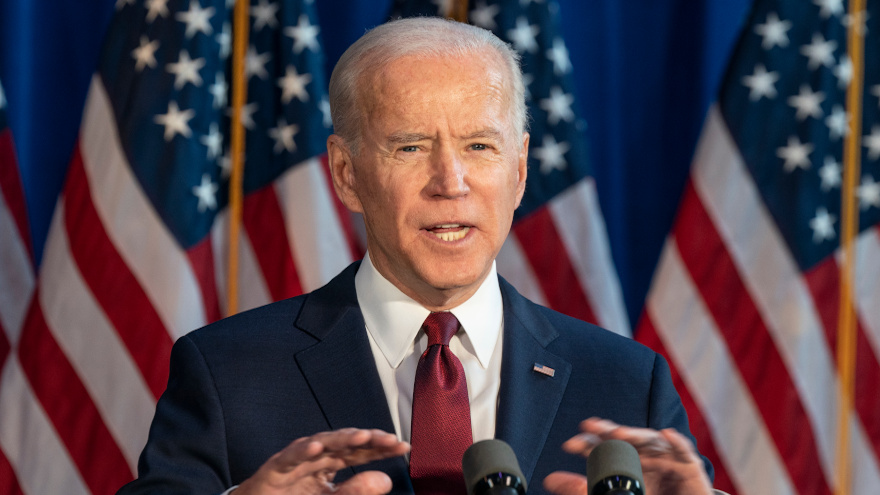

On Jan. 18, President Biden revealed his nominations to lead the Consumer Financial Protection Bureau and the Securities and Exchange Commission.

On Tuesday, the Senate Banking Committee will hold a hearing to interview Rohit Chopra, currently a commissioner with the Federal Trade Commission who has been picked to oversee the CFPB, and Gary Gensler, who previously served as chairman of the U.S. Commodity Futures Trading Commission and has been selected to run the SEC.

Sen. Sherrod Brown, an Ohio Democrat and chair of the committee, met with Chopra earlier this month and shared this synopsis of the gathering through a news release.

“Rohit Chopra is the kind of bold and experienced person we need to serve as the next director of the Consumer Financial Protection Bureau,” Brown said. “During our meeting, we discussed his plans to rebuild the CFPB after the Trump administration weakened the agency, as well the agency’s plans to protect consumers — and in particular homeowners — during and after the pandemic.

“We also discussed the importance of the CFPB’s role in rooting out illegal discrimination and ensuring a fair and equitable market for consumer financial products and services,” Brown continued. “I am confident in Mr. Chopra’s ability to lead the agency and look forward to what we can accomplish together to address racial inequities and help American families during this pandemic.”

Meanwhile, Senate Banking Committee ranking member Sen. Pat Toomey, a Pennsylvania Republican, and Rep. Patrick McHenry, a North Carolina Republican and the U.S. House Financial Services Committee ranking member, delivered a letter earlier this month to the acting SEC director urging Allison Herren Lee “to start or complete seven good government initiatives, several of which have been awaiting action for years.”

Toomey and McHenry also wrote, “We hope that you will be a steady and effective caretaker of the SEC’s tripartite mission of protecting investors, maintaining fair, orderly, and efficient markets, and facilitating capital formation. In the spirit of President Biden’s inaugural commitment to unity, we write to highlight some good government initiatives that the SEC should immediately undertake to advance its mission and the interests of investors.”

The entire letter can be found online here.

On Wednesday, Dave Uejio — the acting director of the Consumer Financial Protection Bureau — said he met with staff from the regulator's Division of Consumer Education and External Affairs (CEEA).

Among the findings and directives originating from last week's gathering, Uejio described how the financial services sector has been responding to consumer complaints, which he called the “lifeblood” of the CFPB.

In a blog post on the regulator’s website, Uejio not only recapped the meeting but also shared some unflattering assessments of what providers currently are doing to remedy consumer complaints, especially during the pandemic.

In fact, Uejio said CEEA should “redouble” its efforts moving forward to ensure the bureau engages all consumers who are economically suffering.

“As I said before, a change in strategic direction is not a reflection on the quality of the work performed by bureau staff over the past several years. I know that the dedicated staff in CEEA has consistently championed vulnerable populations and advocated for engaging directly with the people we serve. I eagerly anticipate this agency doing exactly that,” Uejio said.

“One of my top priorities is making sure that consumers who submit complaints to us get the response and the relief they deserve,” he continued. “Consumer complaints are our lifeblood; our direct connection to consumers in distress, and they are at an all-time high right now.

