Experian’s Q1 2021 State of the Automotive Finance Market report illuminated many attributes about the contracts originated during the opening quarter of the year, including how outstanding balances now are approaching $1.3 trillion as well as metrics based on geography.

This week, S&P Global Ratings shared insights about more seasoned paper, discussing how payments tracked in March as well as the depth deferrals and other accommodations still are being used.

Read more

Similar to an extensive response by the American Financial Services Association, Kroll Bond Rating Agency (KBRA) also refuted recent assertions by the Wall Street Journal that extrapolated TransUnion data to say that more than 9% of subprime auto financing was more than 60 days past due in the closing quarter of last year, which the article said was the highest quarterly figure since 2005.

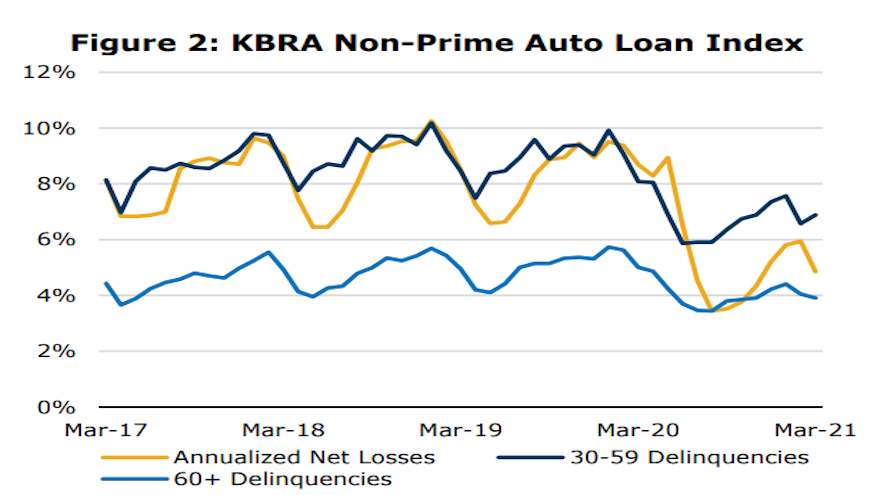

However, KBRA explained when analysts detailed their monthly ABS indexes showed that the delinquency readings are not that high. In fact, KBRA said March remittance reports indicated auto credit trends remained strong during the February collection period.

According to its latest report, early-stage delinquencies (30-59 days past due) in the KBRA Prime Auto Loan Index rose 1 basis point month-over-month to 0.90%, while late-stage delinquencies (60 days or more past due) declined 1 basis point to 0.35%.

Furthermore, early- and late-stage delinquencies in the KBRA Non-Prime Auto Loan Index moved in different directions, up 31 basis points and down 14 basis points, respectively. The actions left those delinquency readings at 6.88% and 3.91%, respectively.

“Annualized net losses in both indices came down from the prior month due to range-bound roll rates and favorable delinquency metrics earlier this year,” KBRA said.

“In both indices, delinquency rates remain meaningfully lower than year-ago levels, as government stimulus and hardship assistance programs have helped to keep many borrowers current on their loan payments,” analysts continued.

The recent Wall Street Journal article certainly triggered an industry response, as AFSA delved into a large well of data to form a completely different argument about the current status of auto financing.

KBRA pointed out that its non-prime index shows that 60-day delinquencies have remained around 4% over the past year, below pre-pandemic levels, as well as pre-crisis levels when adjusted for issuer composition.

Why did the Wall Street Journal create such a stir? KBRA explained the divergence is likely the result of several key factors:

