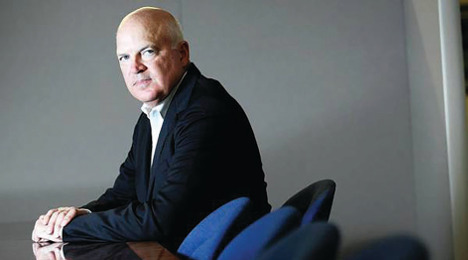

Consumer Portfolio Services chairman and chief executive officer Brad Bradley likes the position where the subprime auto finance company sits after the first quarter.

And it’s not just because CPS posted its 23rd consecutive quarter of positive earnings.

Bradley pointed to the difference where CPS stands with more than 25 years in the subprime business versus newer operations that might have only a fraction of that the portfolio seasoning.

During the company’s Q1 conference call conducted last week, Bradley touched on some similarities in the competitive landscape he’s seeing now that percolated back in 2008 and 2009.

“Both of those were some result of a recession. We haven't had a recession this time, but certainly feels a lot like there is going to be some consolidation in industry. We’re going to lose some of the competitors in the industry,” Bradley said.

“There is a lot of competitors in our industry struggling. Lots of small ones that came into the industry over the last couple of years are now having some real significant problems as the paper they’ve bought hasn’t performed,” Bradley continued a couple of moments later during his opening comments when he often shares his assessment of the entire subprime industry.

“They’re going to have more difficult access to the capital markets. And that also applies to some of the larger players in our industry who have grown real fast and haven’t really done as well as people might have expected. And so again many folks are waiting to see how that shakes out,” he said.

In terms of how the first quarter shook out for Consumer Portfolio Services, the company reported earnings of $4.5 million, or $0.16 per diluted share.

Meanwhile, revenue jumped 6.9 percent year-over-year to land at $107.6 million. However, the company’s Q1 operating expenses spiked 12.9 percent to $99.8 million; impacting in part on the year-over-year decline in net income.

A year earlier, CPS said, its net income came in at $7.2 million, or $0.24 per diluted share.

During the first quarter of 2017, CPS purchased $229.6 million of new contracts compared to $215.3 million during the fourth quarter of 2016 and $312.3 million during the first quarter of 2016. The company's managed receivables totaled $2.323 billion as of March 31, an increase from $2.308 billion as of Dec. 31 and $2.142 billion as of March 31 of last year.

“In terms of originations, as I mentioned, we haven't seen too much signs of tightening overall in the industry,” Bradley said. “I think some of the bigger folks, some of the larger banks have certainly talked about tightening, and you may be seeing a little bit of it there. Down in our end of the neck of woods, you really haven't seen too much of it lately.”

Bradley mentioned that CPS did tighten its loan-to-value ratio to the lowest point it has been since Q2 of 2014.

“We think LTV is one of the real indicators of what you're buying,” he said. “So, that would be an easy way to indicate that we certainly did do some tightening in the first quarter.

“I think other players will tighten as they go or maybe we’ll see more tightening, but at the moment certainly through the first quarter we haven’t seen too much other than sort of ourselves,” Bradley said.

Also noted in the company’s latest financial statement, CPS indicated annualized net charge-offs for the first quarter of 2017 stood at 7.91 percent of the average owned portfolio as compared to 7.57 percent for the first quarter of last year.

The company added its delinquencies greater than 30 days (including repossession inventory) involved 9.74 percent of the total owned portfolio as of March 31, as compared to 8.97 percent on the same date a year earlier.

CPS announces $225.2M securitization

In other company news, Consumer Portfolio Services also announced the closing of its second term securitization in 2017. The transaction is CPS’ 24th senior subordinate securitization since the beginning of 2011 and the seventh consecutive securitization to receive a triple-A rating on the senior class of notes from at least two rating agencies.

In the transaction, qualified institutional buyers purchased $225.17 million of asset-backed notes secured by $230.0 million in automobile receivables originated by CPS. The sold notes, issued by CPS Auto Receivables Trust 2017-B, consist of five classes.

Ratings of the notes were provided by Standard & Poor’s and Kroll Bond Rating Agency, and were based on the structure of the transaction, the historical performance of similar receivables and CPS’s experience as a servicer.

