Ignite Consulting Partners continued its Tip of the Week series by again focusing on the enhanced Safeguards Rule set to be implemented by the Federal Trade Commission.

Ignite said that independent and buy-here, pay-here dealerships should have completed or at least are in the process of compiling their risk assessments and formulated a report mandated by the FTC.

The firm said that these reports should contain details based on your investigation about events where the FTC says pose a foreseeable risk “to the security, confidentiality, and integrity of customer information.”

Those risks could be physical or digital, internal or external, or in any combination of those and no two are going to look the same.

Ignite then noted three components these risk reports must contain, including:

• Be written: The first rule is that it must be documented in writing.

• Define risk criteria: Every assessment must include the criteria you used to determine those risks. Examples include high/medium/low and urgent/not urgent.

• Include plans for periodic reassessment: It is not a one-time event, but ongoing. Changes to your business and the emergence of new threats are ongoing and your assessment procedures should reflect that.

“Examples of changes that would prompt a review include moving to a new building or changing high risk vendors such as your ISP or cloud storage solutions,” Ignite experts said. “During COVID, many of you changed your work from home policies, allowing employees to work remotely and even use their own devices.

“Major structural changes like these present their own set of risks and require a reanalysis. New threats may come from external sources such as new viruses or vulnerabilities found in the hardware or software you use,” they continued.

To help dealerships and finance companies even more, Ignite is rolling out what it’s calling “The Works.” It’s a six-part package designed to help operations navigate through preparations for the intensified Safeguards Rule, which is set to go into practice in December.

And through Oct. 31, Ignite is offering a 40% discount on “The Works.”

If you have questions about compiling this initial report, choosing a qualified individual and would like to speak to a compliance specialist or to get more information about “The Works,” send an email to Ignite at [email protected] or call (817) 900-8754.

In another installment of its Tip of the Week, Ignite Consulting Partners reviewed what the Federal Trade Commission previously has stated about what attributes a qualified individual (QI) should have. These are the individuals at a dealership or finance company who head up matters associated with the revamped Safeguards Rule and other regulations generated by the FTC.

Ignite spelled out four characteristics of a QI, including:

• The QI can be an employee of the company whose information security program (ISP) they are implementing. They can also work for an affiliate of the company or for a completely different company.

• The rule does not require the QI to have a specific degree or technical certification.

• A covered entity with five employees could and will have a QI with a vastly different background than one overseeing the ISP of a 1,000 employee company (and that is OK).

• The QI’s responsibility is to “…implement and supervise your company’s information security program,” not necessarily do all the technical work themselves.

Based on Ignite’s experience, firm experts said successful QIs have some of the following strengths:

• They understand your business, where information is (physical and digital) and how and where it is transmitted.

• They have great communications skills and get along well with others. The QI must be able to work with different departments and types of people.

• They have strong organization skills, which are needed when managing a project of this scope.

• The best QIs have superb writing skills. From the written risk assessment to the Safeguards implementation plan, it is critical that they can formulate and document the process well.

“These are just a few of the things you should be thinking about when designating a qualified individual,” Ignite said in its latest tip of the week message.

To help dealerships and finance companies even more, Ignite is rolling out what it’s calling “The Works.” It’s a six-part package designed to help operations navigate through preparations for the intensified Safeguards Rule, which is set to go into practice in December.

And through Oct. 31, Ignite is offering a 40% discount on “The Works.”

If you have questions about your choosing a qualified individual and would like to speak to a compliance specialist or to get more information about “The Works,” send an email to Ignite at [email protected] or call (817) 900-8754.

Both a federal agency and multiple national associations are urging the Federal Trade Commission to delay implementation of amended Safeguards Rule.

However, if the regulation stays on its course to be enforced beginning in December, the Texas Independent Automobile Dealers Association (TIADA) is trying to help operators prepare.

TIADA recently reiterated that it launched a dealer portal earlier this year to educate dealers across the country and develop an affordable way to address some of the new requirements found in the FTC rule.

TIADA explained that the FTC amended its Safeguards Rule earlier this year, creating new requirements for non-banking financial institutions, including dealerships. The new rules become effective in December and are much more specific than the old rules.

A few key provisions to the updated Safeguards Rule include:

• Each dealership must identify a “Qualified Individual” who is responsible for the program within the dealership and reports to the dealership’s board of directors or management annually,

• Dealerships will be required to have a written information security program and manual,

• And dealerships will be required to have an employee training program.

