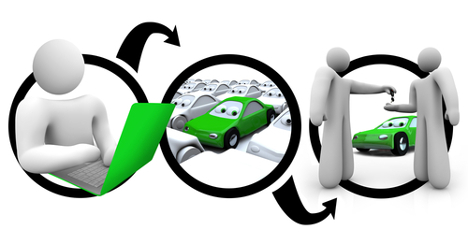

GrooveCar’s vehicle buying resource for credit unions recently launched its new website. Officials highlighted The Everything Automotive platform has a brand new look combined with valuable features to improve the member experience throughout the shopping process.

New features incorporated into the redesigned site are:

— A search tool displaying vehicle choices from all angles

— Payment calculator that populates searches with monthly payment commitment options

— Current vehicle articles, videos

— A loan application tool customized to match credit union branding.

“We are elated to bring credit unions and their members the new GrooveCar website. Our previous website served us well and delivered millions of auto loans to our credit union partners while helping countless members drive away in the vehicle of their dreams,” GrooveCar senior vice president Frank Rinaudo said.

“It’s 2016 and the emphasis is on mobile responsive design while serving up the latest information to insure the vehicle research and buying process is seamless,” Rinaudo continued.

GrooveCar insisted the launch represents the next generation of mobile responsive websites are designed to deliver information the user can experience.

“One of the first impressions the user will feel is the clean, crisp look, bold graphics and easy navigation,” GrooveCar vice president of strategic alliances Robert O’Hara said.

“While pleasing to the eye, the focus of the site is to engage and deliver a car buying experience,” O’Hara continued. “The site is easy to use and gets the user right to where they want to be in the car purchasing process or come back later as searches and information can be saved."

Since 1999, GrooveCar has been providing advanced search and loan application tools for credit union members as they begin contemplating the purchase of a new or pre-owned vehicle.

With more than a year of development and design, O’Hara pointed out the SUPRtec (Smart User Preference Resource Technology) is the horse power behind the site, making it unique to the online car buying community. SUPRtec smart technology powers several key functions on the new website: Smart Payment Calculator, Right Fit Search Preference Tools and My Cars.

“These tools are responsive and interactive to meet the preferences of today’s online shopper,” O’Hara said.

Once the user has explored the site, checked out the cars and taken a virtual test drive, it’s onto the Smart Payment Calculator. This tool can assist users in their search journey as the calculator populates every vehicle viewed with the price they can expect to pay, based on their financial commitment.

The Right Fit Search Tool utilizes user profile and vehicle preference information to help streamline the search process. This capability can refine the search and help the user view the vehicle that meet their preferences.

“What is important to the car buyer will be reflected in the results of their searches,” O’Hara said.

It is the next wave of smart technology which matches user preferences and delivers the inventory based on input criteria,” he went on to say. “Plus, what you can expect to pay is also displayed. These tools are not only super intuitive, but really practical and useful.”

In addition to displaying payment information, the Right Fit feature can display vehicle searches on one side and when highlighted, the vehicle’s options are shown. Choice of colors, photos of the vehicle from all angles, safety features, drive train information and all the information available from the manufacturer, is in full view.

When members are done searching, they are prompted to apply for a loan, right from the auto resource. If they want to continue at a later date, all searches are saved in the “My Cars” feature.

O’Hara insisted that GrooveCar created a vehicle-buying experience for credit union members as they embark on their journey to purchase. For the credit union, the auto buying resource can provide an interactive platform with advanced technology to assist members often before the spark of desire for a new vehicle is ignited.

“In summary, the program was built around making the car buying user experience to be extremely friendly, and resourceful, without the distractions found on other car buying sites,” O’Hara said.

“In return, users will come back often during the four month average car buying process, thereby driving more leads for the credit unions to capture more loans,” he added. “We are excited about what we have built, but even more excited about where we are going to take this next. Stay tuned.”

