New research from LexisNexis Risk Solutions reinforced how the use alternative data often focuses on deep subprime, subprime and near-prime consumers

Last week, LexisNexis Risk Solutions unveiled the findings of its Alternative Credit Data Impact Report, a nationwide survey assessing the adoption, utilization and impact of alternative credit data for credit portfolio growth and management in consumer and small/mid-sized business (SMB) lending.

The report surveyed those who identify as senior decision makers for marketing, lending and credit risk in U.S. financial institutions such as banks, credit unions, non-bank lenders and fintechs.

LexisNexis Risk Solutions recapped that alternative credit data encompasses a broad range of credit risk insights. Experts said these insights are typically not included in traditional credit reports and scores including life event insights such as professional licenses and asset ownership and modern credit seeking behaviors from markets like online lending and short-term lending, rental data, consented data and more.

When paired with the traditional credit behaviors currently used in conventional credit scores, LexisNexis Risk Solutions explained these non-traditional credit insights can deliver a more comprehensive view into a consumer’s creditworthiness.

LexisNexis Risk Solutions discovered at least two-thirds of financial institutions surveyed use alternative data in their credit risk assessments for underwriting and portfolio management.

In fact, 84% of respondents use alternative credit data in prescreening and credit risk across the customer lifecycle, with credit unions taking the lead in using alternative credit data at 91%.

Three other key findings from the Alternative Credit Data Impact Report include:

1. Adoption of Alternative Credit Data

Alternative credit data usage is becoming more common as financial institutions adopt financial inclusion initiatives.

Of the 37% of self-identified leading adopters of alternative credit data, the survey showed 55% named financial inclusion as their top objective, followed by improving segmentation (37%) and improving the ability to swap in/swap out applicants (24%).

LexisNexis Risk Solutions said financial institutions are most likely to use alternative data in their credit risk assessment of deep subprime, subprime and near-prime consumers.

Leaders of alternative data adoption are also particularly likely to use it when assessing the credit risk of prime consumers, according to the survey.

2. Data as a business driver

LexisNexis Risk Solutions pointed out business drivers for alternative data use include improving pricing strategies, increasing financial inclusion, risk mitigation and gaining a competitive advantage.

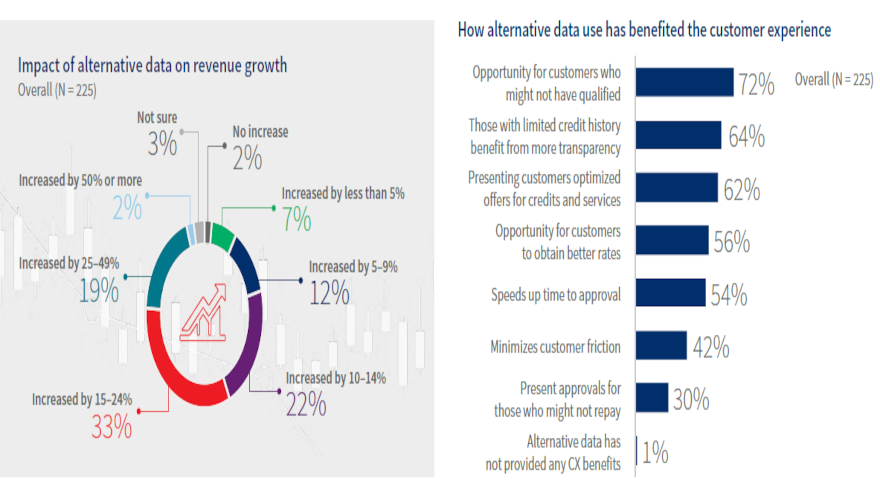

Nearly all financial institutions surveyed indicated that alternative data has increased revenue growth by at least 15% and improved customer experience.

The report also indicated that lack of alternative data usage could lead to lost opportunity, customer friction and limited risk mitigation.

3. Financial institutions satisfied yet challenged

While there is overall satisfaction with alternative data, LexisNexis Risk Solutions acknowledged there are challenges and barriers associated with utilizing alternative credit data for credit risk assessment.

Experts said larger tier 1 banks are significantly more likely than smaller banks to be very satisfied with their data, as a result of having more resources to invest in to obtain alternative types of data.

“The high rate of alternative data adoption across the customer lifecycle reflects how lenders of all sizes are increasingly unsatisfied relying solely on the status quo of traditional credit data to grow and manage their businesses,” said Kevin King, vice president of credit risk and marketing strategy at LexisNexis Risk Solutions.

