In his newest commentary to help finance companies generate the most revenue out of the sale of add-on products, FNI Inc. president David Bafumo spotted what he described as valuable new guidance from the Consumer Financial Protection Bureau in its latest consent order.

Bafumo explained that for the first time, regulators have laid out a “step-by-step” guide to developing a product compliance plan. He noted product value, product transparency, equal opportunity and vendor management remain top issues.

This plan came from the June 19 consent order in which the CFPB demanded that GE Capital Retail Bank, now known as Synchrony Bank, provide an estimated $225 million in relief to consumers harmed by illegal and discriminatory credit card practices. GE Capital must refund $56 million to approximately 638,000 consumers who were subjected to deceptive marketing practices.

As part of the joint enforcement action by the CFPB and Department of Justice, GE Capital must also provide an additional $169 million to about 108,000 borrowers excluded from debt relief offers because of their national origin. This order represents the federal government’s largest credit card discrimination settlement in history.

“The details of the plan, while applicable specifically to Synchrony and the products and allegations at issue, nonetheless provide valuable insight for every finance company involved in the sale or financing of any kind of add-on product,” Bafumo said.

“The order’s compliance plan instructions include guidance for vendor management in connection with the add-on products, and detailed components needed to develop a system to prevent (unfair deceptive abusive acts and practices) UDAAP violations,” he continued.

“How add-on products are sold to consumers and the F&I best practice of offering ‘every product to every customer every time’ are also on point here,” Bafumo went on to say.

According to his assessment of the penalty against GE Capital, Bafumo indicated that regulators took issue with how the products’ benefits, limitations and costs were explained. Furthermore, the bureau questioned why in this case some individuals didn’t get a chance to make a purchase because the products were allegedly intentionally and systematically not offered to a protected class

Bafumo continued his consent order analysis in this first part of a series from SubPrime Auto Finance News by breaking down the compliance plan components indicated in the CFPB action.

1. Include safeguards designed to ensure that the bank’s employees, service providers, affiliates or other agents refrain from engaging in violations of law or regulations in the marketing, sale and administration of add-on products.

Bafumo acknowledged, “Well this isn’t as detailed as we would like. But ‘safeguards’ mean documented procedures that are executed and followed as well as effective to prevent violations.” He noted these safeguards can include ongoing monitoring and auditing.”

For auto finance products, Bafumo explained the order’s language requiring safeguards beyond marketing and sale, specifically to “administration” means developing processes not only for internal and/or dealer network product sales training and program management such as customer assistance and cancellation/refund training, but also substantial oversight and management of the product providers' compliance ability and actual product performance at every point of their interaction with customers and dealers.

2. Address the manner in which the bank informs customers of all fees, costs, expenses and charges associated with the add-on product.

Bafumo reacted by saying, “We’ve been here before. Product costs must be accurately disclosed.

“Here’s the bottom line on cost disclosure no matter what kind of product is at issue,” he continued. “Accurate cost is half the equation for consumers' calculation of product value. Without it, there can be no informed consumer choice and even the best products offered with the most transparent explanation of product benefits and conditions will not meet consumer protection obligations.”

3. Describe how the bank will inform customers of any material conditions, benefits and restrictions related to the add-on product, including how customers who disclose conditions that may make them ineligible for certain products or product benefits will be informed of product restrictions relating to those conditions.

Bafumo explained the bureau’s focus on product transparency — full disclosure of product benefits and limitations — continues on and should by now be a standard in a finance company’s documented product sales policy and sales training.

Furthermore, Bafumo noted that the industry learned this case that during sales presentations, some of the bank’s customers disclosed conditions that impacted the applicability of the bank’s credit protection products' benefits.

“For example the customer may have disclosed their disability or unemployment or other conditions which would limit benefits or make the product valueless to them,” he said. “Synchrony had no scripting or process to handle this information and allegedly some of these customers were sold products they could not actually benefit from.

“This is not necessarily an issue limited to telemarketers working from an inflexible script,” Bafumo continued. “The question of product value remains a top regulator concern — that is, product value to each individual customer. In the auto finance product world, financial institutions are ultimately responsible for ensuring that customers are only sold products that have value to them.”

Bafumo emphasized that documented product underwriting policies and effective product marketing training processes are the solutions to meeting this obligation.

4. Describe how the bank will disclose that by enrolling, the customer is purchasing an optional product with a cost, and that enrolling is not a mandatory or ministerial process.

