Along with naming academics, industry leaders and consumer advocates to a trio of committees, the Consumer Financial Protection Bureau also announced last week that it will establish a taskforce to examine ways to harmonize and modernize federal consumer financial laws.

The bureau explained the Taskforce on Federal Consumer Financial Law will examine the existing legal and regulatory environment facing consumers and financial services providers and report to CFPB director Kathleen Kraninger its recommendations for ways to improve and strengthen consumer financial laws and regulations.

The CFPB continued that the taskforce will produce new research and legal analysis of consumer financial laws in the United States, focusing specifically on:

— Harmonizing, modernizing and updating the enumerated consumer credit laws and their implementing regulations

— Identifying gaps in knowledge that should be addressed through research

— Ways to improve consumer understanding of markets and products

— Potential conflicts or inconsistencies in existing regulations and guidance

“An objective and independent evaluation of our current regulatory framework to identify where there may be gaps or where regulation should be simplified or modernized is needed to help us more effectively carry out our mission of protecting consumers,” Kraninger said in a news release.

“As we work to set up the taskforce, we encourage interested individuals to apply to be considered to be part of the taskforce,” she continued.

The bureau added that this taskforce is in part inspired by an earlier commission established by the Consumer Credit Protection Act in 1968. In addition to various changes to consumer law generally, that act established a national commission to conduct original research and provide Congress with recommendations relating to the regulation of consumer credit.

The commission’s report contains original empirical data, information, and analyses — all of which undergird the report’s final recommendations. The data, findings, and recommendations from the commission were all made public and the report led to significant legislative and regulatory developments in consumer finance.

The bureau went on to mention that will be seeking to fill the taskforce with several members with a broad range of expertise in the areas of:

— Consumer protection and consumer financial products or services

— Significant expertise in analyzing consumer financial markets, laws, and regulations

— Demonstrated record of senior public or academic service

The bureau is accepting applications for members to serve on the taskforce. Go to this website for additional information on the qualifications for members, as well as the process for applying.

CFPB announces advisory committee members

In other news from the regulator, Kraninger also announced the appointment of members to the Consumer Advisory Board (CAB), Community Bank Advisory Council (CBAC), Credit Union Advisory Council (CUAC) and Academic Research Council (ARC). These experts advise bureau leadership on a broad range of consumer financial issues and emerging market trends.

“The bureau is able to protect consumers in the financial marketplace better when it receives input from a wide range of experts and stakeholders,” Kraninger said in a news release.

“With the enhancements we made earlier this year to the structure of the advisory committee program, I am confident that these groups will be able to hit the ground running in their efforts to provide meaningful feedback on Bureau policy and regulations. I look forward to working with them,” she went on to say.

This past spring, Kraninger announced a series of enhancements to the bureau’s advisory committee charters, including:

— Expanding the focus of the meetings to cover broad policy matters

— Increasing the frequency of in-person meetings from two times a year to three times a year for the CAB, CBAC and CUAC

— Elevating the ARC to a director-level advisory committee and increasing its meeting frequency

— Increasing term lengths from one year to two years, among other enhancements

The CAB is mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act to advise and consult with the bureau’s Director on a variety of consumer financial issues.

The bureau also created three additional discretionary councils: the CBAC, CUAC, and ARC. The CBAC and CUAC advise and consult with the bureau on consumer financial issues related to community banks and credit unions. The ARC advises the bureau on its strategic research planning process and research agenda and provides feedback on research methodologies, data collection strategies and methods of analysis, including methodologies and strategies for quantifying the costs and benefits of regulatory actions.

The following members will serve on each of their respective committees:

Consumer Advisory Board (CAB)

Chair of the CAB – Brent Neiser, Senior Director, National Endowment for Financial Education (Denver)

Nikitra Bailey, EVP, Center for Responsible Lending (Durham, N.C.)

Nadine Cohen, Managing Attorney, Greater Boston Legal Services (Boston)

Sameh Elamawy, CEO, Scratch Services, Inc. (San Francisco)

Manning Field, COO, Acorns (Irvine, Calif.)

Clint Gwin, President & CEO, Pathway Lending (Nashville, Tenn.)

Ronald Johnson, Former President, Clark Atlanta University (Atlanta)

Tim Lampkin, CEO, Higher Purpose Co. (Clarksdale, Miss.)

Eric Kaplan, Director – Housing Finance Program, Milken Institute (Washington, D.C.)

Sophie Raseman, Director of Product, Brightside (San Francisco)

Rebecca Steele, President/CEO, National Foundation for Credit Counseling (Washington, D.C.)

