It’s probably the unofficial mantra of buy-here, pay-here dealers when operators say, “We’re not in the car business. We’re in the collections business.”

Well, the newest Bronze-level National Corporate Partner of the National Independent Automobile Dealers Association aims to help operators keep payments coming into their accounts.

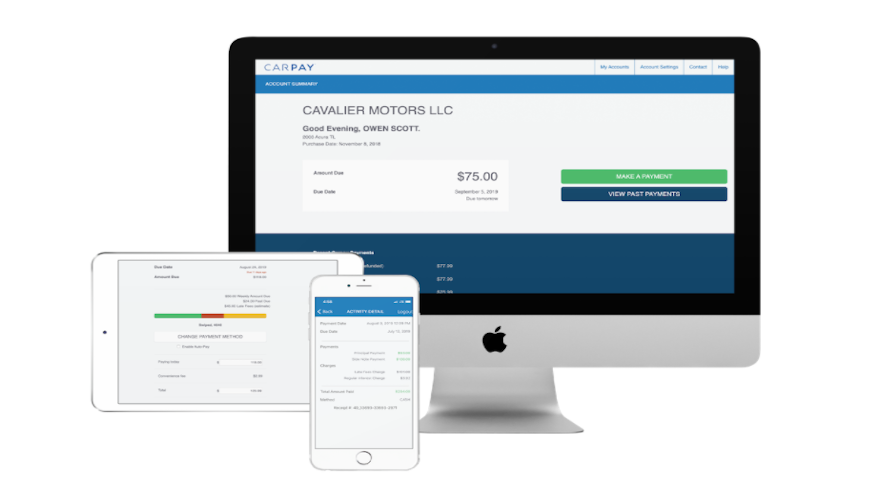

Carpay, a loan management software provider, recently joined with NIADA as a partner.

“Now more than ever, our BHPH members need access to results-oriented, revenue-focused products that elevate their ability to grow their business and provide services that create a meaningful experience for their customers,” NIADA vice president of member services James Gibson said in a news release.

“Having access to Carpay’s loan management software will go a long way toward helping BHPH dealers manage and grow their portfolio,” Gi

Carpay can helps catch late customers up and keep others from falling behind on their payments.

With more than $3 billion of BHPH contract data, Carpay highlighted that its platform is constantly being updated to reduce late payments and help BHPH dealers keep their portfolio on time.

The platform also offers:

• Unlimited text and email reminders (payment due, payment overdue, card failed, etc.).

• Mobile app for borrowers (iOS and Android).

• Web portal for borrowers (pay.carpay.com).

• “Make Payment” button on dealer websites.

• Automated phone number for borrowers to make payments 24/7 (English/Spanish).

• Text-to-pay.

• Work late accounts.

• Smart auto-pay.

• Dealer dashboard with portfolio analytics charts and detailed reporting.

“Most dealers come to Carpay after years of trying to piece together those services themselves,” Carpay chief executive officer Brandon Cavalier said in the news release. “But it’s just much easier and the data plays off of itself when dealers can consolidate all of the services under one vendor that only thinks about how to help BHPH dealers manage their borrowers.

“Carpay helps manage dealers' soft collections so their staff can spend their time on borrowers who need a little bit more attention,” Cavalier went on to say.

The National Corporate Partner program provides NIADA/NABD members with an extensive, highly vetted roster of partners they can rely on to help them grow their business, protect their assets and enhance their profitability.

“Dealers use NIADA to find vetted vendors to help them grow their dealerships and their bottom line,” Cavalier said. “So we’re honored to fill the spot for BHPH dealers looking for ways to keep their customers on time.”

As a Bronze NCP, Carpay is recognized as one of NIADA’s most trusted resources, “with a proven track record of quality and excellence,” according to the association.

For more information about Carpay, visit www.carpay.com.

Textmaxx Pro chief executive officer Chris Leedom told Tech Tank competition audience members during the 2019 Digital Dealer 26 Conference and Expo that 88 percent of all business calls go unanswered on the first try.

Evidently that circumstance was well understood by the show attendees who voted the Sarasota, Fla.-based technology firm as the winner of the fun and informative contest.

Digital Dealer 26’s Tech Tank held on April 10 challenged five leading automotive retail technology firms to detail their technology and its value proposition to business owners in a fast-paced competition. Each contestant had just three minutes to introduce their new product and then answer questions from three industry experts for an additional three minutes. When the presentations concluded, several hundred audience members and the experts voted using a text message application to decide the winner.