Without being too much of an alarmist, Cox Automotive economist Tom Webb asked a question that perhaps auto finance company executives are pondering as well: Are financial markets pointing to credit contraction?

Webb delved into the topic as a part of the latest Manheim Used Vehicle Value Index, which came in at 125.2 in January and virtually unchanged from a year ago.

Besides giving his usual update on the wholesale vehicle market, Webb reflected on what’s been happening since the beginning of 2016 on Wall Street and elsewhere in the investment community, acknowledging that “violent swings in equity and debt markets are notorious for giving false signals of imminent doom. But the root causes of those market movements cannot be ignored.”

The Cox Automotive economist described the characteristics of possible global economic slowdown as containing a “devil’s brew” of ingredients, including:

— Aggressive Bank of Japan and European Central Bank actions

— Collapsing oil and other commodity prices

— Currency manipulation

— Capital controls

— Large amounts of dollar-denominated debt held by countries and companies that can ill afford it

To explain what those developments have to do with the availability of used-vehicle financing, Webb shared that a key industry reaction trigger might be if auto delinquencies and loss severities rise in the first quarter.

“It will be viewed with concern, even if both of those ratios remain low from a historical perspective,” Webb said.

SubPrime Auto Finance News on Friday asked Webb to elaborate about the assessment, especially if finance companies appear to be on sure footing with their portfolios and capital access.

“The issue is as I’m hearing from the financial markets and analysts is that obviously what we saw in January was a lot of turmoil in the market,” Webb said.

“Even if you look at the great credit crunch we had in 2008 and 2009, auto lending got caught up in that and they were not a part of it. The auto lending cycle had not run its course yet. It got caught up in housing,” he continued.

“So to the extent that there’s problems in the overall credit market could be an issue for auto lenders even if their underwriting standards are impeccable,” Webb went on to say.

Ally Financial reported that $14.8 billion of its $41 billion in total auto financing originations in 2015 stemmed from installment contracts for used vehicles. The figure marked a rise of $3.1 billion year-over-year.

Chief executive officer Jeffrey Brown reiterated why the used-vehicle portion of its portfolio is so valuable, especially in light of expectations that charge-offs likely will tick higher as 2016 rolls along. When Ally shared its fourth-quarter and full-year financial statements, investment observers asked Brown about the potential impact if used-vehicle prices soften by 5 percent or more this year.

“Obviously the amount we lend against the car and the (loan to value ratios) are determinant on those used-car prices,” Brown said. “But keep in mind, when we originate a loan for a used car, the predictability of where the value of that car is going over the next few years is pretty consistent. We can predict that pretty well.

“Where you really see the drop off is really on a new car once it rolls off a lot and you see a much bigger drop in the value of that car and it's much harder to predict because it’s a brand new car and you haven't seen it,” he continued.

“So if we're out financing two-year, three-year, four-year old cars, believe me, from a loss perspective, we're very comfortable with that and honestly over the last year as we've gotten more and more into used,” Brown went on to say. “Where we've really exceeded from a loss perspective, where we've done better than expected really has been in the used-car channel. It's been very consistent, so I wouldn't' think that the overall drop in used-car prices that we're expecting is going to be a significant driver really of our loss rate in used cars at this point.”

Earlier in this week’s call, Ally acknowledged that its net charge-offs closed the year at 1.21 percent, a level 56 basis points higher than the 2015 low point that came after the second quarter. The finance company also noted its delinquency rate stood at 2.91 percent after the fourth quarter, a level 18 basis points higher than a year earlier.

“We continue to watch our vintages very closely and overall, we feel very good about credit trends. With stable to improving unemployment, the overall environment continues to show healthy signs and asset quality continues to perform in line or better than expected,” Ally chief financial officer Christopher Halmy said.

