Two of U.S. House membesr who are two of staunchest defenders of dealers and how the indirect auto financing model currently operates — one that still includes dealer reserve — peppered the director of the Consumer Financial Protection Bureau who made his semiannual appearance before the Financial Services Committee on Tuesday.

Like many of his fellow lawmakers, Rep. Scott Garrett referenced a series of recent reports from American Banker recapping internal memos and other documents about the CFPB’s use of disparate impact to generate a “tipping point” enforcement action that might discontinue the practice of dealer participation altogether.

The New Jersey lawmaker then directly asked CFPB director Richard Cordray, “Are you working to eliminate dealer reserves?”

Cordray replied with, “We have been working to try to address a practice that we believe is discriminatory, discretionary markups.”

He added that the CFPB is out “not necessarily to eliminate,” dealer participation. “We had an enforcement action (Monday) in which it would limit dealer reserve, not eliminate it. And we think that might be a fair way to try to address the issue,” Cordray went on to say.

What Cordray referenced was the CFPB enforcement action against Fifth Third Bank, which included a mandate to cap dealer markup at either 1.25 percent or 1 percent depending on the length of the vehicle installment contract.

During a back-and-forth exchange between Garrett and Cordray that had each individual interrupt each other multiple times, the House lawmaker insisted he was asking these questions because “dealers are on the front lines of making these loans.”

Cordray replied with how the Dodd-Frank Act was written that created the CFPB four years ago.

“We have authority in the statute. It doesn’t exempt the auto industry. It exempts auto dealers. It doesn’t exempt auto lenders. We have a responsibility to address auto lenders. We understand we are exempted from addressing auto dealers,” Cordray said.

“Congress drew the statute. I didn’t draw it. I have to live with it. It exempts auto dealers, but gives us responsibility over auto lenders. I’m not sure that makes a lot of sense, but we’re trying our best to observe the lines that Congress drew,” he continued.

“It’s a funny provision in the statute. I’m not sure it’s very logical,” Cordray added.

Before Garrett’s time for questioning expired, Cordray also told the lawmaker that vehicle financing is “made by the auto lender. The auto lender controls the auto lending program.”

And with institutions such as Fifth Third Bank as well as American Honda Finance now restricted on how much dealer markup is allowed, Garrett also questioned whether the CFPB understands the implications on dealerships and their ability to generate revenue by these enforcement actions.

“What I would say is this,” Cordray said, “As we do our work … it does effect auto dealers. I would agree with you on that. That’s why the provision is not very logical.”

Finally, Garrett tried to get Cordray to acknowledge the CFPB’s actions are increasing the consumer costs of making a vehicle purchase based on a wide array of studies from the American Financial Services Association, the National Automobile Dealers Association and other organizations.

“There’s disagreement about that,” Cordray said.

Later during the hearing that lasted more than three hours, Rep. Blaine Luetkemeyer took his turn. The Missouri lawmaker — who has been a part of multiple proposals to modify how the CFPB operates — asked, “Why are you getting involved in the general competiveness of the marketplace?”

Again, Cordray referenced back to this week’s action involving Fifth Third Bank.

“This is not some sort of philosophical thing we’re deciding to do because we have some kind of ideology,” Cordray said.

“This is the result of an enforcement action because of an investigation by us and the Justice Department. We’re not solo on this. The Justice Department has much more lengthy experience with this than us with an investigation about potential discrimination,” he continued.

“There was back and forth with that entity and various other entities in which it was determined this was a reasonable result to address the problem and yet allow the entity to move forward and continue to lend aggressively to customers,” Cordray went on to say.

The entire hearing featuring Cordray can be watched in the window at the top of this page.

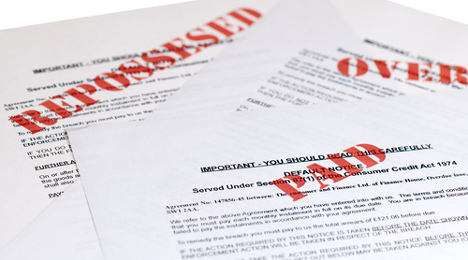

First Ally Financial, then American Honda Finance Corp., and on Monday, the Consumer Financial Protection Bureau added Fifth Third Bank to its list of recipients of multi-million-dollar actions for what the regulators determined to be discrimination in vehicle financing.

As part of its $18 million penalty in the auto space, the CFPB and Department of Justice ordered Fifth Third Bank to substantially reduce or eliminate entirely dealer discretion. Officials told the bank to pay that $18 million to “harmed” African-American and Hispanic borrowers. Meanwhile the dealer participation stipulations included in the agreement are similar to what Honda Finance is being forced to do.