5. Describe how the bank will ensure that the add-on product's availability is accurately represented.

Bafumo explained these last two pieces of guidance are especially targeted at specific language and practices allegedly employed by Synchrony in the sale of the products at issue. However, he stressed that several underlying policy issues shine through for consideration in auto finance.

“First, optional products must be truly optional and not automatic or slipped into the rapidly expanding pile of required signatory pages in a car deal,” he said. “Customers must know they are buying a product and be given sufficient information to make an informed decision about it.

“Secondly, we learned from a previous action that old school sales language about cost like ‘for just pennies a day’ won't pass regulatory muster,” he continued. “Here, language designed to create a false sense of urgency, like ‘limited time offer’ is found deceptive.

“Parallels for traditional F&I products could include inaccurate or misleading statements about customer qualifications for a particular product, or whether products may be available from other sources or purchased for cash,” Bafumo went on to say.

Editor’s Note: In the second portion of this series dissecting the CFPB’s latest consent order, SubPrime Auto Finance News will highlight Bafumo’s recommendations for vendor management.

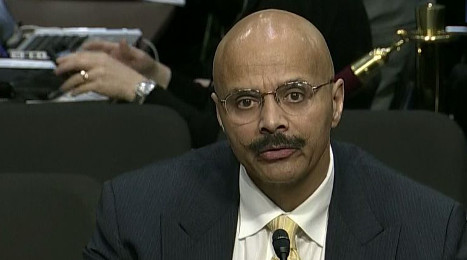

As two more individuals testified this week alleging discrimination at the Consumer Financial Protection Bureau, Rep. Patrick McHenry and CFPB director Richard Cordray clashed over how a current bureau employee received settlements to satisfy claims.

Corday acknowledged the CFPB resolved claims involving Angela Martin, who said she was the victim of discrimination and retaliation dating back two years. During a hearing held by the U.S. House Financial Services Committee this week, McHenry pointed out to Cordray that the CFPB has a “zero tolerance for workplace discrimination and retaliation.”

McHenry then asked whether the alleged perpetrator of the discrimination in the Martin case — Scott Pluta — has been disciplined or dismissed.

“I do not have a basis for disciplining Mr. Pluta,” said Cordray, who later referenced that an examination conducted for the CFPB by the Defense Investigators Group, “proved to be defective. We’re now reopening that investigation and working through it.”

That reply triggered a barrage of questions from McHenry, who also chairs the House Committee on Financial Services Subcommittee on Oversight and Investigations who subpoenaed Martin.

“So, you have not fired someone based on the financial terms of the settlement? It’s clear to me that there is truth in this if you’re going to make such a financial settlement with an employee,” McHenry said. “Likewise, if you’re going to issue taxpayer funds to someone to settle a discrimination and retaliation claim, yet on the other side of the ledger not hold someone accountable, it seems irresponsible to me.”

The North Carolina Republican then turned to Cordray and asked, “How would you see it differently?”

Cordray said, “You said things have been proven. They have not been proven. There is an investigation ongoing.”

McHenry interrupted and asked, “So, you have given taxpayer money based on a frivolous claim?”

Cordray replied, “I don’t know if it was frivolous. It has not been proven.”

The independent investigator assigned to Martin’s case corroborated the alleged discrimination during her House testimony back in April. Misty Raucci is a former investigator at Defense Investigators Group, a firm based in Hanson, Mass., and told lawmakers that she spent six months investigating Martin’s claims.

“I became a veritable hotline for employees at the CFPB, who called to discuss their own maltreatment at the bureau, mainly at the hands of Scott Pluta or Dane D’Alessandro,” Raucci said. “The sum of my findings was that Scott Pluta retaliated against Angela Martin after she filed a formal complaint of discrimination and retaliation.

“In concert with at least three facilitators, Mr. Pluta effectively removed Ms. Martin from her position as chief counsel of consumer response, and saw her relegated to a lesser position in another office. Mr. Pluta attempted to justify Ms. Martin’s removal by expressing doubt as to her ability to perform her duties as chief counsel; however, his criticisms largely occurred after she filed her complaint. This was a major indicator that Mr. Pluta’s rationale for demoting Ms. Martin for what he perceived as shortcomings was masking his other motives,” Raucci continued.

