It’s probably the unofficial mantra of buy-here, pay-here dealers when operators say, “We’re not in the car business. We’re in the collections business.”

Well, the newest Bronze-level National Corporate Partner of the National Independent Automobile Dealers Association aims to help operators keep payments coming into their accounts.

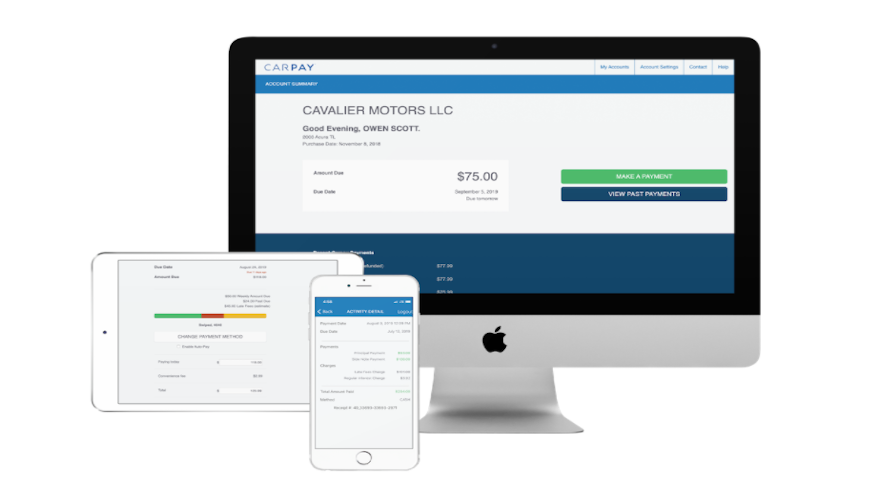

Carpay, a loan management software provider, recently joined with NIADA as a partner.

“Now more than ever, our BHPH members need access to results-oriented, revenue-focused products that elevate their ability to grow their business and provide services that create a meaningful experience for their customers,” NIADA vice president of member services James Gibson said in a news release.

“Having access to Carpay’s loan management software will go a long way toward helping BHPH dealers manage and grow their portfolio,” Gi

Carpay can helps catch late customers up and keep others from falling behind on their payments.

With more than $3 billion of BHPH contract data, Carpay highlighted that its platform is constantly being updated to reduce late payments and help BHPH dealers keep their portfolio on time.

The platform also offers:

• Unlimited text and email reminders (payment due, payment overdue, card failed, etc.).

• Mobile app for borrowers (iOS and Android).

• Web portal for borrowers (pay.carpay.com).

• “Make Payment” button on dealer websites.

• Automated phone number for borrowers to make payments 24/7 (English/Spanish).

• Text-to-pay.

• Work late accounts.

• Smart auto-pay.

• Dealer dashboard with portfolio analytics charts and detailed reporting.

“Most dealers come to Carpay after years of trying to piece together those services themselves,” Carpay chief executive officer Brandon Cavalier said in the news release. “But it’s just much easier and the data plays off of itself when dealers can consolidate all of the services under one vendor that only thinks about how to help BHPH dealers manage their borrowers.

“Carpay helps manage dealers' soft collections so their staff can spend their time on borrowers who need a little bit more attention,” Cavalier went on to say.

The National Corporate Partner program provides NIADA/NABD members with an extensive, highly vetted roster of partners they can rely on to help them grow their business, protect their assets and enhance their profitability.

“Dealers use NIADA to find vetted vendors to help them grow their dealerships and their bottom line,” Cavalier said. “So we’re honored to fill the spot for BHPH dealers looking for ways to keep their customers on time.”

As a Bronze NCP, Carpay is recognized as one of NIADA’s most trusted resources, “with a proven track record of quality and excellence,” according to the association.

For more information about Carpay, visit www.carpay.com.

Advanced Business Computers of America (ABCoA) made a move this week to help independent and buy-here, pay-here dealers collect payments from their customers accurately and safely.

ABCoA Deal Pack announced it is fully integrated with QuotePro Kiosk. Dealers utilizing ABCoA’s Deal Pack DMS now can employ a QuotePro Kiosk as an on-site payment channel.

“We are pleased to offer the QuotePro Kiosk integration to our customers,” ABCoA director of marketing for Evelyn “Evie” Hedy said in a news release. “This partnership with QuotePro offers an automated payment solution that will free-up staff and eliminate data-entry errors — a win-win for all.”

Payments made on a QuotePro Kiosk are relayed in real-time to Deal Pack and cash is serviced by armored couriers.

“Cash is expensive,” QuotePro Kiosk vice president of sales Chris Albu said. “The minute a dealership opens a cash drawer, they open themselves to a list of issues that include robbery, shrinkage and cash drawers that cannot be reconciled. Our cashiering kiosks eliminate these issues while increasing customer satisfaction and office productivity.

“The kiosks save dealers money and improve the entire business process,” Albu added.

For more information about QuotePro Kiosk or ABCoA Deal Pack, call ABCoA at (800) 536-5832 or send a message to [email protected] or call QuotePro at (800) 630.8045 or send a message to [email protected].

For the third time already this year, PassTime is integrating with another technology provider to help buy-here, pay-here dealerships and subprime auto finance companies.

This week, PassTime and BlytzPay announced an integration partnership. PassTime — a solutions company that provides automotive GPS devices — and BlytzPay — a mobile, text payment solution than can allow customers to communicate and pay via text — will be able to offer integrated solutions to dealers and finance companies.

With integrated functionality, BlytzPay’s technology can target what officials said is an ideal industry for adoption. PassTime indicated its customers will be able to provide early warning notifications to mitigate delinquent payments and keep vehicles on the road.

“We are very excited about partnering with BlytzPay. The technology is innovative and will be a complementary add for our auto dealers and finance company customers as a valuable communication and payment tool,” PassTime president and chief operating Chris Macheca said.

“The ability to expedite payments, and with a timely cash option, allow our customers to offer a billing service consumers can utilize anytime, anywhere,” Macheca continued.

BlytzPay explained that it can provide a financial solution for customers to maintain current installment contracts with payment methods that are convenient to them. BlytPay can provide its users convenience without driving back to the dealership, finding an ATM, paying high fees at a cash loan store, or loading a pre-paid debit card, all of which the company believes are common hurdles within the auto financing industry.

With multiple ways to pay, including a cash option, which is an accommodation that benefits both dealer and driver, BlytzPay chief executive officer Robyn Burkinshaw highlighted that customers are able to avoid delinquency and keep vehicles on the road.

“From BlytzPay’s inception, we knew the advantages, convenience, and serviceability of our technology would transform payments, particularly within the auto industry. We have seen the difference a mobile point of sale solution makes in the hands of dealers trying to collect from often hard to reach customers in a timely way,” Burkinshaw said.

“The PassTime/BlytzPay partnership is a significant step toward creating efficiencies, connection, and inclusion for dealers and their customers,” she went on to say.

Burkinshaw added the BlytzPay integration with PassTime can allow dealers and finance companies to include payment versatility to consumers in conjunction with the use of PassTime’s GPS and automated collection technologies. She also mentioned the integration also could tap into dealer management systems to provide customers even more options in managing payments, inventory and their GPS devices.

The alignment with BlytzPay arrived after PassTime also landed relationships with AFS Dealers as well as Solutions by Text (SBT) last month.