Note

Class |

Amount |

Interest

Rate |

Average

Life |

Price |

S&P

Rating |

KBRA

Rating |

| A |

$101.660 million |

1.75% |

.71 years |

99.99332% |

AAA |

AAA |

| B |

$38.985 million |

2.33% |

1.87 years |

99.99341% |

AA |

AA |

| C |

$34.155 million |

2.92% |

2.57 years |

99.98493% |

A |

A |

| D |

$27.715 million |

3.95% |

3.26 years |

99.97496% |

BBB |

BBB |

| E |

$22.655 million |

5.75% |

3.94 years |

99.98065% |

BB- |

BB- |

The company indicated the weighted average coupon on the notes is approximately 3.45 percent.

CPS said the 2017-B transaction has initial credit enhancement consisting of a cash deposit equal to 1.00 percent of the original receivable pool balance and over-collateralization of 2.10 percent.

The final enhancement level requires accelerated payment of principal on the notes to reach overcollateralization of 7.45 percent of the then-outstanding receivable pool balance.

Officials went on to note the transaction utilizes a pre-funding structure, in which CPS sold approximately $145.7 million of receivables in April and plans to sell approximately $84.3 million of additional receivables during May.

“This further sale is intended to provide CPS with long-term financing for receivables purchased primarily in the month of April,” the company said.

Financial advising firm UBS used the grim illustration of the “canary in the coalmine” at the beginning of a report it released this week involving the subprime auto finance space. To recap, that illustration stems from miners using caged canaries as a crude toxic gas detection method.

While birds didn’t appear to be harmed as UBS analysts compiled their report, they did acknowledge that a combination of factors has created an interest spike in subprime auto finance five times the normal level the firm typically receives from the investment community. The combination of deteriorating subprime auto finance metrics and results from its first-quarter consumer survey shedding light on the likelihood people will default sometime this year triggered the Wall Street fervor, according to the report obtained by SubPrime Auto Finance News.

“There are increasing signs that risky assets are vulnerable at elevated levels, from upticks in consumer delinquencies, to a major slowdown in bank and non-bank lending, to a stubborn increase in delinquent working capital loans,” UBS strategists Matthew Mish and Stephen Caprio wrote in the report.

The sentiment about defaulting came from UBS’ own research. Its Q1 survey revealed that 17 percent of participants said they either “strongly agree” or “agree” with the statement that "I am likely to default on a loan payment over the next year.” That question about payment not only includes auto financing but also other non-mortgage categories such as credit cards and student loans.

While the reading softened by 1 percentage point on a sequential basis, UBS pointed out the level soared about the survey mark generated in Q3, which was 12 percent.

And in terms of demographics, UBS’ survey showed that consumers between the ages of 21 and 34 told the firm they were most likely to default this year. Also of note, the annual income level of participants who acknowledged a default was coming this year was the highest segment among the three designated by UBS — individuals making $100,000 or more annually.

Mish and Caprio also referenced a previous report they compiled that mentioned many elements regarding delinquency and default previously highlighted by SubPrime Auto Finance News. The trends touched on S&P Global Ratings reporting that collateral performance in the U.S. subprime auto loan asset-backed securities (ABS) sector weakened in 2016 for the fourth straight year.

Also of note, the Federal Reserve Bank of New York indicated the amount of consumers who had a bankruptcy added to their credit reports during the fourth quarter softened to a new low going back 18 years.

The New York Fed reviewed Equifax data and found about 204,000 consumers had a bankruptcy notation added to their credit reports in the fourth quarter; an amount 4 percent below the same quarter in 2015 and a new series low that goes back to 1999.

In its UBS report, Mish and Caprio wrote, “Academic literature and recent data suggest the stigma associated with bankruptcy has declined post-crisis, particularly for the millennial generation.”

So with so much interest in the topic, what are Mish and Caprio telling UBS clients?

“We would limit corporate debt exposures in autos, auto lenders, rental car companies, credit card lenders, and non-bank providers of consumer loans and mortgages,” they wrote.

Cox Automotive chief economist Tom Webb cautioned watchers of the auto ABS market as well as managers who compute severity of loss at finance companies. Webb insisted that softening wholesale values and what vehicles might be fetching at the auction are not the only components potentially dragging on recovery rates and impacting financial statements.

Webb acknowledged during this final conference call for the company that the recovery rate on repossessions “have been very troubling for some lenders as of late.”