“I understand that some companies have been lax in meeting their obligation to respond to complaints,” Uejio went on to say. “It is the bureau’s expectation that companies provide substantive responses that address the issues consumers describe in their complaints.”

Uejio mentioned another part of addressing consumer complaints that touched on an element that’s gained more attention recently.

“I also understand that consumer advocates have found disparities in some companies’ responses to Black, Brown, and Indigenous communities. This is unacceptable,” he said.

“I have asked Consumer Response to prepare a report highlighting the companies with a poor track record on these issues. We will be publishing this analysis and the senior leadership of these companies can expect to be hearing from me,” Uejio added.

Along with that report, Uejio gave CEEA marching orders to complete other tasks.

First, Uejio wants the bureau to refresh its website to be more user friendly, “focused on consumers rights and signals that in no uncertain terms, we are on their side.”

He also is looking for the CFPB to expand its social media presence “so that we hear directly from the people we serve,” adding that, “to reach consumers where they are, we must keep up with how people access information regardless of device or form.”

Finally, Uejio is seeking that bureau “aggressively” rebuild and repair relationships with consumer, civil rights, racial justice and tribal and Indigenous rights groups.

“We cannot execute on these bold ideas unless we robustly engage with external stakeholders who support economically vulnerable consumers,” he said.

While GWC Warranty isn’t suggesting that dealers need to have a law degree to retail used vehicles, the F&I product provider revisited eight crucial regulations operators should understand to do business in a compliant manner.

Reviewing the basics of these eight regulations might be even more beneficial now with experts projecting an intensifying landscape under the Biden administration and new leaders at both the Consumer Financial Protection Bureau and the Federal Trade Commission.

The eight regulations GWC Warranty specified in a blog post on the company’s website included:

— Americans with Disabilities Act

— Gramm-Leach-Bliley Act

— California Consumer Privacy Act

— Used Car Rule (Buyer’s Guide)

— Equal Credit Opportunity Act

— Fair Credit Reporting Act

— Truth in Lending Act

— Magnuson-Moss Warranty Act

“It’s no surprise to anyone in the industry that automotive dealers are some of the most regulated businesses in the United States. Understanding your legal obligations and the government regulations that impact your dealership can save you thousands of dollars, not to mention severe legal penalties,” GWC Warranty said.

“It’s more important than ever to make compliance a focus of your dealership operations,” the F&I provider continued. “There are complex regulations in place to protect both consumers and your dealership at every step of the sale. Understanding those details can make all the difference when it comes to preventing violations, avoiding a hit to your reputation and hefty fines.”

An enforcement action involving Santander Consumer USA (SCUSA) stemming from four years ago came to a conclusion on Thursday.

Santander Holdings USA and SCUSA confirmed in a news release that the board of governors of the Federal Reserve System has authorized the Federal Reserve Bank of Boston to terminate its written agreement with the bank and auto finance company that often caters to subprime customers.

Back on March 21, 2017, federal officials and the financial institution agreed that SCUSA was required to enhance its compliance risk management program, board oversight of risk management and senior management oversight of risk management.

Just before that agreement was first announced, then-SCUSA chief executive officer Jason Kulas discussed compliance at length during the finance company’s “Investor Day.”

“You’re going to hear us talk about (compliance) several times today and anytime you hear us speak, you'll hear that as a central component of our strategy,” Kulas said, according to the event transcript posted by the company. “We believe strongly that focusing on this is one of the keys to success in consumer finance for many years in the future and regardless of how the political winds may shift every four years or so.

“We’re going to continue to focus on compliance and putting the customer at the center of everything we do and making that a central component of how we are successful going forward,” he continued.

Current executives explained this week’s termination of that written agreement demonstrates the progress Santander has made in recent years.

“I am pleased with the progress we have made resolving these legacy issues,” Santander US chief executive officer Tim Wennes said in that news release. “Today’s announcement is an important milestone for Santander in the US and speaks to the hard work and dedication of our colleagues across the US and particularly at SC.”

And current Santander Consumer USA chief executive officer Mahesh Aditya added, “We are pleased that the Federal Reserve has acknowledged the significant strides that Santander Consumer has made to strengthen our business across the board.

“Our employees have worked tirelessly to build a culture with a compliance mindset where the highest operating standards are the norm. That is the company we have today, and we look forward to our next chapter,” Aditya went on to say.