TIADA pointed out the FTC is ramping up its enforcement efforts this year. According to its website, “The FTC has brought legal actions against organizations that have violated consumers’ privacy rights, or misled them by failing to maintain security for sensitive consumer information, or caused substantial consumer injury.”

Among other things, TIADA pointed out the dealer education portal was built to help dealers stay compliant.

“Our goal is for this training to be used as a tool for dealers to avoid inadvertent exposure of customer information, government enforcement actions, lawsuits, and bad press,” TIADA executive director Jeff Martin said in a news release.

TIADA is working closely with several state and national automobile dealer associations to create an affordable option for their dealer members and help drive revenue for the associations.

“We already have dealers from all over the country taking the course. If a dealer from Colorado takes a course through the portal, we send 50% of that revenue back to Colorado,” Martin said. “Since we already developed the course and have an online platform to deliver it, it just made sense to partner with other associations.”

The safeguards compliance course through the dealer education portal was designed specifically with dealers in mind. There are two courses available, one for the dealership’s qualified individual and another for all other staff.

There is a volume pricing option available for any dealership with ten or more employees who need to take the course.

TIADA said the courses are easy, quick, affordable, and specifically designed for dealers. The program includes model safeguards policies and agreements for dealerships at no additional charge.

For more information, go to www.txiada.org.

ComplyNet president and general counsel Adam Crowell returned for another appearance on the Auto Remarketing Podcast; this time with the topic being the Safeguards Rule enhanced by the Federal Trade Commission.

Dealerships have until December to get its compliance in order to meet the long list of rule requirements ordered by the FTC. Crowell highlights some steps to get on the right path.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Now that the IRS is processing tax returns, the Federal Trade Commission is ramping up its assistance and educational efforts in conjunction with Tax Identity Theft Awareness Week, which runs from Feb. 3-7.

In an effort to help both consumers and small businesses like independent and buy-here, pay-here dealerships, the FTC is co-hosting a series of free events highlighting the warning signs of tax identity theft and government imposter scams, ways consumers can protect themselves and what to do if a consumer is a victim of tax identity theft.

The FTC recapped that tax identity theft occurs when a person uses someone else’s Social Security number to either file a tax return and claim the victim’s refund, or to earn wages that are reported as the victim’s income.

Some of the events include:

—The FTC and the Identity Theft Resource Center host a webinar on Feb. 3 at 2 p.m. ET on identity theft and tax identity theft. Registration can be completed here.

—The FTC and IRS host a webinar on Feb. 4 at 2 p.m. ET for small businesses focused on practical data security practices to protect sensitive business and customer information and imposter scams that target small businesses. Registration can be completed here.

The FTC, AARP, and the U.S. Treasury Department host telephone town hall meetings on Feb. 5, at 10 a.m. ET and 1 p.m. ET, on tax identity theft and government imposter scams. Registration for the first meeting is available here with registration for the second gathering can be found here.

It’s a scenario pretty common to buy-here, pay-here dealerships. Store management tries to satisfy a dispute with an unhappy customer, but that individual turns to the internet to vent — and perhaps badmouth — about the dealer and its personnel.

It might cross operators’ minds to put a clause in an installment contract prohibiting such activities, but the National Automobile Dealers Association sent strong suggestion against that strategy stemming from what the Federal Trade Commission (FTC) could do as a result.

NADA recapped this week that the FTC announced its first enforcement action pursuant to the recently enacted federal Consumer Review Fairness Act (CRFA), suing three businesses and two business owners for allegedly violating the CRFA. The FTC alleged that the companies used form contracts that included clauses barring customers from sharing negative comments and demanded financial penalties (damages and attorney’s fees) against customers who did so.

The regulator said the businesses — including an HVAC contractor, flooring seller and horseback riding company — have reached a preliminary agreement with the FTC to stop using the contract provisions and to inform their customers that the provisions cannot be enforced.

When NADA spotted the development, the association said via a daily e-newsletter, “Under the CRFA, dealerships are prohibited from including provisions in any ‘form’ contract that seek to restrict people from posting honest reviews about the dealership, or penalize them for doing so. This includes any consumer contract or agreement entered at the dealership or in online terms and conditions.