Another part of why Ally feels so strongly about its portfolio is it doesn’t contain as much subprime paper as perhaps the finance company originated in the past. Brown noted in his opening comments that contracts connected with customers holding a FICO score at 620 or below constitutes just 8 percent of Ally’s outstanding portfolio. And deep subprime — customers with a FICO score below 540 — comprises just 1 percent of Ally’s auto financing business, according the CEO.

“Subprime players including one that we often get compared to are well over 40 percent,” Brown said. “This is a very different model. This is a high quality balance sheet generated from the business that has been consistently profitable including during the Great Recession.”

Brown described an upward drift of 10 to 15 basis points in Ally’s charge-offs as “normalization of our mix as some of the older vintages roll off and some of the new mix that we're putting on comes on the books.” He pointed out that during the worst parts of the Great Recession, the levels were more than double the most recent readings. And during that span, Brown insisted Ally had only one quarter where its charge-off rate climbed that high.

“When we think about the overall book, where we’re going, the originations we put on, we think this book is going to be very profitable even through a crisis,” Brown said.

Overall performance

Ally indicated that its core pre-tax income for 2015, excluding repositioning items, improved 11 percent year-over-year to $1.8 billion with $446 million of that amount coming during the fourth quarter.

That $41 billion in auto financing originations for the year marked a 35-percent climb. Ally highlighted the improvement came as the result of successfully replacing and exceeding the reduction in General Motors subvented and leasing originations in Q4. The company added origination volume also was driven by year-over-year growth in the non-subvented new-vehicle channel, which was up 33 percent, and in the used-vehicle channel, which was up 27 percent.

“Ally’s performance in 2015 reflected the fundamental strength and adaptability of our operations and the successful execution of the multi-year plan to improve profitability,” Brown said.

“Our auto finance business is more diversified than ever, and our leading presence in the industry enabled us to shift capital from incentivized business toward retail auto contracts and post $41 billion in auto originations last year, which will be a significant contributor toward a consistent earnings stream in the future,” he went on to say.

SubPrime 125 honoree Auto Credit Express shared a blog post this week with three suggestions for dealerships to help their F&I managers since they fill such a critical role in moving metal.

Billed as a way to keep these managers from feeling like they have a “thankless job,” Auto Credit Express believes these recommendations could aid F&I personnel significantly.

1. Regularly provide resources

While it’s safe to say that your F&I manager is probably on top of what’s new and trending in the world of finance and insurance, be on the lookout for articles and books to share. You may even want to set some time aside to go over a basic training manual with your main F&I person. You will gain a better understanding of what the department does, and the F&I manager will benefit from the refresher course.

2. Emphasize the fact that the F&I manager is part of the team.

The salespeople need to understand how strongly the F&I department influences their profits and F&I people need to know what happens on the floor. So, when you have meetings, include everyone and make it very clear that the sale is far from over when the customer is escorted into the Finance and Insurance office. Selling a car always represents a collaborative effort.

3. Give and ask for regular feedback.

Your awesome F&I manager probably provides you with daily progress reports, and that’s great. Make sure that you’re going over these reports with them, looking for ways to address problem areas and praising success (high five!). And remember that the door swings both ways. Whenever you can, solicit their opinion of what you could do to make their job easier. Any employee will be happier and more efficient if they know their thoughts are valued.

The complete blog post and more advice from Auto Credit Express can be found here.

Kelley Blue Book estimated the average transaction price (ATP) for new vehicles in the United States climbed to $34,112 in January, representing an increase of $919 or 2.8 percent year-over-year.

To keep that metal moving out of dealership inventory and into finance company portfolios, the easiest path continues to be an avenue that worries industry analysts a bit — lengthening contract terms. More consumers have a set amount available to spend monthly on a vehicle so oftentimes terms are lengthened to meet those parameters.

“The intense focus on the monthly payment and the result of that, extended loans, those are things we pay attention to,” Autotrader senior analyst Michelle Krebs said during a conference call this week.

“We have some concerns around the very long loans because it has implications in the used market and people being able to get back into the market,” Krebs added.

