Ask a dealer or general manager where most of their leads come from. “Newspaper,” some will say, and still others, “Radio.”

Occasionally, a dealer cites their own website or credits an online classified site like AutoTrader or Kijiji Autos. Most likely, no one will say “a pediatrician’s office” or, “minivans at the stop light by the dealership across town.”

Yet mobile is the single fastest growing segment in digital (digital is the only media to actually grow in 2012 over 2011 levels of consumption and user engagement), and your customers are using mobile platforms every day to search your cars, find your store and get information about shopping your sales or service department.

According to a recent landmark publication authored and contributed to by the “who’s-who” at Google, 79 percent of consumers say they use their smartphone to help them make shopping decisions.

This same study noted that digital media sources are heavily relied upon in shopping decisions, but almost twice as many sources are used by auto shoppers. And yet this stage of research is not replacing traditional media in terms of brand building or top-of-mind awareness.

Rather, digital platforms including social, desktop search and mobile search are being used by consumers to help them quickly and efficiently seek out highly targeted information, which will either reinforce their opinions about brands and products or change the focus of their subsequent research. In short, everything a prospective car buyer needs to know about your dealership they can fit in the palm of their hand.

Think about it: It takes a lot of effort to drive in to a dealership. Some effort to pick up the phone and call. Still a bit of effort to power up the laptop and connect to the Internet from your home office.

But there’s no work involved in mobile search, really, when the device is probably within arm’s reach 24 hours a day (two-thirds of smartphone owners sleep with their phone beside their bed!), and always connected to the Web with only a few keystrokes required to render neat, tiny little pages of mobile optimized search engine results or reviews.

This explains the level of mobile engagement, with 2012 seeing 82 percent growth over 2011, in terms of time spent online via mobile (Source: Nielsen).

So what do you need to know about mobile to capitalize on the massive traffic and potential customers to be had? For one thing, know who your audience is. Nielsen data suggests that women and people aged 25–34 spend the most time shopping via mobile through either social or Web apps. Use of apps via mobile is absolutely viral, with sites such as Pinterest posting nearly 1,700 percent year-over-year growth.

Post relevant content that is either review related or research driven, in bite sized chunks that lend themselves to pinning or +1’ing to synthesize the reach of social networks with the enhanced credibility associated with digital word of mouth. Do this, and you will be rewarded by people who are actually interested in and have a need for your product.

Mobile allows you as a dealer to reach potential car buyers in hard to segment urban areas, fragmented suburban centers and multi-cultural pockets with efficiency and authenticity.

As a working mom who is on call seven days a week for dealers (and the kids), I estimate that over 90 percent of my Web browsing takes place on my iPhone. A good percentage of that is in waiting rooms, line ups and other effectively dead zones where I am forced to hurry up and wait. It may take me six different sign-ins ofthree to 10 minutes each to figure out what hotel to book for my anniversary, but I can pretty much guarantee I will do it on Safari or via a reservations app — possibly while I am already en route!

I think I’m a pretty desirable customer: reasonable expectations, willing to pay for a great experience and customer service, pleasant to deal with. If you want to attract customers like me, make sure you are a desirable digital dealer, and follow these basic guidelines on your mobile website:

- Make sure you have a mobile site. Period. Nothing is worse that zooming in a scrolling around to try to push a button on the screen.

- Activate click to call so I can call you with just a push of a button.

- Keep it simple. Make it easy for me to find the things I most likely came to your site to do: browse cars (include sub menus on deeper pages), contact you or find your store.

- Make it make sense. Remember that mobile shoppers are often multi-tasking, so don’t make me think too hard or fill in too much information. I once spent twelve minutes trying to order a pizza on my iPhone and have it delivered and finally gave up and drove over to get it. Nothing should be that complicated!

- Let me talk. To you, your employees, your other customers. Provide plenty of quick contact forms and actually monitor them.

In the past 12 months mobile has virtually exploded and is connecting busy people to the information they need in a more efficient and customer-driven way than has ever been possible before.

So when your sales managers tell you that all your leads are walk-ins or from the local paper, ask them where else the customer found you. With stats showing over 18 online sources consulted for every car shopper, chances are good that your opportunity to sell more cars is right there in your own hand.

Cathie Clark is the director of Automotive Insider Consulting.

More elusive than the last unicorn, the secret to success in the car business is hiding in plain sight.

When the “up bus” forgets to stop in front of your store, you may feel an urge to put out an ad (any ad) to get the people in. Call the newspaper! Buy some more radio! Get on TV!

But before you do, put some serious thought into why anyone should buy a car from you.

Let me help you: think of a person, or a group of people, with a certain and specific need, and get a strong picture in your head of you selling them the perfect vehicle in the perfect process at the perfect price for them. Do not tell me why everyone should buy a car from you. Speaking to the masses is less an art than an outdated form of artifice originating in the days before Google became a household name.

Shouting from the rooftop is less effective than whispering to the guy beside you. Moreover, none of these approaches will do anybody any good if you don’t walk your talk and can’t back up your claims. Your dealership has its own unique brand position, different from that of your OEM, and its essential that you know who you are in the landscape of the industry.

Car dealers can be segregated into general groups, or profiles, based on their business practices, volume and goals. If your definition of success is selling 25 like-new used vehicles of the same make as your new-car franchise sign, with a higher than average gross and little fuss about those business office add-ons … be honest with yourself, and be honest with your customers.

