Geared toward operators who are looking to close 2016 strong, the National Alliance of Buy-Here, Pay-Here Dealers released details of its upcoming BHPH Conference set for the first days of November.

The conference, whose theme is “Best Practices to Succeed Now,” is designed for both new and experienced operators. The event marks the 13th annual fall conference hosted by NABD, which is the largest used-vehicle special interest group for BHPH operators with more than 13,000 members.

The conference — to be held Nov. 1-3 at the Rosen Shingle Creek Resort in Orlando, Fla. — features dual-track workshop sessions that will focus on best operating practices, compliance, technology and new developments that operators must learn in order to succeed in today's highly competitive subprime auto finance market.

The program includes several of the nation’s leading attorneys, experts and successful operators who will share their tips and techniques to help attendees succeed in a highly competitive subprime market. The conference opens with a first-time attendee reception at 2 p.m. ET on Nov. 1.

The dual-track workshop, scheduled on the opening afternoon and then the following morning, will feature sessions that showcase new technology, including the latest dealer management software releases, the latest payment device technology and other products and services that increase profits through operating efficiency.

The compliance tracks will include vendor management responsibilities, add-on product compliance and becoming deal documentation compliant.

An accounting and tax "new developments" workshop will discuss new accounting credit loss measurement requirements, which will significantly impact all BHPH operators who carry finance receivables.

Other sessions include lease-here, pay-here as an alternative business model, Internet and social media tips to gain market share, capital solutions and ways to maximize recoveries.

“These workshops will not be infomercials, and will contain important information for operators to compete successfully today,” NABD president and founder Ken Shilson said.

During the second half of the conference, the dual tracks combine into general education sessions featuring a keynote presentation by Harris Rosen, who built a hotel empire with minimal start-up capital. Other general sessions will cover:

—Current developments update discussion

—Benchmarks and trends update

—Improving customer communications and relationships

—Operating best practices for challenging times

—Compliance issues

—Ways to protect your operation

—Avoiding collection mistakes

The exhibit hall will include all the newest products and services that increase profits and cash flow. The receptions, as well as breakfast and a luncheon with the exhibitors, are designed to allow attendees to network with other operators, experts and exhibitors.

Companies interested in exhibiting may call (832) 767-4759 while space is still available.

The Rosen Shingle Creek Resort is one of Orlando’s finest and is located near Universal Drive and many of the newest attractions. Shuttle service is available to Disney properties and to Universal Studios.

“The Rosen Shingle Creek and Orlando is a very attractive and affordable venue,” Shilson said.

Attendees are encouraged to bring their families and enjoy one of the nation’s most popular destinations. NABD has arranged discounted room rates with no resort fees in an effort to make it affordable for everyone. Early registration and member discounts are available, while supplies last, by calling NABD at (832) 767-4759 or going online to www.bhphinfo.com.

A conference agenda and speaker information is posted and will be updated on the NABD website at www.bhphinfo.com. Attendees and exhibitors are encouraged to register soon while space is still available.

“Successful BHPH operators today must understand and adapt to the competitive subprime market environment. The old ways aren’t working anymore,” Shilson said.

“This conference will definitely help operators compete more successfully while avoiding legal and regulatory pitfalls that can cost them millions,” he added.

Spireon highlighted on Monday that it has achieved its 20th consecutive quarter of year-over-year revenue growth. The record revenue growth arises as the company added more than 1 million new connected devices in the past year across all major vehicle telematics segments, including buy-here, pay-here dealers, finance companies, small- and medium-size fleets, transportation, trailer and rental car companies as well as consumer markets.

Spireon reported that its revenue jumped 20 percent year-over-year for the first half of 2016 as the company more than doubled its profitability. Spireon chief executive officer Kevin Weiss insisted this consistent growth in active subscribers extends what he believes is the company’s “leadership position” as the industry’s largest aftermarket vehicle telematics solutions provider.

“Our record revenue and profitability reflects our market leadership, increasing demand for innovative and reliable vehicle telematics solutions, as well as our deep focus on our customers' success,” Weiss said.

“The Spireon team is unmatched in our extensive industry experience and expertise and we expect to continue this historic run as we place customers at the heart of everything we do,” he continued.