“With all of the new safety, fuel economy, emissions regulations, there will be automatically increased costs in the vehicle that have to go somewhere,” she went on to say.

According to its third-quarter data, Experian Automotive pegged the average term length for a new-vehicle contract at 67 months. The average term for a used-car contract ticked up to 63 months. Those terms left the average monthly payment at $482 for a new model and $361 for a used vehicle.

Kelley Blue Book senior analyst Alec Gutierrez explained the dynamics of the vehicle-buying process have changed significantly during the past five years. Gutierrez pointed to the volume of data that shows shoppers spend 12 to 18 hours researching vehicles and their financing options before ever entering the dealership.

It’s why Gutierrez said when consumers are asked about pain point when buying a vehicle, it remains the negotiations over financing; again pointing to the need to meet monthly payment demands.

“Consumers walk in with a pretty solid expectation of what they’re going to expect to pay,” Gutierrez said during this week’s call. “Because lenders have grown more comfortable extending loans to 66, 72 and more months, I think consumers with relative ease have found ways to finance their purchase.”

Santander Consumer USA highlighted that its auto financing originations moved higher both during the fourth quarter and for the full year. However, the finance company that also serves as the captive for Fiat Chrysler Automobiles acknowledged it lost market share.

And SCUSA believes it knows the places where the market share went.

“If you take the top 20 lenders in the market as a group, the top 20 lenders lost share in the fourth quarter, and if you look at them all individually, there are only a few that didn’t lose share,” SCUSA chief executive officer Jason Kulas said when the company shared its Q4 and 2015 financial report.

“We obviously lost some share in the fourth quarter. But, if you compare that to the smallest players in the industry, the smallest players actually picked up share,” Kulas continued. “So, there’s this interesting dynamic going on where the people with the most history and the most data have held the line on credit and structure and lost a little bit of share, and the smaller competitors at sort of the very low end from a size perspective in the industry, appear to be picking up some share.”

Kulas was quick to calm any fears investment observers might have had about SCUSA’s origination capabilities and its market status. The company wrapped up Q4 with $5.9 billion in originations (up 7 percent year-over-year) and generated $27.9 billion in all of 2015; a figure that landed 6 percent higher.

“That’s not a trend because it’s only happened over the last quarter or so, as far as the smaller players, but it’s something we want to watch because the move was pretty significant relative to where they were entering the quarter,” Kulas said.

“Just a sign, I think again of some of the increase in competition,” he added, “So that leads us obviously to watch things very closely.”

The impact of smaller finance companies taking a bigger piece of the market pie also spilled over into SCUSA discussing its performance in the ABS market.

“What we’ve seen is there’s still a lot of demand, and so you’re right, many different types of issuers have been able to access the markets fairly successfully,” Kulas said when asked about the topic. “What we’ve seen as far as changes, is that — and I mentioned this last quarter — there’s been a little bit of an increase in the spreads for the executions, but the demand is still there and that continues into early 2016 with the transaction that we priced recently.

“Although we’re seeing it, the market continues to have its challenges, and so I think what you’re seeing reflected in the market right now is concern about where we are in the credit cycle, concern about some of the volatility that they’re seeing in the credit markets,” he continued.

“Our perspective on that is that we have a significant following in the credit markets because we have such a long history of performing through cycles,” Kulas went on to say. “We tend to be in a position, as liquidity goes away, that we remain fairly strong on a relative basis, and so I think we’ll benefit from that.”

Overall performance

SCUSA reported its net income for fourth quarter came in at $68 million, or $0.19 per diluted common share. That’s down compared to third quarter net income of $224 million, or $0.62 per diluted common share, and fourth quarter of last year of $247 million, or $0.69 per diluted common share.

Executives explained the most recent were negatively impacted by lower of cost of market adjustments on the held for sale personal lending portfolio, driven by seasonal balance increases as earnings were positively impacted by provision model adjustments.