According to second quarter data from Experian Automotive, Fifth Third Bank tied for No. 15 in overall market share, holding 0.99 percent with fellow Midwestern commercial bank Huntington and USAA.

“We are committed to promoting fair and equal access to credit in the auto finance marketplace,” CFPB director Richard Cordray said. “Fifth Third’s move to a new pricing and compensation system represents a significant step toward protecting consumers from discrimination.”

Monday’s enforcement action is the result of a CFPB examination that began in January 2013. Over the time period under review, bureau officials indicated that Fifth Third permitted dealers to mark up consumers’ interest rates as much as 2.5 percent “while giving them the discretion to charge consumers different rates regardless of consumer creditworthiness.”

The examination evaluated Fifth Third’s indirect auto lending program for compliance with the Equal Credit Opportunity Act, which prohibits creditors from discriminating against loan applicants in credit transactions on the basis of characteristics such as race and national origin. The CFPB and DOJ’s joint investigation concluded that Fifth Third’s policies a pair of infractions, including:

• Resulted in minority borrowers paying higher dealer markups: Fifth Third violated the Equal Credit Opportunity Act by charging African-American and Hispanic borrowers higher dealer markups for their auto loans than non-Hispanic white borrowers. These markups were without regard to the creditworthiness of the borrowers.

• Injured thousands of minority borrowers: Fifth Third’s illegal discriminatory pricing and compensation structure meant thousands of minority borrowers from January 2010 through September of this year were charged, on average, more than $200 more for their vehicle installment contract.

The Dodd-Frank Wall Street Reform and Consumer Protection Act and federal fair lending laws authorize the CFPB and DOJ to take action against creditors engaging in illegal discrimination. The CFPB’s order was filed on Monday as an administrative action, and DOJ’s proposed order was filed in the U.S. District Court for the Southern District of Ohio.

“The measures provided in the orders will help ensure that illegal discrimination does not increase the cost of auto loans for consumers on the basis of race and national origin,” officials said.

Monday's announcement arrived about two months after a report surfaced that Fifth Third Bank was about to be penalized

The Wall Street Journal cited what the report described as people familiar with the matter who indicated the CFPB was asking Fifth Third Bank to reduce the amount of dealer mark-up it allows in exchange for a reduced monetary settlement with the regulator.

Agreement details

Under the CFPB order, Fifth Third must:

• Substantially reduce or eliminate entirely dealer discretion: Fifth Third will reduce dealer discretion to mark up the interest rate to only 1.25 percent above the buy rate for auto loans with terms of 5 years or less, and 1 percent for auto loans with longer terms. Fifth Third also has the option under the order to move to non-discretionary dealer compensation.

The bureau said it did not assess penalties against Fifth Third because of the “proactive steps” the company is taking that directly address the fair lending risk of discretionary pricing and compensation systems by substantially reducing or eliminating that discretion altogether.

• Pay $18 million in damages for consumer harm: Fifth Third will pay $12 million into a settlement fund that will go to harmed African-American and Hispanic borrowers whose auto loans were financed by Fifth Third between January 2010 and September of this year.

Based on a determination by the DOJ and the CFPB, officials calculated Fifth Third will receive credit of between $5 million and $6 million for remediation it has already provided to harmed consumers whose auto loans were financed by Fifth Third from January 2010 through June of this year. Fifth Third will then pay any additional funds necessary into the settlement fund to bring its total payment to harmed consumers to $18 million.

• Pay to hire a settlement administrator to distribute funds to victims: A settlement administrator will contact consumers, distribute the funds, and ensure that borrowers who were harmed receive compensation.

The bureau said will provide contact information for the settlement administrator once that person is chosen to address questions that consumers may have about potential payments.

Pattern of settlements

In March 2013, the CFPB issued a bulletin explaining that it would hold indirect auto lenders accountable for unlawful discriminatory pricing. The bulletin also made recommendations for how indirect auto finance companies could ensure that they were operating in compliance with fair lending laws.

Then in December of that year, the bureau handed out a penalty topping $80 million against Ally.

In September of last year, the bureau issued an edition of Supervisory Highlights that explained that the CFPB’s supervisory experience suggests that significantly limiting discretionary pricing adjustments may reduce or effectively eliminate pricing disparities.

“Substantial limits on discretionary pricing like those imposed by Monday order can address the type of fair lending risk identified in the CFPB’s bulletin and Supervisory Highlights,” officials said.