There are more than a few valid business models in the industry today, and the only way to really run a bad business is to not understand your own goals, thus failing to communicate your true brand strengths to your customers.

Pick your position, and play it well.

High-priced, full-service, specialty experience. In this scenario, you advertise a price near or at the top of what the market will bear. You recondition the vehicle (which you likely bought in a closed OEM sale or took in as a lease buyout), possibly to a CPO or enhanced set of standards, and roll out the red carpet in every aspect of your customer experience. To really rock this approach, you need to go all the way on your vehicle presentations, merchandise them like diamonds in the sky and rely on brand strengthening messaging that is not price-centric.

To really confuse your customers, couple your premium brand messaging with assertions of low prices and savings.

Middle of the pack pricing, bigger selection and add-ons for a price. You may have bought some of your units at auction, in order to get some off-make stuff, and while you didn’t steal any of them, you checked your pricing tool and you are right where you want to be, at 98 percent to market. This is where you will sit until either a) you agree to do some extra stuff, to the tune of $600 or $800, on the car to get it sold, or b) you drop the price 90 days in and take a skinny margin to move it off your lot. To find the sweet spot here you need supreme attention to detail; since you have no obvious edge or advantage on the car or the pricing, emphasize your relationships with banks, premium suppliers and value adds like balance shortfall protection or limited warranties which will allow you a better opportunity to upsell into creditor insurance and premium extended service contracts in the business office.

The big mistake in this zone is to fail to give any motivator at all; since you pretty much operate in the “partly sunny” realm of vehicles, you have to really go out of your way to show and tell the “sunset on the beach” story.

Lowest price, massive selection, get what you pay for (no more, no less). You (or somebody in your store) probably likes to consider yourself a true wholesale buyer, savvy in sourcing and dispatching units to fit the price shopper’s needs by the hundreds, pricing them out at low prices but faring better than other dealers would think on front end gross.

This is because you hold your gross, and since your cars book out well, you make some good profit in the business office, too. You safety your vehicles, sell them with however many keys they came in with, and refer to the comments section on your bill of sale. This is where it says “customer declined extended warranty” if non-safety related items pop up as come backs after about thirty days.

To maximize your exposure and your volume (this model relies on high volume, fast turn) focus on your online classified listings and your website. Worry less about brand messaging, and send out flares of general price alerts in static media which cater to budget conscious demos, like families, or accountants. Don’t promise premium experiences unless you can actually follow through.

People actually believe those ads on TV where if you call now, you get not one, not two, but eight for the price of one. And they are seriously miffed if there’s any shortfall or extra shipping and handling charges.

All kidding aside, in this digital age where word of mouth is archived online, and going viral can be the best thing that ever happened to your business, it is vital to make sure you have a clear picture of the state of affairs in all aspects of your store and that you share that image straight up, no twists, to the people who will respond to that projection intuitively.

I have engaged with some key dealers in a guided self discovery process of operations analysis, and that’s a great starting point to assist you in finding out your current habits and practices so you can write your road map to get you from there to where you feel your store’s own unique brand really should be.

Look at your sourcing and stocking approach, your volume and turn rate, and reconditioning and business office activities, to compare to the markers of a consistent image that you feel represents the kind of dealer you want to be. Or maybe, once you figure out who you are today, you will make some adjustments to your ideas of who you wanted to be as a dealer, and begin to sing the real praises in marketing and executions that are congruent with the kind of business you are doing day in and day out. Either way, take your vision and your reality, get it together into one solitary line, and look straight ahead in 2014.

Cathie Clark is a dealership operations consultant specializing in used vehicle sales and digital plus full media marketing strategies. Clark is the principle at Automotive Insider Consulting. Have a question? Email [email protected] .

Ah, new-car smell.

Not to be knocked, but certainly something many consumers are willing to forego to save thousands of dollars on their next vehicle purchase. There is no arguing with the benefits of used vehicles, especially when just about every dealer offers used or pre-owned vehicles (depending on your OEM’s nomenclature, or how up-market you position yourself as an independent).

In most income brackets, there is no longer a stigma attached to purchasing a used vehicle, nor is there any shame to be had in offering them at even the high end of the dealership spectrum.

While used-vehicle sales is a growing segment, there is not even growth across the market. There are (without question) overachievers and under-performers, and the fault line is not location, name plate or square footage. The key determiners of success in used-vehicle sales today lie in the areas of purchasing, merchandising and financial services sales.

The down side to this is that no matter how established your location or how much floor line you have at the bank, you are not guaranteed a profitable used-car department.

The upside is that it’s anybody’s game: with careful strategy and dedicated process, you can build a better used-car business that adds to your dealership’s bottom line and generates not only ROI, but also transactional sales growth that can increase your employees’ income while building your local market area total reach.

As most us plan for next year’s business, here are some guidelines to planning your used-car business, creating a used-car point-of-purchase to point-of-sale chain, and marketing tips to make your used vehicles stand out from the pack.

Plan your Purchasing

Gone are the days when a hundred dealers stood in an auction lane and just stuck their hand up in the air. While the era of unplanned purchasing was a heady time that favored those with gut (instinct) and guts (courage to take risks), the new purchasing climate means that many dealers are using stocking tools and spreadsheets to optimize the big picture of their purchases.

vAuto and Dealertrack Technologies’ AAX bring science to the lanes, and the market reflexivity of such tools helps to break down walls to show dealers what is hot or not, in terms of brand and models that move and make money.