“The vast majority of institutions are now using alternative data to assess the creditworthiness of subprime consumers and those with limited credit history, while forward-thinking organizations are achieving significant advantages applying these insights in near-prime and prime segments,” King continued in a news release.

“This benefits not only the financial institution but the customer experience, helping to ensure lenders present the most appropriate offers to consumers or SMBs, particularly those who might not appear qualified through the lens of traditional data alone,” he went on to say.

LexisNexis Risk Solutions conducted its first nationwide survey to assess the adoption and utilization of alternative data across different financial institutions for credit portfolio management and growth.

Two phases of research occurred.

The first phase involved quantitative surveys; the second phase involved follow-up qualitative interviews. Data collection was performed online and by phone from July to August with a total of 225 completions in the United States.

Respondents included senior decision makers for lending and credit risk in U.S. financial institutions.

Upon completion of analysis with the quantitative findings, researchers interviewed 10 consumer credit lending decision makers to provide further context around certain survey results.

To download a copy of the Alternative Credit Data Impact Report, go to this website.

Equifax recently expanded its offerings connected with alternative data so finance companies still can cater to consumers with thin files or soft credit backgrounds.

Developed in partnership with Urjanet, Equifax introduced Payment Insights, a cloud-based solution that promotes greater financial inclusion, regardless of the consumer’s traditional credit score. Payment Insights is meant to empower consumers to share utility and telecom payment history with banks or lenders when applying for loans and other services.

According to the Federal Reserve, 63 million American adults are either unbanked or underbanked. Equifax said these individuals may rely on high-cost alternative financial products and services such as check cashing services or pawn shop loans to meet their day-to-day financial needs.

Helping more of these consumers obtain access to mainstream financial services and products requires new insights into individual financial history, according to the credit bureau.

“Urjanet data has shown that more than 90% of U.S. adults have at least one household utility service in their name,” said Mark Luber, chief product officer for Equifax United States Information Solutions (USIS).

“The Payment Insights product was designed with the understanding that utility payment information is a powerful source of data when traditional credit insights may not be available,” Luber continued in a news release. “Broader visibility into a person’s ability to pay has the potential to positively impact a person’s financial profile.

“We are giving lenders smarter insights that improve the consumer experience, by uncovering qualified applicants who may have otherwise been hidden from view,” he went on to say.

Equifax highlighted that Payment Insights is designed to make it easy for consumers to share utility payment history.

The cloud-based, API-driven product can allow finance companies and other lenders to seamlessly integrate the data into review processes, while meeting industry-leading standards for protection of consumer data security, confidentiality and integrity.

Individuals simply provide consent to connect their utility accounts from a lender’s branded experience, and up to 12 months of data is immediately delivered directly from the utility provider to the lender in tradeline format.

Equifax said the report pulls account information, obligation details and payment histories to give finance companies and lenders a more holistic view of the applicant.

“Urjanet and Equifax share the belief that consumer-permissioned data will play an increasingly important role in the financial profiles of consumers worldwide,” said Shannon Johnson, head of financial services and chief strategy officer at Urjanet.

“With Payment Insights, consumers can share information from a network of thousands of utility providers covering almost 90 percent of the U.S. population to create a more complete financial portrait. We’re enabling lenders to better reach underserved markets and quickly qualify more borrowers,” Johnson said.

Equifax indicated Payment Insights is available now and joins its suite of consumer-permissioned alternative data offerings, including Cashflow Insights, a solution designed to expand access to credit with bank transaction data.

Equifax advanced analytic capabilities and differentiated data assets also include The Work Number database, The Kount Identity Trust Global Network, The Equifax Commercial Financial Network (CFN), DataX, the IXI Network, PayNet and Ansonia Credit Data.

For more information, visit equifax.com.

If auto-finance companies were not already using alternative data to enhance their underwriting efforts, they appear to have gotten the green light this week from five prominent federal regulators.

Those five agencies — the Federal Reserve, the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corp. (FDIC), the Office of the Comptroller of the Currency (OCC) and the National Credit Union Administration (NCUA) — issued a joint statement on the use of alternative data in underwriting by banks, credit unions and non-bank financial firms.

The statement notes the benefits that using alternative data may provide to consumers, such as expanding access to credit and enabling consumers to obtain additional products and more favorable pricing and terms. The statement explained that a well-designed compliance management program provides for a thorough analysis of relevant consumer protection laws and regulations to ensure firms understand the opportunities, risks, and compliance requirements before using alternative data.

Officials reiterated alternative data includes information not typically found in consumers’ credit reports or customarily provided by consumers when applying for credit. Alternative data include cash flow data derived from consumers’ bank account records.

