The largest monetary penalties handed out by the Consumer Financial Protection Bureau (CFPB) since Rohit Chopra became director in October surfaced publicly on Tuesday afternoon.

And those penalties surpassing $19 million relate to auto financing.

The CFPB penalized Hyundai Capital America for what the regulatory said was repeatedly providing inaccurate information to nationwide credit reporting companies and failing to take proper measures to address inaccurate information once it was identified between 2016 and 2020.

The CFPB explained through a news release that it found that Hyundai’s captive used manual and outdated systems, processes and procedures to furnish credit reporting information that led to widespread inaccuracies and resulted in negative inaccurate information being placed on consumers’ credit reports.

In total, the CFPB said it found that Hyundai Capital America furnished inaccurate information in more than 8.7 million instances on more than 2.2 million consumer accounts during that period.

Officials said their order requires the captive to take steps to prevent future violations and to pay more than $19 million, including $13.2 million in redress to affected consumers who were inaccurately reported as delinquent and a $6 million civil money penalty, making this development the CFPB’s largest Fair Credit Reporting Act case against an auto servicer.

“Hyundai illegally tarnished credit reports for millions of borrowers, including by falsely reporting them to credit reporting companies as being delinquent on their loans and leases,” Chopra said in the news release. “Loan servicers must be complete and accurate when furnishing information that affects a borrower’s credit report.”

Hyundai Capital America purchases and services retail installment contracts and vehicle leases originated by 1,600 Hyundai, Kia, and Genesis dealerships. The CFPB said the captive currently services approximately 1.7 million customers through its retail installment contracts and leases and has more than $45 billion of reported assets as of 2021.

Hyundai Capital America sent this statement to Cherokee Media Group on Tuesday afternoon.

“The Consumer Financial Protection Bureau (CFPB) initiated a review of Hyundai Capital America’s (HCA) credit reporting practices for its consumer retail and lease accounts, which was part of a larger credit reporting review by the CFPB across the industry,” the captive said. “To support our customers and allow us to focus on the future, we have entered into a settlement agreement with the CFPB.

“It is important to note that HCA is not admitting any fault or wrongdoing with respect to credit reporting practices covered by the investigation,” the captive continued. “As part of HCA’s efforts to drive continuous improvement, we have already launched an end-to-end review of our current credit reporting practices. Most importantly, we remain fully committed to providing our customers with timely, accurate, high-quality service and care.”

What went wrong

The CFPB said it received “many” consumer complaints that Hyundai inaccurately reported account information to credit reporting companies. During its investigation, the CFPB said it found that Hyundai repeatedly provided inaccurate credit report information about consumer payments on installment contracts and leases that Hyundai purchased and serviced.

“In many cases, Hyundai knew it was providing inaccurate information and failed to take reasonable measures to address the inaccuracies,” the CFPB said. “Hyundai identified many of the issues causing these inaccuracies in its internal audits, but still took years to address the problems.”

Between January 2016 and March 2020, the CFPB said it also found the captive violated the Fair Credit Reporting Act (FCRA) and its implementing regulation, Regulation V, by:

—Failing to report complete and accurate contract and lease account information: The bureau said the captive repeatedly did not take steps to promptly update and correct information it furnished to credit reporting companies that it determined was not complete or accurate, and continued to furnish this inaccurate and incomplete information.

—Failing to provide date of first delinquency information when required: The CFPB reiterated the FCRA requires data furnishers to provide credit reporting companies the date of delinquency for when a delinquent account is being charged off or placed for collections. The bureau said the captive failed to report a date of delinquency for many consumers who were more than 90 days delinquent.

—Failing to modify or delete information when required: The CFPB said the captive’s furnishing system often overrode manual corrections made by employees in responding to consumer disputes. The furnishing system would provide monthly updates to credit reporting companies that reintroduced the data error after it had been disputed and corrected, according to the regulator.

—Failing to have reasonable identity theft procedures: The bureau also mentioned FCRA requires furnishers to respond to any notifications from credit reporting companies about furnished information that is the result of identity theft. The CFPB said the captive failed to establish reasonable identity theft and related blocking procedures to respond to identity theft notifications and continued to report such information that should have been blocked on a consumer’s report.

—Failing to have reasonable accuracy and integrity policies and procedures: The CFPB explained Regulation V requires furnishers to maintain written policies and procedures regarding the accuracy and integrity of the information furnished. The bureau said the captive failed to review and update its credit reporting furnishing policies and procedures from 2010 to 2017. It was not until 2021 that the company finally updated some of its credit reporting policies and procedures, according to officials.

More details of enforcement action

The CFPB specified the four components of its penalties against Hyundai Capital America, including

—Pay $13.2 million in compensation to current and former customers: As identified by the CFPB, consumers about whom the captive, after determining the information was inaccurate, furnished to credit reporting companies inaccurate information that the consumers were 30 or more days past due on an automobile retail installment contract or lease will receive compensation for the harm incurred.