Spireon indicated more than 14,000 dealership already use its solutions, and the company is making inroads into the franchised store space.

Through the first six months of 2016, Spireon tracked a 15-percent increase in year-over-year sales for its automotive technology solutions group.

Demand for Spireon’s GoldStar GPS vehicle tracking and collateral management solutions increased as auto finance professionals and BHPH dealers saw loan delinquencies hitting their highest rates this year since 2010, according to the company. Spireon GoldStar GPS solutions now connect and protect more than $21 billion in vehicle assets for BHPH operators and automotive finance companies.

Momentum for GoldStar GPS sales and active subscribers derives from the introduction of innovative new products and capabilities for the BHPH and vehicle finance markets. With the addition of the PositionPlus GPS product, Spireon now offers a full suite of GPS-based solutions that can meet the diverse needs of BHPH dealers with varying GPS tracking and collateral management requirements and budgets.

Additionally, Spireon momentum among the franchised dealer segment experienced rapid growth in the first half of 2016 with a 26 percent increase in unit sales.

Bolstered by the recent addition of the SkyLink and Kahu product offerings, franchised dealers now have comprehensive tools to manage their inventory as well as add a new revenue source for their business by offering car buyers connected car services such as stolen vehicle recovery.

With Spireon’s FleetLocate solution delivering significant customer benefits of improved business productivity, operating efficiency and customer service, Spireon experienced dramatic growth among fleet businesses during the first half of 2016. Revenue grew 27 percent in the first half while total contract value for this segment increased 70 percent.

Spireon’s enterprise fleet, trailer and transportation segment growth was fueled by new solution offerings including Spireon’s FleetLocate Temperature Monitoring product and Spireon’s Driver Performance Program, as well as Spireon’s unique model of customer engagement focused on delivering outstanding customer service and support.

Additionally, Spireon’s Local Fleet business segment revenue increased 14 percent year over year. Through Spireon’s VehiclePath channel program, Spireon partners with local and national resellers to provide small- and medium-size businesses GPS-based telematics solutions that help lower their overhead and increase revenue.

Automotive Compliance Consultants president Terry Dortch recapped what he described as “sad and unfortunate” news about employee crimes against dealers. Before going into a few tips for protecting the dealership against such activities, Dortch highlighted a few recent headlines about such occurrences, including:

• Florida couple accused of stealing $2 million from S.C. car dealership, warrants say.

• Kentucky dealership employee arrested and charged with three counts of theft by deception.

• Pennsylvania dealership controller headed to jail after embezzling $10 million.

Dortch acknowledged the criminal activity itself is detrimental, but the breach of trust can be worse. Whether informal or formal, Automotive Compliance Consultants insisted employees make a covenant with their employer when they agree to give their services for compensation.

Said a dealer whose longtime employee was charged with falsifying vendor payables to steal from the dealership, “The crime feels like the betrayal of a family member.”

A survey a few years ago by an accounting firm noted that a third of dealership respondents had “experienced actual or attempted fraud.” Of those, 62 percent of the fraud perpetrators were employees.

“These events can seem to happen out of the blue, but often in retrospect behaviors, practices and outside activities were warnings about such individuals,” Dortch said. “These individuals are often more concerned with what they get from their position than what they can contribute.”

Automotive Compliance Consultants explained that operators can consider these defenses for asset theft:

• Security cameras to watch over parts and materials inventory shelves, supply rooms, parking lots and other outside areas to observe suspicious activities.

• Limit access to areas like the parts department, main office, F&I office, cashier office, materials closets and parts storage.

• Note employees’ lifestyles, habits and behaviors that seem suspicious or otherwise indicate they may live above their visible means.

• Employees hanging around in areas where they have no legitimate reason to do so is a red flag.

• Enforce your internal controls policies.

For back-office defense, Automotive Compliance Consultants shared these suggestions:

• Don’t allow one person to have complete control of bank accounts. Have one individual handle payoffs of trade-in balances and another control license and title activities; have a third person manage the day-to-day bill paying. This would mean having multiple accounts.

• Conduct regular audits of the books; auditing by a third party preferred.

• Daily review the DOC or daily operating control sheet. Look at vendor expenses closely and know each vendor and the service they provide. Look for any abnormalities in the expense, i.e. is it way too high for the service they are providing?