Officials recapped that Monday's auto lending action is part of a larger joint effort between the CFPB and DOJ to address discrimination in the indirect auto lending market.

Most recently, in July, the CFPB and DOJ took an action against Honda Finance requiring the captive to pay $24 million in consumer restitution and take the same steps to substantially reduce or eliminate entirely dealer discretion.

DOJ officials cheered Fifth Third Bank for accepting terms of the agreement outlined on Monday.

“We commend Fifth Third for its commitment to treating all of its customers fairly without regard to race or national origin and its leadership in agreeing to impose lower caps on discretionary markups,” said principal deputy assistant attorney general Vanita Gupta, head of the Civil Rights Division.

“This agreement shows that the indirect auto lending industry is moving toward a model of dealer compensation that fairly compensates dealers for their work related to loans, while limiting the dealer markup that leads to discriminatory pricing,” Gupta continued.

U.S. Attorney Carter Stewart of the Southern District of Ohio added, “Consumers deserve a level playing field when they enter the marketplace, especially when financing an automobile. This settlement prevents discrimination in setting the price for auto loans.”

On the day CarMax Auto Finance completed the second quarter of its current fiscal year with a 6.2-percent increase in net income, the financing arm for the used-vehicle retailer came within the jurisdiction of the Consumer Financial Protection Bureau thanks to the larger participant rule.

When asked how this additional regulatory burden might burden CAF’s performance, CarMax chief financial officer and executive vice president Tom Reedy quickly tried to assuage any concern investment analysts might have held when the company held its quarterly conference call earlier this week.

“The larger participant ruling is out there, and frankly it was nothing of any surprise for us,” Reedy said. “There is no direct impact on our dealer operations, but as we expected all along, CarMax Auto Finance will be subject to the bureau’s supervisory authority, and what that means is we’ll be interacting with them in the future, as we were pretty certain.”

Previously, the bureau supervised auto financing at the largest banks and credit unions. Then as of Aug. 31, the CFPB’s rule extends that supervision to any nonbank auto finance company that makes, acquires or refinances 10,000 or more loans or leases in a year.

The CFPB announced this move back in June so Reedy reiterated that CAF had time to prepare.

“As far as what we’ve been doing, we’ve been paying careful attention to developments in the industry as we see new announcements and new actions by them,” Reedy said. “We’ve been assessing our practices as we see what we think are the expectations of the bureau, and we’ve been working hard to make sure that our compliance and program is up to snuff and will be ready for examination, if and when it comes.”

An examination would show what CarMax Auto Finance reported for Q2, which included $98.3 million in net income. The company also highlighted its average managed receivables grew 16.4 percent to $8.99 billion. The total interest margin, which reflects the spread between interest and fees charged to consumers and its funding costs, declined to 6.2 percent of average managed receivables from 6.6 percent in last year’s second quarter.

Officials also mentioned their allowance for loan losses climbed to $87.8 million in Q2, up from $77.8 million a year earlier.

“I think from the perspective of CAF, it was a straightforward, a boring quarter, which is what we like to see,” Reedy said. “That means everything is going as expected.

“If you remember, last quarter and, I believe, the quarter before, we had some but changes in our loss expectations, which were favorable and actually boosted income growth in those quarters,” he continued. “This quarter, we’ve seen loss experience come in as expected, right where we booked it, which is how we like to see things.

“There’s nothing different going on. It’s just a matter of we’ve seen losses come in exactly as we’d been planning on,” Reedy went on to say.

The reported acknowledgement by the Consumer Financial Protection Bureau that its use of disparate impact could over-count potential discrimination by indirect auto finance companies continues to churn the industry’s frustration with how the regulator operates.

Paul Metrey, chief regulatory counsel at the National Automobile Dealers Association, reiterated his position after American Banker reviewed a series of private documents exchanged between CFPB officials. The report indicated bureau officials say they prefer using disparate impact to the alternative where bias is underestimated.

“In order to have an accurate measurement of potential consumer harm, you have to isolate out legitimate pricing factors that can cause a deviation in the results. There are business factors that the Justice Department has recognized as legitimate that the CFPB appears to be blatantly ignoring during investigations,” Metrey said.

“There’s also an added reputational harm to the actors when the CFPB is basing damages off overestimated figures. If you look at the press releases of these enforcement actions, they are not holding back,” he went on to say.

The American Banker report also touched on subject that triggered a scathing editorial Investor’s Business Daily. The internal documents American Banker obtained as well as its sources reflected back on the largest enforcement action to date the bureau has made in the auto finance space. Sources said the CFPB “chose to act aggressively because it wanted to send a message to the industry and do so quickly,” when it bureau used disparate impact to hand out an $80 million penalty against Ally Financial at the end of 2013.