—Pay a $6 million fine: The captive will pay a civil money penalty to the CFPB, which will be paid towards the victims relief fund. This fund provides compensation to consumers harmed by violations of federal consumer financial protection law.

—Take steps to correct all inaccurate account information: The bureau said the captive will review all account files that it currently furnishes to credit reporting companies and correct all inaccuracies and errors described in the order and send updated information to the credit reporting companies.

Hyundai Capital America will also examine its monthly furnishing data processes for the errors described in the order, take reasonable steps to identify such errors, and resolve identified errors before providing the data to any credit reporting company.

—Address procedures identifying and correcting inaccurate information: The CFPB said Hyundai Capital America will establish and implement written policies and procedures regarding the accuracy and integrity of the information relating to consumers that it furnishes to a credit reporting company. The captive must specifically include processes for identifying and promptly correcting systemic errors in its credit report furnishing system.

Hyundai Capital America will also examine current policies and procedures and implement changes to the practices of its employees to ensure that its employees properly route, categorize, investigate, and respond to all direct and indirect credit reporting disputes.

Both the Consumer Financial Protection Bureau and TransUnion used strong language in statements last week, as the regulator filed a lawsuit against the credit bureau, two of its subsidiaries, and an executive that the company said is no longer with the firm.

Because the bureau said the lawsuit stems from a 2017 law enforcement order CFPB director Rohit Chopra called TransUnion “an out-of-control repeat offender that believes it is above the law.”

The credit bureau responded by saying, “The claims made by the CFPB against TransUnion and John Danaher, a former executive, are meritless and in no way reflect the consumer-first approach we take to managing all our businesses.”

The CFPB recapped that its order with TransUnion was issued to stop the company from engaging in “deceptive” marketing, regarding its credit scores and other credit-related products.

“After the order went into effect, TransUnion continued its unlawful behavior, disregarded the order’s requirements, and continued employing deceitful digital dark patterns to profit from customers,” the bureau said in a news release, noting that its complaint also alleges that TransUnion violated additional consumer financial protection laws.

“I am concerned that TransUnion’s leadership is either unwilling or incapable of operating its businesses lawfully,” Chopra added in the news release.

The rest of TransUnion’s response also made assertions about how the CFPB operated ahead of the lawsuit filing. TransUnion went on to say:

In January 2017, TransUnion entered into a consent order with the CFPB relating to how it markets TransUnion Credit Monitoring, a subscription product that offers consumers credit monitoring and identity theft protection services, as well as access to their credit scores. Shortly thereafter, as required by the consent order, TransUnion submitted to the CFPB for approval a plan detailing how it would comply with the order. The CFPB ignored the compliance plan, despite being obligated to respond and trigger deadlines for implementation. In the absence of any sort of guidance from the CFPB, TransUnion took affirmative actions to implement the consent order.

We have been in compliance with our obligations and we remain in compliance with the consent order today. Rather than providing any supervisory guidance on this matter and advising TransUnion of its concerns — like a responsible regulator would — the CFPB stayed silent and saved their claims for inclusion in a lawsuit, including naming a former executive in the complaint. Despite TransUnion’s months-long, good faith efforts to resolve this matter, CFPB’s current leadership refused to meet with us and were determined to litigate and seek headlines through press releases and tweets. The CFPB’s unrealistic and unworkable demands have left us with no alternative but to defend ourselves fully.

Over the last several years, and under the direction of new leadership, TransUnion has led the credit reporting industry in making significant changes aimed at benefitting consumers and increasing transparency in the credit reporting process.

In its press release, the CFPB explained what dark patterns are, calling them “hidden tricks or trapdoors” companies build into their websites to get consumers to inadvertently click links, sign up for subscriptions, or purchase products or services.

“Dark patterns can complicate or hide information, such as making it difficult for consumers to cancel a subscription service,” the CFPB said.

“As alleged in the complaint, TransUnion used an array of dark patterns to trick people into recurring payments and to make it difficult to cancel them. For example, under federal law, Americans are entitled to a free credit report from TransUnion through annualcreditreport.com,” the CFPB continued. “TransUnion asked consumers to provide credit card information that appeared to be part of an identity verification process. TransUnion then integrated deceptive buttons into the online interface that gave the impression that the consumer could also access a free credit score in addition to viewing their free credit report.

“In reality, clicking this button signed consumers up for recurring monthly charges using the credit card information they had provided,” the CFPB added.

While the CFPB acknowledged in its press release that Danaher recently separated from TransUnion, the regulator explained why the executive’s alleged actions drew the agency’s attention.

“Among other things, Danaher determined that using an affirmative selection checkbox, required by the order to limit unintended subscription enrollments, would result in fewer enrollments into TransUnion’s Credit Monitoring service. Danaher instructed TransUnion Interactive to cease using the checkbox, which led to millions of enrollments,” the CFPB said.

The CFPB mentioned that it is seeking monetary relief for consumers, such as restitution or return of funds, disgorgement or compensation for unjust gains, injunctive relief and civil money penalties.