Tim Welsh, Vice Chairman Consumer and Business Banking, U.S. Bank (Minneapolis)

Community Bank Advisory Council (CBAC)

Chair of the CBAC – Aubrey Hulings, VP, Operations Manager, The Farmers National Bank of Emlenton (Emlenton, Pa.)

J. Erik Beguin, Founder, CEO and President, Austin Capital Bank (Austin, Texas)

Maureen Busch, VP Compliance and CRA Officer, The Bank of Tampa (Tampa, Fla.)

Patrick Ervin, EVP, Independent Bank (Troy, Mich.)

Shan Hayes, President and CEO, Heartland Tri-State Bank (Elkhart, Kan.)

Bruce Ocko, Senior VP Director of Mortgage & Consumer Lending, Bangor Savings Bank (Bangor, Maine)

Valerie Quiett, SVP and Chief Legal Officer, Mechanics and Farmers (M&F) Bank (Durham, N.C.)

Heidi Sexton, EVP/Chief Compliance and Risk Officer, Sound Community Bank (Seattle)

Credit Union Advisory Council (CUAC)

Chair of the CUAC – Sean Cahill, President & CEO, TrueSky Credit Union (Oklahoma City)

Arlene Babwah, VP Risk Management, Coastal Federal Credit Union (Raleigh, N.C.)

Teresa Campbell, President & CEO, San Diego County Credit Union (San Diego)

Rick Durante, VP, Director of Corporate Social Responsibility and Government Affairs, Franklin Mint Federal Credit Union (Chadds Ford, Pa.)

Doe Gregersen, Vice President & General Counsel, Landmark Credit Union (New Berlin, Wisc.)

Brian Holst, General Counsel, Elevations Credit Union (Boulder, Colo.)

Racardo McLaughlin, VP Mortgage Originations/Operations (TwinStar Credit Union, Lacey, Wash.)

Rick Schmidt, President & CEO, WestStar Credit Union (Las Vegas)

Academic Research Council (ARC)

Michael Baye, Bert Elwert Professor of Business Economics, Indiana University (Bloomington, Ind.)

Karen Dynan, Professor of the Practice of Economics, Harvard University (Cambridge, Mass.)

Terri Friedline, Associate Professor, University of Michigan (Ann Arbor, Mich.)

John Lynch, Jr., Director of the Center for Research on Consumer Financial Decision Making and Senior Associate Dean for Faculty and Research, University of Colorado Boulder (Boulder, Colo.)

Brigitte Madrian, Dean/Marriott distinguished professor, Brigham Young University (Provo, Utah)

Tom Miller, Professor of Finance and Jack R. Lee Chair, Mississippi State University (Starkville, Miss.)

Joshua Wright, Professor, Scalia Law School at George Mason University (Arlington, Va.)

It’s no longer just a hunch emanating from dealerships and finance companies that the Consumer Financial Protection Bureau and state attorneys general are working together. The CFPB made an official announcement to the fact on Tuesday.

The bureau, working in partnership with multiple state regulators, launched the American Consumer Financial Innovation Network (ACFIN). It’s an organization that officials explained is designed to enhance coordination among federal and state regulators to facilitate financial innovation.

The CFPB said it invited all state regulators to join ACFIN, and the initial members of ACFIN are the attorneys general of:

— Alabama

— Arizona

— Georgia

— Indiana

— South Carolina

— Tennessee

— Utah

The CFPB insisted ACFIN will enhance shared objectives such as competition, consumer access and financial inclusion. Additionally, the regulator said the ACFIN will promote regulatory certainty for innovators, benefiting the U.S. economy and consumers alike.

Officials went on to say the network also will seek to keep pace with market innovations and help ensure they are free from fraud, discrimination and deceptive practices.

As a result of this partnership, the CFPB added ACFIN members will share information to facilitate coordination among the members and coordinate on innovation-related policies and programs.

“Federal and state coordination promotes consistency in the regulation of consumer financial products and services while facilitating consumer-beneficial innovation,” CFPB director Kathleen Kraninger said. “ACFIN will provide a platform for federal and state regulators to coordinate with each other as they develop new rules of the road and apply existing ones. This coordination can provide greater regulatory certainty across jurisdictions and allow regulators to keep pace with market developments.

“I will continue to work to encourage other state regulators to join this important new initiative that will foster collaboration among federal and state regulators,” Kraninger continued.

CFPB policies to facilitate compliance and promote innovation

The launch of the American Consumer Financial Innovation Network wasn’t the only development surfacing out of the CFPB on Tuesday.

The bureau also issued three new policies to promote innovation and facilitate compliance:

— The No-Action Letter (NAL) Policy

— Trial Disclosure Program (TDP) Policy

— Compliance Assistance Sandbox (CAS) Policy.