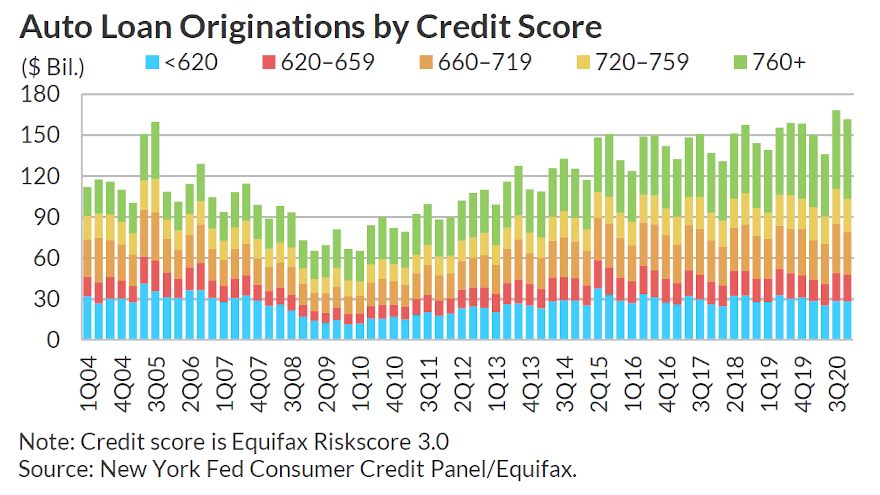

▪ Credit score: The KBRA Non-Prime Index tracks the performance of securitizations with a weighted average credit score of below 680, and analysts estimated that the weighted average credit score of the index is approximately 620. Meanwhile, KBRA the article cited the performance of contracts with a much lower borrower credit score ranging from 300 to 600.

▪ Credit drift: While the KBRA Non-Prime Index considers the credit score of a consumer at the time of origination, TransUnion’s reporting, “in our understanding,” uses the borrower’s current credit score, according to KBRA, meaning borrowers can drift in and out of TransUnion’s definition of subprime.

“Since subprime is TransUnion’s lowest credit cohort, performing borrowers may improve their scores and transition to a higher credit tier, while underperforming borrowers may fall from a higher tier at origination into this cohort, resulting in adverse selection within the subprime category,” KBRA said.

▪ Securitization accounting: KBRA noted that most securitization documents specify that a contract must be charged-off at 120 days delinquent, at which time the contract is no longer counted as delinquent in servicer reports, and by extension, in its nonprime index.

“Once a loan meets this criterion, the charge-off amount will be reflected in our index’s annualized net loss (ANL) rate. This is in contrast to TransUnion’s data, which may continue to count borrowers as delinquent past 120 days,” KBRA said.

▪ Denominator and seasoning effect: KBRA said it has observed positive consumer score migration through the pandemic as well as fewer originations in the subprime cohort due to lender credit tightening.

“As a result, we expect the total number of borrowers with a credit score below 600 (which is the denominator in the delinquency rate formula) to have fallen meaningfully and may have pushed the TransUnion delinquency rate higher in recent months,” KBRA said.

“Furthermore, as new originations slow, the average seasoning of loans in this cohort increases, and delinquencies as well as losses generally rise as months-on-book increases,” the firm went on to say.

With all of those factors in place, KBRA acknowledged that the auto-finance landscape could change since an analysis of March’s asset-level disclosures showed mixed credit metrics.

Analysts said the percentage of prime and nonprime contract holders who went from 30 days delinquent to current rose to 34.7% and 28.6%, respectively, down 314 basis points in prime pools and 560 basis points in non-prime pools versus the previous month.

But, KBRA discovered the percentage of prime contract holders who rolled from 60 days past due to charge-off dropped to 13.1% — down 8 basis points month-over-month — while the non-prime roll rate into charge-off jumped 228 basis points to 22.7%.

AFSA closed its blog post with this assertion about what reports such as what the Wall Street Journal article can do.

“AFSA member companies have always been there to support consumers through trying times, from a job loss to life-altering natural disasters. It is one of the great differentiators between traditional installment lenders and auto-finance lenders and less reputable payday or vehicle title lenders. It is a good story to tell. We are happy to share it and would hope fact-based reporters would find it compelling. This incident highlights another important component to our industry,” AFSA wrote.

“Trust is a big part of the relationship between a lender and a customer. Trust is earned. It is also diminished … in this case when reporters choose to not do basic due diligence to get the facts right,” AFSA concluded.

TransUnion discovered another way this pestering pandemic influenced consumer behavior when it comes to individual’s auto financing.

On Wednesday, TransUnion released findings of a payment hierarchy study focusing on the three most popular credit products in the U.S. — auto financing, credit cards and mortgages.

TransUnion indicated approximately 27.8 million consumers held balances within all three categories as of Q3 2020, and analysts found mortgages were clearly prioritized over the other credit products.

In fact, TransUnion said this dynamic has held true since Q4 2017.

However, analysts explained that the pandemic has caused even greater prioritization of mortgages over the other credit products.

For those consumers possessing auto financing, credit cards and mortgages, the 30 days or more past due delinquency rate at 12 months following observation was lowest for mortgages at 0.75%, as of Q3 2020.

TransUnion indicated auto financing had the second-lowest delinquency rate at 1.13%, followed by credit cards at 1.95%.