Despite recent changes in the lien sale laws, fraud by repair shops in south Florida continues. Some repair shops ignore the law with impunity.

We believe involving the police and moving more aggressively toward fraudulent shop owners will send a message to the shops, and perhaps slow down “lien sale piracy.” We recently sought the assistance of law enforcement, which led to a shop owner’s arrest when a shop owner refused to surrender a vehicle.

In Florida, a lender receiving a lien sale notice for alleged vehicle repairs can post a bond with the clerk of court to recover the vehicle. Upon posting the bond, the clerk issues a certificate of release, which the lender’s agent serves on the shop. At that point, the shop is required to surrender the vehicle. What happens when the shop refuses to surrender the vehicle after being served with the certificate of release? Under Florida Statute 559.917(3), a shop or its employees or agents who refuse to surrender a vehicle once provided with the certificate of release commit a crime.

In a recent case we handled, the shop owner refused to surrender the vehicle to the lender’s agent after being served with the certificate of release. At our request, the agent called the police who came to the shop but did not take any action other than to fill out a report. Undeterred, we immediately contacted the Florida DMV to request a hold on the title to prevent any transfer. We then contacted in-house counsel for the Dade County Police Department and explained our position that the police officer who went to the shop should have arrested the shop owner for refusing to surrender the vehicle. They agreed and assigned a detective to investigate.

When the detective went to the shop, the owner admitted he had the vehicle but said he would only surrender it if he was not arrested. When we would not agree to this “offer,” the detective arrested the shop owner. The police filed four charges against the shop owner, including a felony for grand theft.

After his arrest, the shop owner finally surrendered the vehicle. We will continue to work with the detective to pursue prosecution of the shop owner.

Dennis LeVine is a partner in the statewide firm of Kelley Kronenberg and focuses his practice on bankruptcy litigation and creditors’ rights. He is one of only seven attorneys in Florida to be board certified in both consumer bankruptcy law and business bankruptcy law. He also has written and spoken widely on lien sale fraud.

The American Financial Services Association, in collaboration with the Illinois Financial Services Association, the Independent Finance Association of Illinois and the Illinois Automobile Dealers Association, sent a letter on Friday to Gov. J.B. Pritzker to state their “grave concerns” about a measure about to become law in Illinois that would create a rate cap on loans, including auto financing.

The associations asked Pritzker to veto Senate Bill 1792, which would create the Predatory Loan Prevention Act and institute a 36% rate cap based on the federal military annual percentage rate for all loans not exceeding $40,000.

“While SB 1792 contains many admirable provisions aimed at creating a more equitable Illinois, the proposed rate cap would leave Illinois consumers worse off and immediately cut off access to credit for those most in need,” the associations wrote in their letter.

The associations explained their position by noting the confusion potentially triggered by how this act is crafted.

The letter stated that for more than 50 years, the federal Truth in Lending Act (TILA) has provided a standard of how to calculate the annual percentage rate (APR) of loans, ensuring that all references to APR are consistent and require little interpretation.

“This allowed consumers to have a clear understanding of the terms and cost of credit and to compare costs of similar loan products,” the associations said. “TILA expressly excluded the costs of voluntary products from the APR calculation.”

The letter goes on to note that the federal Military Lending Act introduced a military APR (MAPR) that, unlike TILA, includes the cost of voluntary goods, services, or insurance that are unrelated to the cost of credit and “are not comparable across credit products.”

The associations pointed out that, “Whereas traditional TILA APR applies to all consumers and all credit products, MAPR is only applicable for certain small loans to active-duty servicemembers and their dependents.

“Importantly, this distinction exists, in part, because certain types of insurance and protection products are already available to members of the military as a benefit of their service. For this reason alone, MAPR is not appropriate for broader application beyond servicemembers,” they added.

The letter goes on to specify a host of metrics finance companies consider when deciding whether to extend credit such as average charge-offs, cost of service and cost of capital — all data points that can vary depending on the consumer’s credit standing.

The associations then offered a rudimentary example to give the top Illinois lawmaker another point to consider. It went as follows:

For example, say you lend me $100 today and charge me $1 in interest:

— If I pay you back in one year, the APR is 1%

— If I pay you back in one month, the APR is 12%

— If I pay you back tomorrow, the APR is 365%

— If I pay you back in an hour, the APR is 8760%

Same dollar in interest, vastly different APRs.

Should the act become law, the associations cautioned Pritzker about other potential ramifications.

