Perhaps nowadays more than ever, risk decisions are based on consumer income and employment information to grasp a potential retail installment contract holder’s ability to pay

This week, TransUnion rolled out a new seamless and real-time service to provide finance companies and other businesses access to verified income and employment data so underwriters have a more complete picture of their potential customer.

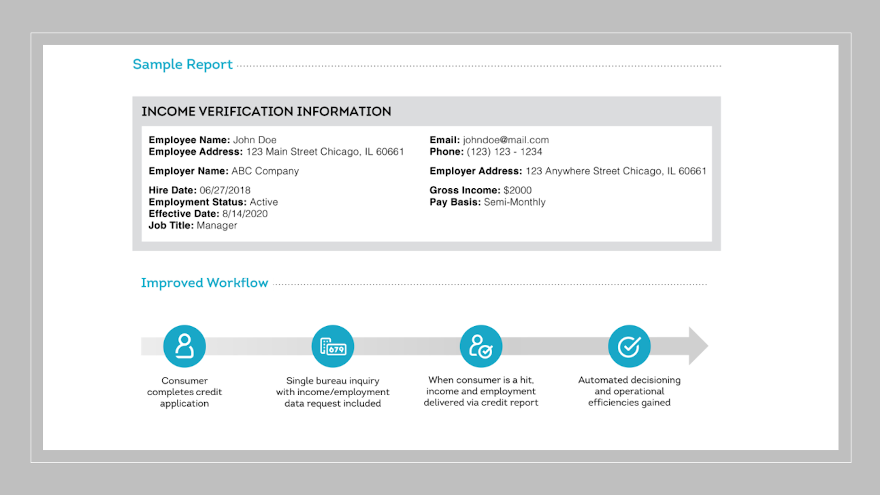

For the first time, TransUnion said this income and employment verification can be seen directly within the credit report. The company explained this capability can remove unnecessary overhead of separate integration efforts and related costs and improve the consumer experience.

“The economic downturn and rising unemployment mean that financial institutions and other organizations are seeking a more complete picture of the consumer as part of their acquisition and risk mitigation strategies,” TransUnion chief global solutions officer Tim Martin said in a news release.

“The current process is cumbersome as consumers often have to provide their own data, or lenders subscribe to separate processes — which could prohibit or slow consumers from accessing credit products and offers. TransUnion income and employment verification provides a much-needed alternative that improves the overall consumer experience,” Martin continued.

TransUnion noted that its income and employment verification is initially launching in collaboration with one of the leading payroll providers in the U.S., which will provide immediate access to tens of millions of active employment records.

The company pointed out that data is updated every pay cycle to supply the most recent view of a consumer’s employment status and income.

Martin added that this rollout marks TransUnion’s entrance into the income and employment verification market and is the first phase of a suite of solutions that will meet the evolving needs of both lenders and consumers.

“This launch demonstrates TransUnion’s commitment to developing innovative solutions that provide consumers access to the credit and services they need and deserve,” Martin said.

For more information on TransUnion’s income and employment verification, go to this website.

Experian’s latest analysis of the credit world showed what experts are calling “promising signs of responsible credit management,” which could benefit auto financing, too.

That assertion came among the key findings from Experian’s 11th annual State of Credit report, which examined how consumers are managing their credit histories against the backdrop of the COVID-19 pandemic.

Experian highlighted this year’s report provided an extended view into how consumers are managing and repaying their debts, showing most Americans are practicing responsible credit management by reducing utilization rates, credit card balances and late payments.

“Against the backdrop of the pandemic, we are seeing promising signs of responsible credit management, including lower credit card balances, decreased utilization rates and fewer missed payments — especially among younger consumers,” said Alex Lintner, group president Experian Consumer Information Services.

“Educating Americans about the factors included in their credit profile and how to manage these responsibly is of critical importance, especially on the road to economic recovery,” Linter continued in a news release.

When compared to 2019, Experian said, Americans are carrying fewer credit and retail cards and less credit card debt on average. Delinquency rates for 30-59 days, 60-89 days and 90-180 days past due all decreased year-over-year.

While retail spending, nonmortgage debt and mortgage debt increased, Experian pointed out that utilization rates — sometimes referred to as balance-to-limit ratios — decreased by 4% to 26% in 2020.