“The complaint is not a final finding or ruling that the defendants have violated the law,” officials said.

The entire CFPB lawsuit against TransUnion is available online as well as the regulator’s 2017 consent order with the credit bureau.

The Federal Trade Commission (FTC) took action against a firm that used a government website as part of its scheme connected with consumer credit reports.

This week, the FTC obtained an order halting a credit repair scheme that allegedly bilked consumers out of millions of dollars by falsely claiming they will remove negative information from credit reports, while also filing fake identity theft reports to explain negative items on customers’ credit reports.

At the request of the FTC and the Department of Justice, an FTC news release indicated a federal judge issued an injunction against Texas-based Turbo Solutions Inc., which does business as Alex Miller Credit Repair, and its owner Alex Miller.

According to a complaint filed by the Department of Justice on behalf of the FTC, the regulator alleged that Turbo Solutions and Miller operate a deceptive credit repair scheme that claims it can help repair consumers’ credit through a “two-step process,” but often fails to deliver on its promises.

The FTC said the company claims it can remove negative information from consumers’ histories through “advanced disputing” of negative items on a consumer’s credit report and by adding “credit building products” to boost credit scores, which can help consumers obtain loans and other credit at lower rates.

The complaint seeks both civil penalties and consumer redress, according to the news release.

Through the company’s website and Instagram account, Miller and his company claim, “We Delete Inaccurate and Negative Accounts,” and promise “results in 40 days,” according to the complaint.

The FTC said its complaint alleges consumers who call a phone number listed on the company’s website and Instagram account reach company representatives who often make many of the same false claims including that consumers’ credit scores would be boosted by 50 to 200 points, a violation of the Credit Repair Organizations Act (CROA) and the Telemarketing Sales Rule (TSR).

Before providing any services, however, the company illegally demands consumers pay a $1,500 fee up front, according to the complaint.

Furthermore, the regulator said Miller and his company have allegedly filed false identity theft reports — usually without customers’ knowledge — through the FTC’s identitytheft.gov website and deceptively claimed that negative items on consumers’ credit reports were the result of identity theft.

“IdentityTheft.gov is a resource for consumers, not scammers,” said Samuel Levine, director of the FTC’s Bureau of Consumer Protection. “Those who abuse this resource by filing fake reports can expect to hear from us.”

The FTC pointed out that credit reporting agencies may decline to remove negative items if they think an identity theft report was wrongly filed.

In fact, in many instances, the regulator said Miller and his company have failed to remove negative items from customers’ credit reports or histories and some consumers reported that their credit scores actually went down as a result of the company’s efforts.

The complaint also alleges that Miller and his company have violated CROA by failing to include disclosures detailing the cancelation policies and failing to provide all consumers with a copy of contracts they are required to sign to obtain the company’s services.

The FTC vote to refer the complaint to DOJ for filing was 4-0. The Department of Justice filed the complaint on behalf of the FTC in the U.S. District Court for the Southern District of Texas, Houston Division.

The court issued the injunction on March 18.

“Credit repair scams affect consumers who already are suffering from low credit scores,” said Principal Deputy Assistant Attorney General Brian Boynton, head of the Justice Department’s Civil Division. “The Department of Justice will use all tools at its disposal to stop credit repair agencies from engaging in unlawful conduct targeting financially vulnerable consumers.”

Beginning this summer, that applicant seeking auto financing might appear a little more worthy of being extended a contract because of upcoming changes by the three nationwide credit reporting agencies.

On Friday, Equifax, Experian and TransUnion announced significant changes to medical collection debt reporting to support consumers faced with unexpected medical bills.

The bureau said in a joint news release that these measures will remove nearly 70% of medical collection debt tradelines from consumer credit reports, a step taken after months of industry research.

According to the Kaiser Family Foundation, two-thirds of medical debts are the result of a one-time or short-term medical expense arising from an acute medical need.

After two years of the COVID-19 pandemic and a detailed review of the prevalence of medical collection debt on credit reports, Equifax, Experian and TransUnion said they are making changes to help people to focus on their personal wellbeing and recovery.

Effective July 1, the bureaus indicated paid medical collection debt will no longer be included on consumer credit reports.

In addition, Equifax, Experian and TransUnion said the time period before unpaid medical collection debt would appear on a consumer's report will be increased from 6 months to one year, giving consumers more time to work with insurance and/or healthcare providers to address their debt before it is reported on their credit file.

In the first half of 2023, Equifax, Experian and TransUnion also said they also no longer will include medical collection debt under at least $500 on credit reports.

The companies’ chief executive officer provided a joint statement on the decision to change medical collection debt reporting.

Mark Begor of Equifax, Brian Cassin of Experian and Chris Cartwright of TransUnion said, “Medical collection debt often arises from unforeseen medical circumstances. These changes are another step we’re taking together to help people across the United States focus on their financial and personal wellbeing.