Simply analyzing your own inventory, as in, what you sold and how fast and with how much gross, is only a small piece of the picture, because you can’t sell what you don’t stock. The dealer down the road might be making a mint turning a row of 4- to-5-year-old minivans, and if all you stock are the cherries from your new-car department’s trades, you lose the chance to get in on the demand and the dollars.

When setting your sales projections, be realistic about how many units you can sell based on how many units you can stock and how fast you get those vehicles to market, sold, and down the road.

With the continued volatility in used-vehicle wholesale values, the only thing certain is that you don’t have 100 of anything: spread your investment over segments that sell in your market, and don’t be afraid to stock units unlike what you’ve sold in the past in order to broaden your selection and beef up your rows.

Market, To Market

If its not online, its not really for sale. There are two main types of advertising: transactional and relational, and both of those take place, more often than any other media source today, online. Use your Web properties to provide the “why” for consumers who are comparing your stock unit to another dealer’s car, and above all else, worry about getting the car online in all its glory: pictures, price, pedigree.

If it takes you 12 days from the date of purchase to get a car online, your goal of a 30- or 40-day turn becomes a pipe dream. If it takes you four days to secure an approval, then another three days to get the car delivery ready, that 30-day turn is more like a tick-tock timer giving you 11 days to marry your car to a buyer.

Scrutinize your Web listing practices, and look for areas to tighten up your timelines. Ask your website provider if you can have more frequent capture visits, or if you can self-load vehicles.

Find out exactly when your data is pushed from your database to the portals; some inventory management systems let you stipulate how frequently you push and edit data, and it may be that all that separating you from live time data online is a few dollars or even a simple request.

As for the relational stuff, build yourself a gold mine of good quality content. No Google algorithm change yet has penalized high quality, original content that is updated at modest intervals. Use this forum to showcase your successes, to humanize your staff and to build integrity in the products you offer on your lot and in your service and parts departments, as well as your financial services office.

A Three-Legged Stool

You stand behind the vehicles you sell, and the same needs to happen with the products in your business office. Today’s dealership can’t survive on car gross alone, and more than ever, service department and business office products are making up for the narrowing gap between wholesale and retail.

To be profitable, we need to look at car purchasing as an ownership experience, much the way home builders have relied upon the cost of upgrades to offset the fierce competition on the “starting from” price in recent years.

Let me say it once and for all: There is no shame in making money in the business office.

There are partners with premiere products which actually add value and improve people’s ownership experience. You don’t have to offer things you don’t believe in, but if you sell it, you better become a believer, otherwise your staff won’t believe it, and neither will your customers. For almost every friend who has bought a used vehicle from me, I have famously said, “You’re taking the warranty, otherwise, in two years, you and I may not be friends.”

That’s how strongly I believe in extended warranty, and I’ve said the same to a 20-something family member about GAP and job loss protection.

If you’re projecting a gross sales figure based on front end per-car profit alone, you are missing the boat on possibly half of your potential per unit gross, in the business office. $3,200 — or $4,000 — per car is still a reality with a strong business office.

The other benefits are that protected customers become happy repeat customers, and owners with warranty keep coming back and ultimately bring you trades which may be in better mechanical shape, lowering your recon costs down the road.

Success in used cars is attainable, but involves a lot more strategy than sticking trades in a row out the back. It’s time for this important market segment to be acknowledged as a business unto its own, and the dealers who take the time to learn it well will reap the rewards. Happy selling!

Cathie Clark is the director of Automotive Insider Consulting.

A colleague passed along a 2013 year-end report from the United Kingdom-based dealer IT research firm Woods and Seaton.

The report details some of the high-profile acquisitions that occurred in the past year as DMS and specialty vendors vie to provide dealers here and abroad with integrated solutions to increase efficiencies and profitability in their dealerships.

Examples include Dealertrack’s recent acquisition of Dealer.com, and Reynolds and Reynolds’ acquisition of companies to aid its data mining and digital marketing offerings.

But I was particularly struck by the report’s overview of e-commerce-related efforts underway among IT providers and OEMs across the globe.

Manufacturers like BMW, Mercedes Benz and Nissan are selling vehicles directly to consumers via the Internet in Europe and India. In the U.S., meanwhile, the report highlights GM’s “Shop-Click-Drive” effort as one OEM-driven effort that essentially seeks to complete every aspect of a deal — aside from the test drive and close — online.

The report also notes that IT providers continue to offer dealers more tools to build their e-commerce presence and process. The report says “the technology for complete on-line sales advanced significantly” in the past year; it also says consumers in the U.S. and elsewhere are “increasingly willing to buy online.”

None of these developments surprises on its own. But collectively, I believe they signal a call to action for dealers.

The call to action is this: The time has come to formulate, if not execute, an e-commerce strategy at your dealership to meet the needs of customers who want more efficient, technology-enabled ways to purchase (and service) vehicles.

Likewise, as dealers craft these strategies, I believe it’s important to recognize the effort as an opportunity to reinvent organizational structure and process to maximize efficiencies, allowing you to serve more customers more effectively and improve your bottom line.

Dale Pollak is the founder of vAuto. This entry and Pollak’s entire blog can be found at www.dalepollak.com

Sun Tzu said, “The supreme art of war is to subdue the enemy without fighting.” As I look ahead to the coming year, I see a trifecta of potential trouble for dealers.