More Allegations Aimed at CFPB

McHenry conducted another subcommittee hearing this week when lawmakers heard from two more witnesses who claimed discrimination at the CFPB. Those individuals included:

— Ali Naraghi, an examiner for the Southeast region within the CFPB’s Division of Supervision, Fair Lending and Enforcement

— Kevin Williams, a former quality monitor within the Office of Consumer Response at the CFPB

“I am the naturalized U.S. citizen that Bureau management referred to as an ‘f’ing foreigner.’ I take great pride in serving my country for 14 years with distinction at the Federal Reserve Board of Governors prior to joining the bureau at its inception and am proud of my Persian heritage,” Naraghi told the committee.

“Like many others, I feel fortunate to have immigrated to the United States, and do not deserve to be referred to in derogatory terms by bureau management,” he continued.

Williams also referenced several racial incidents during his time at the bureau.

“Make no mistake about it. It was clear that I was treated this way and allowed to be treated this way by my few black managers at the bureau because of the ‘plantation’ mentality that exists there,” Williams said. “If my managers had been white, instead of black managers allowed to mistreat a black male, every civil rights organization in America would have protested my treatment, and the treatment of others in my unit.”

In what’s being described as “a very helpful development,” Consumer Financial Protection Bureau director Richard Cordray confirmed on Wednesday that the agency plans to release a white paper about how regulators are using the proxy method of finding disparate impact to determine if finance companies that perform indirect auto lending are being discriminatory.

Cordray indicated this white paper will be released this summer. He made the declaration when he testified during a hearing held by the U.S. House Financial Services Committee to share the CFPB’s semiannual report.

“I think it’s been a source of frustration to the committee, to me and to the bureau that we’ve been back and forth on different kinds of information about this,” Cordray said about questions regarding disparate impact in the vehicle finance space. “I think we’re providing a lot of information but people identify other information they want. Partly as a result of that, we are going to put out a white paper on the proxy methodology that will try to address this very directly later this summer.”

“We’ll continue to try to be responsive on this,” Cordray continued. “The reality is the auto industry and the auto lenders, they know all about this because they’re constantly monitoring it. They have to fend off private lawsuits whether the CFPB ever existed or not. They do the same analysis that we do, I believe. We’ve had lots of discussions with them. We’d like to have more. It’s been an ongoing dialogue.”

To gauge how this development might impact the industry, SubPrime Auto Finance News reached out to former CFPB official Rick Hackett, who now is a partner at Hudson Cook. Hackett previously served as the head of the Office of Installment and Liquidity Lending Markets in the Division of Research, Markets and Regulations. His responsibilities at the bureau included advising all of the regulator’s divisions with respect to market information and policy issues in the installment and specialty lending areas, including vehicle finance, student lending and payday lending.

“The promised white paper on bureau methodology is a very helpful development,” Hackett said. “The bureau will help compliance across the industry by clarifying what they would expect to see in the methods of lender self-testing. I suspect we will see basics of (Bayesian Integrated Surname and Geocoding analysis) and, hopefully, some information on controls that the bureau uses or considers legitimate for use. The bureau should have enough experience now to both explain its basic process and comment on what it has seen in suggested alternative approaches from lenders.”

Hackett also touched on how difficult enforcement actions will be to implement based on disparate impact even after the CFPB white paper is released.

“The other difficult question is what level of disparity is actionable,” Hackett said. “There is a fair argument that, as the bureau has said, there is no single number below which there is a safe harbor. But it might be helpful to at least describe a range of numbers or other less specific thresholds that would be a factor, along with other relevant information (such as the lender’s existing fair lending compliance, past efforts to work with dealers, existing consumer remediation programs, etc.) in determining the regulatory approach the bureau will use.”

The CFPB used its proxy method and disparate impact to hand out the federal government’s largest auto loan discrimination settlement in history.

Just before Christmas, the CFPB and the Department of Justice ordered Ally Financial to pay $80 million in damages to harmed African American, Hispanic, and Asian and Pacific Islander borrowers, along with another $18 million in penalties.

Regulators determined that more than 235,000 minority borrowers paid higher interest rates for their vehicle loans between April 2011 and December of last year because of what federal officials described as “Ally’s discriminatory pricing system.”

Perhaps this CFPB white paper will allay concerns held by many industry outlets. Back in March during an event hosted by the U.S. Chamber, Andy Koblenz, executive vice president and general counsel for the National Automobile Dealers Association, still had many questions about how the CFPB intends to oversee vehicle financing.