“As an industry we remain committed to helping drive fair and affordable access to credit for all consumers,” they added.

TransUnion is trying to give auto-finance companies and other lenders and service providers the clearest glimpse possible of how well consumers handle their payments and other credit obligations.

As a result, TransUnion introduced its new point-of-sale suite of solutions since analysts said up to 100 million U.S. adults have used buy now pay later (BNPL) loans at least once in the past 12 months.

TransUnion rolled out this package of tools because the credit bureau said financial institutions currently do not have access to the valuable insights generated when consumers open and repay these new debt obligations.

The company saw the urgency for these tools based on the 38% of 2,949 U.S. adults in the TransUnion Consumer Pulse study conducted in February who said they had used a BNPL loan in the last 12 months, and the U.S. Census Bureau 2020 count of 258.3 million adults living in the U.S.

TransUnion predicted inclusion of point-of-sale loans on the consumer credit file is likely to benefit the populations most in need of new tools to build and improve their credit.

Approximately 9% of point-of-sale applicants studied by TransUnion are thin file (have three or fewer trades reported). The youngest generations — Gen Z and younger millennials — will benefit as people using this credit product tend to skew younger, according to TransUnion.

Analysts also mentioned one in three point-of-sale financing applicants (33%) are between the ages of 18 and 30, compared to 17% for the overall credit-active population.

And 43% of point-of-sale applicants fall into the subprime credit risk category, compared to 13% overall, according to the TransUnion credit database that classifies subprime as someone with a VantageScore 4.0 metric within the range of 300 to 600.

“The inclusion of point-of-sale loans including BNPL into credit reports and other risk management tools can help tens of millions of consumers gain access to more credit opportunities and potentially secure better loan terms,” said Liz Pagel, senior vice president and consumer lending business leader at TransUnion.

“TransUnion has taken a measured approach in developing our solution suite, working with the top BNPL lenders over the past three years to craft solutions that benefit consumers and do not penalize them for using these products frequently,” Pagel continued in a news release.

“TransUnion’s approach helps lenders and consumers ensure credit activity is captured in a manner that maximizes benefits for consumers and to the overall credit ecosystem,” she went on to say.

TransUnion explained that point-of-sale loans are transactional, like a credit card swipe, but they are underwritten as individual unsecured installment loans. Therefore, a consumer with normal shopping habits could originate several loans per year, which most existing credit models view as risky behavior.

“This could cause undue impact to millions of consumers’ credit scores, making scores less predictive,” TransUnion said.

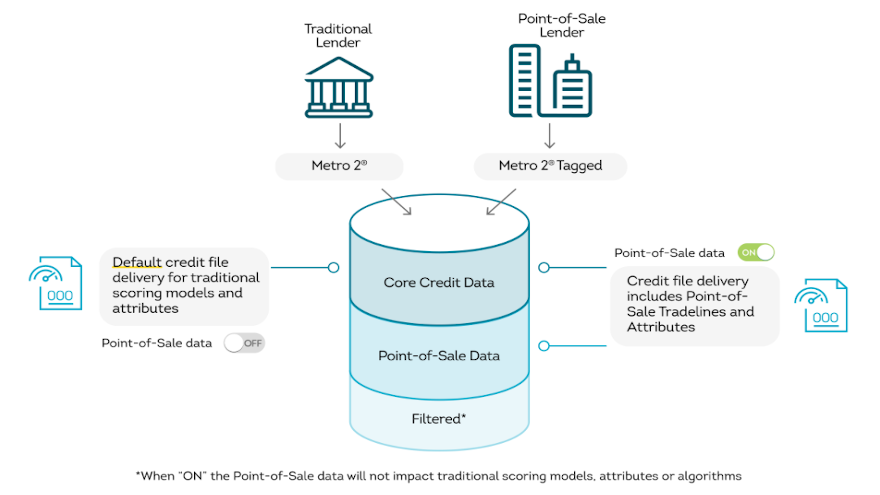

TransUnion is launching the capability to receive point-of-sale lender trades through the traditional credit reporting process, with specific Metro 2 reporting guidance that ensures FCRA compliance.

The credit bureau said the goal is to have a single standard for lenders to report data and accelerate adoption by lenders and scoring providers in the future. The information will be tagged and filtered into a new partitioned part of TransUnion’s core credit file.

Users of TransUnion credit data can choose to receive these tradelines as part of their existing credit data delivery.

Default credit report delivery, which feeds existing scoring models, will remain unaffected, according to TransUnion.

“Over time, as the industry works to enhance models with these data, it is expected that many lenders will choose to use the information in addition to their existing models to help expand their buy boxes — accelerating the consumer impact,” TransUnion said.

Long term, TransUnion highlighted that it plans on including point-of-sale data on the core credit file where it can maximize the number of credit decisions that it impacts.

“The industry needs time to adjust, and each lender will adopt the point-of-sale tradelines and attributes at its own pace,” Pagel said. “Maximizing the financial inclusion impact requires broad usage of this valuable data in more credit decisions.