First, dealers will want to continue the pace of renewed new/used sales volumes and profitability they’ve enjoyed this year (2013).

Second, consumers will get even hungrier for the best deal, heeding calls from TrueCar and others to not “overpay” to buy a vehicle while getting a guaranteed, no-haggle price and experience.

Third, we may well see a softening of consumer demand in new/used vehicles — even as factories want to maintain higher levels of production, and lease returns help normalize supplies of used vehicles.

Taken together, I believe these factors will put more pressure on dealer margins, and accelerate the shift in our business from highly to hyper-competitive. My fear is that many dealers will run headlong into this challenging environment without re-assessing their game plan or strategy.

Like they’ve always done, the dealers will go toe-to-toe with other dealers and their customers to win more deals, even though such battles ultimately mean less for the bottom line.

This thinking has led me to Sun Tzu’s concept of “winning without fighting” and a key question — how can dealers win without fighting in their quest to sell more new and used vehicles and make more money?

For sure, part of the answer lies in knowledge.

The dealers who are most astute about supply and demand data for new/used vehicles in their markets will have an advantage.

As Sun Tzu once said, “If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

The good news here is that technology and tools are available to help dealers mine the market data and spot their strengths and weaknesses in the context of the competition. In new and used vehicles, it’s easier now than it’s ever been to see all the competing cars and their prices — and execute your retailing strategy accordingly.

I don’t believe there will be a single strategy that will help dealers win without fighting. Dealers are too different and distinct for that to happen.

However, I do believe the most successful strategies will share four common elements:

1. Proper Pricing

Most dealers understand the necessity of market-transparent pricing in used vehicles, and many are essentially “transaction transparent” when they put asking prices on cars. In new vehicles, however, it’s still mostly a crapshoot for dealers. I’m convinced transaction-like new vehicle pricing will be the next new frontier for dealers — an evolution that occurs as dealers “know the enemy and yourself.”

2. Proper Promotion

With new technology and tools, dealers can now tell the exact equipment and features that appeal most to new- and used-vehicle buyers. Moving forward, the challenge will be showcasing each car’s specific “value factors” in the most compelling way (via descriptions, photos, videos, etc.) to catch a buyer’s interest. On top of that, buyers will increasingly want to validate you as a dealer who truly offers a less time-consuming, superior experience.

3. Proper Purchasing

Dealers are well aware of the battle to acquire the “right” used vehicles for their inventories and markets. There’s far less analysis and implementation of the “right” inventory profile in new vehicles. It should be readily understood by dealers that those who purchase and stock a higher number of in-demand vehicles will get more deals.

4. Proper Processes

The rising tide of transparency will only climb higher in the coming months. While they don’t like to admit it, I suspect most dealers recognize that traditional sales processes are running out of relevance with buyers. The key here is recognizing the buyers reward dealers who make the transition to transparency in their showrooms.

I would encourage dealers to use the coming holiday season to reflect on the year ahead and ask their teams, “What can we do in 2014 to win without fighting and sell more new and used vehicles?”

Dale Pollak is the founder of vAuto. This entry and Pollak’s entire blog can be found at www.dalepollak.com

Continue the conversation with Auto Remarketing on both LinkedIn and Twitter.

Make no mistake, I’m a retail-first guy. I fundamentally believe that dealers should sell every vehicle they acquire as a retail unit to a retail customer.

But I also recognize that retailing every used vehicle isn’t always possible — even with the best market data, technology and tools to guide a retail exit on every car. The market’s simply too volatile, and dealership people and processes are too fallible, for dealers to get it right 100 percent of the time.

Inevitably, most dealers will need to wholesale some used vehicles to maintain their inventory turns and profitability goals. The challenge then becomes determining the best way to dispatch the vehicles most efficiently and minimize any loss.

On top of that, dealers now have a separate wholesale challenge: What’s the most efficient, least-costly way to get rid of all the high-mileage “as-is” stuff that we’re taking in on trades that we don’t want to retail?

I took both challenges to a handful of retail-first velocity dealers to get their best practice recommendations. The dealers offered the following tips, which could be dubbed, “The Art of Wholesaling Used Vehicles in Today’s Market.”

Go Online: Some dealers use online channels — DealerMatch, OpenLane, OVE, Simulcast, SmartAuction, etc. — more than physical auctions when they need to wholesale aged and “as-is” units. These channels allow dealers to offer vehicles for sale without the expense and time required to transport the vehicles to physical auctions, which they view as a last resort.

For aged units: As used vehicles hit 45 days in inventory, a Midwest dealer group posts the cars across several online auction channels. Each car still has 15 days as a retail unit (the dealer has a 60-day retail window). But each car’s presence in the online wholesale marketplace acts as a hedge against future losses if the car doesn’t retail. The dealership’s used-vehicle manager says this practice eliminates roughly a third of their 45-day-plus units. “It basically takes care of itself. I don’t stress as much as I used to about aged cars, and we’ve seen a dramatic reduction in our wholesale costs and losses,” he says.

For “as-is” cars: A New York dealer started posting fresh, high-mileage trades online early this summer after he took too many lumps at the local auctions. “I’m trying to sell the same high-mileage cars as everybody else,” he says. The dealer estimates he’s able to make up $500 more per vehicle than he would taking a car to the local auction “because it’s got more eyeballs on it online than the local auction.”