“When you look at the indirect auto lending area, every indirect auto lender that I’ve spoken to when I asked them if they understand what the methodology that the CFPB is using for their disparate impact analysis, whether it’s the proxy methodology or the statistical controls methodology, they all say no and they’re still guessing at it,” Koblenz told attendees at the eighth annual Capital Markets Summit orchestrated by the chamber’s Center of Capital Markets Competitiveness.

The State Government Affairs Committee of the American Financial Services Association published a white paper focused on the impact of consumer complaints.

AFSA highlighted the paper details the varying ways that state regulatory bodies and federal agencies collect, report and use consumer complaint information to inform their rulemaking activities.

Officials noted the paper takes a statistical look at complaints collected by the Federal Trade Commission and includes a narrative discussion of the way the Consumer Financial Protection Bureau collects and uses complaint data.

The paper also outlines activities in the consumer complaint reporting space of several state regulatory bodies — from the office of attorney general to department of financial services — specifically looking at annual top 10 lists released by state agencies.

The Consumer Complaints white paper is available on the SGA Resources section of the AFSA website or by using this link.

Two more individuals alleging discrimination within the Consumer Financial Protection Bureau have been subpoenaed to testify for the Subcommittee on Oversight and Investigations that’s part of the U.S. House Financial Services Committee.

Now scheduled to appear during a session set for next Wednesday afternoon are:

— Ali Naraghi, an examiner for the Southeast region within the CFPB’s Division of Supervision, Fair Lending and Enforcement

— Kevin Williams, a former quality monitor within the Office of Consumer Response at the CFPB

According a memo issued before the committee voted this week in favor of subpoenaing these individuals, “The subcommittee believes that these individuals have knowledge pertinent to the subcommittee’s investigation of allegations of improper actions at the CFPB relating to, among other matters, employee discrimination and retaliation. Mr. Naraghi and Mr. Williams have requested that the subcommittee compel their testimony to protect their interests and/or to guard against retaliation by the CFPB.”

Wednesday’s hearing will be the third orchestrated by this subcommittee to examine potential discrimination at the bureau. Previous sessions included testimony from Misty Raucci, a private investigator hired by the CFPB to investigate alleged discrimination claims made by Angela Martin, who works as an attorney at the bureau and told the subcommittee that she was discriminated against and when she filed a complaint, faced retaliation for doing so.

The second hearing featured Liza Strong, director of employee relations at the CFPB; and Ben Konop, Executive Vice President of the CFPB’s employee union, Chapter 335 of the National Treasury Employees Union. That session also was to have included Stacey Bach, assistant director of the CFPB’s Office of Equal Employment Opportunity, but Bach requested her testimony be postponed due to a medical condition.

“The fact is that discrimination on the basis of race, sex or other prohibited factors is destructive, morally repugnant, and against the law,” said Oversight and Investigations Subcommittee chairman Rep. Patrick McHenry, a Republican from North Carolina.

“All government agencies, including the CFPB, must continue to combat discrimination in employment and punish those responsible for discrimination,” McHenry added.

The bulletin connected with indirect auto financing issued by the Consumer Financial Protection Bureau last March could be receiving a significant makeover if a measure working its way through the U.S. House continues to move forward.

In what the National Automobile Dealers Association called a rare show of bipartisan cooperation, officials recapped that the House Financial Services Committee sought to turn back an effort by the CFPB to eliminate dealers' flexibility to discount the interest rate offered to vehicle buyers.

The NADA, a vocal advocate for the legislation, applauded the committee’s action. NADA explained that H.R. 4811, introduced this week by Rep. Marlin Stutzman would rescind the bureau’s 2013 auto finance guidance and inject transparency and safeguards into the guidance-writing process.

“If the CFPB had the benefit of the public's perspective before issuing its auto lending guidance, it would have learned that its changes would likely hike car buyers’ monthly payments and limit access to credit, especially for the marginally creditworthy,” said Ivette Rivera, NADA’s vice president of legislative affairs.

The Guidance Transparency Act bill passed the committee on a bipartisan vote of 35-24 with Democratic Reps. Joyce Beatty of Ohio, Steven Horsford of Nevada and David Scott of Georgia supporting the bill.

“The CFPB has repeatedly chosen to issue guidance in lieu of following a formal rule making process unlike their counterparts at other federal agencies. Notice and opportunity for public comment are critical in the development of good public policy,” the Financial Services Roundtable said in a letter to the committee prior to the vote.

Though the bill would rescind the 2013 auto finance guidance, NADA indicated that the CFPB can reissue it but only with greater transparency and public review.