Ultimately, given the prominence of FICO and VantageScore in the market, the biggest impact from the data will not be realized until the data migrates to the core file and these scores take into account consumers’ good behavior,” Pagel added.

The initial capability will allow FICO and VantageScore, along with major financial institutions, fintechs and other lenders, to have enough time to ensure that they build future versions of their underwriting models that give consumers credit for good performance on point-of-sale products.

“Buy Now Pay Later is helping many consumers access short-term credit for shopping at a time when prices are rising rapidly. BNPL can enable consumers that have not traditionally had credit records to build better credit scores,” VantageScore president and chief executive officer Silvio Tavares said in the news release.

“We think adding this data to credit scores may help drive broader financial inclusion and we are working rapidly to incorporate this into VantageScore models,” Tavares continued.

Sally Taylor is vice president and general manager of FICO Score.

“FICO is committed to financial inclusion and expanding credit access by leveraging more data, where available, and supported by empirical analysis,” Taylor said in the news release. “These are top priorities at FICO and we look forward to working with TransUnion to determine the best approach for inclusion of BNPL data in the credit file considered by the FICO Score family of products.”

More information about TransUnion’s point-of-sale suite of solutions can be found on this website.

Late last month, the three nationwide consumer reporting companies — Equifax, TransUnion and Experian — announced that they would allow people to check their credit reports for free once a week through December.

And coinciding with that decision, the Consumer Financial Protection Bureau (CFPB) is looking for other consumer reporting companies to make a similar move.

The bureau released its annual list of dozens of specialty reporting companies that collect and sell access to people’s data, including individuals’ finances, employment, check writing histories, or rental history records, “often without their knowledge,” according to a CFPB news release.

The list includes operations that the bureau described as “low-income and subprime reporting companies (that) provide consumer information to companies that market and sell products and services specifically to lower-income consumers and credit applicants with impaired credit records.”

The bureau said many of the specialty companies charge people a fee to access this data. The list published can allow people to see which companies provide this information for free, as well as search for those that provide specialized reporting by specific markets, including employment, tenant, insurance, and medical.

Using the list that can be downloaded via this website, CFPB director Rohit Chopra said people can exercise their right to see what information these firms have, dispute inaccuracies and file lawsuits if the firms are violating the Fair Credit Reporting Act.

“Many companies assemble and sell detailed dossiers about us that can determine whether we can get a loan, job, or an apartment,” Chopra said. “Americans have limited legal rights they can use to keep tabs on these surveillance companies and hold them accountable when they violate the law.”

The CFPB has previously highlighted problems that consumers have reported about the three nationwide reporting companies not adequately responding to consumer complaints about errors.

The CFPB also issued an advisory opinion in November affirming that all consumer reporting companies, including tenant and employment screening companies, have an obligation to use reasonable procedures to assure maximum possible accuracy.

A Florida-based group that owns and operates five franchised stores in the Sunshine State as well as Georgia and South Carolina is the first dealer group in the U.S. to work with Grow Credit, which is a financial inclusion platform committed to building credit and improving credit scores.

Murphy Auto Group is leveraging Grow Credit’s credit building service, which combines a small-dollar loan with a virtual Mastercard to manage subscription payments, such as Netflix, and reports loan balances to the credit bureaus. The MasterCard is issued through Sutton Bank and is exclusively designed to pay subscription payments.

Grow Credit is based in Santa Monica, Calif., and was founded in 2018 by financial industry veterans who are now expanding into automotive with partnerships like the one with Murphy Auto Group.

“With car financing APRs approaching pre-2018 levels, car ownership is more attainable than ever, but having to turn away a consumer because of a low credit score is something we never want to do,” Murphy Auto Group owner Michael Dennis Murphy said in a news release.

“With Grow Credit’s 'Grow & Drive' initiative, we’re able to provide a viable path to car financing that sustainably builds a customer’s credit. We believe in this product and are super excited by this partnership,” Murphy continued.

That “Grow & Drive” initiative can provide consumers who are denied auto financing the opportunity to develop their credit score in conjunction with the dealership. Grow Credit mentioned Bankrate data that indicated 21% of consumers were turned down for auto financing in 2020.

Here is how Grow Credit’s platform is designed to function, according to the news release.

When an applicant is denied auto financing, they are referred to Grow Credit where they can choose one of five memberships, designed to raise their credit scores. Grow Credit offers five memberships, including a free plan, a $1 per month credit builder plan for college-age students, and a $1.99 per month secured membership.

After obtaining their target credit score, Grow Credit re-engages with consumers to inform them of their financing eligibility status. As an added incentive for enrolling in Grow Credit, participating dealerships may extend a rebate of up to $200 for financing to consumers.

The customer can then return to the dealership to secure their financing and drive home in a vehicle.

Grow Credit looks to help consumers boost their credit score by leveraging their monthly subscription payment habits with more than 100 supported subscriptions.

