions from dealers.

The speakers included Damion English of the CFPB, Tom Pahl of the Federal Trade Commission, and a contingent from the Small Business Administration, as well as D.J. Gribbin of the National Economic Council and deputy chief of staff Rick Dearborn, representing the White House.

And, as always, the event brought together NIADA's top national leaders as well as those of NIADA's affiliated state associations to conduct association business, develop their leadership skills and get the latest updates on NIADA legislative, education and business initiatives.

“The value of being here is just immeasurable, really,” said Jack Carter of Turn and Burn Motors in Conyers, Ga. “You can’t expect members of Congress to know our business. They’re not car dealers. So we have to continue to try to educate them and develop those relationships. We just have to keep at it.”

BHPH Senior Editor Nick Zulovich was on site at the conference. See his podcast from the event below

BHPH Report and NCM Associates are set to join a free webinar hosted by Dealer Profit Pros that’s meant to give buy-here, pay-here dealers constructive information to form strategy for 2017 and beyond.

The session is scheduled for 1 p.m. ET (10 a.m. PT) on Thursday.

“For the last several years we’ve made predictions and revealed new opportunities for dealers to meet or exceed their goals for the upcoming year. Each year dealers have offered great feedback on the information provided,” said webinar host Kenny Atcheson, who is founder of Dealer Profit Pros; a Las Vegas-based company that facilitates dealer marketing programs and more.

“This year will bring bigger changes than ever in part because of a new administration, starting with the president,” Atcheson continued.

Topics will range from how to improve underwriting and collections as well as other parts of your operation along with an update on what’s happening at the Consumer Financial Protection Bureau.

Space is limited for this webinar. Dealers can complete registration for this event by going to this website.

From Kansas to Georgia to across the Atlantic Ocean over to England, attendees evidently received what they wanted when the National Alliance of Buy-Here, Pay-Here Dealers hosted its Best Practices Conference in Orlando, Fla., at the beginning of this month.

President Ken Shilson highlighted that approximately 60 percent of attendees surveyed afterward had never been to an NABD conference previously. What they told Shilson and the NABD team about the three-day event dubbed “Best Practices to Succeed Now” left organizers excited about how the gathering unfolded.

“Attendee evaluations unanimously indicated that the program will help them succeed in 2017 and beyond,” Shilson said. “Our speakers and sponsors did an outstanding job helping attendees achieve their learning objectives.”

One person who gained significant amount of knowledge was Ciara Kimsey of Momentum Motorcars in Marietta, Ga., who might be considered a “green pea” in the BHPH space.

“As a dealer about to convert to BHPH, the information has been beyond helpful,” Kimsey said.

Taryn Meier of Affordable Transportation Co. in Abilene, Kansas, added, “This conference was very informational and helped bring my focus back to what’s most important in BHPH. Loved it!”

Along with attendees from elsewhere in the U.S. as well as Canada, Gavin Leach made the trip to Florida from Berkshire, England.

“I travel 6,000 miles to come to the convention. Need I say more; I always learn something valuable to take back,” Leach said.

The conference opened with 14 different workshop sessions covering vendor compliance, recoveries, millennial marketing, new technology, deal jacket compliance, reconditioning, F&I best practices, tax refunds, payment devices, capital solutions, lease-here, pay-here and the latest accounting and tax developments. All these workshops were interactive so attendees could ask questions and get answers on all these important topics.

General education sessions began with a highly inspirational keynote presentation by Harris Rosen, owner of Rosen Hotels and Resorts in Orlando. His keynote presentation was followed by sessions covering current developments, sourcing and financing inventory using digital channels and a benchmarks and trends update.

The event concluded with sessions on customer communications, an operating best practices dealer panel as well as a collection best practices panel and presentation. The conference also included a first-timer reception with more than 150 attendees and a sold out exhibit hall with more than 70 exhibitors who offered all the latest products and services to make attendees more profitable.