The CFPB recapped that it proposed the policies in 2018 and received public comments on each from a diverse array of stakeholders.

The bureau acknowledged that regulatory uncertainty can hinder the development of innovative products and services that benefit consumers. Officials explained that NALs can provide increased regulatory certainty through a statement that the bureau will not bring a supervisory or enforcement action against a company for providing a product or service under certain facts and circumstances.

The CFPB said the new NAL Policy is meant to improve on the bureau’s 2016 NAL Policy by having, among other things, a more streamlined review process focusing on the consumer benefits and risks of the product or service in question.

On Tuesday, the bureau also issued its first NAL under the new NAL Policy in response to a request by the Department of Housing and Urban Development (HUD) on behalf of more than 1,600 housing counseling agencies (HCAs) that participate in HUD’s housing counseling program.

In 2018, officials noted that HUD brought concerns to the bureau about HCAs and lenders not entering into agreements that would fund counseling services due to uncertainty about the application of the Real Estate Settlement Procedures Act (RESPA). Expressing similar concerns, the Coalition of HUD Intermediaries filed a comment letter in February noting the insufficiency of the Bureau’s old NAL Policy and supporting the new NAL proposed policy.

Officials indicated the no-action letter essentially states that the bureau will not take supervisory or enforcement action under RESPA against HUD-certified HCAs that have entered into certain fee-for-service arrangements with lenders for pre-purchase housing counseling services.

“The NAL, which is an exercise of the bureau’s supervisory and enforcement discretion, is intended to facilitate HCAs entering into such agreements with lenders and will enhance the ability of housing counseling agencies to obtain funding from additional sources,” officials said.

The bureau went on to mention that under the new TDP Policy, entities seeking to improve consumer disclosures may conduct in-market testing of alternative disclosures for a limited time upon permission by the Bureau. The Dodd-Frank Act gives the bureau the authority to provide certain legal protections for entities to conduct trial disclosure programs, as outlined in the TDP Policy.

The new policy streamlines the application and review process, according to the bureau.

The CFPB also pointed out the CAS Policy can enable testing of a financial product or service where there is regulatory uncertainty.

After the bureau evaluates the product or service for compliance with relevant law, officials explained an approved applicant that complies in “good faith” with the terms of the approval will have a “safe harbor” from liability for specified conduct during the testing period.

Approvals under the CAS Policy will provide protection from liability under the Truth in Lending Act, the Electronic Fund Transfer Act or the Equal Credit Opportunity Act.

Kraninger emphasized why the CFPB took these actions.

“Innovation drives competition, which can lower prices and offer consumers more and better products and services. New products and services can expand financial options, especially to unbanked and underbanked households, giving more consumers access to the benefits of the financial system,” she said.

“The three policies we are announcing today are common-sense policies that will foster innovation that ultimately benefits consumers,” Kraninger went on to say.

If a representative from your collections department is trying to find the person who is behind on their vehicle retail installment sales contract, a reasonable chance exists that other organizations are seeking the whereabouts of that individual, too, because of a debt issue.

The newest report from the Consumer Financial Protection Bureau showed that more than one-in-four consumers with a credit report have at least one debt in collection by third-party debt collectors.

The report, which covers 2004 to 2018, is drawn from the bureau’s consumer credit panel (CCP), a nationally representative sample of approximately 5 million de-identified credit records maintained by one of the three nationwide credit reporting companies. Officials said close to 900 third-party debt collectors furnished collection tradelines in the CCP.

The CFPB explained a tradeline is information about a consumer account that is sent, generally on a regular basis, to a credit reporting company. Tradelines contain data such as account balance, payment history, and status of the account.

The bureau reiterated its findings revealed that more than one-in-four consumers (28%) with a credit report in the CCP in 2018 had at least one third-party collections tradeline on their file.

The study also found that more than three-out-of-four third-party collections tradelines are for non-financial debt. More than half (58%) of these tradelines are for medical debt and another 20% for telecommunications or utilities debt.

Positive payment information is generally not furnished for medical or telecommunications debt, according to the CFPB.

The bureau pointed out that banks and other original creditors may collect their own debts or hire third-party debt collectors. In some instances, the original creditors may sell the debts to debt buyers. The buyers may try to collect on these debts, or hire other third-party debt collectors.

There are approximately 9,330 debt collectors and debt buyers in the United States, according to the CFPB.

The complete report can be downloaded here.

Perhaps involving consumers who also have installment contracts with subprime auto finance providers, the Consumer Financial Protection Bureau and the Federal Trade Commission each announced enforcement actions against firms the regulators deemed to be orchestrating fraudulent debt-relief programs.