Joining NADA, the Alliance of Automobile Manufacturers, the American International Automobile Dealers Association (AIADA), American Financial Services Association (AFSA), Recreation Vehicle Industry Association (RVIA), and the Recreation Vehicle Dealers Association (RVDA) sent a letter of support to the committee for the Guidance Transparency Act prior to the vote.

“The industry has made considerable efforts to work with the CFPB to identify and address any potential problems with indirect auto financing,” the organizations wrote. “Discrimination in any market has no place in society, and we fully support efforts by the CFPB and other federal agencies to eliminate it. We stand ready to work with the CFPB and its sister agencies to eliminate disparate impact risk.

“If there had been an opportunity to review and comment on the CFPB’s auto guidance before it was issued, we believe constructive solutions could have been offered that would effectively address actual disparate impact risk, provide certainty for the regulated community and preserve competition for consumers,” they continued.

“CFPB director Richard Cordray stated in testimony before a Senate committee last November that he would ‘agree with some of the criticism (of the auto finance guidance)’ and that he’d ‘like to have a little more openness and transparency.’ H.R. 4811 promotes such openness and transparency,” the organizations went on to say.

Rivera called on dealers to build support for H.R. 4811.

“Dealers are strongly urged to call their House members to ask them to cosponsor the Guidance Transparency Act (H.R. 4811). Strong bipartisan support is critical for the next step in the process, which is a vote by the full House,” Rivera said.

NADA added that Dealers are urged to call their representative to ask them to co-sponsor H.R. 4811, the Guidance Transparency Act. Congress can be reached through the Capitol Switchboard at (202) 225-3121.

The lone Republican member of the U.S. Commission on Civil Rights wants answers as to whether there is discrimination going on within the Consumer Financial Protection Bureau.

Earlier this week, commissioner Peter Kirsanow sent a written request to the CFPB’s general counsel, seeking documents associated with nine different areas of personnel operations. According to the letter obtained by SubPrime Auto Finance News, those requests directed to the CFPB’s Meredith Fuchs included:

— All internal investigation reports completed by CFPB reviewing claims of discrimination or retaliation at CFPB.

— All investigation reports commissioned by CFPB and completed by third party investigators reviewing claims of discrimination or retaliation at CFPB.

— For every manager in every division of CFPB (i.e. all CFPB employees who are not eligible employees for the CFPB bargaining unit) provide an itemized list of all formal or informal EEO complaints made against them; the nature of each complaint and all non-confidential settlements associated with the complaints. For managers in Office of Consumer Response and Office of Fair Lending, provide all documentation related to formal and informal EEO complaints, including declarations made by staff alleging complaints.

— Itemized list of formal and informal EEO settlements paid by CFPB including the nature of the complaint, and complainant and respondent’s divisions, indicating if any respondent has generated multiple settlements.

— Number of employees in the Office of Fair Lending; disaggregated by race. Number of “1” ratings in Performance Management Reviews for CFPB employees working in Office of Fair Lending, indicating the race of employees receiving the “1” ratings and whether Patrice Ficklin, director of the Office of Fair Lending, approved the “1” rating.

— Steps taken by Office of Fair Lending to address multiple EEO complaints against managers in Office of Fair Lending.

— Itemized list of instances in which CFPB has declined mediation of an EEO complaint, including the name of the CFPB manager involved and the manager’s division within the bureau.

— All comments provided to CFPB for its 2013 CFPB Annual Employee Survey, Supervision, Enforcement and Fair Lending – Division Survey Report.

— Plans of Office of Fair Lending to address comments regarding problems with diversity, favoritism and hiring reported to CFPB in its 2013 CFPB Annual Employee Survey, Consumer Response – Division Survey Report.

In his letter, Kirsanow explained that his requests stemmed from the U.S. House hearing the testimony by Misty Raucci, a private investigator hired by the CFPB to investigate alleged discrimination claims made by Angela Martin, who works as an attorney at the bureau and said that she was discriminated against and when she filed a complaint, faced retaliation for doing so.

“The Commission on Civil Rights is charged with investigating alleged deprivations of civil rights. Given the troubling allegations made against the bureau, it is my duty to investigate the truth of the claims made by Ms. Martin and Ms. Raucci,” said Kirsanow, who also has been a member of the National Labor Relations Board since his appointment in 2006.