“There’s never been an initiative like this that helps both the car buyer and automotive dealership. It’s mutually beneficial for a new car buyer and the dealership that the buyer has a good credit score and feels confident in their purchase,” Grow Credit founder and chief executive officer Joe Bayen said.

“By helping consumers attain a good credit score they can get access to financial products like car loans and credit cards with lower interest rates and better rewards,” Bayen continued.

On average, Grow Credit said its users have increased their score by 51 points after a year of on-time payments. On the free membership, the platform reports a $204 line of credit to Equifax, Experian, and TransUnion, allowing Grow Credit users to demonstrate a positive repayment history to build credit.

For more details, send a message to Grow Credit at [email protected] or sign up at www.GrowCredit.com/Partnerships.

The three largest credit bureaus extended free weekly availability of credit reports for another year to help consumers across the country manage their financial health during the ongoing hardship caused by COVID-19.

However, the Consumer Financial Protection Bureau also is returning to the pre-pandemic level of intensity in monitoring the data and information furnishers send to the bureaus that eventually land in those credit reports.

The three nationwide consumer credit reporting agencies — Equifax, Experian and TransUnion — are extending free weekly credit reports to Americans for an additional year to April 20, 2022.

Under federal law, all consumers are entitled to obtain one free credit report every 12 months from each of the three national consumer reporting agencies, and under other special circumstances. At the start of the pandemic, however, the agencies increased the frequency to weekly for a one-year period to help Americans understand and manage their financial health.

Equifax chief executive officer Mark Begor, Experian CEO Brian Cassin and TransUnion CEO Chris Cartwright made this joint statement about the extension.

“Access to financial information and records on a more frequent basis helps people plan for their future while also taking care of the present. We strive to make credit more accessible and available to people every day and we hope continuing to make free credit reports available each week is helpful to consumers,” they said.

The Consumer Data Industry Association (CDIA) recommended that individuals should review all items appearing in each section of their credit report. If an error is identified, they should contact the credit reporting agency immediately to initiate a dispute of that information.

“For consumers, ensuring that one’s credit remains in good standing during this time goes beyond paying mortgages, auto loans, credit card bills and other financial obligations each month. Consumers should have the tools they need to be knowledgeable about their financial information. The extension of free weekly credit reports is another way for people to regularly monitor their finances,” CDIA president and CEO Francis Creighton said in a statement.

Weekly credit reports can be requested at www.annualcreditreport.com.

Greater scrutiny from the bureau

Meanwhile, the CFPB announced it rescinded seven policy statements issued last year that provided temporary flexibilities to financial institutions in consumer financial markets including mortgages, credit reporting, credit cards and prepaid cards.

The bureau explained the seven rescissions — which became effective on Thursday — are designed to provide guidance to financial institutions on complying with their legal and regulatory obligations.

With the rescissions, the CFPB said it also is providing notice that it intends to exercise the full scope of the supervisory and enforcement authority provided under the Dodd-Frank Act.

Furthermore, the CFPB added that it is also rescinding its 2018 bulletin on supervisory communications and replacing it with a revised bulletin describing its use of matters requiring attention (MRAs) to effectively convey supervisory expectations.

In the statement made by the bureau specifically about credit reporting and references to the Fair Credit Reporting Act (FCRA), the CFPB said:

The statement expressed the bureau’s recognition of the impact of the COVID-19 pandemic on the operations of many consumer reporting agencies and furnishers, including staffing and related resource challenges confronting consumer reporting agencies and furnishers and their counsel. The bureau has concluded that since release of this statement such circumstances have changed. Since March 2020 and over the course of the COVID-19 pandemic, consumer reporting agencies and furnishers, have adjusted operations by, for example, shifting to a remote mode of operation. As states and other jurisdictions have rescinded and modified stay-at-home orders over the course of the pandemic, the bureau has learned that many entities have resumed some level of in-person operations and, in many instances combined with more robust remote capabilities, have demonstrated improved business continuity.

With regard to the temporary flexibility announced in the statement, the bureau believes that consumer reporting agencies and furnishers have had sufficient time to adapt to the pandemic and should be able to regularly meet their obligations under FCRA and Regulation V. In addition, because the statement did not create binding legal obligations on the bureau or create or confer any substantive rights on external parties, it did not create any reasonable reliance interests for industry participants.

CFPB acting director Dave Uejio recapped that the rescinded policy statements were initially issued between March 26 through June 3

“We are now over a year into the disruptive and deadly COVID-19 crisis. The virus has affected industry as well as consumers, but individuals and families have been hardest-hit by the pandemic’s health and economic impacts,” Uejio said in a news release. “Providing regulatory flexibility to companies should not come at the expense of consumers.

“Because many financial institutions have developed more robust remote capabilities and demonstrated improved operations, it is no longer prudent to maintain these flexibilities. The CFPB’s first priority, today and always, is protecting consumers from harm,” he went on to say.

