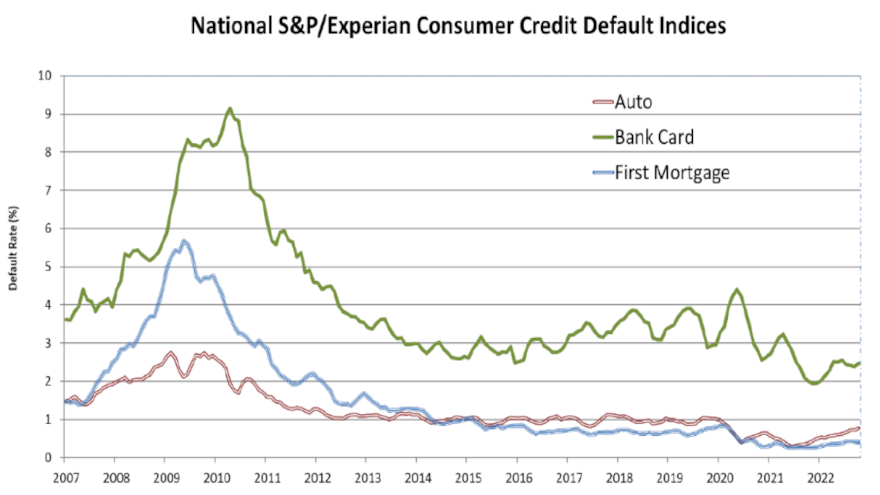

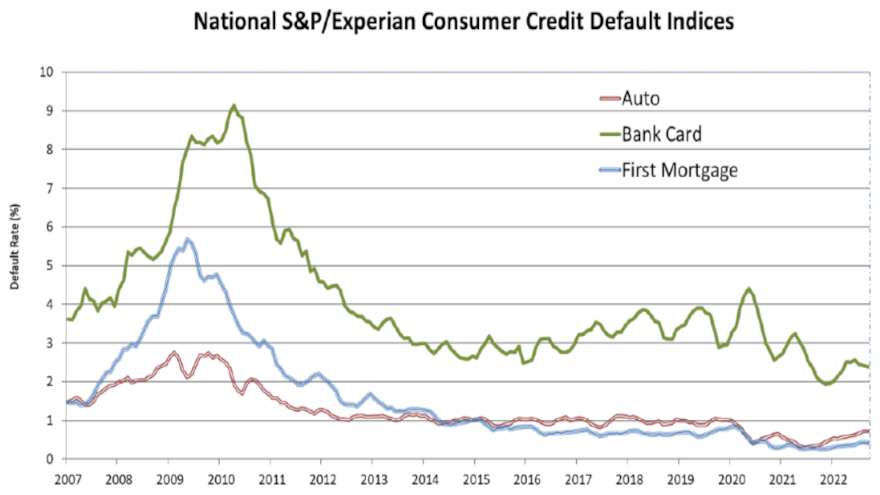

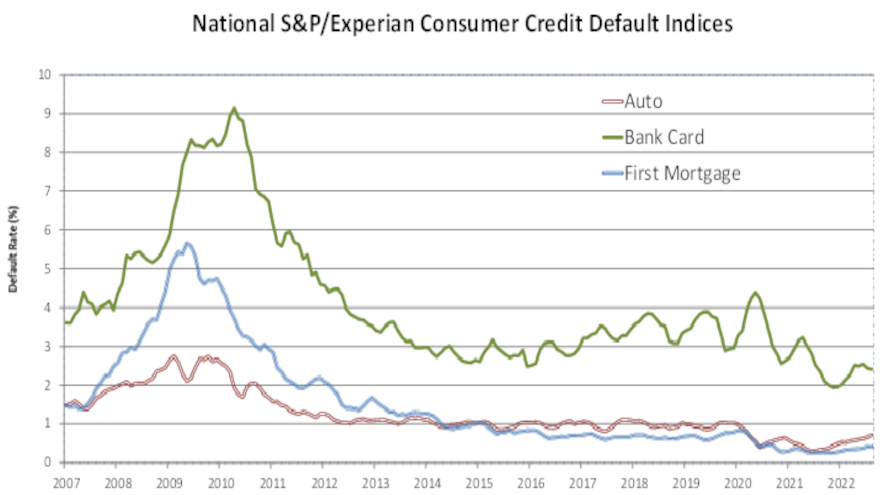

Interest rates have been rising for more than a year, and auto defaults are on a similar trajectory.

S&P Dow Jones Indices and Experian now have seen auto defaults climb nine times in the past 11 months.

According to data through January for the S&P/Experian Consumer Credit Default Indices, the auto default rate moved another …

Read more

Following a month when the auto default rate remained steady, credit availability for new paper tightened. Those findings are among the latest observations from Cox Automotive, S&P Dow Jones Indices and Experian.

Based on data through November for the S&P/Experian Consumer Credit Default Indices, the auto default rate remained unchanged at 0.77%.

The November reading also still is …

Read more

Auto defaults made the second-highest sequential jump so far this year in October, according to the S&P/Experian Consumer Credit Default Indices.

S&P Dow Jones Indices and Experian reported that data through October showed the auto reading at 0.77%, which was 5 basis points higher than September.

The only increase more than the latest one in the auto segment came in …

Read more

For the first time in almost two years, auto defaults stayed at the same level for consecutive months.