Leedom recapped that he used just two visual slides and one visual aid — a cell phone — to detail the power of texting to effectively communicate with customers and prospects.

“My guess is that nearly everyone in this room has texted several people since the lunch break,” Leedom said to the audience members that nodded in agreement.

Leedom told the audience he called upon his decades of experience as an entrepreneur and CEO of a nationally recognized consultancy practice to develop Textmaxx Pro. The cutting-edge, technology platform allows businesses, including auto dealers, to communicate directly with customers and prospects in one-on-one conversations as well as the ability to market their business using SMS (texting) technology using broadcast texts.

Textmaxx Pro’s Tech Tank competitors included a digital F&I platform, a new website development solution, and two digital marketing platforms.

Leedom told the audience Textmaxx Pro’s main value proposition was the ability to communicate effectively in near real time with customers. While 88 percent of business calls go unanswered, Leedom said the opposite is true of text messaging. About 93 percent of SMS messages are read within 10 minutes and a return text is usually sent within 20 minutes, according to Textmaxx Pro.

“It’s the preferred method of communication for most people across virtually every demographic,” Leedom said. “Setting appointments, gathering information, marketing, and much more can be accomplished with lightening efficiency. Quick and effective communication with your customers dramatically improves customer service and profitability.”

Leedom thinks two of the main points he addressed were likely what won the audience over. The first was legal and regulatory compliance.

Using a texting platform to text clients is regulated by the Telephone Consumer Protection Act and carries with hefty fines for violations. Textmaxx Pro’s platform text can enable any business landline or other designated phone line, Leedom said, and that is the number that appears on the customer’s phone. The platform archives the entire body of texts for five years to protect all parties and comply with necessary statutes. If a customer opts out of the service, no one but the customer can get back on the platform.

“We designed this product to help businesses harness the power of texting while ensuring compliance,” he said.

The second value that intrigued the audience was the pricing structure. Leedom said the pricing varies by the number of texts sent out and is scalable to any size business, so monthly fees for any size operation are refreshingly low, typically between $100 and $300 per month.

One of the industry experts asked about integrating the system with the dealers DMS and CRM platforms.

Leedom said Textmaxx Pro is integrated with several very large DMS platforms and the API can be integrated easily with any existing software program.

“We are working with software platforms all the time on full integrations,” Leedom said. “Our API can integrate with virtually any software product.”

Leedom added about the Tech Tank competition, “It was a great format and a lot of fun. The three industry experts asked great questions that were certainly of interest to the dealers and managers in the audience. “There were strong competitors with great presentations, and we were pleased to come out on top.”

For the 2017 National Independent Automobile Dealers Association Quality Dealer of the Year, having a way to accept cash safely for payments on retail installment contracts is crucial to operating its store efficiently and safety.

And now a tool that can help buy-here, pay-here dealerships of all sizes has been enhanced.

QuotePro and Fiserv recently announced that they are facilitating faster, next-day availability of funds and helping mitigate security concerns for businesses that accept payments in cash.

QuotePro Kiosks are the latest generation of self-service machines that can provide a complete cashiering solution to businesses that accept payments via cash, check, credit and debit card. QuotePro data from more than 100 kiosks at businesses ranging from dealers to utilities and insurance companies shows that when given a choice between cash, check, credit and debit card, 70 percent of consumers paying at these kiosks are choosing cash.

Providing faster access to the cash deposited in a kiosk is where Fiserv can help. Its CorPoint cash management solution can capture cash transaction data from the kiosk, enabling banks to provide provisional credit for cash deposited at a business location.

“Rather than waiting for cash to be manually deposited at the bank by staff or having an armored car service to empty the kiosk, process and deposit the cash into the business’s bank account, the provisional cash capability enabled by Fiserv technology allows for next-day availability of funds,” QuotePro chief executive officer Marco Freudman said.

“That helps eliminate risk and improves cash flow. Our business clients have been asking for this capability, and we see it as a game-changer,” Freudman continued.

Texas Auto Center is one of the first businesses to roll out the new capability. The operation was the 2017 NIADA Quality Dealer of the Year.