In light of all the reports and CFPB activity not only against Ally, but also the $24 million action against American Honda Finance, editors of Investor’s Business Daily urgently questioned the bureau’s continued use of proxies to find discrimination since auto finance applications do not require race disclosure.

“Not only does CFPB guess about the qualifications of the applicants they're comparing, it also makes faulty assumptions about the actual race of those applicants,” the publication said in its editorial posted here.

The publication closed its opinion piece by stating, “That’s a lot of speculation for something as serious as racism. Lacking hard evidence to support their discrimination claims, they show no concern about charging people with something that they didn't necessarily do.”

The National Automotive Finance Association enjoyed another great turnout for the opening module of its Consumer Credit Compliance Certification program.

The most recent session last week in Irvine, Calif., drew 78 participants from 55 different companies. Hudson Cook partner Patty Covington, one of the instructors for the opening module of the four-part training endeavor, told SubPrime Auto Finance News in an email message that the topics drawing the most questions from attendees included:

— Adverse action notice requirements

— Furnishing to the credit bureaus

— Text messaging

— Collections

— Compliance management systems

After two days of classroom style learning in Irvine to complete Module 1, participants will move onto the 29 self-paced, Web-based sessions covering federal and state laws and regulations that govern the auto financing business.

Successful testing throughout the program is necessary before progressing in the program, which is available to the staff of NAF Association member companies at the price of $2,000 per person and non-member companies at $3,000 per person.

The certification of Compliance Professional is awarded upon completion of Module 4, a live classroom session covering the Consumer Financial Protection Bureau. The next time the NAF Association is offering Module 4 is ahead of the SubPrime Forum at Used Car Week, which begins on Nov. 16 in Scottsdale, Ariz.

Whether or not they’re participating in Module 4, NAF Association members can take advantage of $100 discount off of the registration fee for the SubPrime Forum, which includes a wide array of presentations as well as networking opportunities at the Phoenician, the site of Used Car Week.

When completing registration, NAF Association members can use the code NAF2015 when prompted.

Agenda and registration details all can be found at www.usedcarweek.biz.

For more information about the Consumer Credit Compliance Certification program, visit nafassociation.com or contact executive director Jack Tracey at (410) 865-5431 or [email protected].

Multiple industry associations disagree with how the Consumer Financial Protection Bureau orchestrates its complaint database. Now a top federal examiner whose primary responsibility is “to detect and deter waste, fraud and abuse,” according to its own website, is questioning how the CFPB is handling this process.

The latest audit report from the Office of Inspector General (OIG) detailed eight recommendations the CFPB can make to its complaint database, which the bureau indicated had grown to more than 677,000 complaints.

“We identified areas in which management controls should be improved to enhance the accuracy and completeness of the consumer complaint database,” OIG said in its report.

“The Office of Consumer Response has implemented controls to monitor the accuracy of complaint data in the internal case management system, which contains all consumer complaints received by the CFPB, but it has not established separate management controls to ensure the accuracy of data extracted from the system and included in the consumer complaint database,” they continued.

OIG indicated that it found “several noticeable” inaccuracies in its analysis of the 254,835 complaints in the database as of June 30 of last year.

“Although the number of complaints with inaccuracies that we identified was relatively small, enhancing existing controls would help ensure that as the number and types of complaints published increase, overall reliability of the data is maintained,” OIG officials said.

Those recommendations included:

— Implement controls to separately assess the accuracy of complaint fields in the consumer complaint database.

— Formally document standards for the data entry of complaints with foreign addresses.

— Implement the planned address verification tool to enhance the accuracy of consumer-provided location information in the consumer complaint database

— Develop approaches for monitoring company closing responses to ensure consistency with the response definition.

— Verify the effectiveness of the recent system change to ensure that untimely company closing responses, regardless of investigation status, are published.

— Formally clarify the time limit for consumers to dispute company closing responses.

— Verify that the recent system change ensures that consumers can dispute untimely company closing responses within a defined time frame and consumer dispute data are properly published in the consumer complaint database.

— Develop and implement a policy that states when the public should be notified of consumer complaint database update failures and includes procedures for the notification process.

The OIG audit also found two other issues with the CFPB’s department that monitors responses associated with complaints. Officials noted the Office of Consumer Response does not review all company closing responses, including verifying whether the company-selected response is consistent with the definition and consistently publish untimely company closing responses in the consumer complaint database.