“NABD Orlando did not disappoint as the trend of improved success continued in our exhibitor space,” TaxMax founder Bill Neylan said. “It’s nice to have the ability to get in front of BHPH dealers who are decision makers that are there to take action. We meet new attendees every year who come to NABD with the goal of improving their business.”

NABD also announced that it will hold its 19th annual National BHPH Conference at a new venue — Encore in Las Vegas on May 23-25. Encore is a premier Las Vegas hotel and casino facility, and NABD has arranged unprecedented discounted room rates with no resort fees. The conference will focus on the “changing world of BHPH and of NABD” with an entirely new and exciting program agenda.

“This is a must attend for both new and experienced operators who want to compete successfully in the subprime auto finance market,” Shilson said.

For information or to register, visit www.bhphinfo.com or call (832) 767-4759.

The National Independent Automobile Dealers Association highlighted how its members continued to expand their already considerable presence in Washington D.C., coming in record numbers to last week’s National Leadership Conference and Legislative Summit.

NIADA reported that more than 175 dealers and industry leaders came from across the country to the nation's capital — the most since the event returned to Washington in 2013 — to meet with federal legislators and regulators and make the voice of the independent dealer and small business heard.

The event concluded Wednesday with the climactic Day on the Hill, when 14 teams of NIADA dealers and industry partners swarmed Capitol Hill and met with 90 members of the Senate and House of Representatives or their legislative staff. That figure obliterated the previous record of 63 meetings set during last year’s event.

“NIADA’s footprint in Washington today is by far the largest it's ever been,” NIADA senior vice president of legal and government affairs Shaun Petersen said. “In the four years since we began doing this, we’ve seen it grown exponentially.

“When we told people we had 180 dealers in 14 teams on the Hill, it really opened some eyes in Congressional offices. That's because of the commitment of NIADA members to be in Washington and make sure their voice is heard,” Petersen continued.

Among the teams were a record 10 representing NIADA's affiliated state associations. Teams from Georgia, North Carolina, South Carolina, Alabama, Texas, Ohio, Pennsylvania, Colorado, Florida and New Mexico visited all or most of their representatives and senators.

“This was a great opportunity to actually sit down face-to-face with decision-makers and really allow them to understand — not just tell them — our point of view and the issues we’re facing,” said Tamaria Yarbrough of First Class Auto Sales in Pleasant Grove, Ala.

“To actually be able to educate them on how those issues affect our businesses, as well as our customers, is vital,” Yarbrough continued.

Once again, NIADA’s teams focused on the issues of automotive recalls and the Consumer Financial Protection Bureau.

Dealers urged Congress to reject calls for a complete ban on sales of vehicles with open recalls, pointing out that independent dealers by law cannot make recall repairs and grounding those vehicles would have devastating effects on small businesses and consumers.

Operators also expressed support for the Financial CHOICE Act, an alternative to the controversial Dodd-Frank Act that is measure’s author said would make the CFPB more accountable.

In addition, the NIADA contingent pressed senators to act on S. 2663, the companion bill to H.R. 1737, which passed the House overwhelmingly last year. It would rescind the CFPB’s disputed auto financing guidance action regarding dealer discretion on interest rates issued by the CFPB in March 2013 and provide a more transparent and accountable process for dealing with the issue.

Featured speakers at National Leadership Conference events during the week included Sen. Joe Donnelly (D-Ind.) and Reps. Henry Cuellar (D-Texas), Roger Williams (R-Texas), Jeff Denham (R-Calif.), Kevin Yoder (R-Kan.), Bill Posey (R-Fla.), Tom Reed (R-N.Y.) and Steve Pearce (R-N.M.).

In addition to legislators, representatives of several federal regulatory agencies spoke to attendees Tuesday, providing regulatory updates and answering specific compliance questions from dealers. The speakers included John McNamara of the CFPB, Lois Greisman of the Federal Trade Commission, Department of Labor branch chief Derrick Witherspoon and Daniel Mosteller of the Department of Justice.

That afternoon, keynote speaker Ralph Reed of the Faith and Freedom Coalition offered an analysis of the current election season.