Analysts pointed out these findings very likely are connected to the growth in home prices over the last several years as housing markets across the country have remained strong, and consumers’ desire to protect the equity in their homes. TransUnion also acknowledged that as lockdowns and the shift to work/school from home permeated during the pandemic, keeping current on home loan payments took on increased importance in 2020.

“Mortgage is once again the clear priority for U.S. borrowers,” said Matt Komos, TransUnion’s head of research and consulting in the U.S.

“The mantra, ‘you can’t drive your home to work’ doesn’t have the same effect when millions of Americans are waking up, showering, eating breakfast and taking only a few steps to their home office,” Komos continued in a news release.

In addition to more people working from home and rising home values, TransUnion noted that mortgage loan performance is likely benefitting from thousands of mortgage borrowers entering accommodation programs soon after the onset of the pandemic.

The study indicated subprime and near-prime credit risk mortgage borrowers have been benefitting the most from these programs as they were able to delay payments and maintain their accounts.

Also of note, analysts spotted a shift in the prioritization of payments if a consumer possessed only one credit card.

Of the 27.8 million U.S. consumers in the study possessing an auto financing, credit card and mortgage, only 5.3 million people had one credit card in their wallet. For this subset of the population, TransUnion said mortgage remains the clear priority, but consumers with only one credit card valued it more than their auto financing beginning in Q2 2020.

Analysts explained this shift suggests the heightened importance of maintaining access to at least one credit card as online commerce and digital transactions have become a daily necessity for many U.S. households.

TransUnion survey data highlighted that U.S. consumers valued their mortgages over other loans because the credit product has the highest perceived value of all expenses.

Furthermore, analysts said six in 10 U.S. consumers expected to receive a call from their lender if they missed one mortgage payment and more than half (52%) said their missed payment would have a negative impact to their credit score.

Nearly one in five consumers (17%) said they would experience foreclosure or their home would be repossessed if they miss a mortgage payment, according to TransUnion.

“The pandemic has changed so much in the world, but understanding why consumers are making important credit decisions only serves to better help the lending ecosystem in the future,” Komos said.

For more information about TransUnion’s payment hierarchy report, go to this website. TransUnion is also hosting a webinar on April 22 to discuss the findings. Registration for that event can be completed here.

Consumers Prioritizing Mortgages Above All Other Major Credit Products

|

Credit Product 30+ DPD Rate** – Timeframe

|

Q3 2020

|

Q3 2019

|

Q3 2018

|

Q3 2017

|

Q3 2016

|

|

Auto Loans

|

1.13%

|

1.42%

|

1.37%

|

1.37%

|

1.23%

|

|

Credit Cards

|

1.95%

|

2.62%

|

2.40%

|

2.41%

|

2.12%

|

|

Mortgage Loans

|

0.75%

|

1.28%

|

1.29%

|

1.40%

|

1.34%

|

**30+ days past due rate at 12 months for those borrowers possessing all three credit products. Source: TransUnion

Fitch Ratings pinpointed subprime auto financing as one of five areas to watch should consumer indicators deteriorate; especially as federal assistance winds down and accommodations by finance companies expire.

Analysts made that assertion in a report shared with SubPrime Auto Finance News on Friday. Along with subprime auto financing, Fitch Ratings also mentioned certain segments of student loans, retail credit cards, unsecured consumer lending and mortgages to low- to moderate-income borrowers as the other credit segment the firm plans to monitor closely.

Fitch Ratings acknowledged that the most recent $1.9 trillion federal stimulus package provides substantial aid that will boost household income, specifically for lower- and middle-income individuals.

Among other measures, analysts recapped that the American Rescue Plan includes:

— One-time stimulus checks of $1,400 to individuals making less than $75,000

— Extends $300 enhanced unemployment benefits until Sept. 6

— Makes $10,000 of unemployment benefits tax free

— Grants fully refundable child tax credits

— Increases healthcare subsidies for those buying healthcare plans offered pursuant to the Affordable Care Act.

According to the Fitch Rating report, the Tax Policy Center estimated that the major tax provisions in the American Rescue Plan will lift after-tax income of the lowest income quintile by 20.4% and those in the second lowest quintile by 9.3%. However, Fitch Ratings pointed out that this boost in income is temporary, as the credits only apply for 2021.