“While elite borrowers in Illinois may be able to find other sources of credit or afford larger loan sizes, lower-income individuals will likely be left in credit deserts and forced to turn to more dangerous, or illegal, options like pawnbrokers and loan sharks,” they wrote.

“Because our members report to credit bureaus, they help hundreds of thousands of Illinois adults graduate out of subprime credit scores each year—so we deeply understand the effects of this bill,” they continued. “This will have a ripple effect in those communities where unregulated lenders will operate and proliferate, credit mobility will decline, debt costs will increase as will overall debt loads, and long term wealth will decline when people lose access to both affordable credit and means to improve their credit scores.”

Signing the letter were AFSA senior vice president Danielle Fagre Arlowe and Mark Dapier of the Independent Finance Association of Illinois as well as Illinois Financial Services Association executive director and general counsel Brett Ashton and IADA president Pete Sander.

The entire six-page letter can be found here.

It turned out to be an active holiday season at the Consumer Financial Protection Bureau.

Along with naming two new staff members and reaching a consent order with a provider of personal loans, the CFPB also penalized Santander Consumer USA for the second time in three years.

The bureau issued a consent order against Santander to address the regulator’s finding that the finance company violated the Fair Credit Reporting Act (FCRA). Officials explained the consent order was issued in connection with SCUSA providing erroneous consumer loan data to consumer reporting agencies (CRAs).

The CFPB pointed out that Santander furnishes credit information on the auto contract it services by sending monthly data files to CRAs. The bureau said in a news release that it found that the consumer loan data Santander furnished to CRAs between January 2016 and August 2019 contained many systemic errors that, in many instances, could have negatively impacted consumers’ credit scores and access to credit.

The consent order requires Santander to take certain steps to prevent future violations and imposes a $4.75 million civil money penalty.

“The bureau found that Santander furnished consumer loan information to CRAs that it knew or reasonably should have known was inaccurate, including failing to furnish accurate information regarding whether accounts were open or closed and whether consumers were carrying a balance or obligated to make future payments,” the regulator said in that news release.

“The bureau found that Santander failed to promptly update and correct information it furnished to CRAs that it later determined was incomplete and failed to provide the date of first delinquency on certain delinquent or charged-off accounts,” the CFPB continued.

“The bureau further found that Santander failed to establish and implement reasonable written policies and procedures regarding the accuracy and integrity of information provided to CRAs,” the regulator went on to say while also noting that it believes Santander’s conduct violated the FCRA and its implementing regulation, Regulation V, as well as constituted violations of the Consumer Financial Protection Act of 2010.

Under the terms of the consent order, the CFPB indicated Santander must correct all inaccuracies and errors that the bureau identified and take certain steps to improve and ensure the accuracy of the consumer information it provides to CRAs. These steps include conducting monthly reviews of account information to assess the accuracy and integrity of information Santander furnishes.

“Santander must also establish and implement reasonable policies and procedures regarding the accuracy and integrity of information it furnishes to CRAs,” officials added.

SCUSA last faced an enforcement action from the CFPB just before Thanksgiving 2018 in connection with a GAP product.

And in May, Santander finalized a voluntary settlement topping $550 million with 33 states and the District of Columbia that alleged that contracts that the finance company funded through certain dealers dating back to 2010 violated consumer protection laws because of the high risk that certain individuals would default.

Lender involved in MLA violation

In other bureau enforcement activities before 2020 closed, the CFPB issued a consent order against Omni Financial of Nevada. The bureau said it found that Omni violated the Military Lending Act (MLA), Electronic Fund Transfer Act (EFTA), and Consumer Financial Protection Act of 2010 (CFPA) in connection with making installment loans.

Omni, which has its principal place of business in Las Vegas, specializes in lending to consumers affiliated with the military, originating tens of thousands of loans each year with individual loans typically ranging from $500 to $10,000.

The consent order requires that Omni pay a $2.175 million civil money penalty and imposes injunctive relief to stop ongoing violations and prevent future violations.

Officials explained the MLA puts in place protections in connection with extensions of consumer credit for active-duty servicemembers and their dependents who are defined as “covered borrowers.” These protections include prohibiting that loans to covered borrowers be required to be repaid by “allotment.”

The CFPB pointed out the Department of Defense runs the allotment system, which allows servicemembers to designate a portion of their paycheck to certain recipients. The bureau found that since October 2016, Omni’s loans to covered borrowers violated the MLA’s prohibition of requiring repayment by allotment.

The bureau added that it also found that Omni violated EFTA and the CFPA.