And, as always, the event brought together NIADA’s top national leaders as well as those of NIADA’s affiliated state associations to conduct association business, develop their leadership skills and get the latest updates on NIADA legislative, education and business initiatives.

“I'm excited to see this Leadership Conference grow and succeed as it becomes a critical component of NIADA's government affairs initiative,” said NIADA chief executive officer Steve Jordan, who also is among the industry leaders also coming to Used Car Week at the Red Rock Resort and Casino in Las Vegas on Nov. 14-18.

“Shaun Petersen and his team did a phenomenal job this year building on the momentum we’ve created since we brought this event back to D.C. in 2013,” Jordan continued.

“For as much as we’ve succeeded, we still have much more work to do as we continue to advocate on behalf of our dealers and assist our members in telling their stories,” he went on to say.

NIADA-PAC announces contributions

The Political Action Committee of the National Independent Automobile Dealers Association made contributions to Sen. Joe Donnelly (D-Ind.) and Rep. Henry Cuellar (D-Texas) in conjunction with last week’s NIADA National Leadership Conference and Legislative Summit in Washington D.C.

In addition, NIADA-PAC announced contributions to Reps. Roger Williams (R-Texas), Tom Reed (R-N.Y.), Steve Pearce (R-Kan.), Jeff Denham (R-Calif.), Kevin Yoder (R-Kan.), Bill Posey (R-Fla.), who highlighted the inaugural Friends of the Auto Industry Congressional Member Reception last Monday.

Donnelly spoke to the association at Tuesday’s PAC Cup dinner, while Cuellar was the featured speaker at a luncheon Wednesday in the Kennedy Caucus Room of the Russell Senate Building during the NIADA’s Day on the Hill.

“These contributions are crucial as we seek to help officials who are committed to work on behalf of the auto industry and small businesses, both of which are key components to the American economy,” NIADA CEO Steve Jordan said.

Donnelly, Indiana's junior senator, was elected in 2012. Before entering politics he ran a small printing and rubber-stamp business in Indiana, and has been recognized as a strong advocate for small business in the Senate, earning the National Federation of Independent Business' Guardian of Small Business award and the U.S. Chamber of Commerce Spirit of Enterprise award.

Donnelly serves on the Housing, Transportation, and Community Development Subcommittee of the Senate Banking Committee.

In his remarks, Donnelly told independent dealers their job is “to build great opportunities with your customers to take care of their needs — not only this time, but time after time after time. And our job (in government) is to try to stay out of your way as much as we possibly can, to let you make your dream come true, to take care of your customers, to see smiles on their faces and to keep moving our country forward.”

Donnelly expressed concern about the negative impact on small business of the many federal regulatory agencies, particularly the Consumer Financial Protection Bureau.

“I'm an elected representative of Indiana,” he said. “I am not part of a regulatory government agency. If we regulated like some of them, we'd all be thrown out on election day. … That’s where the CFPB has to understand it’s not all academic. It’s not all on a piece of paper. It’s real life.”

Like Donnelly, Cuellar also criticized overregulation by the CFPB and others, telling dealers that Congress must create “legislation to stop the bad regulations that might affect you and try to either change it, modify it or stop it completely.”

Cuellar is considered one of the most bipartisan legislators and has supported numerous pro-small business bills since he began representing south Texas in Congress in 2005. This year he was one of four Democrats to vote for a financial services appropriation bill that included proposals to restructure the CFPB and make it more transparent and accountable.

Cuellar told dealers their annual visit to Washington is important to educate legislators about their industry and how policies set in Washington affect them in the real world. But he added that process must continue when the dealers return home and urged them to invite their Representatives and Senators to visit their businesses.

“You can e-mail, you can send a letter, you can make a phone call, but there is nothing like sitting down with a member of Congress or a Senator or their key staff and explaining how something is positive or something is negative,” he said. "That is why it's very important for you to keep making these trips.

“There's nothing like a show and tell. What does that mean? If you want members to understand your industry better, invite them to your industry. … Whenever you have time, invite them over to come down and sit down with you. … Everybody has a member of Congress. Everybody has two Senators. Invite them over whenever you can. … Go over the rules and regs you have to deal with."