In addition, we found that Office of Consumer Response allows 60 days for consumers to dispute company responses, rather than 30 days as stated in Consumer Response publications,” officials said.

“Further, consumers are not consistently offered the opportunity to dispute untimely company responses,” they continued.

“Finally, although the consumer complaint database website asserts that complaint data are refreshed daily, we found that Consumer Response did not consistently notify the public when the database was not updated,” OIG officials went on to say. “Consumer Response has resolved the causes for the majority of the daily update failures that we observed, but it has not established procedures to inform the public when complaint data are incomplete or outdated.”

The entire 45-page document titled, "Opportunities Exist to Enhance Management Controls Over the CFPB’s Consumer Complaint Database," can be downloaded here.

The Consumer Financial Protection Bureau took action on Wednesday against the nation’s two largest debt buyers and collectors for allegedly using deceptive tactics to collect bad debts, which may have included auto finance recoveries.

The bureau found that Encore Capital Group and Portfolio Recovery Associates bought debts that were potentially inaccurate, lacking documentation, or unenforceable.

Without verifying the debt, the CFPB charged that the companies collected payments by pressuring consumers with false statements and churning out lawsuits using robo-signed court documents.

The CFPB has ordered the companies to overhaul their debt collection and litigation practices and to stop reselling debts to third parties. Encore must pay up to $42 million in consumer refunds and a $10 million penalty, and stop collection on more than $125 million worth of debts.

Portfolio Recovery Associates must pay $19 million in consumer refunds and an $8 million penalty, and stop collecting on over $3 million worth of debts.

“Encore and Portfolio Recovery Associates threatened and deceived consumers to collect on debts they should have known were inaccurate or had other problems,” CFPB director Richard Cordray said.

“Now, the two biggest debt buyers in the market must refund millions and overhaul their practices. We will continue to take action to protect consumers from illegal and obnoxious debt collection practices,” Cordray continued.

Encore Capital Group is headquartered in San Diego. Its subsidiaries also named in Wednesday’s action are Midland Funding, Midland Credit Management, and Asset Acceptance Capital Corp. Together, they form the nation’s largest debt buyer and collector.

Portfolio Recovery Associates is the nation’s second largest debt buyer and collector. Portfolio Recovery Associates is a Delaware for-profit corporation headquartered in Norfolk, Va. and is a wholly-owned subsidiary of PRA Group, which also includes PRA Location Services that specializes in the auto finance space.

As debt buyers, the CFPB explained Encore and Portfolio Recovery Associates purchase delinquent or charged-off accounts for a fraction of the value of the debt. Although they pay only pennies on the dollar for the debt, they may attempt to collect the full amount claimed by the original finance company.

Together, the regulator indicated these two companies have purchased the rights to collect more than $200 billion in defaulted consumer debts on credit cards, phone bills and other accounts.

The CFPB found that Encore and Portfolio Recovery Associates attempted to collect debts that they knew, or should have known, were inaccurate or could not legally be enforced based on contractual disclaimers, past practices of debt sellers, or consumer disputes.

Officials also mentioned the companies filed lawsuits against consumers without having the intent to prove many of the debts, winning the vast majority of the lawsuits by default when consumers failed to defend themselves. These practices violated the Fair Debt Collection Practices Act and the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Collecting bad debts

The CFPB determined Encore and Portfolio Recovery Associates illegally attempted to collect debt that they knew, or should have known, may have been inaccurate or unenforceable. Specifically, the CFPB found that the companies:

• Attempted to collect on unsubstantiated or inaccurate debt: Encore and Portfolio Recovery Associates stated incorrect balances, interest rates, and payment due dates in attempting to collect debts from consumers. The companies purchased large portfolios of consumer debt with balances that sellers claimed were “approximate” or that otherwise did not reflect the correct amount owed by the consumer.

• Sellers also warned the companies that some of the debts they were buying may not have the most recent consumer payments deducted from the balance. Some sellers also represented that documents were not available for some of the accounts. The companies continued purchasing from these sellers and then collecting on that debt without first conducting any investigation to determine whether the debts were accurate and enforceable.

Illegal litigation practices

The bureau found Encore and Portfolio Recovery Associates collected debts through lawsuits and threats of legal action in unlawful ways. Specifically, officials said the companies:

• Misrepresented their intention to prove debts they sued consumers over: Encore and Portfolio Recovery Associates regularly attempted to collect on debts by suing consumers in state courts across the country. In numerous cases, the companies had no intention of proving these debts. They placed tens of thousands of debts with law firms staffed by only a handful of attorneys and in many cases made no effort to obtain the documents to back up their claims. Instead, the companies relied on consumers not filing a defense and winning the lawsuits by default.