In addition to lending to active-duty servicemembers and their dependents, the bureau mentioned that Omni lends to civilians and non-covered servicemembers such as military retirees. The CFPB said it found that Omni requires all of its borrowers to provide bank-account information and authorize Omni to withdraw funds from that account on the first business day after each missed payment.

“Omni’s requirement that consumers allow it to withdraw funds from their bank accounts violates EFTA’s prohibition against requiring consumers to preauthorize electronic fund transfers as a condition of receiving credit,” officials said in a news release. “The bureau further found that these EFTA violations constituted CFPA violations.”

In addition to prohibiting future violations, the consent order requires Omni to provide notice of the bureau’s findings to all customers repaying their loans by allotment along with notice that they may change their repayment method.

Officials added that Omni also must provide training to employees and is prohibited from providing any incentives to employees or performance evaluations that consider the number or rate of consumers who choose to repay by allotment.

New staff members

And just before 2020 closed, the CFPB announced the addition of a deputy chief of staff and an assistant director for the office of innovation.

Ann Epstein will serve as the assistant director of the office of innovation. The CFPB said Epstein was most recently a financial technology consultant advising clients on consumer financial wellness and sustainable housing projects.

Before arriving at the bureau, Epstein worked for 18 years at Freddie Mac.

Jocelyn Sutton will serve as the deputy chief of staff for the bureau. Sutton joined the bureau in 2012. She worked in the office of regulations, before transitioning to the office of the director. Since then, she has served in various capacities, most recently as the bureau’s executive secretariat.

The Consumer Finance Protection Bureau recently entered into a consent order with a national lender regarding certain practices related to vehicle repossession. Since the CFPB appears to generally “regulate by enforcement,” lenders can learn valuable lessons by reviewing the CFPB’s consent orders.

In this case, the CFPB found that lender violated the Consumer Financial Protection Act of 2010 (CFPA) by engaging in a “unfair, deceptive, or abusive act or practice.” The CFPB assessed significant fines and required remediation steps be taken. This article will summarize the consent order.

The first thing learned is that two of the primary violations cited by the CFPB were not actions taken by lender at all, but made on its behalf by third-party service providers. This emphasizes how important it is for lenders to carefully scrutinize the policies and actions of these third-party vendors.

The following four actions were deemed by the CFPB to violate applicable statutes:

1. Wrongfully repossessed vehicles, despite having agreements in place with consumers to prevent repossession.

2. Through repossession agents, kept personal property located in consumers’ vehicles at the time of repossession and would not return that personal property until consumers paid a fee for its storage.

3. Through its service provider, deprived consumers making auto-loan payments by phone of the ability to select a payment option with a significantly lower fee than the one they were charged.

4. Made a deceptive statement in its agreements to extend consumers’ auto loans that appeared to limit consumers’ bankruptcy protections.

The consent order provides details of these violations:

1. Wrongful repossessions.

The lender repossessed vehicles of hundreds of consumers who had:

—Made payments that decreased their delinquency to less than 60 days past due

—Made and kept promises to pay

—Made promises to pay by a future date that had not yet passed

—Agreed to extension agreements

Each of these actions taken by consumers should have prevented repossessions. The CFPB noted that as a result of lender’s wrongful repossessions, consumers lost the use of their vehicles which caused hardships such as missed work, expenses for alternative transportation, repossession-related fees, detrimental credit reporting and vehicle damage in the repossession process.

2. Withholding personal property in repossessed vehicles.

In many cases, consumers’ vehicles contain the consumers’ personal property (e.g. children’s car seats, college textbooks and prescription sunglasses). The lender’s third-party repossession agents in many instances imposed fees on consumers for holding personal property contained in repossessed vehicles. These repossession agents often refused to return consumers’ personal property unless and until the consumers paid the fees. The lender was aware that its repossession agents often refused to return consumers’ personal property until after the consumers paid the up-front fees.

The also represented to some consumers that it had no control over the fees repossession agents charged, but in some instances the lender directed repossession agents to have repossession agents lower the fees charged to consumers. The CFPB found LENDER liable for the actions of its repossession agents.

3. Fees for making payments

The lender permits consumers to make account payments online, telephonically, by mail, or through an auto-debit program. The lender engaged a third-party payment processor to handle consumer calls regarding telephonic payments and to process those payments. This payment processor handled millions of payments for the lender.