Apply A Retail Mindset: Whether it’s an aged or “as-is” unit, the velocity dealers tell me they always post condition reports and photos as they wholesale their vehicles through online channels. The dealers consider their wholesale efforts akin to the way they retail cars—the more information they offer, the better.

A Southeast dealer says the extra effort makes all the difference. “I’m not selling to guys running around in the lane,” he says. “I’m selling to a guy who’s at his computer for eight to 10 hours trying to figure out what cars he wants to buy. It’s like my retail customers, why wouldn’t I want to make it easier to buy my car than the next guy’s?”

(An emerging retail-style approach: Dealers are experimenting with walk-around videos as a lower-cost way to showcase wholesale vehicles online without a condition report or photos. For some wholesale buyers, the video, which includes starting up the vehicle and highlighting its good, bad and ugly characteristics, is enough evidence to give them confidence to purchase the car.)

Price them to the market. Because dealers don’t incur the expense of transporting vehicles to a physical auction, the online channels can pose a temptation to “hold out for gross” on wholesale units. The New York dealer thinks this is a no-no. “It doesn’t make any sense for me to have ‘dead money’ tied up in a car that hasn’t or won’t work for me as a retail unit,” he says. “We set our floor prices to get rid of the cars, reinvest the money and move on.”

Dale Pollak is the founder of vAuto. This entry and Pollak’s entire blog can be found at www.dalepollak.com

Since the early 1980s, auto detailing and appearance care has been evolving from a wholesale service done by or for the auto dealer to restore used vehicles for resale to a legitimate retail automotive service.

This evolution was sparked by a number of factors:

- Rising costs of automobiles from $2,500 in 1975 to more than $20,000 today.

- Extended length of loan contracts of up to six and seven years.

- Increasing length of vehicle ownership from an average of 3.2 years in 1978 to nearly nine years today.

In short, the motorist is paying more for their vehicle, owning it longer and is more aware of the need to take better cosmetic care of it in order to maintain its value.

Another factor, unrelated to, but definitely affecting the rise in popularity of the auto detailing service, is the consumer's obsession with protecting their leisure time.

People today have less leisure time and want to protect it. With both parents working, many families have the disposable income to pay for services. They recognize that cosmetic car care is not something they want to spend the weekend doing themselves, especially if there is some where they can go to have it done better and faster.

Restoration & Maintenance Detailing

As mentioned, detailing traditionally was done by or for auto dealers to restore their used vehicles for resale. As such, the service was complete including: engine cleaning, wheel cleaning, body washing, trunk cleaning and shampooing, interior cleaning and shampooing, buffing, and polishing and waxing the paint. These are what can be called restoration detailing services.

These services are performed on older vehicles, or vehicles that have not been well-maintained cosmetically. Either the interior or the exterior, or both, are in need of extensive restoration to get that “new car” look again.

Restoration detailing services require a commitment in space (usually three to four bays), advanced equipment, skilled personnel and a full knowledge of paint finishes, leathers, vinyls, etc. For the dealer, restoration services are necessary.

And for the free-standing detail shop, they present an excellent financial reward. These same financial rewards are also available to the dealer who chooses to sell restoration detailing services to the public. A complete restoration detail will bring from $200 to $500 for a job that will take about four to five hours to complete.

There Is Another Side

The other side of detailing is called express maintenance detailing — and it is what the words connote — detailing services that can be completed quickly and are performed to “maintain,” rather than restore, a vehicle's condition.

To clarify; late-model vehicles or vehicles that have been well-maintained do not require what we describe as restoration detailing. For such vehicles, it would be overkill. These vehicles do, however, need to be maintained cosmetically on a regular basis.

Such services would include: regular washing, periodic waxing and periodic cleaning and shampooing of carpets, floor mats and maybe seats. These are professional services, performed by knowledgeable and informed personnel, but they are different from restoration, in that you are only maintaining a vehicle that is already in good condition.

30 Minutes or Less

The benefit of performing one of these services is that it can be done by one person in 30 minutes, less if done by two people. They are easy to perform, require minimum training, require a small investment in equipment and can be done anywhere you have electricity.

Best of all, they are like a gasoline or quick lube purchase; they are an impulse buy. Why? Because they are done quickly while the customer is already at your place of business.

Will They Work for an Automobile Dealer?

Before answering that question, look again at the potential. First and foremost, they are an in-demand service. The motorist wants to take care of their vehicle. In fact, cosmetic appearance is actually more important to the motorist than the mechanical condition because the appearance is what they see.

Next, realize that most existing detail shops provide restoration detailing services. They are not set up to do a quick wax or carpet shampoo in 30 minutes or less, at a low price.

On the other hand, you, the dealer, have a huge bank of regular customers who come to the dealership because they trust the service and capability. They want convenience and are willing to pay a reasonable price.

An auto dealer has everything going for them to be able to capitalize on the opportunity that express maintenance detailing presents. You have numbers; consider the volume of service customers that pass through a dealership everyday.

All customers with relatively new or well-maintained vehicles could be sold express services that can be done while the vehicle is in for service.