“While the recent round of coronavirus stimulus will undoubtedly provide immediate financial boost to the U.S. consumers, particularly at the lower income levels, the long-term effects may not look as promising given a significant labor market dislocation due to the pandemic,” analysts said.

“We expect that as aid runs out and forbearance expires, weaker borrower loan performance is expected to worsen from current levels of strong performance,” they continued. “There will be an increase in defaults for those who may have been already struggling pre-pandemic and those with longer-term job loss.”

Fitch Ratings also touched on another element that’s impacting how it plans to monitor subprime auto financing and other credit products, noting that ABS asset performance has benefitted from credit tightening.

“Since the onset of the pandemic, many traditional lenders have pulled back from higher-risk lending and tightened their underwriting standards by raising minimum credit scores and down payment requirements,” analysts said. “This has restricted access to credit for many individuals with weaker credit profiles and lower incomes, as well as those who may have lost their jobs.”

Contract extensions for auto financing are trending down. Consumer expectations for their household financial situations are improving. President Biden just signed the newest federal stimulus package.

As individuals and industries acknowledged the first anniversary of COVID-19, analysts and experts are seeing a wide array of positive trends; ones that might help your current portfolio and future paper.

Beginning first with S&P Global Ratings, analysts there discovered that January showed extensions on auto paper in public asset-backed securities (ABS) decreased significantly relative to December.

For the public prime pools that the firm tracks, the monthly average extension rate decreased 27 basis points to 0.46% from 0.73%. And for public subprime pools, it dropped 134 basis points to 3.50% from 4.84%.

“We attribute the substantial improvement to stimulus checks that were paid in January ($600 per individual and child),” S&P Global Ratings analysts said in a news release. “These checks helped ease the financial burdens for many, thereby reducing the need for extensions. Employment levels also improved during the month, with nonfarm payroll employment increasing by 166,000.”

Even with the tremendous reduction in extension rates, S&P Global Ratings pointed out that they remained elevated relative to pre-pandemic levels recorded last January.

In the prime segment, extensions were 15% higher (0.46% versus 0.40%), while for public subprime issuances, they were 75% higher (3.50% compared with 2.00%).

“However, performance differed greatly by issuer, with many granting fewer extensions this January compared with a year ago,” analysts said.

Furthermore, S&P Global Ratings indicated the average number of full payments that have been made on contracts since their first COVID-19-related extension continues to grow. In December, analysts said they started to track the number of full payments made on contacts extended since March.

Consumer sentiment improves

Arriving this week, too, the Federal Reserve Bank of New York’s Center for Microeconomic Data released its February Survey of Consumer Expectations, which showed sharp increases in year-ahead gas and rent price growth expectations.

However, other segments of the survey showed positive trends.

For example, after remaining flat at 2% for the past seven months, the survey showed median one-year-ahead expected earnings growth increased to 2.2% in February, driven by respondents with more than a high school education. The overall median remains well below its year-ago level of 2.6%.

Analysts said mean unemployment expectations — or the average probability that the U.S. unemployment rate will be higher one year from now — decreased from 40.2% in January to 39.1% in February, falling slightly below its trailing 12-month average of 39.7%.

Also of note, the survey perceptions of credit access compared to a year ago and expectations for year-ahead credit availability both were largely unchanged in February. And the average perceived probability of missing a minimum debt payment over the next three months decreased from 10.5% in January to 10.1% in February, according to the survey, remaining below its 2020 average of 11.4%.

More stimulus funds

After the House and Senate passed the American Rescue Plan, President Biden signed it into law on Thursday. White House press secretary Jennifer Psaki said on Thursday afternoon that some individuals could see direct deposits into bank accounts as soon as this weekend.

Here’s an overview from the White House about the direct payments in the American Rescue Plan:

— For households who have already filed their income tax return for 2020, the IRS will use that information to determine eligibility and size of payments.

— For households that haven’t yet filed for 2020, the IRS will review records from 2019 to determine eligibility and size of payment. That includes those who used the “non-filer portal” for previous rounds of payments.

— For tax returns with direct deposit or bank account information, the IRS will be able to send money electronically. For those households for which Treasury cannot determine a bank account, paper checks or debit cards will be sent.

The White House then offered what the American Rescue Plan means for a typical family of four — with parents making $75,000 a year combined, and with children in school ages 8 and 5:

— That family of four will soon be getting $5,600 in direct payments, $1,400 for each parent and child.

— Because of the expanded Child Tax Credit, they will also get $2,600 more in tax credits than before.