“The CRFA protects a broad variety of consumer assessments including people’s ability to share their honest opinions about a business’s products, services, or conduct, in any forum, including social media. A business can be found to have violated the CRFA whether they actually seek to enforce such a contract provision or not,” NADA continued in special material to help stores.

In a separate blog post, the FTC also shared a trio of recommendations for dealerships and other businesses in order to comply with the CRFA. They included:

1. Review your form contracts.

Has it been a minute since you’ve read your form contracts? What do they say about consumer reviews or other communications covered by the CRFA? And where did the language come from in the first place? If you haven’t given your contracts the once-over since the CRFA took effect on March 14, 2017, it’s time to take a closer look. Read Consumer Review Fairness Act: What Businesses Need to Know to review the basics.

2. The FTC and states can enforce the CRFA whether or not a company follows through on its threats.

You’ve probably seen press reports about companies that have tried to enforce illegal provisions against consumers. It’s not the kind of publicity any business wants. But it’s a mistake to think you’re in the clear if you include those provisions in form contracts, but haven’t followed through against consumers. The CRFA establishes that the existence of an illegal contract provision alone could subject a company to a federal or state enforcement action — and the consequences can go beyond FTC or court orders. Companies can be subject to financial penalties for knowing violations of the CRFA.

3. The FTC Act also applies.

Courts have looked at companies’ practices related to consumer reviews through the lens of the FTC Act’s prohibition on unfair or deceptive practices. Of course, companies should comply with the Consumer Review Fairness Act, but questionable conduct also can be challenged under Section 5 of the FTC Act.

The National Independent Automobile Dealers Association reminded operators about an important change from the Federal Trade Commission that went in effect this past Sunday.

NIADA said dealers now are required to display the new version of the federally mandated buyers guide form on all used vehicles displayed for sale to consumers.

Following a lengthy review of the Used Motor Vehicle Trade Regulation — commonly referred to as the Used Car Rule — in November 2016, NIADA recapped that the FTC released a revised rule that includes changes to the buyers guide form.

The FTC gave dealers until Jan. 28, 2018 to exhaust existing supplies of the old buyers guide before requiring the revised form.

“NIADA worked extensively with the FTC on its review of the Used Car Rule to ensure any change to the rule did not impose a new regulatory burden on dealers,” association officials said.

“Through NIADA’s efforts, the amendments to the rule do not change its essential requirements – but the Buyers Guide form has changed,” they continued.

NIADA recapped that the revisions to the form include:

• A recommendation consumers get a vehicle history report before buying a used car that sends them to ftc.gov/usedcars for more information on how to get one

• Directions for consumers to visit safercar.gov to check for safety recalls before purchasing a used vehicle

• A new description of an “As Is” sale to clarify that “As Is” refers only to whether the vehicle is offered with a warranty from the dealer

• Boxes dealers can check if they wish to indicate whether a vehicle is covered by a third-party warranty and whether a service contract may be available

• A box dealers can check to indicate an unexpired manufacturer’s warranty applies

• A statement in Spanish on English versions of the form advising Spanish-speaking consumers to ask for the Buyers Guide in Spanish if the dealer is conducting the sale in Spanish

• Addition of air bags and catalytic converters to the list of major defects that can occur in used vehicles.

Dealers can obtain an English version of the new buyers guide through this website.

NIADA members left an opportunity to meet with a variety of federal lawmakers and their staffs with a sense of accomplishment in relaying what it’s like to be an independent dealerships nowadays.

The National Independent Automobile Dealers Association's National Policy Conference and Day on Capitol Hill wrapped up last week, providing an illustration of — and a reason for — NIADA’s growing footprint in Washington D.C.

NIADA's annual Washington event brought independent dealers to the nation's capital from across the country to meet with federal legislators and regulators and make the voice of the independent dealer and small business heard among America's policymakers.

This year's event drew 202 attendees, the most ever for what was formerly known as the National Leadership Conference.

“This is what makes a difference to our industry and our members,” NIADA president David Andrews said.

“We need to tell these people who we are, what we do and what we do for the communities we operate in,” Andrews continued. “We’re telling them what’s going on in our world — the real world. We’re trying to protect our businesses, our industry, our members and our future.

“And you can see what a big difference it makes. Now they know about NIADA and what we do, and they care about us and about what we have to say,” Andrews went on to say along with elaborating even more during a recent episode of the Auto Remarketing Podcast that’s available here.