Monday's reception featured Williams, himself a dealer in Weatherford, Texas, who said the used-vehicle industry is “where the rubber meets the road. That’s the community. That’s the Little League team. That’s the Little Miss Texas. That's what we are every single day. We're fighting for that and it's my honor to be able to represent all of you in Congress.”

Yoder — like Williams, a member of the Congressional Auto Caucus — praised the dealers in attendance for their tenacity as well as taking the initiative to make the trip to D.C.

“We know most of the jobs in this country are created by small business owners, entrepreneurs, people getting up every day and putting every ounce of their retirement, everything they've got into their business," he said. And they watch Washington D.C. put more burdens and pressure on them every single day.

“We get that, but you coming up here and reminding us of that is very helpful, because this town is very forgetful. We’re happy to be soldiers in the army for free enterprise and entrepreneurship and opportunity for every American, and it starts with mom and pop companies all across this country.”

NIADA PAC Cup stays in the Southeast region

Region II — the Southeast — won the NIADA PAC Cup fundraising competition for the third consecutive year.

Region II, which includes the Carolinas, Georgia, Florida, Alabama, Tennessee and Kentucky, raised $29,000 in contributions to the National Independent Automobile Dealers Association’s Political Action Committee to again claim the prize, which was awarded last week during the NIADA National Leadership Conference and Legislative Summit in Washington D.C.

The PAC Cup competition, in its third year, pits the association’s four regions in a competition to raise the most money for the NIADA-PAC fund between the NIADA Convention and Expo in June and the National Leadership Conference. The winning region receives the PAC Cup trophy — and, of course, bragging rights.

Between them, the four regions contributed $79,850 to the NIADA-PAC fund, a record for the competition, surpassing last year’s total by more than $23,000.

Region II narrowly defeated Region III (Midwest), which raised $27,350. Region I (Northeast) was third, followed by Region IV (West).

As always, NIADA highlighted the competition came down the final minute, with dealers from all four regions making contributions during the annual PAC Cup dinner Tuesday, trying to push their region over the top. More than $61,000 was contributed during the NLC, which began Monday.

“This is an important event for us because the funds raised will advance our industry and help elect legislators who will work to support our industry and small business,” said NIADA president Billy Threadgill of Van’s Auto Sales in Florence, S.C. “The winners here are all of our dealer members.”

NIADA-PAC was created to enhance the association's mission to promote and protect the interests of the used-vehicle industry and NIADA's dealer members nationwide. NIADA-PAC supports Congressional members and candidates who seek to protect “this vital industry and keep the economic engine of small business running strong,” according to the association.

Independent and buy-here, pay-here dealers from across the U.S. are arriving in the nation's capital today for one of their association's most significant events of the year.

The National Independent Automobile Dealers Association's National Leadership Conference and Legislative Summit convenes in Washington, D.C., for the fourth consecutive year, giving independent dealers the opportunity to meet face-to-face with legislators and regulators and make the voices of independent dealers and small businesses heard.

The conference, which begins today at the Dupont Circle Hotel, will be highlighted by Wednesday’s Day on the Hill, when 14 teams of dealers and industry partners will participate in more than 80 meetings with congressional offices, advocating in support of Rep. Jeb Hensarling's Financial CHOICE Act and against a blanket ban on sales of recalled vehicles by independent dealers.

NIADA indicated both of those numbers will be the most ever for the NLC.

In addition, Sen. Joe Donnelly (D-Ind.) will speak at Tuesday night's PAC Cup Dinner and Rep. Henry Cuellar (D-Texas) is the featured speaker for Wednesday's Power Lunch during the Day on the Hill.

And today, the conference's opening day will be capped by a new event, the Friends of the Auto Industry Congressional Member Reception, a meet-and-greet scheduled to include appearances by nine U.S. Representatives. That group includes:

Rep. Roger Williams (R-Texas)

Rep. Jeff Denham (R-Calif.)