For example, Consumer Portfolio Services reported that as of Dec. 31, its finance receivables related to the repossessed vehicles in inventory totaled $40.1 million. CPS applied a valuation adjustment, or loss allowance, of $28.9 million, which was based on a recovery rate of approximately 28 percent.

And over at Nicholas Financial, the company reported at the close of the third quarter of its fiscal year that its write-off to liquidation percentage rose to 12.35 percent. Nicholas Financial defined this metric as net charge-offs divided by liquidation, which is the beginning receivable balance plus current period purchases minus voids and refinances minus ending receivable balance.

When explaining how he sees severity of loss, Webb said, “Please do not write this up as simply lower wholesale used-vehicle values. In many cases, that was the minor factor.

“Clearly if you inflate your loan-to-value ratio to 130 percent, your severity of loss will increase. But it’s even more than that,” he continued. “Just how squishy is that quote value in the loan-to-value ratio. Value is an editorialized guidebook assumption at the time of the contract origination, not the market value at the top of repossession. More importantly, what exactly is in that value figure? Service contracts? Fancy wheel rims etc. at $150 a pop? Or even the possible stealth hiding of negative equity to empower booking?”

With conjecture about diminishing recoveries impacting underwriting decisions — especially in the subprime space — Webb compared the situation to the fable, “The Boy Who Cried Wolf.” As you might recall, the story goes on about a shepherd boy who repeatedly tricks nearby villagers into thinking wolves are attacking his flock. When one actually does appear and the boy again calls for help, the villagers believe that it is another false alarm.

“In the end, there was a wolf,” Webb said.

So is credit availability about to be eaten up like a wolf might devour a sheep?

“I do expect that some time credit conditions will roll over,” Webb said. “Whether they roll over gently or not remains to be seen. That will put an additional downward pressure on used-vehicle values.”

Views on residual values

During the conference call, Webb also explained how changing used-vehicle values might be misunderstood in the leasing arena, as well. Of course, residual values are a huge factor since new-vehicle leasing constituted a roughly 30 percent of new-vehicle deliveries in 2016, according to reports released each quarter from Experian Automotive.

“It is not inconsistent for the Manheim Index to show high and stable pricing while at the same time our commercial consignors are reporting larger end-of-term lease losses and lower repo recovery rates. There are two simple reasons for that,” Webb said.

“First, the bleed-over from new-vehicle pricing. Let’s put it in very simple terms,” he continued. “Basically, the Manheim Index today has been flat for years. It was 124.4 in March 2014 versus 124.1 today. Meanwhile new-vehicle transaction prices rose from $32,073 to $34,342 today, according to Kelley Blue Book.

“Thus, if your three-year lease residual written in 2014 was at 45 percent, that meant an end-of-term dollar amount of $14,433,” he went on to say. “If wholesale pricing was flat, as it was, then at today’s new-vehicle pricing you would need to reduce your residual percentage to 42 percent. Well, we all know lessors did not reduce their residual assumptions. Indeed they raised them.

“So let’s face it, residual setting remains very much a look-in-the rear-view mirror type of exercise,” Webb added.

Webb also mentioned the return rate — a vehicle not bought by the grounding dealer nor by the lessee — is currently running at about 50 percent to 55 percent. Webb emphasized that level is much less than back in 2002 when return rates soared past 80 percent as many commercial banks got into the leasing game and the remarketing industry wasn’t as evolved as nowadays.

“As you get a wider spread between contract residuals and market values it certainly goes up,” he said. “As you get a higher number of units, it certainly goes up.

“We expect it to go up, but it will not go anywhere close to what it was in the last lease cycle in 2002,” Webb continued. “The primary difference is leasing is primarily controlled by the captive finance companies. They have a lot of carrots and sticks to get the grounding dealer to buy that vehicle at end of term. Of course, they offer that dealer a fair market price, not the contract residual.

“The reason a grounding dealer would pass is simply because he has too many of that particular model. He might have that particular car already in stock, so they’ll pass,” he went on to say.

Dealership compliance auditing firm Total Dealer Compliance (TDC) recently launched its virtual training platform: a solution aimed at helping stores mitigate risk faced by proactive regulators to create a culture of compliance at a fraction of the cost.

TDC claims to be charging roughly 80 percent less than its competitors for these virtual compliance training modules to enable dealers to be fully compliant with federal regulations across their sales, BDC, F&I, fixed ops, HR and IT departments.