The Civil Rights Act of 1957 created the U.S. Commission on Civil Rights, which is an independent, bipartisan, fact-finding federal agency on a mission is to inform the development of national civil rights policy and enhance enforcement of federal civil rights laws.

Finance company compliance departments as well as legal counsel to trade and dealer associations are still sorting through the ramifications of the indirect auto lending and compliance bulletin the Consumer Financial Protection Bureau sent out more than a year ago. One of the crafters of that document who is no longer with the CFPB reiterated a succinct point when reflecting back on the time since the agency’s decree.

“The bulletin is real,” said Rick Hackett, who spent about two years at the CFPB before officially joining Hudson Cook in March. Hackett was the head of the Office of Installment and Liquidity Lending Markets in the Division of Research, Markets and Regulations at the CFPB. His responsibilities at the bureau included advising all of the regulator’s divisions with respect to market information and policy issues in the installment and specialty lending areas, including vehicle finance, student lending and payday lending.

Now back in the private sector, Hackett has the unique position of being able to share candid assessments from the viewpoint as both a regulator and compliance adviser. Hackett spoke with SubPrime Auto Finance News from his office in Portland, Maine, to discuss a wide array of issues.

Hackett will be switching roles during this week’s 18th annual Non-Prime Auto Financing Conference hosted by the National Automotive Finance Association. A year ago at this same event in Fort Worth, Texas, he represented the CFPB and answered questions submitted in advance by NAF Association members. This time, Hackett will be posing the vetted questions to a pair of CFPB representatives, including a former bureau colleague.

The NAF Association conference is one of many stops on Hackett’s new private practice agenda. He also was a part of the National Alliance of Buy-Here, Pay-Here Dealers National Conference last week in Las Vegas.

“I can’t talk about information from a supervisory or investigative proceeding. There’s a bureau rule that applies to former employees and anyone else who has confidential information that comes from those two kinds of processes,” Hackett said.

“It comes with a measly $1 million a day penalty. You can understand why I can’t talk about those things,” he added.

Bulletin Launch and Enforcement

The CFPB released the bulletin last March. Between that point and when he departed the bureau last summer, Hackett recapped highlights about the dialogue he exchanged with various segments of the industry and regulatory worlds.

“The industry reaction to the bulletin certainly got a lot of attention because it was very strong. I spent a lot of time with NADA, other dealer associations and a lot of time with the buy-here, pay-here associations,” Hackett said. “The bureau doesn’t have jurisdiction over NADA members. But when it became clear to the exempt dealers that it was going to have an impact on them, there was a great deal of desire on their part to interact. That happened at both the CFPB offices and over at NADA headquarters.

“We got a very strong set of messages that they felt this was neither good for their business nor justified,” he continued.

The intensity hit a new threshold before 2013 closed. That’s when the CFPB and the Department of Justice ordered Ally Financial to pay $80 million in damages to harmed African American, Hispanic, and Asian and Pacific Islander borrowers, along with another $18 million in penalties.

While Hackett no longer was in his CFPB role when the bureau handed out the penalty, he said, “We clearly have Ally as an example of how this bulletin might be applied. It’s an example of how a process can start in confidential supervisory treatment and morph into what’s certainly been the most public, and frankly, the strongest public supervisory remedy, which is a consent decree.

“The bureau feels that if this is something that ought to be done in public then it ought to be done in public in a fairly significant, forceful way,” Hackett went on to say.

Hackett emphasized how the bulletin was crafted with plenty of industry knowledge at the bureau’s disposal.

“I came in with 30-plus years of representing lenders of all types, including those in the auto finance business. I’ve probably written a fair number of participation agreements for lenders. I’ve written way too many more retail installment contracts than I probably want to think about,” Hackett said. “It was my job to know something about that business coming into the bureau and how to interact with the industry on a regular basis and seed that interaction into the perspective of the bureau and how they formulated their strategies and how they would spend their time.”

Six-Month Rejuvenation

After the rigors of being one of the principals in organizing the CFPB indirect auto lending bulletin, Hackett felt compelled to do something he had never undertaken since he graduated from high school — step away from professional commitments for six months.

Hackett called it “a great way to get perspective. Just play golf and read the trades and follow things from a far. Check the bureau website every day.

“Frankly, that was a great perspective provider,” he added.

Hackett then shared with SubPrime Auto Finance News why he chose to join Hudson Cook. Hackett now focuses on all aspects of state and federal regulation of retail financial products origination and marketing, e-payments, regulation of financial service entities, and lending, deposit and insurance transactions.