“That’s $8,200 more in the pockets of this family as they try to weather this storm — on top of additional money in this bill to reopen schools safely, get shots in arms faster, and help those who have lost their jobs through no fault of their own,” the White House said.

Upbeat GDP forecast

Fueled in part by that federal stimulus, the first quarterly UCLA Anderson Forecast of 2021 expects robust growth for the U.S.

Following the 3.5% decline in real GDP in 2020, the national forecast called for 6.3% growth in 2021, 4.6% growth in 2022 and 2.7% growth in 2023. Forecasters said these rates of growth are considerably higher than the 2.3% rate the country averaged during the recovery from the Great Recession between 2010 and 2019.

The forecast also sees real GDP surpassing its 2019 peak by the end of the second quarter of this year and to surpass the trend it was on prior to the pandemic in early 2022.

“For the economy, a waning pandemic combined with fiscal relief means a strong year of growth in 2021 — one of the strongest years of growth in the last 60 years — followed by sustained higher growth rates in 2022 and 2023,” UCLA Anderson senior economist Leo Feler said in a news release.

“We have embarked on a once-in-a-lifetime policy experiment to test the ability of government intervention to make even deadly pandemic-sized economic shocks a short blip in our economic history,” Feler continued, also noting that governments around the world ensured a “vaccine race” by guaranteeing purchases and that U.S. policies helped keep businesses afloat and maintained employer-employee relationships.

“If the motto of the pandemic was to survive, the motto post-pandemic is to thrive, and because of the policies implemented to date, we’re in a position to have a rapid economic recovery,” he added.

“This all means we have the opportunity to test how much we can stimulate the economy and how rapidly employment can recover without overheating the economy,” Feler went on to say. “If real GDP goes above ‘potential GDP’ without generating sustained inflation, it will signal that we have been too modest in our assumptions about the productive potential of our economy … These next few years will help us discover if secular stagnation has been a myth we’ve mistakenly bought into and whether we have the capacity to grow much faster than we’ve done in decades.”

Kroll Bond Rating Agency (KBRA) spotted delinquency increases in both the prime and non-prime market segment in January, but analysts see metrics remaining on “solid footing” at least in the short term.

According to the firm’s latest report looking at January data, early stage delinquencies— what it classifies as 30 to 59 days past due — within the KBRA Prime Auto Loan Index climbed 7 basis points month-over-month to 1.04%, while late-stage delinquencies — 60 days or more past due — remained unchanged at 0.39%.

Meanwhile, analysts determined early and late-stage delinquencies in the KBRA Non-Prime Auto Loan Index climbed to 7.60% and 4.41%, respectively. Those January readings represented rises of 23 basis points and 19 basis points compared to the previous month.

In both indices, KBRA said delinquency metrics remained “meaningfully” lower on a year-over-year basis since government stimulus and hardship assistance programs have helped to keep many contract holders current on their monthly payments

“Similarly, annualized net loss rates continue to trend up, but remain well below pre-pandemic levels, partly driven by a strong used-car market and low delinquency rates since the start of the pandemic,” analysts said in the report.

“Moreover, recoveries on a large number of loans charged off early in the pandemic were delayed until later in the summer and fall, which has also helped to keep net losses subdued to date,” analysts continued.

“We expect auto loan credit metrics to remain on solid footing for the time being, as borrowers benefit from a second round of stimulus checks and an additional $300 of federal unemployment compensation passed by Congress and signed into law in December 2020,” they went on to say. “The additional impact of a third round of stimulus, which is currently being negotiated in Congress, would only serve to extend the positive credit trends we have seen since March 2020.”

KBRA closed its latest update by reviewing its examination of January’s Reg AB II asset-level disclosures. What analysts found was mixed credit metrics.

The firm said the percentage of prime and non-prime contract holders who went from 30 days or more delinquent to current came in at 31.9% and 28.9%, respectively. Those January readings constituted jumps of 112 basis points in prime pools and 188 basis points in non-prime pools compared to the previous month.

Furthermore, KBRA indicated the percentage of prime contract holders who rolled from 60 days or more past due to charge-off in January dropped to 13.9%; that’s down 53 basis points month-over-month. In the non-prime space, that roll rate into charge-off dropped 54 basis points to 21.5%.

Perhaps Kroll Bond Rating Agency (KBRA) offered evidence that the atmosphere in auto financing might actually be returning to normalcy, especially when it comes to delinquency and losses.