“We love our QuotePro Kiosks because they help eliminate the need for staff to handle cash, reduce errors and security concerns associated with cash payments, and they can make change. Adding provisional cash services makes it a complete solution for us,” Texas Auto Center chief financial officer Mona Rodriguez said.

“It substantially reduces our cash risk and improves availability to next day. We can reduce the frequency of armored car pick-ups and still have access to our cash flow,” Rodriguez contined.

Pat Korb, president of financial and risk management solutions at Fiserv, elaborated about the collaboration.

“For many retail businesses, cash is the dominant form of payment and innovations in self-service and technology help reduce the burden of managing cash payments,” Korb said.

“Faster access to funds, reduced overhead and enhanced security are key benefits for businesses, and consumers appreciate the flexibility and convenience to pay in the way they prefer,” Korb went on to say.

Dealers can visit quotepro.com for more information.

The Insurance Research Council (IRC) might have uncovered another market challenge for buy-here, pay-here operators who sell vehicles in Louisiana, which already ranks near the top for deliquencies.

According to a new study from the IRC, Louisiana ranks No. 1 on a list of least affordable states for auto insurance. Study orchestrators found that key cost drivers of the state’s high insurance rates include the frequency of auto accidents and resulting injury claims, as well as the prevalence of attorney involvement and litigation.

IRC calculated that Louisiana’s affordability index (2.64 percent) was the highest in the U.S. from 2011 to 2015. The affordability index is the ratio of average expenditures on auto insurance to median household income.

And also of note, the latest data from Experian Automotive showed Louisiana ranked second nationally for both 30-day and 60-day delinquency. Experian indicated the rate for 30-day delinquency rate in Louisiana during the second quarter was 3.28 percent. The 60-day rate stood at 1.08 percent.

Turning back to the IRC study, the report again showed one factor behind the high cost of insurance in Louisiana is the frequency of auto accidents and resulting insurance claims. In 2017, Louisiana had the highest bodily injury (BI) liability claim frequency in the country (1.75 claims per 100 insured vehicles, almost double the countrywide rate of 0.90 claims per 100 insured vehicles).

IRC went on to mention another important factor is the propensity of Louisiana claimants to hire attorneys and file lawsuits. Among 2017 BI claims, 54 percent of Louisiana claimants hired attorneys, compared with 48 percent of claimants in other states.

Moreover, Louisiana claimants were 60 percent more likely to file lawsuits (16 percent compared with 10 percent countrywide).

“The affordability of auto insurance is an important issue in Louisiana and many other states,” said Elizabeth Sprinkel, senior vice president of the IRC. “As policymakers seek to address this issue, it is vital to have an understanding of the cost drivers that underlie variations in the cost of auto insurance for consumers.”

The report, “Auto Insurance Affordability: Cost Drivers in Louisiana,” combines information from IRC closed-claim research and other sources and is part of IRC’s ongoing research into the factors driving the affordability of auto insurance.

For more information on the study’s methodology and findings, contact David Corum at (484) 831-9046 or at [email protected].

Buy-here, pay-here dealers and finance companies that use GPS solutions from PassTime now have access to a new gateway to leverage the company’s platform and tools.

PassTime recently launched what’s being dubbed the InTouch Summit, an all-new device management portal for its InTouch product line. InTouch is a GPS solution connecting vehicles for dealers and consumers.

Dealers can use InTouch to monitor inventory on their lot, keep track of test drives, and as a theft recovery tool. Consumers who purchase InTouch from an authorized dealer take advantage of InTouch’s connected car features for vehicle monitoring and theft recovery.

InTouch Summit — the customer portal where dealers can manage their InTouch devices — features a completely redesigned interface, faster actionable items, enhanced data analytics and a better overall user experience.

“InTouch Summit is a ground-up design that has been built completely with our InTouch customers in mind. The new portal provides a single pane of glass experience where information pertaining to all of their assets is one click away,” said Jerry Morgan, PassTime’s executive vice president of development.

Along with the companion suite of InTouch mobile apps, InTouch Summit can give customers a great experience when managing their InTouch connected vehicles.

InTouch Summit is currently available to select customers.

Clients can contact PassTime for a demonstration by calling (877) 727-7846 or sending a message to [email protected].

With the National Alliance of Buy-Here, Pay-Here Dealers (NABD) hosting its Buy-Here, Pay-Here Subprime Conference with the National Independent Automobile Dealers Association this week in Las Vegas, two GPS providers rolled out enhancements to their suite of tools.

