COMMENTARY: Bad retailing habits developed during past 48 months could come home to roost in 2023

Graph courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

There has been a surreal quality to the market developments that have unfolded in the automotive sector through a pandemic-defined economy that has disrupted production without diminishing demand.

Nowhere has this manifested itself more dramatically than in the used-vehicle market. Success has been more closely tied to buying (putting cars on lots) than selling (guiding shoppers through the buying journey). In the process, it is more than possible that essential customer engagement skills across the dealership environment have dulled — if not atrophied altogether — while new important competencies have failed to be nurtured.

As we move past the headlines of the day and prepare for a market rationalization that is likely to manifest itself during the course of 2023, shortcomings that have carried few, if any, consequences today may return to inflict severe damage as the market inevitably reverts to the mean.

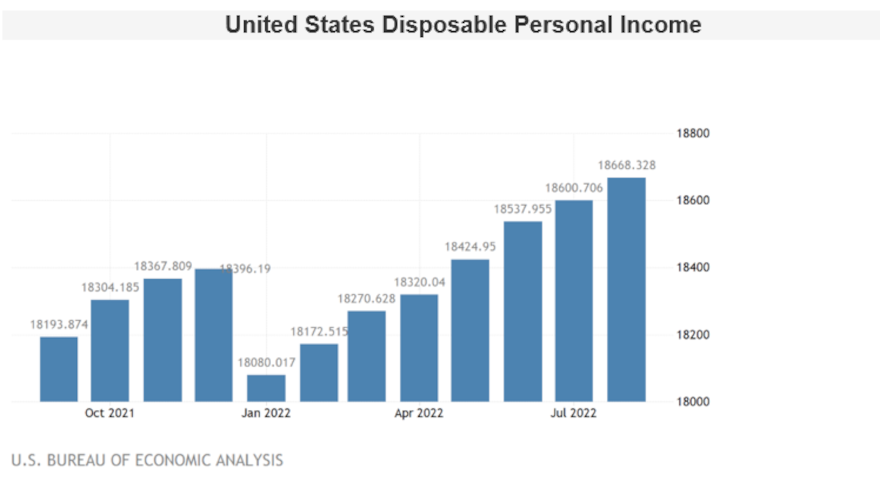

To be clear, dealerships' focus on securing supply has been totally appropriate during the past two and a half years. The strength of demand, driven by exceptionally low unemployment, pent-up market pressure and record high consumer liquidity (as measured by disposable income), has resulted in an “if you get it, it will move” mentality that has indeed delivered.

Fissures in the economic outlook, however, are already being widely covered in the business and general press. While J.D. Power does not expect to see a major demand-side cliff that will have catastrophic effects on the industry, we do anticipate a steady shift in the competitive landscape. Inventory maintenance—which revealed a tremendous level of creativity on the part of dealers across the country — will no longer be enough to meet critical objectives as we move toward the middle of the decade.

A return to strategy and demand analysis

Subtle adjustments in improved new-vehicle production combined with the mitigating effects of initiatives to cool the economy will ultimately require players in the used-vehicle market to re-focus efforts on ensuring that dealers secure the right vehicles based on accurate insights of what is actually moving and a sophisticated understanding of evolving consumer demand.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The factor that will most complicate a return to demand analysis is that shoppers have fundamentally changed how they purchase—and sell—their vehicles. They have enthusiastically embraced digital engagement channels to support their buying journey, in whole or in part.

To their credit, dealerships have also leaned into new technologies, as evidenced by their ability to leverage online resources to re-supply their lots after conventional wholesale auction markets were disrupted. What is less clear is how prepared dealerships are — over the short- to mid-term — to leverage those same tools to capture, engage and establish relationships with buyers that bridge the online-to-onsite gap.

Effective customer engagement will hinge on the ability of dealerships to make significant adjustments to conventional strategies. They will have to move from a current state that almost exclusively revolves around the showroom experience and adopt a digital culture that proactively seeks to engage and guide consumers through each phase of the buying journey: research, evaluation and conclusion.

The long-term picture is perfectly clear. We have seen this movie before.

Similar dynamics unfolded in the wake of the Great Recession. New infrastructures emerged from the 2008 economic crisis. These introduced higher levels of market efficiency that have well-served consumers, dealerships and manufacturers. The same will happen as the industry works through the current economic cycle. Indeed, few in the industry question that mastering the subtleties of the emerging digital market will eventually become a competitive requirement.

It is during the transition to the new normal, however, that the market will see customer-focused digital engagement strategies separate leaders from laggards

Jonathan Banks is vice president & general manager of vehicle valuations at J.D. Power. He will be among the speakers at Used Car Week, which starts Nov. 14 in San Diego