TDC president Max Zanan explained this virtual compliance program comes at an impactful time for dealerships looking to strengthen their reputation and incorporate a culture of compliance without breaking the bank. Zanan said compliance is essential in today’s dealership environment as the count grows to 17,540 franchised dealerships and independent stores composing a level triple that number.

“With both the FTC and OSHA increasing fines for compliance violations, the cost for non-compliant car dealers average $792,000 loss per year in profit,” Zanan said. “Car dealers should proactively seek a solution that provides peace of mind and promises defensible proof of compliance to both auditors and executives.”

TDC’s virtual compliance training is readily available to all dealerships and includes the following:

• Comprehensive online training modules for each department and employee of the dealership

• Cloud-based e-learning platform with analytic reporting

• End of course assessment and certification

TDC’s virtual compliance training costs are based on user/employee headcount:

• Up to 25 employees: $699 annually

• Up to 50 employees: $1,299 annually

• Up to 100 employees: $2,499 annually

“As the nation’s leader in auto dealer compliance solutions and services, we are so proud to finally be able to provide this robust compliance training online and at a much lower price point than our competitors,” Zanan said.

“Compliance is essential to today’s dealership environment,” he continued. “With our courses updated throughout the year and both affordable and easily accessible, we are excited to help car dealers safeguard their business, mitigate risks and increase their profits.”

More details can be found by visiting www.totaldealercompliance.com or calling (888) 243-5204.

Digital Recognition Network (DRN) recently embedded DRNsights, powered by vehicle location data plus analytics, into Westlake Financial’s servicing platform to manage risk and reduce losses. The companies shared that Westlake’s recent monthly performance report showed DRN’s data assisted Westlake with an increase in recoveries and a drop in charge-offs during a one month period by using the new DRN-provided location data.

Digital Recognition Network highlighted its vehicle location data can improve the repossession process by helping finance companies recover up to 35 percent more vehicles and avoid charge-off losses. DRNsights leverage DRN’s vehicle location data and analytics to help finance companies better understand their customer’s needs, provide new locations for making right party contact, and enable faster recovery and reduce charge-off losses.

The vehicle location data is gathered 24/7, 365 days a year nationwide through license plate recognition (LPR) technology. DRN’s nationwide coverage with more than 5 billion vehicle sightings includes the date, time and location of each sighting. This data can provide alerts of possible risk, protection from lien losses, new locations for making contact on 30 percent or more accounts, the ability to collect earlier to reduce charge-offs, and a 50 percent reduction in the days to recover vehicles out for repossession.

“The top auto lenders in the U.S. have been using our vehicle location data for repossessions with great success for some time,” DRN chief executive officer Chris Metaxas said. “Those same lenders are now starting to use the data to help make right party contact.

“Under the leadership of Ian Anderson, group president of Westlake Financial and Jorge Alvarado, operations manager, Westlake is taking DRN’s data to the next level by deploying DRNsights earlier in the servicing process. The results have been remarkable; they are able to reach out to customers, cure loans and prevent loans from going into recovery,” Metaxas continued.

DRN provided Westlake training on the system that guided Westlake’s collectors through the process of using vehicle location data to enhance skip-tracing efforts

“We were impressed by the training and the impact it had on our servicing team,” Alvarado said. “Our servicing team remarked on the difference the training and DRN’s data and analytics will have on their success.”

Anderson looked back on the recent developments and where Westlake now stands with its collection efforts.

“We knew the power of DRN could assist us in locating and recovering vehicles, so it was only logical to integrate DRN data into our servicing process,” Anderson said. “By using DRN’s vehicle location data, we are provided notifications through a series of flags based on what the data demonstrates.

“This is a game-changer for us. We can help customers earlier in the process and we are more efficient with our servicing and recovery,” Anderson went on to say.

This week, repossession services provider Del Mar Recovery Solutions announced that the company expanded its partnership with MBSi Corp. to encompass MBSi’s new suite of products.

For the past several years, Del Mar Recovery Solutions has utilized MBSi’s iRepo platform to manage repossession assignments for many of its auto finance company clients. Del Mar Recovery Solutions will be expanding the partnership with MBSi with the adoption of Recovery Connect (RC) and Compliance Made Easy (CME), MBSi’s next generation assignment and compliance management platforms.