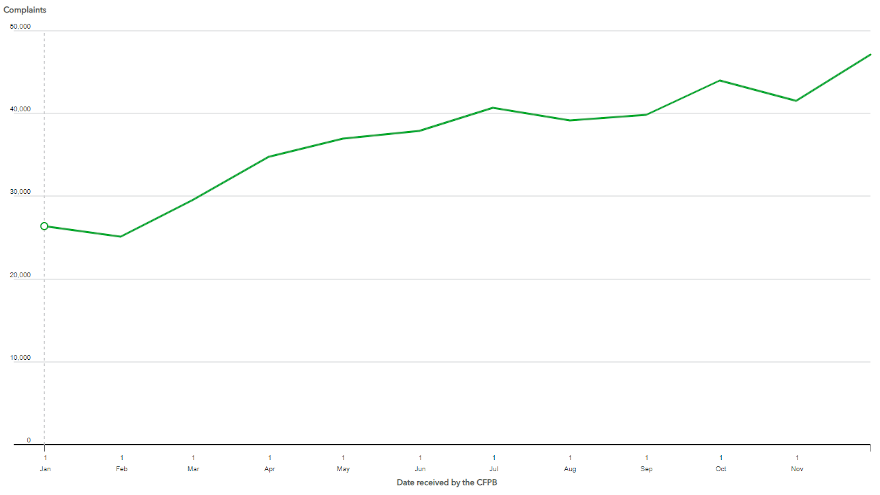

Consumer advocates and other regulators began National Consumer Protection Week on Monday in part by pointing to the significant jump in cases recorded in the complaint database housed by the Consumer Financial Protection Bureau.

According to the CFPB’s online dashboard, complaints in 2020 came in at 443,143; that’s up from the 206,607 complaints registered in 2019.

All told, the CFPB dashboard indicated there have been 1,987,591 complaints sent to the regulator since the database’s inception in December 2011.

By far, the category where the most complaints landed with the CFPB in 2020 fell within credit reporting. The dashboard said that category contained 282,977, more than double the next four categories combined. Those other four segments included debt collection, credit cards, mortgage and checking/savings accounts.

The U.S. PIRG Education Fund used those metrics as part of a report it released on Monday, stating that the number of complaints about credit reporting doubled in 2020 demonstrating what “a headache this industry causes for Americans.” The report pointed to consumer clashes with Experian, TransUnion and Equifax arriving amid the pandemic.

“Mistakes in credit reports lead to lower credit scores and denial of credit, housing or employment, but under President Trump, the CFPB gave the credit bureaus a free pass from handling consumer disputes in a timely manner,” said Lucy Baker, U.S. PIRG Education Fund’s consumer program associate.

“That hands-off approach couldn’t have happened at a worse time. It exacerbated family finance problems during a pandemic that had already left many consumers teetering on the edge of financial ruin,” Baker continued in a news release.

The report included several recommendations to Congress and the CFPB, including three steps that the consumer advocate organization said should be taken immediately. The suggestions included mitigating the financial harms posed by the COVID-19 pandemic; rescinding the actions the Trump administration took “to weaken CFPB rules against predatory payday lending,” and rolling back Trump-era rules that allow debt collectors “to harass debtors and other consumers.”

Frontier Group analyst and report co-author Gideon Weissman added, “The surge in complaints is a signal of the strain the pandemic put on consumers, and of the minefield of tricks and traps they face in the financial marketplace. Americans who share their stories are telling us exactly what kinds of help they need, and the CFPB would do well to start listening and responding.”

On Tuesday, the Senate is set to hold a hearing to question President Biden’s nominee, Rohit Chopra, to lead the CFPB. Should Chopra be confirmed, he would replace acting director Dave Uejio, who has taken an active stance since coming into the position in an interim capacity.

“Dave Uejio has acted swiftly to get the CFPB back on track to protecting consumers,” said Mike Litt, U.S. PIRG Education Fund’s consumer campaign director.

“The next step is Senate confirmation of Rohit Chopra to direct the bureau. Chopra helped build the CFPB from the start and he is the right person Americans need in the driver’s seat.”

Meanwhile, one of the most active state attorneys general also made an announcement on Monday in connection National Consumer Protection Week

New York attorney general Letitia James listed the top 10 categories of consumer complaints sent to her office last year. What James’ office classified as internet related led the way at 9,832 cases. Coming in No. 5 was automotive, including sales, financing and repairs, with 2,561.

“The havoc unleashed by the COVID-19 pandemic, in addition to the numerous other ways consumers were defrauded in 2020, sadly resulted in my office receiving a record number of consumer fraud complaints in 2020,” James said in a news release.

“Consumers who have helped identify and report issues to our office have been invaluable partners in our efforts to stop deceptive scams and will continue to be vital partners going forward,” she went on to say.

It turned out to be an active holiday season at the Consumer Financial Protection Bureau.

Along with naming two new staff members and reaching a consent order with a provider of personal loans, the CFPB also penalized Santander Consumer USA for the second time in three years.