The company’s full-year net income rose to $866 million, or $2.41 per diluted common share, up 13 percent from $766 million, or $2.15 per diluted common share in 2014, and up 3 percent from 2014 core net income of $842 million, or $2.37 per diluted common share.

“We continue to be strategic in our originations approach, maintaining disciplined underwriting practices and selectivity while growing auto originations 6 percent over the prior year,” Kulas reiterated.

“Recognizing our reported results for the quarter are challenging, there are several factors that are not a true reflection of the earnings power of our franchise,” he continued.

“I would like to thank our employees, customers and dealers for being a large part of another successful year. SC's fundamentals remain robust and we remain committed to generating shareholder value,” Kulas went on to say.

SCUSA highlighted its finance receivables, loans and leases held for investment increased 4 percent to $30.0 billion as of Dec. 31, up from $28.8 billion a year earlier.

The company indicated its average APR as of the end of the fourth quarter for retail installment contracts held for investment was 16.8 percent, in line with 16.9 percent as of the end of the third quarter and up from 16.0 percent as of the end of Q4 2014.

“The year-over-year APR increase is driven by the opportunity to increase originations in a disciplined manner within lower FICO buckets at appropriate returns,” executive said.

SCUSA noted its provision for credit losses increased to $800 million Q4, up from $560 million a year earlier. Executives mentioned the Q4 2014 reading benefited from $149 million in model impacts, including seasonality and a reduction in months' coverage; neither of which impacted provision in Q4 2015. The year-ago figure also benefited from $58 million due to outperformance in net charge-offs.

“Additionally, effective in the fourth quarter 2015, SC recognized changes in value of the personal lending portfolio, including customer defaults, as lower of cost of market adjustments in net investment gains or losses, rather than recognizing provisions and charge-offs on this portfolio,” executives said.

They went on to point out that after adjusting for these impacts and net growth and mix of the portfolio, Q4 2015 provision was impacted by $41 million related to deterioration of forward-looking loss expectations, consistent with the trends in net charge-off ratio and delinquencies.

SCUSA’s net charge-off ratio and delinquency ratio on the individually acquired retail installment contract portfolio increased to 9.6 percent and 4.4 percent, respectively, for Q4 2015 from 8.1 percent and 4.2 percent, respectively, for the fourth quarter 2014. The company’s full year net charge-off ratio on the individually acquired retail installment contract portfolio was 7.3 percent.

After adjusting for lower of cost of market impairments, the company’s the net charge-off ratio of 7.0 percent was up 10 basis points compared to 2014.

"This quarter, seasonal balance increases and seasonally high customer default activity drove net investment losses on our personal lending portfolio, which was classified as held-for-sale as of the beginning of the quarter,” SCUSA deputy chief financial officer Jennifer Davis said

“Balances on this portfolio and customer defaults both generally decline throughout the first half of the year, so we expect smaller lower of cost of market adjustments over the next couple of quarters,” Davis added.

SCUSA announces approximately $900M in asset sales related to its personal lending business

In other company news, SCUSA said on Monday that it completed the sale of assets from its personal lending portfolio to an undisclosed buyer. The portfolio was comprised solely of Lending Club installment loans with an unpaid principal balance of approximately $900 million as of Dec. 31.

“This sale is consistent with our decision, in the third quarter of 2015, to focus on our core objectives of expanding the reach of our vehicle finance platform, creating opportunities in our serviced for others platform, diversifying our funding sources and growing capital,” Kulas said.

“The assets in the personal lending portfolio were classified as held-for-sale beginning in Q3 2015, and we are pleased that this sale of a significant portion of the portfolio is complete,” he continued.

Deutsche Bank Securities acted as sole financial advisor and Mayer Brown acted as legal counsel for SCUSA.

The attorney general in the Empire State found reason to bring more allegations against franchised dealership accused of illegal selling products and services through the F&I department.