Executives explained the adoption of these two platforms allows Del Mar Recovery Solutions to integrate assignment and compliance management for full transparency of its agent network and assignment portfolio.

In today’s increasingly regulated industry, Del Mar Recovery Solutions said that it’s aiming to ensure that its agents are compliant, trained and meet the highest quality standards. MBSi’s CME suite, comprised of Contract Comply, Vendor Comply and Training Comply, along with the RC platform, not only can provide line-of-sight into the compliance status of each agent, but also can tie compliance data to the assignment level to ensure that each assignment is being serviced by qualified agents.

The RC platform that includes RC Office and RC Mobile can provide real-time field insight and efficiency during a recovery. Jeff Rau, senior vice president business development at Del Mar Recovery Solutions, said this level of transparency is geared to give clients the confidence in knowing that Del Mar Recovery Solutions can provide full agent compliance details, on-demand reporting and assignment-level compliance tracking throughout the repossession process.

“Utilizing these products will help bring these vital components into one ecosystem. This enables our staff to spend less time manually moving data between systems, and spend more time building stronger working relationships with our clients and vendors,” Rau said.

MBSi founder and general manager John Rhodes insisted MBSi is the first service provider to integrate compliance data down to the assignment level to offer the most complete and integrated assignment and compliance management solution on the market.

“We are pleased to be expanding our relationship with Del Mar Recovery Solutions,” Rhodes said. “Through our centralized vendor vetting database with complete compliance information, we have simplified Del Mar’s vendor compliance management.

"In addition, MBSi’s exclusive relationship with Recovery Industry Services Company (www.riscus.com) and their industry standard CARS (Certified Asset Recovery Specialist) training program allows Del Mar Recovery Solutions to provide its agents with continual education on the ever-changing compliance requirements of the auto repossession industry,” Rhodes continued.

Rau added that Del Mar Recovery Solutions believes that the transition to MBSi’s next generation platforms will provide significant benefits to its clients and vendors.

“We appreciate that change requires commitment and dedication,” Rau said. “We have thoroughly vetted these solutions and are confident that the long-term advantages of increased efficiency and compliance for our vendors will far outweigh any challenges.

“We began rolling out Recovery Connect 60 days ago and encountered some initial skepticism from some of our vendors, but after experiencing significant time reduction in recovery processing, those same vendors can’t imagine doing recoveries any other way,” he went on to say.

Alex Price, director of risk solutions at Digital Recognition Network and one of the leading experts on skip-tracing, will host the first segment of a free, four-part webinar series designed to give collection departments at finance companies “tactics and techniques that get results.”

The three main topics Price plans to cover during this 45-minute opening event include:

• How to find contacts to interview

• What you need to ask

• How to drive the conversation

The first skip-tracing series webinar is scheduled to begin at 2 p.m. ET on Wednesday.

“Getting the right information is the biggest challenge collectors and skip-tracers face,” Price said. “In a digital world, collectors and investigators often overlook one of the quintessential pillars of skip-tracing — the interview.

“In this 45-minute webinar, I will teach you interview tactics I have honed over the last 30 years that will get you vital information to retrieve more assets,” he continued.

Price also highlighted that future segments will be conducted on the second Wednesday of the month, each time starting at 2 p.m. ET. He noted additional details, including

Part 2: Tools of a skip-tracer on April 12

Part 3: Skip-tracing basics on May 10

Part 4: Vehicle behavior meets LPR on June 9

Managers and other finance company personnel can register for the opening webinar by going to this website.

The amount of debt consumers are absorbing to acquire a new or used vehicle reached record highs during the fourth quarter, according to the latest State of the Automotive Finance Market report from Experian.

With consumers turning to longer-term contracts to help reduce costs of monthly payments, Experian reported on Thursday the average contract amount for a new vehicle reached a record high of $30,621 in Q4 2016. The average finance amount for a used vehicle also reached record levels, jumping from $18,850 in Q4 2015 to $19,329 in Q4 2016.

The report also showed the number of consumers opting for contracts with terms of 73 to 84 months on their new vehicles increased from 29 percent in Q4 2015 to 32.1 percent in Q4 2016. In the used-vehicle market, Experian found there was an increase in 73- to 84-month loans from 16.4 percent in Q4 2015 to 18.2 percent in Q4 2016.