As always, the conference concluded with the climactic Day on the Hill when 14 teams of NIADA dealers and industry partners took to Capitol Hill and met with more than 110 members of the Senate and House of Representatives or their legislative staff.

Association leadership insisted that number clearly shows how NIADA's political reach continues to expand. It’s 20 more than last year, and it means dealers had direct interaction with more than a fifth of the combined membership of the House and Senate in a single day.

“Our presence has really expanded in Washington D.C., and as a result, Congress is taking notice of the importance of our industry's positions,” NIADA chief executive officer Steve Jordan said. “This is exactly how we drew it up five years ago when we decided to restart this event and bring our member dealers to Washington.”

Among the teams were 10 representing NIADA's affiliated state associations. Teams from Georgia, North Carolina, South Carolina, Alabama, Texas, Ohio, the Mid-Atlantic region (MARIADA), Colorado, Illinois and Virginia visited all or most of their representatives and senators.

NIADA’s teams spoke to legislators about a number of issues currently pending in Congress, advocating in support of tax reform as well as major reforms to the Consumer Financial Protection Bureau to make it more responsive, transparent and accountable.

They also spoke in favor of repealing the CFPB's arbitration rule — a measure that has already passed the House and is awaiting a vote in the Senate — and against a blanket ban on sales of recalled vehicles by independent dealers.

“It’s absolutely crucial for us to be here,” said Stephanie Isakson of Parker Auto Sales in Knoxville, Tenn. “There were a lot of issues we talked about that had the legislators and staffers genuinely surprised by what we told them, about the things that happen day to day that they don't live.”

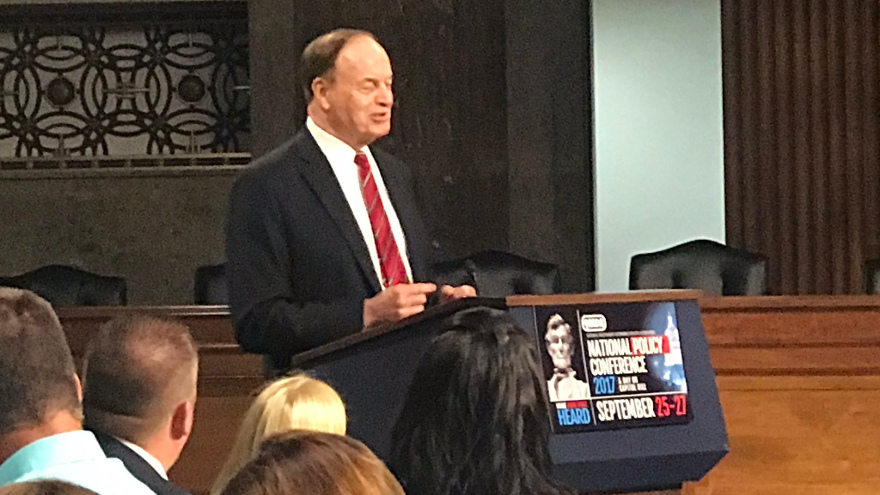

During the Day on the Hill's Power Luncheon in the Senate Rules and Administration Committee meeting room, Sen. Richard Shelby (R-Ala.) told attendees he’d been asked why businesspeople need to come to Washington.

“I’ll tell you why you need to come,” Shelby said. “You need to come up here and see what’s going on. Somebody's going to influence the tax policy. You’d hope to be part of that. Somebody’s going to influence the regulatory policy that affects everything you do.

“That's why you're here and why you should be here. … When we vote on things, it affects you, one way or the other — good or bad. When people push regulations and you say, 'Gosh, who did this? How could they do that? Why would they do that? It makes no sense.' All of it affects you,” Shelby went on to say.

The 2017 National Policy Conference also included the presentation of the inaugural NIADA Legislator of the Year award to Rep. Roger Williams (R-Texas) at a Tuesday night reception.

That same evening, the PAC Cup was awarded to the Southeast Region for contributing the most to the NIADA-PAC fund from among the association's four regions. In all, the competition raised more than $100,000 for the PAC fund.

In addition to legislators, representatives of several federal regulatory agencies — and, for the first time, the White House — spoke to attendees Tuesday, providing updates and answering specific compliance questions from dealers.

