In its newest study of used-vehicle sales, LendingTree analyzed more than 600,000 auto-finance queries from prospective contract holders in the top 100 U.S. metro areas based on population.

Analysts found the city with residents financing the oldest used vehicle on average worked with providers adding units into their portfolio that were nearly 8 years old.

Topping this LendingTree list was Spokane, Wash., pushing the previous top city — Portland, Ore. — to 10th place. Vehicles in that eastern Washington city were 7.66 years old on average.

Coming in at No. 2 was Wichita, Kan., where the average age of used vehicles was 6.96 years, following by Ogden, Utah, with an average age of 6.80.

Conversely, LendingTree found that consumers in San Jose, Calif., in heart of the wealthy Silicon Valley, who are taking on auto financing prefers the newer used vehicles. The average there came in at 3.54 years.

Analysts noticed financed used-vehicle buyers in Miami also settled below the 4-year mark with used vehicles there being 3.85 years on average.

Across the board, LendingTree discovered the average age of vehicles for which people are seeking financing has dropped from 6 years in 2018 to 5.34 years in its latest data.

Those top 25 cities financing the oldest vehicles according to LendingTree’s research included:

1. Spokane, Wash.

2. Wichita, Kan.

3. Ogden, Utah

4. Knoxville, Tenn.

5. Colorado Springs, Colo.

6. Greenville, S.C.

7. Boise City, Idaho

8. Tulsa, Okla.

9. Chattanooga, Tenn.

10. Portland, Ore.

11. Winston-Salem, N.C.

12. Albuquerque, N.M.

13. Salt Lake City

14. Grand Rapids, Mich.

15. Dayton, Ohio

16. Des Moines, Iowa

17. Columbia, S.C.

18. Virginia Beach, Va.

19. Bakersfield, Calif.

20. Greensboro, N.C.

21. Kansas City, Mo.

22. Augusta, Ga.

23. Louisville, Ky.

24. Omaha, Neb.

25. Scranton, Pa.

A refreshed F&I menu was part of the newest innovations rolled out by DealerSocket at the 2020 NADA Show.

That menu is connected with DealerSocket’s PrecisePrice digital retail solution and stems from an integration with F&I Express and its Express Digital Media.

DealerSocket highlighted PrecisePrice’s new VIN-specific F&I menu can extend the tool’s pricing capabilities by directly connecting the product to 160 F&I product providers. The connection can provide users with access to detailed product information and video content.

Other PrecisePrice enhancements include:

A new kiosk experience

To provide customers with the same digital experience in-store that dealers offer online, DealerSocket is rolling out a new customized version of its PrecisePrice digital retail software that scales to an iPad Pro and fits within a stand-up kiosk. This tool can enable vehicle shoppers to use an iPad with or without a kiosk format in-store to start or continue their shopping experience, on their own or while speaking with a knowledgeable salesperson.

Text label editing capabilities

PrecisePrice users can now edit text labels directly within the digital retail module. The company said this functionality is important for dealers looking to update their consumer experience based on specific dealership language and nomenclature.

New lead verification functionality

DealerSocket explained PrecisePrice’s new lead verification enhancement can solve a significant issue plaguing price-unlock features on dealer websites, where customers enter false information to access the dealership’s discounted pricing.

With this new feature available and integrated as an option into PrecisePrice, vehicle shoppers are asked to enter a valid phone number or email to receive a verification code which is then entered in the system to engage PrecisePrice and access the dealer’s special pricing. The new capability is especially useful for dealers representing brands with strict advertising guidelines.

The company went on to mention these innovations continue the strong momentum for DealerSocket’s digital retail tool from 2019 when PrecisePrice earned certifications from Volkswagen, Toyota, Lexus and Hyundai.

These certifications provide dealers representing those brands with exclusive access to data, reporting, and, in some cases, co-op dollars, according to DealerSocket.

The latest TransUnion data gives crystal clear evidence to show just how much the auto-finance market has grown during the past three years.

Analysts reported 2016 closed with 75.8 million contracts in portfolios. By the close of this past year, TransUnion discovered that figure of outstanding contracts grew to 83.8 million.