Spireon introduced GoldStar Connect, a full-featured connected car mobile application designed to give BHPH dealers and subprime auto finance companies the opportunity to increase customer loyalty and profitability.

Meanwhile, PassTime announced the launch of its ELITE 6 device, the next generation of its award-winning Elite line of GPS solutions.

PassTime and Spireon each had a presence this week as operators from throughout the country are congregating at the MGM Grand in Las Vegas for three days of networking and training.

As the newest addition to the GoldStar GPS solution suite, Spireon highlighted GoldStar Connect can help dealers and finance companies recoup the cost of GPS, while also increasing value, convenience and safety for consumers.

Dealers and finance companies use GoldStar to stay connected to their customers in order to facilitate payment collection, monitor default predictors and streamline recoveries when necessary. With the new GoldStar Connect mobile app, consumers now can have access to all the benefits of connectivity — real-time location access, trip history, vehicle health alerts and recovery solutions for stolen vehicles — as an add-on at the time of purchase.

“In marrying the GoldStar solution with a consumer-facing mobile app, our dealer and lender customers not only improve asset management and protection, but also can offer their consumers a significant value add—modern connected car benefits regardless of the vehicle make, model and year,” said Reggie Ponsford, senior vice president of sales at Spireon.

“We have had a number of larger BHPH dealers piloting the GoldStar Connect solution in the past few months and seeing up to 90 percent consumer sell-through,” Ponsford continued.

With GoldStar Connect, consumers can gain a host of added benefits with their vehicle purchase, including:

— Safety and security: GPS tracking and geofencing capabilities can enable consumers to know the location of the vehicle at all times, helping to ensure the safety of the vehicle and the driver.

— Trip history: Provides visibility to the activity of the vehicle by date, time and duration.

— Smart alerts: Consumers can receive notifications of speeding, geofenced locations and battery condition directly to their mobile devices.

— Stolen vehicle recovery: An in-app recovery guide can provide vehicle location data and instructions to assist in reporting and recovery of a stolen vehicle.

— Insurance discounts: Many carriers provide discounts of up to 15 percent.

“Consumers want connected vehicle features and benefits, and the app helps dealers and lenders build customer loyalty while also driving additional revenue and margin,” Ponsford said. “By bundling the purchase into the vehicle loan, it’s seamless and easy for dealers and buyers.”

GoldStar Connect is available now, according to the company. To learn more, visit www.spireon.com/connect.

“We’re excited to help our customers in the vehicle finance industry evolve their thinking about GPS from solely managing risk to now providing an opportunity to increase consumer loyalty and profitability,” said Brian Deeley, director of product management at Spireon.

“The GoldStar solution is trusted by more BHPH dealers than all of our competitors combined. The addition of GoldStar Connect creates even more distance between Spireon and the rest, maintaining GoldStar as the GPS gold standard for BHPH,” continued Deeley, who will be leading a panel discussion about connecting customers with GPS during Used Car Week 2018, which begins Nov. 12 at the Westin Kierland Resort and Spa in Scottsdale, Ariz.

Early bird discounts are available through Oct. 16 by going to www.usedcarweek.biz/register.

Developments at PassTime

As mentioned, PassTime announced the launch of its ELITE 6 device, the next generation of its award-winning Elite line of GPS solutions.

PassTime highlighted Elite 6 offers the most versatile and advanced installation capabilities of any product in its history. With a unique, installer-configurable starter-interrupt setup option, installers can now easily integrate Elite 6 into a much broader selection of vehicles.

The company noted the highly flexible setup configurations also can allow Elite 6 to more easily address the challenges posed by newer ignition technologies found in push-button start vehicles as well as many advanced stop/start engine systems.

“As automotive technology continues to advance, GPS solutions need to be flexible in the way they can be installed in a vehicle. Over the last several years, the automotive industry has seen vehicle ignition systems evolve far more rapidly than ever before. Quite frankly, any GPS provider that isn’t innovating in this area is falling behind,” said Todd Goodnight, PassTime’s executive vice president of product management.

Elite 6 also features LTE communications for superior network longevity as well as a discrete, precision GPS system for enhanced location pinpointing.

In addition to the advancements in installation flexibility, PassTime went on to point out Elite 6 also boasts a 20-percent size reduction making installation easier than ever before.