• Relied on misleading, robo-signed court filings to churn out lawsuits: Encore and Portfolio Recovery Associates filed affidavits that contained misleading statements in debt collection lawsuits across the country. For example, they both used affidavits that misrepresented that the affiants had reviewed original account-level documentation confirming the consumers’ debts when they had not. The companies also submitted affidavits with documents attached that they claimed were the consumers’ specific account contracts or records when they weren’t. These shortcuts allowed the companies to churn through lawsuits without doing the research and due diligence required to obtain a legitimate judgment.

• Sued or threatened to sue consumers past the statute of limitations: From at least July 21, 2011 to March 31, 2013, Encore sent thousands of letters offering a time-limited opportunity to “settle” without revealing that the debt was too old for litigation. From January 2009 to March 2012, Portfolio Recovery Associates sent similar letters to consumers. Both of the companies also filed cases past the applicable statute of limitations.

• Pressured consumers to make payments using misrepresentations: Encore and Portfolio Recovery Associates made other inaccurate statements to consumers to press them to make additional payments. Specifically:

• Encore falsely told consumers the burden of proof was on them to disprove the debt: In sworn affidavits, Encore falsely told consumers and courts that the debt should be assumed to be valid because the consumer had not disputed it within a certain time period. In fact, Encore had the burden to first prove the debt was owed and accurate before the consumer had to challenge it.

• Portfolio Recovery Associates falsely claimed an attorney had reviewed the file and a lawsuit was imminent: The company’s collectors, who identified themselves as from the “Litigation Department,” misrepresented to consumers that litigation against them was planned, imminent, or even underway. In reality, in many cases, an attorney had not reviewed the account and the company had not decided whether to file suit.

Other illegal collection practices

Officials noted four other actions by the companies found during their investigation, including:

• Encore disregarded or failed to adequately investigate consumers’ disputes: If a consumer disputed their debt more than 45 days after Encore started collecting, Encore would require the consumer to produce specific documents or other “proof” to support their dispute or it would not conduct the legally-required investigation of the issues raised by the consumer.

• Encore farmed out disputed debts to law firms without forwarding required information: In numerous instances, Encore assigned disputed debt to law firms and third-party debt collectors without informing them that the debt was disputed. As a result, law firms evaluating Encore accounts for litigation did not know which accounts were disputed.

• Encore made harassing collection calls to consumers: Encore called consumers repeatedly or continuously with the intent to annoy, abuse, or harass them into paying. Encore’s subsidiary, Asset Acceptance, made thousands of calls to consumers before 8 a.m. or after 9 p.m. and called hundreds of consumers more than 20 times in a two-day period.

• Portfolio Recovery Associates misled consumers into consenting to receive auto-dialed cell phone calls: For approximately a year, and ending in August 2013, Portfolio Recovery Associates told consumers that they could only prevent collection calls to their cell phones before 9 a.m. if they consented to receive calls on their cell phones from a dialer. The company penalized representatives who failed to adhere to this policy.

Enforcement action

Pursuant to the Dodd-Frank Act, the CFPB said it has the authority to take action against institutions or individuals engaging in unfair, deceptive, or abusive acts or practices or that otherwise violate federal consumer financial laws. Under the terms of the CFPB orders released on Wednesday,

• Encore and Portfolio Recovery Associates are required to stop reselling debts: The companies are prohibited from reselling the debts they buy to other debt collectors. Officials believe this step will protect consumers from the potential harm that results when debt collectors continue to sell and resell debts that may be inaccurate or lack the business records and information needed to collect them.

• Encore must pay up to $42 million in refunds: The company must provide refunds where it collected payments by misrepresenting that it could sue on a time-barred debt or by misrepresenting in court that a debt was assumed valid because the consumer did not previously dispute it.

• Portfolio Recovery Associates must pay $19 million in refunds: The company must provide refunds where it collected payments by misrepresenting that an attorney had reviewed a debt or that collectors were calling on behalf of attorneys, and where it collected payments on judgments that it should not have obtained because they were barred by the statute of limitations from suing to collect the debt.

• Encore must stop collecting on $125 million of debt: The company must release or move to vacate all judgments and dismiss all lawsuits where it misrepresented that a debt was assumed valid, and stop any attempts to enforce or collect on these judgments. The face value of this debt is estimated at more than $125 million.