The payment processor’s agents spoke to consumers on the lender’s behalf to obtain payments on the lender accounts. The payment processor charged the lender’s consumers $5 for payments by electronic check or in-network debit card payments, but charged more than twice the amount for credit-card and out-of-network debit-card payments. Some of the lender’s consumer-facing materials, such as billing invoices, stated that “transaction fees may apply” for telephonic payments; however, none of their consumer-facing materials disclosed the fee amounts for telephonic payments, or the considerable price difference between available methods of payment by phone.

The lender’s third-party phone-payment processing vendor also failed to tell consumers about significant differences in the fees. As a result, the CFPB found that the actions of the lender, through its third-party service provider, were deceptive and deprived consumers of the ability to choose pay-by-phone options with significantly lower fees.

4. Extension agreement suggests customers cannot file bankruptcy

An agreement to waive an individual’s right to file bankruptcy is void as against public policy. The lender sent extension agreements or written confirmations of oral extension agreements including to numerous consumers which included the following language:

“As a condition of you making this request, you represent that you have not filed and agree that you will not file for bankruptcy protection within 120 days after the date of this correspondence, and that an extension is contingent upon the absence of any such filing. If you should so file for bankruptcy protection, then this agreement is void for misrepresentation, and we may seek payment of the extended payments as originally scheduled and may deem such payment to be in default”.

The CFPB found this language in the lender’s extension agreements created the impression that consumers could not file for bankruptcy. In fact, consumers could file for bankruptcy. The CFPB stated these statements are material because they were likely to affect consumers’ conduct in executing the written extension agreement or considering whether to file for bankruptcy. The CFPB found that the lender’s representations to the contrary were false and misleading.

The consequences: Actions required by the consent order

The CFPB imposed significant multi-million dollar monetary sanctions against the lender. In addition, the consent order requires the lender to do a number of things to remediate these violations by taking the following actions:

• Review its repossession assignment and cancellation process and implement additional system or employee controls and adopt reasonable policies and procedures to avoid wrongful repossessions.

• Review its process for monitoring and addressing system-error messages related to cancelling or holding a repossession and develop and implement any changes necessary to ensure errors are flagged and responded to in a timely manner.

• Track all future wrongful repossessions.

• Conduct a quarterly review of any wrongful repossessions that occur to identify any patterns or practices which need to be addressed.

• Adopt reasonable policies and procedures to remedy instances of future wrongful repossession.

• Provide consumers with remediation for such wrongful repossessions, including waiver or refund of all repossession-related fees, correction of the consumer’s credit report, and a refund of actual costs incurred for both loss of use of the consumer’s vehicle (such as alternate transportation costs) and other reasonable and verifiable consequential damages incurred by the consumer.

• Prohibit its repossession agents (through contract or otherwise) from charging personal property fees to consumers directly and demanding fees as a condition of returning personal property.

• When offering consumers the option to make account payments by phone, the lender (or its third-party service provider) must, on each call during which a consumer makes such a payment, clearly disclose to the consumer the fee for each method of making a payment by phone, before the consumer is asked which method they wish to use. Where the lender charges consumers fees to make payments via other channels (e.g., online portal, postal mail), the lender must disclose all fees for each method on its website or its monthly billing statements.

• Not misrepresent, or assist others in misrepresenting, expressly or impliedly that a consumer may not file for bankruptcy or any other fact material to consumers concerning their rights related to initiating a bankruptcy proceeding.

• Provide reports regarding its compliance with the terms of the consent order

Since its inception, the CFPB has been a powerful and feared regulator. Since the CFPB is an executive agency, it is uncertain who will lead the agency, or how the CFPB will handle rulemaking and enforcement actions in the next administration.

Nevertheless, we strongly recommend auto lenders review and implement policies regarding their payment and repossession procedures to take the findings in this consent order into account. The CFPB will expect lenders to do so.

Dennis LeVine is a partner in the Tampa., Fla., office of Kelley Kronenberg. He can be reached at [email protected].

In a message sent to SubPrime Auto Finance News on Tuesday, U.S. Equity Advantage (USEA) and chief executive officer Robert Steenbergh explained how they ended up entering into a consent order with the Consumer Financial Protection Bureau when the payment processing firm reached “a bridge too far” during its dialogue with the regulator.

To recap, the bureau distributed a news release on Friday, saying it issued a consent order against USEA and Steenbergh. The CFPB said it found that the company’s disclosures and advertisements of its auto-finance payment program contained misleading statements in violation of the Consumer Financial Protection Act of 2010’s prohibition against deceptive acts or practices.