Analysts said these factors attributed to an average credit score of 688 — a six-point increase from the same period in 2019.

|

2020 State of Credit Report

|

2019

|

2020

|

|

Average VantageScore

|

682

|

688

|

|

Average number of credit cards

|

3.07

|

3.0

|

|

Average credit card balance

|

$6,629

|

$5,897

|

|

Average revolving utilization rate

|

30%

|

26%

|

|

Average number of retail credit cards

|

2.51

|

2.42

|

|

Average retail credit card balance

|

$1,942

|

$2,044

|

|

Average nonmortgage debt

|

$25,386

|

$25,483

|

|

Average mortgage debt

|

$213,599

|

$215,655

|

|

Average 30–59 days past due delinquency rates

|

3.9%

|

2.4%

|

|

Average 60–89 days past due delinquency rates

|

1.9%

|

1.3%

|

|

Average 90–180 days past due delinquency rates

|

6.8%

|

3.8%

|

Positive results driven by younger borrowers

Experian explained the year-over-year increase in average credit scores can be attributed to younger consumers practicing responsible credit management.

While average utilization rates dropped for every generation, analysts discovered the most significant decreases were seen in Gen Z consumers who saw a 6% reduction in their use of available credit, followed by millennials, or Gen Y, who saw a 5% decrease year-over-year.

While Gen Z and Gen Y are carrying more credit cards than they were in 2020, Experian reported their credit card balances decreased year-over-year.

Looking at 30-59 days, 60-89 days and 90-180 days past due delinquency rates showed Gen Z had fewer missed payments than all generations except the silent generation, according to Experian data.

Experts added lower utilization rates, less credit card debt and fewer missed payments fueled a 13-point increase in average credit scores for Gen Z and an 11-point increase for millennials.

“Credit scores are a reflection of the information included in your credit report,” said Rod Griffin, senior director consumer education and advocacy at Experian. “They are one piece of the puzzle. From buying a home to purchasing a new family car and much more, the types of purchases that are going to create meaningful change in consumers’ lives require a strong credit history.

“It is encouraging to see trends of responsible credit management for consumers of all ages,” Griffin went on to say.

|

2020 findings by generation

|

Gen Z

|

Gen Y

|

Gen X

|

Boomers

|

Silent

|

|

Average VantageScore®

|

654

|

658

|

676

|

716

|

729

|

|

Average number of credit cards

|

1.64

|

2.66

|

3.3

|

3.45

|

2.78

|

|

Average credit card balance

|

$2,197

|

$4,651

|

$7,718

|

$6,747

|

$3,988

|

|

Average revolving utilization rate

|

30%

|

30%

|

32%

|

24%

|

13%

|

|

Average number of retail credit cards

|

1.64

|

2.1

|

2.59

|

2.63

|

2.21

|

|

Average retail credit card balance

|

$1,124

|

$1,871

|

$2,353

|

$2,100

|

$1,558

|

|

Average nonmortgage debt

|

$10,942

|

$27,251

|

$32,878

|

$25,812

|

$12,869

|

|

Average mortgage debt

|

$172,561

|

$232,372

|

$245,127

|

$191,650

|

$159,517

|

|

Average 30–59 days past due delinquency rates

|

1.6%

|

2.7%

|

3.3%

|

2.2%

|

1.2%

|

|

Average 60–89 days past due delinquency rates

|

1.0%

|

1.5%

|

1.8%

|

1.2%

|

0.7%

|

|

Average 90–180 days past due delinquency rates

|

2.5%

|

4.4%

|

5.3%

|

3.2%

|

1.9%

|

Source: Experian

The coronavirus pandemic certainly has disrupted so many parts of finance-company operations.

But a group of seven industry organizations, including the American Financial Services Association, is urging federal lawmakers to make sure the pandemic impact doesn’t spread to one of the most important tools for underwriting and portfolio maintenance — credit reporting.

The organizations sent a letter this week to the top two members of the Senate Banking Committee to refrain from adding new credit reporting provisions that may negatively affect consumers as federal lawmakers consider potential financial provisions for the COVID-19 response legislation now being discussed on Capitol Hill.