Study Car Wash Success

The car wash industry pioneered express maintenance detailing services, and many automatic car wash operations across the country that offer express maintenance Detailing are reporting monthly sales in excess of $30,000 in simple waxes and carpet shampoos. Not bad for 15 to 30 minutes work per service. There is no reason a dealer could not do the same. The national average pricing for Express Services is $39.95 for a wash and wax, and from $29.95 to $39.95 for a carpet and mat shampoo. Seats go for $49.95 to $59.95.

The Decision Is Yours

The purpose of this article is to expose you to another moneymaking opportunity for your dealership. Whether you do it or not is up to you. But you owe it to yourself to investigate it further. If I can provide you with more information on this concept, call me toll free at 1-800-284-0123 or email me at [email protected].

There are many ways an auto dealer can increase employee productivity, including training, better equipment, proper use of the employee's talents and a lot of positive feedback.

Unfortunately, few dealerships operate an efficient or productive detail department. But if they expect things to get better, they have to be willing to change.

To have a productive department, you must pay more attention to the type of employee you hire, the kind of training they receive and the kind of reviews they receive.

You can achieve an efficient department by applying 10 ideas that add up to what could be called a “total program” for productivity. And the best thing is that all of these ideas are very affordable and cost-effective, in fact some can be implemented with no cost at all.

1. Communication: Increasing the shop's productivity begins by talking less and listening more.

Every successful dealer knows, or should know, how important communication is to employee productivity. You must listen to employees. “It is not the tail wagging the dog;” it is nothing more than valuable interchange between you and employees. When was the last time you spoke to your detail employees? Or the person in charge of the recon department had a meeting with the entire staff?

If the detailers do not know what is expected, how can they be productive? What is needed are meetings — every morning, in fact — to keep everyone in touch with what is happening and what is expected for the day.

Obviously, the dealer principal or GM cannot do that, but a competent shop manager (by shop manager, we mean manager, not a detailer) can. And that shop manager should be reviewed by his superior once or twice a week at a minimum.

One example of communication put to good use occurred in a shop where the detailers suggested a vinyl curtain be placed between the wash bay and the detail bays. The curtain kept the water overspray off the vehicles in the detail work bays and off the other detailers. The suggestion resulted in increased productivity and a cleaner shop.

2. Employee Participation: This is essential. A problem cannot be acted upon unless someone in power knows it exists.

A dealer should be receptive to employee feedback. Since you do not work in or around the detail shop, it is critical that you listen to what the detailers have to say, and to their ideas. You must want your employees to talk. This shows they care about the work they do and about the dealership. If they have an idea that will work, try it. Wait a few days; you will know if it works. If it does not, go back to the old way.

No dealer wants a “dead horse” in their dealership, but detailers will not present ideas if they are always slapped down.

3. Measuring Productivity: Learn what employees do best, and place them where they are the most effective.

Once there are communications lines open with detail employees, the first step to take is to measure detail shop productivity. If you want to increase productivity, you have to know what it is now. Watch shop production for a few weeks. If a production does “give” with paid labor, then you have something tangible to correct.

4. Proper Compensation Programs: Use the most effective compensation plan for your shop.

When and how employees are paid is a huge factor that affects employee productivity. You may want to track productivity based on the present pay plan, then institute another plan or variation of the current plan and measure the results. Is there an increase or a decrease?

You may be paying by the vehicle or job and decide to charge to by the hour, or vice versa. It will be quite easy to measure the results.

An interesting fact that one dealer presented to me was that he found that the last 25- to 30- percent of the pay period was the most productive, regardless of what day of the week it is. By shortening the pay cycle, you might have productivity over the entire pay period.

5. Incentives: Learn what motivates your employees, and use that knowledge to your best advantage.

Incentives never hurt production; that is a given. Incentives can be based on how much work they get done beyond the standard. For example, if you expect the equivalent of two complete details per man per eight-hour shift, and they get two-and-a-half or three completed, you can provide an incentive for that. Or, you can have team bonuses. Apply the same principal above to the entire team for the day.

6. Benefits: This goes hand-in-hand with incentives; the more you have to work for the harder you will work.

An employee who receives health insurance, profit sharing, retirement benefits, paid vacation or paid sick days, will be more likely to consider their job an investment. Employees with an investment in a business will, in turn, be more productive.

7. Training: Every bit of training improves productivity. Training is never wasted — if you have employees who want to learn.

Every successful dealer will tell you that in addition to communication and monitoring of workflow, training ranks as one of the most effective ways to increase employee productivity.

Training is a big part of productivity. Things change so fast that training is a must. Detailers have to be trained in today's high-tech paint finishes, and what they can and cannot do to them. They need to understand the different types of leathers and how to clean each. They must know what they are doing if they are going to be productive.

Keeping up with the innovations and techniques in the detail industry will result in savings of up to one hour per car. For example, there are hand held orbital waxers that will allow a detailer to wax an entire vehicle in five minutes versus the 20 30 minutes by hand. There are also rotary shampooers that will allow the detailer to friction shampoo the entire carpet and upholstery area better and with less fatigue, in about 10 minutes.

8. State of the Art Equipment: Productivity depends on how efficient the equipment is that is

being used.

You must have equipment in your shop that will allow the detailing job to be completed as efficiently as possible — this means with very little wasted motion, which translates into time. The right equipment for the job has to be there for productivity, and the employees must be trained in its use. You should have a plan to purchase as much new equipment as possible. To get the employees trained on it, demand on-site training from the supplier to insure that all employees are trained in their environment. Training at a school is great, but at a school, you have no pressure, everything is clean and spotless. You need on-sight training.