Rep. Kevin Yoder (R-Kan.)

Rep. Ryan Zinke (R-Mont.)

Rep. Bill Posey (R-Fla.)

Rep. Tom Reed (R-N.Y.)

Rep. Dennis Ross (R-Fla.)

Rep. Robert Pittenger (R-N.C.)

Rep. Steve Pearce (R-N.M.)

Tuesday's agenda includes regulatory briefings from the Consumer Financial Protection Bureau, the Federal Trade Commission, the Department of Labor and the Department of Justice.

“The National Leadership Conference and Legislative Summit is one of our association's most important events,” NIADA chief executive officer Steve Jordan said.

“By coming as a group, NIADA shows Congress we are a large, committed force representing an industry that has a huge nationwide impact on America’s economy and its communities — a force that must be taken seriously,” Jordan went on to say.

Leading into the 18th annual National Conference for BHPH hosted by the National Alliance of Buy- Here, Pay-Here Dealers, we spoke with Ken Shilson, the president and founder of NABD, about a host of issues impacting operators.

BHPH Report asked Shilson about the diminishing market presence BHPH dealers possess nowadays, how moves made by investment leaders on Wall Street are impacting dealers on Main Street, as well as some tidbits that dealerships can leverage during the second half of the year.

How are BHPH operators surviving the storm from subprime finance companies that seems to have been going on for several years now?

Based on numbers that Experian has provided through December 2015, it appears that buy-here, pay-here has lost about 40 percent of its market share to subprime finance companies, credit unions and franchised dealers. That’s a pretty big slice out of the market, and therefore it has to result in some adjustments. One of the big adjustments is in order to survive today you have to have financial flexibility and capital availability. You have to get your financial house in order to be able to weather the Storm, so to speak, where all this competition is going on. If you to sell a car today to pay the bills tomorrow you’re in deep trouble because it’s going to take time for us to regain our market share. It’s not going to come back automatically.

You must have a compliance focus today. That’s because in the past the industry has not been scrutinized the way it is now. You cannot ignore that big brother is looking. You can’t ignore it. Whether you’re big or small, or in between, you better get your compliance management system in place.

You have to have consistent underwriting. Trying to match what Wall Street is doing, what franchised dealers are doing and what credit unions have done is not smart. What is smart is to keep a consistent underwriting approach and follow your business model. I have a saying: Never match underwriting with stupidity. If you try to do it, you’ll end up with disastrous results. You need to be consistent and disciplined in your underwriting.

You need to get efficient by embracing technology. With the loss in market share, you have to reduce your costs. You have to operate more efficiently in order to operate more profitably. In other words, you need to be able to do more with less. Th e good news is that once the industry rebounds you’ll make that much more money because you’ve already streamlined things to be more profitable.

No need for specific numbers, but what’s your assessment as to how many good operators have departed the business in the last couple of years? What void is it leaving?

I think that’s a great question and no one has asked me that question before. It’s a very valid question. My answer is none. No good operators have left the business because good operators understand that it’s a marathon, not a 100- yard dash. They’re prepared to stay the course. Operators. What we’ve lost is people who were over-leveraged, who didn’t discipline themselves properly, who tried to match underwriting with stupidity, who didn’t get compliant, who didn’t do any of the things that I just said.

They continue to fail. They will continue to fail as long as they don’t have a long-term plan. I know these guys. I know who the good operators are, not based on subjectivity but based on performance. They’re all still there.

Both Fitch Ratings and Moody’s have shared reports this year about the deterioration of subprime auto ABS. What’s your reaction to the concern shown by Wall Street?

I have been tracking this for two years now. I talk with Wall Street people who are both investors and securitizers. I have said for the last year, maybe the last 18 months, that there are some deep subprime securitizations that were poorly put together and poorly structured. To that end, they are starting to fail. What I mean by that is the securitizers who had no experience in the underwriting or collection of this kind of paper, those who did not structure deals where they matched the right vehicle with the right customer, are failing and will continue to fail. Not all securitizations are bad. Th ere are many that are performing well. Those people who structured them right and those people who did do the right matching process, that paper continues to perform. But I think in the months ahead more of these poorly structured ABS transactions are going to surface. Th is is going to create an enormous opportunity for the buy-here, pay-here industry to get the customers and those vehicles back from the defaults that come out of these poorly structured deep subprime deals.