On Tuesday, S&P Dow Jones Indices and Experian released data through September for the S&P/Experian Consumer Credit Default Indices, and the auto reading came in at …

Read more

At least one part of the subprime auto finance market is starting to resemble what the landscape was before the pandemic.

S&P Global Ratings published a report last week highlighted the U.S. auto ABS sector’s performance for August, noting that it weakened, with prime and subprime losses increasing month-over-month.

Analysts explained the deterioration in subprime was …

Read more

Here’s another piece of auto finance industry data to consider as you close the books on another month and quarter.

While perhaps still relatively modest, auto defaults made their largest month-over-month rise so far this year. According to data from S&P Dow Jones Indices and Experian, the August auto default rate came in at …

Read more

While the auto finance default rate has ticked up during 11 of the past 12 months, none of those month-over-month increases have been more than 6 basis points.

The latest rise according to the S&P/Experian Consumer Credit Default Indices came in below that level, as data through July compiled by S&P Dow Jones Indices and Experian showed the auto default reading at …

Read more

What Kroll Bond Rating Agency (KBRA) has been discussing for much of the year continues to come to fruition.

Analysts said July remittance reports showed a second straight month of deteriorating credit performance and declining recovery rates across securitized prime and non-prime auto finance pools.

According to its latest update, annualized net losses in

Read more

After recently releasing its monthly indices, Kroll Bond Rating Agency (KBRA) asked a question that your finance company might be pondering, too.

Considered through the prism of the auto securitization market, KBRA titled a new report, Auto Loan ABS: Rough Road Ahead?

Analysts began their response by giving their assessment of the current auto finance landscape.

“Government stimulus, a strong labor market and a sharp rise in used-vehicle prices helped to push auto loan delinquency and loss rates to historic lows in 2020 and 2021,” KBRA began in the report. “However, given the recent and expected rate hikes as central banks desperately battle inflation, improving vehicle manufacturing logistics, and strong recessionary signals, the benign credit environment of the past two years may be in the rearview mirror.”

KBRA arrived at that rearview mirror analogy after recapping its latest metrics. Analysts said the percentage of securitized contracts sitting 60 days or more past due rose to 1.52% in June. That’s 86 basis points higher year-over-year and 40 basis points above the same month in 2019, according to KBRA’s tracking via auto ABS data.

“However, we have not yet seen a corresponding rise in securitized net loss rates, as net losses have remained near historic lows,” KBRA said. “We believe the current divergence between delinquencies and losses — which typically track in lockstep — has been driven by two main factors.”

Analysts then articulated those two factors, including:

— High wholesale prices, which have boosted recovery rates

— Higher delinquency churn rates because some delinquent consumers have avoided repossession by making at least a portion of their monthly payments

KBRA explained that second reason is likely due to inflated replacement costs and elevated vehicle equity.

“However, we believe both factors are transitory, and as both metrics normalize, auto loan net losses will likely move higher over the coming months,” analysts said.

After noting those trends, KBRA turned its attention toward how portfolios and resulting securitizations germinated, especially considering trends other firms such as Edmunds have highlighted in recent weeks.

“Surging vehicle prices and rising interest rates have led to increased initial loan amounts and higher monthly payments for borrowers,” KBRA said. “Originators have been cognizant of the potential negative credit implications that increased monthly payments may create. In some cases, originators have extended loan terms to keep monthly payments affordable.

“Additionally, many lenders have payment-to-income (PTI) thresholds built into their credit underwriting to further mitigate borrower cash flow risks. That said, we have observed rising PTI ratios across all credit segments, indicating that monthly payments have risen at a faster pace than borrower incomes,” KBRA continued.

If vehicle retail prices remain at current levels, KBRA is expecting recovery rates to settle back to their pre-pandemic norm of 45% to 50%, which will naturally place some upward pressure on net loss rates, according to analysts.

“However, if the pandemic-related supply and demand imbalances abate — causing used vehicle prices to soften — loans originated in today’s market will likely experience meaningfully lower recoveries than we have seen over the last 18 months, placing additional pressure on securitized credit performance,” analysts said.

KBRA wrapped up its report by elaborating about how it believes underwriting is currently unfolding and how those strategies helped to form its latest forecasts.

“Many of the loan originators in KBRA-rated transactions have indicated that valuation-related underwriting criteria, such as PTI, loan-to-value (LTV), and debt-to-income (DTI), have been appropriately considered as vehicle values rose,” analysts said. “For example, many auto finance companies have retained the same maximum borrower DTI or PTI knock-out rules in their underwriting criteria.

“If the value of the financed vehicle increases more than the borrower’s income, the maximum financed amount will be capped to maintain PTI and DTI ratios within required thresholds. If PTI or DTI criteria is exceeded, the loan will be declined, the term would be extended, or the customer would be offered a less expensive vehicle or required to pay a higher down payment,” analysts continued.

“Many loan originators have increased the down payment a borrower is required to make, helping to reduce initial LTVs. Only a handful of issuers have contributed loans to securitizations that were originated since vehicle prices began to plateau in the first few months of this year, as originators typically warehouse new loans for four to 12 months before transferring to a securitization,” KBRA went on to say.

“Although there may be a rough road ahead, as auto loan losses will likely trend higher in the coming months, any movement should be fairly gradual, and we do not expect losses to rise meaningfully above levels from the years immediately preceding the pandemic, as we believe most originators have factored many of these rising risks in their underwriting decisions,” analysts added.