“With the average loan amount for new and used vehicles hitting all-time highs, we are seeing the need for affordability drive consumer purchasing behavior,” said Melinda Zabritski, Experian's senior director of automotive finance.

“Our latest research shows an $11,000 gap between the average loan amount on a new and used vehicle — the widest we have ever seen,” Zabritski continued. “This upward trend is causing many consumers to find alternative methods like extending loan terms, getting a short-term lease or opting for a used vehicle to get what they want while staying within their monthly budget.”

For consumers who still want to drive something new, Experian computed that leasing a new vehicle costs an average of $92 less per month compared with financing. The average monthly payment for a new leased vehicle is $414, versus $506 per month for a new-vehicle purchase.

The number of consumers who chose to lease a new vehicle increased slightly from 28.87 percent in Q4 2015 to 28.94 percent in Q4 2016, according to Experian’s report.

Delinquency on the rise, too

Another key finding in the report is the increase in delinquency rates year-over-year. Experian indicated 30-day delinquencies inched up slightly from 2.42 percent in Q4 2015 to 2.44 percent in Q4 2016, while 60-day delinquencies increased from 0.71 percent to 0.78 percent.

In response to these increases in delinquencies, Experian asserted that finance companies continue to adjust their underwriting strategies by shifting more contracts toward customers with better credit.

For new-vehicle financing, the average credit score moved from 712 in Q4 2015 to 714 in Q4 2016. For used-vehicle contracts, the average credit score jumped 5 points from 649 in Q4 2015 to 654 in Q4 2016.

Overall, Experian said financing to deep-subprime and subprime customers decreased from 22.05 percent of the total lending market in Q4 2015 to 20.82 percent in Q4 2016. Financing to prime and super prime customers jumped from 57.86 percent in Q4 2015 to 59.41 percent in Q4 2016.

“Delinquencies are always an important indicator of the overall health of the automotive lending market, but it's equally important to watch how lenders react when they see a rise,” Zabritski said.

“The shift to a higher percentage of prime and subprime customers is a natural consequence of the slight growth in delinquencies,” she continued. “Overall, we are still looking at a very healthy lending market.”

The report also showed that used vehicle financing grew to 41.85 percent in the super prime consumer segment, an increase of 5.4 percent year over year. Moreover, franchised and independent vehicle dealers saw their biggest year-over-year increases in super prime consumer lending, with 5.91 percent and 13.8 percent, respectively.

Other key findings for Q4 2016:

—Total open automotive finance balances reached a record high $1.072 trillion in Q4 2016, up from $987 billion in Q4 2015; however, year-over-year growth is continuing to slow.

—Banks lost market share of total vehicle financing, dropping from 35.6 percent in Q4 2015 to 32.9 percent in Q4 2016.

—Credit unions and captives increased market share of total vehicle financing, growing to 19.1 percent and 28.4 percent, up from 18 percent and 27.8 percent, respectively.

—The average monthly payment for a new-vehicle contract was $506, up from $493.

—The average new-vehicle lease payment was $414, up from $412.

—The average monthly payment for a used-vehicle contract was $364, up from $359.

While analysts looked to sooth concerns about the bank card default rate reaching a 42-month high, S&P Dow Jones Indices and Experian pointed out that auto finance defaults in January remained at a level typically seen during the opening month of a calendar year.

According to the S&P/Experian Consumer Credit Default Indices released on Tuesday, auto finance defaults came in at 1.06 percent, up 3 basis points from the previous month. For perspective, here are the January readings of auto finance defaults analysts have determined going back 10 years:

January 2007: 1.43 percent

January 2008: 1.98 percent

January 2009: 2.64 percent

January 2010: 2.57 percent

January 2011: 1.58 percent

January 2012: 1.27 percent

January 2013: 1.10 percent

January 2014: 1.11 percent

January 2015: 1.03 percent

January 2016: 1.04 percent

Meanwhile the January composite rate, a comprehensive measure of changes in consumer credit defaults, also ticked up 3 basis points from the previous month to land at 0.92 percent.

The January bank card default rate came in at 3.21 percent, up 26 basis points from December. While still generating a notable rise, the latest bank card default rate still is only a fraction of the all-time high S&P Dow Jones Indices and Experian spotted back in April 2010 when it was 9.15 percent.