At the federal level, how informed — or misinformed — are regulators and lawmakers when it comes to how BHPH dealerships operate? What can be done to improve the situation?

There are some regulators that I would consider to be fairly well informed and others who are not. I don’t think it’s fair to generalize one way or the other. What I would say is the key To this is a continuing communication, which needs to exist between the industry leaders and the regulators to try to help more of them to have a clearer understanding of the importance of subprime auto finance industry in America today. How important of a source of transportation it is? Now at the end of the day as the leaders step up to do that — and I want to applaud NIADA’s efforts through their leadership conferences that NABD totally supports — it’s not going to be what NIADA does or what NABD does, it’s what the individual operators do. We’re going to be judged by their actions. If the industry is waiting for us to make all of the problems go away, that’s not going to happen. They’ve got to take compliance seriously. They’ve got to operate properly within regulatory constraints to do the right things or suffer the consequences.

The NABD is approaching 20 years of hosting the National Conference. What’s your assessment of the journey not only for the organization but for the BHPH industry during that span?

We want to thank the tremendous support from the many operators in the industry and other, our sponsors, people who are involved in the industry who have embraced and supported us over that journey. To them I say this: Buy-here, pay-here is a vital source of transportation in America. Without the buy-here, pay-here industry, millions and millions of Americans would not have any transportation at all and would have difficulty working and living. Buy-here, pay-here is a critical component of the American transportation system. Our consumers are car dependent.

Now NABD has championed the cause for the self-financed, buy-here, pay-here operators throughout its entire existence. We believe that the industry continues to need that type of representation. At the end of the day, we believe that the education and the training that we’re providing and offering have never been more important in this journey. The journey is not over. The journey continues.

What pearls of knowledge and wisdom would you like to leave with BHPH operators going into the second half of 2016?

I urge operators to stay the course, to get their capital and financial flexibility in order to continue in the highly competitive environment of today. I urge them to reconnect with their customers, which will help them regain market share. I urge them to take compliance very seriously and to get a compliance management system in place.

I would also say to them if they are not willing to get the education and training necessary to help them do those things, they need to expect the worst results. We’re at a time where you have to have more skill and more knowledge to navigate the course successfully than ever before. That cannot be attained by doing the same old things every day and expecting a different result.

With the discounted room block at the Wynn in Las Vegas set to expire on Sunday, Ken Shilson highlighted 10 reasons to attend the National Conference for BHPH hosted by the National Alliance of Buy-Here, Pay-Here Dealers.

Shilson, NABD’s president and founder, shared this list with BHPH Report on Thursday — less than three weeks before operators, accounting and legal experts as well as capital and service providers are set to gather during the 18th annual conference May 24-26. Without further ado, here are those 10 reasons Shilson pinpointed:

1. New regulatory developments they need to know.

2. Capital hour to find the funding they need.

3. Largest exhibit hall with all the latest products and services.

4. Several new sessions added this year.

5. The Wynn for $199 per night with no resort fees — an unprecedented discount.

6. First-timer reception with food and drinks.

7. Updated benchmarks/trend information.

8. Compliance moves to protect your operation now.

9. The only show exclusively for BHPH.

10. Best practices to regain market share.

More information about the conference — including the agenda, registration and links to discounted accommodations — is available at www.bhphinfo.com or by calling NABD at (832) 767-4759.

Shilson reiterated that NABD is a special industry group organized for the betterment of the BHPH industry nationwide, and has more than 13,000 members. Membership is obtained by attending NABD training and conferences, and members pay no annual dues.

“Our services are designed to complement and work with other automotive industry groups on matters pertaining to this segment of the automotive finance industry,” Shilson said.