USEA responded by stating Friday’s announcement ended “a four-year, far-reaching and exhaustive examination requiring hundreds of man hours and thousands of pages of documents.” The company insisted the settlement makes clear that USEA does not admit to any of the CFPB’s allegations.

In fact, Steenbergh went so far as to call most of the bureau’s allegations “factually inaccurate and patently false.”

At the end of this four-year investigation, Steenbergh said the CFPB could not produce a single customer complaint nor any examples of actual consumer harm. Instead, he said the CFPB took issue with language that occurred in two lines of a “long-ago” revised and frequently unused supplemental disclosure tool, as well as one phrase in a discontinued generic advertisement.

“That was it. That’s all the CFPB could allege after four years,” Steenbergh said. “And, in making these ‘findings,’ the CFPB ignored evidence showing that 95% or more of our customers could not have possibly even seen or potentially relied on the disclosures at issue — which we changed two-and-a-half years ago.”

Nonetheless, the consent order imposes a judgment against USEA requiring it to pay $9.3 million in consumer redress and contains requirements to prevent future violations.

While the CFPB does not “approve” businesses in the process of reaching this settlement, USEA said the CFPB did not take issue with the company’s biweekly payment services, including aligning payments to paychecks, payment processing, enrollment process and/or amortization calculations.

USEA also said the bureau acknowledged the value of all its products and services, including credit monitoring, credit scoring, vehicle valuation and recall alerts.

Furthermore, USEA asserted that the CFPB found no other potential law violations, including anything related to Regulation E.

Steenbergh then acknowledged what resulted in USEA entering into the consent order despite these assertions.

“While we were willing to stand up to the CFPB, when its attorneys threatened to subpoena F&I managers, it became a bridge too far,” Steenbergh said. “Despite never stepping foot in a dealership and failing to identify a single customer complaint about our service, the CFPB claims it ‘knows what goes on’ in dealerships. That’s their idea of evidence. It was ridiculous, but I wasn’t about to let them continue their modern-day inquisition and drag anyone else into it. So, we settled.

“While we are not thrilled with having to pay $900,000 to resolve this situation, it’s a small fraction of what the CFPB originally demanded,” he continued.

The CFPB said the ordered redress amount is suspended upon payment of $900,000 and a $1 civil money penalty to the bureau.

While perhaps weary from the clash with the CFPB, Steenbergh described how USEA plans to proceed.

“The good news is that this settlement will not impact our business at all. It will do nothing to impact the best-in-class service and value our 60+ team members have been providing to our business partners and customers for over 17 years,” Steenbergh continued.

“We are happy to put this injustice behind us, and we look forward to continuing our rapid growth and nationwide expansion. And, most importantly, I would personally like to thank all of our loyal dealer, banking and agent partners who told us when we informed them about this forthcoming settlement, that it didn’t change their perception of USEA in the slightest,” he went on to say.

Joe Biden’s victory likely will usher in a new era of consumer protection and compliance challenges for auto dealers. Four out of the five Federal Trade Commission (FTC) Commissioners will have their terms expire during the Biden Administration. President-Elect Biden will have the power to replace the head of the Consumer Financial Protection Bureau. The Democrats will, for at least two years, control the House and maybe the Senate, too.

The Democratic Party Platform stated that a Biden administration would work “to ensure equitable access to credit and banking products for all Americans, and reinvigorate the Consumer Financial Protection Bureau (CFPB) to ensure that banks, financial institutions, and lenders cannot prey on consumers.” The Platform also indicates Democrats will “eliminate the use of forced arbitration clauses.” Strong language is also given to protecting consumers’ rights to privacy and protecting consumers from data breaches.

In short, as Democratic Sen. Chuck Schumer said with respect to the Supreme Court, everything is on the table.

That being said, it is reasonable to expect changes in the automobile world to be evolutionary not revolutionary. The Trump administration has put new staffers at senior levels in the CFPB and FTC. While some of these people may leave or be replaced, there will not be a wholesale firing and replacement of Republican staffers on day one.

Here are some thoughts on what to expect.

CFPB

It is important to remember that Sen. Elizabeth Warren, the original architect of the CFPB, will have an important voice in Biden administration policy. Warren raised concerns earlier this year about auto finance and has indicated her disdain for auto dealers in the past.

“Auto dealers got a specific exemption from CFPB oversight, and it is no coincidence that auto loans are now the most troubled consumer financial product,” Warren said. “Congress should give the CFPB the authority it needs to supervise car loans – and keep that $26 billion a year in the pockets of consumers where it belongs.” The $26 billion per year is Warren’s estimate of total dealer participation which Warren would like to eliminate.