Over at the CFPB, the bureau recently settled its lawsuit against Freedom Debt Relief, one of the nation’s largest debt-settlement services providers. The company agreed to pay $20 million in restitution to affected consumers and a $5 million civil money penalty.

Meanwhile, the FTC said it recently has stopped a student loan debt relief scheme, alleging it bilked more than $23 million from thousands of consumers with false claims that it would service and pay down their student loans.

The bureau’s lawsuit alleged that Freedom Debt Relief violated the Telemarketing Sales Rule by charging advance fees and failing to inform consumers of their rights to funds they deposited with the company. The bureau also alleged that Freedom Debt Relief violated the Consumer Financial Protection Act of 2010 by charging consumers without settling their debts as promised, charging consumers after having them negotiate their own settlements with creditors, and misleading consumers about the company’s fees and its ability to negotiate directly with all of a consumer’s creditors.

Officials explained the settlement enjoins Freedom Debt Relief from engaging in this conduct in the future. The company has also agreed to a consent order with the Federal Deposit Insurance Corp (FDIC).

The bureau will remit $493,500 of the $5 million civil penalty it assessed in light of the penalty that the company was ordered to pay the FDIC.

“This settlement is subject to approval by the court,” the CFPB said.

The judicial system also is involved in the FTC’s newest matter. After the FTC filed a complaint seeking to end deceptive practices by the firm connected to its investigation, officials said a federal court temporarily halted the scheme and froze its assets.

According to the FTC’s complaint, since at least 2014, the operators of Mission Hills Federal and Federal Direct Group have lured consumers into paying hundreds to thousands of dollars in illegal upfront fees with false promises to lower consumers’ monthly student loan payments. The defendants also allegedly tricked consumers into submitting their monthly student loan payments directly to the defendants by falsely claiming to take over servicing the consumers’ loans.

In reality, Andrew Smith, director of the FTC’s Bureau of Consumer Protection, explained the defendants either only applied minimal payments on consumers’ loans or, in many instances, applied none of the payments to the loans, diverting consumers’ payments to themselves.

“Debt relief companies can’t collect advance fees or masquerade as federal student loan servicers,” Smith said in a news release. “Anyone asking for upfront fees to help with student loan debt is likely a scammer, and consumers should hang up and alert the FTC.”

The FTC also alleged that the defendants obtained consumers’ student loan credentials, such as their FSA ID — a username and password used to log in to U.S. Department of Education websites — to log in and change consumers’ contact information, effectively hindering or entirely preventing consumers’ loan servicers from communicating with consumers.

Many consumers went months or years before discovering that their student loans were not being repaid, according to the complaint.

The FTC has charged the following defendants with violating Section 5 of the FTC Act and the Telemarketing Sales Rule:

— Elegant Solutions (also doing business as Federal Direct Group)

— Trend Capital (also doing business as Mission Hills Federal)

— Dark Island Industries (also doing business as Federal Direct Group and formerly known as Cosmopolitan Funding)

— Heritage Asset Management (also doing business as National Secure Processing)

— Tribune Management (also doing business as The Student Loan Group)

— Three individual defendants, Mazen Radwan, Rima Radwan and Dean Robbins

The commission vote authorizing the staff to file the complaint was 5-0. The U.S. District Court for the Central District of California entered a temporary restraining order in the case on July 10.

The FTC reiterated that it files a complaint when it has “reason to believe” that the named defendants are violating or are about to violate the law and it appears to the regulator that a proceeding is in the public interest.

“The case will be decided by the court,” the FTC added.

The Consumer Financial Protection Bureau is setting its regulatory target next on debt collection in light of technology advances such as text messaging and more.

On Tuesday, the bureau issued a notice of proposed rulemaking (NPRM) to implement the Fair Debt Collection Practices Act (FDCPA). CFPB officials said the proposal would provide consumers with “clear protections against harassment” by debt collectors and “straightforward options” to address or dispute debts.

Among other things, the CFPB explained the NPRM would set “clear, bright-line” limits on the number of calls debt collectors may place to reach consumers on a weekly basis as well as clarify how collectors may communicate lawfully using newer technologies such as voicemails, emails and text messages that have developed since the FDCPA’s passage in 1977.

The bureau also noted that its initiative would require collectors to provide additional information to consumers to help them identify debts and respond to collection attempts.

“The bureau is taking the next step in the rulemaking process to ensure we have clear rules of the road where consumers know their rights and debt collectors know their limitations,” CFPB director Kathleen Kraninger said.

“As the CFPB moves to modernize the legal regime for debt collection, we are keenly interested in hearing all views so that we can develop a final rule that takes into account the feedback received.”

