Overall delinquency rates change little in Q4

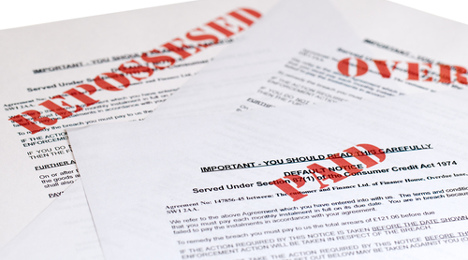

Photo from Shutterstock.com

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

SCHAUMBURG, Ill. –

According to the latest State of the Automotive Finance Market report from Experian Automotive, none of the overall readings for either 30-day or 60-day delinquencies moved higher by more than 10 basis points year-over-year during the fourth quarter.

Analysts indicated the overall delinquency reading to make the highest jump was the percentage of outstanding balances at 60 days or more past due as that reading climbed from 0.68 percent at the close of 2015 to 0.78 percent at the end of last year.

The percentage rate of contracts 60 days or more past due moved up from 0.71 percent to 0.78 percent.

Within 30-day delinquencies, Experian reported that that percentage of contracts in that category ticked up just 2 basis points year-over-year (2.42 percent to 2.44 percent) while the percent of balances in that stage of delinquency edged 7 basis points higher (2.41 percent to 2.48 percent).

Drilling deeper into the delinquency data Experian shared revealed that many of the provider categories analysts pinpoint — commercial banks, captives, credit unions and finance companies — did not sustain startling increases in rates during the fourth quarter. One of the highest was the 60-day delinquency percentage of outstanding balances at finance companies — operations that do not hold consumer deposits and often specialize in originating subprime paper — as the metric jumped from 1.84 percent to 2.00 percent.

Also registering a noticeable increase was the 30-day delinquency percentage of outstanding balances at captives. Experian determined that reading rose from 2.62 percent to 2.85 percent in Q4.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Looking at state-level data, the location with the highest 60-day delinquency rate was Maryland, as Experian pinpointed the rate in the Old Line State at 1.53 percent. Other states with 60-day delinquency rates at 1.00 percent or higher included:

—Mississippi: 1.40 percent

—Louisiana: 1.28 percent

—South Carolina: 1.09 percent

—Alabama: 1.07 percent

—Georgia: 1.03 percent

—New Mexico: 1.01 percent

—Texas: 1.00 percent