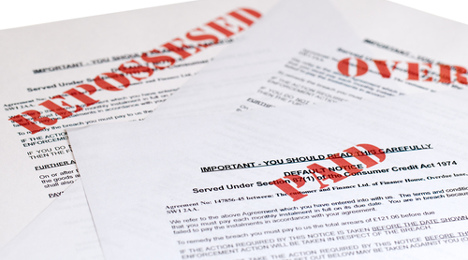

Repo volume to rise ‘modestly’ in 2016

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ATLANTA –

While the activity might remain stable once the vehicle enters the wholesale market, Manheim expects repossession volume to climb “modestly” this year based on one simple reason. There are more outstanding vehicle installment contracts in finance company portfolios nowadays.

Cox Automotive chief economist Tom Webb insisted “it will take some time” for the industry to see a return to the peak level of repossessions, which was 1.9 million repos in 2009.

“The previous peak obviously was caused by the financial market collapse where many households were sort of torn apart,” Webb said during a conversation with Auto Remarketing following the release of the 2016 Manheim Used Car Market Report, which contained the repossession projection.

“To get back to those (default) ratios, you would have to have an event such as that,” he continued. “If it just marginally increases up, the industry is very good about adjusting their underwriting standards as conditions deteriorate a little bit.”

Webb reiterated that finance companies are naturally focused on converting repossessed units into cash as quickly as possible. The report highlighted that various laws and regulations dealing with the processes of collateral collection and liquidation often present a “stumbling block” to that quick conversion. But Manheim pointed out that finance companies and their auction partners have been successful in streamlining the processes they do control.

Webb emphasized that the entire process involving repo units is certainly different from the other commercial consignors in terms of their remarketing practices.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“As opposed to an off-lease unit, you don’t know what’s coming back,” Webb said. “The issue of reconditioning, to a large extent, it really hasn’t changed that much and to a certain extent it probably won’t. The repossessors in most cases they’re sole objective is to turn it into cash as quickly as possible.

“In terms of their practices, they’re more driven by whatever the compliance and regulatory issues are as opposed to trying to maximize the value of that vehicle,” he continued. “That’s certainly not to say that they don’t partner with an auction where they think the vehicle will sell well and an auction that properly markets their vehicles.

"(Finance companies) certainly have opportunities in the lanes to segment their own repo units,” Webb went on to say. “A lot of them are putting their repo vehicles into certain tiers corresponding to the quality of those units as opposed to doing a lot of reconditioning. They’re just pulling out those units that they know are better and letting the dealers know that.”