New York attorney general Eric Schneiderman this week announced a lawsuit against several Queens dealerships, including Koeppel Nissan, Koeppel Subaru, Koeppel Mazda, Koeppel Auto Group, and Koeppel Volkswagen.

The lawsuit, filed in New York Supreme Court, alleges that the Koeppel dealerships, all owned by the Koeppel family, unlawfully sold “after-sale” products and services, including credit repair and identity theft protection services to 1,426 consumers that sometimes exceeded a cost of $2,000 per consumer.

The attorney general also announced new settlements with dealerships in Nassau and Suffolk counties for selling credit repair and identity theft protection services to consumers.

According to the lawsuit, the Koeppel dealerships used deceptive sales tactics, including charging consumers for services while concealing such charges from the consumers, or by misrepresenting that the services were free. In fact, law enforcement indicated consumers did not receive the credit repair and identity theft protection services for which they were charged.

The court papers also alleged that the Koeppel dealerships collected more than $1 million from consumers between January 2013 and November 2014 for the credit repair and identity theft protection services alone using such deceptive tactics. The suits seek a court order prohibiting the Koeppel dealerships from engaging in these kinds of practices in the future and directing them to refund all illegally obtained overcharges to consumers.

Schneiderman’s office said the Koeppel dealerships arranged with an independent company, Credit Forget It, to sell Credit Forget It’s credit repair and identity theft protection services beginning no later than early 2013. Officials indicated it is a violation of state and federal law to charge upfront fees for services that promise to help consumers restore or improve their credit.

“Contracts that violate the credit repair laws are void,” Schneiderman’s office said.

The court papers further alleged that the Koeppel dealerships added on charges for other after-sale items like VIN etching and key replacement services, without clearly disclosing what they were charging for such services. Officials said the costs of these services were often bundled into the vehicle sales price and not separately itemized.

“As a result, unknown to the consumer, the price of the car stated on purchase and lease documents was inflated by the amount of these after-sale items,” Schneiderman’s office said.

In addition, the Koeppel complaint alleged that the dealerships sometimes negotiated purchase and lease terms with consumers in Spanish and then only provided contracts and documents in English. New York City law requires that when the terms of an installment agreement are negotiated in Spanish, the seller must provide documents translated into Spanish.

“When consumers shop for a car, they should not be misled by deceptive dealerships looking to make a quick buck off New Yorkers,” Schneiderman said.

“Unfortunately, some dealers pad their pockets with fees for products and services that unaware consumers don’t need, and don’t want,” he added.

Other settlements in NY

The attorney general also entered into a separate settlement with Westbury Jeep Chrysler Dodge and Fiat of Westbury — related dealerships in Westbury, N.Y., that also sold CFI credit repair and identity theft services.

That settlement requires the dealerships to stop selling illegal credit repair products and using deceptive and misleading sales tactics. It also requires the dealerships to itemize the cost of after-sale items in its sale and lease agreements.

Officials indicated Westbury will refund more than $100,000 to consumers, which represents the full profits it received from selling credit repair and identity protection. The store will also pay $5,000 in penalties and $5,000 in costs.

The attorney general also settled with Security Auto Sales, which operates Security Dodge in Amityville, N.Y., for similar practices.

In addition to injunctive relief, Security Dodge will refund more than $18,000 to consumers, which represents the full profits the dealership received from selling credit repair and identity protection. The store will also pay $5,000 in penalties.

“The office is continuing to investigate a number of other New York auto dealers that sold or sell after-sale services without the knowledge and consent of consumers,” officials said.

Past actions by Schneiderman’s office

Officials explained these lawsuits and settlements are part of the attorney general’s initiative to end the practice that automobile dealers call “jamming,” or charging consumers for hidden purchases.

Last year, Schneiderman announced a settlement with Credit Forget, the company that purported to provide the credit repair and identity theft protection services. The attorney general also settled with a trio of dealers — Paragon Honda, Paragon Acura, and White Plains Honda, located in Queens and Westchester Counties — that Schneiderman’s office determined had also fraudulently sold these same Credit Forget It contracts.