When comparing the bank card default rates among the four census divisions, analysts noticed the default rate in the South is considerably higher than the other three census divisions.

Also of note, the January first mortgage default rate stood at 0.72 percent, up 1 basis point from December.

Turning to another segment of its monthly update, S&P Dow Jones Indices and Experian also reported all five major cities they track regularly saw their default rates increase in January.

Miami had the largest increase, reporting at 1.67 percent, up 14 basis points from December. Miami’s composite default rate now sits at a 31-month high.

Dallas and Los Angeles both reported 8 basis point increases from the previous month at 0.75 percent and 0.80 percent, respectively, in January.

Chicago saw its default rate increase 5 basis points to 1.03 percent.

New York reported a default rate increase of 1 basis point from the previous month at 0.88 percent.

David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, looked to offer some perspective on what the latest data means.

“While consumer credit default rates on mortgages and auto loans remain low and stable, default rates on bank cards have popped up to the highest level seen since July 2013,” Blitzer said. “Recent data point to consumer optimism: retail sales rose 5.5 percent in January compared to a year earlier, consumer sentiment measures rose over the last two years, and employment and labor market conditions are favorable.

“Federal Reserve data on consumer credit and mortgage debt outstanding reveal that consumers are borrowing money,” he continued.

“Current default levels do not present any immediate concerns for the economy,” Blitzer went on to say. “During 2004-2006, a period of strong retail sales and consumer spending, bank card defaults were higher than today. Moreover, even if interest rates were to increase much faster than the Fed or most analysts currently expect, the cost of borrowing money is unlikely to create problems for consumers.

“The weak spot, if there is one, would come with a rise in unemployment and an economic downturn,” he added.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

Consumer Portfolio Services chairman and chief executive officer Brad Bradley not only summarized how his company navigated the fourth quarter, but the outspoken industry veteran also perhaps gave a concise assessment of what’s happening at other subprime auto finance companies and the dealerships within their networks.

First, here are CPS numbers to give a backdrop of how Bradley approached his remarks during the company’s quarterly conference call with the investment community.

CPS posted its 22nd consecutive quarter of positive earnings, generating $7.5 million, or $0.26 per diluted share. The figure marked a bit of a drop-off from the $9.0 million, or $0.29 per diluted share, in net income the company posted during Q4 of 2015, but Bradley insisted the performance was in line with company expectations.

CPS’ revenue climbed 13.5 percent during Q4 and 16.1 percent for the full year, landing at $108.2 million and $422.3 million, respectively.

During the fourth quarter, CPS said it purchased $215.3 million of new contracts compared to $242.1 million during the third quarter of 2016 and $269.2 million during the fourth quarter of 2015. The company’s managed receivables totaled $2.308 billion as of Dec. 31, an increase from $2.292 billion as of Sept. 30 and $2.031 billion as of the close 2015.

The company’s annualized net charge-offs for Q4 stood at 6.97 percent of the average owned portfolio as compared to 6.23 percent for the fourth quarter of 2015. Delinquencies greater than 30 days (including repossession inventory) ticked up to 10.96 of the total owned portfolio as of Dec. 31 as compared to 9.53 percent a year earlier.

Bradley opened his remarks to the Wall Street watchers by referencing a Chinese proverb that states in part, “May you live in interesting times.”

He continued with, “We at least at CPS — and the industry — are living in interesting times. Again everything you see — higher delinquency, higher losses — now in the fourth quarter everybody slowed down as everybody dropped something between 15 percent and 20 percent in volume.

“There’s a lot concerns, regulatory and the economy and the industry in general. So these are interesting times,” Bradley went on to say.

Having been in the subprime auto finance business since 1991 is part of the reason why Bradley is confident CPS will navigate through whatever challenges might be coming later this year.

“Generally speaking that’s a lot of what the fourth quarter came out at, that’s a lot of what 2017 is going to come out at,” Bradley said. “(The company will be) trying to stay the course and just see how the rest of these moving pieces shake out and hopefully be in a position to take advantage of it and maybe be in a position to have done the best of everyone there. So we’ll see how it goes but that is kind of the focus we’re going to have.”

As mentioned previously, CPS bought less paper during Q4 and Bradley explained why — again referencing what might be the case for other companies, too.