When asked to offer perspective, TransUnion senior vice president and automotive business leader Satyan Merchant replied, “It shows to me that we have a continued trend in the industry of consumers financing their auto purchases. It’s particularly showing up on the used side where consumers are seeking financing.

“People are taking out loans that stay on the books longer,” Merchant continued during a phone conversation with SubPrime Auto Finance News. “It’s not as if a consumer is financing a vehicle and paying it off in one or two years. These loans are staying on the books longer and longer.”

TransUnion reported earlier this month that 7.5 million contracts filled portfolios during the third quarter, representing a rise of 4.3% year-over-year. Analysts are still compiling the Q4 origination tally as there is a lag in reporting from providers. Still Merchant noted, “The story of Q4 2019 is really about a bounce back in the resiliency of originations.”

Elaborating about those 7.5 million new accounts recording during Q3, Merchant added, “That’s the large amount we’ve seen in quite some time. The last time we saw a number that large was back in 2016, which was one of our peak vehicle sales years in the industry.”

TransUnion’s Q4 2019 Industry Insights Report showed the average new account balance grew to $22,232, a 3.3% uptick over the same period last year. A combined analysis with IHS Markit, using a newly introduced business intelligence tool, Catalyst for Insight — Credit Module, found that account balances grew as consumers continued to move from cars to more expensive trucks and SUVs.

Analysts noticed trucks and SUVs grew to 71% of new financed vehicles and 60% of used financed vehicles in Q3 2019, compared to 68% and 57%, respectively, in Q3 2018. To help offset climbing costs, consumers across all risk tiers are entering the used-vehicle market in growing numbers.

TransUnion indicated the proportion of used financed vehicles versus new is large and growing, with a 53%/47% used/new split in Q3 2019.

“Not only are vehicles lasting longer, an increase of inventory to the used car marketplace has supply aligning with growing consumer demand,” Merchant said.

“Used vehicles can be an attractive alternative for consumers, especially those who are in the market for pricier vehicles such as a truck or SUV. On average, they can save approximately $13,000 by opting for a used vehicle over a new one,” he continued.

As consumers continue to pursue manageable monthly payments, TransUnion reported contract terms have lengthened for both new and used vehicles.

New-model financing terms grew moderately to 69 months in Q3 2019 versus 68 months a year earlier. Analysts explained this trend has helped slow monthly payment growth to 3.6% year-over-year with an average monthly payment for new-vehicle financing at $561 in Q3 2019, up from $542 in Q3 2018.

Analysts pointed out terms have also lengthened for used vehicles, growing from 63 months in 2018 to 64 months in 2019. The lengthened terms for used vehicles has slowed the rate of growth for monthly loan payments to 3.0% year-over-year, bringing the average used monthly payment to $389.

And as the amount financed and terms have increased, TransUnion noticed average loan-to-value (LTV) at origination has inched up. Used LTVs grew to 112.2 from 109.4 a year earlier, while new LTVs grew to 100.0 from 99.6 a year earlier.

With all of this growth, TransUnion highlighted an important element — performance has remained relatively strong.

Analysts determined the delinquency level of contracts 60 days or more past due increased to 1.50% in Q4 2019, up from 1.44% in Q4 2018 and 1.43% in Q4 2017. They emphasized that delinquency rates continue to be well-managed even as average balances rise.

“External factors may have put pressure on the affordability crunch in the auto industry, but it has not put a damper on consumer appetite for credit,” said Matt Komos, vice president of research and consulting in TransUnion’s Financial Services business unit.

“As a result, consumers are taking control of their financial situations and weighing their financing options. We anticipate growth to continue in the used financing sector of the market as consumers pursue pricing that is a bit more palatable and offers a more manageable monthly payment,” Komos went on to say.

One subprime auto finance company is absorbing much of the portfolio of another provider.

On Thursday, Nicholas Financial announced today that it has entered into an agreement with Platinum Auto Finance to acquire approximately $19 million of Platinum’s active and performing portfolio.

According to a news release, this deal is the third bulk portfolio purchase of Platinum Auto Finance’s receivable base in as many months. Nicholas Financial indicated the first bulk purchases were $1.1 million and $0.9 million, respectively, laying the groundwork for this much larger acquisition.