• Portfolio Recovery Associates must stop collecting on $3 million of debt: The company must release or move to vacate all judgments and dismiss all pending lawsuits it filed past the statute of limitations and stop any attempts to enforce or collect on those judgments, estimated to have a face value of $3.4 million.

• Stop collecting debts they can’t verify: Encore and Portfolio Recovery Associates can’t collect unsubstantiated debt. Under the order, they must review original account-level documents verifying a debt before collecting on it when, for example, a consumer has disputed it, the seller didn’t promise it was accurate or valid, or the debt was part of a portfolio they knew included unsupportable or inaccurate information.

• Ensure accuracy when filing lawsuits: The companies cannot file lawsuits to enforce debts unless they have specific documents and information showing the debt is accurate and enforceable.

• Provide consumers information before filing suit: Encore and Portfolio Recovery Associates must provide consumers with information about a debt, such as the name of the creditor and charge-off balance, and offer to provide consumers with original documents relating to the account before they are allowed to file a lawsuit or threaten to file suit to collect the debt.

• Use accurate affidavits: The companies cannot use affidavits to collect debts unless the statements contained in the affidavits specifically and accurately describe the signer’s knowledge of the facts and the documents attached.

• Reform collection of older debts: Encore and Portfolio Recovery Associates are prohibited from suing or threatening to sue to collect on time-barred debt. They also cannot collect on such debt unless they disclose to consumers that they can’t sue to collect it.

• Encore must pay a penalty of $10 million to the CFPB’s Civil Penalty Fund.

• Portfolio Recovery Associates must pay a penalty of $8 million to the CFPB’s Civil Penalty Fund.

The more the Consumer Financial Protection Bureau highlights details about its consumer complaint database, the more industry associations make their own grievances about how the regulator constructs its reports, which are often critical of how providers are performing.

The American Financial Services Association emphasized that the information in the CFPB’s consumer complaint database is “not always correct and so is not reliable.”

AFSA executive vice president Bill Himpler recapped in a letter delivered to the bureau earlier this week that the CFPB had asked for feedback on best practices for “normalizing” the raw complaint data that the bureau makes available via the complaint database. The regulator contends the process is geared to make it is easier for the public to use and understand.

Himpler explained that to normalize data is to transform “raw” data so that it may be compared in meaningful ways. As an example, the CFPB said that providing the total number of complaints against an issuer of credit cards may offer limited opportunities to analyze that company against other credit card issuers. Providing additional information on the size of the issuer’s credit card business as compared to others provides another an aspect from which consumers may make better informed decisions.

“AFSA opposes the CFPB’s effort to normalize the complaint data for this simple reason — data normalization is only worth the effort if the data is reliable,” Himpler said in his latest letter to the CFPB that’s available here.

“The data in the database is not always correct and so is not reliable. Therefore, normalizing the incorrect data will not help better inform consumers, but instead will further misinform consumers,” Himpler added.

Instead of normalizing the data, AFSA recommended that the CFPB should focus on collecting better data. Himpler told the bureau that AFSA members receive complaints without vital information, such as the borrower’s address, property address, loan number, phone number or email.

“In order to solve this problem, more of the fields in the complaint form should be mandatory for the complaintant to complete. It would also be helpful for the categories on the complaint form to be more granular,” Himpler said.

“In short, normalizing the complaint data would be a great amount of work with likely little consumer benefit,” he continued. “If the CFPB decides to proceed with the effort to normalize the data, the CFPB should give everyone an opportunity to comment on the specific approach that the bureau proposes using.

“We understand that the CFPB has said that this would be the last opportunity to comment, but we respectfully request that the CFPB reconsider that position given the amount of work that companies would be required to perform to normalize their data,” Himpler went on to say.

Meanwhile, AFSA wasn’t the only industry organization to send its own complaint about the CFPB database normalization. The Consumer Bankers Association (CBA) had its own regulatory counsel, Kate Larson, deliver a long proposal to the CFPB, too.

“The CFPB has a fundamental duty to publish accurate, reliable information,” CBA president and chief executive officer Richard Hunt said. “Publishing out of context, unverified data will only mislead consumers.

“As outlined in the letter CBA submitted, we urge the CFPB to shift their focus,” Hunt continued. “They must verify the data before they work to normalize it because only then will consumers truly benefit from the ‘complaints.’”

CBA’s complete recommendations can be seen here.

When the Consumer Financial Protection Bureau released its monthly consumer complaints snapshot report a little more than a week ago, one of the categories drumming up the most activity was credit reporting. Potential problems with how that metric developed is precisely what the Consumer Data Industry Association (CDIA) attempted to articulate to the CFPB in advance of that snapshot.