“The agencies recognize that use of alternative data in a manner consistent with applicable consumer protection laws may improve the speed and accuracy of credit decisions and may help firms evaluate the creditworthiness of consumers who currently may not obtain credit in the mainstream credit system,” officials said in a news release issued by the CFPB.

The entire three-page statement can be found here.

Finance companies, especially ones that participate in the non-prime and subprime spaces, often gather as much information as possible during the underwriting process before a funding decision, making the potential of alternative data even more dramatic.

George Coutros, the head of analytics, product and data management at Clarity Services, described how much more robust alternative data is nowadays. Coutros joined Nick for this podcast recorded during the National Automotive Finance Association’s annual conference in June in Plano, Texas.

The full episode can be found below.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

You can also listen to the latest episode in the window below.

Catch the latest episodes on the Auto Remarketing Podcast homepage and on our Soundcloud page.

Please complete our audience survey; we appreciate your feedback.

Along with rolling out a tool that’s designed to deliver precise damage exposure data from a tornadic event within minutes, CoreLogic on Wednesday launched a solution aimed at leveraging the capability of alternative credit data.

The global property information, analytics and data-enabled solutions provider unveiled the new CoreLogic Teletrack platform, offering lenders and credit issuers what the company thinks is “superior access and greater insight” into alternative credit data through one of the industry’s largest alternative credit databases.

The new platform and solution combine upgraded services, data, products and an analytics engine to help users discover new market segments, make smarter risk decisions and grow their business throughout the credit lifecycle.

With the new platform, CoreLogic Teletrack customers can access traditional and alternative consumer credit data, and a suite of credit risk attributes and fraud prevention solutions, through the customer segmentation, customer acquisition, portfolio management, and collections and recovery phases.

“CoreLogic Teletrack has been a leader in the alternative credit data market for 30 years,” CoreLogic Teletrack senior leader Irina Kovach said in a news release. “The new CoreLogic Teletrack platform is built upon the same technology and trusted data that industry professionals have come depend on, but with new state-of-the-art enhancements such as an intuitive user interface, expanded data attributes and increased flexibility around how data is reported leveraging certain Metro 2® reporting fields.

“These benefits provide users with faster, more robust alternative credit data solutions,” Kovach continued.

Kovach mentioned CoreLogic Teletrack can provide information on more than 86 million thin-file, unbanked and under-banked consumers. With the ability to receive real-time updates, the database can accept new inquiries and a continuous stream of consumer loan performance data from businesses nationwide.

The new CoreLogic Teletrack platform is available now. For more information, visit this website.

CoreLogic launches tornado path maps solution

According to the National Weather Service, a tornado struck the capital of Missouri just before midnight on May 22, packing winds approaching 160mph and causing immense destruction in its path that included Riley Chevrolet, a large franchised dealership.

To help the industry respond to disasters like what recently happened in Jefferson City, Mo., CoreLogic announced its launch of Tornado Path Maps. The company claims it has the only solution available on the market that can deliver precise damage exposure data from a tornadic event within minutes — an analysis that can take up to two days to complete using other methods.

CoreLogic said insurers benefit from the ability to anticipate claims volume and adjuster deployment for streamlined claims processing, allowing policyholders to get the support they need faster than ever before.

Unique to CoreLogic, the company explained Tornado Path Maps can offer a data layer updated every 15 minutes following a tornado, displaying area probabilities (from 10% up to 90%) of tornadic damage. In addition to allowing insurance carriers to quickly calculate claims needs, this parcel-level exposure analysis means emergency responders, utility companies, transportation departments and others will be able to quickly determine resource allocation and deployment to begin offering on-the-ground support to the people and properties affected.

“Until now, understanding exposure from tornadoes has been a daunting challenge for most insurers, as typical ground-based observations and reporting are hampered due to infrastructure damage when a tornado moves through an area,” said Curtis McDonald, senior professional product management and meteorologist for CoreLogic Weather Verification Services. “These challenges can create frustrating policyholder experiences.

“Our goal with Tornado Path Map is to enable insurers to efficiently and accurately identify customers under duress immediately following tornadic storms, meaning they’re able to assist with communications and swift response to help their policyholders in need,” McDonald continued.

Tornado Path Maps is based on the proprietary CoreLogic Tornado Verification Model, which combines a novel comprehensive approach to using all available radar data, as well as public and social media reports, backed by the expertise of experienced meteorologists. The end result is the Tornado Verification Model that can provide 250-meter resolution with neighborhood-level detail across most of the United States.

Tornado Path Maps is part of the CoreLogic Severe Convective Storm suite of solutions, which also offers forensics on hail, wind and lightning.

For more information, visit the CoreLogic Tornado Path Maps page.