Warren is also closely aligned with Richard Cordray who headed the CFPB during the Obama administration. You may recall that the CFPB under Cordray published the agency’s bulletin on auto finance indicating that dealer participation resulted in disparate impact credit discrimination. In May 2018, the Congress passed a joint resolution that was signed by President Trump disapproving the bulletin.

Disparate impact credit discrimination involves facially neutral practices that have the effect of discrimination. Actual intent to discriminate is not required. Disparate treatment credit discrimination generally requires intent to discriminate.

The U.S. Supreme Court in 2015 decided the case of Texas Department of Housing versus Inclusive Communities Project. This case appeared to make it harder to bring a disparate impact credit discrimination case under a statute like the Equal Credit Opportunity Act (ECOA) although ECOA was not at issue in the case. ECOA prohibits “any creditor to discriminate against any applicant with respect to any aspect of a credit transaction.” This picks up disparate treatment credit discrimination. But ECOA does not prohibit acts that “otherwise make unavailable” credit to protected classes as does the Fair Housing Act which was at issue in the case. It was this language that the Supreme Court ruled 5-4 picks up disparate impact credit discrimination. The Supreme Court has not ruled on whether ECOA prohibits disparate impact.

FTC

FTC commissioners serve staggered terms. No more than three commissioners can be of the same political party. Two Republican commissioners will have their terms expire in 2023 and 2024, respectively. When replacing a commissioner, including a Democratic commissioner as will occur in 2022, it is reasonable to believe that a Biden administration will appoint someone more leftward leaning than a Republican president would appoint. Over time, this could lead to a more activist FTC including against auto dealers and auto finance about which the FTC has held hearings.

FTC staff members may also turn over and it is not unreasonable to believe that more liberal replacements may be appointed. Expect the FTC to be more active during the Biden Administration although how soon and how much so will remain to be seen.

The Department of Justice (DOJ)

The DOJ has brought criminal actions against auto dealers, their owners, and their employees for bank fraud, interstate wire fraud, and other federal criminal law violations. Several dealer principals as well as F&I personnel have served jail terms for defrauding federally regulated lenders by, for example, submitting falsified credit applications, power booking, and other fraudulent behavior.

President Biden will appoint a new head of the Department of Justice to replace William Barr early in his term. This person will obviously be more liberal than Mr. Barr. It is reasonable to expect that senior levels in the DOJ may likewise move to the left. This could result in more investigations, enforcement actions, and criminal proceedings against auto dealers who falsify documents and misrepresent transaction information to lenders.

State attorneys general

The CFPB and State Attorneys General (AGs) act in close concert on consumer protection matters. During the Trump administration, many enforcement actions against auto dealers have originated with State AGs.

An activist CFPB and aggressive AGs can be expected to pursue more claims against auto dealers. Your state AG is the most likely regulator you will encounter. It is critical that you have a policy and procedure for addressing consumer complaints. Use this procedure for every consumer complaint. Remember that even a small complaint can become a big problem if the consumer reports it to the Attorney General.

What’s a dealer to do?

If you have put compliance on the back burner during the Trump Administration, now is the time to get prepared, review and update your policies, and train/retrain your employees. A checkup with your legal or compliance advisor is an excellent idea.

The Biden administration is likely to focus on safeguards and privacy so make those first on your list. (Review your privacy notice and make sure it states what your actual sharing practices are). Consumer protection in sales and f & I will be another area for activist agencies. If you have not already done so, adopt and implement the NADA Fair Credit Compliance Program and the NADA Voluntary Protection Products policy and program.

In recent enforcement actions, the FTC has made dealer principals jointly and personally liable with the dealership for violations including broad unfair and deceptive practices violations. This trend will continue. That should be reason alone for your senior management to give priority to compliance as the Biden Administration takes over.

Randy Henrick is an auto dealer compliance expert who provides compliance consulting services to dealers directly at www.AutoDealerCompliance.net. He served for 12 years as Dealertrack’s lead regulatory and compliance attorney and wrote all Dealertrack’s Compliance Guides. He has presented workshops at five NADA national conventions and speaks to dealer associations, 20 Groups, performs deal jacket auditing, and prepares training and other compliance materials for dealers. Because of the general nature of this article, it is not intended as legal or compliance advice to any person but raises issues you may want to discuss with your attorney or compliance professional.