CDIA president and chief executive officer Stuart Pratt explained why the organization believes that the monthly complaint reports currently being published using the raw complaint data from the CFPB database “inaccurately reflects” the complaint volume and trends associated with its members, which includes Equifax, Experian and TransUnion. Pratt articulated the reasons in a letter to CFPB director Richard Corday, including:

1. Allowing complaints where no dispute was previously submitted to CDIA members

2. Complaints misattributed to CDIA members

3. Complaints submitted by credit repair services not recognized

4. The importance of context

“In many instances, consumers will often misidentify the actual party about which they are complaining due to the multiple parties involved in the ecosystem of credit reporting (and other types of consumer reporting agencies), thus wrongly submitting a complaint against one of our members,” Pratt said.

“We respectfully request that the CFPB postpone the production of additional reports which include individual company data until the CFPB has completed its work through its published request for information focused on determining … best practices for normalizing’ the raw complaint data it makes available via the database so they are easier for the public to use and understand,” he continued.

“To continue to publish raw data at the company level is unfair and does not, to quote the CFPB’s own notice, ‘… provide consumers with timely and understandable information to help enable them to make responsible financial decisions and to enhance market efficiency and transparency,’” Pratt went on to say.

The bureau said it has handled approximately 105,000 credit reporting complaints since it began accepting them in October 2012. The CFPB reported that it saw a 56-percent increase in the number of credit reporting complaints submitted by consumers between June (4,289 complaints) and July (6,969 complaints).

In analyzing the period of May through July, officials noticed complaints increased by 45 percent compared to the prior year.

The entire letter in which Pratt goes into much more details about the reasoning behind the CDIA’s four major concerns can be view here.

Unlike a college student scrambling to submit an assignment on time, there doesn’t appear to be much turbulence in the auto finance space since the larger participant rule from the Consumer Financial Protection Bureau went into practice on Monday.

Previously, the bureau supervised auto financing at the largest banks and credit unions. Now, this rule extends that supervision to any nonbank auto finance company that makes, acquires or refinances 10,000 or more loans or leases in a year.

The CFPB announced this move back in June, and National Automotive Finance Association executive director Jack Tracey indicated the agency made little changes, if any, to the protocol.

Under the rule, those companies will be considered “larger participants,” and the bureau may oversee their activity to ensure they are complying with federal consumer financial laws, including the Equal Credit Opportunity Act, the Truth in Lending Act, the Consumer Leasing Act, and the Dodd-Frank Wall Street Reform and Consumer Protection Act’s (Dodd-Frank Act) prohibition on unfair, deceptive or abusive acts or practices.

The CFPB estimated that it will have authority to supervise about 34 of the largest nonbank auto finance companies and their affiliated companies that engage in auto financing.

“Monday is sort of a non-event because I think the companies have been trying to comply and do everything the CFPB has wanted them to do much before this,” Tracey told SubPrime Auto Finance News. “I don’t think there’s any apprehension or concern on the part of the larger participants that Monday will change anything.”

David Missimer, general counsel for Automotive Compliance Consultants, took a similar stance.

“Non-bank auto finance companies falling under the umbrella of the Consumer Financial Protection Bureau's larger participant rule will, for the most part, be in position to respond to CFPB supervisory initiatives come (Monday),” Missimer said.

“The majority of auto finance companies were aware such a rule would be implemented long before the official rule was announced,” he continued. “Certainly there has been a flurry of activity, creation and refinement of compliant processes, and in consultations with law firms well versed in the examination process since the rule was announced.

“There will be a few companies unprepared, but the majority have been working hard to get their houses in order for expected CFPB examinations,” Missimer went on to say.

Both Tracey and current NAF Association president Mark Floyd acknowledged the dynamics could change if the CFPB chooses to make further regulatory modifications or more finance companies are placed under the bureau’s microscope.

When asked about how prepared finance companies are now that the “larger participant” rule is in effect, Floyd said, “That’s difficult to know until these companies actually undergo examinations by the CFPB.

“I’m confident that all of the companies take the CFPB’s oversight seriously and are doing their best to comply with the new regulatory environment we face in our industry,” continued Floyd, whose vast industry experience includes leading AmeriCredit as well as the overseeing of Exeter Finance, where he previously served as chief executive officer and currently remains a board member.

“Although the agency has recently published its examination procedures, these procedures could be subject to interpretation as they’re applied to actual situations. It’s a developing process and only time will tell how well-prepared various finance companies are,” Floyd went on to say.

A copy of the rule can be found here.

The examination procedures for auto finance can be found here.