• Investigate anything that looks different or out of place on vehicle values, bank statements, inventory balances or number of ROs.

• Don’t shrug off any swing in profit, revenue or payables — always investigate.

• Pay close attention to used inventory and the water that exists. Market fluctuations will occur, but you don’t want to see large swings that could signal something amiss.

• Pay close attention to your wholesaled vehicles run a report at least monthly to see what is being wholesaled and check the price it was sold at.

• Pay close attention to contracts in transit — again, this could mean something other than just waiting on stips or stipulations, the documents required by a lender to fund a loan, such as proof of income, residence, and proof of insurance.

• Check bank statements personally; randomly look for abnormalities.

• Keep an eye on used car reconditioning; if looks out of place, dig deeper.

• Conduct monthly inventory of all vehicles, used and new, and match to the dollar amount on the books and/or floor plan.

And when it comes to data security, Automotive Compliance Consultants recommended that operators engage a managed security services provider to monitor your store’s network and alert your IT staff when an intrusion occurs so immediate action can be taken. Absent such real-time network monitoring, the dealership will likely remain open to network compromise and perhaps substantial loss.

Finally, Automotive Compliance Consultants stressed that dealerships need to make sure every employee knows that no internal theft of any kind will be tolerated — and be sure they understand violations will cause dismissal, at least, and criminal prosecution often.

“Sometimes having a third party audit the dealership’s exposures will provide the most prevention and peace of mind,” Automotive Compliance Consultants added.

Automotive Compliance Consultants specializes in dealership compliance, providing in-dealership consultations and analysis, compliance audits and training, and offers solutions for all compliance needs. The Automotive Compliance Consultants staff has extensive experience in the automotive retail industry and focuses exclusively on dealership compliance issues.

For information, contact Dortch at [email protected] or visit www.compliantnow.com.

In an effort to help buy-here, pay-here dealerships as well as other finance companies in the subprime space, PassTime on Tuesday introduced SurePass Installation Solutions, a full service installation program for its GPS and telematics solutions.

The company explained the installation program will offer three levels of service and will be available in conjunction with PassTime products as well as a stand-alone offering. The nationwide program will give customers access to hundreds of certified installers for mobile, on-site and fixed location options.

“The SurePass Installation Solutions product will fit perfectly in the PassTime offering. From banks, finance companies and credit unions which do not have installation locations to pre-loading franchise lots without tying up internal resources, SurePass Installation Solutions will meet a wide variety of customer needs,” PassTime chief operating officer Chris Macheca said.

“Full-service installations are something PassTime has been working on for some time and we are excited to offer this to our customers,” Macheca continued.

In order to deliver PassTime’s SurePass Installation Solutions, PassTime has acquired an equity stake in Sure-Trac.

“We’re excited about the recent equity position acquired by PassTime and what our combined products and services will bring to the industry,” said David Wonner, president and chief executive officer of Sure-Trac.

The company stated that SurePass Installation Solutions is available now and that additional details will be available in the coming weeks.

“SurePass also provides additional services like vehicle equipment validation and visual electrical observation, giving indirect finance companies validation about the vehicles they finance,” said Kevin Carr, vice president of financial services for PassTime.

“We hear from our finance companies how valuable this service has been by eliminating concerns of improper installations and confirming the device will perform as expected,” Carr added.

With the discounted room block at the Wynn in Las Vegas set to expire on Sunday, Ken Shilson highlighted 10 reasons to attend the National Conference for BHPH hosted by the National Alliance of Buy-Here, Pay-Here Dealers.

Shilson, NABD’s president and founder, shared this list with BHPH Report on Thursday — less than three weeks before operators, accounting and legal experts as well as capital and service providers are set to gather during the 18th annual conference May 24-26. Without further ado, here are those 10 reasons Shilson pinpointed:

1. New regulatory developments they need to know.

2. Capital hour to find the funding they need.

3. Largest exhibit hall with all the latest products and services.

4. Several new sessions added this year.

5. The Wynn for $199 per night with no resort fees — an unprecedented discount.

6. First-timer reception with food and drinks.

7. Updated benchmarks/trend information.

8. Compliance moves to protect your operation now.

9. The only show exclusively for BHPH.

10. Best practices to regain market share.

More information about the conference — including the agenda, registration and links to discounted accommodations — is available at www.bhphinfo.com or by calling NABD at (832) 767-4759.