In April, KBRA placed 229 securities on watch across the unsecured consumer and auto ABS sectors. Over the subsequent months, the firm said credit performance has been better than expected, and the transactions have continued to pay timely interest, while credit enhancement levels have generally risen due to structural de-levering.

As a result, KBRA said all ratings previously on watch were removed from watch status and affirmed as of Oct. 23. This move included 169 unsecured consumer credit deals and 60 auto ABS deals.

“Unsecured consumer and auto loan performance has so far been resilient amid the pandemic, supported by government stimulus checks, enhanced unemployment benefits, and payment relief options offered by loan servicers. In addition, most originators had implemented tighter underwriting standards leading up to the crisis as many were anticipating a business cycle downturn,” KBRA said in its report that highlighted the watch moves.

“In the aggregate, we have seen lower net losses and delinquency rates from March through October compared to the start of 2020 and versus year-over-year levels. These trends demonstrate that borrowers are resuming payments, even as hardship assistance programs wane and additional government stimulus is stalled,” analysts continued.

“While delinquency rates have started to increase in recent months, KBRA believes this is a return to normal delinquency patterns rather than an indication of significant stress. KBRA expects delinquencies and losses to increase through the remainder of the year, however, this may again be moderated if an additional stimulus program is implemented and similar payment assistance programs are extended,” analysts went on say.

KBRA then elaborated on what elements could trigger more turbulence for auto-finance companies; factors outside of the industry.

“Even though securities have shown good performance, clouds remain on the horizon. The markets continue to operate in an uncertain environment in regard to the virus, and federal stimulus does not appear imminent, with some indicating it may not come until after the presidential inauguration,” the firm said.

“Further, many forms of relief including eviction moratoriums for renters and homeowners as well as mortgage and student loan forbearance, will expire as we enter next year. However, the deleveraging that occurred in many deals leaves them better positioned, from a credit enhancement perspective, to withstand future performance degradation, particularly investment-grade securities,” analysts went on to say.

S&P Global Ratings discovered contract extensions in both the prime and subprime credit segments are trending lower, according to its latest report released on Friday.

Analysts found that extensions in U.S. public auto loan asset-backed securities (ABS) declined for the fourth consecutive month in August. They made that assertion based on portfolio data filed with the Securities and Exchange Commission.

Across the 17 prime shelves tracked by S&P Global Ratings, extensions dropped 27% to 0.63% from 0.86% in July.

For the four public subprime shelves in their analysis, experts said extensions decreased 39% to 3.22% from 5.29% in August.

Also of note, S&P Global Ratings pointed out the outstanding balance of contracts remaining in extension status also decreased.

For prime paper, analysts spotted a 42% decline with the August reading coming in at 0.99%, after a reading of 1.71% in July. For subprime deals, the firm noticed a 34% drop with the August figure coming in at 7.88%, compared to 11.90% in July.

“This is an especially informative metric given that many of the prior months’ extensions were for multiple months — four months at a time in some cases,” S&P Global Ratings said.

Analysts mentioned a couple of other key observations, including:

• For public issuers, monthly extension rates declined for the fourth consecutive month in August due to the unemployment rate dropping to 8.4% from 10.2%. However, half of the subprime issuers reported an increase.

• The level of 60-day delinquencies for previously extended contracts whose deferral periods have ended increased to 1.58% from 1.29% in the prime segment and 4.27% from 3.46% in the subprime space as of the end of August.

“Despite mounting delinquencies on these loans, more are being repaid in full than are defaulting,” analysts said.

While credit performance has improved during recent reporting periods, TransUnion is cautious about the sustainability that contract holders can continue to make their monthly auto-finance payments along with other credit obligations. That sentiment stems from findings through its latest consumer survey.