Prior to the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), the CFPB explained Congress had not delegated to any agency the authority to issue substantive rules to interpret the FDCPA. The Dodd-Frank Act delegated that authority to the bureau.

Officials reiterated that their proposal would:

— Establish a clear, bright-line rule limiting call attempts and telephone conversations: The proposed rule generally would limit debt collectors to no more than seven attempts by telephone per week to reach a consumer about a specific debt. Once a telephone conversation between the debt collector and consumer takes place, the debt collector must wait at least a week before calling the consumer again.

— Clarify consumer protection requirements for certain consumer-facing debt collection disclosures: The proposed rule would require debt collectors to send consumers a disclosure with certain information about the debt and related consumer protections. This information would include, for example, an itemization of the debt and plain-language information about how a consumer may respond to a collection attempt, including by disputing the debt. The proposal would require the disclosure to include a “tear-off” that consumers could send back to the debt collector to respond to the collection attempt.

— Clarify how debt collectors can communicate with consumers: The proposed rule would clarify how debt collectors may lawfully use newer communication technologies, such as voicemails, emails and text messages, to communicate with consumers and would protect consumers who do not wish to receive such communications by, among other things, allowing them to unsubscribe to future communications through these methods. The proposed rule would also clarify how collectors may provide required disclosures electronically. In addition, if consumers want to limit ways debt collectors contact them, for example at a specific telephone number, while they are at work, or during certain hours, the rule clarifies how consumers may easily do so.

— Prohibit suits and threats of suit on time-barred debts and require communication before credit reporting: The proposed rule would prohibit a debt collector from suing or threatening to sue a consumer to collect a debt if the debt collector knows or should know that the statute of limitations has expired. The proposed rule also would prohibit a debt collector from furnishing information about a debt to a consumer reporting agency unless the debt collector has communicated about the debt to the consumer, such as by sending the consumer a letter.

The proposed rule can be found online here.

Officials said the public is invited to submit written comments on the proposed rule. The bureau said it will carefully consider comments received before a final regulation is issued.

During prepared remarks covering an array of topics, Consumer Financial Protection Bureau director Kathleen Kraninger revisited a subject particularly important to auto finance companies — how in-person, onsite examinations might unfold.

Kraninger told attendees at an event hosted by the Bipartisan Policy Center: “To quote one of the bureau staff in New York — people act differently when they know there is a regulator who will be checking their work.”

Last week’s public appearance was one of only a handful Kraninger has made since being officially installed as the agency’s leader last December. She appeared during hearings orchestrated by both the House and Senate in March and reflected on those events during her time with the Bipartisan Policy Center, which is a Washington, D.C.-based think tank.

Kraninger emphasized that the bureau possesses supervision authority that can prevent violations of laws and regulations from happening.

“Bureau examiners can review compliance management systems at an institution to assess whether the institution is taking its obligations seriously, and whether it has a culture of compliance that tries to prevent harm in the first instance,” she said, according to the remarks shared by the bureau.

“Supervision can uncover inattention to compliance and other internal controls that, if unaddressed, might lead to future violations. We can then suggest ways the institution can make improvements that might stop this from happening,” Kraninger continued.

“In fact, traditional banking institutions and non-bank lenders alike have noted the value of the exam process in supporting their compliance efforts — I heard it repeatedly in my conversations over the listening tour. Heading trouble off at the pass may not grab big headlines, but it will prevent a lot of headaches for the consumers we serve,” she went on to say.

To reinforce her point, Kraninger recapped how she recently joined examiners at an onsite investigation. She said the examiners explained the systems they use, the information requests they sent, the data they received back and the steps they take to evaluate whether an institution is complying with its legal obligations.

“They talked about how they review an institution’s compliance management systems,” Kraninger said. “I was encouraged to hear their focus on working with the institution to prevent consumer harm, and I will encourage and expect this productive focus going forward.”

Perhaps as a response to critics on Capitol Hill and within the consumer advocate community, Kraninger also stressed the CFPB still has a significant percentage of its personnel and resources dedicated to conducting exams.

“I am focused on ensuring we use this tool as effectively and efficiently as possible to prevent consumer harm,” she told the Bipartisan Policy Center.

Kraninger elaborated about that particular point in light of her being director for only a few months.

“Focused on these goals for supervision, I have challenged the staff to take a fresh look at the entire process — the prioritization and frequency of exams, the size of the exam teams, the days spent onsite, the systems and job aids that support the work, the time it takes to complete an exam and deliver a report and how we empower examiners to provide input on the exam process, among other things.

“From a substantive standpoint, to ensure a culture of compliance means working confidentially in a back-and-forth process with a financial institution to prevent consumer harm until the institution demonstrates that process won’t work for them. That institution needs to self-examine, self-report and provide restitution where appropriate,” she continued.