“We have had a positive relationship with Platinum for some time now, and we are pleased we could see this acquisition through,” said Doug Marohn, president and chief executive of Nicholas Financial, which is a branch-based subprime auto finance company focused on servicing the needs of local, independent dealerships.

“Bringing over this portfolio to Nicholas increases our indirect portfolio by approximately 10% and will be immediately accretive,” Marohn continued. “It also frees up liquidity for Platinum as they look to further their own strategic initiatives.”

In addition to these transactions, Nicholas noted that it has been working together with Platinum on several joint ventures during the last several months. These joint venture initiatives include cross-marketing, application pass-throughs and other related projects.

“We are excited to continue to build our relationship with the Nicholas Financial Team,” Platinum Auto Finance CEO Michael Kaplanis said.

“Our companies share a core philosophy to structure transactions that set up consumers for success and we complement each other strongly in our approach to providing great service to our dealer clients and customers,” Kaplanis went on to say.

Nicholas Financial is coming off the third quarter of its fiscal year that included a 15.2% rise in originations while its 60-day delinquency rate dropped to 4.0% from 5.7% a year earlier.

“We are very pleased with the progress we have been making overall, and particularly pleased with the progress in our third quarter of fiscal year 2020. On both new indirect contract purchases and direct loan volume we have outpaced year-over-year results for the third quarter and year to date,” Marohn said.

“Our targeted efforts to improve same store sales, rollout our direct loan product to more states, continue new market expansion and be open to other strategic partnerships is yielding positive results,” he continued.

“Our expansion efforts are underway in Las Vegas, Nevada in addition to the other areas previously identified,” Marohn added. “We are in the process of initiating expansion in Salt Lake City, Utah, Boise, Idaho, and Des Moines, Iowa; just to name a few.”

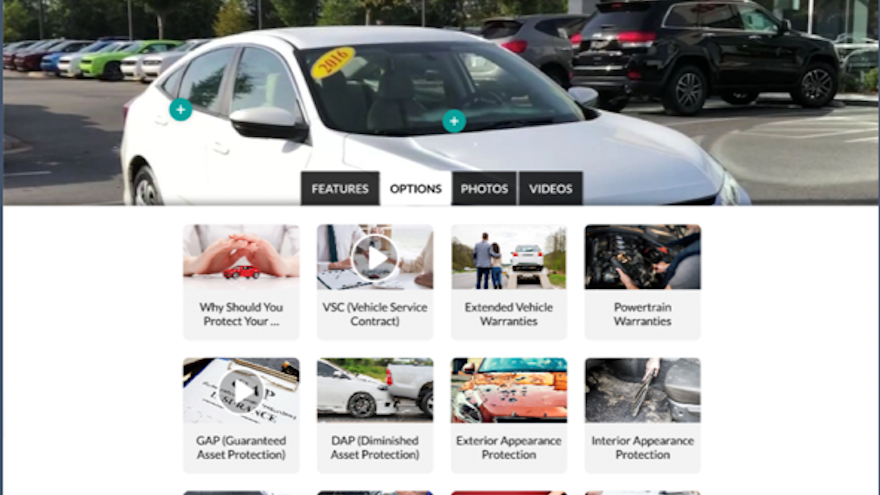

SpinCar is looking to give dealers another education tool to benefit their F&I sales strategies.

During NADA Show 2020 in Las Vegas, the digital automotive merchandising software provider launched an F&I merchandising solution designed to integrate directly with dealer website vehicle detail pages (VDPs). SpinCar explained F&I Advantage can enable dealers to increase F&I sales by educating consumers and creating demand for vehicle protection, warranty and insurance products before shoppers arrive at the dealership.

The firm indicated F&I Advantage is designed to be a specialized digital merchandising product that can be seamlessly added to VDPs on any dealer’s existing website. By highlighting available protection, warranty and insurance offerings directly on the VDP, SpinCar said dealers can educate shoppers on the benefits of these products early in their car shopping journey.

SpinCar indicated F&I Advantage can build shopper confidence with easy-to-understand explainer content, infographics and videos. Educational content is currently available for all major categories of F&I products, including vehicle protection and extended warranties, service contracts and prepaid maintenance plans, supplemental insurance, roadside assistance and more.