The groups emphasized in the letter that the CARES Act established requirements that are “appropriately calibrated” to protect and preserve the long-standing benefits derived from credit reporting.

“Reliable credit reporting serves consumers well, enabling lower-cost and more expansive access to credit,” the organizations said in the letter.

Along with AFSA, the other organizations included in the letter were:

— American Bankers Association

— Consumer Bankers Association

— Housing Policy Council

— Independent Community Bankers of America

— Mortgage Bankers Association

— U.S. Chamber of Commerce

The organizations reiterated how important credit report are in all segments of financial services, not just auto financing.

“Financial institutions — including banks, credit unions, mortgage lenders, vehicle finance companies, installment lenders, payment card issuers, as well as the parties who support lending in the secondary market — depend on access to reliable historical information not only to originate, finance, insure, and invest in sustainable loans, but also to price those loans to make them as affordable as possible for qualified consumers,” the groups said.

“Following the reforms instituted in the wake of the Great Recession, public policy has supported the goal of ensuring that all lenders assess a borrower’s ability to repay a loan, an evaluation that depends on accurate information about the borrower’s debts and payment history,” they continued.

The groups address their letter specifically to Sen. Mike Crapo, chair of the Senate Banking Committee, and Sen. Sherrod Brown, the committee’s ranking member.

The organizations closed by projecting what pending legislative proposals to prohibit the reporting of credit information during the COVID-19 crisis might do to credit availability.

They wrote, to account for the uncertainty created by the unnecessary removal of credit information, loans would increase in cost, thereby reducing affordability. At the same time, the key institutions that help make credit available would pull back, again diminishing access to credit and increasing the cost of credit.

“These outcomes would be disruptive to the market and harm the financial well-being of consumers,” they added.

The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) will host a public workshop on Tuesday to discuss issues affecting the accuracy of both traditional credit reports and employment and tenant background screening reports.

The regulators shared 11 different questions they might be tackling in light of marketplace changes during the past five years.

Since the FTC released its 2012 study on accuracy in credit reporting, officials acknowledged there have been several changes in the landscape that impact the accuracy of consumer reports. In 2012, the CFPB began conducting supervisory reviews over large credit reporting agencies (CRAs), as well as various providers of consumer financial products or services that furnish information about consumers to CRAs.

In addition, in 2015, following state investigations regarding various credit reporting issues, officials recollected that the nationwide CRAs agreed to a multi-state settlement that requires stricter standards for matching records, removal of certain public record information, and restrictions on medical debt reporting. Also, new developments, such as the use of machine learning and alternative data in making eligibility determinations, present both opportunities and challenges for the consumer reporting industry.

The CFPB and the FTC said their workshop seeks to bring together stakeholders — including industry representatives, consumer advocates and regulators — for a wide-ranging public discussion on the many issues impacting the accuracy of consumer reports.

Potential topics for discussion include:

— What are the lessons from the CFPB’s supervisory reviews of CRAs and furnishers on accuracy and dispute obligations?

— What are the lessons from CFPB and FTC enforcement cases on furnisher and CRA accuracy obligations?

— How do furnishing practices differ based on the types of furnishers and the information they furnish to CRAs, and how does that impact accuracy?

— What has been the effect of the removal of most civil judgments and tax liens from credit reports and recent changes in the reporting of medical debt?

— How do background screening CRAs address accuracy in light of the limited personal identifying information included in public records?

— What opportunities or challenges does inclusion of non-traditional data in credit reports, credit scoring models, or background screening reports present for accuracy?

— Can new technologies and data management practices be used to improve accuracy?

— How do consumers learn about inaccuracies on their consumer reports and navigate the current dispute process? What are the experiences of victims of identity theft in the dispute process?

— How have the changes to the dispute process contained in the National Consumer Assistance Plan, which evolved out of the 2015 multi-state settlement, impacted the consumer experience?

— Once consumers get erroneous information removed from their credit files through the dispute process, do they still have difficulties getting loans or other credit?

— What government measures (including changes in the law) and private sector measures could improve accuracy? What are the costs and benefits of these possible measures?

The workshop, which is free and open to the public, will be at the Constitution Center, 400 7th St., SW in Washington, D.C., and will be webcast live on the FTC’s website.