“Given the pace of the world today, that institution — and consumers — expect agility from the bureau in terms of how quickly we can adjust to address changing risks, including how promptly we acknowledge that actual or potential harm has been addressed,” Kraninger went on to say.

The CFPB leader closed this segment of her prepared remarks by acknowledging that the bureau is not the only regulator watching what finance companies and other participants in the automotive space might be doing. Kraninger also mentioned she recently became chair of the Federal Financial Institutions Examination Council, a group of federal and state agencies that regulate financial institutions.

“Financial institutions in this country are subject to myriad laws and regulations, all while being examined by a variety of federal and state regulators. In my short tenure, I have gotten to know my federal counterparts and am building strong relationships with them,” she said. “I have also prioritized meeting and speaking with state attorneys general and commissioners at every opportunity.

“As (Federal Financial Institutions Examination Council chair), my focus will be on strengthening coordination and collaboration with our sister regulators who review the same or similar information at the same institutions, albeit for different reasons,” Kraninger continued.

“It is incumbent upon us to ensure that we do not impose unmanageable burdens while performing our duties. A more efficient and effective deployment of resources toward monitoring and addressing the risks will help all agencies do their jobs better and will help the bureau to prevent harm to consumers and address violations where they occur,” she went on to say.

The Consumer Financial Protection Bureau indicated that it took a deep look at what it called “unfair and deceptive practices” regarding rebates for certain ancillary products after examining the protocols executed by at least one captive finance company.

CFPB officials recapped through its latest Supervisory Highlights that vehicle buyers sometimes also finance the purchase of ancillary products such as an extended warranty when they take delivery and enter into a retail installment sales contract. Then as finance companies know, if the contract holder later experiences a total loss or repossession, the servicer or contract holder may cancel such ancillary products in order to obtain pro-rated rebates of the premium amounts for the unused portion of the products.

In these situations, the bureau acknowledged the rebate is payable first to the servicer to cover any deficiency balance and then to the borrower.

“Generally, the servicer contractually reserves the right to request the rebate without the borrower’s participation, although it does not obligate itself to do so. The borrower also retains a right to request the rebate,” the CFPB said in the latest Supervisory Highlights.

During its examinations of extended warranty products and policies used by this unnamed captive, the CFPB found the amount of a potential rebate for the products depended on the number of miles driven. The bureau said its examiners observed instances where one or more servicers used the wrong mileage amounts to calculate the rebate for extended-warranty cancellations.

“For some borrowers who financed used vehicles, the servicers applied the total number of miles the car had been driven to calculate rebates,” the CFPB said. “However, the servicer(s) should have applied the net number of miles driven since the borrower purchased the automobile.

“The miscalculation reduced the rebate available to certain borrowers and led to deficiency balances that were higher by hundreds of dollars. The servicer(s) then attempted to collect the deficiency balances,” the bureau continued.

“One or more examinations found that servicer attempts to collect miscalculated deficiency balances were unfair,” the CFPB went on to say. “Collecting inaccurately inflated deficiency balances caused or was likely to cause substantial injury to consumers. And these borrowers could not reasonably have avoided collection attempts on inaccurate balances because they were uninvolved in the servicer’s calculation process.”

The CFPB explained the injury of this activity is not outweighed by the countervailing benefits to consumers or competition. For example, officials emphasized the additional expense the servicers would incur to train staff or service providers to ensure that refund calculations are correct would not outweigh the substantial injury to consumers.

In response to these findings, the CFPB said the finance companies conducted reviews to identify and remediate affected contract holder based on the mileage they drove before the repossession or total loss of their vehicles. The bureau added that the finance companies also began to verify mileage calculations directly with the issuers of the products subject to rebate.

Additionally, the bureau pointed out its examiners observed instances where one or more servicers did not request rebates for eligible ancillary products after a repossession or a total loss. The regular indicated that the finance company then sent these contract holder deficiency notices listing a final deficiency balance purporting to net out available “total credits/rebates,” including insurance and other rebates. The notices also stated that future additional rebates may affect the amount of the surplus or deficiency, but that “at this time, we are not aware of any such charges.”

The CFPB said that the servicers’ records contained information that it had not sought the eligible rebates. Examinations showed that the average unclaimed rebate was roughly $1,700.

“One or more examinations identified these communications as a deceptive act or practice. The deficiency notice misled borrowers because it created the net impression that the deficiency balance reflected a setoff of all eligible ancillary-product rebates, when in fact, the servicers’ systems showed that it had not sought one or more eligible rebates,” the CFPB said.