Why does it matter? SpinCar cited information from the National Automobile Dealers Association that indicated F&I product sales can account for more than 50% of a dealership’s new- and used-vehicle gross profits. However, SpinCar acknowledged traditional “end of the process” approaches to selling these products can leave consumers feeling confused and pressured.

“Because the majority of consumers don’t fully understand F&I offerings before they walk into a dealership, most feel ill-prepared to make purchase decisions,” SpinCar said.

F&I Advantage can streamline the post-sales financing meeting by equipping consumers with knowledge that can allow them to make faster and more confident buying decisions, while enabling dealership business managers to save time and personalize their conversation.

One user shared what SpinCar’s newest tool can do. Casey Tuggle is chief marketing officer at the Kelly Auto Group in Chattanooga, Tenn.

“We recognize that better F&I product merchandising before the sale improves product penetration, but until now we have struggled to find the right solution,” Tuggle said in a news release.

“We love SpinCar’s approach as our products are introduced during the customer’s feature exploration phase, which has led to a 19% increase in F&I penetration. It’s the perfect time to get customers acquainted with the value of additional protection for their purchase,” Tuggle continued.

SpinCar recapped how F&I Advantage is designed to work.

Powered by SpinCar’s personalization platform and rich multimedia library of F&I educational content, available aftermarket protection and insurance options are automatically presented to a consumer through several different entry points on each VDP. Product offerings can be tailored based on inventory type, make and mileage.

Once configured by the dealership’s F&I manager, relevant content is populated for a dealer’s entire inventory of new, used and certified pre-owned vehicles. Online shoppers who visit those VDPs are able to access F&I content while they browse a dealer’s website from any PC, tablet or mobile device.

A report detailing each consumer’s interactions with the rich content is then sent to the F&I manager, allowing them to customize their in-dealership product review discussion.

“Digital technology has been rapidly changing every aspect of the auto sales process, and F&I is no exception,” SpinCar co-founder and chief executive officer Devin Daly said in a news release. “The most profitable dealers have known for years that introducing dealership visitors to F&I products earlier in the sales process drives higher attachment rates, but until now they haven’t been able to extend their efforts to shoppers browsing their online showroom.

“F&I Advantage provides a powerful digital merchandising solution that enables dealers to reach consumers even earlier in their shopping journey, resulting in greater sales of these high-margin products while at the same time delivering a better experience for consumers,” Daly went on to say.

More details can be found at SpinCar.com.

As dealerships continually strive for ways to improve the quality and accuracy of targeted marketing campaigns, 700Credit and NCompassTrac understand that knowing the disposition of the customer credit velocity is critical.

With that thought in mind, 700Credit partnered with NCompassTrac to create an offering that is designed to give dealerships a leg up by prescreening consumers and delivering personalized offers that match customer disposition.

The companies highlighted this joint offering can make it simple and easy to identify and take actionable efforts to engage with customers using the best possible approach.

“By using the 700Credit offering within the NCompassTrac Dashboard, a dealership can instantly visualize its DMS database in real time, segment the data into target groups based on behavior and further filter those credit-qualified individuals that are most likely to engage with the offer being presented,” said Ken Hill, managing director of 700Credit.

“As with all NCompassTrac Marketplace Products, all of the tracking, distribution and revenue metrics are directly derived from various sources within the DMS to show the campaign effectiveness,” Hill continued in a news release.

NCompassTrac chief executive officer Chris Daden added, “We are incredibly excited to roll this out to our existing and onboarding clients.

“As a premium NCompassTrac Marketplace offering, the efficiencies derived by pre-knowing customer disposition and credit velocity creates a marquee benefit to our clients in a way we’ve never seen before,” Daden went on to say.

The NCompassTrac Dashboard integration with 700Credit is immediately available for dealership use.