Shilson reiterated that NABD is a special industry group organized for the betterment of the BHPH industry nationwide, and has more than 13,000 members. Membership is obtained by attending NABD training and conferences, and members pay no annual dues.

“Our services are designed to complement and work with other automotive industry groups on matters pertaining to this segment of the automotive finance industry,” Shilson said.

PassTime recently announced that the United States Patent and Trademark Office invalidated the entirety of a patent owned by LunarEye that was the subject of a patent lawsuit claiming infringement by certain PassTime products.

The patent, No. 6,484,035, had claimed an apparatus and method for triggerable location reporting and listed Alvin C. Allen, Jr. (also known as Chuck Allen) as the alleged inventor.

In its opinion on Feb. 2, PassTime highlighted that a panel of three judges of the Patent Trial and Appeal Board for the United States Patent and Trademark Office ruled that PassTime “has shown by a preponderance of the evidence that claims 1–24 of the ’035 patent are unpatentable” and entered an order that “claims 1–24 of U.S. Patent No. 6,484,035 B2 are held unpatentable under 35 U.S.C. § 103.”

Back on Sept. 28, PassTime indicated the Patent Trial and Appeal Board had previously found that claim No. 3 of the patent was invalid, which had been the sole subject of a prior validity challenge by PassTime.

“We are pleased to have prevailed both times we have sought relief from the Patent Trial and Appeal Board on this invalid patent, which we had considered to have been used for filing a frivolous suit,” PassTime chief executive officer and founder Stan Schwarz

“We plan in the future to contemplate our options regarding the actions taken so far by Chuck Allen, LunarEye, and its counsel,” Schwarz continued.

In public filings, PassTime noted LunarEye stated that it intends to appeal the decision of the Patent Trial and Appeal Board.

Stewart Mesher of Conley Rose, legal counsel in the patent lawsuit, stated that “we understand that our client is pleased with the result, and we look forward to it being affirmed should LunarEye appeal it.”

PassTime added the patent lawsuit, Case 9:13-cv-00091 pending in the Eastern District of Texas, is on hold pending the outcome of any appeals that LunarEye continues to pursue.

On Wednesday, PassTime introduced the company’s new corporate brand, logo and redesigned website. The GPS tracking solutions provider explained the rebranding effort is designed to reflect the evolution of the company as well as its direction for the future.

The new website features a complete design update and streamlined layout, featuring new product logos and an emphasis on PassTime’s market segments. One of the key drivers in the new site is consolidation of the company’s fleet and theft recovery divisions into a comprehensive solution.

Additionally, PassTime pointed out that it has taken a more active role in many social media platforms, which are reflected on the new website. The creation of PassTime News Network, an online video channel, allows viewers an inside source to the company and its involvements. More information on the channel will be shared with its public release occurring in the following weeks.

The company noted its new website can work seamlessly with Facebook, Twitter, Instagram, LinkedIn and other social media platforms dedicated to promoting the new branding.

PassTime’s new website can be found at PasstimeGPS.com. It’s currently live and additional key components of the rebranding effort will continue to roll out of the next several weeks.

“I am tremendously proud of the redesign and am excited about the launch,” said Stan Schwarz, founder and chief executive officer at PassTime, which has been in business for nearly 25 years offers wireless GPS telematics products that are available for multiple sectors of the automotive industry including dealers, auto finance companies, auto leasing companies, insurance companies and fleet transportation providers. .

“PassTime has experienced tremendous growth in recent years. The rebranding initiative reflects that growth, especially in new vertical markets as well as our expansion internationally,” Schwarz went on to say.

Here’s some good news for buy-here, pay-here operators who have interests in Wisconsin.

PassTime, Hudson Cook and Minneapolis-based law firm Reinhart Boerner Van Deuren recently met with the Wisconsin Department of Financial Institutions (DFI) to discuss how GPS and payment assurance technology functions as well as how the technology protects creditors and benefits consumers.