“It was reasonable for consumers to interpret this deficiency balance as reflecting any eligible rebates because the servicers were both contractually entitled and financially incentivized to seek and apply eligible rebates to the deficiency balance. And the misrepresentation was material to consumers because they may have pursued rebates on their own had the servicers not represented that there were not additional rebates available,” the bureau continued.

“In response to these findings, the servicers conducted reviews to identify and remediate affected borrowers. The servicers also changed deficiency notices to clarify the status of eligible ancillary product rebates,” the CFPB concluded.

Having been unsuccessful in becoming governor of Ohio, former Consumer Financial Protection Bureau Richard Cordray appears to have resurfaced on the West Coast in connection with a high-ranking California state lawmaker.

Multiple social media posts from California Assemblymember Monique Limon show her pictured with Cordray having what she said was a “great conversation” with the previous leader of the CPFB “on the attacks against consumer protections.”

Limon is chair of the state assembly’s banking and finance committee. She already made two proposals within the committee with one titled, the Fair Access to Credit Act as well as another action that “would revise the definition of a broker to include anyone who is engaged in the business of performing specified acts in connection with loans made by a finance lender, including, among other things, transmitting confidential data about a prospective borrower to a finance lender with the expectation of compensation in connection with making a referral unless a specified exception applies.”

According to the biography on her website, Limon was elected to the assembly in November 2016. She is only the second woman ever to be chair of the chamber’s banking and finance committee.

“As only the second women in California history to serve in this role, I do not take the responsibility that comes with this position lightly,” she said in a news release from last May in connection with state regulation of personal loans.

Cordray announced in November 2017 that he would departing the CFPB after serving as its first director thanks to an appointment by President Obama. Cordray lost to Mike DeWine in the election to be Ohio’s governor a year later.

The meeting involving Limon and Cordray was first reported by American Banker.

Anyone who has been involved with the repossession industry over the past several years knows that the world looks very different today than before the Consumer Financial Protection Bureau arrived. Most of the focus during this period has been on third- and fourth-party oversight. Given the CFPB’s official position on vendor management, it is no longer acceptable to rely solely on the agent or repossession management company to keep their shops in order.

Today, extensive vetting, on-site visits to every storage lot, proper contracting, performance/compliance score cards and broader insurance coverage are the norm. As a result, lenders and regulators can be comfortable that the agents recovering cars on their behalf have been well vetted and are closely monitored. Indeed, the CFPB has expressed general satisfaction on this aspect of vendor management

At this point, there are two primary areas the CFPB is focused on when it comes to repossession:

1. Fees that consumers are charged for retrieving personal property, and to a lesser extent redeeming their vehicle

2. Repossessions made in error

Adequately addressing these issues will pretty much squeeze out the remaining regulatory concern and legal exposure.

The “fees” issue has largely been addressed, especially by major lenders. Most have either mandated that any consumer charges be billed back to the lender (and posted to the customer’s account) or the allowable charges have been capped at defined and reasonable levels. There is still the issue of ensuring that agents follow the requirements, but we will save that for another post.

This leaves the issue of repossessions in error as the final major area to be addressed. Indeed, the CFPB has referenced the matter in its last two bulletins.

The vast majority of repossession in errors occur due to communication breakdowns. We see two types:

1. Internal communication breakdown within the lender’s operation where the auto repossession management company or agent was not notified when a repossession order was put on hold or closed. As a repossession management vendor for lenders, there is not much we can do to impact their internal processes/operations.

2. Vendor(s) communication breakdowns when a hold/close has been issued properly by the lender but the proper communication and systems updating by all involved parties did not take place.

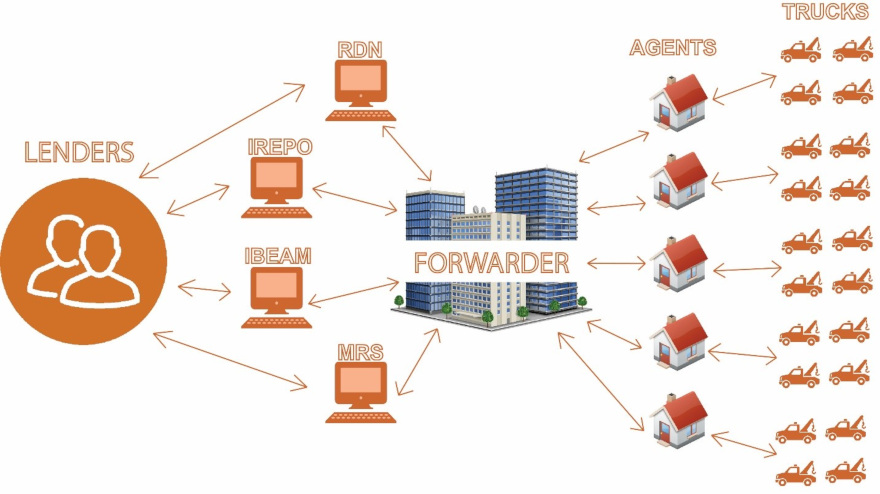

The latter is largely a technology issue. The lenders, management companies (forwarders) and agents generally operate on different platforms and degrees of sophistication. And for each of these players, there are multiple platform options. Breakdowns can occur at each point along the way and these breakdowns account for a large percentage of repossession in errors. The diagram at the top of this page illustrates the challenge and the components/integrations that must be in place to solve the problem.