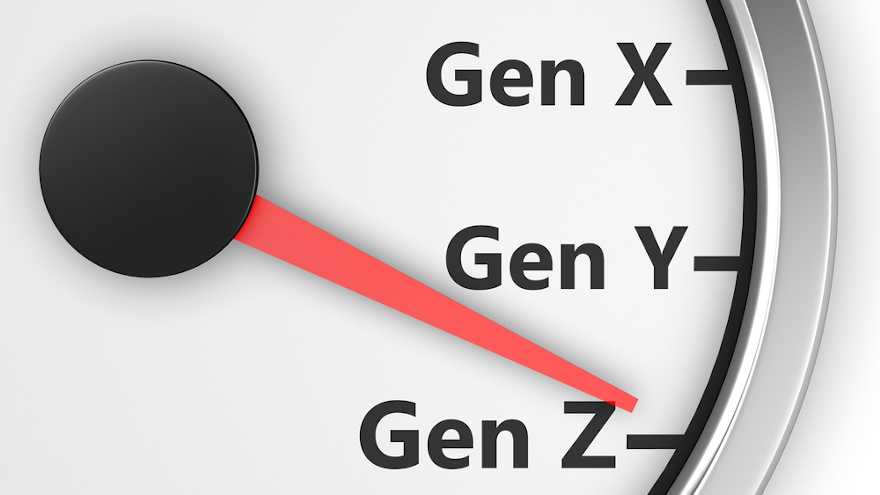

Your portfolio might be filling with contract holders from Generation Z — consumers born in or after 1995. Recent research from TransUnion showed that this generation isn’t necessarily just staring at smartphone constantly. These individuals also are getting behind the wheel, and sometimes leveraging auto financing in order to do so.

“First and foremost, the interesting insight is that Gen Z consumers are interested in auto financing and are purchasing vehicles,” said Matt Komos, vice president of U.S. research and consulting for TransUnion.

“Generally, there were some anecdotes and stories about that maybe there wasn't as much of an interest in that space for younger consumers,” Komos continued during a phone conversation with SubPrime Auto Finance News. “But we are seeing that when you compare to millennials at the same age, Gen Z consumers are taking out auto loans at a higher rate.”

In the U.S., the study also compared the credit activity and performance of millennials (consumers born between 1980 and 1994) and Gen Z consumers. To have a true “apples to apples” view, TransUnion observed millennials who were between the ages of 18 and 24 years old in 2012 and Gen Z consumers who were 18 to 24 years old as of 2019, adjusted for risk and age differences.

Across traditional credit products, Komos and the study team found preferences for these two groups were broadly similar. However, a combination of finance company supply and consumer demand has caused some differences between generations.

TransUnion discovered the lower rate of unemployment during Gen Z’s young adulthood has resulted in more Gen Z adults joining the workforce rather than enrolling in school. As a result, more millennials (44%) had a student loan than Gen Z (37%).

While TransUnion acknowledged it is often assumed that younger consumers inherently present greater risk to finance companies, Komos and his fellow researchers found it interesting to note that 50% of credit-active Gen Z consumers are prime and above (with a VantageScore 661 or higher), compared to the 39% of credit-active millennials who were prime and above at the same age.

Even with a less risky credit-active population, TransUnion indicated Gen Z consumers have benefited from favorable underwriting standards toward non-prime borrowers with a VantageScore 660 and below in both the auto and credit card industries.

Komos and his colleagues noticed this underwriting expansion into riskier tiers has driven nearly 10% more credit-active Gen Z consumers into auto financing compared to millennials over the same age period. There has also been an increase of subprime (VantageScore 300-600) bankcard activity for Gen Z, as 23% of subprime consumers have a credit card in comparison to 12% of subprime millennials.

“The oldest set of Gen Z consumers came of age during an elongated economic expansion and relaxed underwriting environment, which allowed for a comparatively easier entrance into the credit market than their millennial counterparts,” Komos said.

“Gen Z has been able to access credit cards and auto loans with greater ease, particularly because lenders have been extending their buy-box into non-prime — which has been beneficial to these Gen Z consumers as they enter the credit market,” he continued.

And those previously mentioned smartphones, Komos mentioned how those devices remain important in the auto-financing market, too, when discussing Gen Z.

“Given that this is our first digital native generation, they've grown up in a digital environment,” Komos said. “That’s the way they're used to doing business.

“I think it’s important for lenders to understand the ongoing trends and preferences that these consumers are exhibiting and really try to serve them as best as possible with not just their preferred engagement protocol or method but also with valuable products and solutions that serve the needs of these consumers,” he went on to say.

Dealertrack is heading to Las Vegas for annual events hosted this week by the American Financial Services Association (AFSA) and the National Automobile Dealers Association (NADA) armed with a half dozen new-product enhancements and enriched partnerships to highlight.