“I wanted to come back into this space because I felt that there are a lot of folks in the industry who had an interest in trying to do things the right way and trying to see how the business can be operated in such a way that would align with compliance issues,” Hackett said.

“Of course, Hudson Cook is a firm that focuses exclusively on trying to help people be in compliance with consumer financial laws as opposed to going out and litigating when people have already been told they’re not in compliance. That lined up with what I wanted to do,” he continued.

Like partners such as Tom Hudson, Patty Covington, Michael Benoit, Eric Johnson and Joel Winston, Hackett explained that now he can share insights and a sense of where he thinks compliance trends might be heading with clients and the industry at large without revealing confidential information.

“Things have changed for me because I don’t know exactly what’s going on inside the bureau, but I still have some fairly decent ideas, and within limitations, I can candidly share that with people in pursuit of the goal of trying to be in compliance with consumer financial laws,” Hackett said.

Bureau Replacement

Hackett is more than familiar with the individual who replaced him at the CFPB. Now holding his former bureau role is Jeffrey Langer, who most recently served as senior counsel at Macy’s in Mason, Ohio.

Langer also has served as a partner in several law firms, including Jones Day and Dreher Langer & Tomkies. He is a founding fellow and treasurer of the American College of Consumer Financial Services Lawyers and is a former chair of the Consumer Financial Services Committee of the American Bar Association Business Law Section.

“I’ve known Jeff for more than 20 years. He has more than 30 years of experience with all sorts and conditions of consumer lending. He also has a strong background in collections,” Hackett said.

“I was one of the people who suggested to him that my position would be kind of fun for him after I saw him at the place we usually meet, which is the American Bar Association meetings,” Hackett continued. “He mentioned that he was thinking of winding down his in-house position and moving to Washington where his children had moved. I said, ‘Wow, this makes sense. Have I got a job for you.’”

During the Non-Prime Auto Financing Conference featured session, Hackett will be posing questions to Langer as well as Eric Reusch, who is the program manager in the Office of Installment and Liquidity Credit Markets with the CFPB. Hackett had high praise for both CFPB representatives.

“(Jeff is) an extremely hard working guy. I worked for him when he was chair of the ABA Consumer Financial Services Committee. I could tell you how hard he works because I used to get his five-page emails timed at 1 o’clock in the morning telling me what I was supposed to do when I was a subcommittee chair running a substantive committee under his guidance. I think he’ll be great for what the bureau is looking for in a markets lead,” Hackett said.

Hackett continued about Reusch saying, “He’s a really bright guy with a lot of industry experience. When he’s working Excel, it’s like he’s flying a 747 simulator. It’s so fast and so engaging. That helped me do the quantitative side on just a ton of different issues. He interacts really well with the industry.

“I’m impressed that (NAF Association executive director Jack Tracey) has been able to get both of these guys on stage at the same time. Often the bureau will send just one person. I’m looking forward to interacting with them,” Hackett went on to say.

Future Developments

No matter what is shared during the NAF Association event, Hackett described the “long, evolving process” that’s unfolding in indirect auto lending.

“It’s the first time you’ve had a federal regulator focused on the finance space strictly in consumer and with concern only for consumer protection, not for other sometimes conflicting issues like safety and soundness,” Hackett said. “The federal financial regulators have done a lot of work on consumer protection but they also have a bunch of other hats to wear. The Federal Trade Commission has done some great work in consumer protection, but they have many markets other than consumer finance to deal with.

“I think there will be growing pains for quite some time as the industry gets used to dealing with a regulator that’s solely focused on consumer finance and no other hats to wear. That’s just what Dodd-Frank said should happen. I think that also explains why so many people would like it to go away,” he went on to say.

“But over time, I think the bureau’s focus on getting everyone to have an appropriate compliance management system, appropriate to their size and complexity, if lenders spend the resources and bandwidth on compliance, they’ll find that’s it not more complex than making sure your mechanics can deal with whatever vehicles they have to work on,” he concluded.

As part of its ongoing investigation into allegations of racial and gender discrimination and employee retaliation at the Consumer Financial Protection Bureau, the U.S. House Financial Services Oversight and Investigations Subcommittee this week heard testimony from witnesses who were subpoenaed to appear before the panel.

The hearing arrived nearly a month after subcommittee members voted 20-0 to issue subpoenas to Stacey Bach, assistant director of the CFPB’s Office of Equal Employment Opportunity; Liza Strong, director of employee relations at the CFPB; and Ben Konop, Executive Vice President of the CFPB’s employee union, Chapter 335 of the National Treasury Employees Union.