9. Work Flow: A detail job should move smoothly through the shop, cutting down on employee and vehicle movement.

The layout of the shop and the positioning of equipment should be done in the most effective way to optimize workflow. This translates into greater productivity. Do not look only at the labor-saving features of the equipment, but how it will fit into the shop layout. For example, a multi-bay detail shop should really have a central vacuum with hose drops in each detail bay, or the wash bay should be equipped with a remote-mounted pressure washer and a hose boom mounted to the ceiling.

Chemicals should be dispensed from some type of central dispensing system delivering the chemicals to the work bays via lines, not bottles. This eliminates all those inefficient plastic squeeze and spray bottles. You cannot have proper workflow with inefficient technology.

10. Morale: A disheartened worker is not an efficient worker.

You must provide feedback to your detail employees if you want them to be productive and have high morale in your shop. When you recognize employees and their performance it means a lot to them. Little things are important and do affect productivity. Bringing in lunch once a week, or better yet taking the entire staff out for lunch, or closing down early on a slow day, can be effective in developing employee morale.

Remember all you may need is just a 10 or 15 percent increase in productivity to be profitable or more profitable.

It goes without saying that training — ongoing training — is the key to the success for any dealership detail department. If dealers want their employees to be efficient and become more effective in their jobs, they have to train them, review and correct on an on-going basis. How often is this happening in your detail department?

One of the problems most dealers have with this approach to training in the detailing department is that in most cases, there is no formal training and the people hired were not even capable of being trained. It was easier to hire someone “with experience” and put them to work. But what is their experience? And those with experience are only good if you let them do what “they” want. Where is the control then?

Where to Begin

Like any procedures, detailing procedures must be written so the employee has something to read during initial training and something to refer back to later on. Certainly, something that the supervisor can use to evaluate performance — if there is even a competent supervisor in the detail department, which is most often, not the case.

By having procedures and putting them in writing, a dealer can insure consistency from vehicle to vehicle, employee to employee, each and every day. They will increase productivity and reduce labor with these written and enforced procedures for detailing a vehicle.

The procedures are no good, however, unless the supervisor updates them and constantly reviews employee performance and adherence to the procedures. When our company operated its own freestanding retail detail centers, the hardest thing I personally had to do was to get the manager to follow the procedures and review the employee adherence. The detail employees, who I personally hired, were never the problem. It was the manager.

A great deal of time should be spent on the initial employee orientation and training. In fact, I suggest at least a half-day to a full day in a classroom situation, discussing equipment and tools, chemicals, paint finishes, carpets and upholstery, leathers, and then the how-to of each detailing job.

If you expect someone to do something with their hands, first you have to get into their head. That is where the classroom comes in. After the classroom, you can put them into the detail bays with some assurance that they have an understanding of what they are expected to do.

Remember that a good employee does have a productive attitude when they begin a new job. They do want to learn and make a favorable impression and be productive. If they do not, you have done a poor job of hiring. The lack of supervision or poor supervision causes employees to fall down in performance. Remember who is in charge, or at least who is supposed to be in charge.

Detailing Job Procedures

Starting with the premise that detailing is not an art as some detailers would have you think, but a learned skill, I have developed an extensive, yet simple set of procedures for each job in a detailing department.

The jobs are divided into five main categories:

- Exterior cleaning process

- Interior cleaning process

- Buffing, polishing and waxing process

- Final detailing process

- New-car get ready

Under each category are a number of specific jobs.

Exterior Cleaning Process

- Engine clean

- Wheel clean

- Car wash (automatic car wash and final if you have an automatic car wash; prewash and hand wash if automatic is not available)

- Door and trunk jamb cleaning

- Vinyl or convertible top cleaning (if applicable)

- Tar removal

Interior Cleaning Process

- Trunk clean and shampoo

- Vacuum

- Headliner cleaning

- Carpet shampoo

- Upholstery shampoo

- Vinyl dressing

- Leather conditioner

- Interior window cleaning

- Deodorizing

Buffing, Polishing, and Waxing Process

1. Buffing (correction of a problem)

2. Polishing (swirl removal)

3. Protecting (wax or paint sealant)

Final Detailing Process

1. Wax residue removal

2. Chrome cleaning and polishing

3. Exterior rubber/vinyl dressing

4. Window cleaning

5. Final inspection

There may be more, but these jobs and their procedures allow you to efficiently, consistently and profitably detail vehicles.

The outline followed for each job is simple.

First, the purpose of the job is described. That is, what you are attempting to do. Simple as this seems, many employees really do not know, or bother to think about, why they are doing something.

Second, the areas of concern are identified. For example, in the engine area it is noted to inspect the underside of the hood, edges, etc.

Third, the equipment to be used is listed. In the handbook, each and every tool and accessory is identified.

Fourth, the tools and chemicals to be used are listed.

Fifth, the procedure to be followed is outlined.

Manpower

With the job procedures in place, you must set a time standard to be followed by the employees in performing the job. Because the labor is the largest expense in the detail business, you can only control labor by controlling the performance of the employee.

The following chart will provide a formula in calculating the labor requirement.