The bureau issued a consent order against Santander to address the regulator’s finding that the finance company violated the Fair Credit Reporting Act (FCRA). Officials explained the consent order was issued in connection with SCUSA providing erroneous consumer loan data to consumer reporting agencies (CRAs).

The CFPB pointed out that Santander furnishes credit information on the auto contract it services by sending monthly data files to CRAs. The bureau said in a news release that it found that the consumer loan data Santander furnished to CRAs between January 2016 and August 2019 contained many systemic errors that, in many instances, could have negatively impacted consumers’ credit scores and access to credit.

The consent order requires Santander to take certain steps to prevent future violations and imposes a $4.75 million civil money penalty.

“The bureau found that Santander furnished consumer loan information to CRAs that it knew or reasonably should have known was inaccurate, including failing to furnish accurate information regarding whether accounts were open or closed and whether consumers were carrying a balance or obligated to make future payments,” the regulator said in that news release.

“The bureau found that Santander failed to promptly update and correct information it furnished to CRAs that it later determined was incomplete and failed to provide the date of first delinquency on certain delinquent or charged-off accounts,” the CFPB continued.

“The bureau further found that Santander failed to establish and implement reasonable written policies and procedures regarding the accuracy and integrity of information provided to CRAs,” the regulator went on to say while also noting that it believes Santander’s conduct violated the FCRA and its implementing regulation, Regulation V, as well as constituted violations of the Consumer Financial Protection Act of 2010.

Under the terms of the consent order, the CFPB indicated Santander must correct all inaccuracies and errors that the bureau identified and take certain steps to improve and ensure the accuracy of the consumer information it provides to CRAs. These steps include conducting monthly reviews of account information to assess the accuracy and integrity of information Santander furnishes.

“Santander must also establish and implement reasonable policies and procedures regarding the accuracy and integrity of information it furnishes to CRAs,” officials added.

SCUSA last faced an enforcement action from the CFPB just before Thanksgiving 2018 in connection with a GAP product.

And in May, Santander finalized a voluntary settlement topping $550 million with 33 states and the District of Columbia that alleged that contracts that the finance company funded through certain dealers dating back to 2010 violated consumer protection laws because of the high risk that certain individuals would default.

Lender involved in MLA violation

In other bureau enforcement activities before 2020 closed, the CFPB issued a consent order against Omni Financial of Nevada. The bureau said it found that Omni violated the Military Lending Act (MLA), Electronic Fund Transfer Act (EFTA), and Consumer Financial Protection Act of 2010 (CFPA) in connection with making installment loans.

Omni, which has its principal place of business in Las Vegas, specializes in lending to consumers affiliated with the military, originating tens of thousands of loans each year with individual loans typically ranging from $500 to $10,000.

The consent order requires that Omni pay a $2.175 million civil money penalty and imposes injunctive relief to stop ongoing violations and prevent future violations.

Officials explained the MLA puts in place protections in connection with extensions of consumer credit for active-duty servicemembers and their dependents who are defined as “covered borrowers.” These protections include prohibiting that loans to covered borrowers be required to be repaid by “allotment.”

The CFPB pointed out the Department of Defense runs the allotment system, which allows servicemembers to designate a portion of their paycheck to certain recipients. The bureau found that since October 2016, Omni’s loans to covered borrowers violated the MLA’s prohibition of requiring repayment by allotment.

The bureau added that it also found that Omni violated EFTA and the CFPA.

In addition to lending to active-duty servicemembers and their dependents, the bureau mentioned that Omni lends to civilians and non-covered servicemembers such as military retirees. The CFPB said it found that Omni requires all of its borrowers to provide bank-account information and authorize Omni to withdraw funds from that account on the first business day after each missed payment.

“Omni’s requirement that consumers allow it to withdraw funds from their bank accounts violates EFTA’s prohibition against requiring consumers to preauthorize electronic fund transfers as a condition of receiving credit,” officials said in a news release. “The bureau further found that these EFTA violations constituted CFPA violations.”

In addition to prohibiting future violations, the consent order requires Omni to provide notice of the bureau’s findings to all customers repaying their loans by allotment along with notice that they may change their repayment method.

Officials added that Omni also must provide training to employees and is prohibited from providing any incentives to employees or performance evaluations that consider the number or rate of consumers who choose to repay by allotment.

New staff members

And just before 2020 closed, the CFPB announced the addition of a deputy chief of staff and an assistant director for the office of innovation.

Ann Epstein will serve as the assistant director of the office of innovation. The CFPB said Epstein was most recently a financial technology consultant advising clients on consumer financial wellness and sustainable housing projects.

Before arriving at the bureau, Epstein worked for 18 years at Freddie Mac.

Jocelyn Sutton will serve as the deputy chief of staff for the bureau. Sutton joined the bureau in 2012. She worked in the office of regulations, before transitioning to the office of the director. Since then, she has served in various capacities, most recently as the bureau’s executive secretariat.