At that meeting, Passtime urged DFI to consider clarifying its position to allow the responsible use of the technology.

PassTime announced this week that DFI issued a new interpretive opinion, which states:

“Installation of a GPS and/or a device that is designed to remotely disable a vehicle is not illegal. However, use of this technology must comply with the Wisconsin Consumer Act in addition to any other laws that may govern the usage in a particular situation.

“This statement supersedes and replaces any previous statements or positions by the department on this issue.”

PassTime vice president of compliance and public relations Corinne Kirkendall described the impact this development could mean for BHPH operators in Wisconsin.

“As this technology enters the Wisconsin marketplace, we look forward to fostering the positive relationship with Wisconsin regulators that we have been able to establish,” Kirkendall said.

“When used in compliance with the Wisconsin Consumer Act (including complying with notice of default and cure requirements) and other applicable laws (including providing proper disclosures and obtaining consumer consent), we believe GPS and payment assurance technology will present a positive benefit for consumers and the automotive industry in Wisconsin,” she went on to say.

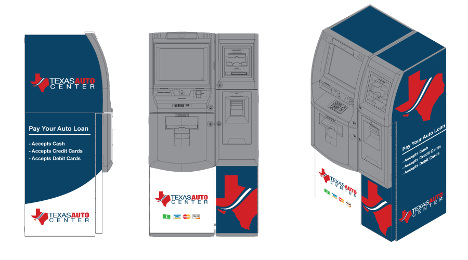

Quotepro, a provider of sales and payment technology for buy-here, pay-here dealers across the country, unveiled a payment kiosk that can accept cash, check, money order, debit card and credit card transactions.

The company highlighted the kiosk can be used for loan payments, down payments and insurance premium payments — with more enhancements in the works. It also can function as an ATM and is the first kiosk to be fully customized around each dealer’s accounting needs, weaving seamlessly into back-end book keeping.

“These kiosks save dealers thousands of dollars each month by eliminating the overhead and risks normally associated with handling cash payments,” Quotepro president Marco Freudman said.

“In addition, each kiosk is equipped with the same comparative rating technology Quotepro provides in the F&I office through its DMS integrations,” Freudman continued.

“The Quotepro software offers up to six insurance quotes from trusted local agencies who personally serve buy-here, pay-here customers, rather than selling the leads to a third party,” he went on to say. “Whether in the F&I office or at the kiosk, buyers can sign up for quality car insurance within minutes.”

Quotepro went on to mention BHPH dealers will benefit from:

— Increased traffic to storefront: Because the kiosk can double as an ATM, it can provide extra functionality that encourages customers to pay in person. In addition, by accepting all forms of payment in an automated process, the kiosk can attract customers who would otherwise pay off site at one of the popular money transfer franchises.

— Continual service from open to close: The machine never takes a break, gets distracted, has a personal emergency, or calls in sick.

— Greater accountability for vehicle buyers: The customer keys in all payment information themselves, eliminating the possibility of cashier mistakes — both actual and perceived — when recording payments or counting out change.

— Stronger long-term relationships with customers: Quotepro dealers don’t just replace a cashier with a kiosk. Operators can use that change to empower sales staff to interact more with customers every time they enter the store.

— Time savings for employees: Managers no longer need to spend time counting money or making multiple bank deposits on busy days.

— Eliminated risk of fraudulent bills: The kiosk automatically can detect and kick back any counterfeit bills.

— Improved safety: Handling large amounts of cash is a tremendous safety risk for employees, both in the store and during the transfer to the bank. Plus, if the dollar amount counted at the bank differs from the total confirmed when the cash left the dealership, there’s no easy way to locate the discrepancy.

Neighborhood Autos general manager Eddie Hale implemented at least one kiosk at each of his eight Texas locations.

“Cash is extremely difficult to control. Even with the strong systems we had in place, it was a consistent frustration,” Hale said. “Now, all the cash is counted and boxed for us. We never even touch it, and an armored vehicle picks it up at the end of each day.

“We receive a report to reconcile with our statements, so our role is just bookkeeping now,” he continued. “Thanks to these kiosks, 100 percent of our cash management issues have been eliminated.”

Hale explained the deciding factor to implement the kiosks was Quotepro’s ability to customize the supporting software for his dealership’s accounting needs.