“The business was slow in the fourth quarter, significantly slower than we would have expected. Again our focus is on quality over quantity,” Bradley said. “You can almost feel the other companies reaching to provide their earnings or the growth that they’re expected to have, (but) we’re not in that kind of position. And so we’re not trying so hard and as a result our numbers are down a bit. But again we would rather have the quality over the quantity any day of the week.”

Later in the call, Bradley went on to say. “Lot of people in the originations area are seeing more and more sort of challenging or bad loans that we don't want to buy, and that’s a real good indicator of what's coming out of the dealership. And the way it works is if we’re seeing a lot of good loans, it means we get what we want to the extent, and also it means that dealers have lots of loans to send you.

“To the extent that problems are getting more difficult, dealers start trying to push through riskier and not-as-good loans. And so when you start seeing more of those, you can almost tell that in the marketplace, the dealers are struggling just as much as we are because they’re trying to push through bad deals that we don't want and they know most times we’re not going to buy them,” he continued.

“So that gives you an idea that they're even trying to send and shows you that the market is difficult. But again keeping our originations model the way we want it, and buying what we want to buy, in the end will pay off much better than any other course,” Bradley said.

View of collections

Bradley also touched on how CPS is handling collections. It’s been nearly three years since CPS agreed to pay more than $5.5 million to settle charges from the Federal Trade Commission that the company used “illegal tactics” to service and collect consumers’ contracts.

“In terms of collections, I think everybody is now, at least we are, comfortable with the new dynamic that given all the technology our customers are a whole lot smarter and a whole lot more aware of what's going on. And so when we’re looking for them, they just look at their iPhone and decide whether or not to take the phone call,” Bradley said. “However, when we then tell them we’re going to take their car, they pay.

“And so we’ve now for over a year or more run this higher (delinquencies), but not with horribly higher loss rates,” he continued. “If the loss rates truly tracked the (delinquencies) that we’ve been seeing, the losses would be much, much worse. And so there really is this new thing or new dynamic where customers pay you when you’re going to take their car as opposed to just paying you as soon as you start calling them. We’ve gotten used to that.

“We’ve redone the way we collect and certainly part of that is the regulatory environment, the way you now have to speak to customers and how often you can call them and things like that,” Bradley went on to say. “That whole thing is now settled in as our culture has changed and so we’re real happy with that.”

Update on securitizations

Back in January, CPS announced the closing of its first term securitization in 2017. The transaction was CPS’ 23rd senior subordinate securitization since the beginning of 2011 and the sixth consecutive securitization to receive a triple-A rating on the senior class of notes from at least two rating agencies.

In the transaction, qualified institutional buyers purchased $206.3 million of asset-backed notes secured by $210.0 million in automobile receivables purchased by CPS. The sold notes, issued by CPS Auto Receivables Trust 2017-A, consisted of five classes.

Ratings of the notes were provided by Standard & Poor’s, DBRS and Kroll Bond Rating Agency, and were based on the structure of the transaction, the historical performance of similar receivables and CPS experience as a servicer.

Note

Class |

Amount |

Interest

Rate |

Average

Life |

Price |

S&P

Rating |

DBRS

Rating |

KBRA

Rating |

| A |

$99.12 million |

1.68% |

.87 years |

99.99906% |

AAA |

AAA |

AAA |

| B |

$29.92 million |

2.68% |

2.14 years |

99.98567% |

AA |

AA (high) |

AA |

| C |

$32.66 million |

3.31% |

2.84 years |

99.98111% |

A |

A |

A |

| D |

$24.57 million |

4.61% |

3.59 years |

99.99845% |

BBB |

BBB (low) |

BBB |

| E |

$20.05 million |

7.07% |

4.14 years |

98.98958% |

BB- |

BB (low) |

BB- |

The weighted average coupon on the notes was approximately 3.91 percent.

The 2017-A transaction has initial credit enhancement consisting of a cash deposit equal to 1.00 percent of the original receivable pool balance and over-collateralization of 1.75 percent.

The final enhancement level requires accelerated payment of principal on the notes to reach overcollateralization of 5.15 percent of the then-outstanding receivable pool balance.

Bradley mentioned in a company news release that the securitization CPS completed last October “achieved the lowest blended cost of funds of any deal since the second quarter of 2015.”

During the quarterly conference call, CPS chief financial officer Jeffrey Fritz added, “The asset-backed market continues to be very liquid, and so we continue to take advantage of that.”