The speakers included Damion English of the CFPB, Tom Pahl of the Federal Trade Commission, and a contingent from the Small Business Administration, as well as D.J. Gribbin of the National Economic Council and deputy chief of staff Rick Dearborn, representing the White House.

And, as always, the event brought together NIADA's top national leaders as well as those of NIADA's affiliated state associations to conduct association business, develop their leadership skills and get the latest updates on NIADA legislative, education and business initiatives.

“The value of being here is just immeasurable, really,” said Jack Carter of Turn and Burn Motors in Conyers, Ga. “You can’t expect members of Congress to know our business. They’re not car dealers. So we have to continue to try to educate them and develop those relationships. We just have to keep at it.”

BHPH Senior Editor Nick Zulovich was on site at the conference. See his podcast from the event below

The National Independent Automobile Dealers Association highlighted how its members continued to expand their already considerable presence in Washington D.C., coming in record numbers to last week’s National Leadership Conference and Legislative Summit.

NIADA reported that more than 175 dealers and industry leaders came from across the country to the nation's capital — the most since the event returned to Washington in 2013 — to meet with federal legislators and regulators and make the voice of the independent dealer and small business heard.

The event concluded Wednesday with the climactic Day on the Hill, when 14 teams of NIADA dealers and industry partners swarmed Capitol Hill and met with 90 members of the Senate and House of Representatives or their legislative staff. That figure obliterated the previous record of 63 meetings set during last year’s event.

“NIADA’s footprint in Washington today is by far the largest it's ever been,” NIADA senior vice president of legal and government affairs Shaun Petersen said. “In the four years since we began doing this, we’ve seen it grown exponentially.

“When we told people we had 180 dealers in 14 teams on the Hill, it really opened some eyes in Congressional offices. That's because of the commitment of NIADA members to be in Washington and make sure their voice is heard,” Petersen continued.

Among the teams were a record 10 representing NIADA's affiliated state associations. Teams from Georgia, North Carolina, South Carolina, Alabama, Texas, Ohio, Pennsylvania, Colorado, Florida and New Mexico visited all or most of their representatives and senators.

“This was a great opportunity to actually sit down face-to-face with decision-makers and really allow them to understand — not just tell them — our point of view and the issues we’re facing,” said Tamaria Yarbrough of First Class Auto Sales in Pleasant Grove, Ala.

“To actually be able to educate them on how those issues affect our businesses, as well as our customers, is vital,” Yarbrough continued.

Once again, NIADA’s teams focused on the issues of automotive recalls and the Consumer Financial Protection Bureau.

Dealers urged Congress to reject calls for a complete ban on sales of vehicles with open recalls, pointing out that independent dealers by law cannot make recall repairs and grounding those vehicles would have devastating effects on small businesses and consumers.

Operators also expressed support for the Financial CHOICE Act, an alternative to the controversial Dodd-Frank Act that is measure’s author said would make the CFPB more accountable.

In addition, the NIADA contingent pressed senators to act on S. 2663, the companion bill to H.R. 1737, which passed the House overwhelmingly last year. It would rescind the CFPB’s disputed auto financing guidance action regarding dealer discretion on interest rates issued by the CFPB in March 2013 and provide a more transparent and accountable process for dealing with the issue.

Featured speakers at National Leadership Conference events during the week included Sen. Joe Donnelly (D-Ind.) and Reps. Henry Cuellar (D-Texas), Roger Williams (R-Texas), Jeff Denham (R-Calif.), Kevin Yoder (R-Kan.), Bill Posey (R-Fla.), Tom Reed (R-N.Y.) and Steve Pearce (R-N.M.).

In addition to legislators, representatives of several federal regulatory agencies spoke to attendees Tuesday, providing regulatory updates and answering specific compliance questions from dealers. The speakers included John McNamara of the CFPB, Lois Greisman of the Federal Trade Commission, Department of Labor branch chief Derrick Witherspoon and Daniel Mosteller of the Department of Justice.

That afternoon, keynote speaker Ralph Reed of the Faith and Freedom Coalition offered an analysis of the current election season.

And, as always, the event brought together NIADA’s top national leaders as well as those of NIADA’s affiliated state associations to conduct association business, develop their leadership skills and get the latest updates on NIADA legislative, education and business initiatives.