Paragon agreed to pay restitution potentially totaling nearly $14 million.

GrooveCar, an online vehicle buying resource for credit unions, highlighted this week that five new partners joined the program.

The credit unions now leveraging the platform include:

— Telco Plus of Longview, Texas

— Picatinny Federal Credit Union of Dover, N.J.

— Port Washington Federal Credit Union of Port Washington, N.Y.

— Lehigh Valley Federal Credit Union of Allentown, Pa

— Longview Consolidated Credit Union of Longview, Texas

“Our program provides credit unions with the ability to grow from within, while providing members with the best data, research and value in the auto buying market,” said Robert O’Hara, vice president of strategic alliances at GrooveCar.

“Additionally, we provide the relevance credit unions so desperately need in order to communicate effectively to their membership, while increasing their loan growth and product-per-member ratios,” O’Hara continued.

In a recent GrooveCar survey, credit unions from across the U.S. were asked what areas of growth were a priority for them. Officials indicated more than 50 percent responded that they would be concentrating on their auto loan growth, ahead of mortgages, credit cards and home equity loans.

GrooveCar can provides a host of resources credit union members can access during the vehicle buying process that are designed to streamline the experience.

“Our program aims to make the manner of completing all the essential tasks of researching and locating a vehicle, timely for the member,” O’Hara said.

Some of the features members can enjoy include:

— A search tool displaying vehicle choices from all angles

— A payment calculator that populates searches with a monthly payment commitment comfortable for the user

— Current vehicle articles and videos

— A loan application tool

O’Hara mentioned all of these features on the website are designed to match the credit unions’ branding while offering a clean, crisp look accompanied by easy navigation.

The GrooveCar program can provide information relating to vehicle buying and leasing that is appealing to the member and can give the member a reason to investigate a credit unions’ auto offerings in greater detail.

“The success of the GrooveCar program is not predicated on what size the credit union is or where they are located or what type of charter they have,” O’Hara said.

“As long as the credit union wants to close more auto loans with their existing members or enhance their dealer relationships, this program will drive results,” he went on to say.

You now can add three F&I solutions to what Cox Automotive can provide to dealerships.

Officials highlighted on Thursday that GO Financial and NextGear Capital affiliated dealers will soon be able to offer warranty, insurance and theft recovery products to consumers as a result of Cox Automotive’s strategic investment in SilverRock Holdings.

The company announced the acquisition of a minority interest in SilverRock Holdings — majority owned by Ernest Garcia and Ray Fidel of DriveTime Automotive — through their separate company, Oreno Holdings. SilverRock Holdings provides F&I products such as extended vehicle service contracts, global positioning system (GPS) theft recovery products, guaranteed asset protection products (GAP) and auto insurance solutions to consumers through independent and franchised dealers.

Brian Geitner, president of financial services and NextGear Capital, explained this investment in SilverRock Holdings provides Cox Automotive dealer customers opportunities to offer products in the rapidly growing finance and insurance space. Geitner also noted that it supports the need for retail customers across the credit spectrum to have better options for insurance needs and to protect themselves against unforeseen mechanical failures, accidents and theft.

“Our stake in SilverRock Holdings supports our goals of delivering the types of products and services that dealers need to grow and compete. The aftermarket vehicle ancillary products industry is highly fragmented,” Geitner said.

“This partnership will offer GO Financial and NextGear Capital affiliated dealers a greater variety of services, creating a one-stop approach and a more efficient transaction for retail customers,” he went on to say.

Cox Automotive indicated the transaction closed on Dec. 31. SilverRock Holdings owns the following warranty and insurance companies:

1. SilverRock Automotive: a vehicle service contract administrator and obligor

2. SilverRock Insurance: an online insurance agency

3. BlueShore Insurance Company: a property and casualty insurance company

“This new arrangement with Cox Automotive is a result of our close collaboration and mutual desire to offer our clients what they need and want to succeed,” said Garcia, who is the DriveTime chairman and majority owner of equity partner Oreno Holdings.