“There are a lot of ‘boxes’ you can stick your money in, but this kiosk was completely tailored to how we do business,” he said. The product adapts to our processes rather than the other way around.”

Hale chose to reinvest his cost savings from the kiosk into an additional salesperson, furthering his plan to reconnect sales staff with their customers.

“Before installing the kiosks, our sales team rarely interacted with customers after they purchased a vehicle. All future discussions happened with the cashier,” Hale said.

“Now, my sales team members have so many more opportunities to talk with their customers,” he continued. “They’re having the important conversations about referrals, the customer’s next trade, or their teenager’s upcoming car purchase.”

Quotepro’s kiosks are now available in all 50 states. The company plans several enhancements in 2016, including the ability to accept payments for more than 9,000 billers such as municipalities, utilities, cell phone companies and cable companies.

Coming on the heels of another successful educational boot camp for new and veteran operators, the National Alliance of Buy-Here, Pay-Here Dealers has become an Authorized Education Provider for DBA International, the nonprofit trade association that represents more than 575 companies that purchase performing and nonperforming receivables on the secondary market.

The organizations explained that individuals in the receivables industry can earn continuing education credits toward DBA International certification for completion of in-person, live webinar, or online courses offered through NABD.

NABD indicated that it earned the Authorized Education Provider designation by demonstrating excellence in providing instruction to the BHPH industry. The association is dedicated to improving the quality of BHPH dealers through education, ongoing training, and by promoting the interests of self-finance dealers nationwide. NABD hosts two large, well-attended conferences annually; two of which DBA International board members have participated in as presenters this past year.

“NABD is very pleased that DBA International has selected us as an Authorized Education Provider. As a special interest group, we are organized to work with other associations, like DBA, for the betterment of the subprime auto finance industry,” NABD president and founder Ken Shilson.

“The BHPH industry faces several new legal and regulatory challenges, and we are working diligently to help our members successfully meet them” Shilson continued.

Our evolving relationship with DBA International will provide NABD members with access to experts in debt collection, compliance, loss mitigation, and with new capital market resources. It will benefit both organizations,” he went on to say.

NABD plans to have DBA International conduct an interactive workshop at its National BHPH Conference at the Wynn in Las Vegas on May 24 to 26.

“Auto finance receivables and the subprime market are growing at an unprecedented pace,” DBA International executive director Jan Steiger said.

“Many of our members already work in this area, and many more are exploring opportunities to expand in this asset class,” Steiger continued.

“As an Authorized Education Provider, our members will benefit from the expertise and resources of NABD’s education offerings and conferences as it simplifies the process for obtaining certification credits for our members,” she went on to say.

NABD completes ninth successful BHPH boot camp

NABD celebrated its run of hosting Boot Camps earlier this month with another successful event in Monroe, N.C., on Jan. 9 and Jan. 10.

The training took place at the operations of Ingram Walters and included tours of his entire operations. Attendees received procedures and human resources manuals, compliance materials, financial modeling software, and many other resources to help them operate more successfully.

“This is the only BHPH training where attendees can see a BHPH operation while learning in the classroom,” Shilson said.

“Attendees from around the nation attended this two-day session,” he continued. “Boot Camp sponsors included Auto Zone, Auto Search Technologies, Primalend, and Stars GPS, who made expert presentations during the training about reconditioning, Web design and social media, capital acquisition and GPS technology. CounselorLibrary and Hudson Cook provided the compliance materials to attendees.”

Shilson and Walters conducted the training and moderated the interactive classroom sessions.

“This was our ninth Boot Camp and attendees have been extremely complimentary of the quality and depth of the training they have received,” Shilson said. “All operating and financial aspects of running a successful BHPH operation are covered,”

Shilson added that attendees included both experienced and operators who are new to the industry. Networking during the Boot Camp was exceptional and all attendees received an individual critique of their business plans, as well as training takeaways.

“This training will help them compete more successfully in 2016 and beyond,” Shilson said.

NABD also announced that it is holding its 18th annual National BHPH Conference at the Wynn Resort & Casino in Las Vegas on May 24 to May 26.

For more information or to register, visit www.bhphinfo.com or call (832) 767-4759.