To address the challenge, there must be close to real time communication from lender to forwarder to agency system of record to repo truck driver. Fortunately, recent improvements in systems integrations and the emergence of mobile platforms supporting repossession agency operations, provide solutions to the challenge, for the first time.

Today, there are two primary mobile platforms that, if integrated properly, can support the data exchange requirements. These are RDN/Clearplan and the Recovery Compliance Mobile (RCM) platform provided by MBSi. While each takes a somewhat different approach, both are solid systems that are designed to provide compliance functionality at the truck level. The recent acquisition of Clearplan by RDN and KAR Auction Services does offer some additional functionality and efficiencies made possible by the fact that the vast majority of repossession agencies use these two platforms as their systems of record.

If your institution relies on repossession management companies (forwarders) to coordinate the repossession activity, deep integrations with these platforms must be in place. Due to internal constraints, very few have the capability to facilitate the data between the various parties regardless of the source. At ALS Resolvion, we have invested heavily in these integrations and by mid-February, we will be only utilizing repossession agencies that deploy this type of mobile technology in the field.

Our expectation is that more and more lenders will be mandating real time “two-way” communication all the way down to the truck level. Doing so will bring us all very close to meeting both regulator and lender senior management expectations for squeezing out repossession made in error.

Mike Levison is the chief executive officer of ALS Resolvion. More details about the company can be found at www.alsresolvion.com.

Additional products sold to buyers during the financing process along with their terms and conditions continue to create issues for servicemembers, according to the newest report from the Consumer Financial Protection Bureau.

The agency’s Office of Servicemember Affairs (OSA) monitors and analyzes complaints from servicemembers, veterans and military families. The regulator released its annual report last week that contained a specific segment dedicated to rehashing how add-on products are triggering issues.

The bureau reported that roughly 75 percent of servicemembers have a vehicle and make monthly payments. The regulator acknowledged many add-ons are marketed as particularly helpful to servicemembers due to the unique aspects of military life.

“We have heard from many servicemembers who did not understand that these add-ons were optional and that they would be added to the total amount financed,” officials said in the 40-page report that’s available here.

“We have heard from many servicemembers who didn’t understand how they wound up financing thousands of dollars in add-on products like service contracts, window etching, guaranteed asset protection (GAP), key replacement warranty and tire, dent and paint protection packages,” the CFPB continued.

The report went on to mention that confusion about GAP intensified when the servicemember took the vehicle overseas. Officials recapped what they were told:

“I am a military member… (Company) is refusing to pay on the GAP insurance that I purchased at the time I signed the financing agreement. While stationed at (military base), I purchased a (new car) … When I purchased the vehicle the original financing agreement included an option to purchase GAP insurance for an additional (cost). … (Company) agreed in writing for me to ship my vehicle to (country) when I received military orders re-assigning me to (country). The letter explicitly authorized me to drive the vehicle here in (country) while I am stationed overseas. The vehicle was totaled in an accident. Now (company) is refusing to honor the GAP insurance/waiver provisions because the loss occurred outside of the United States. … I simply want (company) to honor its commitment to cover the deficiency between the insurance payout and the remaining balance on the loan.”

The bureau emphasized at the close of its section on auto financing that, “It remains important for servicemembers to comparison shop when it comes to car add-on products such as GAP.”

The bureau reiterated that complaints submitted by servicemembers serve as a key initial indicator of emerging issues and continuing trends in the financial marketplace.

The report is designed to provide data and analysis around the most common complaints submitted by servicemembers. These complaints are used to help to inform the bureau and external stakeholders in addressing these issues as they evolve.

The bureau went on to note that the majority of complaints received from servicemembers during the reporting period revolve around credit or consumer reporting followed by debt collection issues.

“We regularly hear from servicemembers who are worried that incorrect information on their credit reports will put their security clearance, duty status, potential promotion or even military career in jeopardy. Recent changes to the Department of Defense (DOD) security clearance rules make credit reporting and debt collection issues even more important to resolve as quickly as possible,” officials said in the report.