“I'm excited to see this Leadership Conference grow and succeed as it becomes a critical component of NIADA's government affairs initiative,” said NIADA chief executive officer Steve Jordan, who also is among the industry leaders also coming to Used Car Week at the Red Rock Resort and Casino in Las Vegas on Nov. 14-18.

“Shaun Petersen and his team did a phenomenal job this year building on the momentum we’ve created since we brought this event back to D.C. in 2013,” Jordan continued.

“For as much as we’ve succeeded, we still have much more work to do as we continue to advocate on behalf of our dealers and assist our members in telling their stories,” he went on to say.

NIADA-PAC announces contributions

The Political Action Committee of the National Independent Automobile Dealers Association made contributions to Sen. Joe Donnelly (D-Ind.) and Rep. Henry Cuellar (D-Texas) in conjunction with last week’s NIADA National Leadership Conference and Legislative Summit in Washington D.C.

In addition, NIADA-PAC announced contributions to Reps. Roger Williams (R-Texas), Tom Reed (R-N.Y.), Steve Pearce (R-Kan.), Jeff Denham (R-Calif.), Kevin Yoder (R-Kan.), Bill Posey (R-Fla.), who highlighted the inaugural Friends of the Auto Industry Congressional Member Reception last Monday.

Donnelly spoke to the association at Tuesday’s PAC Cup dinner, while Cuellar was the featured speaker at a luncheon Wednesday in the Kennedy Caucus Room of the Russell Senate Building during the NIADA’s Day on the Hill.

“These contributions are crucial as we seek to help officials who are committed to work on behalf of the auto industry and small businesses, both of which are key components to the American economy,” NIADA CEO Steve Jordan said.

Donnelly, Indiana's junior senator, was elected in 2012. Before entering politics he ran a small printing and rubber-stamp business in Indiana, and has been recognized as a strong advocate for small business in the Senate, earning the National Federation of Independent Business' Guardian of Small Business award and the U.S. Chamber of Commerce Spirit of Enterprise award.

Donnelly serves on the Housing, Transportation, and Community Development Subcommittee of the Senate Banking Committee.

In his remarks, Donnelly told independent dealers their job is “to build great opportunities with your customers to take care of their needs — not only this time, but time after time after time. And our job (in government) is to try to stay out of your way as much as we possibly can, to let you make your dream come true, to take care of your customers, to see smiles on their faces and to keep moving our country forward.”

Donnelly expressed concern about the negative impact on small business of the many federal regulatory agencies, particularly the Consumer Financial Protection Bureau.

“I'm an elected representative of Indiana,” he said. “I am not part of a regulatory government agency. If we regulated like some of them, we'd all be thrown out on election day. … That’s where the CFPB has to understand it’s not all academic. It’s not all on a piece of paper. It’s real life.”

Like Donnelly, Cuellar also criticized overregulation by the CFPB and others, telling dealers that Congress must create “legislation to stop the bad regulations that might affect you and try to either change it, modify it or stop it completely.”

Cuellar is considered one of the most bipartisan legislators and has supported numerous pro-small business bills since he began representing south Texas in Congress in 2005. This year he was one of four Democrats to vote for a financial services appropriation bill that included proposals to restructure the CFPB and make it more transparent and accountable.

Cuellar told dealers their annual visit to Washington is important to educate legislators about their industry and how policies set in Washington affect them in the real world. But he added that process must continue when the dealers return home and urged them to invite their Representatives and Senators to visit their businesses.

“You can e-mail, you can send a letter, you can make a phone call, but there is nothing like sitting down with a member of Congress or a Senator or their key staff and explaining how something is positive or something is negative,” he said. "That is why it's very important for you to keep making these trips.

“There's nothing like a show and tell. What does that mean? If you want members to understand your industry better, invite them to your industry. … Whenever you have time, invite them over to come down and sit down with you. … Everybody has a member of Congress. Everybody has two Senators. Invite them over whenever you can. … Go over the rules and regs you have to deal with."

Monday's reception featured Williams, himself a dealer in Weatherford, Texas, who said the used-vehicle industry is “where the rubber meets the road. That’s the community. That’s the Little League team. That’s the Little Miss Texas. That's what we are every single day. We're fighting for that and it's my honor to be able to represent all of you in Congress.”

Yoder — like Williams, a member of the Congressional Auto Caucus — praised the dealers in attendance for their tenacity as well as taking the initiative to make the trip to D.C.