Further, Elite 6 contains advanced self-override features that can give consumers multiple options, including a mobile app, to utilize disable override commands.

The company said Elite 6 will begin shipping to PassTime customers in early November.

For more information, contact PassTime at (877) 727-7846 or [email protected].

Buy-here, pay-here dealers and other finance companies that leverage PayNearMe now have a wider net to capture customer payments.

PayNearMe, a service of Handle Financial, on Thursday announced the release of a complete mobile-first payment platform, enabling merchants to accept payments from their consumers at any time, anywhere and any way they want to pay. The expanded system provides the ability to accept debit, credit and ACH payments in addition to cash; and features payment reminders and mobile wallet integration.

The PayNearMe system was initially designed to accept cash from underserved consumers for online goods and services at more than 27,000 retail locations nationwide, including 7-Eleven, ACE Cash Express, Casey’s General Stores and Family Dollar. PayNearMe can reduce the expense and operational challenges of accepting cash while providing consumers a fast, easy way to make payments.

These benefits and ease of use are now being extended to include all forms of payment.

With the launch of PayNearMe’s debit, credit and ACH payment capabilities, merchants can now securely accept and manage all types of payments, driving more on-time payments to keep customers current on their vehicle installment contracts.

The mobile-first design offers a simple and intuitive user experience that makes paying faster and more convenient. Consumers can store their payment credentials in their mobile wallets for easy access, and receive timely text reminders when their payments are due.

PayNearMe said competitive solutions require the use of third-party products at additional cost that also can increase complexity for consumers and merchants.

“PayNearMe has consistently delivered innovative yet simple payment solutions to address lenders’ most pressing needs,” said Danny Shader, chief executive officer of Handle Financial and founder of PayNearMe.

“Today, we are introducing the industry’s first complete payment platform, putting cash, debit, credit and ACH all together in one single trusted platform, along with payment reminders and mobile wallet integration,” Shader continued.

“It has never been easier for lenders to process all of their payments while delivering an outstanding mobile-first experience to their customers,” he went on to say.

The company also emphasized PayNearMe’s transparent fee structure eliminates the hidden or confusing fees charged by competitive offerings, and makes bills clear and easy to understand.

“We are incredibly excited to gain the ability to process all forms of payment through our most trusted payment platform,” said Mike Meltser, chief executive officer of Capital Auto Financial. “The interface is very easy-to-use and gives us a number of ways to engage our customers to ensure on-time payments without additional charges or hidden fees.”

Marcus Berkowitz, senior director, technology and innovation at microfinance organization, Grameen America, added, “PayNearMe’s debit and cash payment options have worked extremely well for our members.

“Making payments by debit card has proven to be faster, more convenient, and hugely beneficial for them,” Berkowitz continued.

To learn more about the expanded PayNearMe solution for billers or to experience a free demo, visit www.paynearme.com/business or email [email protected].

A leading provider that helps buy-here, pay-here dealers track their vehicles as defaults and repossessions arise now is getting involved with a firm that’s been providing another way for buyers to generate down-payment funds.

This week, HyreCar, the carsharing marketplace for ridesharing, through its alliance with DriveItAway and its dealer-focused shared mobility mission, announced a strategic partnership with PassTime, a leading provider of GPS solutions. The companies explained this partnership offers advanced vehicle asset tracking and management to dealers and fleet owners who are leveraging Mobility-as a-Service (MaaS) through the HyreCar platform.

HyreCar can offer retailers a tool allowing dealers to enter and learn the MaaS business. This gives dealers the opportunity to profit from the growing need for vehicles of rideshare drivers, while simultaneously giving rideshare drivers a “Path to Ownership” for a vehicle purchase.

DriveItAway’s “Drive for Your Down Payment” program can provide ridesharing drivers the ability to earn a down payment for their vehicle through driving for ridesharing services like Uber and Lyft, through dealer rentals.

“As we see an increasing demand in the ‘Path to Ownership’ program through our partnership with DriveItAway, it became clear that our dealer partners needed access to a more comprehensive MaaS solution with asset tracking and management,” HyreCar chief executive officer Joe Furnari said.

“As one of the leaders in telematics for over 25 years, PassTime was a natural fit to give our dealers the leveraged advantage that they need to maximize opportunities in this space,” Furnari continued.