These latest partner integrations and enhancements include:

— Dealertrack partners with Darwin: Darwin brings the latest in analytics and mobile technology to Dealertrack’s platform. The result is less keystrokes and more deal data from Darwin’s final menu, telling the dealer which aftermarket products were accepted and which were declined by the customer and how those choices affect monthly payment, term of loan and cash down. All this information can flow seamlessly into Dealertrack’s one online deal jacket to ensure deal compliance.

— F&I insights reporting powered by StoneEagle F&I: Dealertrack is partnering with StoneEagle F&I, a provider of innovative solutions for the automotive retail industry, to bring SEcureMetrics F&I to the Dealertrack platform. This partnership can allow dealers to analyze the deal and see new ways to grow profits using insights that will be presented within the online deal jacket. SEcureMetrics F&I is easily customizable and can arm dealers with actionable insights to help improve efficiency, drive performance and increase potential profitability.

— Dealertrack partners with National Credit Center (NCC): Dealers now have access to an enhanced financing process through an all-new partnership with National Credit Center (NCC). NCC credit bureau service will integrate directly into Dealertrack’s online deal jacket, improving the finance process for dealers to make smarter and immediate credit decisions. Key features and enhancements include Military Lending Act (MLA) inclusion on reports and Smart Default capabilities (coming in March 2020) that can give deeper insights to secure better finance terms and to automatically pull an additional bureau if a higher score is available. This improved financing process increases the value dealers derive from Dealertrack’s credit application network.

— New CRM integrations: Committed to mapping to a dealership’s unique workflow, Dealertrack will offer enhanced integrations with several CRM providers to now push a completed credit application directly from their CRM to Dealertrack, helping save time and reducing the need for data re-entry.

— Enhanced compliance checkpoints throughout the deal: Dealers can protect profits and ensure mishaps are mitigated through real-time updates and checkpoints along each step of building one complete digital deal jacket. Dealertrack’s annual Compliance Guide is also going paperless in 2020, so dealers can easily access and share updates.

— Paperless deal submission: Dealertrack’s unique Digital Contracting capabilities now include local file upload so dealers can now add stips and documents in multiple ways. Additional enhancements, such as built-in verifications, live funding checklists and point-of-sale capture allow dealers to submit more accurate contracts for same day funding to a growing list of leading lenders.

One Dealertrack user shared his experiences with some of these enhancements.

“From a customers’ viewpoint, the less time they have to spend at the dealership, the better,” said Will Pollard, finance director of Tim Short Auto Mall in Corbin, Ky.

“On Dealertrack uniFI, we’re now able to connect the entire deal workflow through one single platform, minimizing back and forth and enhancing employee productivity for faster funding and happier customers,” Pollard continued in a news release.

Cheryl Miller, senior vice president and general manager of Dealertrack F&I Solutions, elaborated about what the company is trying to deliver to finance companies and dealerships.

“At Dealertrack, we believe in the course of doing business dealers should never have to turn their back on a customer to access the information needed to structure a payment, secure financing, calculate taxes and fees, or jump between technology solutions,” Miller said.

“By leveraging the power of partnership, Dealertrack is giving dealers the flexibility and connectivity they need to drive a seamless workflow for faster funding and a renewed, more fully engaging customer experience,” Miller went on to say.

For more information about Dealertrack and to schedule a demo at NADA 2020, visit https://us.dealertrack.com/ or visit the company Booth No. 2336C.

A new vehicle is one of the worst investments you can make. We’ve all heard it before: “Half the value is lost as soon as you drive it off the lot.”

The fact is, however, that vehicles today are hanging on to more of their value for longer than ever before because the quality, reliability and technology in today’s vehicles continue to improve.

J.D. Power estimates that the depreciation for a car up to 8 years old will reduce to a rate of 13.3% in 2020. This is noteworthy when you consider that in 2012 the depreciation rate was 14.2%. In a business that is as margin sensitive as the automotive sector, that is remarkable. By 2024 we expect depreciation to slow to a rate of exactly 13%.

For many American owners, the point is moot.