“Our deep knowledge of the subprime vehicle market and independent dealers pairs well with Cox Automotive’s expansive products and services across the automotive ecosystem,” Garcia added.

A month after making its first move with respect to interest rates in almost a decade, the Federal Reserve on Wednesday chose to pass on increasing the federal funds rate any further.

The Federal Open Market Committee (FOMC) decided to maintain the target range for the federal funds rate at 0.25 percent to 0.5 percent based on the stance that monetary policy remains “accommodative” and supporting further improvement in labor market conditions as well as a return to 2 percent inflation.

Officials explained that information received since the FOMC met in December suggests that labor market conditions improved further even as economic growth slowed late last year. They also mentioned household spending and business fixed investment have been increasing at moderate rates in recent months, and the housing sector has improved further.

However, officials acknowledged net exports have been soft, and inventory investment slowed.

“A range of recent labor market indicators, including strong job gains, points to some additional decline in underutilization of labor resources,” the Fed said while making its announcement on Wednesday.

“Inflation has continued to run below the committee's 2 percent longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports,” officials continued. “Market-based measures of inflation compensation declined further; survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.”

All 10 members of the FOMC voted to keep rates at the current level. The group meets again on March 15 and 16.

“The committee is closely monitoring global economic and financial developments and is assessing their implications for the labor market and inflation, and for the balance of risks to the outlook,” officials said.

Impact on auto financing

Since the Fed chose not make any further increase federal funds rate on Wednesday, much of the assessment auto industry observers gave about the impact on vehicle financing back in December might still be valid.

Cox Automotive chief economist Tom Webb began a discussion just before the holidays by reiterating how crucial financing is to the vehicle retailing system.

“There is nothing more important to the vitality of the new and used vehicle markets than the availability of retail financing,” Webb said. “Little wonder then that near-record new-vehicle sales and record used-vehicle profits came hand-in-hand with an auto finance market that topped $1 trillion in loans outstanding in 2015.

“With both loan rates and delinquency rates at historic lows, it’s been good times for lenders, dealers and consumers,” he continued.

“Will that change now that the Federal Reserve has embarked on what will likely be a series of rate hikes? Absolutely not,” Webb went on to say. “Auto loan portfolios are performing extremely well and there is no reason to believe that will change anytime soon. So lenders will keep lending and investors will continue to find that the auto loan market provides attractive yields with little risk.”

Even if there are several rate hikes, Webb insisted the cost of funds will remain “exceptionally low” and captive finance companies won’t find it “overly expensive” to buy rates down to today’s “attractive” 0 percent offers.

“In any event, the old industry truism that ‘the availability of credit is more important than the cost of credit,’” Webb said.

Webb then touched on what he is watching as the Fed makes further moves later in the year.

“We are concerned about possible macro-economic reverberations — volatility in emerging markets, capital flows and exchange rates,” he said. “These are forces that could derail an otherwise slow growing U.S. economy. So we, like the Fed, will be monitoring how markets react.”

Jack Nerad, executive editorial director and analyst at Kelley Blue Book, agreed with Webb back in December about the impact on vehicle financing from a rise in interest rates. But Nerad also touched on another consumer element where interest rates moves might alter the buyer environment.

“The issue is not so much what a quarter point increase would do to the typical car payment (answer: not much) but what a climate of increasing interest rates would do to consumers’ perception of their personal finance situations,” Nerad said.

“Rising interests rates will negatively affect home values, and that, in turn, will negatively affect individuals’ perception of their own financial health,” he continued.

“When people don’t feel positive about their financial situations they don’t buy cars,” Nerad went on to say. “So will a quarter point rise in interest rates cause a drastic downturn in car sales? No, but it could signal we are nearing or have reached a peak.”