Detail Service Man Hours Required

Engine Clean .5 hour

Hand Wash .5 hour

Trunk clean & shampoo .5 hour

Complete interior shampoo 1–1.5 hour

Carpet shampoo .5 hour

Upholstery shampoo .75 hour

Window cleaning .25 hour

Tar removal 10 minutes

Buffing .5 hour

Swirl removal or polish .5 hour

Wax/sealant .5 hour

Final detail .5 hour

Complete detail 3–5 hours

Exterior/Interior 2–2.5 hours

Exterior 1–1.5 hours

Interior 1–1.5 hours

By correlating the services to be performed on a given day with the standards above, the department manager can easily calculate the number of employees required for the day. For example, let us look at a potential day's business:

Four completes (4 hours each for a total of 16 man hours).

Two exteriors (1.5 hours each for a total of 3 man hours).

Three engine cleans (.5 hours each for total of 1.5 man hours).

Two exterior/interiors (2.5 hours each for a total of 5 man hours).

The total man hours involved is 25.5. When divided by 8 hours in a day, it will take 3.18 employees.

Normally, the manager or supervisor would not be a regular detailer. Therefore, in addition to three full time employees, you would have a part-time person, or you could use the supervisor.

The key to employee time performance is to be clear as to when you want a job done. Instead of “hurry up and get this job done,” be specific. Give a set time, which leaves no room for interpretation.

As involved as this may seem for the detail business, remember this is what McDonald's did to make the simple production of hamburgers into a billion-dollar business. Remember, too, that the detailing business today is where the hamburger business was when McDonald's started.

Applicable to All Dealerships

Keep in mind that this concept will apply to all detail shops, not just those dealerships using the sophisticated equipment. However, in most dealer detail shops, the organization will be more difficult because of the use of spray and squeeze bottles, portable vacuums, and cumbersome electric tools. But do not use that as an excuse for not setting standards and procedures for your employees.

For years now you’ve heard everywhere that you can’t measure social media ROI (return on investment). I’m not sure if it’s been an excuse to discount social media’s value or a fear of adapting to a new marketing model. Perhaps it is a little bit of both.

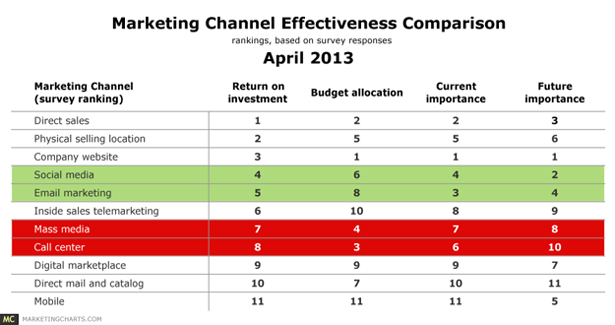

Marketing Charts recently outlined on a new report by the Platt Retail Institute, conducted in association with the American Marketing Association comparing marketers’ rankings of various channels’ budget allocations against the channels’ perceived importance and ROI. The study reveals that of the 11 channels identified, social media marketing ranks fourth in both current importance and ROI, but ranks only sixth in budget allocation.

Scott Monty of Ford Social explained in his blog that “The study reveals there’s a mismatch between marketing budget and effectiveness in key areas. Two are mass media and customer support, which are being overspent on versus their return on investment. Alternatively, email and social are being under spent on while they have a more effective ROI.”

When you know more, you can do more. Social media’s ROI can be tracked. But keep in mind that tracking is only the measurement of the result of your efforts. You must be able to tie those results back to your objectives to get real return on investment.

The following are Facebook objectives and results we track here at Kruse Control on a weekly basis:

1. Community Growth: number of likes obtained. This metric shows how your page is growing and can be tied in with budget spent on Facebook ads.

2. Engagement: number of likes, comments and shares. Content is what drives your social media success. When you track how your content is being received by the audience, you get smarter about what to post in the future.

3. Total Reach: number of people that viewed your content. This is another metric that can be tied to Facebook ad spend. Facebook allows you now to pay to reach more people. While it’s a lot different than even last year at this time, as a Facebook marketer I’m glad to have that available to me.

4. Popular Posts: The posts got the highest engagement. This is a useful metric for content curation. As marketers, we always use our best guess as to what the audience is looking for. Keeping track of your most popular posts allows you to give your audience more of what they like.

I have a client who shares a lot of content around a certain female service adviser. She’s well known in the community and has a bubbly, enthusiastic personality. Their posts with Mackenzie get off-the-chart engagement.

5. Budget Spent (Facebook ads, software tools, design, etc). Facebook is not free. You have to pay to play. If you want to increase your reach then you need a budget for ads. Beyond an ad budget, you’ll need money for software monitoring tools, scheduling software, photos and graphic design. Since it’s actual money spent, this is the easiest one to track.

6. Leads: number of leads generated. This is the golden ring here folks. There are two types of leads from Facebook – organic and traditional. Organic leads happen in the comments section of your posts.

Share a special offer and many times someone will ask, “How long is this on for?” or “Do you service Nissans?” Be ready to answer their question and pose another one to keep them engaged.

The traditional type of lead comes from a more proactive approach. It involves the strategic use of Facebook Ads that click through to specific landing pages. There are thousands of ways to use this tactic, it all ties back to your objectives and the results you’re looking for.

7. Sales: number of sales closed. Because of their very nature, organic leads will be known intimately by your social media manager. They’ve had conversations with the lead sometimes over months. When you’re running more traditional campaigns with landing pages, it’s helpful to have lead tracking software to know who the leads were so you can follow up on them.