Strong and Konop appeared at Wednesday’s hearing. Bach requested her testimony be postponed due to a medical condition.

“The fact is that discrimination on the basis of race, sex or other prohibited factors is destructive, morally repugnant, and against the law,” said Oversight and Investigations Subcommittee chairman Rep. Patrick McHenry, a Republican from North Carolina.

“All government agencies, including the CFPB, must continue to combat discrimination in employment and punish those responsible for discrimination,” McHenry said.

Konop testified that the employees union repeatedly raised concerns with the CFPB about its employee performance review system.

“We alleged that women and minority employees were being underpaid when compared to similarly situated white male colleagues,” Konop said.

“To date, the bureau has denied each of these grievances at all stages, often using inconsistent reasoning, despite what I feel is convincing evidence of low pay for numerous women and minority workers,” Konop went on to tell the subcommittee.

In addition to the subpoenaed witnesses’ testimony, committee members indicated the hearing shed new light on long-standing problems concerning the CFPB’s treatment of its employees.

During the hearing, the subcommittee discussed a report commissioned by the CFPB and conducted by Deloitte Consulting. The findings of Deloitte’s report corroborate whistleblower and CFPB employee Angela Martin’s testimony that there have been problems related to the CFPB’s hiring, staff promotions, performance reviews and employee pay since the Bureau’s inception.

Deloitte’s report also suggests that the bureau’s Office of Minority and Women Inclusion (OMWI) is ineffective and that CFPB leaders and employees are uncertain what OMWI actually does.

“Out of the 31 leadership interviews Deloitte conducted, approximately 80 percent expressed that they do not understand the purpose or objectives of the OMWI office,” the report said.

Deloitte delivered the study to the CFPB last September.

Online reports about allegations of discrimination and retaliation at the CFPB started to appear in American Banker in early March.

On April 2, the Oversight and Investigations Subcommittee held a hearing where CFPB attorney and whistleblower Angela Martin testified “there is a pervasive culture of retaliation and intimidation that silences employees and chills the workforce from exposing wrongdoing.”

At that same hearing, the subcommittee also heard from Misty Raucci, an outside investigator hired by the CFPB to examine Martin’s claims. Raucci concluded after an investigation that Martin’s claims of retaliation were valid.

“During my time in Congress, I have yet to witness an outpouring of employee complaints from a federal agency's employees such as I have seen from the CFPB since the American Banker article was released and this subcommittee announced that we would be investigating the matter,” McHenry said.

Last week, the Consumer Financial Protection Bureau rolled out what the agency described as an updated and improved version of its eRegulations tool, including a new, electronic, user-friendly version of the Truth in Lending Rule — the flagship federal regulation protecting consumers when it comes to credit products.

The CFPB noted that eRegulations is not an official legal edition of the Code of Federal Regulations or the Federal Register, and it does not replace the official versions of those publications.

That point was emphasized by Dan Sokolov, who is deputy associate director for CFPB’s Division of Research, Markets & Regulations, and David Cassidy, who is a business analyst in CFPB’s Technology and Innovation Division.

“We also launched a user survey to solicit user feedback from industry, advocates, and other users in order to continue to improve the tool,” Sokolov and Cassidy said in a blog post on the CFPB’s website.

Sokolov and Cassidy insisted that the public, industry, and the government all benefit from regulations that are easier to find, read and understand.

“That is why last year we launched our eRegulations tool which combines important information that can often be difficult to navigate or is spread throughout a regulation, often separated by dozens or even hundreds of pages. Ideally, using eRegulations will lead to better compliance and improved accessibility,” the CFPB officials said.

Now, as part of the eRegulations tool, the bureau is launching what it contends is an intuitive, easier-to-navigate electronic format of Regulation Z, which implements the Truth in Lending Act. Regulation Z is the flagship federal regulation protecting consumers when it comes to credit products.

“Regulation Z can be complex to understand for people who have not specialized in it. And it has changed a lot recently with the addition of new rights and disclosures for mortgages,” Sokolov and Cassidy said.

“As we continue our work to make regulations easier to use, we need to hear from you about what works best and how this tool is valuable to you,” they continued.

The CFPB mentioned the eRegulations tool is an open source application, “so we’d love for other agencies, developers or groups to use it and adapt it.”