“We know most of the jobs in this country are created by small business owners, entrepreneurs, people getting up every day and putting every ounce of their retirement, everything they've got into their business," he said. And they watch Washington D.C. put more burdens and pressure on them every single day.

“We get that, but you coming up here and reminding us of that is very helpful, because this town is very forgetful. We’re happy to be soldiers in the army for free enterprise and entrepreneurship and opportunity for every American, and it starts with mom and pop companies all across this country.”

NIADA PAC Cup stays in the Southeast region

Region II — the Southeast — won the NIADA PAC Cup fundraising competition for the third consecutive year.

Region II, which includes the Carolinas, Georgia, Florida, Alabama, Tennessee and Kentucky, raised $29,000 in contributions to the National Independent Automobile Dealers Association’s Political Action Committee to again claim the prize, which was awarded last week during the NIADA National Leadership Conference and Legislative Summit in Washington D.C.

The PAC Cup competition, in its third year, pits the association’s four regions in a competition to raise the most money for the NIADA-PAC fund between the NIADA Convention and Expo in June and the National Leadership Conference. The winning region receives the PAC Cup trophy — and, of course, bragging rights.

Between them, the four regions contributed $79,850 to the NIADA-PAC fund, a record for the competition, surpassing last year’s total by more than $23,000.

Region II narrowly defeated Region III (Midwest), which raised $27,350. Region I (Northeast) was third, followed by Region IV (West).

As always, NIADA highlighted the competition came down the final minute, with dealers from all four regions making contributions during the annual PAC Cup dinner Tuesday, trying to push their region over the top. More than $61,000 was contributed during the NLC, which began Monday.

“This is an important event for us because the funds raised will advance our industry and help elect legislators who will work to support our industry and small business,” said NIADA president Billy Threadgill of Van’s Auto Sales in Florence, S.C. “The winners here are all of our dealer members.”

NIADA-PAC was created to enhance the association's mission to promote and protect the interests of the used-vehicle industry and NIADA's dealer members nationwide. NIADA-PAC supports Congressional members and candidates who seek to protect “this vital industry and keep the economic engine of small business running strong,” according to the association.

Independent and buy-here, pay-here dealers from across the U.S. are arriving in the nation's capital today for one of their association's most significant events of the year.

The National Independent Automobile Dealers Association's National Leadership Conference and Legislative Summit convenes in Washington, D.C., for the fourth consecutive year, giving independent dealers the opportunity to meet face-to-face with legislators and regulators and make the voices of independent dealers and small businesses heard.

The conference, which begins today at the Dupont Circle Hotel, will be highlighted by Wednesday’s Day on the Hill, when 14 teams of dealers and industry partners will participate in more than 80 meetings with congressional offices, advocating in support of Rep. Jeb Hensarling's Financial CHOICE Act and against a blanket ban on sales of recalled vehicles by independent dealers.

NIADA indicated both of those numbers will be the most ever for the NLC.

In addition, Sen. Joe Donnelly (D-Ind.) will speak at Tuesday night's PAC Cup Dinner and Rep. Henry Cuellar (D-Texas) is the featured speaker for Wednesday's Power Lunch during the Day on the Hill.

And today, the conference's opening day will be capped by a new event, the Friends of the Auto Industry Congressional Member Reception, a meet-and-greet scheduled to include appearances by nine U.S. Representatives. That group includes:

Rep. Roger Williams (R-Texas)

Rep. Jeff Denham (R-Calif.)

Rep. Kevin Yoder (R-Kan.)

Rep. Ryan Zinke (R-Mont.)

Rep. Bill Posey (R-Fla.)

Rep. Tom Reed (R-N.Y.)

Rep. Dennis Ross (R-Fla.)

Rep. Robert Pittenger (R-N.C.)

Rep. Steve Pearce (R-N.M.)

Tuesday's agenda includes regulatory briefings from the Consumer Financial Protection Bureau, the Federal Trade Commission, the Department of Labor and the Department of Justice.

“The National Leadership Conference and Legislative Summit is one of our association's most important events,” NIADA chief executive officer Steve Jordan said.

“By coming as a group, NIADA shows Congress we are a large, committed force representing an industry that has a huge nationwide impact on America’s economy and its communities — a force that must be taken seriously,” Jordan went on to say.