PassTime has set up a special-order portal for DriveItAway-HyreCar dealers to procure vehicle telematics units and will be integrating all of the PassTime telematics services within its dealer focused vehicle administration platform for easy vehicle specific applications.

“PassTime is excited to enter the emerging shared mobility market through its strategic partnership with DriveItAway and HyreCar,” said Kevin Carr, vice president of financial services at PassTime.

“We look forward to providing dealers with a turnkey solution, leading the way through the application of our telematics innovations,” Carr continued.

Operators can get some treats ahead of Halloween as the biggest buy-here, pay-here specific event of the year is headed back to Las Vegas.

The NABD Buy-Here, Pay-Here Subprime Conference, powered by the National Independent Automobile Dealers Association, is set for Oct. 8-10 at the MGM Grand in Las Vegas, offering the industry’s best BHPH-specific training for both new operators and BHPH veterans.

The conference features education from the BHPH experts at the National Alliance of Buy-Here, Pay-Here Dealers and NIADA, including Ken Shilson, Ingram Walters and Chuck Bonanno, as well as top names from the subprime sphere.

Attendees will learn about new industry technology, the latest marketing strategies including digital marketing, collections and underwriting, and best practices that work today – and in the future.

There are also opportunities to network with industry experts, explore ways to secure capital to fund your operation, get updates on compliance and legal issues, and check out an exhibit hall filled with the latest products and services to improve any BHPH business.

“NABD continues, bigger and better than ever,” said Shilson, NABD president and founder. “You can't afford to miss this event. Opportunity knocks for BHPH operators who capitalize on it — and this conference will show you how to do it.”

The discounted early registration rate of $495 per person applies through Sept. 22. Group discounts are also available.

For more information or to register, visit www.nabdsubprimeconference.com or call (832) 767-4759.

Spireon has claimed another accolade for its mantle.

The GPS provider recently was named the IoT Vehicle Telematics Company of the Year in the 2018 Compass Intelligence awards. Voted on by a judging panel of more than 40 industry-leading journalists, editors and analysts covering technology and the IoT, mobile devices and software sectors, Spireon was chosen for its continued innovation in aftermarket telematics, strong market traction and exceptional customer service metrics.

This is the eighth award earned by Spireon in the past 13 months, including four awards for customer service, and a Silver Stevie award for New Product of the Year from the American Business Awards for the company’s NSpire platform.

Spireon was also named IoT Vehicle Telematics Company of the Year by Compass Intelligence in its 2016 awards program.

“Our team has worked tirelessly to continue delivering the most advanced vehicle intelligence solutions our customers need to make critical business decisions,” said Kevin Weiss, chief executive officer of Spireon.

“The introduction of our NSpire 3.0 platform and the numerous new products and enhancements we brought to market in 2017 are direct results of the passion, commitment and expertise of our people. It’s an honor to be recognized once again by Compass Intelligence, and to add this coveted award to our list of achievements over the past year,” Weiss continued.

Spireon’s NSpire cloud-based IoT platform powers all of the company’s solutions across all markets served, including GoldStar, Kahu, FleetLocate and the FleetLocate Connected by OnStar solution, developed in partnership with General Motors.

In 2017, the company introduced NSpire version 3.0, adding enhancements that dramatically increased scalability, type and volume of data collected, interoperability via open application programming interfaces (APIs) and mobility support. New micro-services were also added to accelerate development and go-to-market velocity across the company’s software applications. As a result, Spireon was able to deliver more new products to market in 2017 than any other year in its history, including six major software applications, five new hardware devices and five new mobile apps.

As a result of technology innovation and outstanding customer service, Spireon achieved significant market traction.

Following the introduction of Kahu in 2017, Spireon increased its device shipment to franchise dealers by 144 percent in the second half of 2017 over the same period in 2016. The company partnered with four of the top 10 dealer groups in the country and added 47 new dealerships that preload their full inventory of vehicles with Kahu to its customer list in 2017.

Furthermore, Spireon added 1,858 new fleet and trailer customers to its roster and grew FleetLocate device shipments to SMB customers by 120 percent compared to 2016.

“Spireon continues to excel, innovate and advance in the IoT industry. Congratulations to Spireon for leading and innovating in this very competitive market,” said Stephanie Atkinson, chief executive officer of Compass Intelligence.