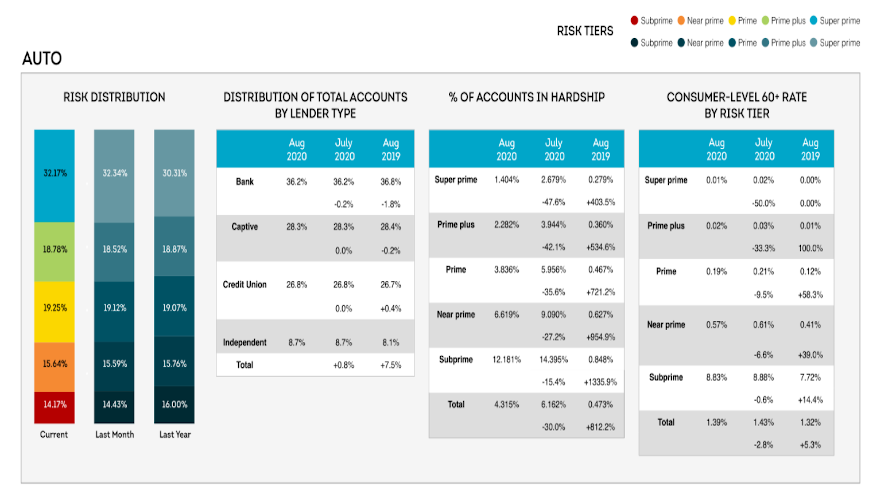

TransUnion reported on Thursday that serious delinquency rates in August improved once more across all consumer credit segments — including auto financing, credit cards, mortgages and personal loans — even as the number of people in accommodation programs dropped for the second consecutive month.

That assertion is part of TransUnion’s latest Monthly Industry Snapshot, which also points to potential challenges in the near future.

Since the start of the pandemic in March, TransUnion indicated consumer performance has been mostly positive with continued month-over-month improvements for many of these credit products.

“A significant percentage of consumers utilized financial accommodations to defer or freeze payments during the early stages of the pandemic. As the first wave of consumers exit accommodation and a period of excess liquidity, they are returning to their debt obligations and continuing to perform,” said Matt Komos, vice president of research and consulting at TransUnion.

“Consumers who still remain in hardship could be more likely to face income losses and thus have more difficulty exiting these programs than consumers who may have entered into hardship programs as a precautionary measure,” Komos continued in a news release.

August Industry Snapshot of Consumer-Level Delinquency Performance by Credit Product

|

Timeframe

|

Auto

|

Credit Card

|

Mortgage

|

Personal Loans

|

|

August 2020

|

1.39%

|

1.23%*

|

1.03%

|

2.53%

|

|

July 2020

|

1.43%

|

1.37%*

|

1.08%

|

2.79%

|

|

June 2020

|

1.50%

|

1.48%*

|

1.07%

|

3.11%

|

|

May 2020

|

1.55%

|

1.76%*

|

1.14%

|

3.14%

|

|

April 2020

|

1.33%

|

1.87%*

|

1.27%

|

3.27%

|

|

March 2020

|

1.37%

|

1.96%*

|

1.40%

|

3.40%

|

|

August 2019

|

1.32%

|

1.72%*

|

1.45%

|

3.08%

|

*Credit card delinquency rate reported as 90+ DPD per industry-standard; all other products reported as 60+ DPD. Source: TransUnion

The August Monthly Industry Snapshot Report found the percentage of accounts in “financial hardship” continued a downward month-over-month trajectory for auto financing, credit cards, mortgages and personal loans from the months of July to August.

TransUnion explained its financial hardship data includes all accommodations on file at month’s end and includes any accounts that were in accommodation prior to the COVID-19 pandemic.

Across all credit products, analysts determined the percentage of accounts in financial hardship during the month of August dipped to pre-May levels. Accommodation programs provided consumers with payment flexibility and added liquidity during the course of the pandemic.

However, as the number of consumers leveraging such programs decreases and government relief funds are not expected to renew, TransUnion acknowledged many consumers may find themselves at what the credit bureau called “an inflection point.”

August Industry Snapshot of Financial Hardship Status by Credit Product

|

Timeframe

|

Auto

|

Credit Card

|

Mortgage

|

Personal Loans

|

|

August 2020

|

4.32%

|

2.21%

|

5.92%

|

5.14%

|

|

July 2020

|

6.16%

|

2.83%

|

6.15%

|

6.92%

|

|

June 2020

|

7.21%

|

3.57%

|

6.79%

|

7.03%

|

|

May 2020

|

7.04%

|

3.73%

|

7.48%

|

6.15%

|

|

April 2020

|

3.54%

|

3.22%

|

5.00%

|

3.57%

|

|

March 2020

|

0.64%

|

0.01%

|

0.48%

|

1.56%

|

|

August 2019

|

0.47%

|

0.01%

|

0.86%

|

0.26%

|

Source: TransUnion

Potential challenges on the horizon

While serious delinquency rates continued to decline in August, TransUnion observed some negative movement in 30-day delinquency rates.

Analysts explained this metric — which may serve as an early indication that an account will default and potentially be charged off — increased slightly in August for the two largest payments consumers often have to make: their vehicle and mortgage payments.