While depreciation rates of vehicles are slowing down, it is scant comfort for owners who moved beyond the once-standard three-year loan and taken on extended four- or five-year loan, find themselves underwater.

The past year has seen a significant increase in so-called negative equity loans in which the amount due is more than the value of the vehicle. It is a trend that has been steadily rising over the past 10 years. In 2009, only 3.2% of outstanding vehicle loans carried negative equity. In 2019, more than 8% of owners were stuck in these deals. Negative equity loans have more than doubled in that time.

As mainstream media coverage of this phenomenon has picked up, it has conjured images of exploitative institutions that are trapping consumers in a financial conundrum. However, when you look at the numbers closely, an interesting fact emerges. The biggest funders of this segment of new and used auto loans have been your friendly neighborhood credit unions.

Indeed, credit unions have doubled down on this category of auto financing. Back in 2009, only 7% of loans issued by credit unions would result in negative equity situations. In 2019, that number has more than doubled to 18%.

Will Rising Tide of Car Sales Get Swamped by Underwater Loans?

If we see another doubling of owners with negative equity, demand for new and used vehicles could be hampered. That is why the effect of rising negative equity on the industry is worth exploring. An uncertain economic outlook, a change in the price of credit for consumers, and/or the availability of credit-worthy buyers could conflate in any number of ways to soften sales in 2020 and beyond.

All stakeholders in the ecosystem will be affected.

The finance community will have to come to grips with crafting loans that pay off old vehicle debt to facilitate new purchases. The risk management issues around collateral alone are substantial.

Dealers could respond by requiring consumers to come up with higher down payments. This, however, is not likely to be an attractive option for many prospective buyers, particularly millennial and Gen Z customers. These emerging generations already have higher debt and lower savings than other demographics. To resolve the impasse, dealers may resort to reducing prices of new purchases or accepting higher valuations for trade-ins to bridge the gap between what people owe and what financial backers are willing to lend.

However it shakes out, lenders, dealers — and even OEMs — should prepare now for a growing portion of shoppers coming onto the lot carrying significant negative equity.

David Paris is a senior analyst at J.D. Power Valuation Services. With over a decade of experience in the automotive industry, David is an expert in the analysis of new and used vehicle market data. David is responsible for the creation of data-driven insights on new and used vehicle market performance and author of Guidelines, a monthly in-depth review of the automotive industry.

This week, MaximTrak launched the latest tool available through its F&I platform by leveraging the capability and convenience of text messages.

The company highlighted MaximTrak GO is designed to be a customer-driven, dealer-controlled menu presentation that can allow consumers to discover and select protection products, any time, any place, and through the convenience of their own mobile device.

In light of today’s modern consumers that expect a speedy, frictionless, omni-channel shopping experience, MaximTrak looked to position its latest technology release so dealers can achieve this objective by texting a link to their customers to launch a unique “text-to-transaction” experience that can improve customer satisfaction, product penetration and profitability.

After creating a custom protection package for the customer, dealers can send a link directly to that customer’s smartphone or tablet via text or email. From the comfort of any chosen environment, customers can discover and select the products that work for them, in advance of the in-store F&I and delivery process. They can engage with sales tools, videos, and educational information with real-time calculations showing the financial impact of the products they select.

Customers also can interact with MaximTrak GO to learn about product options and accept or decline products, creating their own package. After a customer selects their product options, they can confirm their package, triggering a dealer notification to complete the transaction.

The company insisted MaximTrak GO also is suited for post-sale follow up, generating a great opportunity for dealers to improve profitability and enable customers to further protect their purchase.

“MaximTrak is dedicated to delivering innovative tools to dealers to improve processes and boost customer satisfaction,” MaximTrak vice president of operations Imran Mussani said in a news release. “Maximtrak GO is an integral piece to this equation, moving the point of sale to where consumers are at and creating a seamless online to in-store experience.”

MaximTrak GO is available to dealers as a stand-alone offering or as a complementary offering to MaximTrak’s FLITE, which is an interactive showroom tool that can engage dealership customers in a survey. That survey can help the customer self-identify risks and build a completely customized profile and menu of products that are directly aligned with the customer’s needs and driving habits.

Dealers interested in MaximTrak GO can call (800) 282-6308 or visit www.maximtrak.com to get more information or request a demo.