“This uptick for both products could signify that consumers are starting to roll forward on deferred payments as they come off of hardship programs,” Komos said.

“However, it’s still much too early to tell. It could simply be a missed or delayed payment that is late by a few days or weeks, though the consumer’s intention is still to make the payment,” he added.

Komos mentioned that close attention is being paid to delinquency levels as TransUnion’s latest Financial Hardship Survey from the week of Aug. 24 found that COVID-19 continues to financially impact consumers.

While TransUnion discovered the percentage of financially impacted Americans dipped to 52% — the lowest level since the ongoing survey series began in March — the concern among impacted consumers regarding their ability to pay bills and other obligations remains high (75%).

According to the survey, TransUnion reported that about one-third of impacted consumers are turning to savings to pay bills or loans and 13% cited they plan to open new credit cards. Despite these concerns, data from the monthly snapshot found that consumers are continuing to make payments as the average credit card balance per consumer dropped to $5,127 in August, compared to $5,686 the previous year.

In addition, TransUnion noted the average Aggregate Excess Payment (AEP) — defined as the average amount consumers are paying over their respective minimum payments — increased to $330 in August. Although analysts acknowledged that average is similar to what they observed at the same time last year when it came in at $300.

“Many consumers have continued to make payments even when enrolled in financial accommodation plans,” Komos said.

“The real litmus test in regards to consumer credit health will become apparent in the coming months when these safeguards begin to expire and consumers have less payment flexibility,” Komos went on to say.

TransUnion’s August Monthly Industry Snapshot features insights on consumer credit trends around personal loans, auto financing, credit cards and mortgage loans.

Additional resources for consumers looking to protect their credit during the COVID-19 pandemic can be found at transunion.com/covid-19.

Kroll Bond Rating Agency (KBRA) found more evidence that federal assistance helped the auto-finance industry since August remittance reports showed what analysts called “solid” credit performance during the July collection period.

The firm’s newest report dissecting information from the auto ABS market released on Tuesday showed that early stage delinquencies — 30 to 59 days past due — increased 5 basis points month-over-month, but fell 42 basis points year-over-year to 0.80% in the KBRA Prime Auto Loan Index.

Meanwhile, analysts indicated the percentage of contract holders in the early stages of delinquency in the KBRA Non-Prime Auto Loan Index stayed at 5.91%. That level is months month-over-month but 367 basis points lower year-over-year.

KBRA reported that later-stage delinquencies — 60 days or more past due — dipped modestly month in both indices and remained “well below” the levels seen at this time last year, according to analysts, who added, “lower delinquencies in recent months resulted in fewer loan defaults that, coupled with a strong used-car market, have helped drive further declines in annualized net loss rates within both indices.”

KBRA elaborated how what federal intervention to help consumers negatively impacted by the coronavirus pandemic did to the latest trends. Analysts also discussed what movements might be ahead as more time passes since the expiration of assistance programs and other initiatives.

“We believe enhanced unemployment benefits and federal stimulus checks have helped borrowers catch up or stay current on their auto loan payments,” analysts said in their report. “The large percentage of borrowers receiving payment relief in recent months (in the form of loan extensions) has also likely contributed to keeping delinquency rates subdued.

“However, we expect delinquencies to climb in the coming months as enhanced unemployment benefits expired in July and borrowers began rolling off payment holidays over the last few months,” KBRA continued.

“Further stimulus, which at this point looks unlikely before the election, and a continuing labor market recovery could help soften the blow, but we still expect delinquency rates to rise through the latter part of the year given the ongoing impact of the pandemic across the country, leading to elevated charge-off rates and annualized net losses by year end and into 2021,” analysts went on to say.

KBRA wrapped up its latest analysis of August’s asset-level disclosures by mentioning the information showed mixed credit metrics during the July collection period.

Analysts discovered the percentage of prime and non-prime contract holders who went from 30 days or more delinquent to current dropped 116 basis points to 33.9% and 290 basis points to 33%, respectively, versus the previous month. KBRA pointed out the August readings are still slightly above their pre-pandemic levels.

Meanwhile, KBRA also found that the percentage of contract holders who rolled from 60 days or more past due to charge-off remained relatively flat in prime pools, rising 15 basis points to 17.3%.

However, this percentage decreased 200 basis points to 17.5% in nonprime pools; again “well below” pre-pandemic levels, according to the firm.